Opportunities With Mid-Tier And Junior Royalty Companies – Part 3

Excelsior Prosperity w/ Shad Marquitz – 04-27-2024

Welcome back to another update reviewing the opportunities in the mid-tier and junior royalty companies. In the first 2 articles in this series, we established the key value drivers, diversification advantages, risk mitigation advantages, and large net asset value per employee found in the royalty and streaming companies. We also broke down the general definitions and deal mechanics around royalties and streams. Additionally, we highlighted the first 2 companies in this category; Sandstorm Gold (SSL.TO) (SAND) and Metalla Royalty & Streaming (TSX.V:MTA – NYSE:MTA).

Here is a link to [Part 1]:

https://excelsiorprosperity.substack.com/p/opportunities-with-mid-tier-and-junior

Here is a link to [Part 2]:

https://excelsiorprosperity.substack.com/p/opportunities-with-mid-tier-and-junior-6b8

Now that the royalty sector nuances have been established, here in (Part 3) of this series let’s just jump right into company number 3 – Elemental Altus Royalties Corp. (TSXV: ELE) (OTCQX: ELEMF).

Personally, I have been investing and position-trading around a core Elemental Altus position since mid-2021 (back when they were just Elemental Royalties, before the hostile bid came in from Gold Royalty Corp in early 2022 and was rejected by existing shareholders, and also before the subsequent merger with Altus Strategies in August of 2022). Due to maintaining a more active trading approach, I have not always been fully positioned in the stock during that entire time frame, as I often accumulated more shares or trimmed down more shares of the core position based on fundamental and technical reasons. For a few periods of time, I also fully exited the position completing the position trade, before initiating the next trade. I’ve been in my most recent Elemental Altus position since September of 2023, and have the view in this acceleration phase of the PM bull market, towards just holding onto this position; more like a value investing “buy and hold” approach moving forward. (So, I’m biased in that sense as a shareholder, and as always, this is not investing advice.)

Since early 2021, I have gotten to know the CEO Fred Bell through a number of Zoom conversations, electronic email exchanges, physical meetings at resource conferences, and over a dozen official interviews on the KE Report. I’ve also watched the company continue executing on its plan by growing the number of producing and developmental assets, via both acquisitions and royalty generation, and growing in gold equivalent ounces produced. (So, I’m also biased in that sense in that I’ve grown to appreciate Fred and the team over at Elemental Altus over the course of the last 3.5 years, holding the personal opinion that they are doing a bang-up job of building longer term accretive value. From my perspective, they have been forthcoming and transparent as to both their challenges and successes along this journey, which is appreciated and distinguishing in a sector notoriously full of hot-air).

With those caveats out of the way, my goal in this series is to be fair-minded in my assessment of these companies for readers here. Really I just want to overview their unique company fundamentals, to outline the value proposition that I recognize, and to review why they are included in my personal portfolio. None of these companies have asked me to write about them, and the purpose of this Substack channel is just to share investing ideas and concepts with readers here. So let’s get into it…

In their own words, here is how the Company describes themselves:

“Elemental Altus is an income generating precious metals royalty company with 10 producing royalties and a diversified portfolio of pre-production and discovery stage assets. The Company is focused on acquiring uncapped royalties and streams over producing, or near-producing, mines operated by established counterparties. The vision of Elemental Altus is to build a global gold royalty company, offering investors superior exposure to gold with reduced risk and a strong growth profile.”

