Opportunities In Growth-Oriented Polymetallic Producers – Part 1

Excelsior Prosperity w/ Shad Marquitz (03-02-2025)

In this series we are going to dive into opportunities in growth-oriented polymetallic mining stocks that are producing at least 3 or more different metals out of a mining complex; giving them a diversified blend of assets. First though, let’s start off this series with a brief primer on polymetallic stocks:

These companies are a bit harder to categorize, since they often span the spectrum of both precious metals and base metals in their production mix. As we know, each metal’s pricing is moving separately from the others, meaning that a given mix of metals is always fluctuating in combined value, and changes over time. Sometimes there are hidden opportunities when analyzing this niche within the resource stocks, and that is what we are going review over this series. Some polymetallic developers and producers in this subsector have been doing quite well recently in share-price performance. We are going to review 2 of these newer polymetallic producers later on in this article.

Now, one could make the legitimate argument that most mining stocks are polymetallic, because most companies produce a range of several metals. However, in some deposits, mines, and even overall companies, it is clear that their main payable is gold or copper or iron or uranium. Often times though, it is not so simple…

There are very few primary silver deposits, as most are a mix of silver-lead-zinc-tin or silver-copper or silver-gold. We could make the case that majority of “silver” resources or “silver stocks” are really polymetallic projects. We are still going to cover those in the series in this channel on “silver” stocks.

Most nickel projects are often accompanied by other metals like platinum, palladium, copper, and sometimes gold.

Most PGE (Platinum Group Elements) projects are conversely accompanied by other metals like nickel, copper, and gold.

There are actually a number of primary copper deposits; but the copper is still often accompanied by a range of other metals as bi-products.

These types of polymetallic deposits are complicated, but they can be quite valuable and quite lucrative to mine.

These polymetallic companies are harder for investors to value when reviewing the drill results and mineral resources in polymetallic terms, or quarterly production reports from operations, because they don’t have a primary single-metal focus.

It is a challenge for most people, including many geologists and enthusiastic rock nerds, to quickly assess drill intercepts that include 4 or 5 or 6 different metals in it, and then separate out mentally which ones could actually be economic and extractable as a payable component. Some companies define which metals are really payable, and other companies just include all the reporting metals in there as part of their marketing efforts. Sometimes it is so early-stage in exploration that they legitimately don’t even know which metals are going to be economic or impactful in the mix, so they just throw them all in their press releases.

There are times where drill hits or estimated resources are shrugged off that are actually fantastic, when one considers the sum of the parts; but they are initially too difficult for most people to decipher. Other times the market gets all jacked up on polymetallic results, because everyone else is excited about the mix of metals present; but most folks haven’t thought through whether or not some of the metals will even make it into the concentrates, and if so in what percentages.

Then it gets wilder and weirder if higher priced specialty metals or critical minerals show up in the mix in meaningful ways. The company may get on their megaphones and market to it “Hey, we’ve got antimony, tungsten, geranium, cobalt, lithium, or rare earths!” That may be true, but it may not be a deposit that even has significant enough amounts to actually be worth the candle to develop. This makes it very difficult for an investor to be able to make a snap decision on if a given exploration result or resource estimate is subpar, ok, good, or great.

Sometimes a metal will be present but not in large enough quantities to really matter, and yet other times the mix of metals can be very valuable co-credits.

Sometimes grades will seem too low in the accompanying metals to be legitimate contributors in simple extraction method. (ie… heap leach)

Sometimes the combination of metals may complicate or prevent a simpler processing method from working correctly, adding in processing complexity.

There have been a lot of industry improvements to processing different ores. Sometimes there will be multiple steps involved with pulling out a certain recoverable amounts of a given metal with multiple step processes or separating the metals into different concentrates.

This is when we see all those complicated flow sheets. There may be a front-end gravity circuit to knock off the coarse gold before the remaining material enters flotation circuits, and carbon-in-leach or carbon-in-pulp circuits, or maybe a step that includes electrowinning the copper, or a high-pressure processing of other metals like manganese, or a crystallization or advanced separation process for rare earths. They key is to define what will work and at what percentages.

Sometimes everything is just shipped to smelters with more advanced facilities that can separate out all the different metals, and with different payable values. Typically this is more of a boon for the smelters, as they often don’t pay the mining companies on some of the lessor metals present, keeping those profits for themselves.

Then there are the smelter penalty metals: like arsenic, mercury, cadmium, thorium, and fluorine and sometimes even prized specialty metals like antimony, manganese, germanium, bismuth, and tellurium can receive penalties from a smelter for processing base metals (due to the complexity and costs involved).

