Opportunities In Copper Explorers And Developers – Part 2

Excelsior Prosperity w/ Shad Marquitz 10-17-2024

In the most recent article in this channel, “Copper Sector Update – The Good Doctor Is Just Taking A Breather At The Dance”…

https://excelsiorprosperity.substack.com/p/copper-sector-update-the-good-doctor

…we discussed the compelling supply/demand fundamentals for this critical energy mineral, and the general uptrend in prices of the red metal and related ETFs over the last couple of years.

The point was made that: “If we just see $5-$6 copper prices again in the next year or two, then many copper development projects are going to have numbers that jump off the pages of their economic studies. Explorers that find meaningful copper deposits will continue to be richly rewarded, as the mining industry is hungry for new economic copper deposits... As a result, I’ve personally been getting more interested this year in positioning in the quality copper junior stocks, that have been exploring for and defining what appear to be the next significant copper deposits.”

I’m happy to report that we’ve got some intriguing updates to share in this [Part 2] of Opportunities In Copper Explorers And Developers where we’ll review 5 copper juniors with compelling value drivers on projects that do seem to have some of these next significant copper deposits. We’ll get important updates on 2 copper advanced explorers/developers that we have already discussed briefly in [Part 1] in this series, and then introduce 3 new companies in this niche of the resource sector.

Accompanying embedded interviews with management teams of each of these 5 companies are also included, that we recently hosted over at the KE Report. If the overall investing thesis resonates with readers here, then there is huge value in hearing directly from the management teams as they unpack the value proposition in their respective companies. We’ll be diving into a number of these stocks more granularly down the road in future updates. Additionally, I can already think of a half-dozen other copper juniors that we still have not had time to get into for future articles to come… so stay tuned.

(In full disclosure, I personally have portfolio positions in a few of these copper advanced exploration / early-stage development stocks that we are covering in this series. I’ve not been commissioned by these companies to write these articles on Substack. This is not investment advice, nor am I suggesting that anyone position in these stocks. Rather, this is simply an editorial on the value proposition these companies demonstrate to my mind, and why I got positioned in them over the last couple of years. The junior part of the resource sector is very volatile and full of risk. Investors should do their own due diligence and talk with a financial consultant about their own goals and unique risk tolerance profiles.)

With all of that said, let’s get into it…

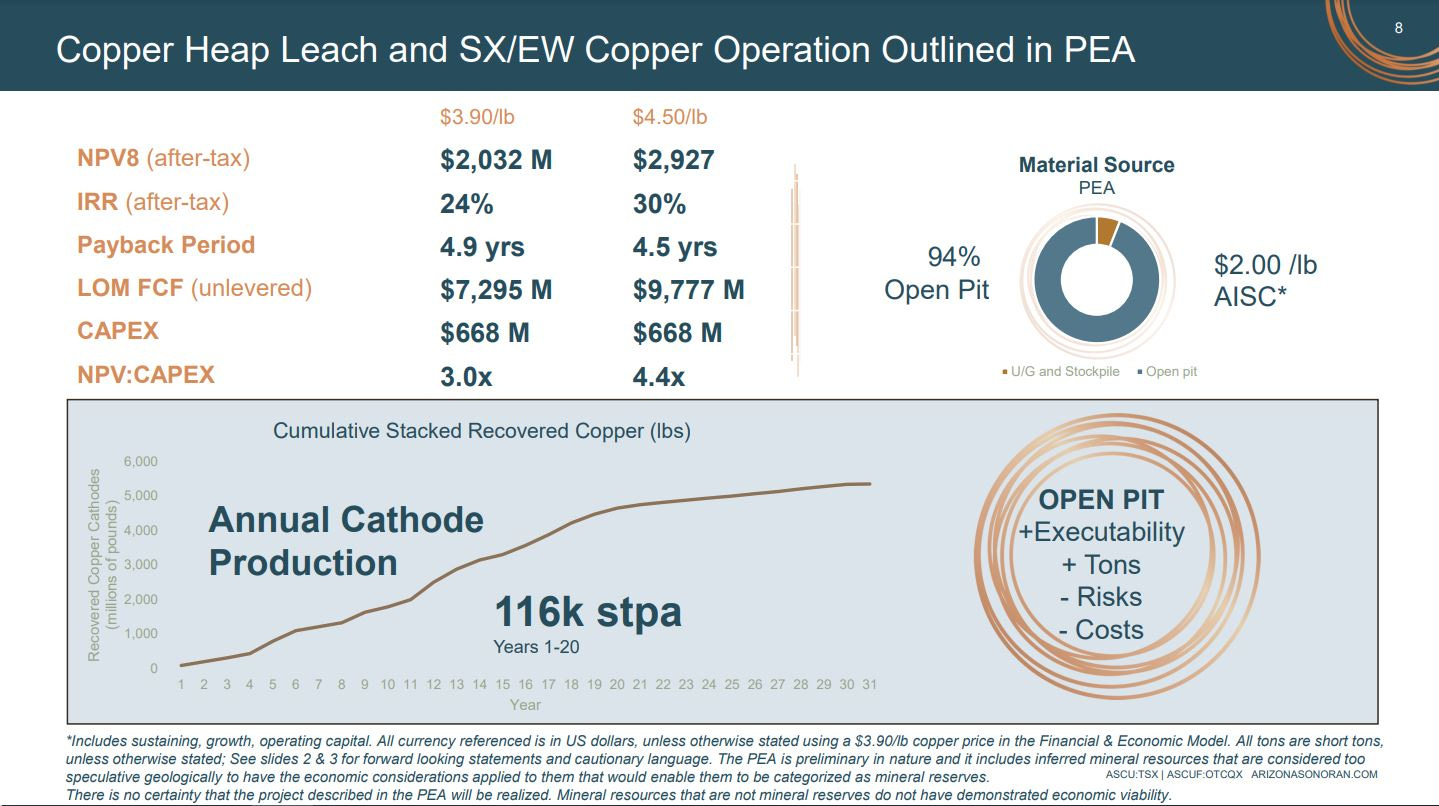

In Part 1 of this series, we introduced Arizona Sonoran Copper (TSX:ASCU – OTCQX:ASCUF), and the company just recently announced on August 27, 2024 their updated Preliminary Economic Assessment (PEA) of the Cactus Project in Arizona. This PEA now incorporates the newly discovered and defined Mainspring deposit, which changed the overall mining method in the economic study and allows them to now mine this project as a larger open-pit, including at Parks-Salyer, and Cactus West, and presenting better economics. The overall Cactus Project now contains over 11 billion pounds (“lbs”) of copper in all categories – 7.3 billion lbs of copper in measured and indicated, and 3.8 billion lbs in the inferred category.

Arizona Sonoran Cactus Project Standalone PEA Technical Report Reporting Post-Tax NPV8 of US$2.03 Billion and IRR of 24% is now Filed

Highlights from the PEA: With Key Performance Indicators at $3.90/lb copper demonstrate a $2,032 million Net Present Value (“NPV”) (8% discount, after-tax), a 24% Internal rate of return (“IRR”, after-tax), 4.9 years Payback Period, and $668 million development capital including contingency. There is a Life of Mine (“LOM”) Gross Revenue of $20.8 billion, LOM Free Cash Flow of $7,295 million, Cash costs (C1) of $1.82 and All in Sustaining Costs (“AISC”) of $2.00 per pound of copper. Of course, it is also important to highlight just how robust those economic metrics become when looking at the adjacent metals sensitivity table above using a $4.50/lb copper price assumption.

Over at the KE Report last month on September 20th, I had a good interview with George Ogilvie, President and CEO of Arizona Sonoran, where he outlined the details of this updated Standalone PEA on the Cactus Project in Arizona. For those legitimately interested in learning more, in just 17 minutes listeners can hear the company strategy directly from management, and we get into the ongoing work initiatives and future company milestones.

Arizona Sonoran Copper - Updated PEA On The Cactus Project - NPV8% of US$2.03 Billion and IRR of 24%

George outlines how the inclusion of the recently acquired and drilled out to inferred resource of the MainSpring Property, which had previously not been included in economic studies, not only brought in an additional 1.9 billion lbs of copper but was also amenable to open pit mining. This also allowed for Parks-Salyer to be transitioned into an open-pit scenario as well, bringing in an additional 1.5 billion lbs of copper into the resources, and allowed it all to be developed as an enlarged pit. This confirms Parks/Salyer and MainSpring are now grouped together as one deposit, renamed to “Parks/Salyer.” This transition to open pit mining increases the efficiencies, improves costs, reduces capex, and takes away the need to put in the twin declines initially proposed.