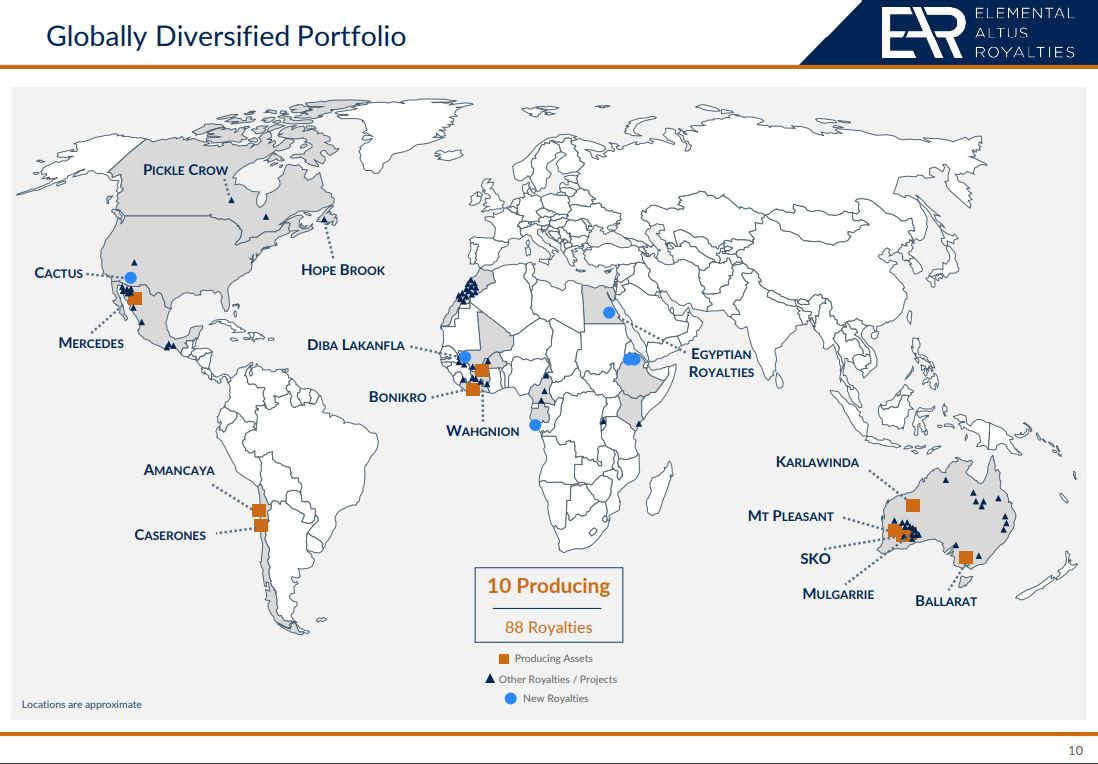

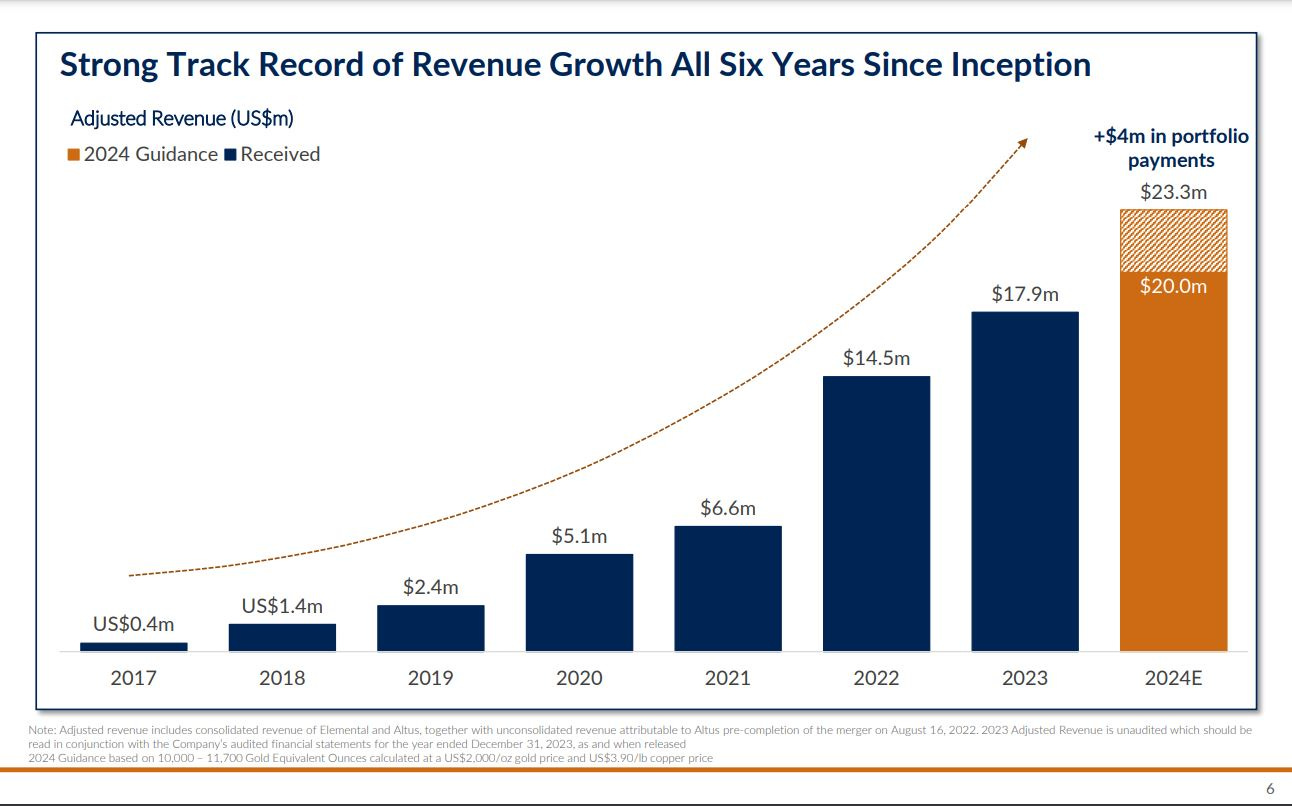

Over the years, I’ve watched the company bulk up to those 10 producing royalty assets, and to a total of 88 royalties, diversified across 15 jurisdictions, and continue to keep growing revenues each year. Their approach from the beginning (initially when private back in 2017, and publicly since 2021) has been focused on acquiring revenue-generating royalty assets that were either in production, or that had a pathway to near-term production.

In contrast to a number of other junior royalty companies over the last few years, it is impressive that they were able to quickly amass such a portfolio of producing assets, that equated to actual gold or copper production and revenues generated. This is a space that has seen many peer prospect generators fail to materialize a meaningful basket of producing assets, or peer junior royalty companies that concentrated most of their acquisitions on long-dated earlier-stage assets that have been further away from production. In the pool of larger junior royalty companies or smaller mid-tier royalty companies, there are few other companies that have 10+ producing royalty assets at present, so that feat alone is impressive for Elemental Altus.

Another misconception and fallacy about royalty companies is that they are boring and just sit there stagnant with fixed portfolios of royalties and streams, biding their time for higher metals prices. As we’ve outlined during this series so far, that reality is far from the case in the quality junior and mid-tier royalty companies. The most obvious point is that the legitimate companies having been active for years growing their portfolio assets through royalty generation, royalty creation, or by acquiring existing royalties. Then there are the other value drivers of both exploration optionality and production optionality, where more value can be daylighted in existing royalties as competent operator partners explore, expand, and extend their mining projects. There are other catalysts that can impact royalty companies at no additional cost, like stronger operators taking over a project and thus a royalty, or existing operators uncovering new areas of a mine to be brought into the development process earlier, that expedite anticipated timelines. So there are a lot of ways that royalty companies can grown and Elemental Altus has experienced some of all of those milestones over the years.

Elemental Altus has grown revenue for the last 6 years, and will be growing revenue further in 2024.

Most of the established royalty companies have a few cornerstone assets, which make larger contributions to the production profile and revenue generation. For Elemental Altus we’ll highlight two cornerstone assets -- their copper royalty at the Lundin Mining’s Casserones Mine in Chile, and the gold royalty on Capricorn Metals Karlawinda Mine in Western Australia. These are both long-life production assets with substantial potential to expand the mine life or increase production through targeted exploration programs. Fred and I specifically discuss the exploration upside and optionality at Casserones in a recent interview we did last week over at the KE Report (included further down in this article).