To deal with all these complexities around polymetallic deposits, many companies will try and streamline things for investors by converting all the metals over to a single metal equivalent; (ie… a silver equivalent, copper equivalent, or zinc equivalent).

This is a blessing and a curse.

It definitely helps to have a single metal equivalent for wrapping one’s head around the larger headline metrics like the overall quality of a drill intercept, or size of a deposit, or ounces or pounds produced, as a means of comparing the project or company to others.

Converting it all over to a silver or copper equivalent gives an investor some familiarity with how a project or the results stack up to other peers, but it can give unfair impressions as to the true importance of the metal being singled out for the equivalent calculation.

Sometimes it really is the co-credits carrying the economics or carrying the production revenues. There are examples where the equivalent metal is only 30% or 40% of the actual value, and yet the company is branded as a “silver” or “copper” or “nickel” or “platinum” or “palladium’ company. The truth is they are polymetallic, and so all those moving parts need to be analyzed.

Many savvy investors insist though that the metals each be broken out separately, so they can see what percentages of each metal actually makes up the single metal equivalent calculation… and rightly so.

Sometimes there are a bunch of metals that get lumped together as in-situ value to show a larger combined value, but it is rarely quite that simple.

It is unfair to count the value of all the metals present at 100%, and yet some companies do so, and some retail investors fall for it.

Maybe they’ll only get 70% recoveries on one metal, and 80% on another, but maybe one metal needs to report to a specific concentrate and only gets 40-50% recoveries. Just because they are present doesn’t mean they’re 100% recoverable.

To get the actual ratios and values of each metal involves all kinds of metallurgical studies and engineering studies to flush out what a deposit is actually worth in the later stage economics. It takes time to refine this data.

So, even the people that want see all the metals broken out separately, still won’t know for a long time which ones actually count and what specific value they bring to the economics of the project. These analysts can actually come to wildly incorrect assumptions based on the metals prices of all the component pieces, and then be disappointed when the metallurgical results and process flow sheet demonstrate which ones and in which amounts are actually payable.

Let’s be real here…

The vast majority of resource investors are not geologists or metallurgists, and so it gets really complicated really fast and this is one of the big challenges with attracting “generalist investors.”

In contrast - if generalists are speculating on Nvidia they know it’s a company that makes semiconductor chips and just look to see if their earnings track estimates. If they are speculating on Dogecoin, they know it’s a bit of “greater fool” ruse, but it’s a simple concept. Mining stocks can get very complex, and have so many challenges and risks, that it really is a very tough sector to invest in.

Having said that, it would not be worth all the extra due diligence if there wasn’t also corresponding outsized performance when certain mining companies really get things dialed in as a business strategy.

For the sake of this series on polymetallic producers, we are going to make the assumption that these management teams have spent the time to parse out the geological model in their resources, that they have done robust metallurgical testing, and that they have a team of experts that has ascertained the best processing and recovery methods.

Often times it really is a work in progress, and can be an art of blending different crush sizes of mineralized ore or different percentages of chemical agents into the flow sheet to get things dialed in.

We don’t want to get off into the weeds here too much though…

For us, as resource investors, we are simply looking for quality companies, quality management teams, and quality deposits that are economically viable. We want to buy into underappreciated opportunities before they are more widely recognized by the masses and capture that alpha from value creation.

Now that we’ve reviewed that initial primer on polymetallic stocks, we are ready to review the value proposition in a couple of them. So, let’s get into it…

