Opportunities With Mid-Tier And Junior Royalty Companies – Part 1

Excelsior Prosperity w/ Shad Marquitz – 03-15-2024

The whole royalty sector is a very enticing value proposition, due to the long-term expected returns on capital deployed, and it is a superior business model to individual resource extraction companies for a number of reasons. This is true whether the royalties held by a company are exposed to precious metals, base metals, oil & gas, lithium, or uranium properties.

In addition to long-term accretive growth, there is also the reduction of the extreme risks that most individual mining companies are exposed to, through a much wider diversification across multiple jurisdictions and operational partners. These royalty and streaming companies have all the blue-sky upside of both exploration optionality and production optionality, without having to deploy their own capital, employees, equipment, to achieve this potential growth. Additionally, these companies do not have to deal with the most of the permitting process, surface or underground development, construction of mines, or operational execution risks. As a result, they require only very small staffs, compared to mining companies, and have the highest net asset value per employee compared to any other companies in the resource sector. We’ll get into all of that and more in this series, and also dive into a number of the quality individual companies.

The particular focus in this series will be uncovering the opportunities presenting themselves in the mid-tier and junior royalty companies focused on the metals, particularly gold, silver, and copper. There is a great deal of attraction from investors to this superior business model found with royalty and streaming companies, and this will be an ongoing series, where we’ll eventually branch out the conversation to include other royalties from the energy sector (oil, nat gas, lithium, uranium, niche energy metals, and renewable energy sources) as well.

Let’s start off this series with a quick primer on what we mean by royalty and streaming companies and assets, and the power behind this business model. Specific royalty assets in these companies are generally held with a contract and agreement that allows them to receive a fixed percentage of the metal produced from a deposit, or particular portion of a deposit, from an operator’s net or gross production.

It is most common to see a royalty percentage in the range of 0.25% - 4.0% of a specific metal produced (although there are even a few royalties on projects higher than that range). There are also some royalty contracts based around a percentage on all the metals produced from a specific project held on the land the royalty covers, instead of limited to just one metal, but those are more rare. The royalty company is then paid for that percentage of metal ounces/pounds produced once returned from the metals smelter (minus the fees to process, refine, ship the ore) by the primary operator of the project; thus generating their royalty revenues.

Streams are a similar kind of asset, that also generate revenues based on partial production output of a metal over the specific project, but they differ from a royalty in the following way: The streaming company will have paid a lump sum of money in advance, (normally to have helped finance the exploration, development, the construction of a mine build, or a mine expansion), that allows this company the right to then purchase a certain percentage of future production at a low set metals price or at a set percentage of the current metals spot price at that time.

These particular companies will have a number of producing royalties or streams, operated by a number of 3rd party operating mining companies in a number of different jurisdictions, and potentially over several different kinds of commodities. This provides royalty companies with FAR more diversification than what is found in individual producing mining companies. This is a big part of the appeal to investors that want the upside of metals production, but spread out over a number of projects, operators, metals, and jurisdictions for a gradually increasing value accretion over time.

It should also be mentioned that in addition to the current producing revenue-generating assets, there could also be option payments, and stage-gate or milestone payments; that essentially bring in additional revenues on the remaining portfolio of development-stage or exploration-stage assets, over time during the derisking process on a given deposit. So royalty revenues are not limited to just production inflows.

Lastly, there are 2 kinds of optionality, as further value drivers on royalty and streaming projects. First off, there is the potential exploration discovery optionality from companies making new discoveries on existing royalty lands, where the royalty company is not the one paying for all those additional drill meters and resource expansion. Then second there is the production optionality, where competent operating mining company partners may announce expanding their production profile by finding larger reserves, opening up more underground stopes, identifying more at-surface open pits, or by finding higher grade parts of the deposit to mine. As mentioned earlier, these optionality factors provide further bluesky upside on these royalty assets, with no additional costs or payments required by the royalty companies, and without them using their staff or taking the operational risks.

