Opportunities in Silver Explorers and Developers – Part 5

Excelsior Prosperity w/ Shad Marquitz (11/10/2024)

We are moving along to the next company to review in this series on opportunities in Silver Explorers and Developers, and taking a deeper look at Silver Tiger Metals. Additionally, we’ll also be checking in on key news and interview updates from the first 4 companies covered in this series: AbraSilver Resource Corp, Dolly Varden Silver, Blackrock Silver, and Vizsla Silver Corp.

(In full disclosure, I have a reasonably heavy weighting inside of my own personal portfolio in these silver advanced exploration / early-stage development stocks that we are covering in this series. I’ve not been commissioned by these companies to write these articles on Substack. This is not investment advice, nor am I suggesting that anyone position in these stocks. Rather, this is simply an editorial on the value proposition these companies demonstrate to my mind, and why I got positioned in them in my own portfolio.)

As far as investing in junior pre-revenue silver stocks, it should be pointed out that this is one of the riskier subsectors and stage of resource stocks within the precious metals sector. Riding these equities through bull markets and bear markets is definitely not for the faint of heart, and the stock price action can be wildly volatile. This, of course, also means that with that kind of volatility comes multiple waves of price rises and then price declines to potentially capitalize on for either swing-trading or position-trading. This volatility also provides ample opportunities to accumulate positions for the longer-term, by layering into a position over several buying tranches. This layered approach to scaling into a position, via multiple partial purchases, is a great way to smooth out the volatility, while building a good cost-basis over time.

With all of that said, let’s get into it…

Let’s briefly kick things off with a review and update on the first 4 silver explorers and developers that we’ve looked at in this series thus far:

First up let’s check out some recent exploration news from AbraSilver Resource Corp (TSX.V:ABRA – OTC:ABBRF).

AbraSilver Announces New High-Grade Drill Results at Diablillos; Intersecting 50 Metres at 250 g/t Ag Beyond JAC & 15 Metres at 496 g/t Ag at Oculto NE

On October 24th, over at the KE Report, John Miniotis, President and CEO and David O’Connor, Chief Geologist of AbraSilver Resource Corp, join me to review the next batch of drill assays returned from the ongoing 20,000 meter Phase 4 diamond drill campaign on their wholly-owned Diablillos property in Salta Province, Argentina. The results came in from extensions at both the JAC Zone and Occulto NE, as well as a new discovery made outside of the known resources at the Sombra Target. We also touch upon the drilling underway at the copper-gold porphyry targets at Cerro Blanco and Cerro Viejo.

John and Dave highlight the significance of each of these 3 areas of step-out or discovery drilling, and with regards to the new Sombra Target, how the chargeability data suggests that there could be a parallel trend that heads up to the northeast all the way to the Cerro Bayo Target. We also review that the first hole of 3 planned holes at Cerro Viejo and Cerro Blanco are currently underway testing for the copper-gold porphyry mineralization.

AbraSilver Resource – Exploration Update From Ongoing Phase 4 Drill Program - JAC, Occulto, & Sombra

For quick reference, here’s the initial article from this series highlighting AbraSilver:

Opportunities in Silver Explorers and Developers – Part 1

In this new series on opportunities in Silver Explorers and Developers, I’m going to mix in some future updates that are just a mashup of investment ideas on junior silver companies, but then other times just take a deeper dive into just one company. In this [Part 1] we’ll do just that and kick things off with a look into one these companies.

The second company we profiled in this series was Dolly Varden Silver (TSXV:DV) (OTCQX: DOLLF), and the released more high-grade gold intercepts from their Homestake Silver Deposit.

Dolly Varden Silver Intersects 12.23 g/t Au and 84 g/t Ag over 34.93m, 29.24 g/t Au and 16.94 g/t Ag over 13.94m at the Homestake Silver Deposit

While this particular area of their Kitsault Valley Project is more gold dominant, make no mistake about it, Dolly Varden also has a substantial amount of silver resources and exploration targets. They are developing a true precious metals project in Canada.

Shawn Khunkhun, President and CEO of Dolly Varden Silver (TSX.V:DV – OTCQX:DOLLF), joined us over at the KE Report on November 4th, to review these additional wide high-grade gold assays returned from the Homestake Silver Deposit as part of the 2024 exploration program at the Kitsault Valley Project; located in the Golden Triangle of British Columbia.