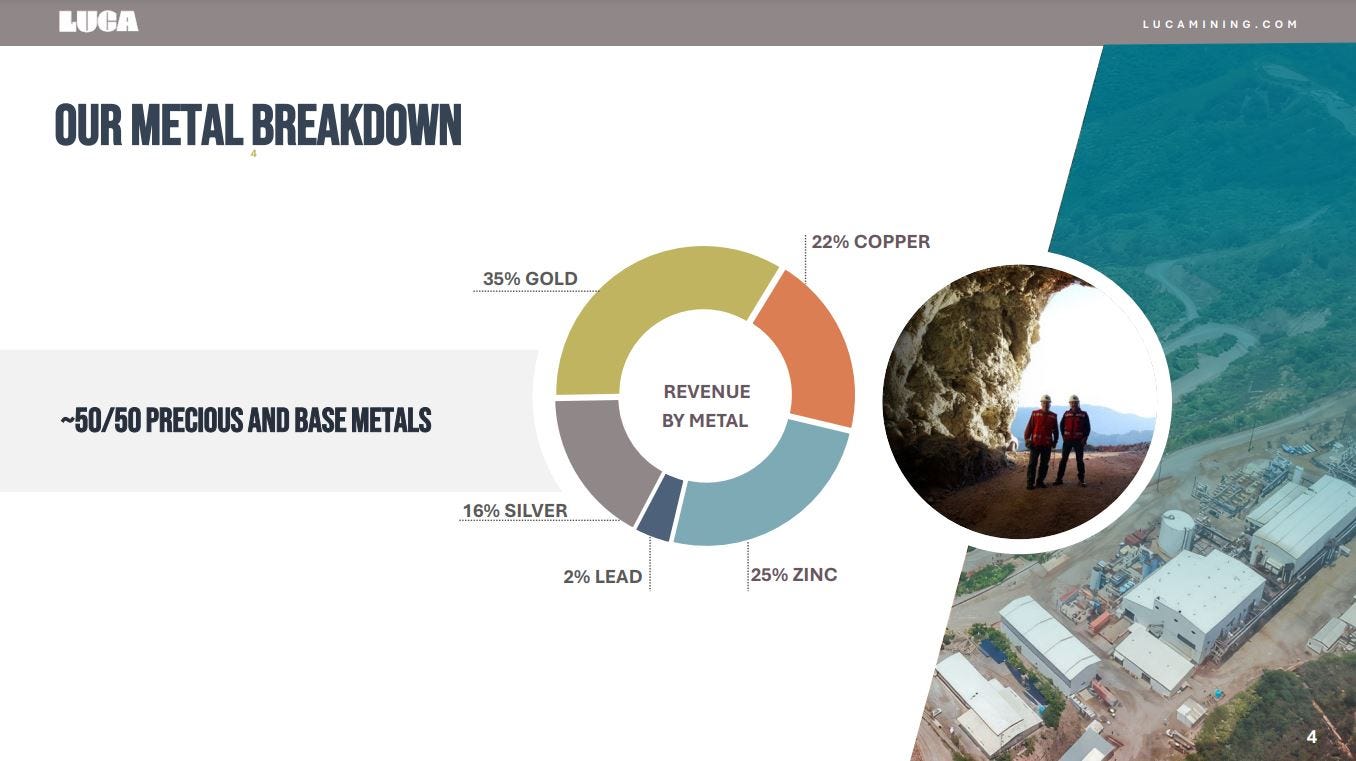

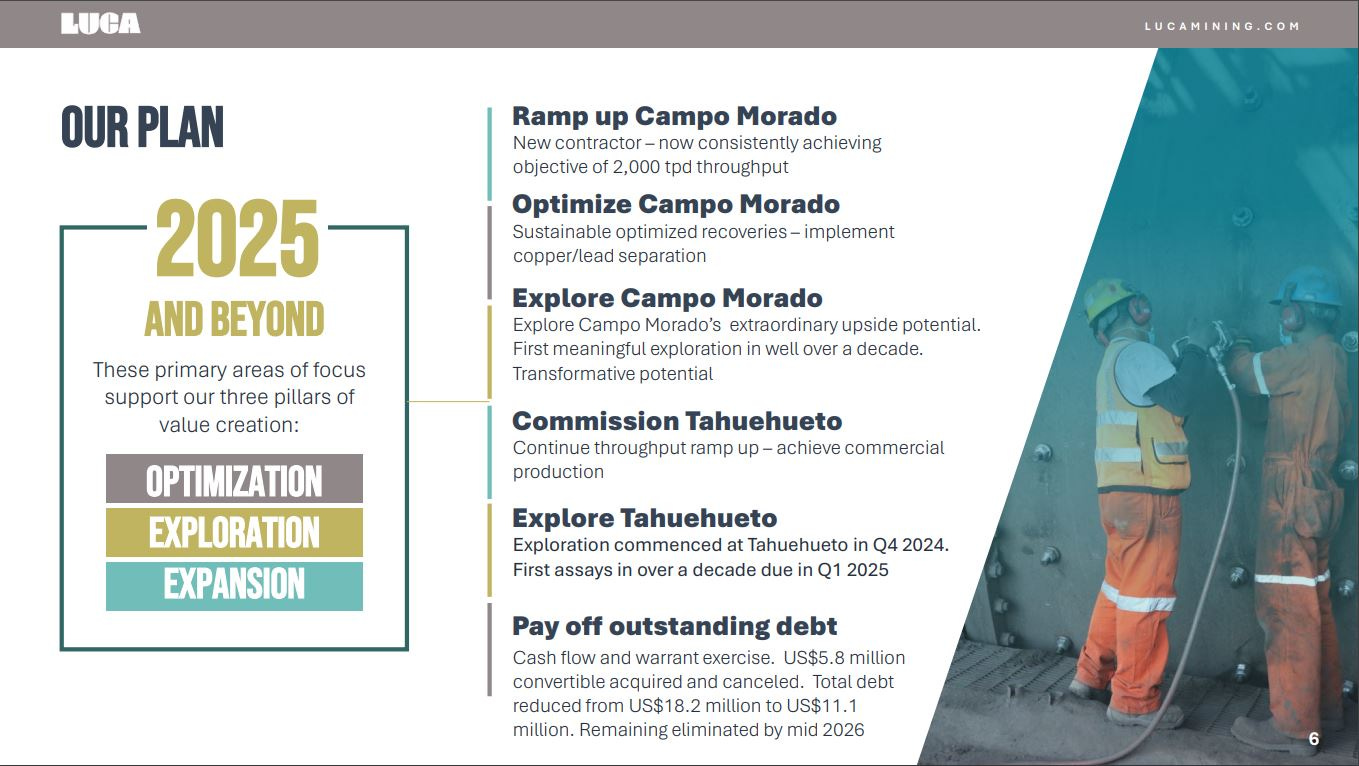

Luca Mining (TSX.V: LUCA) (OTCQX: LUCMF) is a diversified Canadian mining company with two 100%-owned producing mines within the prolific Sierra Madre mineralized belt. The Company produces gold, copper, zinc, silver and lead from these mines, and has a nice mix of both precious metals at 51% and base metals at 49% of their overall production mix. Both mines have considerable development and resource