Opportunities in Silver Explorers and Developers – Part 1

Excelsior Prosperity w/ Shad Marquitz – 06/02/2024

In this new series on opportunities in Silver Explorers and Developers, I’m going to mix in some future updates that are just a mashup of investment ideas on junior silver companies, but then other times just take a deeper dive into just one company. In this [Part 1] we’ll do just that and kick things off with a look into one these companies.

(In full disclosure, I have a reasonably heavy weighting inside of my own personal portfolio in a few of these silver advanced exploration / early-stage development stocks that we are covering in this series. I’ve not been commissioned by these companies to write these articles on Substack. This is not investment advice, nor am I suggesting that anyone position in these stocks. Rather, this is simply an editorial on the value proposition these companies demonstrate to my mind, and why I got positioned in them over the last couple of years.)

As far as investing in junior pre-revenue silver stocks, it should be pointed out that this is one of the riskier subsectors and stage of resource stocks within the precious metals sector. Riding these equities through bull markets and bear markets is definitely not for the faint of heart, and the stock price action can be wildly volatile. This, of course, also means that with that kind of volatility comes multiple waves of price rises and then price declines to potentially capitalize on for either swing-trading or position-trading. This volatility also provides ample opportunities to accumulate positions for the longer-term, by layering into a position over several buying tranches. This layered approach to scaling into a position, via multiple partial purchases, is a great way to smooth out the volatility, while building a good cost-basis over time.

With all of that said, let’s get into it…

AbraSilver Resource Corp (TSX.V:ABRA – OTC:ABBRF), is a company I’ve followed for a long time… Initially it was because of the drilling success a prior management team had in 2017, back when the company was called AbraPlata Resource Corp. I remember it was running higher on some solid exploration results back when many companies were conversely correcting. At the time I felt it had run too far / too fast and didn’t want to chase it. However, I did put it on a closer watchlist with an asterisk to keep tabs on it down the road. Then in July 2019, it was announced a new management team was entering the picture from a proposed merger with Aethon Minerals Corp., which then finalized in December of 2019. I saw that M&A news at the time, but initially, it really didn’t trip my trigger; because I didn’t really know about Aethon Minerals, nor the incoming management team.

I really must give a special hat tip here to my buddy Brian Leni (publisher of the Junior Stock Review), that first got me to take a more serious look at the company again back in early 2020, when he posted this article:

A Conversation with David O’Connor, Chief Geologist at AbraPlata Resources

March 18, 2020

When Brian writes about a company, I usually make a note of it, and really respect the way he looks at advanced explorers and development-stage companies. Then he appeared on the KE Report a few months later to discuss the company again in the summer of 2020.

Insights into AbraPlata Resource Corp.

June 25, 2020

https://www.kereport.com/2020/06/25/insights-into-abraplata-resource-corp/

This interview got me paying much closer attention, but I confess to hesitating and not acting on it in early 2020, and actually waiting to start trading it until later in 2020 and into 2021. I missed part of the move up for most of 2020, and then sold too it too early in 2021. It was just a nice trade for me at the time, but in retrospect, felt a little bitter-sweet about it, when the company just kept ramping up so much higher through mid-2021. I had my hands full at the time with a whole portfolio of other resource stocks, (well, nothing has changed in that regard as my portfolio is still crammed full of a lot of mining stocks – Ha!), and didn’t give it a lot more thought.

In March of 2021, the name was changed to AbraSilver Resource Corp (which was not really a big change as “plata” means silver in Spanish, but the thinking was to appeal to a larger base of international investors that would more readily pick up on the English word “silver” being in the name). I remembered noting their name change, and thinking “smart move” for branding and visibility purposes, and that the company had executed, had a lot of investor chatter, but that I had missed the opportunity already. They were drilling out the Occulto deposit in more detail by that time, and I felt like the value was mostly baked in.

