Opportunities in Silver Explorers and Developers – Part 4

Excelsior Prosperity w/ Shad Marquitz – 07/27/2024

We are moving along to our next company to review in this new series on opportunities in Silver Explorers and Developers, and taking a look at Vizsla Silver Corp (TSX.V: VZLA) (NYSE: VZLA).

(In full disclosure, I have a reasonably heavy weighting inside of my own personal portfolio in a few of these silver advanced exploration / early-stage development stocks that we are covering in this series. I’ve not been commissioned by these companies to write these articles on Substack. This is not investment advice, nor am I suggesting that anyone position in these stocks. Rather, this is simply an editorial on the value proposition these companies demonstrate to my mind, and why I got positioned in them in my own portfolio.)

As far as investing in junior pre-revenue silver stocks, it should be pointed out that this is one of the riskier subsectors and stage of resource stocks within the precious metals sector. Riding these equities through bull markets and bear markets is definitely not for the faint of heart, and the stock price action can be wildly volatile. This, of course, also means that with that kind of volatility comes multiple waves of price rises and then price declines to potentially capitalize on for either swing-trading or position-trading. This volatility also provides ample opportunities to accumulate positions for the longer-term, by layering into a position over several buying tranches. This layered approach to scaling into a position, via multiple partial purchases, is a great way to smooth out the volatility, while building a good cost-basis over time.

With all of that said, let’s get into it…

I’ve been following Vizsla Silver for about 4 years now and first got positioned in March of 2020, as the markets were falling apart in the middle of the pandemic. This was a busy time period for me as an investor, because I added to over 2 dozen positions in gold, silver, uranium, lithium, and base metals projects at that time; not wanting to miss the opportunity to buy when everything was on clearance sale.

Here is the post where I initiated a first buy on Vizsla (BUY:VZLA) on March 18, 2020 at 9:47am.

https://ceo.ca/vzla?ff8abe5a7f63

As stated that day, this was only an initial tracking position (which for me is typically a 10-20% sized position, and I then will layer onto that in more tranches of buying as I gain more confidence in the position). So, this was just where my Vizsla journey began, and I did layer in more in the weeks and months that followed. Since then I’ve actually traded around a core position dozens of times over the last 4 years. The takeaway point here is that I’d had Vizsla on my close watch list and had been waiting and waiting for a good correction to get positioned, stalking the stock…. so when the waterfall decline finally came, I was ready for it.

Anyone reading this should have their own watchlist of dream stocks they’d like to get positioned and then wait for the inevitable pullbacks the market routinely provides, to then start layering in if the valuation becomes too attractive to ignore. If there is another big exogenous world event (like Y2K, 9/11, the Great Financial Crisis, or the Pandemic Crash, etc…), then it could very well be that everything goes on sale all at the same time. Then it becomes an exercise in quickly prioritizing the stocks one must absolutely buy into the chaos. This may mean fortifying existing positions that have sold off below one’s cost basis, or it could mean initiating new positions, now that the market has brought you a gift of a valuation.

That was what I was seeing with Vizsla in March of 2020, a great entry into a stock I’d been watching for many months from afar, waiting for an opportunity to position. There is also nothing like putting your own money into a stock, to really sit up and pay more attention to the newsflow and price action. I liked the exploration news and ability of the management team, backstopped by Inventa Capital, to raise money and ensure future access to capital.

In early 2021 I started talking with the CEO, Mike Konnert, periodically as he came on the KE Report for news updates and interviews. I really liked Mike right away, as he’d mix in humor and candor, with really amazing news and information, and just seemed like he had a good handle on where things were moving with his company. Mike is really gifted at painting the big picture on just how significant their Panuco silver and gold district has been historically, and how it could grow into not just a meaningful deposit, but a meaningful modern mining district in Mexico. These discussions gave me even more confidence to press my position in Vizsla Silver.