All of these ways to generate further diversified value across their portfolio of royalties and streams, have allowed this sub-sector of the resource space to grow immensely over the last few decades (starting in the oil and gas mineral right space, and then expanding over the last 20 years into the metals and many other commodities and energy sectors). We have seen more and more metals companies piling into this space, over the last decade, or having evolved into it via the prospect generator approach over time, having realized the brilliance of the business model.

It’s important to note that these companies also provide an option for funding and capital to mining companies, outside of the normal equity dilution, debt transactions with financial institutions, or the strategic partnerships taking over a percentage of a project. Royalties and streams provide yet another avenue for raising funds, and sometimes at a better cost of capital for the underlying operating mining companies, who are doing the hard work on the actual projects.

In the small universe of metals-focused royalty companies, there is already plenty of analyst coverage and many investor discussions around the very largest metals royalty companies; like Franco-Nevada, Royal Gold, Wheaton Precious Metals, Triple Flag, and Osisko Gold Royalties. For that reason, I’m not going to spend much time on those larger “Majors” in the sector. To be sure, they are all solid companies, and have wonderful portfolios of assets, but I feel that these companies have already been parsed by analysts for a very long time, and that overall they are much more fairly valued at present; compared to some of the other mid-tier and smaller royalty and streaming companies.

In the course of this first article, I’m simply going to share some of the value drivers I see with the royalty companies that are held in my own portfolio: Sandstorm Gold, EMX Royalty, Metalla Royalty & Streaming, Elemental Altus Royalties, Vox Royalty, and Orogen Royalties. There are plenty of other interesting companies that I’m not positioned in currently that have merit for future review as well though: (like Altius Minerals, Ecora Resources, Gold Royalty Corp, Trident Royalties, Empress Royalty, Sailfish Royalty, Star Royalties, Riverside Resources, and Electric Royalties). So in a nutshell, I do really like this whole sub-sector, and think there is tons of value to be had in most of the companies. Having said that, I’ll provide my thinking and rationale for positioning into the specific aforementioned companies in my own portfolio.

In Part 1 here, I’ll do a deeper dive into Sandstorm Gold to kick things off in this series of articles on the royalty and streaming companies, and provide some of the value drivers I see moving forward. However, further down in this article I will also provide YouTube videos of the recent interviews we completed over at the KE Report with the management teams of EMX Royalty, Metalla Royalty & Streaming, Elemental Altus Royalties, Vox Royalty, and Orogen Royalties. These interviews will provide readers here with a great deal of insights and concise overviews of each company and their recent news along with longer-term value drivers.

Sandstorm Gold (TSX: SSL) (NYSE: SAND)

Sandstorm Gold, with a $1.5Billion market cap, is the largest mid-tier royalty company in my personal portfolio, and while I typically opt for smaller market cap companies under $1Billion, Sandstorm is a special case. (SAND) appears to be undervalued compared to it’s larger peers on a number of metrics, where I could see it getting rerated up 2x-3x just to catch up to peer valuation trends. Most notably, it has been typically valued at 0.6%-0.8% of Net Asset Value (NAV), where the other mid-tier companies trade closer to 1.2% of NAV (Triple Flag and Osisko Gold Royalties), and the Majors trade just under 2% of NAV (1.7%-1.9% for Royal Gold, Franco-Nevada, and Wheaton PMs)