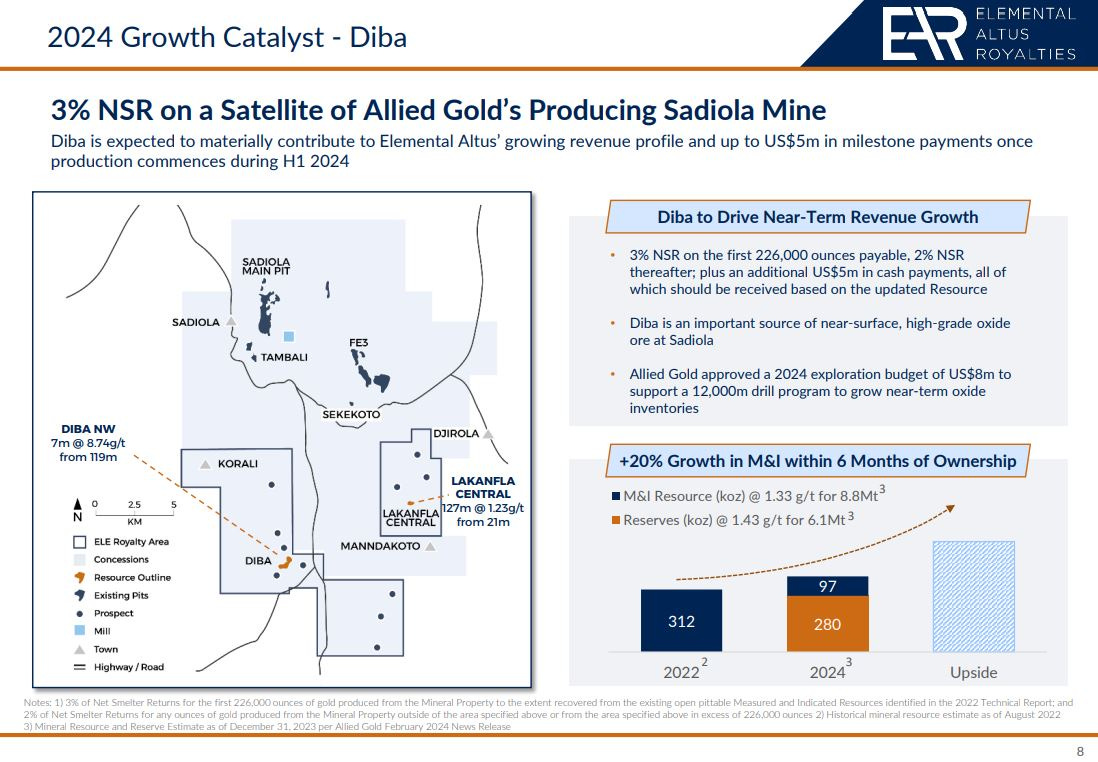

Another asset, which has been expedited towards production in 2024 through the royalty generation model, is on the Diba Project now operated by Allied Gold. Initially, there was some grumbling from legacy Altus Strategies shareholders concerned about the value received from this asset in the somewhat recent transaction with Allied Gold. Apparently, there were some people anticipating the team at Elemental Altus to keep carrying this asset and exploring on it to build more value and then work to develop it more on their own. Fred highlighted why lowering the G&A costs, exploration costs, and personnel by optioning out the project out to a solid operating partner, was far more in line with their overall business strategy. Now Allied Gold has already expanded the exploration far beyond anything ELE could or would have done, is already operating nearby, and now they are fast-tracking this asset into production, making it a revenue generating asset within the Elemental Altus portfolio. The brilliance of the royalty generation side of the business model is starting to shine through now to the vast majority of investors in this equity.

In addition to the producing royalty assets, Elemental Altus also has a basket of 78 other development-stage or exploration-stage assets that have a substantial amount of ongoing value creation going on.

One of these royalties that ELE highlights on their slide deck (and that Fred has reviewed with me in prior interviews over at the KE Report), is on the Cactus Project operated by Arizona Sonoran Copper Company Inc. (TSX:ASCU | OTCQX:ASCUF) . Arizona is the USA’s top copper producing state, and this is brownfields project, with a formerly producing mine with significant infrastructure on-site. In addition, on December 14th of last year Arizona Sonoran announced a JV with Nuton, a wholly owned Rio Tinto subsidiary developing proprietary copper leach related technologies. I think this is a more significant partnership and newer mining extraction method for copper, than Arizona Sonoran is getting credit for.

Arizona Sonoran and Nuton LLC Announce Option to Joint Venture on Cactus Project in Arizona

The other thing about the Cactus Project is that these copper resources from Arizona Mining are sitting adjacent to Ivanhoe Electric’s Santa Cruz Project (run by copper bull and industry heavyweight Robert Friedland); but at a far more compelling value. Another strength from the permitting side of things is that this land in Arizona is on a private landholding, making it much easier to move towards a development scenario. (In full disclosure, I’ve started accumulating shares in Arizona Sonoran recently, to prepare for the multi-year copper bull market that seems to be setting up to my eyes, and so in that sense I’m biased about how favorably I look at this project, for the exposure to both ASCU and ELE).

