Opportunities in Silver Explorers and Developers – Part 2

Excelsior Prosperity w/ Shad Marquitz – 06/08/2024

We are moving along to our next company to review in this new series on opportunities in Silver Explorers and Developers, and taking a look at Dolly Varden Silver (TSXV:DV) (OTCQX: DOLLF).

(In full disclosure, I have a reasonably heavy weighting inside of my own personal portfolio in a few of these silver advanced exploration / early-stage development stocks that we are covering in this series. I’ve not been commissioned by these companies to write these articles on Substack. This is not investment advice, nor am I suggesting that anyone position in these stocks. Rather, this is simply an editorial on the value proposition these companies demonstrate to my mind, and why I got positioned in them over the last couple of years.)

As far as investing in junior pre-revenue silver stocks, it should be pointed out that this is one of the riskier subsectors and stage of resource stocks within the precious metals sector. Riding these equities through bull markets and bear markets is definitely not for the faint of heart, and the stock price action can be wildly volatile. This, of course, also means that with that kind of volatility comes multiple waves of price rises and then price declines to potentially capitalize on for either swing-trading or position-trading. This volatility also provides ample opportunities to accumulate positions for the longer-term, by layering into a position over several buying tranches. This layered approach to scaling into a position, via multiple partial purchases, is a great way to smooth out the volatility, while building a good cost-basis over time.

With all of that said, let’s get into it…

Dolly Varden Silver (TSXV:DV) (OTCQX: DOLLF) is a company I’ve followed and been invested in for a long time… (trading the stock since 2015). There were 2 key factors that caught my attention to position in it initially: jurisdiction in the Golden Triangle, and Hecla as a senior mining neighbor.

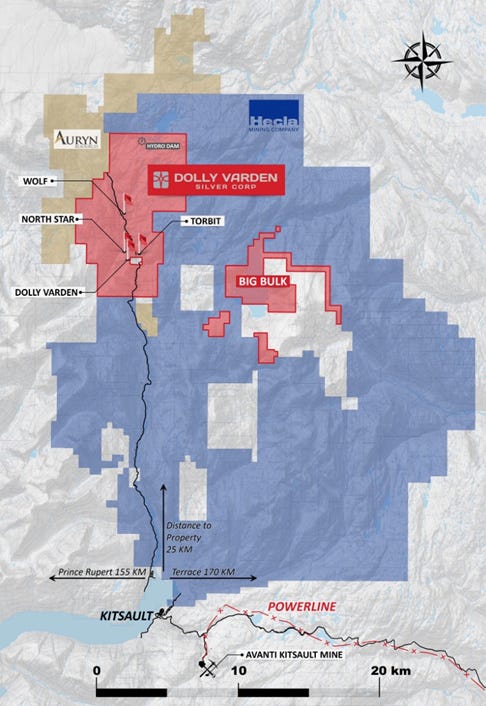

The primary interest for me in Dolly Varden stemmed from the desire to diversify my jurisdiction risk in silver stock exposure outside of the concentration in Mexico and Latin America and into Canada. As a long-time shareholder of Hecla Mining (NYSE: HL), I noted their massive Kinskuch Project surrounded Dolly Varden’s Torbrit, Dolly Varden Mine, and Wolf projects. It made sense to me that Hecla would eventually just absorb them, and I had postulated that a number of times on public chat boards.

Well…. Hecla did eventually make an attempt to acquire Dolly Varden back in July of 2016, after Dolly Varden had paid back a restrictive Hecla loan using a new Sprott loan. Hecla was playing hardball and was using their restrictive loan as a potential means for getting the project via a loan default. This forced the hand of the DV board at the time to take out the other loan to pay off the restrictive Hecla loan. When HL didn’t get the property that way, and saw their loan repaid, then they decided to go right for the acquisition of Dolly Varden. I figured that would be the end of my investing journey in DV, but was fine with the acquisition going through as a HL shareholder.

Dolly Varden Forms Special Board Committee in Response to Hecla’s Proposed Unsolicited Takeover Bid - July 4, 2016

What I was not expecting was for that prior management team to announce a poison-pill financing for $6Million to essentially block the takeover deal. (something that did not make Hecla very happy, and it ended up going to legal hearings where they tried to block this private placement from even happening).

Dolly Varden Announces Private Placement of Common Shares - July 5, 2016

https://dollyvardensilver.com/dolly-varden-announces-private-placement-of-common-shares/

In a manner of speaking, Dolly Varden had responded back to Hecla’s unsolicited takeover offer, (through their announcement of the private placement), with not just a no… but hell no! This poison-pill private placement initiative then went to legal commission hearings and Hecla was declined the request to stop the announced Dolly Varden private placement.