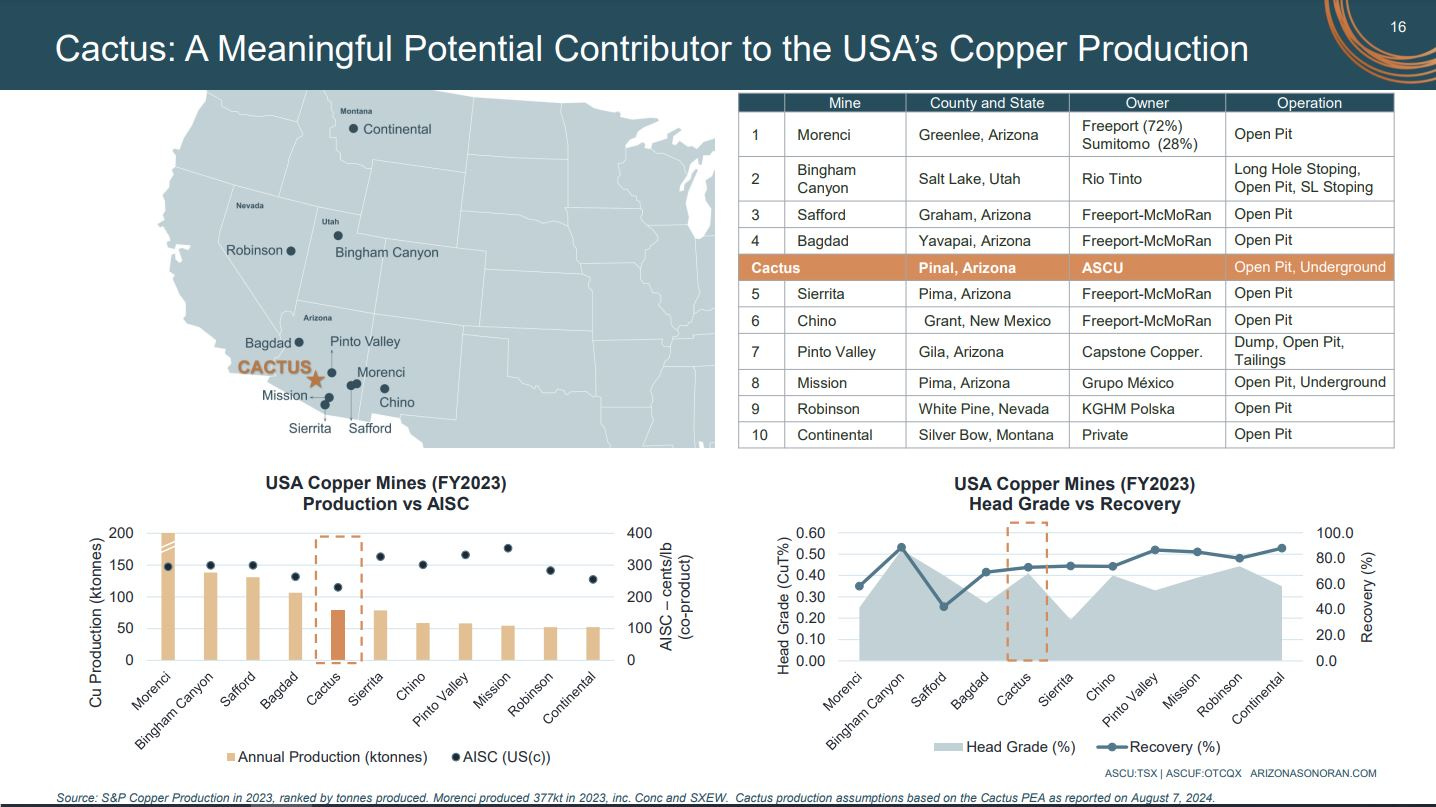

It was mentioned at the onset of this article that we want to focus on projects of significance in the copper exploration and development sector, and by all indications the Cactus Project could and should be a meaningful contributor to the field of US copper producers, when it is built and constructed into a mining operation.

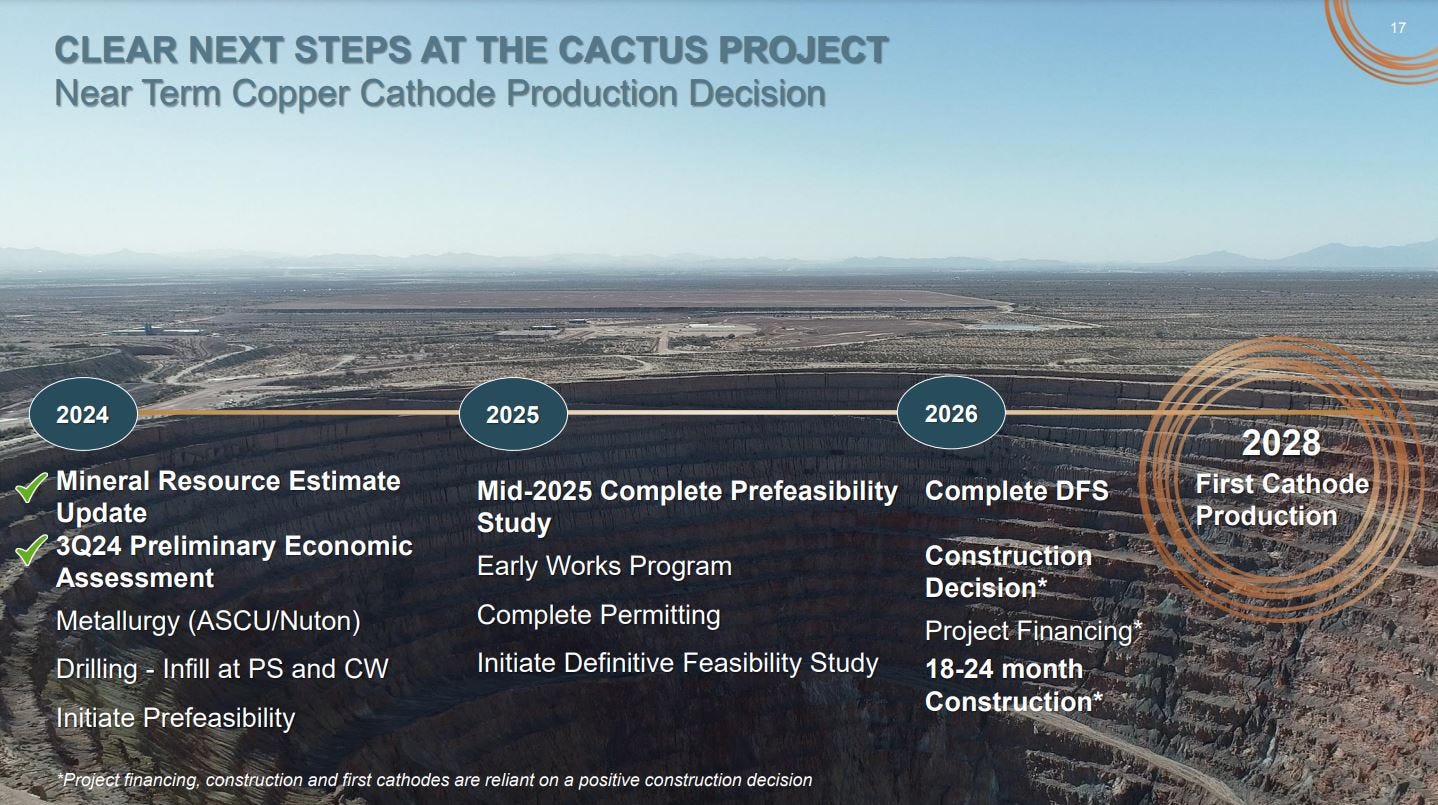

There is a great deal of drilling at Mainspring being completed to move the resources from inferred to indicated, as well as more metallurgical work to prepare for incorporating all of that into a Pre-Feasibility Study (PFS), projected to come out in the summer of 2025. We also discuss some recent drill results returned from the sulphides as Cactus West, that show the resources are continuing to grow and will either add longevity to the existing planned 31-year mine life, or provide a potential larger producer with the option of increasing the throughput in a mining scenario.

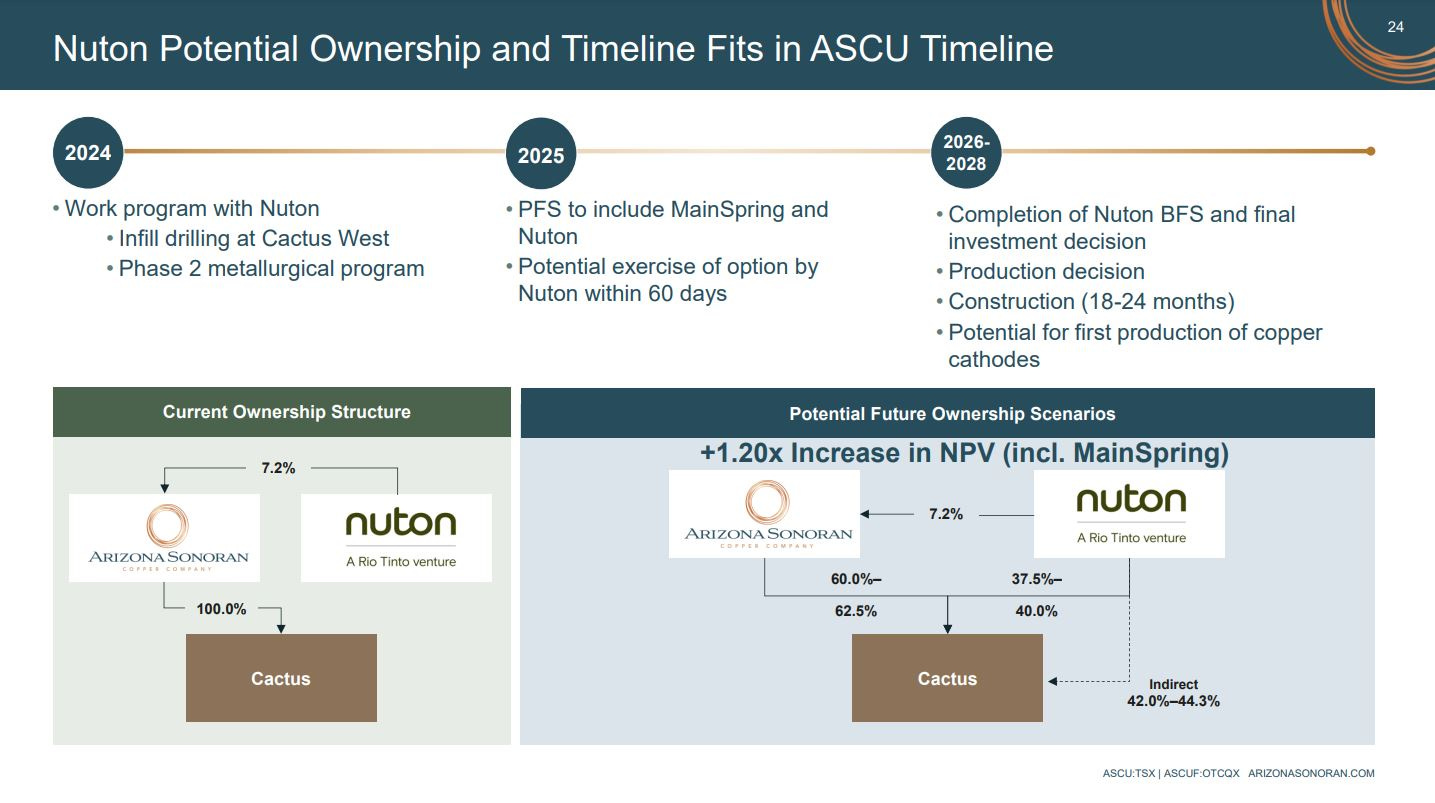

In the interview with George, he and I discussed another layer of optionality to improve the process with the investment by Nuton LLC (a wholly-owned subsidiary of Rio Tinto) and subsequent option to Joint Venture (“JV”) the Cactus Project to Nuton LLC using their proprietary leaching recovery methods.