Shawn reviews what these wide envelopes of gold mineralization mean to the growth of the Homestake area of the deposit, the balance of gold and silver across the overall Kitsault Valley Project, and how investors should think of the growing resources in relation to changes in the gold:silver ratio. We also review the periodicity of the high-grade silver mineralization in the southern part of the project, and how every 1,400 meters from Torbrit to Wolf to Moose to Chance, there are recurring deposits, and this is helping the team vector in on future targets with ongoing surface sampling and ground-truthing work.

Dolly Varden Silver – More Wide High-grade Gold Assays Returned From The Homestake Silver Area

For quick reference, here’s the initial article from this series highlighting Dolly Varden:

Opportunities in Silver Explorers and Developers – Part 2

We are moving along to our next company to review in this new series on opportunities in Silver Explorers and Developers, and taking a look at Dolly Varden Silver (TSXV:DV) (OTCQX: DOLLF).

Next, let’s have a look at some of the exploration news coming out of Blackrock Silver (TSX.V:BRC) (OTCQX:BKRRF).

BLACKROCK SILVER DRILLS 3,745 G/T AGEQ (1,921 G/T AG AND 20.26 G/T AU) OVER 2.6 METRES AND REPORTS MULTIPLE +1K G/T AGEQ INTERCEPTS AT TONOPAH WEST

Andrew Pollard, President and CEO of Blackrock Silver (TSX.V:BRC – OTCQX:BKRRF), joined me on October 16th to review the first batch of high-grade silver and gold intercepts returned from this year’s 20,000 meter drill program on the 100% controlled Tonopah West Project, located along one of the largest historic silver districts in North America on the Walker Lane trend in Nevada. This is the first significant expansion drilling program in 2 years.

Highlights from this first batch of drill results:

TXC24-087 returned 2.59 metres of 3,744 grams per tonne (g/t) silver equivalent (AgEq) (1,920.93 g/t silver (Ag) and 20.26 g/t gold (Au)), including 1.07 metres of 8,514.5 g/t AgEq (4,328 g/t Ag and 46.5 g/t Au)

TXC24-101 returned 1.28 metres of 1,286 g/t AgEq (687 g/t Ag and 6.56 g/t Au)

TXC24-092 returned 3.35 metres of 952.6 g/t AgEq (470.56 g/t Ag and 5.35 g/t Au), in addition to 1.13 metres of 1,156 g/t AgEq (534 g/t Ag and 6.9 g/t Au)

TXC24-100 returned 2.26 metres of 898 g/t AgEq (530.30 g/t Ag and 4.08 g/t Au), including 0.92 metres of 1,587.1 g/t AgEq (943 g/t Ag and 7.15 g/t Au)

Blackrock Silver – High-Grade Silver And Gold Intercepts Returned In The First Batch Of Drill Assays From The 2024 Drill Season

For quick reference, here’s the initial article from this series highlighting Blackrock Silver:

Opportunities in Silver Explorers and Developers – Part 3

We are moving along to our next company to review in this new series on opportunities in Silver Explorers and Developers, and taking a look at Blackrock Silver (TSX.V:BRC) (OTCQX:BKRRF).

Next up we’ll check in on Vizsla Silver Corp (TSX.V: VZLA) (NYSE: VZLA).

On October 15th over at the KE Report, Mike Konnert, President and CEO of Vizsla Silver, joined us to provide a long term outlook for the Panuco Project, in Mexico. Mike lays out plans to target production by 2027 while also exploring new areas on the project and other projects in Mexico acquired this year.

On the production front, we discuss the work planned to move from the current PEA on the Copala area to a Feasibility Study in the second half next year, updated resource prior to the feasibility, updated mine plan, and permitting which is ongoing.

For exploration, the Company has just started a 10,000 meter drill program focused on other areas on the project to find new “centers of mass” that could hold significant resources.

Vizsla Silver – Panuco Project Long Term Strategy: Production Vs Exploration

For quick reference, here’s the initial article from this series highlighting Vizsla Silver:

Opportunities in Silver Explorers and Developers – Part 4

We are moving along to our next company to review in this new series on opportunities in Silver Explorers and Developers, and taking a look at Vizsla Silver Corp (TSX.V: VZLA) (NYSE: VZLA).

Now, let’s dig in to the fifth company in this series Silver Tiger Metals (TSX.V:SLVR – OTCQX:SLVTF).

This is a company that I’ve been following for years, [and it is another stock held in my personal portfolio, and also a sponsor over at the KE Report, so I am biased in those ways].