We hear all the time about the importance of good management, and to stick with the winning teams that have brought you success before. One of the factors for me with Vizsla was seeing Craig Parry associated with it, as I’d done well with both NexGen and Skeena, when Craig was involved, so seeing he and Mike as Co-Founders of Inventa Capital gave me confidence that they’d be ensuring that this company had access to capital and was staffed by informed board members and directors. People that follow this channel will know that I also have been recently building a position in the uranium exploration company, Cosa Resources, where once again Craig is involved on the board level. I actually just shook his hand for the first time very briefly in May at the Energy Transition Metals Summit in Washington D.C., but have been quietly following his success for many years. Success leaves clues…

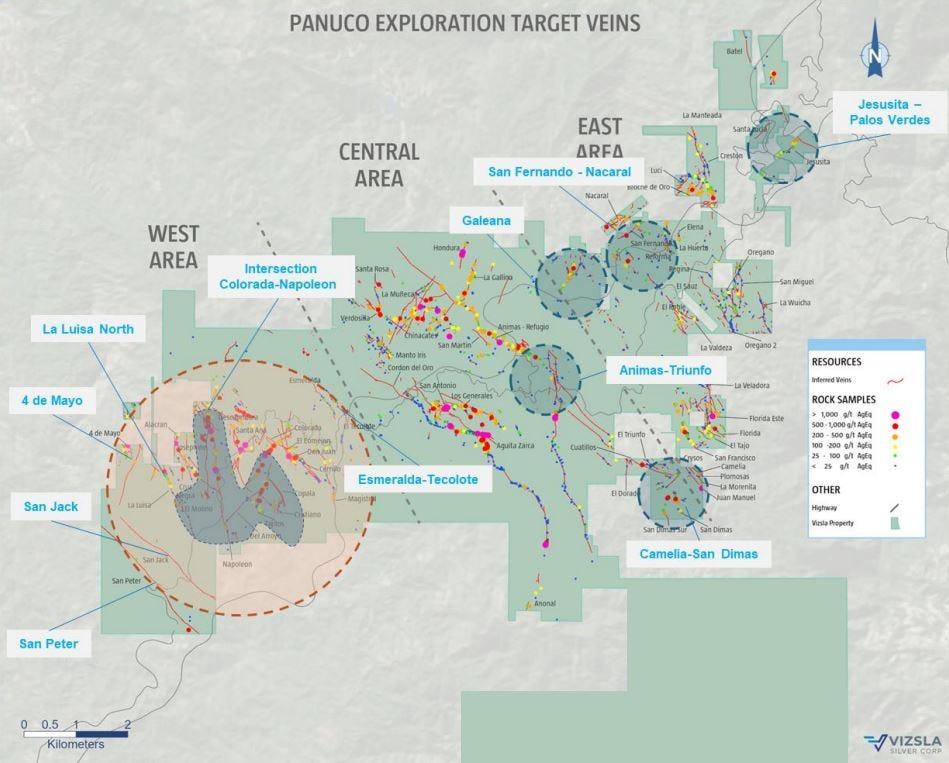

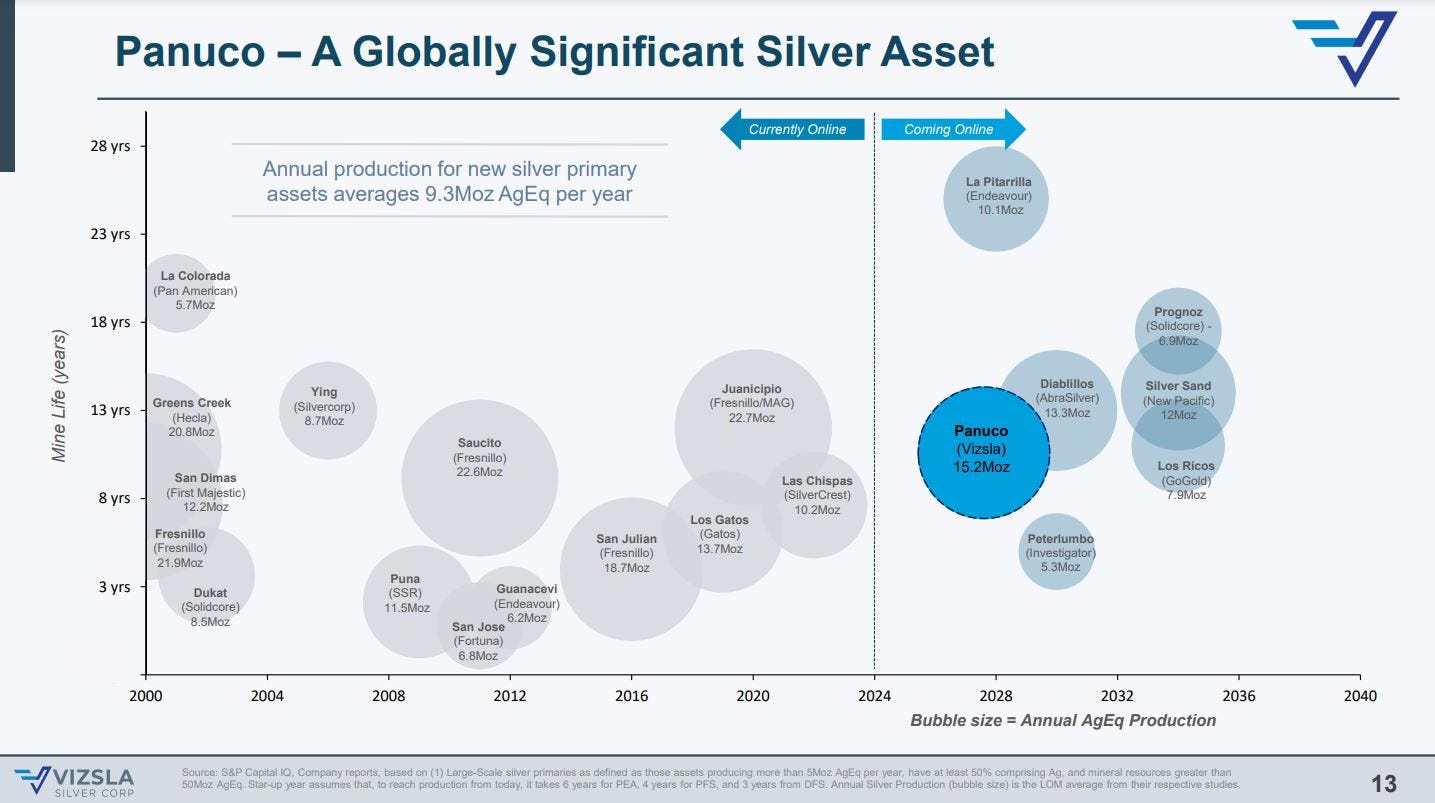

In addition to the good management team and board, Vizsla Silver has a simply huge land position with well-endowed mineralized prospectivity on their Panuco Project, and they’ve only explored a small portion of it so far. Now at face value, that may sound like the other 1,000 exploration drill plays out there that all think they are district scale and have “only scratched the surface.” Statements like that in the mining sector and quite trite and overused, but in the case of Vizsla in the course of just 5 years of exploration work they have already amassed a resource of 325 million ounces of silver (155.8 Moz AgEq measured and indicated + 169.6 Moz AgEq inferred), just from the Western Area, and what they are calling their “center of mass.” They really have so much more to still explore.

First of all, they’ve not really fully explored the Western Area yet and still continue finding new veins and making new discoveries there, year after year. But also - look at all those targets in the Central Area and East Area. For goodness sakes, they’ll need to clone themselves 2 times over just drill all those potential exploration targets! What if they also have 300-500 million ounces of silver equivalent resources in both of those areas? (that is just speculation on my part, but you can see all the veins and surface samples and future drill targets.)

