Opportunities in Silver Explorers and Developers – Part 3

Excelsior Prosperity w/ Shad Marquitz – 07/21/2024

We are moving along to our next company to review in this new series on opportunities in Silver Explorers and Developers, and taking a look at Blackrock Silver (TSX.V:BRC) (OTCQX:BKRRF).

(In full disclosure, I have a reasonably heavy weighting inside of my own personal portfolio in a few of these silver advanced exploration / early-stage development stocks that we are covering in this series. I’ve not been commissioned by these companies to write these articles on Substack. This is not investment advice, nor am I suggesting that anyone position in these stocks. Rather, this is simply an editorial on the value proposition these companies demonstrate to my mind, and why I got positioned in them in my own portfolio.)

As far as investing in junior pre-revenue silver stocks, it should be pointed out that this is one of the riskier subsectors and stage of resource stocks within the precious metals sector. Riding these equities through bull markets and bear markets is definitely not for the faint of heart, and the stock price action can be wildly volatile. This, of course, also means that with that kind of volatility comes multiple waves of price rises and then price declines to potentially capitalize on for either swing-trading or position-trading. This volatility also provides ample opportunities to accumulate positions for the longer-term, by layering into a position over several buying tranches. This layered approach to scaling into a position, via multiple partial purchases, is a great way to smooth out the volatility, while building a good cost-basis over time.

With all of that said, let’s get into it…

Blackrock Silver is an advanced silver exploration company operating near Tonopah, Nevada, that I’ve been trading in my portfolio since 2021. I remember having the company on my watchlists prior to that trading under the name Blackrock Gold, but didn’t follow it as closely in those years when it was mostly focused on it’s Silver Cloud Project (which it still has in it’s portfolio, and the company did conduct some more work on it just last year). Then in mid-2020 the company shifted the focus over to it’s Tonopah West Project, and that is when the bonanza grade silver results started rolling in and caught my attention.

Blackrock Drills 3 Metres Of 2,198 G/T Silver Eq. In New Vein And Extends Victor Vein Down Plunge With 29 Metres Grading 965 G/T Silver Eq. On The Tonopah West Project - July 20, 2020

Blackrock Gold Makes Second Discovery Drilling 2,215 g/t Silver Eq. over 3.0 Metres Within 4.6 Metres of 1,577 g/t Silver Eq. at Tonopah West- Sept 1, 2020

Blackrock Drills 4,643 G/T Silver Eq. Over 1.5M Within 3M Of 2,466 G/T Silver Eq. And Successfully Steps Out 500M At Tonopah West - October 8, 2020

https://blackrocksilver.com/blackrock-drills-4643-g-t-silver-eq-over-1-5m-within-3m-of-2466-g-t-silver-eq-and-successfully-steps-out-500m-at-tonopah-west/

Those were some really high-grade silver equivalent zingers from the Tonopah West Project back in mid to late 2020. With results demonstrating more silver mineralization as the primary and gold mineralization as the secondary metal of focus, many investors quipped that they needed to change their name to Blackrock Silver, and the company agreed and did so by March of 2021.

Blackrock Gold Announced Name Change To “Blackrock Silver Corp.”- (03/15/2021)

https://blackrocksilver.com/blackrock-gold-announces-name-change-to-blackrock-silver-corp/

One thing that really caught my eye, at the time, was that these drilling results didn’t contain as many base metals as say projects in Mexico, that usually had silver equivalent calculated from the zinc, lead, and copper along with the silver. In contrast these results were mostly silver and gold, and the stock took off like a rocket as a result in 2020, with (BRC) going from $0.22 up to $1.61 by the early August peak (which was also the peak the for the whole precious metals sector). Of course, like many other PM stocks, it’s gradually pulled back down since then, but curiously, back to the same shareprice level it was at before the discoveries.

Over at the KE Report, we started talking again with the CEO, Andrew Pollard, in the fall of 2021, and they became a site sponsor. That is where I got more comfortable with the project, their exploration strategy, and the plan to put out a resource estimate the following year; and thus got positioned in the company in my own portfolio. I’m always looking to diversify out of Mexico more with my silver stock positions (because there are just so many “silver” companies operating in Mexico), and I really liked that the projects were in Nevada “The Silver State,” in the USA.