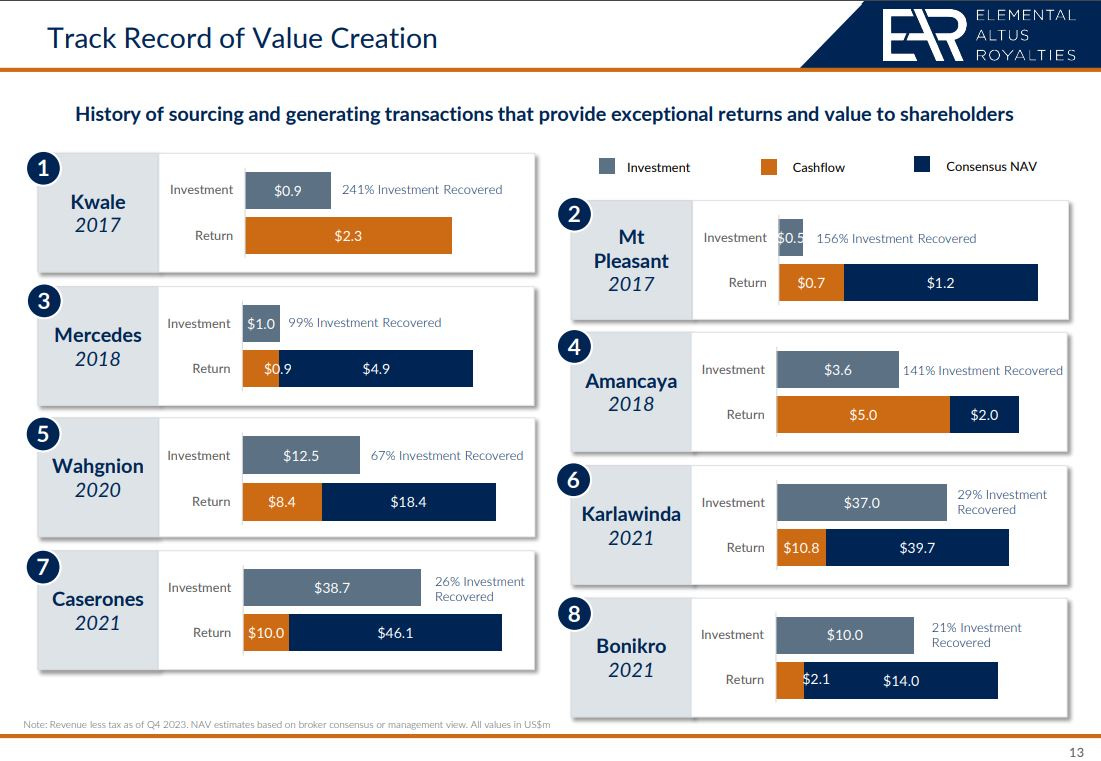

Every royalty company I’ve ever talked with in meetings, or have ever listened to in interviews, points out the value creation that they’ve achieved on the funds deployed. Overall in this space, it is the truth. The royalty business model is the most attractive company structure in the resource sector, regardless of the commodities it is deployed on (gold, silver, copper, oil, base metals, specialty metals, nat gas, coal, uranium, lithium, etc…). However, there are companies, like Elemental Altus, that have truly excelled beyond most companies in consistently putting the “proof in the pudding,” and demonstrating solid percentage returns for the capital invested, based on the cashflow already achieved, and the ongoing future production value to bring in based on consensus Net Asset Values of the producing projects they hold royalties on.