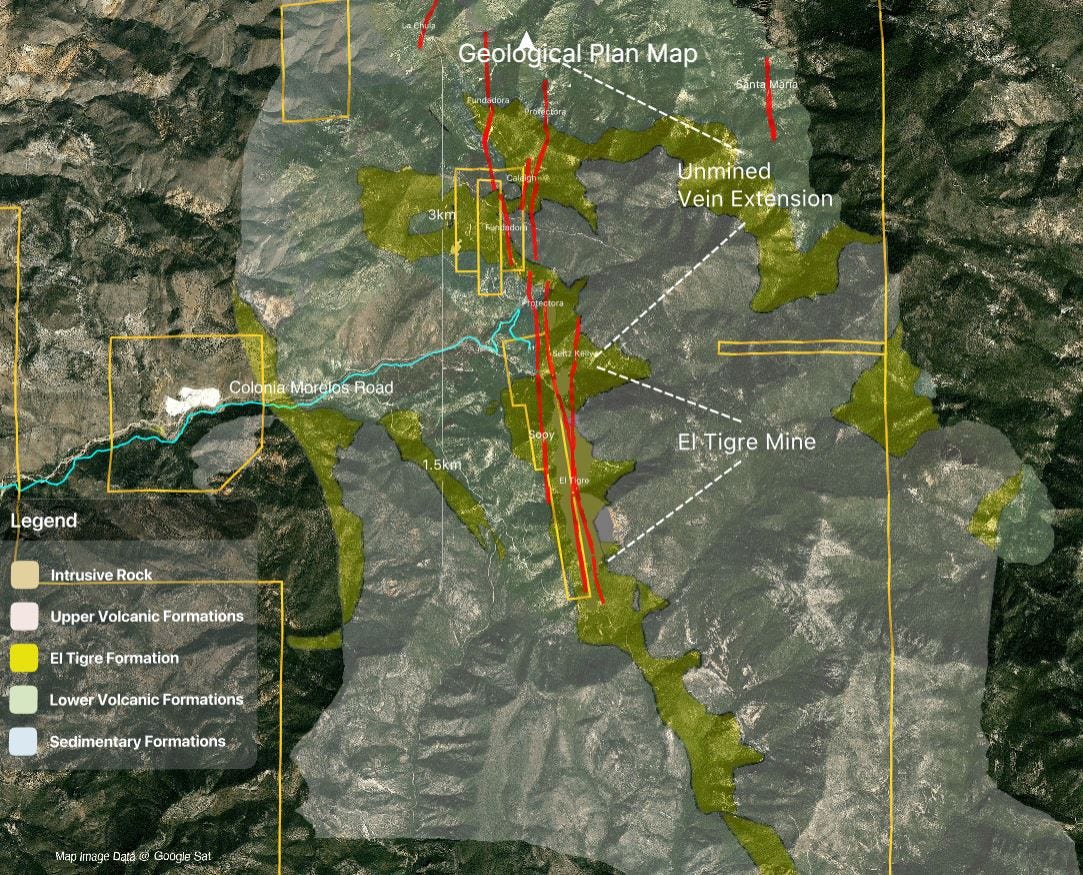

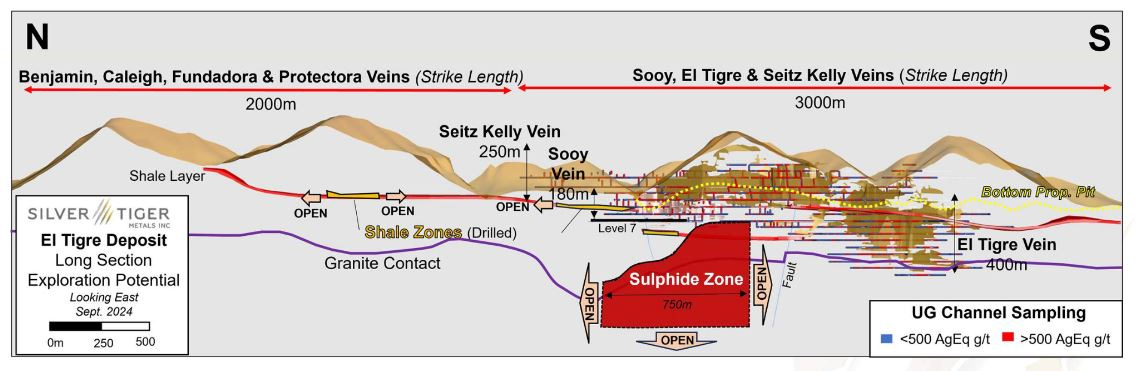

What impresses me about Silver Tiger is the combination of the management team, the quality of the project, and both the recent and upcoming catalysts and milestones. This project is segmented into 2 phases of development at both their open-pit gold-silver first phase, and then their underground high-grade silver sulphide, shale, and vein material, which makes up the longer-dated second phase for development.