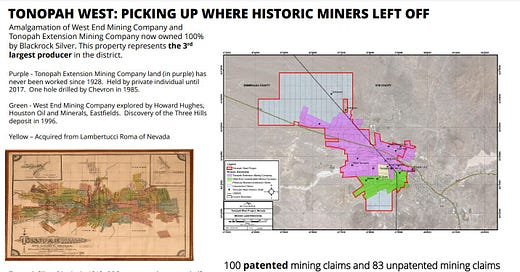

It was compelling to see that Blackrock Silver had consolidated 3 separate land blocks from the previously producing Tonopah Extension Mining Company, the West End Mining Company (previously explored by the aeronautical business genius Howard Hughes), and the claims from Lambertucci Roma of Nevada, into one larger project. This gave the project a number of drilling targets and veins to follow up on, as well as the kind of scale that could entice a senior producer to be interested in the project down the road.

Well, the company kept drilling fantastic drill holes at Tonopah West, even as the markets were contracting, so the great drill results fell on deaf ears and those that didn’t have the eyes to see it coming together. Now, Andrew was very confident in the work their team was doing, and in one or two public interviews on different platforms (not on ours), he initially indicated that the resource was going to be robust and that he felt the project could eventually have north of 100 million high-grade ounces.

This is all that the retail markets remember him saying for some reason (as those interviews had gone somewhat viral), and many punters do have very selective memories and hear what they want to hear and run with that narrative. However, as more and more drill results came out and some of the veins ended up being a bit more narrow, Andrew noted repeatedly that it may take longer than anticipated to get the resource up to it’s true potential, and that the inaugural resources were not going to make it quite that far, but were still going to show a robust resource.

Fast forward to May of 2022, where the initial Maiden Resource Estimate was released, and it came out to a “stope optimized” 42.6 million silver equivalent ounces.

Really, that was a fantastic initial resource after only 2.5 years of drilling (it was already larger than many juniors in the sector that had been drilling for 5-10 years on their projects). It was also clearly a conservative estimate, because the “stope optimized” qualifier meant that these were actually mineable ounces (not just lots of ounces for the sake of a marketing document like so many mining companies will produce). Sometimes being too conservative gets punished.

Blackrock Announces Tonopah West Maiden Stope Optimized Resource Estimate; 2.9 Million Tonnes Grading 446 G/t Ageq For 42.6 Million Ounces Ageq -May 2, 2022

Well, it didn’t matter that it was a really significant maiden resource, or that they could have released a bigger resource if they hadn’t have put the “stope optimized” constraints on it… The market participants lost their minds and online chat forums, market pundits, and behind the back conversations got really nasty towards Blackrock and Andrew. Vocal retail punters wanted Andrew’s head on a stake, claiming he had zero credibility now, because the resource didn’t come in at 100 million ounces right out of the gates on the first resource estimate.

Again, Andrew had tried to get out in front of the resource, working to dial back market expectations, but people had logged his comments from much earlier interviews during the drilling from 2021 in their mind, and they didn’t bother staying current with how the drilling was evolving. Even a range of thought-leaders and pundits in the sector were dogging on the resource and company privately in discussions we had over at the KE Report, or in conversations at sector conferences.

In those conversations, I had stuck up for Andrew and the accomplishments of the Blackrock Silver exploration team, and pointed out some of the conservative nuances in the resource calculation, and highlighted what they had actually achieved in a just a few years. Well, I got a TON of pushback and the equivalent of verbal eye-rolling from a LOT of people that are household names, pundits, and newsletter writers in the PM sector. It was a real head-shaker for me personally, but I sensed a growing opportunity as the stock was beat up to the downside after the resource came out.

Now, as pointed out in the prior article in this channel “Turn-Around Stocks - Snatching Victory From The Jaws Of Defeat,” https://excelsiorprosperity.substack.com/p/turn-around-stocks-snatching-victory , there are moments like these where perceived negative news stories create fishing-line selloffs, even though the company fundamentals still remain very robust under the surface. At the time, the market was puking up shares, and so I added a lot more, and when they bounced right back up in June, I clipped a quick swing-trade on most of the shares I’d added, but held onto a core position.

My investing thesis was that Blackrock Silver had the potential to start climbing higher, more akin to what had happened in Gatos Silver since their resource over-statement news (as highlighted in that prior article). However, my thesis didn’t play out and the whole sector remained under pressure into the fall of 2022 and BRC corrected with most other stocks. I made the decision to sell the remaining portion at a double-digit loss for tax loss purposes that late summer, and then I started averaging back into a position from late 2022 through early 2023. Picking up the tax loss credit, and adding in a few small trades for some small gains the prior experience had washed out as a net positive. However, my overall remaining core position left is down 40% at the time of this article, so net-net all in, I’m still underwater cumulatively on my Blackrock Silver journey thus far.