upside, and I see that exploration upside as the large growth potential for the company in the next couple years.

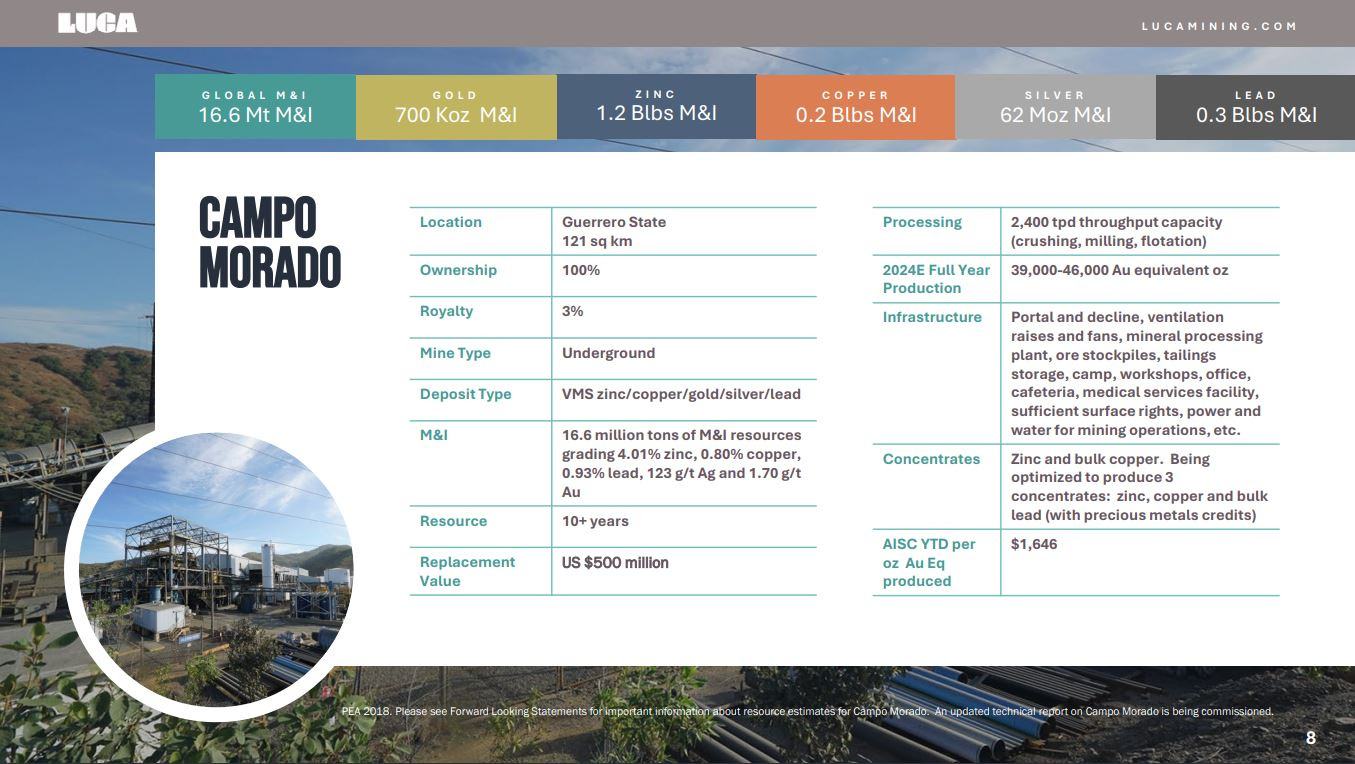

The Campo Morado polymetallic VMS mine is an underground operation located in Guerrero State . It produces copper-zinc-lead concentrates with precious metals credits. It is currently undergoing an optimization program which is already generating significant improvements in recoveries, grades, efficiencies, and cashflows.