Here is a good image from their corporate slide presentation highlighting the timeline of key company milestones since acquiring the El Tigre project in 2016.

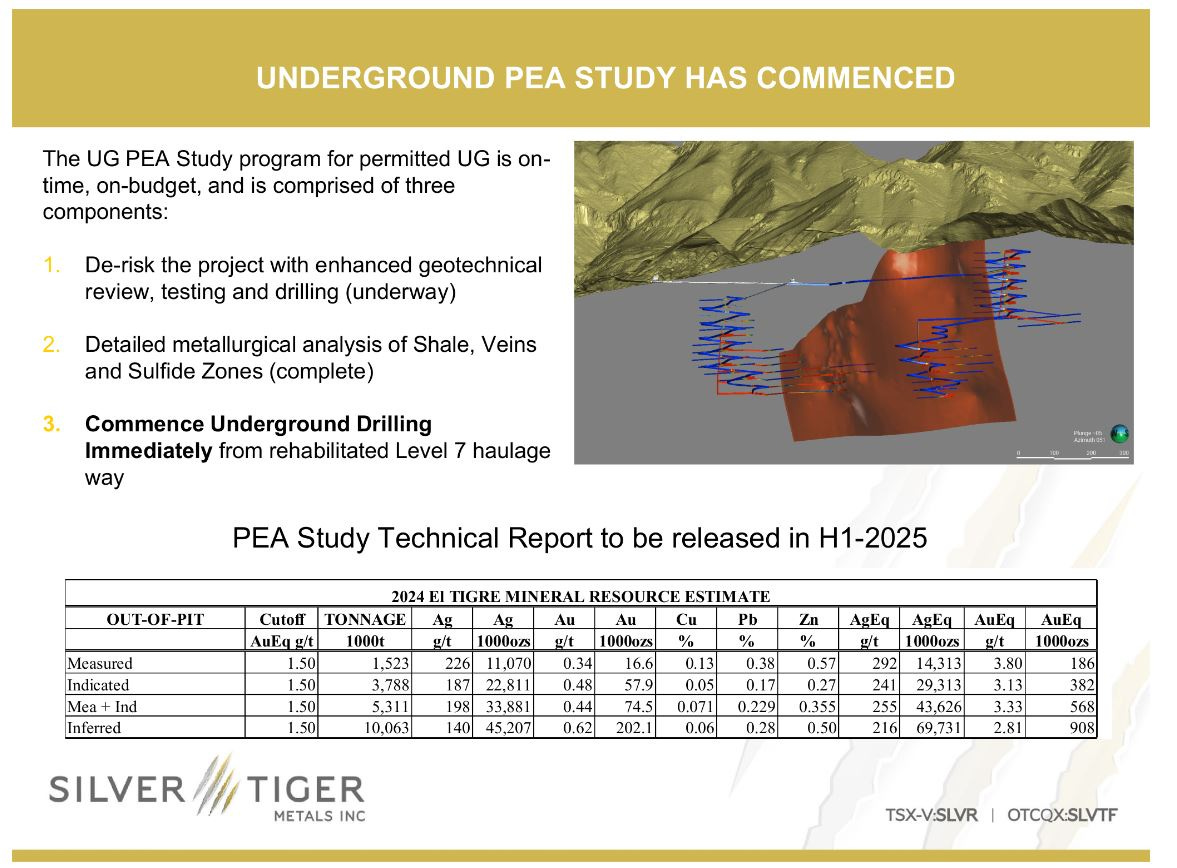

Earlier this year the company updated it’s Mineral Resource Estimate, showing high-confidence ounces in the Measured and Indicated categories at over 200 million ounces of silver equivalent, and then total Out-of-Pit resources at 113 million ounces of silver equivalent (from the underground and tailings portions of the mineral inventory). This has become a key silver-gold project of size and scale.