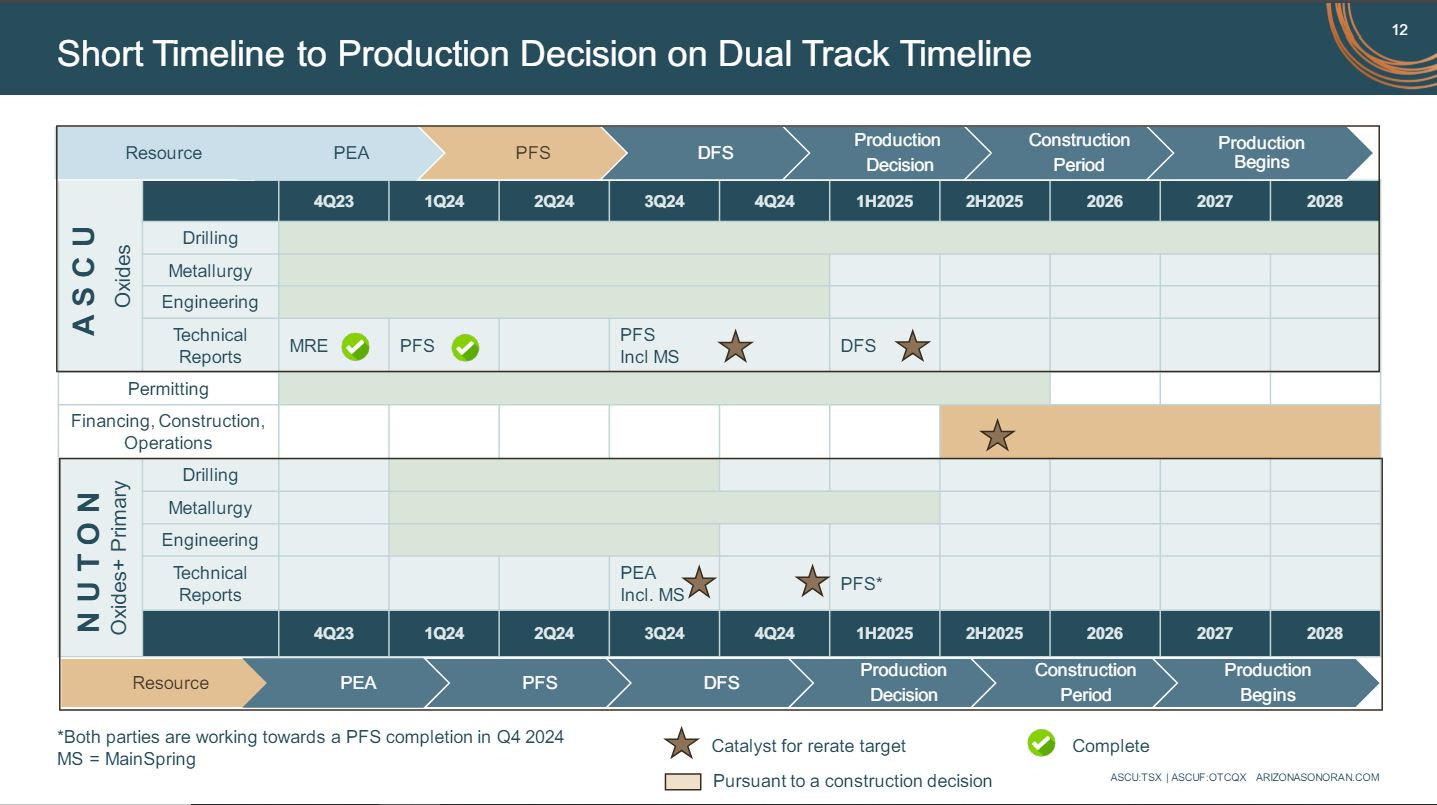

Arizona Sonoran and Rio Tinto feel this Nuton technology could be so significant that they are running parallel studies to incorporate into future economic reports that show the impact that the efficiencies and cost benefits to this leaching technology could provide. As a result, there is a “Dual-Track” workflow and timeline for upcoming key company milestones and studies as outlined below.

Speaking of RioTinto’s Nuton heap leaching technology… there are 2 other advanced copper development projects run by CEO John Black, Regulus Resources (TSXV:REG) (OTCQX:RGLSF) and Aldebaran Resources Inc. (TSXV:ALDE)(OTCQX:ADBRF) that are studying the application of this Nuton technology. Again, this Nuton process is focused on copper leaching technologies, with potential to unlock copper from hard-to-leach ore and low-grade material, with industry-leading recoveries, and comes with large benefits to ESG. Both sister companies have been on my watchlist for a while, and are the next 2 that we’ll introduce in this article as copper projects of merit, that appear to be moving down the derisking curve towards development into new copper mines down the road.