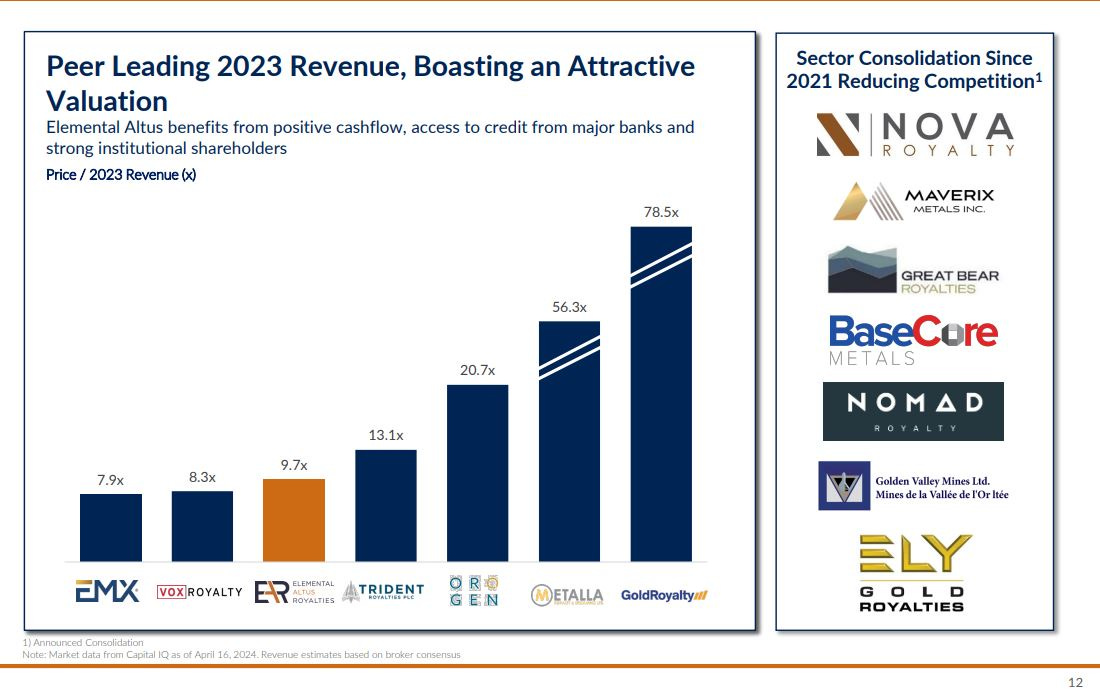

Another area where I think companies like Elemental Altus, Vox Royalty, and EMX Royalty have an edge for a potential rerating higher in this emerging PM bull cycle, is where they are currently valued versus their revenue generation capabilities. This slide below, found in the Elemental Altus slide deck, not only illustrates the disconnect between many companies valuations versus their revenue generation, but also highlights the number of mergers and acquisitions from prior junior and mid-tier royalty companies that have been rolled up into larger companies over the last few years.

This revenue generation allows these junior and mid-tier companies more optionality to purchase existing revenues in the market that may be too small for the majors like Franco-Nevada, Wheaton PMs, and Royal Gold, or conversely, too large for earlier-stage royalty companies without the larger base of incoming revenues. Additionally, having revenues and cashflows allows these nimbler junior and mid-tier companies to structure mid-sized deals with individual mining companies to create new royalties, while offering a more competitive cost of capital to the sector operators.

Let’s conclude this article with the interview I conducted with CEO, Fred Bell, over at the KE Report on last Friday April 19th. Fred does a solid job highlighting many of the points we reviewed together in this article, and in articulating the journey on where the company has arrived at present, and the future vision of the company’s larger strategy moving forward.

Elemental Altus – 2023 Delivered Record Financials – 2024 Guidance, And Royalty Partner Updates

That’s it for this (Part 3) in this evolving series on junior and mid-tier royalty and streaming companies, and there will be a number more of these articles on this topic in the weeks and months ahead.

Stay tuned for updates to other sectors and commodities in the article to come, that will get into M&A in the sector and ongoing series that will kick off soon on which development stage or advanced exploration companies I’m personally targeting that could be the next takeover candidates. There is also the plan to get into which kinds of junior metals companies have the most torque and optionality in a full-on bull market. Additionally we’ll circle back around for a uranium sector update soon, take a deeper dive into oil and nat gas stocks, and review some of the copper stocks both larger and smaller that seem to have good value propositions. Of course, we’ll also keep expanding on the ongoing series on growth oriented gold producers, and will be starting a new series on growth-oriented silver producers.

As always, thanks for reading and may you have prosperity in your trading and in life!

- Shad