I do agree with my friend and colleague, Peter Krauth, that it is easy to envision how this Panuco Project could grow to become a 1 Billion ounce silver district in the fullness of time. Speaking of Peter… he and I just had a great conversation on investing in silver juniors this last week, over at the KE Report; where we actually discussed Vizsla Silver, and noted all the optionality the company has with this giant land package and so many drill targets to go after in the West, Central, and East Areas. This should hotlink you right to that part of the conversation on Vizsla Silver:

Vizsla Silver currently has a 2-pronged approach:

1) Development objectives - They just updated the market with a Preliminary Economic Assessment. They are continually working on maintaining a healthy social license and advancing permitting, and plan to do another resource estimate with all of last year’s and this year’s drilling in the 4th quarter, and then further derisking through trial mining the end of this year in the Western Area

2) Keep expanding resources in Western Area and drill targets near the resource

A great 3rd objective would be to get to all that drilling at the Central and East Areas. The reality is that it would take a lot more capital and time to really drill those out in the same way that the exploration team has delivered at the Western Area. If Vizsla is moving towards a development and eventual production scenario over the next few years in the Western Area, of course, it would be nice to have all that upside in the other 2 areas, but right now they are not getting any value for them from the market. If a larger company was to make a move on Vizsla Silver in a takeover acquisition, then those projects could also be spun out into Vizsla 2.0, which is an idea Peter and I tossed around in the interview linked above.

I’m sure for now they want to keep all those projects under one roof, but it is an enticing prospect to think that there may be 2 more massive deposits there in the Central and East Areas, and whether that means a producing company has a truly district scale property, or if 3 different companies eventually produce from 3 different projects remains to be seen. The point being is, they have optionality with a land package this large.