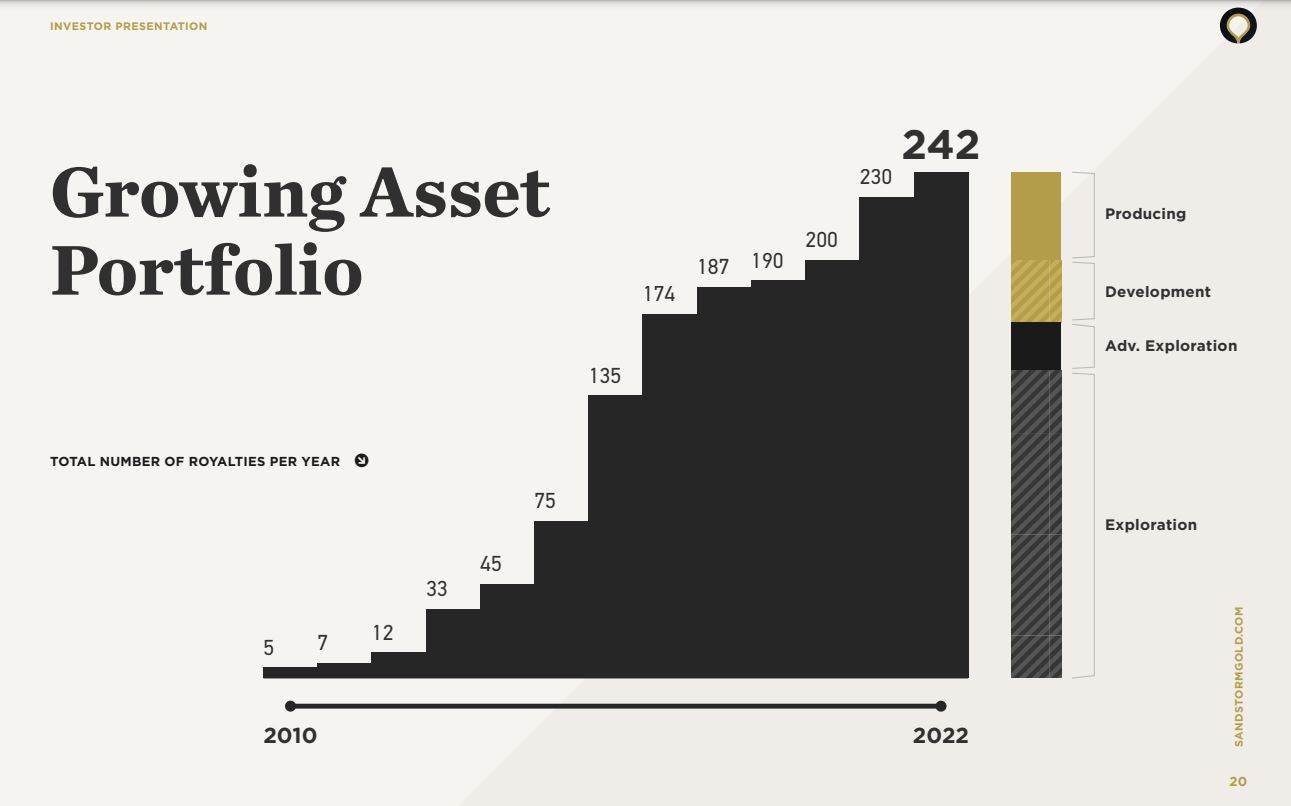

Sandstorm has roughly 250 royalties, in gold, silver, copper, zinc, molybdenum, and iron ore, with over 40 cash-flowing assets, and spread out in over a dozen countries. I have been following this company ever since I started actively trading the mining stocks in 2010, and have been very impressed that they have gone from 5 royalties when they first popped on my radar to 242 royalties by 2022, after their 2 major acquisitions of Nomad Royalty and BaseCore Metals Royalty Package (from Glencore).

While it is currently more balanced across different metals at 56% gold/44% silver, copper, other metals, it is transitioning over the next 6 years to eventually have over 80% of its metals exposure be to gold by 2029; once the Mara stream transaction with Glencore comes online. So this is a royalty and streaming company that will get more concentrated in the yellow metal over time, but still has some nice kickers from silver, copper, zinc, molybdenum, and iron ore in the interim.

Due to the constraints of this article size I’m not going to go into much more detail of all their key producing royalties, or development stage royalties, but I’ll link to their 16 page “Royalty Ounces Reserves and Resources” handbook below that provides plenty more detail and a very thorough overview for those interested.