Then a year later, in March of 2022, I got on a Zoom call with CEO John Miniotis, and Chief Geologist, David O’Connor, for the Swiss Mining Institute virtual conference, and out of all the meetings I sat through for that event, it was AbraSilver that really stood out to me. They had just made the new discovery at the JAC Zone, and it was higher-grade, and closer to the surface than what had been drilled out previously at Occulto. Occulto still had a solid resource in place and compelling economics, but the new holes coming back in from JAC were eye-popping grades and widths, and I remember saying “Wow! This could change the whole front-end of a development scenario if you keep finding mineralization like this.” Both John and Dave agreed, and noted that they were very encouraged by the results that had come in, and they had a lot more drilling to go. Right after that event, we started working with them as sponsors over at the KE Report, and I decided to start building a position in AbraSilver once again, for the potential drilling upside and due to what the JAC Zone could mean for this deposit. (So I’m biased in that sense with regards to this company).

Let’s fast-forward to today and we’ll look into where things stand in the here and now, over 2 years later…

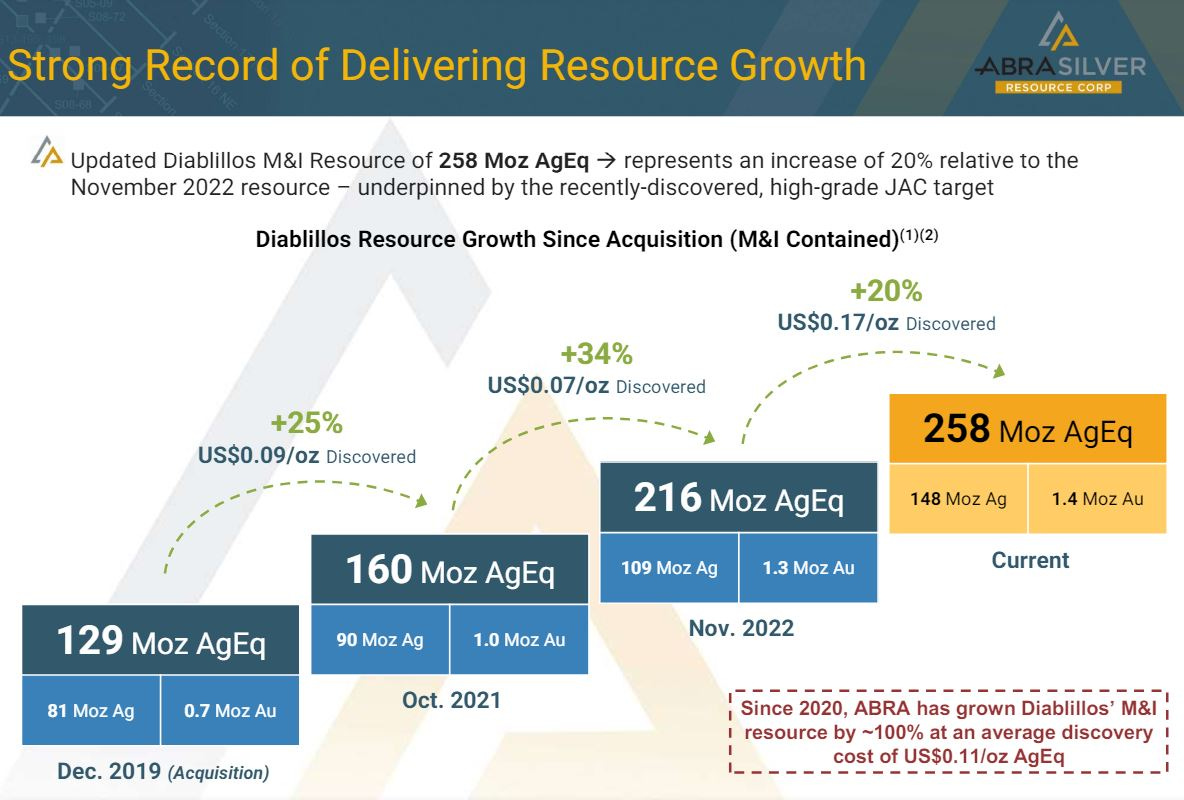

Dave and the exploration team continued to deliver in their drilling at both JAC, and also at other targets like Fantasma, Alpaca, Laderas, and more recently at JAC North. They’ve updated the resources a couple of times, and now are sitting on 258 million silver equivalent ounces on their overall Diablillos Project (which encapsulates all the deposits and targets aforementioned).