Dolly Varden Prevails at Commission Hearings - July 25, 2016

“The Commissions denied a request by Hecla Mining Company to stop Dolly Varden from completing a previously announced private placement financing and agreed with Dolly Varden that Hecla’s unsolicited bid for Dolly Varden was an insider bid and therefore Hecla must obtain and disseminate to the Company’s shareholders (at its own expense) an independent formal valuation.”

https://dollyvardensilver.com/dolly-varden-prevails-at-commission-hearings/

At the time, this was still a somewhat controversial move from management, as many felt it would have been better to let the deal go through with Hecla, as clearly it makes sense for them to bring that land into the fold with their larger Kinskuch Project. However, the whole unsolicited offer process wasn’t ideal for existing shareholders either, and so that was that and the takeover was off the table.

I’m starting off this article with this failed takeover bid saga from Hecla back in 2016 for a reason:

- Does anybody believe Hecla has forgotten this chapter of their history with Dolly Varden? (Nope)

- Don’t the projects still potentially make a lot of sense combined together in a larger project with a solid senior operator? (Yep)

- Hasn’t Hecla Mining maintained a solid strategic stake in Dolly Varden? (HL has a 15% stake in DV)

- Isn’t it reasonable to then speculate that Dolly Varden will once again receive a takeover offer from Hecla Mining? (that seems like a reasonably solid speculation and potential exit strategy in this company).

- If Hecla doesn’t make a bid for Dolly Varden (and I’ll be very surprised if they don’t), then there are still other companies that will appreciate the growing resources and consistent exploration success the team at DV has been having the last few seasons. It’s getting big enough to support stand-alone operations.

Moving forward in the investing story…. The management team at Dolly Varden changed shortly thereafter this whole chapter of the failed takeover bid, and in December of 2016, in came Gary Cope, as the new President and CEO and as a director of the board. Now, I had personally scored a nice win in Orko Silver Corp when they were acquired by Coeur Mining (NYSE: CDE) back in 2013, with Gary Cope at the helm, so I saw this new appointment by the DV board as a nice move in upping the pedigree of the management team for the company.

In 2017, 2018, and 2019 there was actually a substantial amount of solid exploration work done by Dolly Varden, particularly around their Torbrit deposit, but also in defining new high-grade silver mineralized trends across other targets on their property. While there were good drill results returned, the messaging from the company needed some work, as most investors were still asleep on the opportunity. Granted, the backdrop at that time was of waning sector sentiment as the blistering run higher in the PM sector in the initial 2016 “baby bull” phase of the new bull market, was being consolidated through time and a sideways-to-down trend.

Then in 2020, there was now a 3rd management change in the company, and in this case I personally feel it was “3 times a charm.” On February 18, 2020, the Dolly Varden board appointed Shawn Khunkhun as President, CEO, and Director, and has appointed Robert McLeod as a Director and technical advisor. Gary Cope resigned from his position as President and Director in order to focus on other business interests.

Dolly Varden Appoints New CEO and Adds New Board Members with Changes to Management Team - February 18, 2020

At the time, as a shareholder, I was interested to see how this baton pass in leadership would go, and just hoped that maybe now the company would work on it’s messaging and getting the vision of the Dolly Varden potential out to a wider audience. Shawn did not disappoint. He has done a fantastic job of properly capitalizing the company, bringing in the right kinds of geological expertise on the team to reinterpret many areas, conducted a fantastic acquisition of the Homestake Ridge project from Fury Gold consolidating the larger project, and the DV team has also grown the resources organically at the larger Kitsault Valley Project through the drill bit.

Over at the KE Report, I started having conversations with Shawn regarding Dolly Varden, in 2021, and from my very first encounter, came away impressed at his knowledge of the silver and gold markets, the capital markets, the opportunity at DV, and his sincerity and drive to move the company forward and onto the radar screens of more investors. I’ve watched Shawn grow for years in the interviews we’ve conducted with the company, on other platforms where he’s been interviewed, and from stage at conferences when he is presenting the company’s value proposition.

He is a fantastic communicator, and does exactly what a CEO of a company should do – paint the larger vision of where the company is, what they have achieved to date, and most importantly, where they are heading. Success leaves clues, and following along with the Dolly Varden newsflow for the last 4 years with Shawn at the helm is full of these clues, results, and key company milestones.

>> With all of that having been said, let’s dive into the current set up in Dolly Varden Silver:

As noted earlier, my initial interest was in diversifying some of my silver stock portfolio outside of Mexico and Latin America, and the Golden Triangle has been a hot area of focus in British Columbia, Canada for the big boy mining companies.