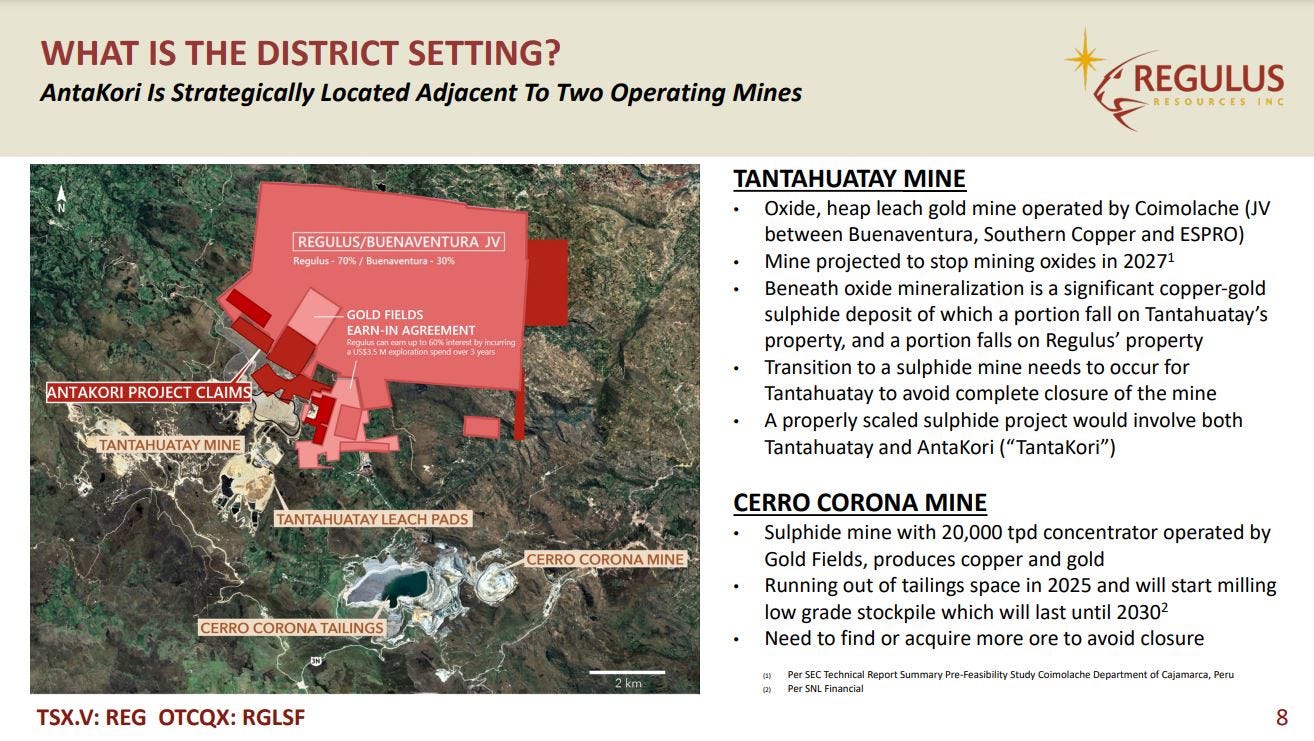

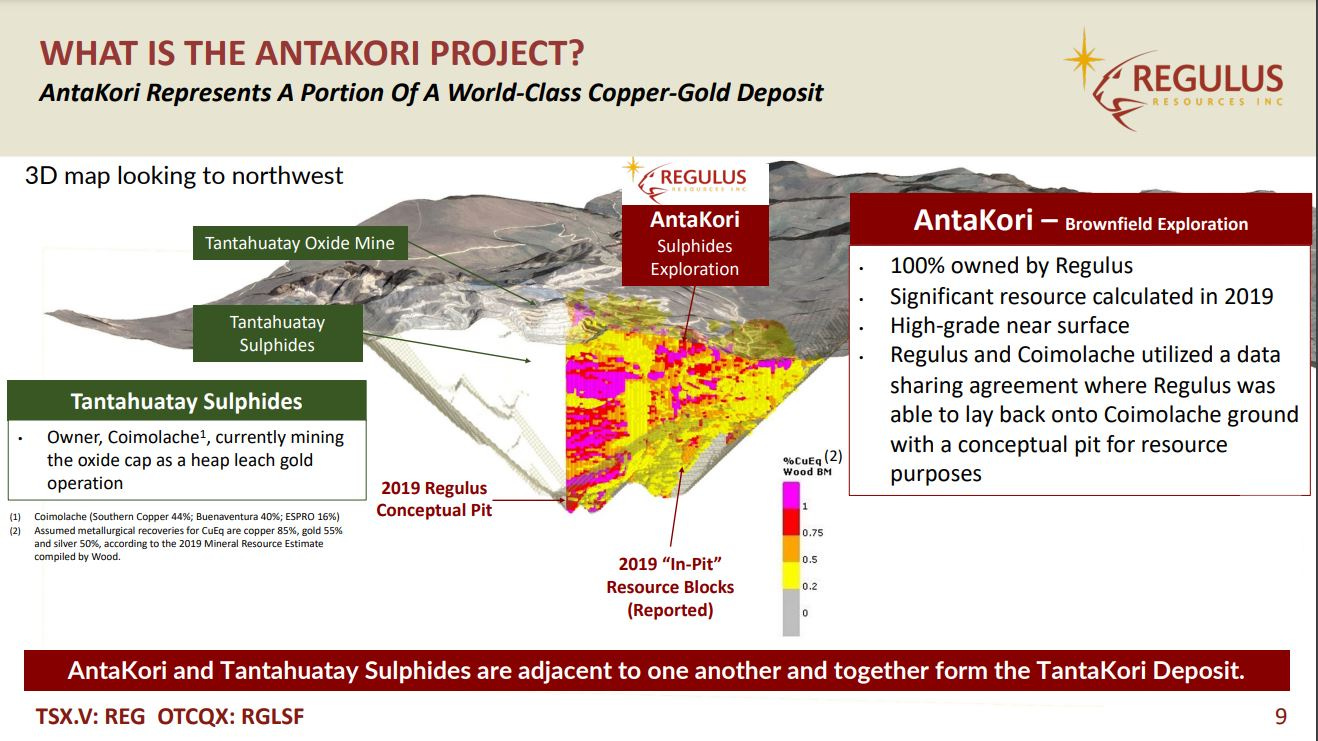

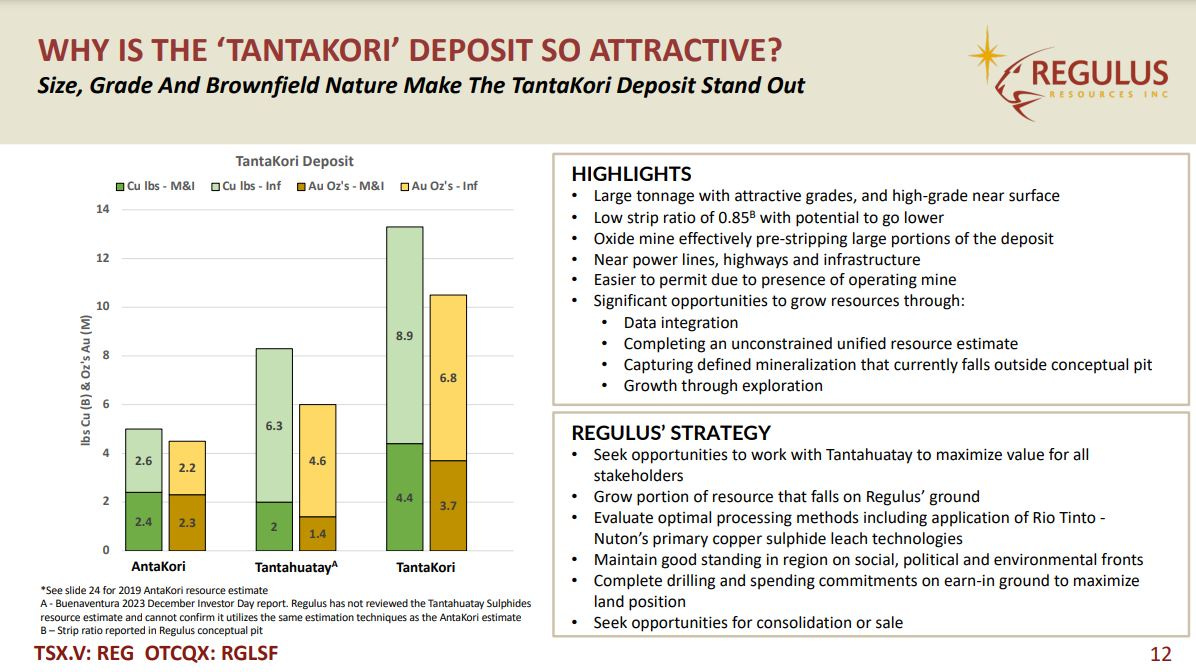

The flagship project for Regulus Resources is their AntaKori Copper-Gold Project in northern Peru, with the potential for consolidation of the surrounding projects in this very prolific mineralized belt into a larger major project in the years to come. The AntaKori project currently hosts a resource with indicated mineral resources of 250 million tonnes with a grade of 0.48 % Cu, 0.29 g/t Au and 7.5 g/t Ag and inferred mineral resources of 267 million tonnes with a grade of 0.41 % Cu, 0.26 g/t Au, and 7.8 g/t Ag. The AntaKori project is immediately adjacent to the Tantahuatay Mine and mineral concessions owned by Compañía Minera Coimolache S.A. (which is a JV between Buenaventura, Southern Copper and ESPRO).

On July 27th, Regulus Resources announced that it had entered into a collaboration agreement with Coimolache to evaluate the viability of an integrated Coimolache Sulphides/AntaKori copper-gold project. The evaluation will consist of a mineral resource estimate (“MRE”) with the option, upon mutual agreement of the Parties following the completion of a MRE, to complete a preliminary economic assessment (“PEA”).

Costs of the evaluation program will be split with Regulus paying 50% and Coimolache paying 50%. The results of the MRE and PEA can only be publicly released upon mutual agreement of the Parties. Additionally, the MRE and PEA results can be shared with third parties upon mutual agreement of the Parties.

This is important for majors considering consolidation of both projects into one larger project, that has been dubbed the “Tantakori Project” in a construction and production scenario. Clearly it makes sense to move forward as 1 combined project with superior resources and assumed better economics.

One of the other factors that impressed me when I sat down with John Black in both Washington D.C. in late April, and at the Beaver Creek PM Summit in September of this year was the strong holding of management and insiders at over 11%, and key strategic shareholders like Route One at nearly 22% and Rio Tinto at over 16%. That only leaves about half the float for institutions and retail, and has helped keep the stock well bid, especially over the last year.

Over at the KE Report, on October 4, 2024, John Black joined us for conversation where he introduced the value proposition for Regulus Resources, got into the strategic partnerships that both they and their neighbors have in their respective joint ventures, and really encapsulates the bigger vision with this whole copper and gold district.

Regulus Resources – Introducing The AntaKori Copper-Gold Project, And The Potential For Future Consolidation Of This Area Of Peru

Pivoting over next to Aldebaran Resources Inc. (TSXV:ALDE)(OTCQX:ADBRF), let’s get an introduction to their flagship Altar Copper-Gold Project in San Juan, Argentina. There has been a great deal of solid work completed by prior operators, before John Black and the other co-founders of this company struck an option agreement with Sibanye-Stillwater back in 2018 to start earning into this project. At this point the capital has been paid and the work commitments completed for them to earn-in to 80% of the project, with Sibanye Stillwater at a 20% stakeholder in Altar.

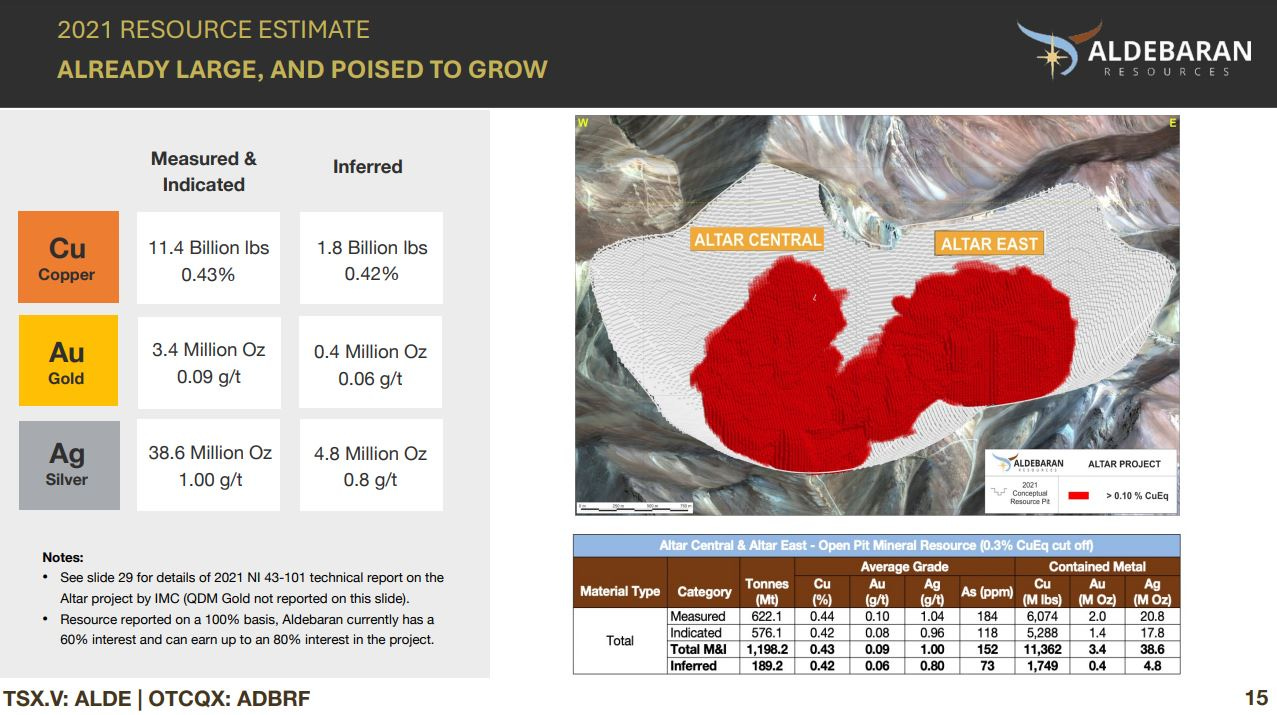

In March 2021 the Company announced an updated mineral resource estimate for Altar, prepared by Independent Mining Consultants Inc. and based on the drilling completed up to and including 2020. This project is robust with 13.2 billion pounds of copper, 3.8 million ounces of gold, and 43.4 million ounces of silver — in all categories.