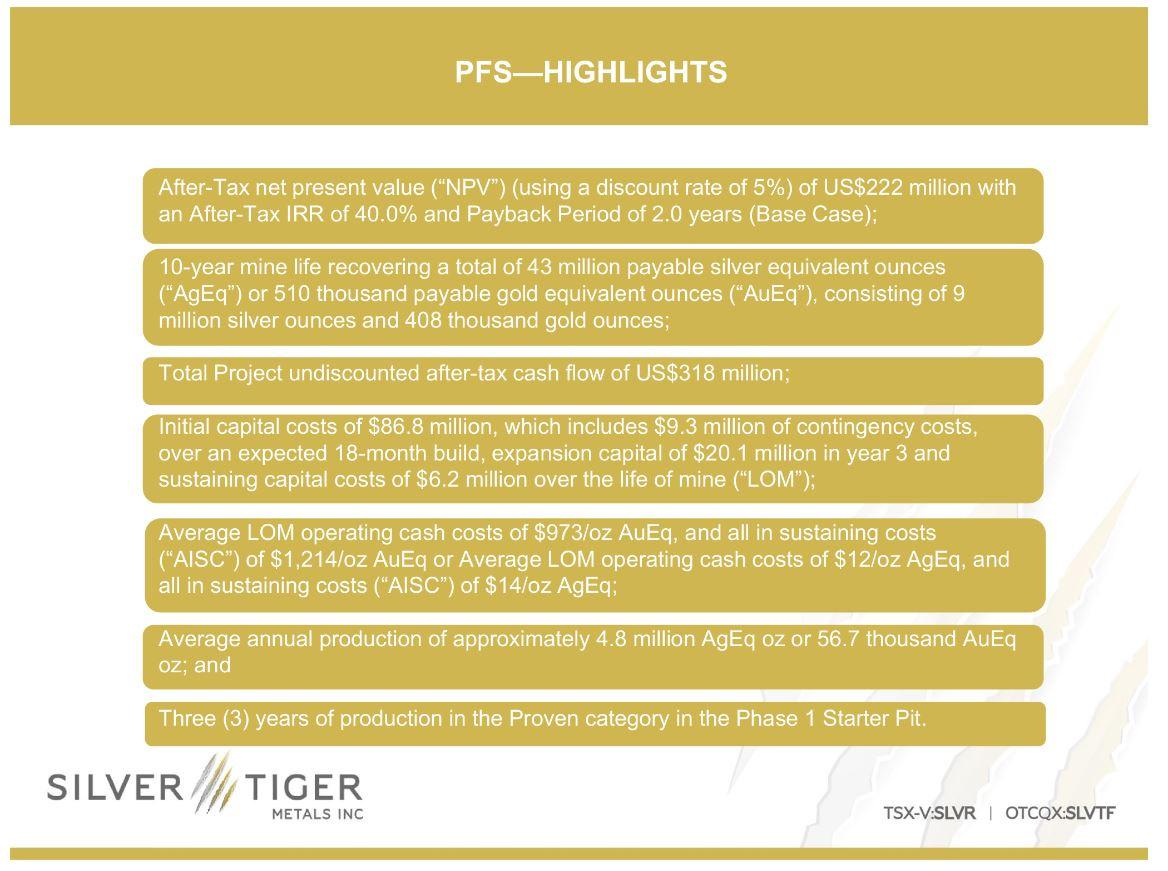

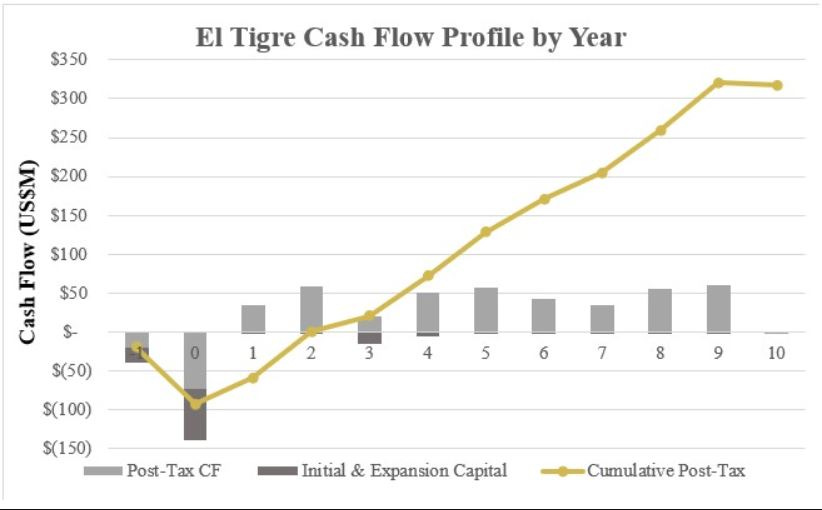

The Company just released their Pre-Feasibility Study (PFS) on the first phase of the Open-Pit Portion of the El Tigre Project, which is again, more gold-dominant at more of 2/3 gold and 1/3 silver component. This is typical for projects of this size in Mexico, and really all over the world, to start with open-pit mining for the near-surface oxide mineralization, and then transition to underground mining with the higher-grade sulphide mineralization and fresh rock at depth; more 75/25 silver/gold.

Silver Tiger Announces PFS with NPV of US$222M for the Stockwork Zone of the El Tigre Silver-Gold Project, Sonora, Mexico

Oct 22, 2024

