It Is Official – Copper Just Made New All-Time Highs

Excelsior Prosperity w/ Shad Marquitz (03-26-2025)

Just last week, on March 20th I wrote an article:

While Gold and Gold Stocks Continue To Shine, Dr Copper Has Been Starting To Dance Like Nobody’s Watching.

https://excelsiorprosperity.substack.com/p/while-gold-and-gold-stocks-continue

In that article I quipped that Dr. Copper is “dancing like nobody’s watching” playing on the whole Dr. Copper putting on his dancing shoes motif, mixed with the lack of interest, discussion and overall focus from retail investors on what has been happening lately in this sector.

We reviewed that copper looked to be breaking out of two different W-shaped double bottom patterns, and it was in a bullish posture.

I mentioned in that article that “Copper bulls will want to see pricing close above that $5.199 level from last May.”

Yesterday, on Tuesday March 25th, copper closed the day at a new all-time high of $5.21 (a whole copper penny above last May’s prior ATH of $5.199).

It’s now official. Copper is at new all-time highs and we are seeing follow through in the early morning trading here on Wednesday March 26th.

In overseas trading copper gapped up to $5.37 but has since been consolidating in the $5.23-$5.30 range.

We could reflect on what Dr. Copper is suggesting about the outlook on the health of the economy and global growth… However, then we’d likely get snared up in all kinds of countervailing macroeconomic forces from tariffs to GDP to manufacturing to calls for stagflation and recession in the US, and then over the stock market rallies in Europe and China. While those topics are fun to debate and opine on, nobody really knows what is going to unfold in an economic sense, domestically or abroad.

The great part about looking at pricing charts is that it strips away the incessant spinning of narratives from the mainstream financial media. Ultimately the narrative doesn’t really matter.

What matters is price, and the copper price is breaking out to new all-time highs here and now. It is always significant when any chart makes a new ATH.

Copper stocks have been responding, but not as much as one would expect in a commodity making record high prices.

Let’s take a look at the Global X Copper Miners ETF (COPX):

What jumps off this chart is that the (COPX) price close yesterday at $43.32 [when copper closed at it’s all-time high of $5.21] is nowhere close to where it closed last year at that $52.00 May peak [at essentially the exact same copper price of $5.199].

Are these same copper producers suddenly 17% less valuable at the very same copper price just less than a year later? (No, that would make no sense)

What has changed is sentiment and pricing momentum in the copper stocks. You can tell this by going into resource chat forums or just by following the coverage that many resource investing outlets have been pumping out (almost exclusively focused on gold, tariffs, and maybe a little focus on silver).

Resource investors are asleep at the wheel on this move higher in copper, and the early stirrings in the copper equities back into upward moves. That is an opportunity hiding in plain sight, especially if we see this trend continue to accelerate to the upside.

Investors that are positioned or that get positioned in the larger copper producers should be in a good situation. For those folks that don’t want to take on the individual company risk of a larger copper producer, then ETFs like (COPX) or (ICOP) or (COPP) are good ways to play a range of copper miners, diversifying the risk, and capturing the sector beta to the underlying metals price.

For those that are comfortable taking on more risk with pre-revenue explorers and developers, then let’s do a quick review of the copper junior stocks we’ve already discussed here in this channel, looking for potential opportunities to capitalize on moves in this sector.