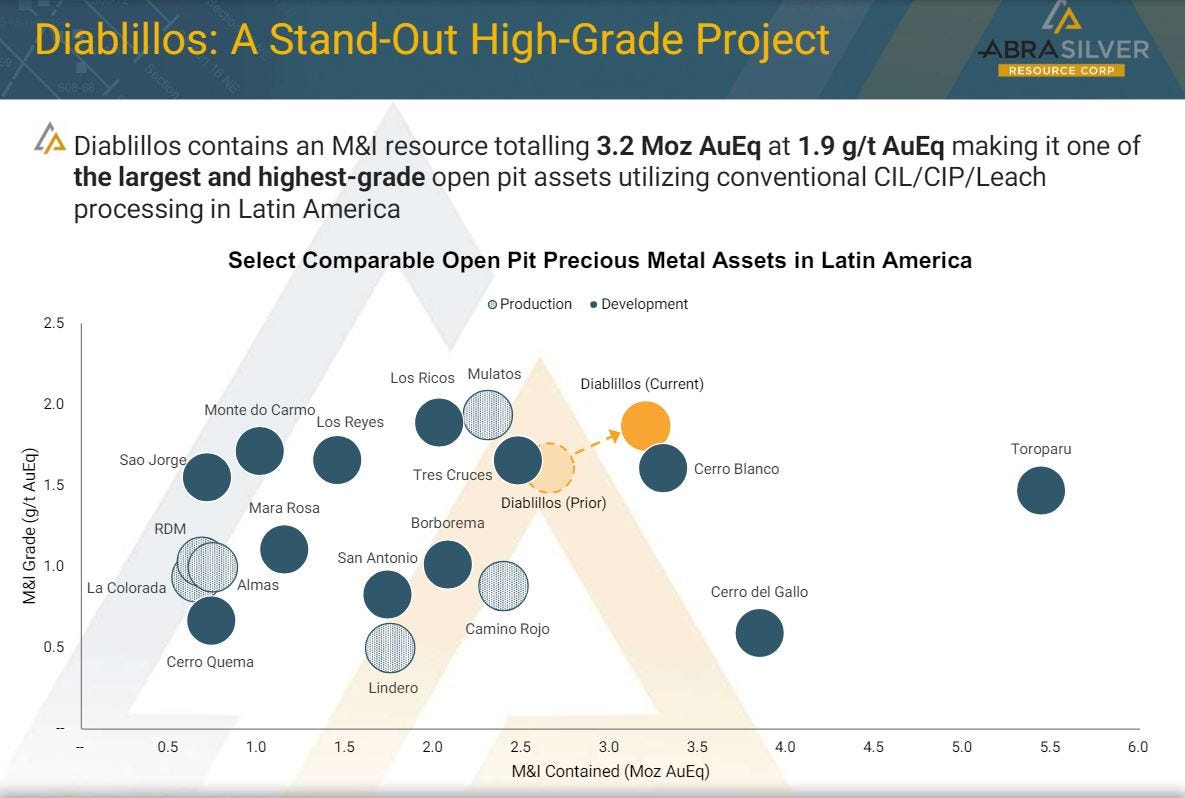

For those that prefer or are maybe more used to seeing resource estimates for gold companies, then another way of looking at the Diablillos Project is that they have 3.2 million gold equivalent ounces. It’s worth noting that when the gold and silver ounces and grades are combined through these metrics it is one of the larger and higher-grade open-pit development projects in Latin America, as demonstrated in the graphic below. I find this impressive, because there are not that many projects that have over 3 million ounces of gold equivalent resources, or 258 million ounces of silver equivalent resources. Additionally, I find it interesting that the co-credit with silver is mostly gold, but there is also some copper sulfides in the deposit at depth. Many supposedly “silver” companies, are actually more base metals companies with zinc, lead, copper but AbraSilver is really a true precious metals deposit with silver and gold making up the majority of the defined resources. That is rare.