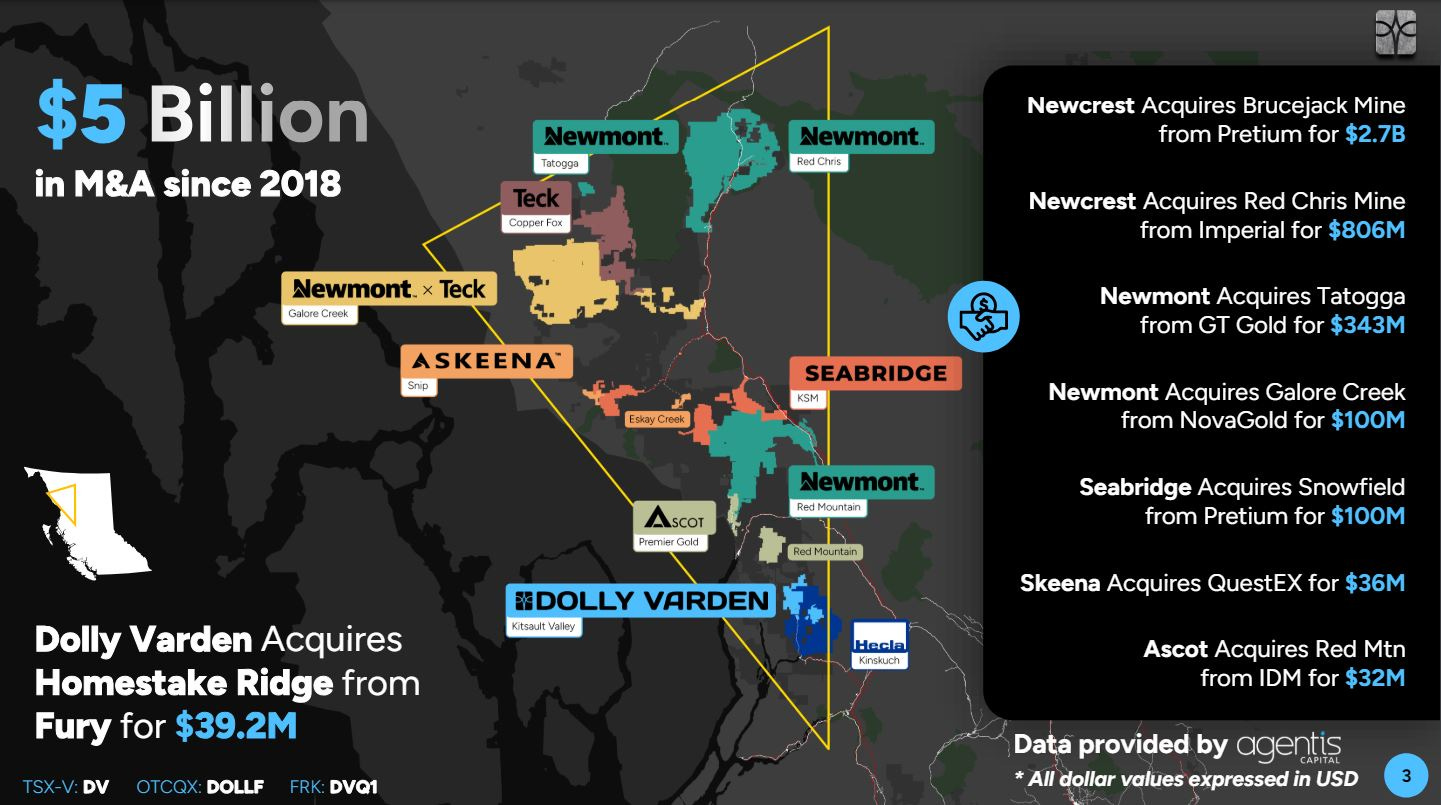

This slide from page 3 of the Dolly Varden Corporate Presentation highlights the $5Billion in merger and acquisition deals in the Golden Triangle just in the last half dozen years. You’ll also note that they highlighted their acquisition of the Homestake Ridge project from Fury Gold, which was a fantastic transaction for Dolly Varden to bring the 2 halves of this project together under the same roof and management team. This acquisition made all the sense in the world, and makes the eventual takeover of this combined Kitsault Valley project by a larger entity like Hecla, all the more likely.