Many investors would just cut bait and find a different company to fish for gains in. At this point, many investors have already done that with this stock. There have been many times in the past where I have cut bait after just 15%-25% corrections in other stocks, to look for greener pastures. However, with Blackrock Silver, their team has pressed on, and in addition to finding lithium claims at Tonopah East, and still doing some work at Silver Cloud, the exploration work they’ve continued to do, growing the resources at Tonopah West, with such a low discovery cost of ~ $0.29 per ounce, has kept me in the story.

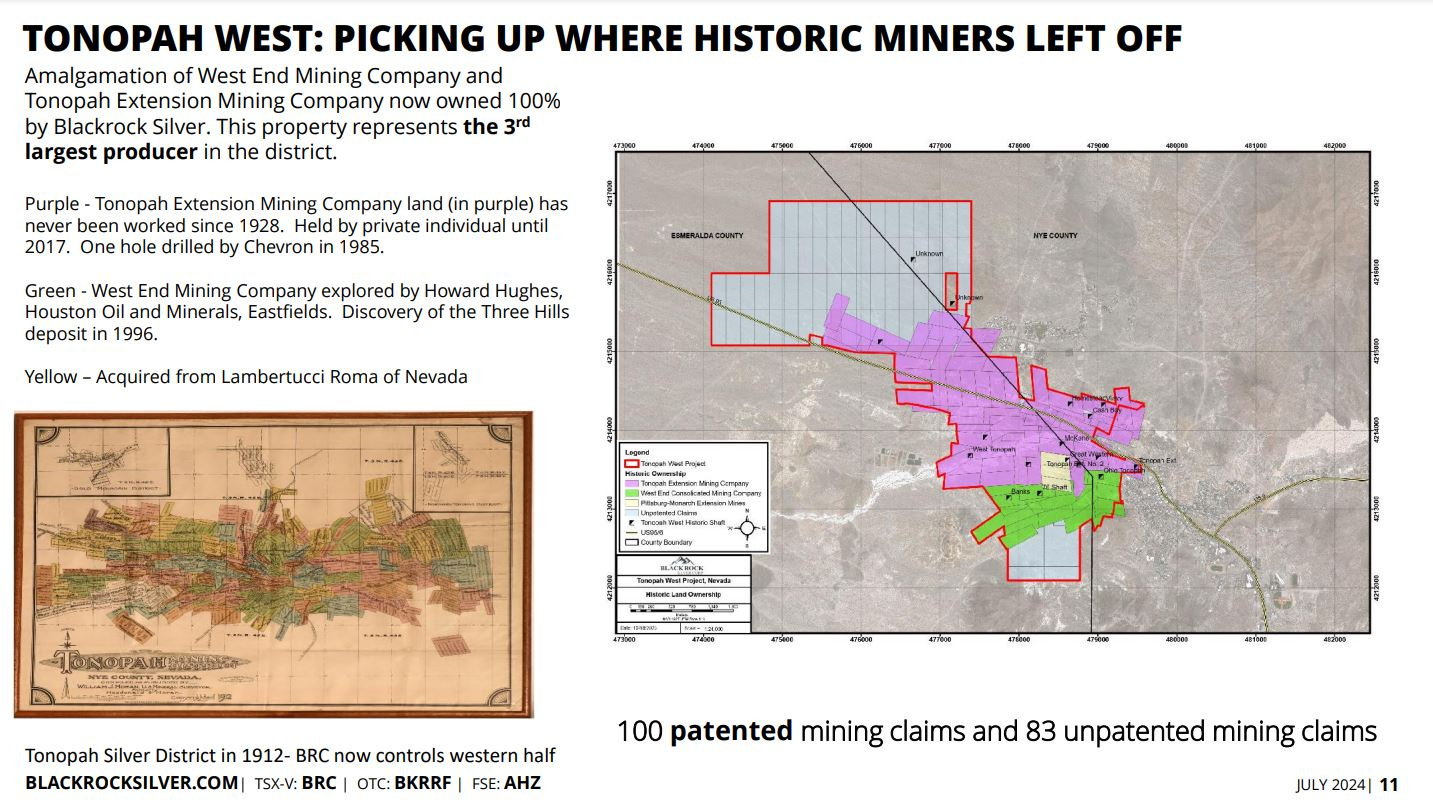

Now, fast-forward to October of 2023, and the resource at Tonopah West was upgraded to 100 million ounces of silver equivalent, just like Andrew had envisioned, and it was just a little over a year after the maiden resource was announced.