In March 22, 2024 they updated to their economic studies, the Company released a very attractive Pre-Feasibility Study (PFS), with an NPV of CAD $672Million at a 5% discount rate, an Internal Rate of Return (IRR) of 26%, and a payback period of 2.4 years at a silver price assumption of $23.50 and a gold price assumption of $1,850. That’s an NPV per ABRA.V share of $5.37, where the stock closed last week at $2.37, so lots of room to be rerated higher, just based on that economic study.

What I find even more compelling is that they have a sensitivity table in their recent corporate presentation that highlights that if we look at the potential upside using prices we just saw last month in May of 2024, with silver prices at $31.25 and gold prices at $2,380, then it turns into a project with an IRR of 41%, an NPV of CAD $1,376Million, and NPV / share ($CAD) of $11.01 per share. That would be almost a 5x potential rerating higher from where the shares are trading currently at $2.35.

Now, most projects don’t achieve their full NPV value, unless getting bought out by another company (which is a definite possibility down the road with Diablillos), and maybe some investors believe (and rightly so) that an 8% discount rate should be applied instead of 5% rate. One can run the numbers at an 8% discount rate and still come away with a very compelling and economic project, that could still go up multiple-fold in valuation. It’s definitely not pricey at the current valuation.

I’ve had many conversations with management over the last couple of years, and they are starting to really outline how the drilling they’ve completed and development work they’ve integrated into economic studies is starting to pull together into a compelling mine development scenario.