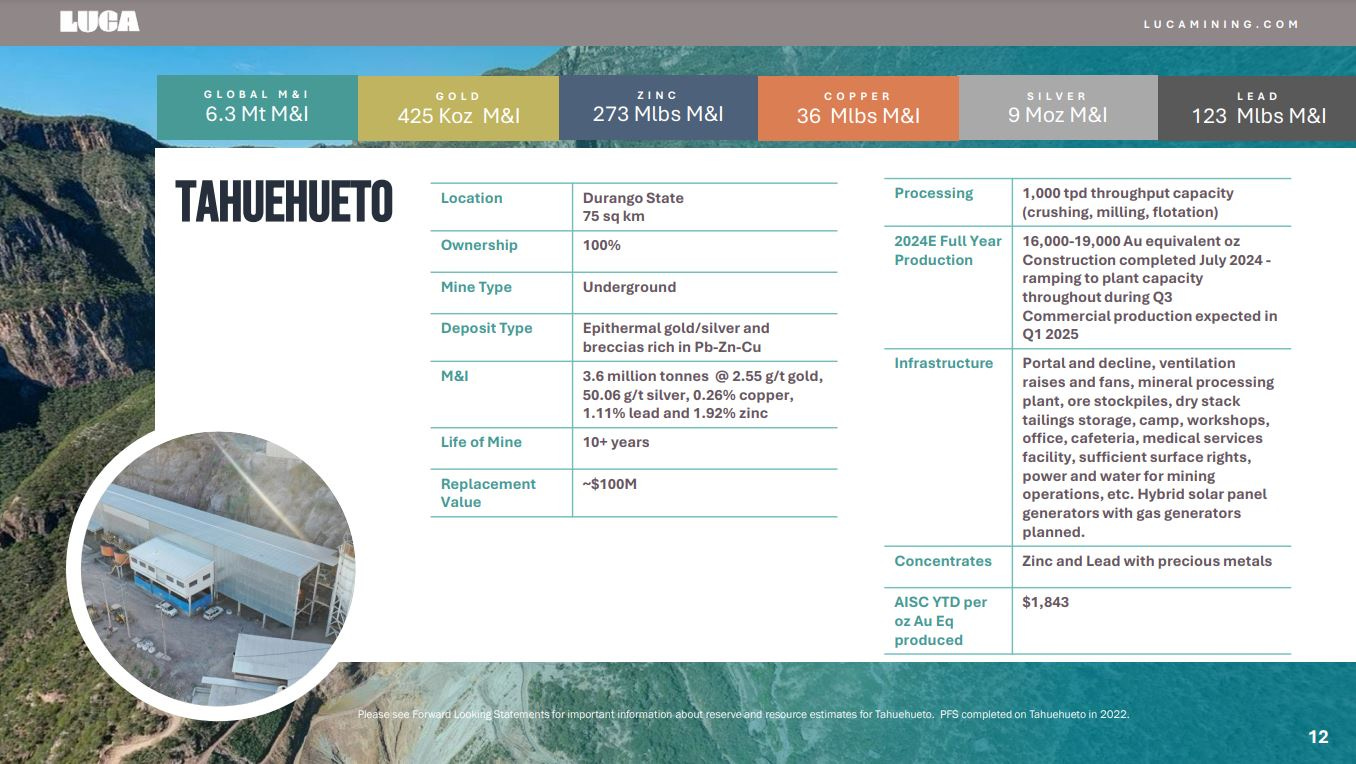

The Tahuehueto epithermal gold and silver mine is a new underground operation in Durango State. The Company is commissioning the Tahuehueto mill and expects to achieve commercial production in early 2025.

Over at the KE Report on January 27, 2025, Dan Barnholden, CEO of Luca Mining, joined us to provide an exploration update at the Campo Morado Project, their debt repayments, and the operational and production developments.