Opportunities in Copper Explorers and Developers – Part 1

https://excelsiorprosperity.substack.com/p/opportunities-in-copper-explorers

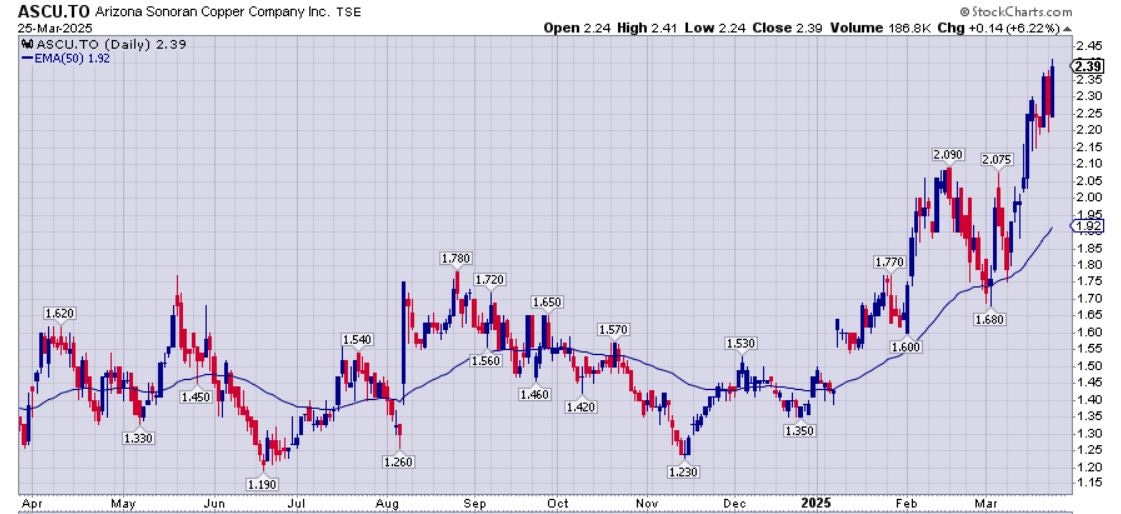

In that [Part 1] article, we highlighted a handful of quality copper juniors: Arizona Sonoran Copper Company (TSX:ASCU) (OTCQX:ASCUF), Surge Copper (TSX.V:SURG – OTCQX:SRGXF), Faraday Copper (TSX.V:FDY – OTCQX:CPPKF), Metallic Minerals (TSX.V:MMG – OTCQB:MMNGF), Cascadia Minerals (TSX.V: CAM) (OTC: CAMNF).

Out of that batch of companies, my two heavier weighted portfolio positions are in Arizona Sonoran and Faraday.

My preference at this point in the cycle is to lean towards the more derisked juniors, and that is why Arizona Sonoran has been my heaviest weighted pre-revenue copper holding.

Let’s do a quick update on this company as it has been very busy with important press releases thus far in 2025.

Arizona Sonoran Announces C$19.9 Million Strategic Private Placement with Hudbay - January 9, 2025

· “Hudbay Minerals Inc. (TSX, NYSE: HBM) has agreed to subscribe for 11,852,064 common shares of the Company in a non-brokered private placement at a price of C$1.68 per Common Share for total consideration of C$19,911,467.”

· “Hudbay will hold a 9.99% interest in ASCU, following the closing of the Private Placement.”

That strategic position by Hudbay is big news for Arizona Sonoran, because it brings in another potential suitor for this company, and adds to the strategic partnership with Rio Tinto’s Nuton Technologies division.

Arizona Sonoran Provides 2024 Recap and 2025 Work Plan - February 4, 2025

https://arizonasonoran.com/news-releases/arizona-sonoran-provides-2024-recap-and-2025-work-plan/

There is too much density of information in that press release to get into here in this article, but I encourage interested readers to open it up parse through all the success bullet points the company has had last year and moving into this year. They’ve successfully raised capital a few times, then came out with a PEA on the whole Cactus project, that now incorporates all the exploration success and new resources at the Parks/Salyer deposit, and they’ve outlined their new open-pit mining approach to developing this Project.

On February 25th the company announced that they are continuing to have success with the drill bit as they do further infill drilling at Parks/Salyer hitting another long economic copper intercept.

Arizona Sonoran Reports the Southern Extension of the High-Grade Core at Parks/Salyer through Infill Drilling, including 391 m @ 0.74% Total Copper

The Arizona Sonoran stock has continued to rip higher over the last several months, essentially doubling in price from the November trough at $1.23, and blasting up to close yesterday at $2.39. This is an example of where a quality derisked project is getting the bigger bid versus speculation on other earlier-stage drill plays that are simply looking to make a discovery.

On our last Weekend Show on March 22nd, over at the KE Report, Joe Mazumdar, Editor of Exploration Insights, shares his insights on recent breakouts in gold, silver, and copper. He highlights strategic investments by producers in juniors, the importance of jurisdictional advantages in the U.S. He singles out Arizona Sonoran as a company he is also bullish on due to their ability to produce copper cathode, versus having to produce a concentrate and then send it over to China, like many copper companies (making those other companies subject to the tariffs). I also ask Joe to elaborate on why he is giving the strategic position from Hudbay Minerals more weighting than the prior strategic investment from Rio Tinto’s Nuton Technologies division.

The link below should jump listeners to that part of the discussion on copper and Arizona Sonoran from the 19:07 - 25:40 minute mark.

Joe Mazumdar & Dan Steffens - Gold, Copper, Nat Gas & Oil Stocks: Sector Trends and Opportunities

Moving on in the universe of pre-revenue copper stocks, let’s have a look at the 2nd part in the series focused on some of the other junior names to watch in this sector.