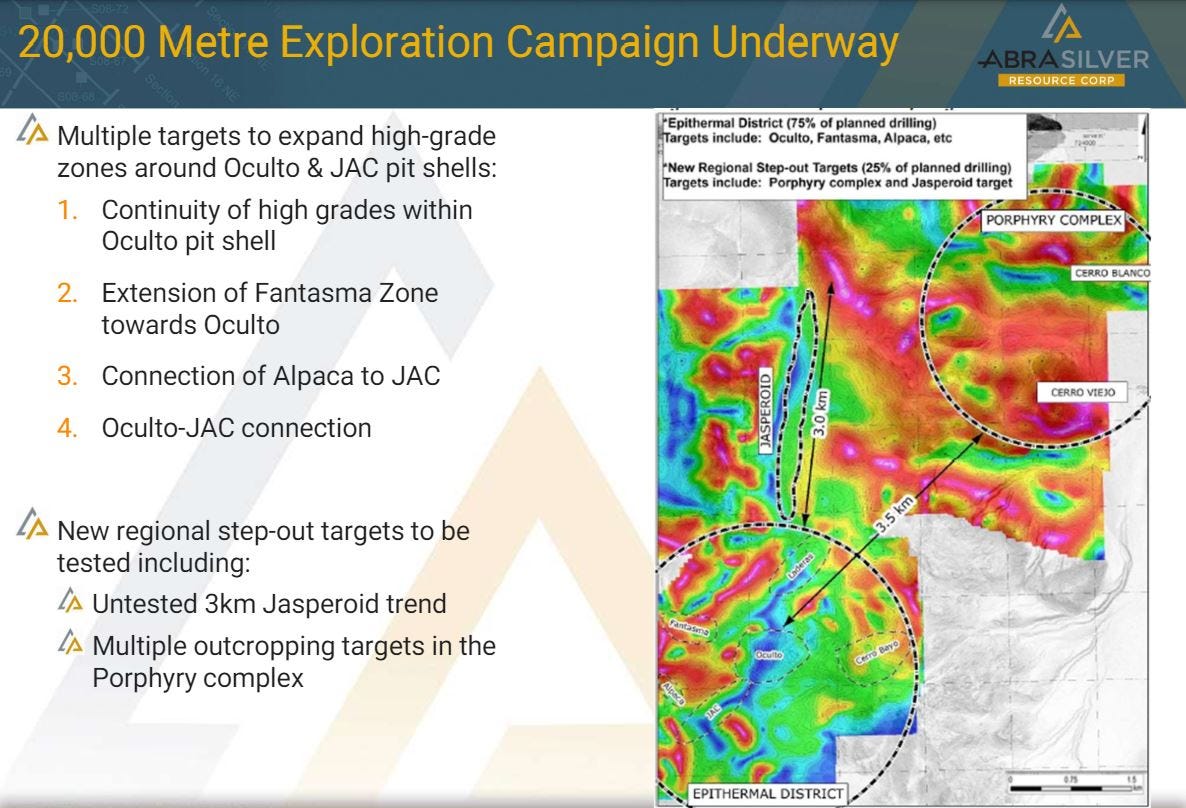

Just based on what they’ve already defined in resources, it looks to be a solid development-stage silver/gold project, that can stand on it’s own 2 feet. It has all the hallmarks of project that will likely become a legitimate mine. Any further rise in metals prices will only further underscore that point. However, what really animates me about AbraSilver is the exploration upside still on tap as they go back this year to keep drilling on JAC, JAC North, Alpaca, Fantasma, Laderas, Cerro Bayo, and a few new regional targets like Cerro Blanco / Cerro Viejo, and Jasperoid.

Early last month at the KE Report, I reconnected with John Miniotis, President and CEO and David O’Connor, Chief Geologist of AbraSilver Resource Corp to review their exploration strategy and a number of these key targets for the recently commenced 20,000 meter Phase 4 diamond drill campaign on its wholly-owned Diablillos property in Salta Province, Argentina.

John reviews how the drilling done to expand the known targets will feed data into future resource updates, where the exploration team is also now looking for more near-surface high-grade silver and gold oxide mineralization to expand and extend the front-end economics of a project development scenario. Then on the more discovery step-out drilling side of things, the exploration team is going to be going after regional sulphide targets focused on gold and copper.

Dave reviews that approximately 25% of the drill program will be focused on these new regional step-out exploration targets that remain largely untested to date. These targets include the substantial alteration zone and associated anomalous gold in historical shallow holes drilled at Cerro Viejo Porphyry Complex (Cerro Blanco / Cerro Viejo), located approximately 3.5 km northeast of Oculto. Following an electromagnetic survey the Company plans to drill select deeper holes to explore for an underlying porphyry system.

Then there is also the newly defined Jasperoid magnetic target identified in the geophysical survey conducted in late 2023. The zone follows the trend of a major north-south regional fault and a nearby historical drill hole intersected anomalous gold in vuggy silica. The geology of this zone makes it is a high priority target for epithermal gold-silver mineralization. Drilling activities have now commenced with one drill rig and two additional drill rigs are expected to arrive at the Project within the next few weeks, for a 3 drill-rig program.

AbraSilver – Exploration Strategy And Targets For The 20,000 Meter Phase 4 Drill Campaign

Another key development for this company was announced on April 24th, that outlined 2 new strategic investors coming into the Abrasilver stock, senior gold miner Kinross Gold (NYSE: KGC, TSX: K) and a large publicly traded utility company, Central Puerto (NYSE: CEPU), at 4% each. That is a big vote of confidence for the Diablillos Project, from 2 major companies, and further vets ABRA in a way and level of scrutiny that individual retail investors are unable to do. Additionally, the company very wisely, rolled back their shares in a 5:1 consolidation in tandem with this good news, just to tighten up the share structure.