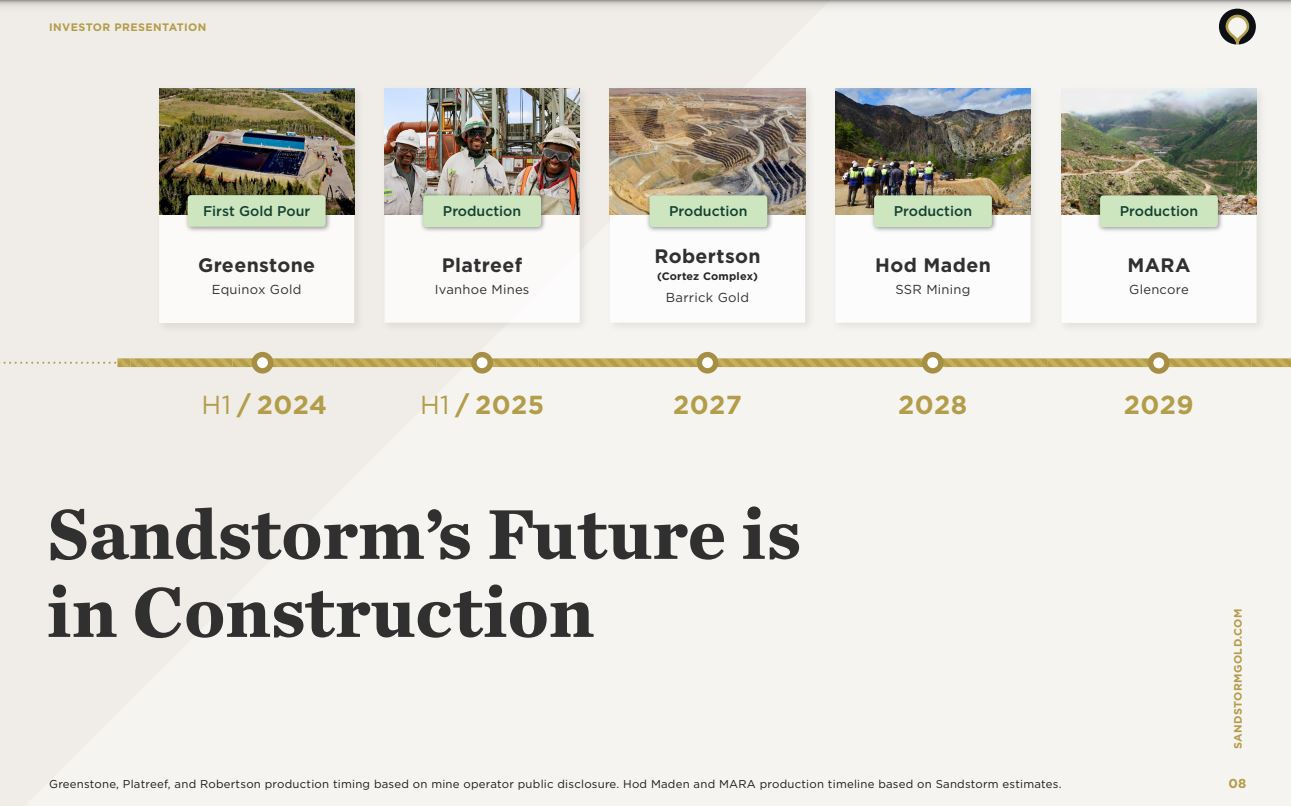

One of the taglines that the Company is using in their marketing at present, is very clever and incredibly appropriate: “Sandstorm’s Future Is In Construction”

This, of course, eludes to their royalties that are about to come into production and start generating revenues on major global mining projects over the next 6 years, like Equinox Gold’s “Greenstone Project,” Ivanhoe Mines “Platreef Project,” Barrick Gold’s “Robertson Project," SSR Mining’s “Hod Maden Project,” and Glencore’s “Mara Project.”