Dolly Varden and Fury to Consolidate Emerging Canadian Silver-Gold District in the Golden Triangle - December 6, 2021

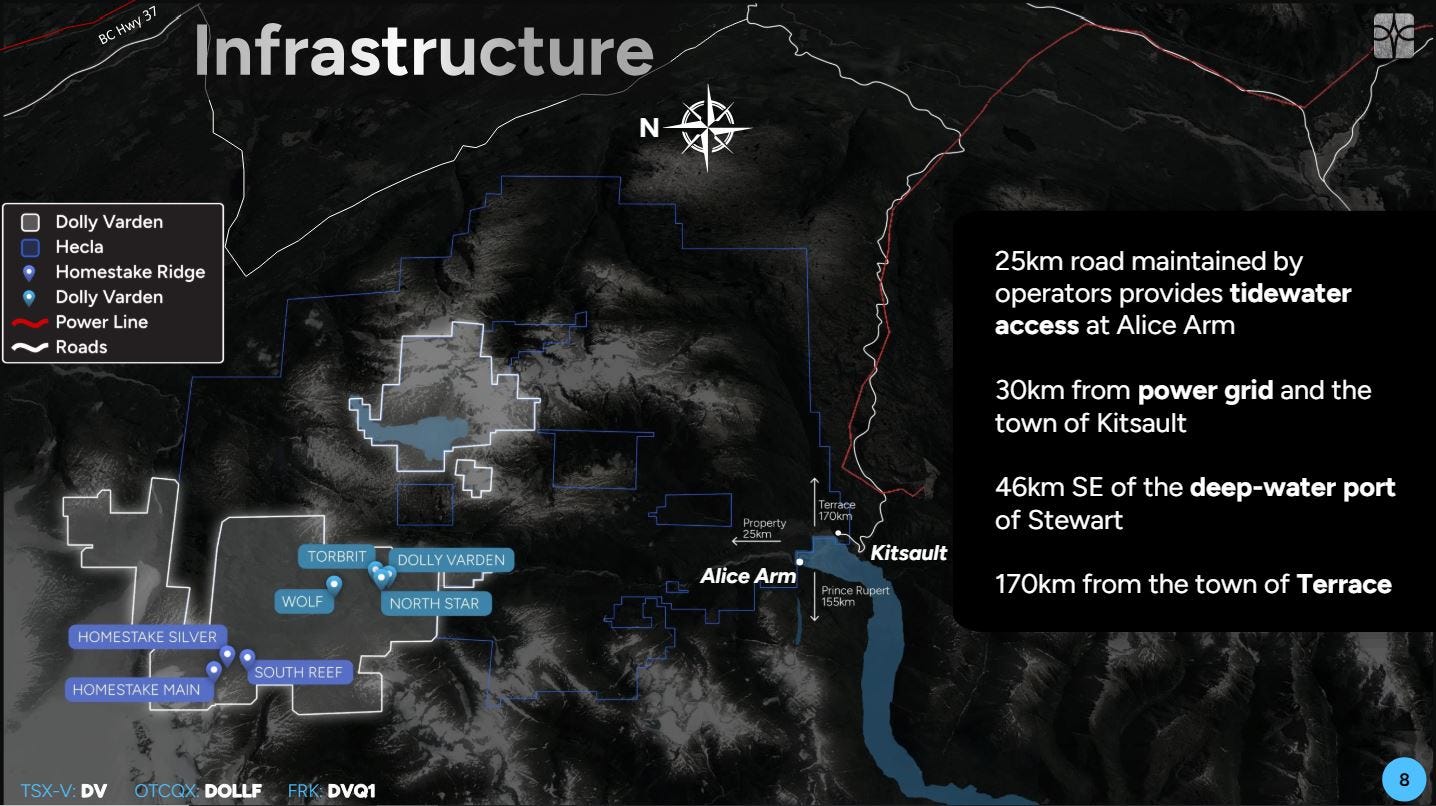

Dolly Varden have a rich history of past production, with mining starting back in 1919, where 20 million ounces of silver were produced from both the Torbrit and Dolly Varden Mine. Prior US president Herbert Hoover even had a period where he was heavily invested as part of the Taylor Mining Company before his presidency. Then in the 1950s Torbrit went back into mining and produced around 18 million more ounces of silver. Today there is plenty of infrastructure nearby, with the power grid and the town of Kitsault 30kms away, 25 kms to tidewater access in Alice Arm, and 46km to the deep-water port of Stewart, B.C.