AbraSilver Announces Closing of C$20 Million Strategic Investments by Kinross Gold and Central Puerto - April 24, 2024

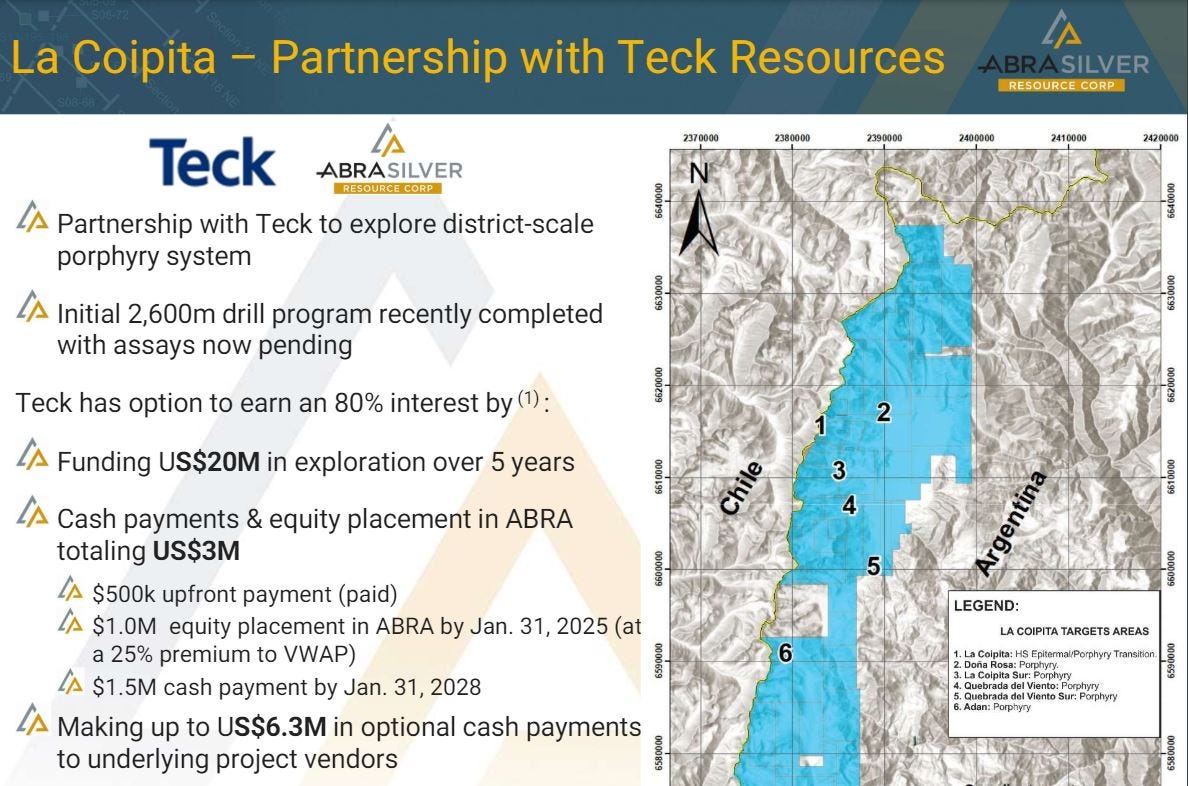

In addition to those 2 strategic partnerships at the Diablillos Project, the Company, also has their La Coipita Project, focused on large-scale copper discoveries, now in a JV partnership with senior base metals producer Teck Resources (TSX: TECK.A and TECK.B, NYSE: TECK), with the option for them to earn-in up to 80% on this project. This type of strategic partner with a big boy miner, is precisely what I want to see to compliment and help fund the exploration and drill programs for junior explorers. It is expensive to properly go after a copper porphyry or sedimentary or VMS system of size or scale, and really needs the capital support and expertise of a senior company to push the size and scale of exploration program forward that will be necessary.