Luca Mining – Exploration, Debt Repayment, Production Updates

https://www.kereport.com/2025/01/27/luca-mining-exploration-debt-repayment-production-updates/

The conversation begins with details about Luca Mining’s 5,000 meter drilling program at the Campo Morado project in Mexico, which aims to extend the mine life and improve production quality with newly mobilized drills. This is the first drilling since 2014 on the Project. The drilling will cover both underground and surface targets, focusing initially on adding near-mine resources and eventually expanding further afield. The discussion then moves to progress reports on Luca Mining’s operational goals. Dan shares that their milling capacity at Campo Morado has increased successfully exceeding a targeted production rate of 2,000 tons per day.

On the financial front, Dan provides insights into the Company’s debt buyback that reduced their principal debt by 39% and removed convertible debentures. These efforts, along with incoming funds from warrant exercises, have put the Company on solid financial footing and positioned it to be potentially debt-free by summer. The conversation wraps up with an update on Tahuehueto Operations; emphasizing current efforts to ramp up production to a thousand tons per day, anticipated to be achieved in a month.

It should also be pointed out that Luca Mining was named one of the OTCQX Best 50 companies in January, and to the Top 50 TSX Venture companies in February. So, the market is waking up to this polymetallic producer.

LUCA NAMED TO 2025 OTCQX BEST 50

https://lucamining.com/press-release/?qmodStoryID=7944450444944486

LUCA NAMED TO TSXV LIST OF TOP 50 PERFORMING COMPANIES

https://lucamining.com/press-release/?qmodStoryID=5714882908891983

Now let’s have a look at the daily price chart of Luca Mining over the last year.

As one can ascertain by looking at the 1-year daily price chart of Luca Mining, it was making gradual progress in 2024, but really kicked in the upward price movement in 2025. This stock went up 7-fold from it’s February 2024 low of $0.20 to its February 2025 high of $1.40. Wow! That has been some solid action in this polymetallic producer, and outperformed most single-metal producers.

I didn’t catch anywhere near all of that move personally, but I did eventually get positioned in Luca Mining in late September 2024 (right after having a solid meeting with the co-founder Javier Reyes in Beaver Creek). Then I added another tranche to that starter position in mid-December of last year during tax loss silly season. At one point I was up about 279% on the overall position at the recent peak, but thought it had gotten to a technical exhaustion point and did trim some back in late February to lock in partial profits of 248%. Now after the recent corrective action, and blended cost basis from the 2 prior buys I’m still up well over 200% on the remaining position in the last 5 months.

Luca Mining has demonstrated really solid price appreciation, as another quality growth-oriented gold/silver/base metals producer. It has rolled over hard though, and could keep correcting down further to see price meet the upward sloping 50-day Exponential Moving Average. If that is what plays out, then I’ll likely add back to my position I trimmed at that support level.