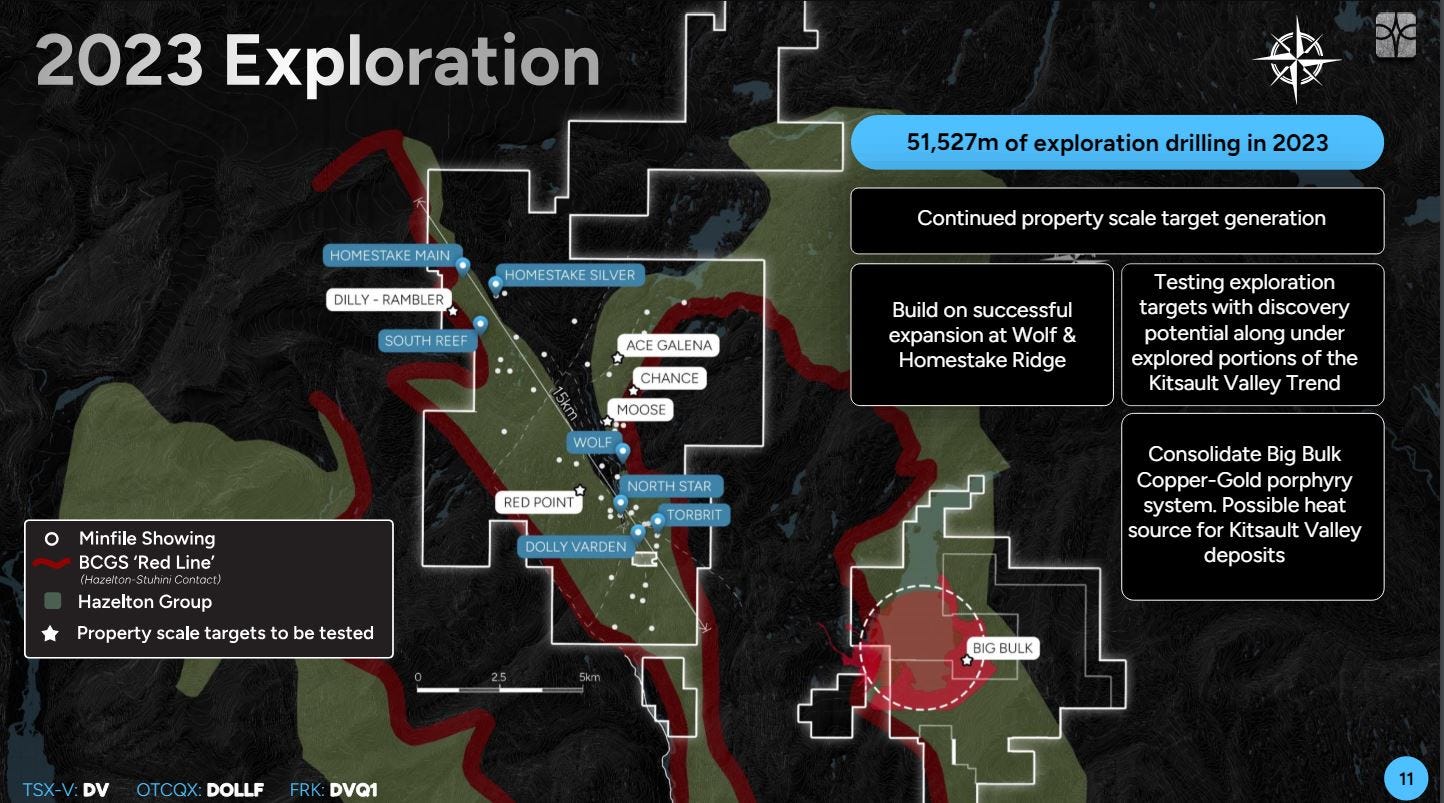

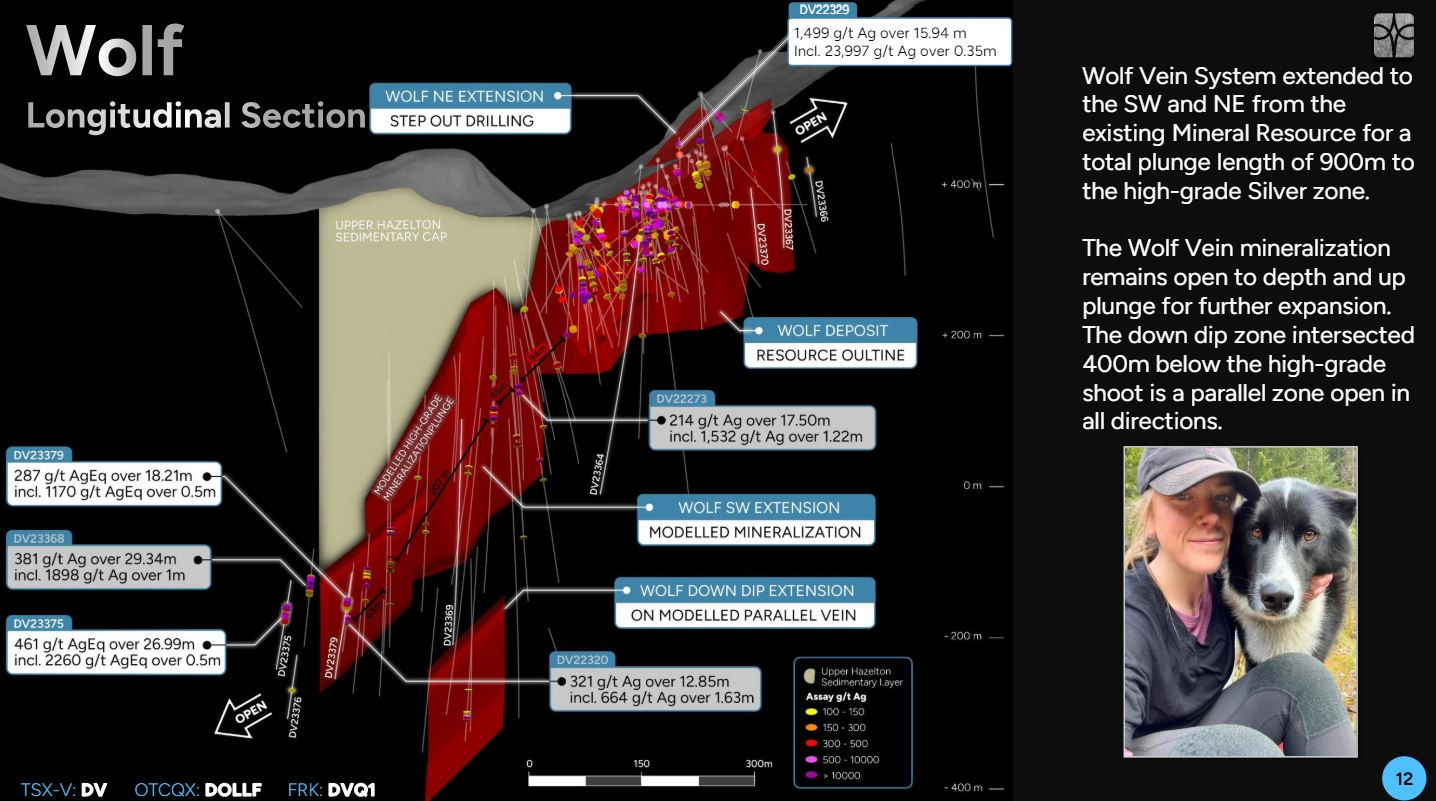

The exploration team at Dolly Varden has been delivering year after year uncovering even more mineralization at Torbrit, the Dolly Varden Mine, Wolf, and the Homestake areas of the project, but in particular, the step-outs from Wolf, and step-outs from Torbrit in the Kitsol Extension have been of particular interest on the silver side of the property. Then on the Homestake there are 2 areas of focus: Homestake Main which is more gold-dominant, and Homestake Silver and South Reef, which is more silver-forward but some areas also have a lot of gold.

Really, almost everywhere the team has stepped out with new drill pads and holes, they’ve found more mineralization and have grown the resources to 137,711,400 ounces of combined silver equivalent resources in all categories. If viewed through lens of combined gold equivalent ounces then there are 1,836,152 ounces of gold equivalent in all categories.

What is fascinating is all the drilling the exploration team at DV has competed in last year’s 51,527 meter drill program, where they continued to hit paydirt. The market noticed, and most of those results are not yet factored into the updated resources, so the project is obviously still growing in a meaningful way.