Opportunities In Copper Explorers And Developers – Part 2

https://excelsiorprosperity.substack.com/p/opportunities-in-copper-explorers-24f

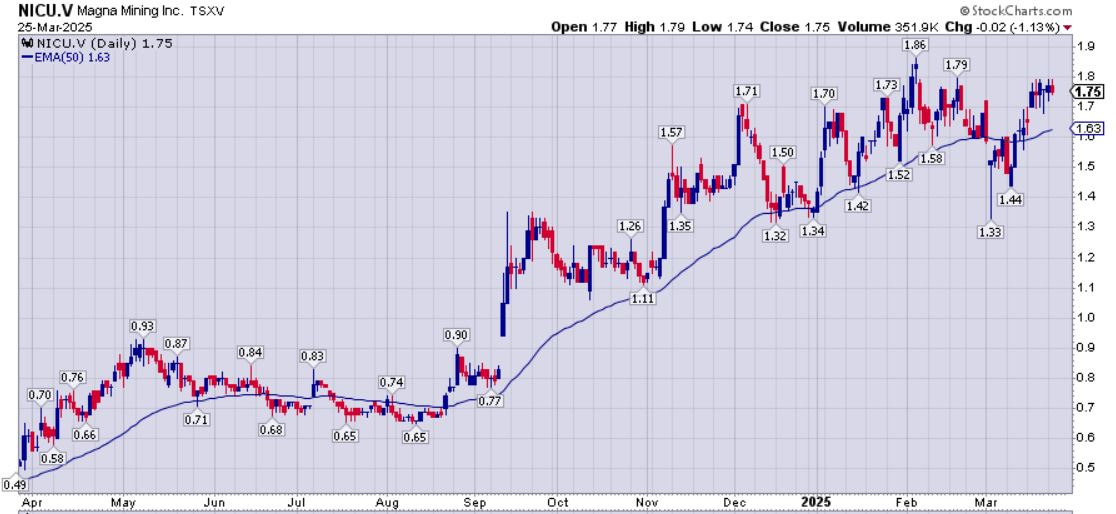

In that [Part 2] article from that series, we once again highlighted a handful of quality copper juniors. We kicked it off once again with updates on Arizona Sonoran Copper Company (TSX:ASCU) (OTCQX:ASCUF) [noticing a trend here?], but then shifted over into 2 quality copper exploration and development companies run by CEO John Black: Regulus Resources (TSXV:REG) (OTCQX:RGLSF) and Aldebaran Resources Inc. (TSXV:ALDE)(OTCQX:ADBRF). We then circled back to news updates and an interview with Faraday Copper (TSX.V:FDY – OTCQX:CPPKF), and ended with the big news from the Beaver Creek PM summit where Magna Mining (TSX.V: NICU) (OTCQB: MGMNF), which had just made a transformative acquisition of a producing copper mine, several other prior producing copper mines with exploration upside, and a whole package of other copper/nickel/PGM exploration and development projects.

There is a lot of meat on the bone in that [Part 2] article linked above, and it was one of my most opened and read articles from last year, so there is clearly some interest from investors looking at these copper juniors. Regulus, Aldebaran, and Faraday have continued to grow resources, derisk their projects, and have been seeing and uptick in their shareprices lately as copper has been running.

We’ve already taken a deeper dive into Magna Mining in this more recent article on Opportunities in Polymetallic Producers, and they remain the only primary copper producer I hold in my portfolio at this time. Again, I prefer to use the ETFs for the copper producers for my exposure, but Magna Mining was too good of a developing growth story for me not to have exposure to. For those that missed that article, we also dive into Luca Mining (TSX.V: LUCA) (OTCQX: LUCMF), that has 22% copper production in their overall metals mix, so the red metal is a meaningful contributor.

Opportunities In Growth-Oriented Polymetallic Producers – Part 1

https://excelsiorprosperity.substack.com/p/opportunities-in-growth-oriented-ad9

The pricing action in Magna Mining has remained in a strong uptrend and it is back above the 50-day Exponential Moving Average in a bullish posture. They couldn’t have picked a better time to go into copper production with the red metal at all-time highs.

One more article from last month, that I’d point readers here back to, was the one where I recapped my main takeaways from the World Outlook Conference.

Gold, Silver, Copper, Oil, Nat Gas, And World Outlook Conference Recap

https://excelsiorprosperity.substack.com/p/gold-silver-copper-oil-nat-gas-and

While there at that conference on Feb 6th & 7th, the copper stock that most captured my interest at this conference was NorthIsle Copper & Gold (TSX.V:NCX). CEO, Sam Lee, did a great job of delivering the value proposition at their North Island Project in northern Vancouver Island, BC. The project currently has a resource base of 3.1 billion lbs of copper (indicated) and 6.9 million ounces of gold (indicated); with even more metals in the inferred categories.

Their NCX chart has really ripped higher since that conference, gapping up in price right afterwards. It has finally been getting the overdue rerating that they deserve for delineating those substantial copper and gold resources.

The good news for readers here is that most copper juniors have not run nearly as much as Arizona Sonoran, Magna Mining, or Northisle Copper & Gold. Many of the sector companies are just starting to wake up from their slumber, so there are still plenty of opportunities to pounce on copper producers, developers and explorers before they run any further.

As a reminder, for those that don’t like individual junior company risk, there is also a relatively new and well-allocated Sprott Junior Copper Miners ETF (COPJ). It is a good trading vehicle and diversified way to get exposure to some of the mid-tier producers, smaller producers, and larger developers within the copper sector and it has a big board listing (unlike some of the juniors).

Again, just like with COPX, it is interesting to see that COPJ at higher underlying metals prices is still far below where it traded last May at the same prices. To my mind, there is opportunity here for a catchup trade {not investment advice… just sharing my thesis}.

Well that wraps us up for this article on the break out to new highs in copper and some different potential ways for investors to participate in this constructive underlying price environment.

Thanks for reading and may you have prosperity in your trading and in life!

· Shad