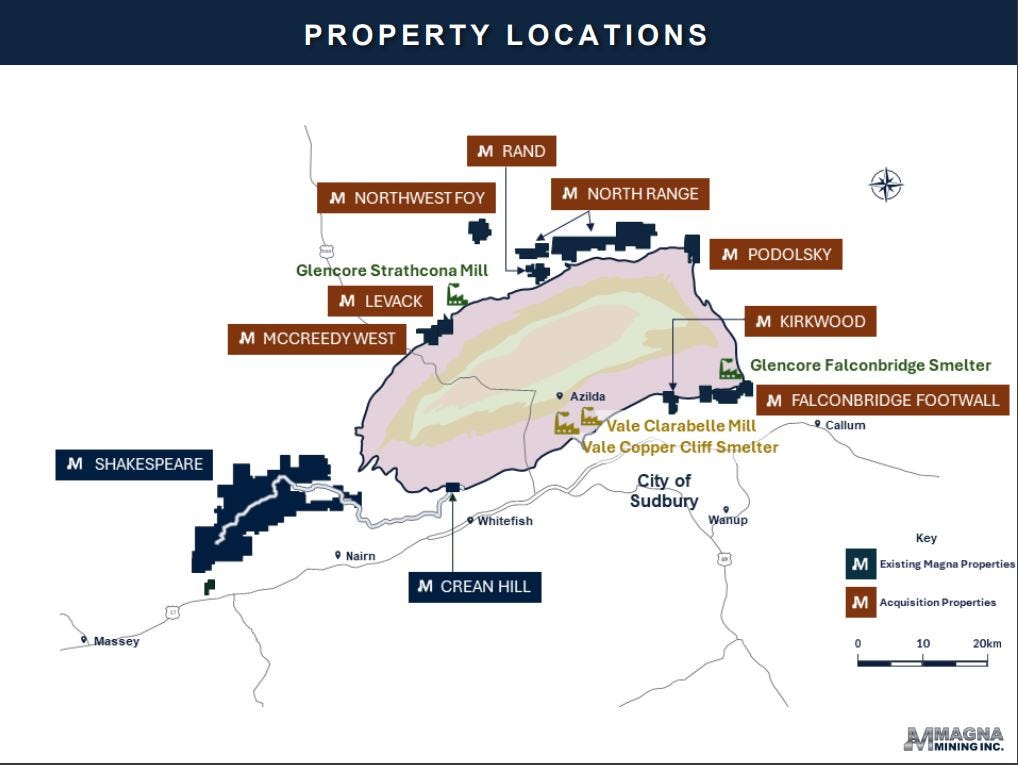

Magna Mining (TSX.V: NICU) (OTCQB: MGMNF) has just graduated in the month of March to a producing mining company with a portfolio of copper, nickel and PGM operating, exploration and development projects in the Sudbury Region of Ontario, Canada.

We have mentioned Magna Mining previously in this channel as an explorer and developer of copper/nickel/PGM projects and have noted the M&A deal in the series on mergers. It is quite significant in that they just press released on Friday that they’ve completed their transformative acquisition of the KGHM assets; which includes 1 producing copper mine, several past producing polymetallic mines, and several exploration/development properties around Sudbury, Canada.

Magna Mining Completes Acquisition of Producing Copper Mine in Sudbury from KGHM International Ltd. – February 28, 2025

The company already had 2 fantastic polymetallic assets in both its Crean Hill and Shakespeare development projects prior to this acquisition. The company spent the last couple of years exploring and expanding resources at both projects, and they are still very germane for the future development pipeline of the company, in concert with the new portfolio of projects.

Magna Mining has relationships with both Vale and Glencore, for processing their ore at their respective mills and smelters in Sudbury. That is a huge benefit, because it allows them to generate revenues in production without having to fund, build, and staff the expensive processing centers themselves.

Over at the KE Report on February 26th, 2025, Jason Jessup, CEO and Director of Magna Mining, joined me to unpack a number of key Company milestones that were recently achieved and on tap in the near-term, as well as the work strategy developing for the balance of 2025, at the McCready West mine and multiple other prior-producing polymetallic mines and development projects located in Sudbury.

Magna Mining – TSX Venture Top 50 Recognition, Anticipated Acquisition Closing On Multiple Polymetallic Mines And Development Projects In Sudbury, And The 2025 Work Strategy

We started off reflecting on the announcement February 19th that Magna Mining has been included in the 2025 TSX Venture 50 list. The TSX Venture 50™ is a ranking of the top fifty performing companies on the TSX Venture Exchange over the prior year. Jason remarks that this stems from the results of the solid work their team had executed on growing their asset base and value creation over the course of the last year.

This leads us into a discussion on their transformative move into copper, nickel, platinum, palladium, and gold production that commences in March, once the KGHM International Ltd. acquisition transaction closes at the end of this month on a portfolio of base metals assets located in the Sudbury Basin. These assets include: the producing McCreedy West copper mine, the past-producing Levack mine, the past-producing Podolsky mine, and past-producing Kirkwood mine, as well as the Falconbridge Footwall (81.41%), Northwest Foy (81.41%), North Range and Rand exploration assets.

Jason outlines how he and multiple members of the Magna Mining team had worked and operated the McCreedy West, Levack, and Podolsky Mines in the past when they were with FNX Mining. They are very familiar with these assets.

While the current flagship will be the McCreedy West Mine, he also lays out the development pathway for bringing back into production the Levack Mine in 2026, and the Podolsky Mine and Crean Hill by late 2027 or early 2028. That development pipeline of projects, over the next few years, is why they are in this series on “growth-oriented” polymetallic producers.

Next, we review that the payment from the bulk sample that was mined at Crean Hill and processed at Vale’s facilities last year is slated to come in about a month out, which will bring in more capital to the company. Additionally, we reviewed the financial health of Magna Mining now that they have upsized the Debenture Offering from C$15 up to C$22 million of Convertible Debentures. Concurrent with the Debenture Offering, the Company previously announced a “best efforts” private placement offering of up to 6,451,612 common shares of the Company at a price of C$1.55 per Common Share for aggregate gross proceeds of up to C$10 million. Combined, this will take the total financing up to C$32 million raised in the Offering, and is expected to close by month end.