Rather than spinning out these concessions, at least at present, they are doing the opposite – They’ve actually been adding on more prospective land concessions to their Panuco Project.

VIZSLA SILVER TO ACQUIRE LARGE CLAIM PACKAGE ALONG HIGHLY PROSPECTIVE STRUCTURAL TREND, SOUTH OF PANUCO - APRIL 16, 2024

While we are talking about spinouts…. Let’s also note that Vizsla took a page from the Great Bear success story and in January of this year announced the spinout of a royalty on it’s Panuco Project to existing shareholder.

VIZSLA SILVER TO SPIN OUT NET SMELTER ROYALTY TO SHAREHOLDERS – Jan 17, 2024

The Royalty consists of: (i) a 2.0% net smelter return royalty on certain unencumbered concessions comprising the Project; and (ii) a 0.5% net smelter return royalty on certain encumbered concessions comprising the Project which have a pre-existing 3.0% net smelter return royalty

I remember being at the Vancouver Resource Investment Conference (VRIC) in January, and hearing a few other silver companies trash talk this decision to put a net smelter royalty in place on the Panuco Project. Some analysts also published reports that were critical of this decision from management, feeling that they played that card a bit too early based on the stage of company they were. Critics thought that they lost the potential upside of working that royalty into their capital stack in a development scenario; much closer to when it could go into production.

I walked over to visit very briefly with Mike at their Vizsla booth and mentioned the knives were out, and he was surprised as he’d only had positive feedback about the royalty spinout from the folks he was speaking to. He asked me how I felt about the decision as a Vizsla shareholder? My response back was, “Oh… I love it! And think it is wise to give existing shareholders, in position now in the growing years, the future upside of the royalty exposure, in the event a hostile takeover bid comes in.” He smiled and said, “Exactly. Well there you go.” I smiled and let him know I remained a happy shareholder and walked away thinking to myself, “where there is one position in my portfolio that I don’t have to worry about.”

Fast-forward past all kinds of great drill results, metallurgical testing, engineering studies, and other derisking and out came a banger of a Preliminary Economic Assessment:

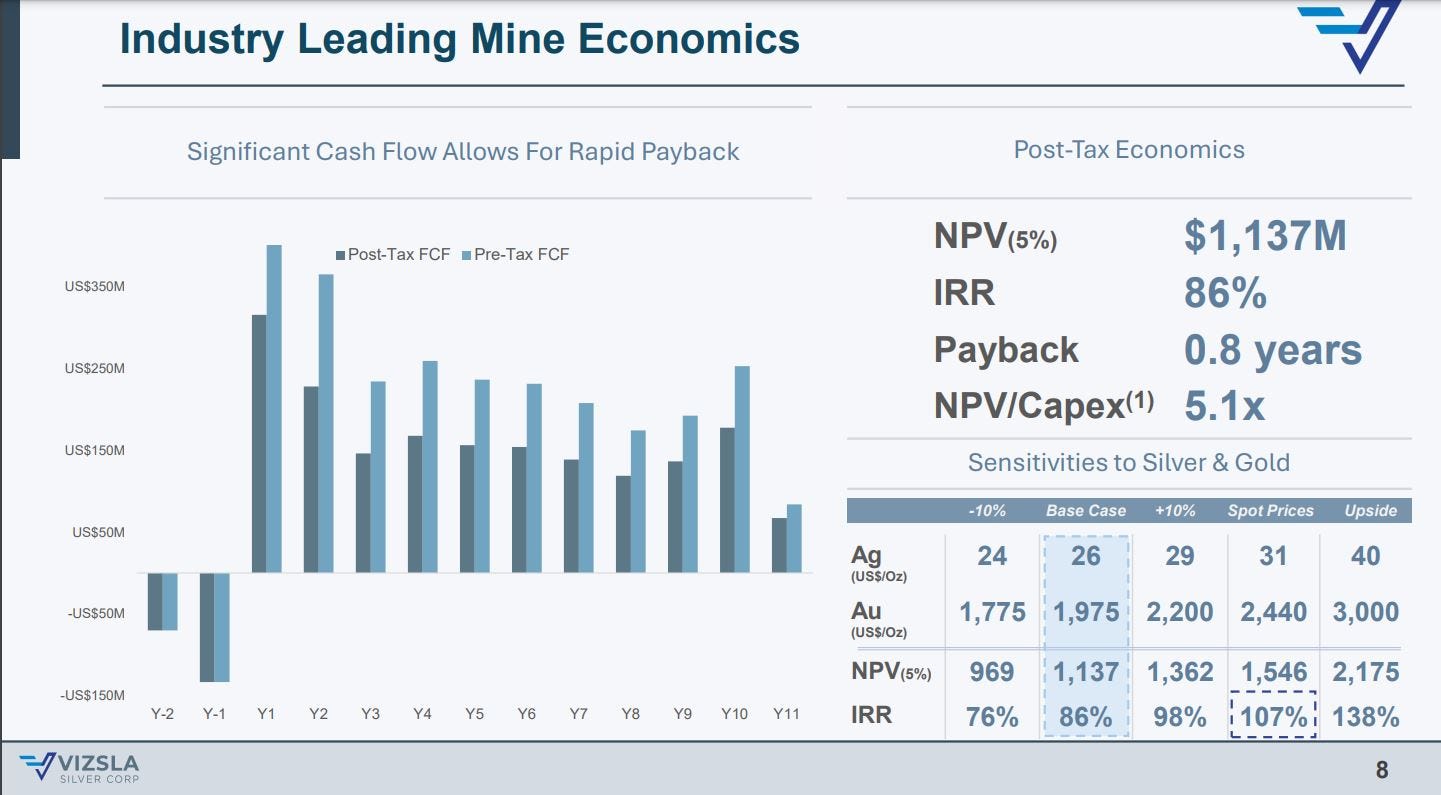

Now, most people I’ve talked with thought it was a fantastic PEA where there is an 86% Internal Rate of Return and a Net Present Value of $1.137Billion with a payback period in under a year (8 months). The initial capex at $224Million is not very onerous and it gives that NPV/Capex state of 5.1x, which is rare to see on economic studies. The sustaining capital is a bit high at $230Million though.

I’ve seen some silly comments on internet chat forums though, where people called the “base case” metals assumptions ridiculous or too high. What? $26 Silver and $1975 Gold is too high? Silver was just above $31 a few weeks back and is likely heading into the mid $30’s to low $40s over the next 2 years, and gold has been above $2000 for many months now (and peaked above that level for years now) and is hovering between $2300-$2400 at present. Now, could the precious metals pull back lower again – of course. However, they have the sensitivities metrics in there for that with $24 silver and $1775 gold, then the IRR is still at 76% and the NPV is still near a $Billion at $969Million. Bottom line, even if metals go down dramatically from here, this project is going to print money.

I’ve seen very few defending the upside potential… even at the recent metals prices we just saw in May, with $31 silver and $2440 gold, the IRR spikes up to 107% and $1.546Billion. How about if silver and gold do move to where many technical analysts, (me included), believe it is headed at $40 silver and $3,000 gold? Well at those levels (which are not hard to imagine by 2025-2026), the IRR is 138% and the NPV is $2.175Billion. Show me some more projects like that please mining industry.

Now some folks are critical of the 5% discount rate to calculate the Net Present Value, and rightly so, but that is what the industry has been using for many years now in peer economic reports. For them to put out something with a higher discount rate does not allow for comparing it easily to other projects that also all used a 5% discount rate. I think an 8% discount rate, or maybe even a 10% discount rate may be more appropriate for all mining projects, but people can do their own math there and still come away with the realization that this is going to be an incredibly economic project, even at a higher discount rate. [Put those constraints on other projects and see how they fare…]