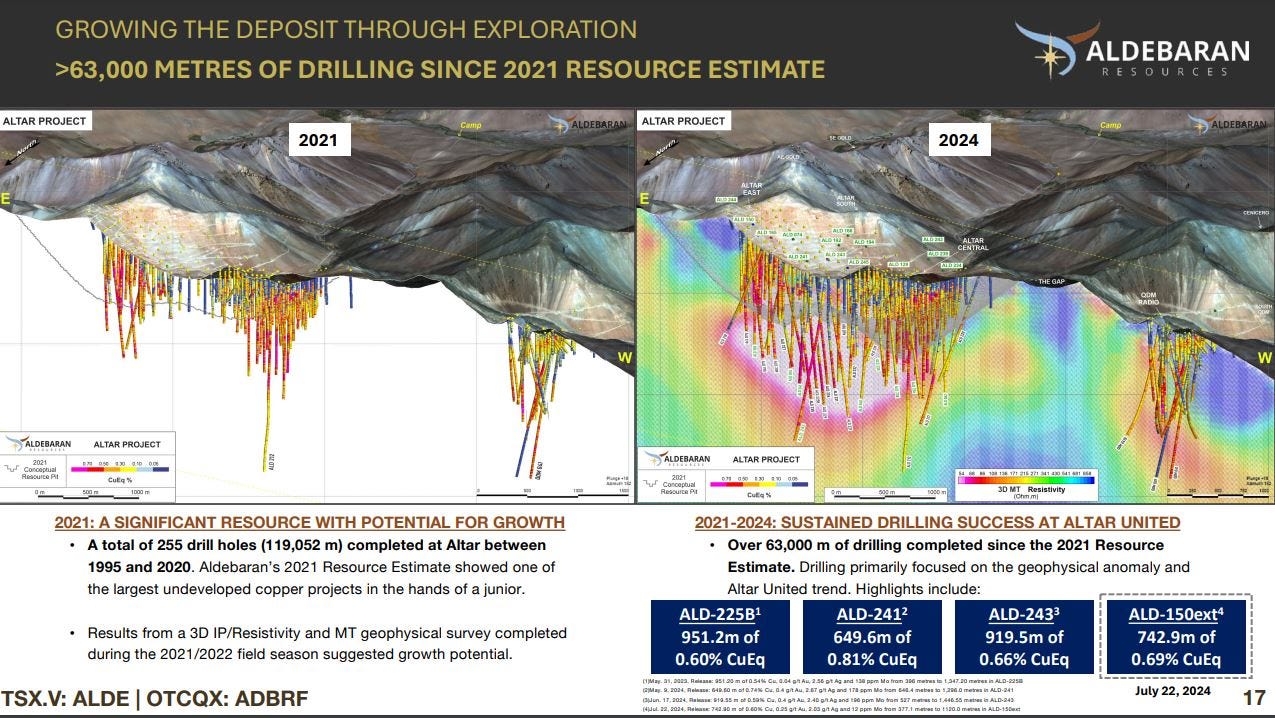

After approximately 63,000 meters of additional drilling between the known Altar Central and Altar East mineralization, their exploration team has now defined the Altar United area at depth, uniting the 2 prior deposits, and setting up for a larger open pit that will include not only the new mineralization, but the tails from the prior envisioned pits.

There is an updated resource estimated slated to be released to the market next month in November, and then ongoing derisking and development work that will feed into a Preliminary Economic Assessment (PEA) in the 2nd quarter of 2025.

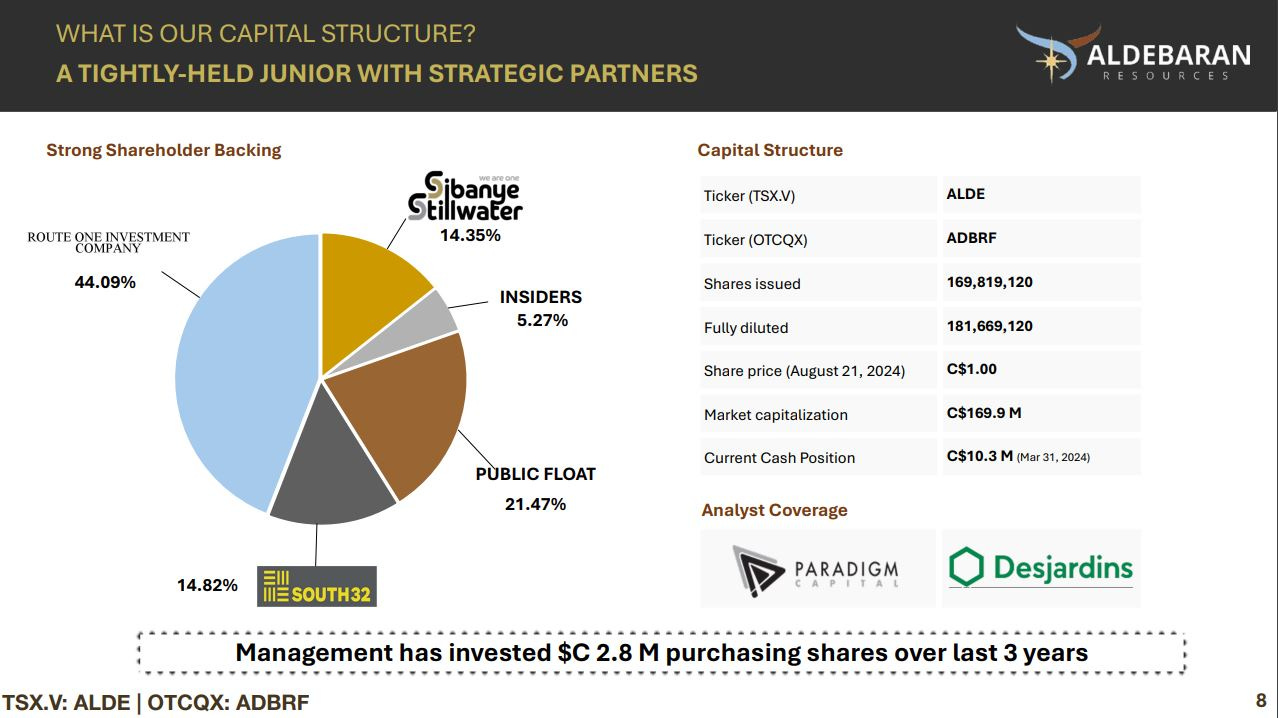

Very much like my comments with regards to Regulus, one of the other factors that impressed me when I sat down with John Black in both Washington D.C. in late April, and at the Beaver Creek PM Summit in September of this year was the strong roster of key strategic shareholders like Route One at 44%, South32 at almost 15%, Sibanye Stillwater at over 14%, management and insiders at over 5%, and really only just over 21% of the float available to the public. That is a really tight available stock situation, as most of the stock is in very strong hands, and this has helped keep the stock well bid, especially over the last year.

With most investors keen on looking ahead to the coming catalysts and value drivers, the Aldebaran team has a fairly well mapped-out timeline for the balance of 2024 and moving into 2025, with the next key milestone being the updated resource estimate due out in November, just next month.

Over at the KE Report on October 11, 2024, we interviewed John to have him share the history of the project, key historic work completed, key work their company has completed, their ongoing partnership with Rio Tinto, with an interest in utilizing their Nuton technology, and some of their key strategic shareholders with South32, Sibanye-Stillwater, and Route One Investment Company. John shares his background in the industry, along with the background of the other co-founders and key management team members, and the financial health of the company. It’s a great resource to quickly become acquainted with the Altar Project, and further catalysts and milestones.

Aldebaran Resources – Introducing The Altar Copper-Gold Project In Argentina, The Upcoming Resource Estimate In November, And PEA In Mid-2025

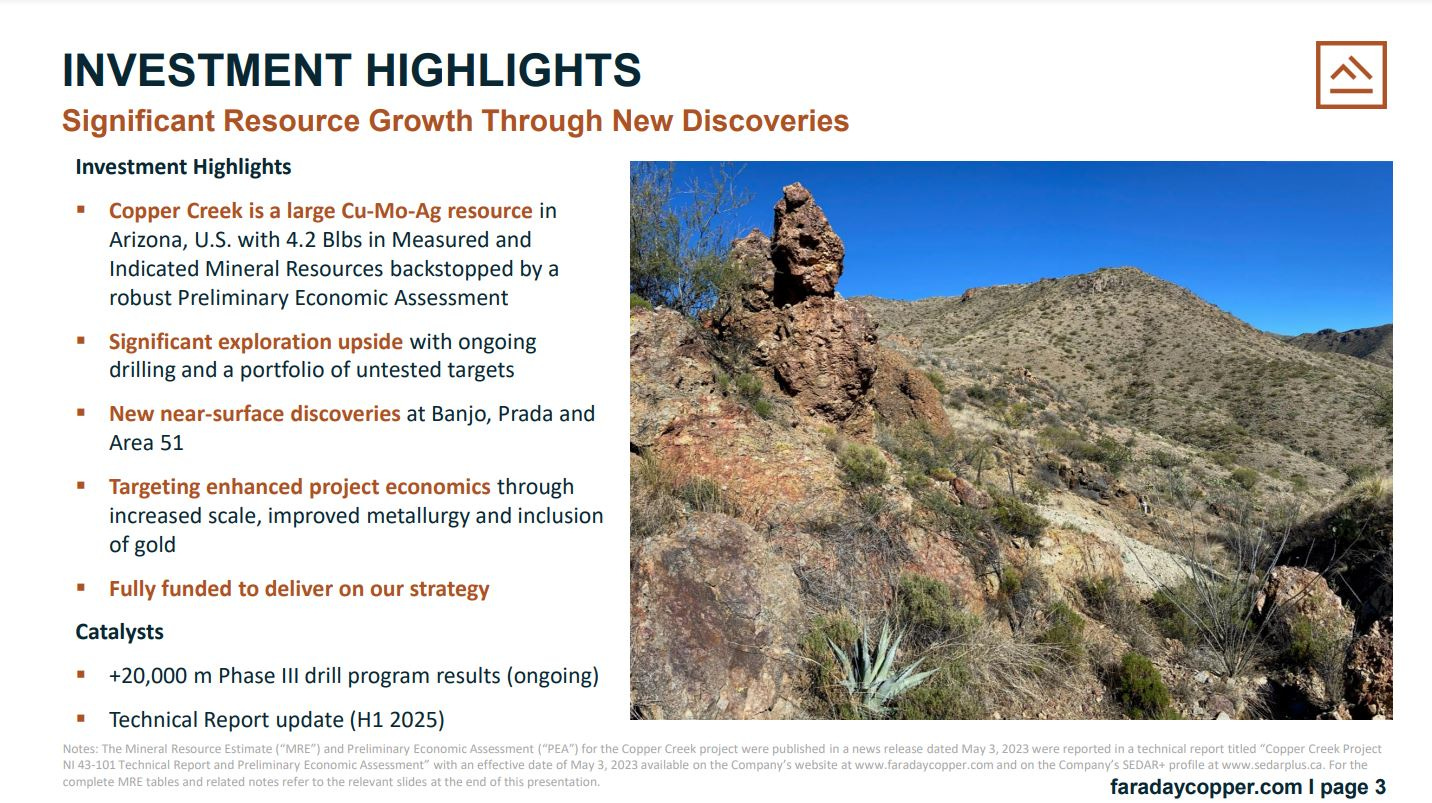

In [Part 1] of this series we introduced Faraday Copper (TSX.V:FDY – OTCQX:CPPKF), after I came away from a sit-down meeting in late April with the management team in Washington D.C., at the Energy Transition Metals Summit. I went home very impressed and took out a starter position in the company to start tracking it in my own portfolio.