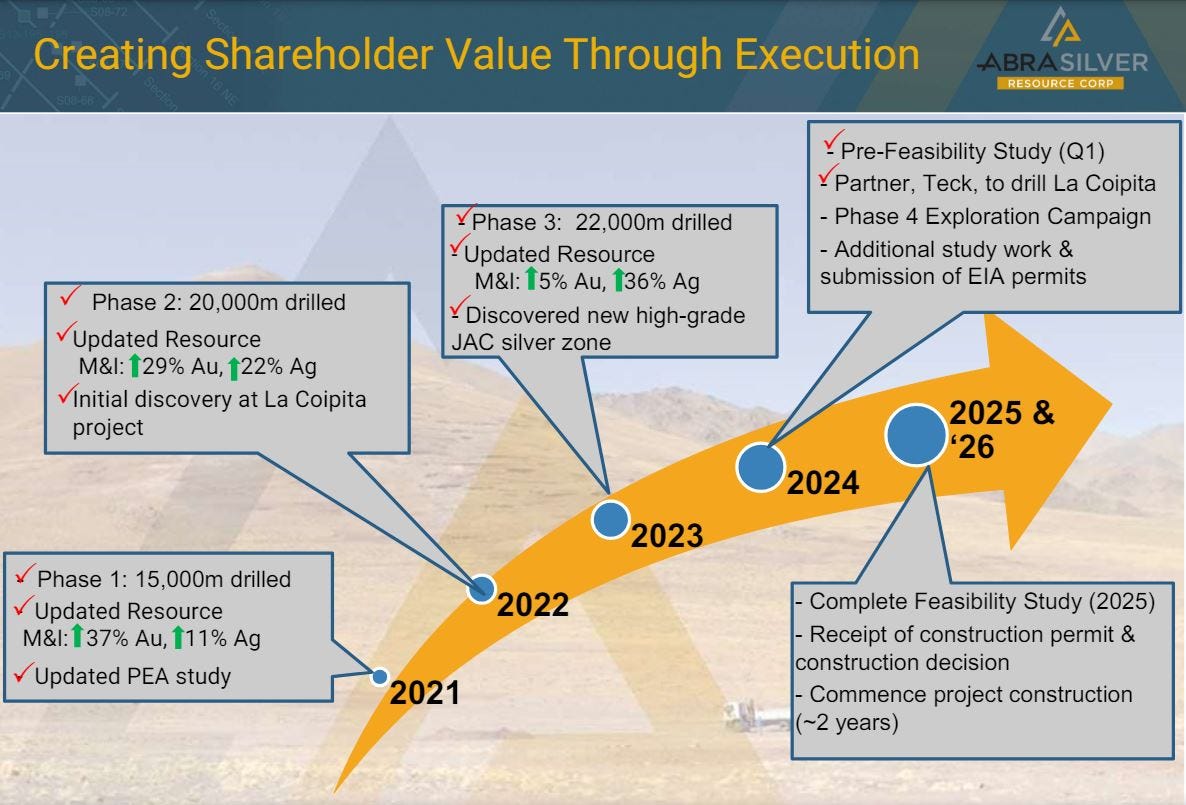

Wrapping up, there are number of key milestones the company has achieved over the last few years, that I still believe are very underappreciated by the markets, and they have a number of key milestones on tap for the next few years, mapped out to 2026.

For me personally, being positioned in Abrasilver for their Phase 4 exploration program, permitting work in process, and Feasibility Study due out in 2025, sets them up to have a large takeover target on their backs for late 2025 or early 2026. In the meantime, my thesis is that the company can keep rerating higher just based on the silver and gold they’ve already defined. However, if they further delineate some of the news zones to be similar to that of JAC then the rerating could be enhanced, and then if they really hit it big on any of the copper/gold exploration work on the regional targets at Diablillos or at La Coipita, then fuggedaboutit.

Kind of short-notice, but I also just found out that my friend and colleague, John Feneck, has a webinar Zoom call open for other investors to also join tomorrow on June 3 at 10am Pacific/ 1pm Eastern, with CEO John Miniotis. He said it was OK to share this with people in my network, so I thought it would be nice to include this option for readers here in Substack that see this note in time:

Join this AbraSilver Zoom Meeting tomorrow at:

https://us06web.zoom.us/j/86401155940?pwd=Q7JW6fqIzZe8W2CebOXw3h0LYz0Ems.1Meeting ID: 864 0115 5940

Passcode: 498592

Well that wraps us up for this first article on some of the opportunities presenting themselves in the silver exploration and development-stage stocks, with PLENTY more of these to come in this series over time.

Thanks for reading and may you have prosperity in your trading and in life!

- Shad