https://silvertigermetals.com/files/Silver_Tiger_press_release_PFS_-_FINAL_October_22_2024.pdf

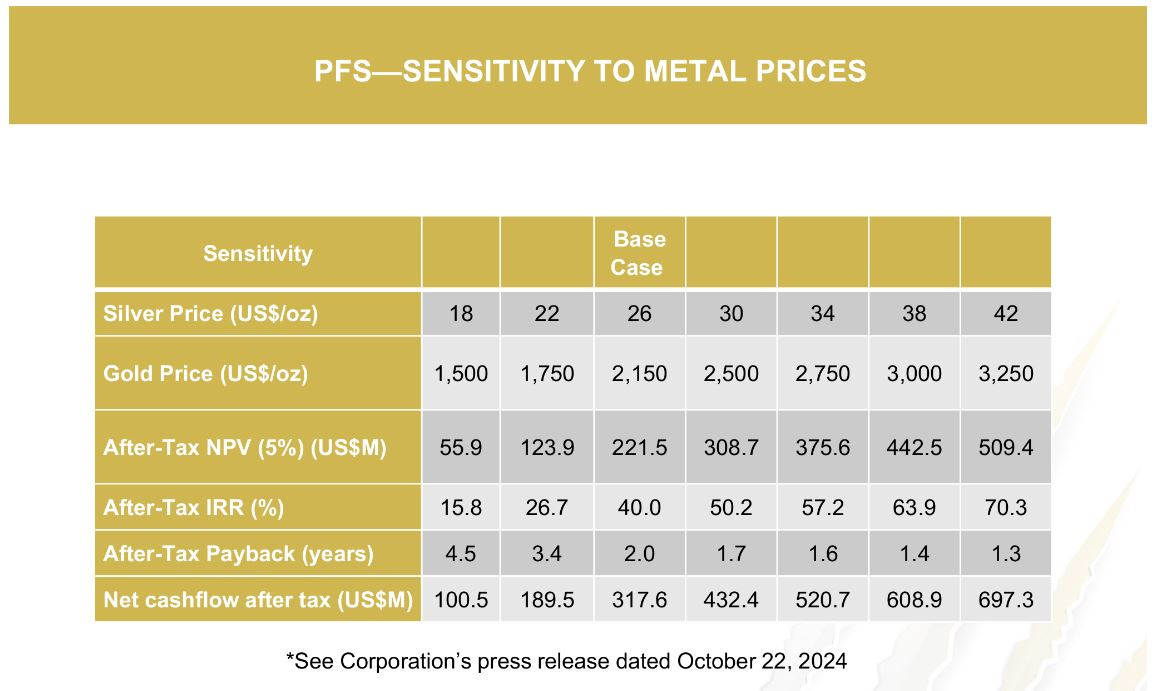

The base case assumptions for the PFS at $26 silver and $2,150 gold are very attractive in and of themselves. However, one area of the PFS that really got my attention, was how profitable the project is around current metals prices.

We just saw north of $34 silver and $2,750 gold back in mid-October a few weeks back, and at those prices just the Open-Pit Portion of this project has a Net Present Value (5%) at $375.6Million, an IRR of 57%, and a payback period of 1.6 years. So those price sensitivities are very germane, especially if people can envision even higher metals prices for silver and gold in the years to come.