What stood out to me was the good jurisdiction for copper in Arizona, the size their flagship Copper Creek deposit that already came in at 4.2 billion pounds of measured and indicated copper-molybdenum-silver resources, and the huge upside to continue growing both open-pit resources with near-surface breccia mineralization, and at depth with porphyry-style mineralization.

It also didn’t hurt that Faraday Copper is now part of the Lundin Group of companies. [for those that don’t know the Lundin family is the equivalent of “mining royalty” and their group has excelled for decades in moving forward projects of merit and significance].

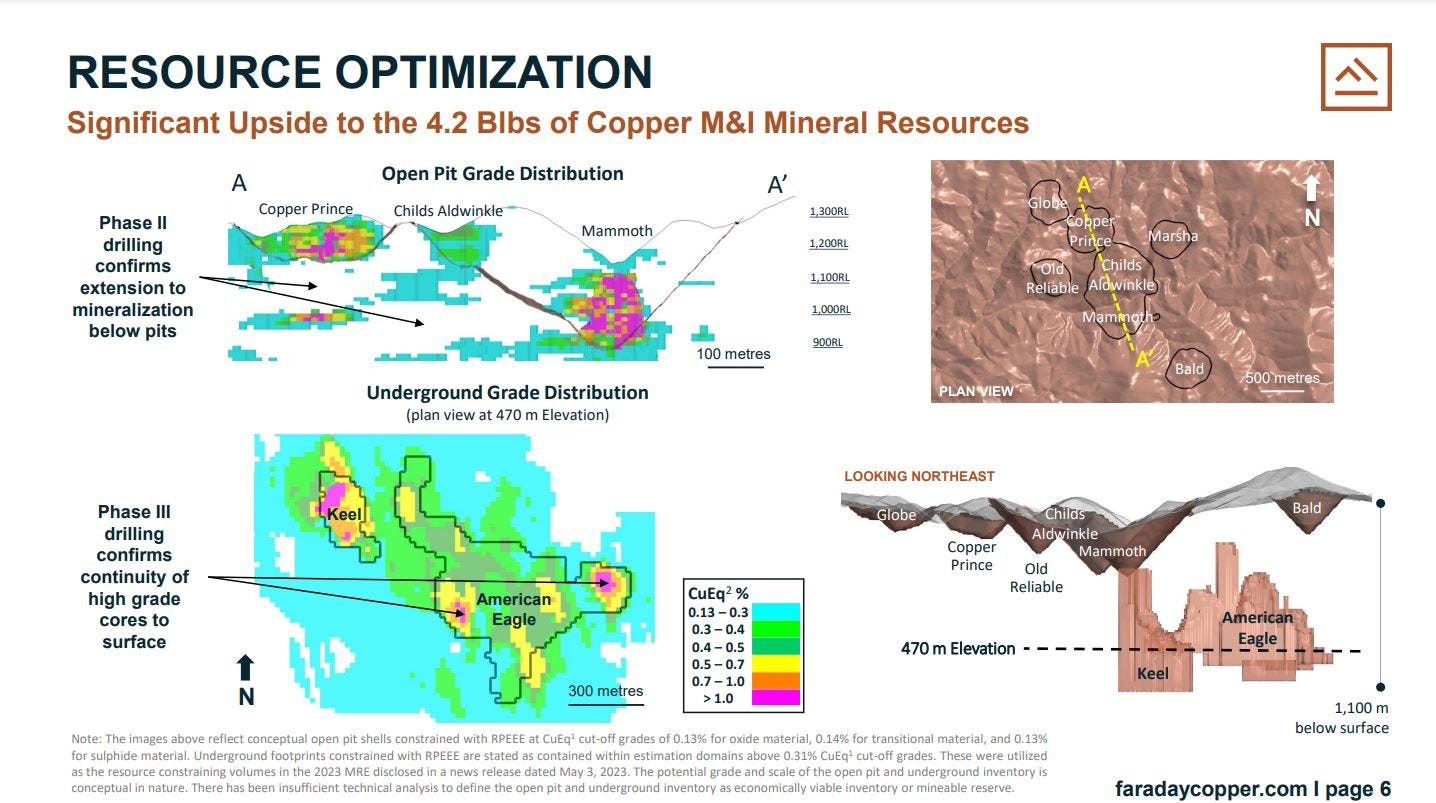

Faraday has a combination of near-surface oxide copper mineralization hosted in breccia open-pits, and then copper sulphide mineralization at depth in porphyrys.

It is stunning to me that there are over 300 breccia expressions, across their property, but with about 40 that have a drill hole into them, and only 17 are currently factored into the resources (that leaves a lot of potential exploration upside to keep finding new satellite pits). Some of the notable open-pits that have been defined are Mammoth, Child’s Aldwinkle, Copper Prince, Marsha, Globe, Bald, and Old Reliable, but with the newest discovery being the Banjo Breccia.

Then porphyry sulphide areas mass up resources at depth like in the Keel and American Eagle deposits, making them more amenable to underground mining. While the easiest ounces to mine are at surface in the open pits, the underground mining gives the project that potential long mine life.

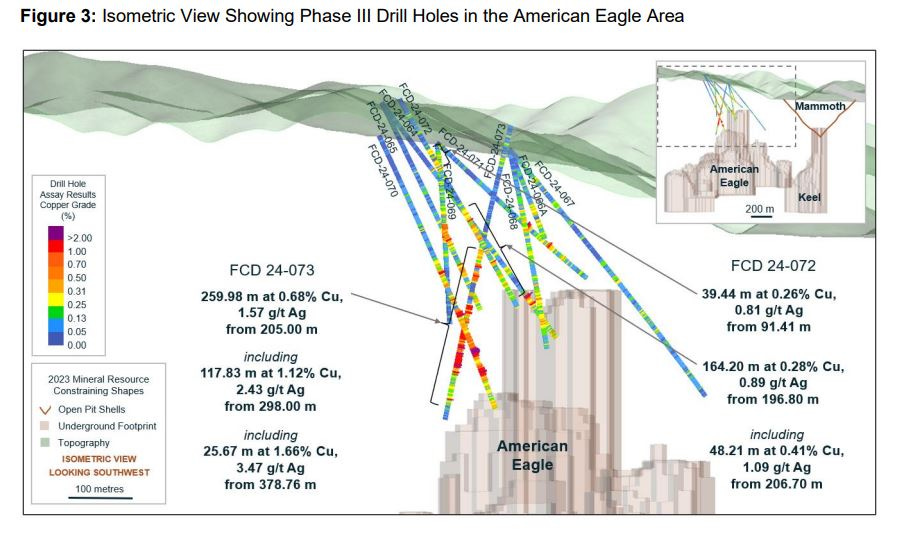

Over at the KE Report on Sep 27, 2024, Graham Richardson, CFO of Faraday Copper, joined us to provide an exploration update from 2 high-grade wide-intercept drill holes at the new Banjo Breccia discovery, in the American Eagle Area, at the 100% owned Copper Creek Project in Arizona. These ongoing drill results from this Phase 3 exploration program are going to be going into a new resource estimate and updated Preliminary Economic Assessment (PEA) in 2025.

Faraday Copper – 2 Drill Holes Each Return 1% Copper Over 117meters At The Banjo Breccia Discovery

Drill hole FCD-24-070 was the discovery hole for the high-grade Banjo breccia intersecting 117.90 metres (“m”) at 1.01% copper and 1.87 grams per tonne (“g/t”) silver from 323.52 m, within 269.65 m at 0.64% copper and 1.32 g/t silver from 229.49 m.

Drill hole FCD-24-073 intersected 117.83 metres at 1.12% copper and 2.43 g/t silver from 298.00 m. This intercept is within 259.98 m at 0.68% copper and 1.57 g/t silver from 205.00 m.

Graham discussed how this near-surface mineralization ties in with all the other breccia mineralization delineated thus far that would be amenable to open-pit mining, and that further at depth there are still the porphyry areas at Keel and American Eagle that may be more of a future underground opportunity.

We then pivoted to all the regional drilling still planned in this expanded Phase 3 exploration program, where a 2nd drill has been added to test the Rum target, Horse Camp target, and to do more follow up drilling at the new Area 51 discovery, which was identified in the Phase 2 drill program.