Blackrock Announces Updated Mineral Resource Estimate for the Tonopah West Project: Reports 6.12 Million Tonnes Grading 508.5 G/T AgEq For 100.04 Million Ounces AgEq - 10 Oct 2023

After this resource was updated, I heard or read very few people do a “Mea Culpa” for the nasty things they had said about Andrew, or the potential of the Tonopah West Project. There it was, hiding in plain sight at over 100 million ounces of silver equivalent, as the highest- grade silver significant undeveloped silver deposit in the market. (Tonopah West has a higher average grade than the resources at both Vizsla Silver and Dolly Varden Silver – two other companies I hold big positions in my personal portfolio and 2 of the more widely followed advanced silver exploration companies in the sector. Granted it’s not as large of a deposit). Where were all the haters and people dissing on Andrew or the Tonopah West project now? (they were quiet as church mice)

Industry icon, Rick Rule, has stated over and over again, that in most of his multi-bagger returns, he had to endure 2-3 pullbacks of 50% in a position held, before those projects were re-rated up to match the value the underlying company had created. I don’t keep many positions in my portfolio that are down 40% (or even 30%) for that matter, but in the case of Blackrock Silver, it remains a special case where there is a massive discount to the value created versus the market cap of the stock.

My thesis remains that this company is severely undervalued for their ounces in the ground, low discovery costs, and their tier-one Nevada jurisdiction; in comparison to the rerating I believe this stock will eventually receive.

Blackrock Silver, may look like an ugly duckling now, but I believe it will swim away into the sunset as a stellar swan. I wouldn’t be writing about Blackrock Silver in my 3rd article in this series on “Opportunities in Silver Explorers and Developers,” if I didn’t think it was going to snatch victory from the jaws of defeat.

With (BRC) having a market cap of CAD $69Million, and 100 million ounces of high-grade silver in Nevada, that is an insanely lopsided value arbitrage to the ounces in the ground (receiving $0.69 per ounce), very much in favor of those accumulating anywhere close to current levels. Silver is around $30 per ounce.

The stock just had a recent bottom in June of 2024 at $0.22, the same price level it was at prior to all the discoveries at Tonopah West from back in 2020! Yes, I recognize there are more shares out now than back then, but they also now have 100 million ounces of silver, and the highest-grade undeveloped significant silver deposit (… and yeah, I know Outcrop Silver is technically the highest-grade undeveloped deposit, but it is about a 1/3 of the size at 35Million ounces silver equivalent and is located in Colombia…not Nevada… and it actually has a higher market cap at CAD $73Million for only 1/3 of the size in a far worse jurisdiction. Don’t get me wrong, Outcrop Silver is also undervalued at present… but I’m just highlighting here how extremely undervalued Blackrock Silver is relative to its peer valuations and historic sector valuations for ounces in the ground.)