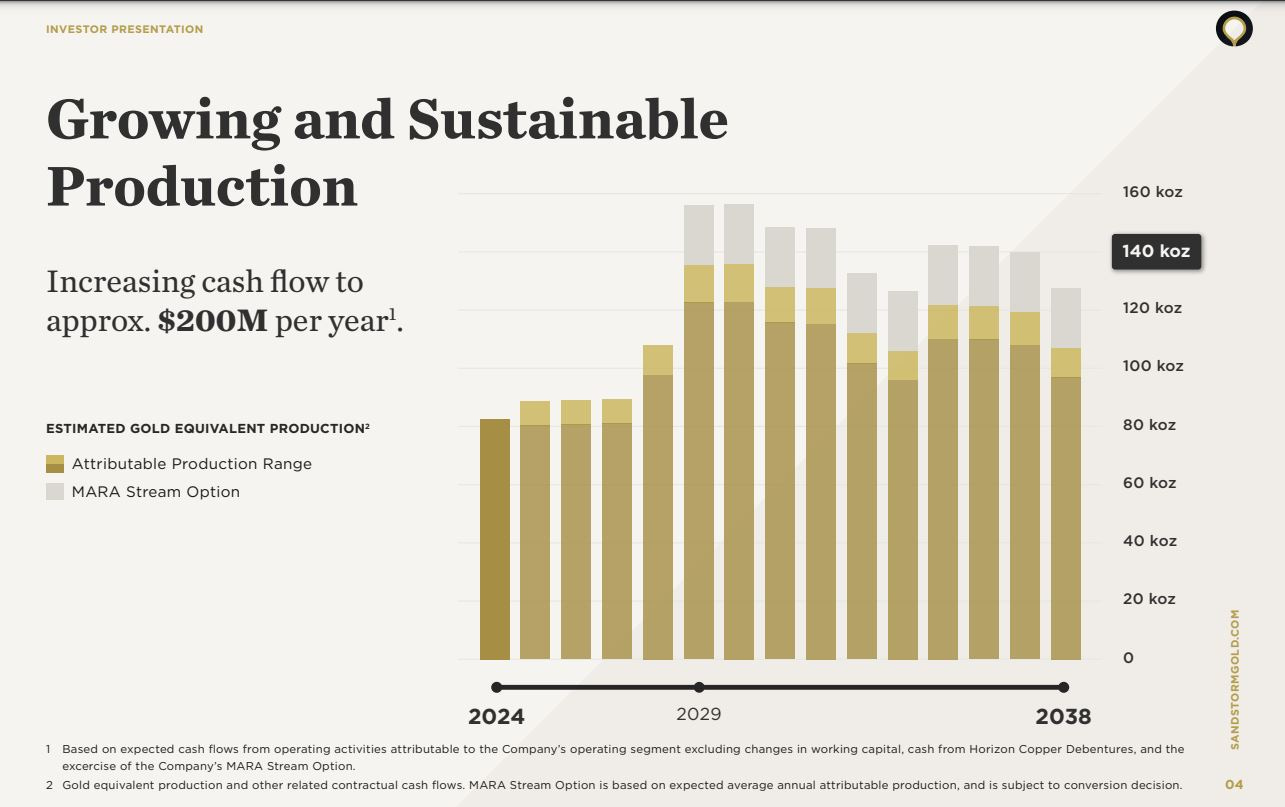

With all of these large mines coming into production over the next 6 years, it will greatly increase the gold equivalent ounce production for (SAND) from around 90,000 ounces this year to around 150,000+ ounces by 2029 (once the MARA stream comes online). In 2023 Sandstorm had 97,245 gold equivalent ounces of production, and they are guiding 75,000-90,000 gold equivalent ounces for 2024, which is slightly lower than last year’s record production. My hunch is that they come in on the upper end of that guidance based on how well things went in Q4 of last year and are set up at present.