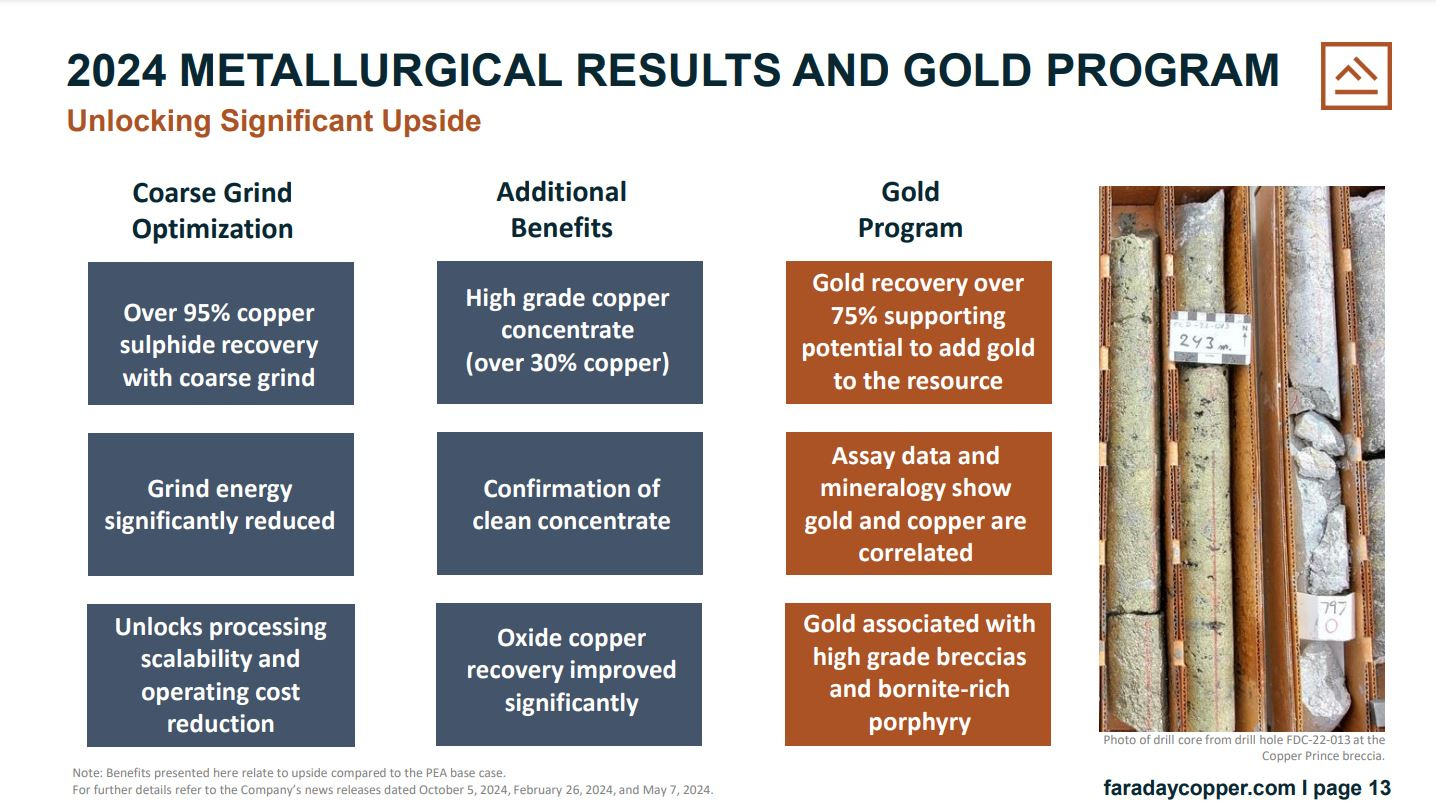

Another key value driver and derisking workflow for Faraday is their 2024 metallurgical testing program on both the coarse grind copper and gold recoveries, that brings more metals into the proposed concentrates, reduces the energy required, lowers costs, and improves the scale potential.

The 5th copper company we’re going to introduce is one that I’ve been closely following for the last 2 years, initially as more a nickel, platinum, and palladium company, but because of a transitional acquisition transaction, they’ve really become front and center a junior copper production, development, and exploration company. This company is Magna Mining (TSX.V: NICU) (OTCQB: MGMNF).

Most of the mining world was busy buzzing around the Beaver Creek, CO Precious Metals Summit from September 10th-13th, and then right in the middle of the event the news dropped that Magna Mining had acquired a collection of producing and past-producing copper-nickel mines, and a few other additional polymetallic exploration and development projects.

As a funny aside: I was eating lunch at a company presentation at the Beaver Creek, PM Summit. At the next table over was CEO of Magna Mining, Jason Jessup and Senior Vice President, Paul Fowler, so I dropped by their table to briefly catch up. In chatting I mentioned championing their recent news with other investors on their bulk tonnage sample from the 109 Footwall at Crean Hill being processed at Glencore’s the Sudbury Integrated Nickel Operations’ Strathcona Mill, which was completed on September 6, 2024.

In the brief chat my feedback was that most people I spoke with were underestimating their team’s ability to get back into base-metals production in Sudbury, Canada. (they had produced in a prior company known as FNX Mining)

Jason smiled at my comment and said “I guess you haven’t seen the news out today then?” I had not, and so they mentioned the transformative acquisition transaction, that had been announced that morning and I was blown away. “Wow! I hadn’t heard! Congrats guys!”

Magna Mining Acquires Producing Copper Mine in Sudbury from KGHM International Ltd. - September 12, 2024