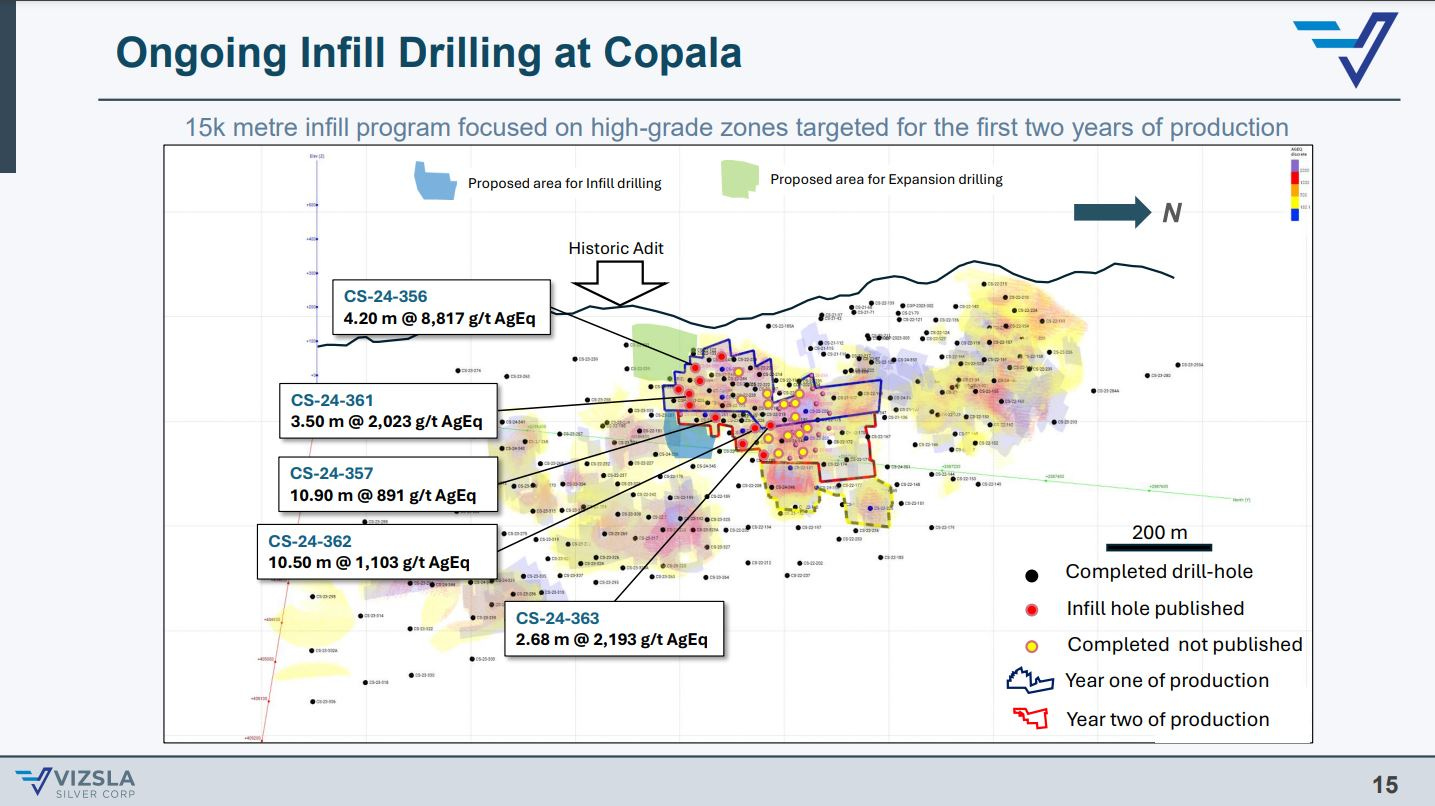

Keep in mind that when a PEA is generated, that this is where the project metrics and value of this project are estimated if they found nothing else. Critics and near-sighted investors are forgetting an important point though – this is all based off a resource where the drilling was cut off in 2022, and all of last year’s drilling in 2023 and this year’s drilling in 2024 is not yet included and will be coming out in the upcoming resource estimate slated for Q4.

Is it reasonable that the resources are going to expand? (if you’ve been following their stellar drill results then you already know the answer to that question)

If the resources expand, and grade improves, and metals recoveries improve, then is it possible that future economic estimates will be even better? (Yep)

Most investors are so myopic on what just happened, or a recent quarterly report, or in this case a moment in time summed up in a preliminary economic assessment. They have recency bias, and can’t make the mental leap of where a project is going moving forward, because they get stuck on one data point or one moment in time. Investors would be well-suited to consider the philosophy that Wayne Gretsky so famously stated, “I skate to where the puck is going to be…”

So in this example, people are splitting hairs over where the metals price assumptions are at, or the discount rate that should be used, but are missing the larger point… the project is huge, economic, and Panuco is going to be a mine. However, the company has done a massive amount of drilling the last 2 years not even factored in yet, and they are still working on optimization methods. Additionally, we are still far from seeing this precious metals bull market hit a mania level, which will happen at much higher prices. So… if you skate to where the resource and economics of the Panuco puck is going, it will be at much higher levels than this PEA anyway…. That’s why they call these initial economic projections “preliminary.”

For anyone truly interested in learning more about the company vision, the PEA economics, the development work underway, and the exploration upside, then I’d recommend listening to the interview my partner over at the KE Report, Cory Fleck, conducted with CEO, Michael Konnert, just this last week and hear it straight from the mouth of management:

Thanks for reading and may you have prosperity in your trading and in life!

Shad