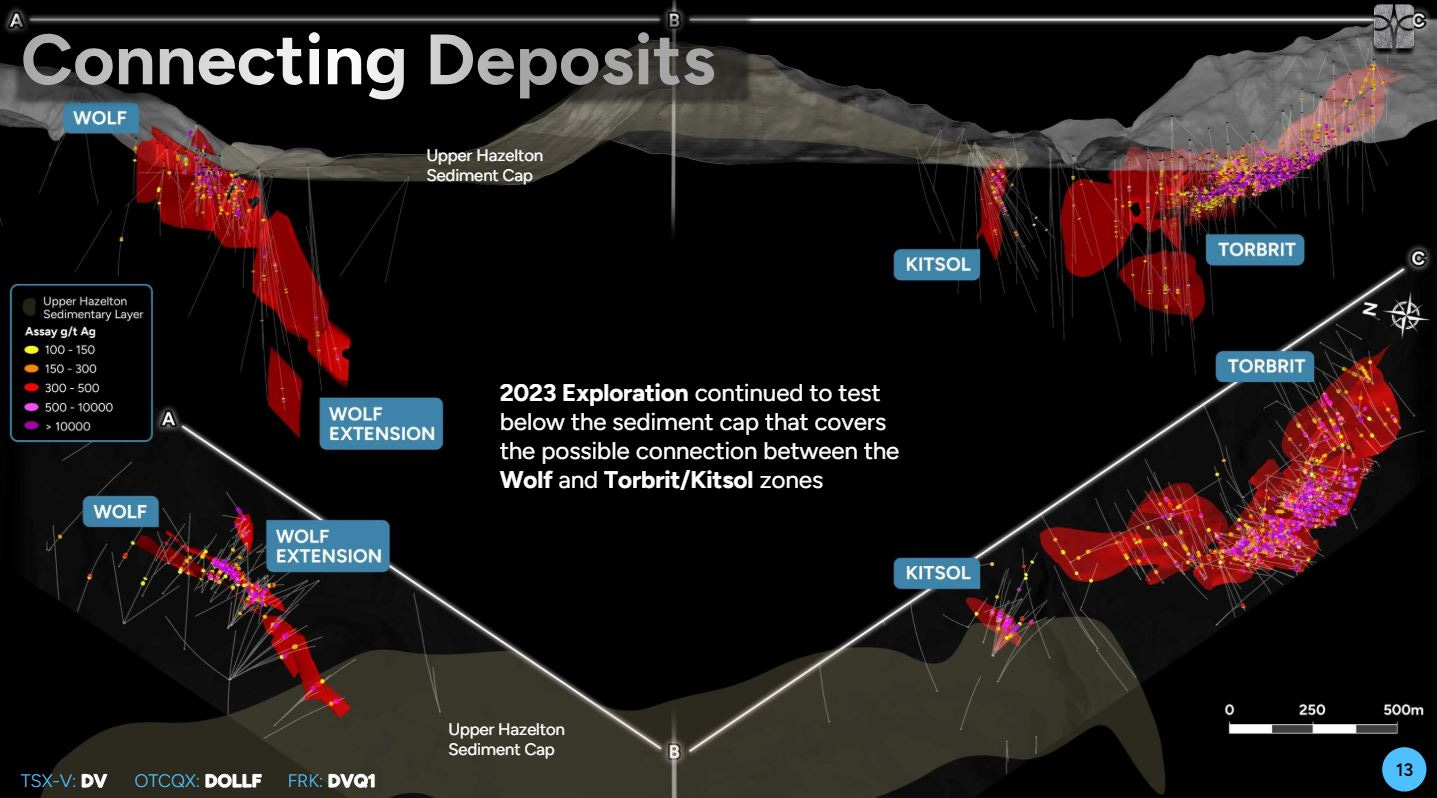

One of the ideas that fascinates me about this land package is the potential that it all ties together at depth. In talking with Shawn in prior meetings and listening to him outline this same point in a number of public presentations, the team is also testing the potential for all these separate deposits to be part of a larger system.

Fast-forward to 2024’s exploration program, where there is an initial 25,000 meters of diamond drilling planned, utilizing three drill rigs.

Dolly Varden Silver Outlines 2024 Resource Expansion and Discovery-Focused Exploration Drill Program - April 23, 2024

“The focus will be on following up on new discoveries as well as stepping out from wide, higher-grade intercepts from the 2023 drilling, particularly at the Homestake Silver and Wolf deposits. Mobilization will be in the first week of May, allowing for an earlier start on exploration than previous years due to a low snowpacks.”

“The drill program will be split approximately 50/50 between the Dolly Varden Property and the Homestake Ridge Property, with an overall project split of 1/3 to Homestake Silver deposit area, 1/3 to Wolf deposit area and 1/3 to project wide exploration targets with new discovery potential.”

“Our drill results from Homestake Silver were among the highest-grade gold and silver intercepts anywhere in the Golden Triangle in 2023; our priority with this early start is to continue with step-outs as well as infill drilling to confirm continuity of the potentially bulk-mineable mineralization. Further south, silver mineralization at Wolf remains wide open for expansion and this seasons’ introduction of directional drilling technology will allow for highly accurate placement of drill intercepts,” said Shawn Khunkhun, CEO of Dolly Varden Silver.

It should also be noted that Dolly Varden picked up an option agreement earn-in on the Big Bulk Copper-Gold porphyry project from Libero Copper at the end of last year. When combined with the exposure DV already had in the Big Bulk area, then this fills in another key area of land within the larger Hecla land package, and giving even more reason to have Dolly Varden brought under the HL banner at one point down the road. They also believe it could be the potential heat source for the larger mineralized trend.