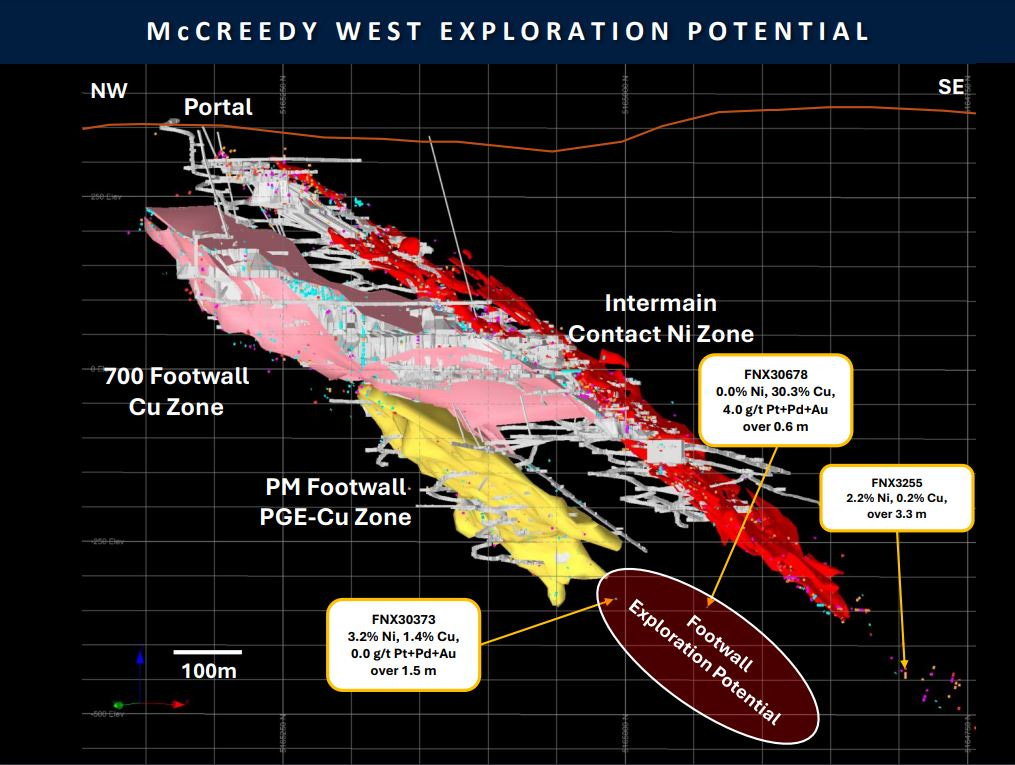

Wrapping up we discussed how these funds would be used for both ongoing development and a healthy exploration program at the McCreedy West copper mine, and around the past-producing Levack mine to keep optimizing future mining operations and resource expansion. This exploration team has this geological model dialed in on these polymetallic deposits in Sudbury, so I anticipate a steady string of positive exploration updates throughout the year, growing the resources.

Magna Mining Initiates Diamond Drilling at the Levack Mine and Reports 2024 Drilling Results at the McCreedy West Mine

March 3, 2025

“Magna has initiated surface diamond drilling at the Levack Mine. Additionally, previously unreported 2024 drilling at the McCreedy West Mine has intersected up to 14.3% Cu, 3.5% Ni, 6.0 g/t Pt+Pd+Au over 9.6 metres in drillhole FNX33223.”

McCreedy West drilling to expand known mineraliztion

Levack Mine vertical section and historical drill hits.

{In full disclosure, Magna Mining is a sponsor of the KE Report, and I hold it in my personal portfolio; however, the company did not pay me or commission me to write this article about them. I’m sharing it with readers of this chanel because I believe it epitomizes what a growth-oriented polymetallic producer looks like.}

Now let’s have a look at the daily price chart of Magna Mining over the last year.

This is another really solid chart with a clear trend up and to the right. I love how this Magna Mining pricing really respects the 50-day Exponential Moving Average (EMA). A breach below that support level would bring in the 144-day EMA as next support. We saw the stock price bounce off the 50-day EMA the end of last week, and so I’ll be watching for follow-through action in the week(s) to come for it to keep trekking higher as production and revenue generation has officially commenced.

Technical Update: Right after I had released this update, we entered a tough slog in the mining stocks to kick off March, and Magna was hit along with everything else. The setup at the time of writing the article showed the strong support being respected at the 50-day EMA and then (of course) days later it broke in a freefall move. As mentioned previously up above, the 144-day EMA would be next support and today that level was tagged and then the stock price quickly reversed back higher again to close at $1.52. At this point Magna bulls will want to see that 144-day EMA continue to hold, and preferably for pricing to get back up above the 50-day EMA into a better posture.

Well, that wraps up our first article in this series on growth-oriented polymetallic producers, but we’ll have more companies to feature here as this series evolves.

Thanks for reading and may you have prosperity in your trading and in life!

• Shad