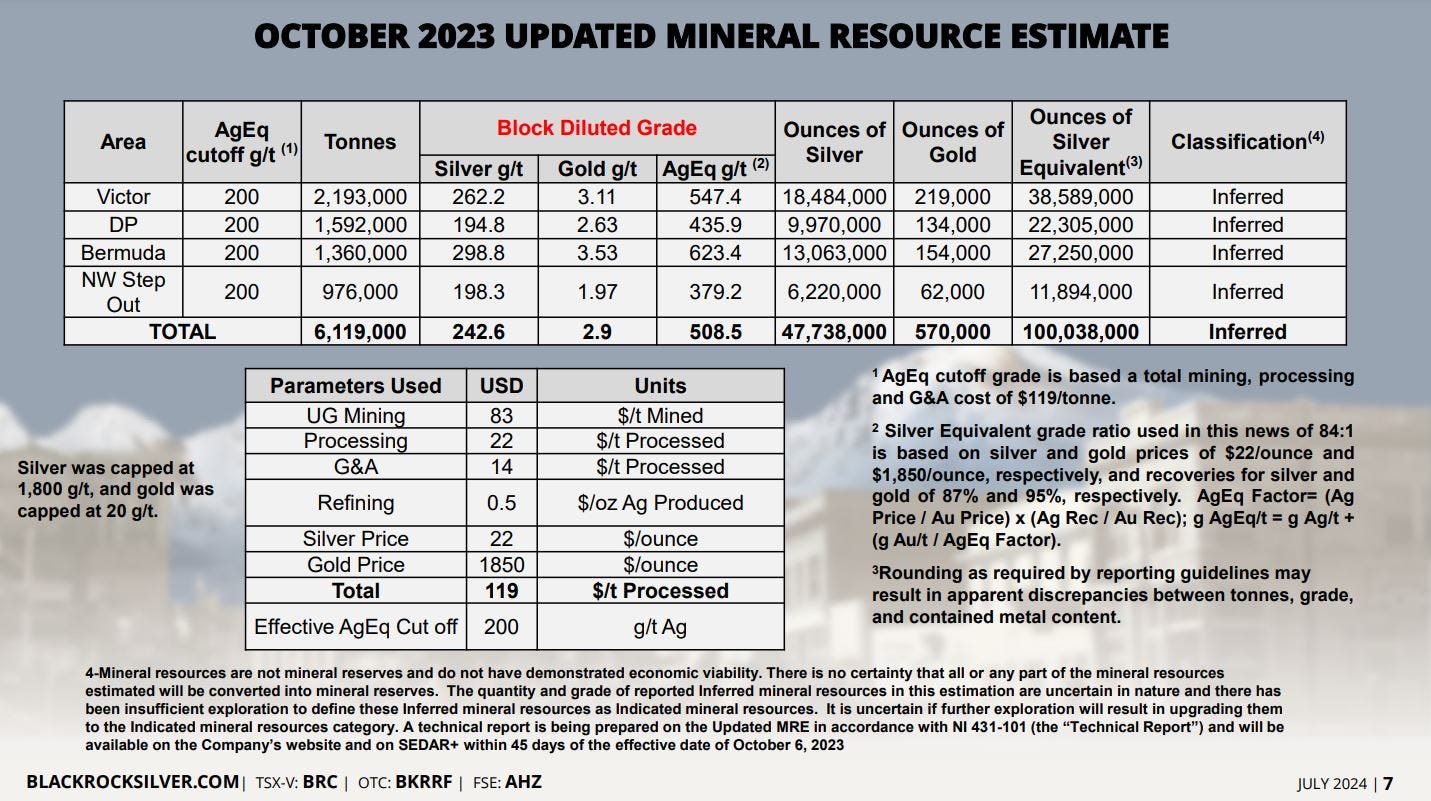

So what is the plan and strategy moving forward? They have just embarked on a 20,000 meter drill program at Tonopah West that kicks off next week in late July.

Earlier this month, on July 7th, over at the KE Report, I invited Andrew back on our podcast show to discuss the goals of this 20,000 meter drill program at Tonopah North.

Andrew outlines that the key initiatives with this year’s drill program will be to put in approximately 50 drill holes, with the goal to convert inferred resources to “measured and indicated” on their Merten and Bermuda veins, as well as to crystalize further expansion along the 1km vein corridor between the DPB, Victor, and NW Step-out areas. At present there are multiple deposits along 2.5kms of strike length and tracked across open vein corridor spanning 4km in strike length. One of the goals of this program is drill in between the large gaps (1.5km) remaining to infill these areas and bridge the deposits together as one larger deposit. The system also remains open to the south, northwest, and at depth.

We also discuss the various project derisking that their team is doing in the background like metallurgical testing and process flowsheet, hydrology studies, environmental studies, site infrastructure and the potential placement of a decline and processing mill, all in tandem with the exploration strategy. The company just raised $10Million in May, bringing in a larger stake from Eric Sprott, and is cashed up to do work beyond this drill program.