Dolly Varden Silver Consolidates Big Bulk Copper-Gold Porphyry Property - December 20, 2023

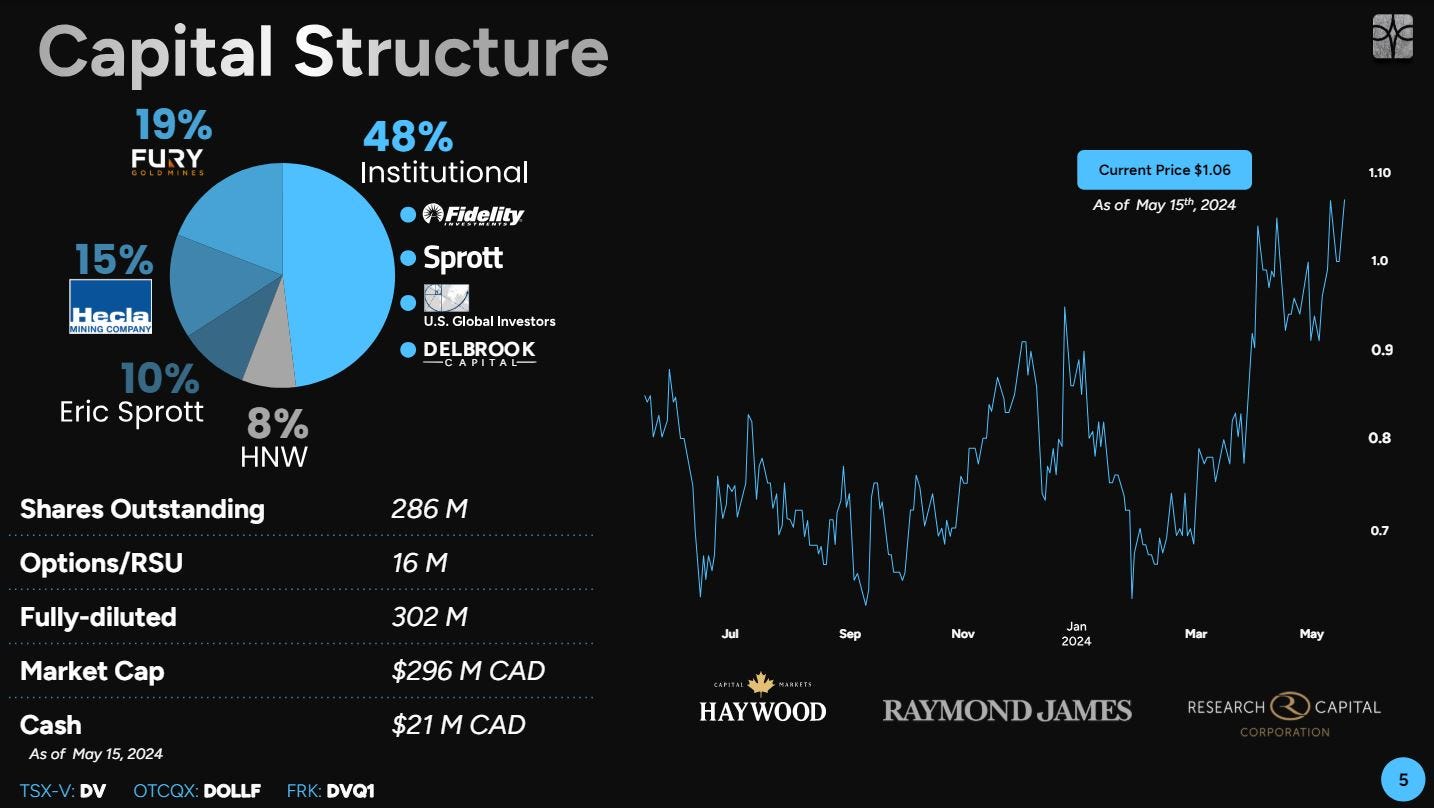

Wrapping up I think it is impressive to look at the key strategic shareholders in Dolly Varden today which include Fury Gold, Hecla Mining, Eric Sprott, 48% from institutional firms like Fidelity, Sprott, US Global Investors, Delbrook Capital, and then another 8% from high-net-worth individual investors.

I want to close this particular article with a corporate video from Dolly Varden, that was very well done, and lets people interested in this story hear from Shawn and the team about the value proposition for Dolly Varden Silver.

Reawakening of Past Treasures: Our Journey | Dolly Varden Silver

Actually, here is a bonus interview with Shawn Khunkhun, that we just released over at the KE Report on June 14th. We cover the strategies of this year’s drill program and a few of the distinguishing strengths of Dolly Varden’s value proposition.

Dolly Varden Silver – 25,000 Meter Drill Program Strategy, And Overall Company Value Proposition - June 14th, 2024

Thanks for reading and may you have prosperity in your trading and in life!

- Shad