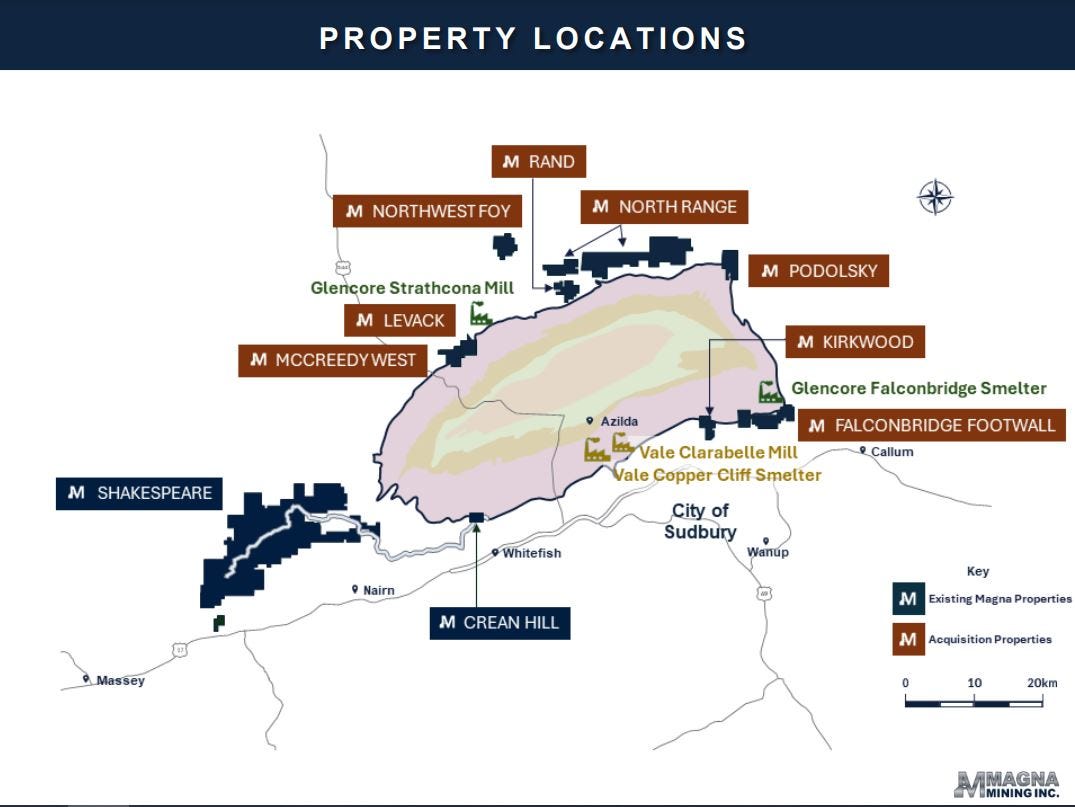

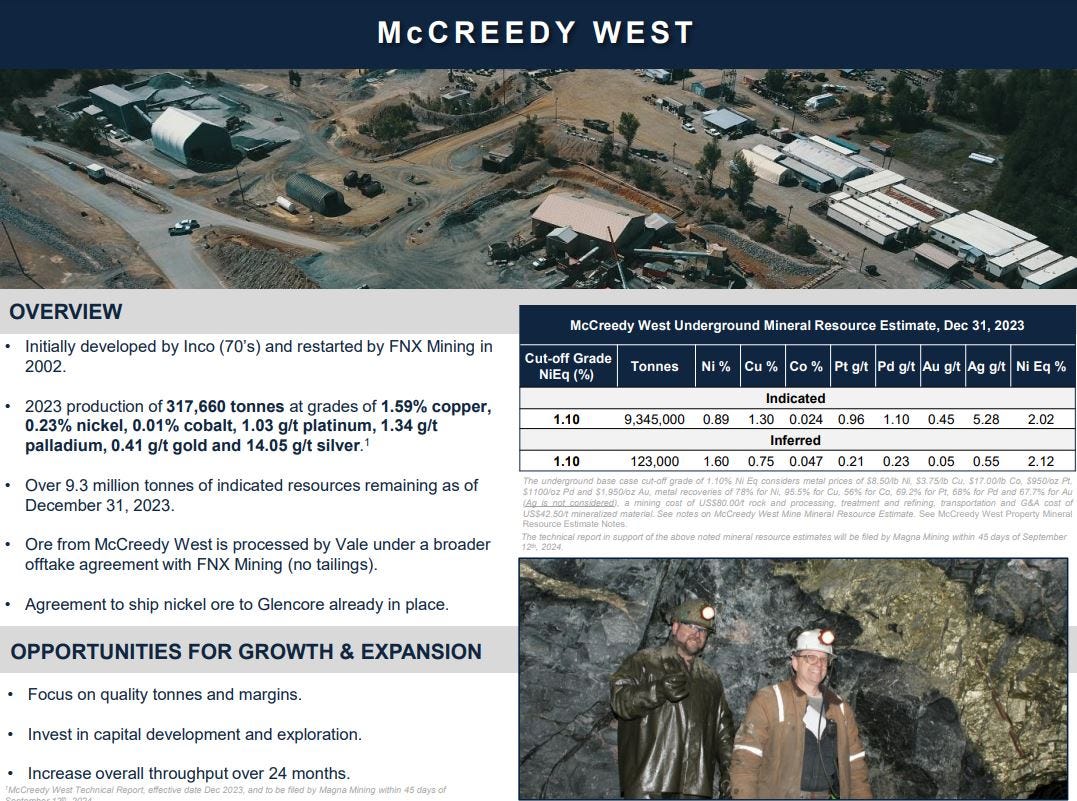

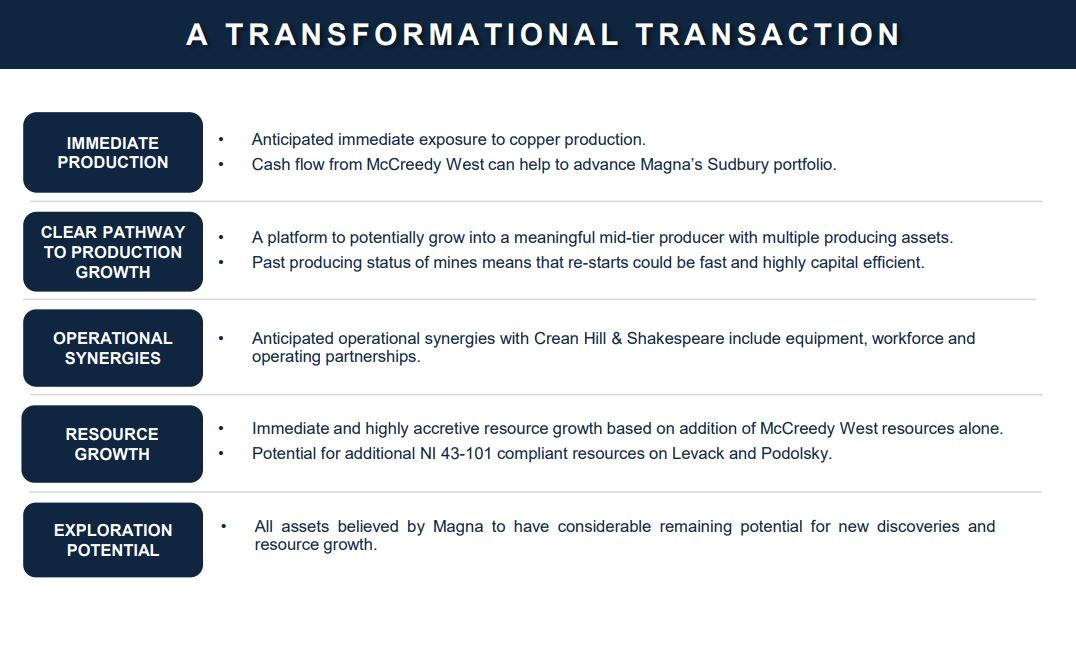

Their move into copper production highlights an agreement with a subsidiary of KGHM International Ltd. to acquire a portfolio of base metals assets located in the Sudbury Basin that includes: the producing McCreedy West copper mine, the past-producing Levack mine, the past-producing Podolsky mine, and past-producing Kirkwood mine, as well as the Falconbridge Footwall (81.41%), Northwest Foy (81.41%), North Range and Rand exploration assets.

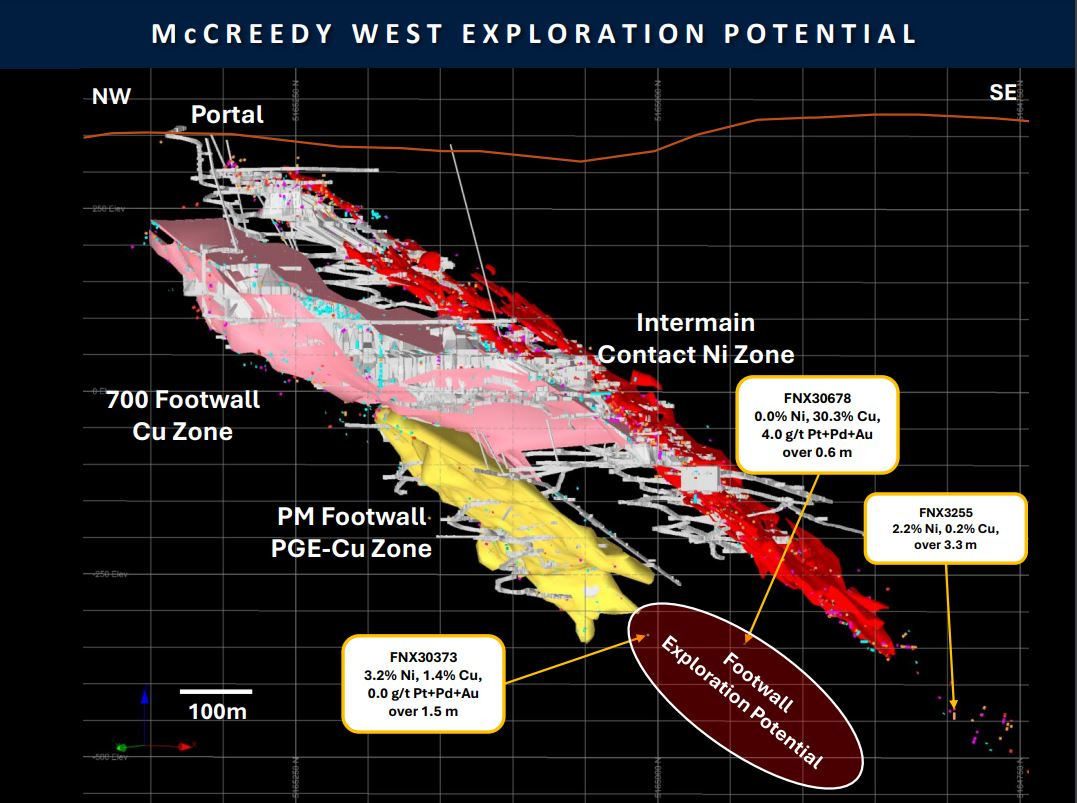

While most of the focus is rightly on the move into production at McCready West, what really struck me was the layers of other past producing mines and other exploration/development projects that could present so much exploration upside. This is why I’m including this company in an article on copper exploration and development.

On Oct 10, 2024 over at the KE Report, we had Jason Jessup back on the show to unpack a number of key Company milestones all just achieved in the last few months, including the transformative move into copper and nickel production at the McCready West mine in Sudbury, Canada. We dive into the details of the recently announced acquisition of multiple polymetallic prior producing mines and exploration projects around the Sudbury Basin, the results of the Preliminary Economic Assessment (PEA) from Crean Hill, and the results of the recent bulk sample processing. Additionally, we review the conditional approval for the Federal Critical Mineral Infrastructure Fund that was just received, to help fund further studies and future development of their projects.

Magna Mining – Moving Into Copper and Nickel Production - PEA And Bulk Sample Updates At Crean Hill

Jason outlines how he and multiple members of the Magna Mining team had worked at and run the McCreedy West and Levack Mines in the past when with FNX Mining, so that they are very familiar with these assets. While the current flagship will be the McCreedy West Mine, he also lays out the development pathway for bringing back into production the Levack Mine in 2026, and the Podolsky Mine by late 2027.

Shifting over to the Crean Hill Mine Project; Jason reiterated that their management team and board is still very interested on developing this asset and moving it towards production by 2027. The PEA was just released to the market on September 17th and highlighted a Pre-tax NPV (8%) of $265.3 million and an Internal Rate of Return (“IRR”) of 142% at conservative metal prices. There would be a low pre-production capital cost of $27.7M following AdEx period; and a payback of pre-production period capital within the first year of commercial production, and payback of all capital including AdEx period capital within the second year of commercial production. Crean Hill would have an average underground production rate of 2,200 tonnes per day (“tpd”) consisting of 1,650 tpd of higher-margin primary feed and 550 tpd of lower grade, incremental feed.

We also reviewed the completion of the recent initiative to mine surface bulk sample at the 109 Footwall Zone at Crean Hill, which commenced on July 2, 2024, and then process the material through the Sudbury Integrated Nickel Operations’ (“Glencore”) Strathcona Mill, which was completed on September 7, 2024. A total of 20,524 dry tonnes of feed (see Table 1) from the 109 FW Zone was processed over a 5-day period. Concentrate was produced which will be processed through Glencore’s Falconbridge Smelter. Jason reiterated that this surface bulk sample program was successful and acquired much of the data required to fully assess the base case metallurgical performance of the 109 FW Zone. Additional testing is being completed on samples collected during the program and will be used to advise future test work, and the ultimate pathway towards nickel, copper, platinum, palladium and gold production in the prolific mining district in Sudbury.

Additionally, back on March 27, 2024, Magna announced the signing of a Definitive Offtake Agreement for advanced exploration at Crean Hill with Vale Canada. The Vale agreement excluded the 109 FW Zone as Magna wanted to explore other processing options to improve recoveries for the copper-PGM rich mineralization in this zone. These two agreements with both Glencore and Vale demonstrate the various options for Magna to do future toll-milling agreements and grow their mining business in the Sudbury region.

Lastly, on October 9th, Magna Mining announced that it has received notification from Natural Resources Canada (NRCAN) that pending final due diligence, certain initiatives at both the Crean Hill and Shakespeare Mines have been conditionally approved for funding from the Critical Minerals Infrastructure Fund (CMIF). The funding will support pre-construction activities to help advance clean energy and transportation infrastructure at both projects. Nice to see some of that critical minerals funding finally being earmarked for quality projects.

Well, that wraps up this article on opportunities in the copper explorers and developers, and there are still plenty more companies to get to, in addition to checking in on some other companies already introduced in [Part 1]. While there have been some positive moves in select companies, the big move in copper juniors hasn’t really gotten underway in the same sense that the copper senior producers have already moved. That spells opportunity for those investors cognizant of the larger macro thesis underway in the copper sector. The will be handsome rewards for junior companies that are exploring for the red metal and expanding on significant resources that would be of interest to larger companies to take them into production. We’ll have much more to say and more companies to dive into with this sector over the fullness of time.

Thanks for reading and may you have prosperity in your trading and in life!

Shad