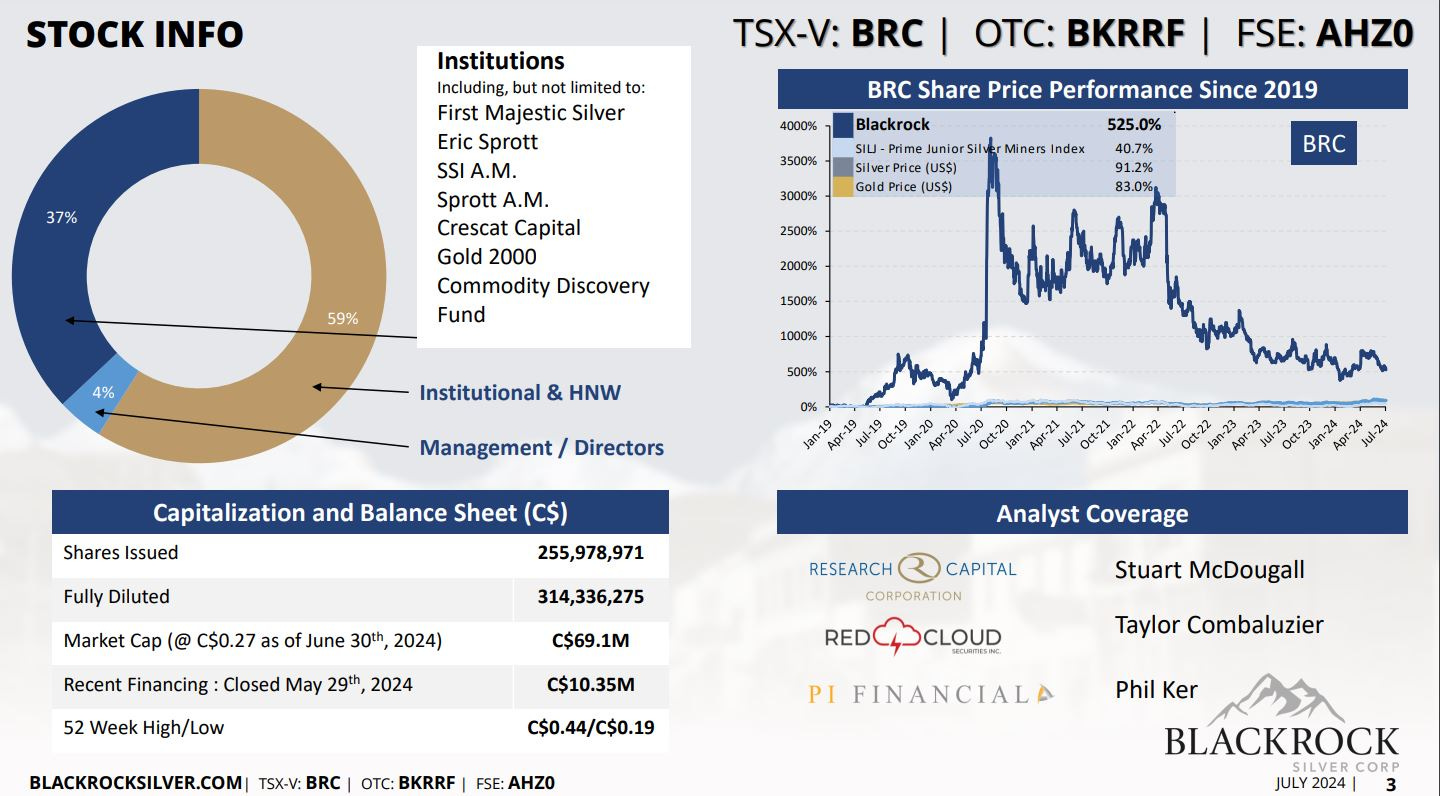

This brings up the point on key strategic shareholders: Eric Sprott, First Majestic Silver, Sprott A.M., Crescat Capital, the Gold 2000 Fund, and the Commodity Discovery Fund, hold 37% of the shares. Management holds 4%. That makes 41% of the shares held in very strong hands. Personally, I continue to believe that these funds and individuals have far more experience and bandwidth than I do to analyze the merits of Blackrock Silver and they are obviously positioned for a reason. As the silver sector wakes up out of it’s slumber, then is it reasonable to assume that silver equivalent ounces in the ground should be valued at $1? $2? $3? Or more?

If 100 million in-situ ounces were valued at $2 or $3 or more per ounce, then where could the market cap rise to?

As the 20,000 meters being drilled this year expands the resources further and upgrades categories and confidence in the deposit, then is that even being remotely factored in at today’s share price?

I’ve had the good fortune to regularly speak with the CEO, Andrew Pollard, getting periodic updates over the years, and know the personal drive he has and that their team has to make this project a viable takeover candidate. They are continuing to press on with drilling and growing the high-grade resources, despite the present market disbelief or disinterest. My personal thesis (not investing advice), is that Blackrock Silver will snatch victory from the jaws of defeat, as this silver bull market really picks up some traction over the next 1-2 years. From the present share-price and market cap levels, multi-fold gains over a couple years do not seem like a stretch. While the chart looks ugly now, it will be very curious to see how it looks 12-24 months out. Contrarian investing is always lonely… until the thesis becomes more obvious and then a euphoric crowded trade. Until then…

Thanks for reading and may you have prosperity in your trading and in life!

- Shad