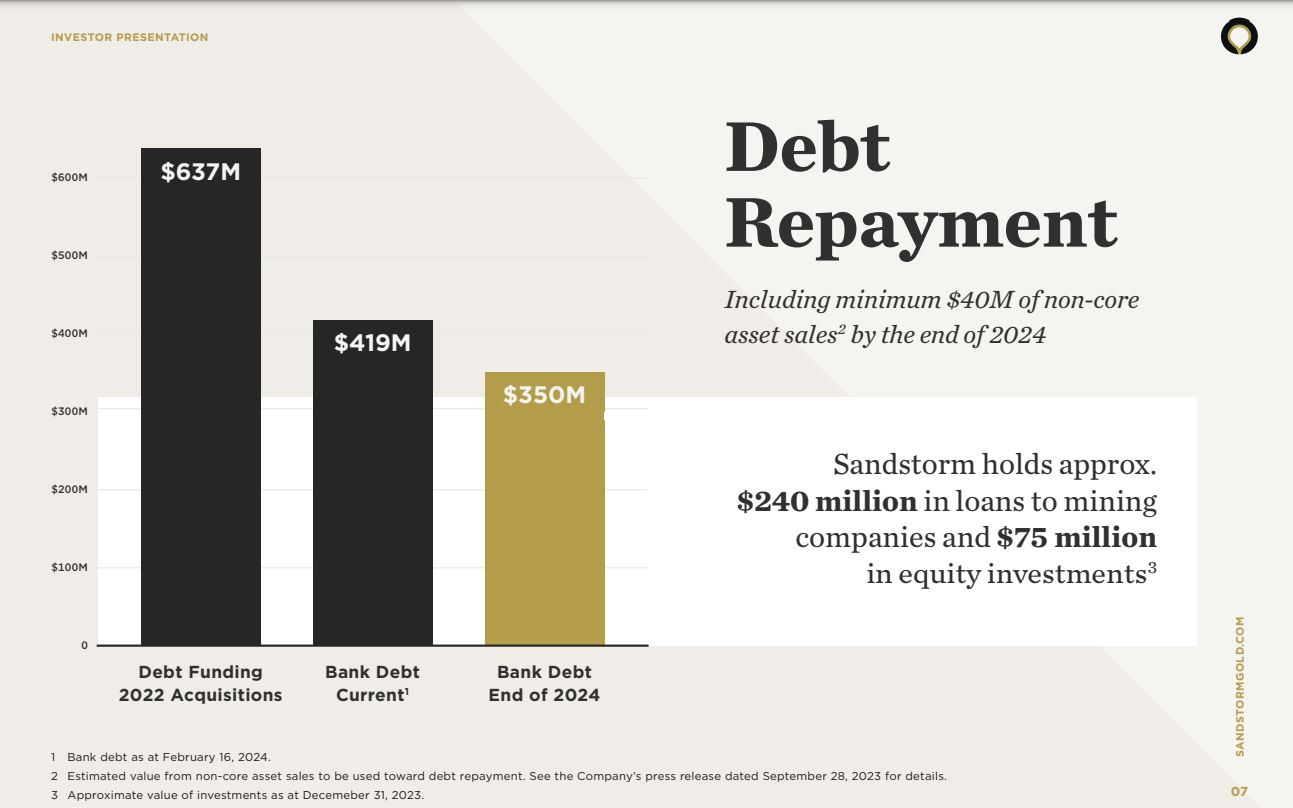

The current negative knock against Sandstorm Gold, from vocal retail investors and institutional funds alike, is that they are currently carrying a large amount of debt, after their large acquisitions of Nomad Royalty and BaseCore Metals Royalty Package around 2 years ago. While this is a legitimate concern from investors, the company does have a plan to take their corporate bank debt down to around $350Million by the end of this year. This will be a substantial reduction from the levels seen the last 2 years since those 2 acquisitions. My perspective is also that, compared to individual mining companies, the concerns are not nearly so dire with a royalty and streaming company with 40 cash-flowing assets, a small staff, and very little sustaining capital needed to see a large increase in production in the years to come. I see their bankruptcy risk as near zero, and instead a company that has an initiative to chop down their debt substantially in the next 12 months.

One of the points that I spend some time talking about with Kim Bergen, VP of Capital Markets for Sandstorm Gold, (in the interview linked below), is that the company has the largest percentage of lowest quartile costs with their producing partner projects, compared to any of the other mid-tier or major royalty and streaming peer companies. This bodes well for their operating partners on their royalty projects to continue to have fat margins and bring in the revenues and cashflows to help them propel their projects forward, (and possibly find more resources or extend mine life at many assets).