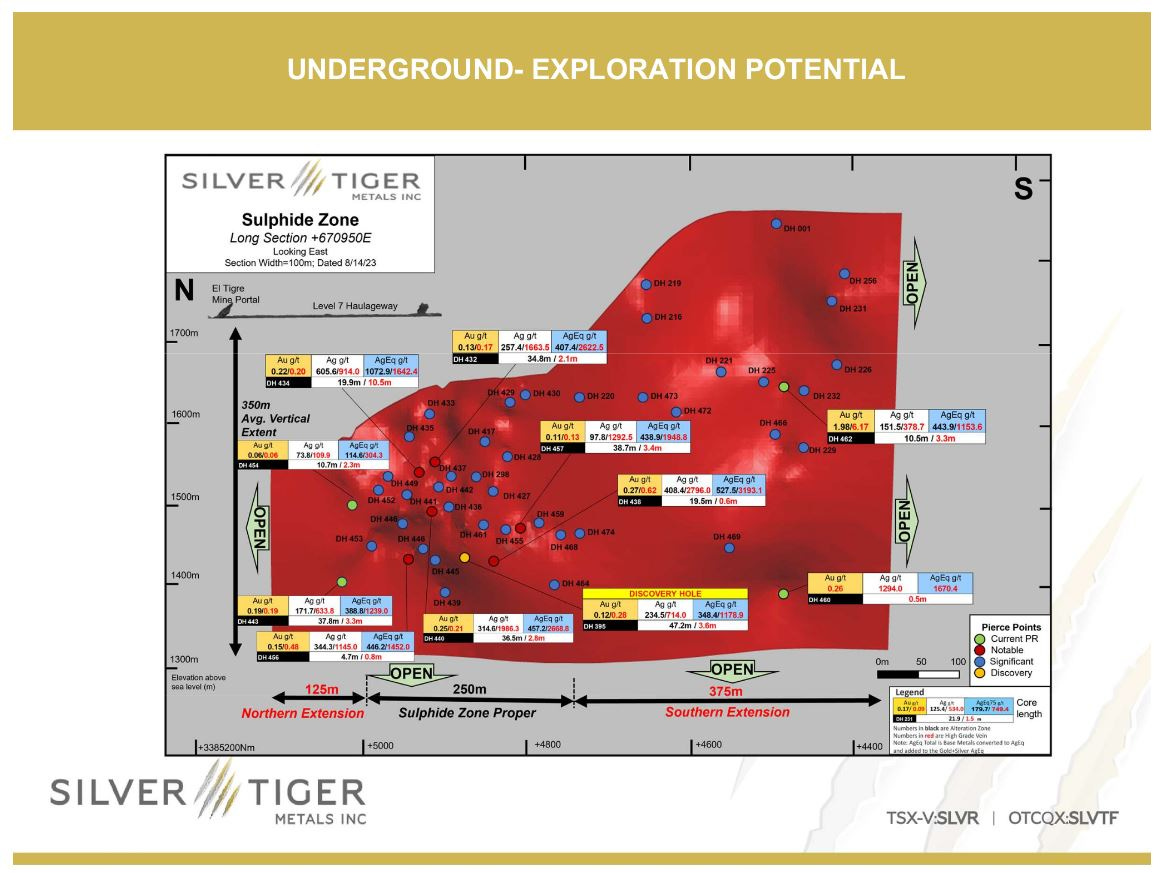

Again, these economics are just on the initial Open-Pit Portion of the project, and the company is now drilling at depth and along strike to further define and expand the resources for the envisioned Underground Portion of the project. To me the open-pit phase is quite compelling, but the underground phase is the real jewel.

On November 5th, Glenn Jessome, President and CEO of Silver Tiger Metals, joined us over at the KE Report to review the key takeaways from the Pre-Feasibility Study (PFS) on the open-pit mine at the El Tigre Silver-Gold Project in Mexico.

Additionally, the company now plans to have the Preliminary Economic Assessment (PEA) out on the underground mining second phase out in the first half of 2025.

We also expand the conversation to touch upon the political change in administrations in Mexico in October and what it means for the mining sector, and expectations around when their open-pit permit will be received. We also discuss the silver market and what this environment means for the quality projects and teams operating silver companies.

Silver Tiger Metals – Key Takeaways From El Tigre Open Pit PFS, Looking Ahead To Underground Mining PEA

That’s it for this update on silver and investing in the junior silver stocks.

Thanks for reading (and listening) and may you have prosperity in trading and in life.

Shad