On Feb 23rd, I interviewed Kim Bergen, Vice President of Capital Markets for Sandstorm Gold, and she provided an excellent overview of the value proposition for the Company, that makes a complimentary addendum to this article.

Sandstorm Gold – Introduction To A Diversified Mid-Tier Precious Metals Royalty Company

As promised, here are some recent interviews with the other royalty and streaming companies held in my portfolio, and that we’ll be doing future deep dives into as this series continues… These overviews and updates are well worth the brief listens.

EMX Royalty (TSX.V: EMX) (NYSE: EMX)

Dave Cole, President and CEO of EMX Royalty Corp (TSX.V: EMX) (NSYE: EMX), joins us for a comprehensive update on their distinguishing value proposition in the royalty space, a number of copper, gold, and nickel royalty partner project updates, and the balance of paying down debt in tandem with buying back Company shares.

EMX Royalty – Value Proposition, Royalty Partner Updates, Paying Down Debt, & Buying Back Stock

Feb 15, 2024

Metalla Royalty and Streaming (TSX.V: MTA) (NYSE: MTA)

On March 7th, Brett Heath, President and CEO of Metalla Royalty & Streaming, joined my business partner at The KE Report, Cory Fleck, to provide an update on the Gosselin & Côté Royalty, where IAMGOLD just updated the Mineral Resource, and he outlines the 2024 portfolio catalysts.

Metalla Royalty & Streaming - Key Royalty Update, 2024 Royalty Portfolio Catalysts

Elemental Altus Royalties (ELE.V) (OTCQX:ELEMF)

Fred Bell, CEO of Elemental Altus Royalties (TSX.V:ELE – OTCQX:ELEMF), joined me on March 4th to review the Q4 and full year 2023 operations and financial metrics, a number of royalty partner updates, the sale of the Ming royalty, and the business strategy in 2024 with the optionality from being cashed up and cash-flowing.

Elemental Altus – Record 2023 Revenues, Royalty Partner Updates, Sale of Ming, And 2024 Outlook

Vox Royalty (VOXR.TO) (VOXR):

Kyle Floyd, CEO and Chairman of Vox Royalty (TSX: VOXR) (NASDAQ: VOXR), joined me on March 10th, to review their record 2023 operational results in revenues and cash flows from their portfolio of royalties, and a few partner project updates that are moving towards development. I personally feel Vox is the most undervalued junior royalty company on my radar and we also get into that during the interview.

Vox Royalty – Record 2023 Revenues And Cash Flows From Operations Across Their Royalties Portfolio

Mar 10, 2024

Orogen Royalties (TSX.V: OGN – OTCQX: OGNRF)

Paddy Nicol, President and CEO, and Marco LoCasio, VP of Corporate Development, at Orogen Royalties (TSX.V: OGN – OTCQX: OGNRF) both join me for a comprehensive update on this hybrid royalty company and prospect generator, reviewing some of the key cornerstone royalty assets, and some of the up and coming projects moving from exploration into development. AngloGold Ashanti (AU) outlined a 9.05 million toz gold inferred resource for the Merlin deposit that is a part of the Expanded Silicon Project. Now, the project contains inferred and indicated resources of 13.27 million toz gold in total. Orogen holds a 1% NSR royalty over the project.

Orogen Royalties – Comprehensive Update On Key Cornerstone Royalties And Royalty Generation

Feb 29, 2024

That will wrap us up for this Part 1 in an ongoing series on the royalty and streaming companies, and I appreciate you reading and listening to the accompanying interviews. If you see value in these articles please feel free to forward them to a friend or peer investor.

Also come check out our interviews at The KE Report during the week, with various thought leaders in economics, general equities, technical analysis, resource investing, and a number of resource companies at https://www.kereport.com/

May you have prosperity in your trading and in life. Thanks!

- Shad