Opportunities With Mid-Tier And Junior Royalty Companies – Part 2

Excelsior Prosperity w/ Shad Marquitz – 04-13-2024

Welcome back to another update on the mid-tier and junior royalty companies. There is a great deal of attraction from investors to this superior business model, and I also share that passion and interest. As mentioned in [Part 1], the initial focus in this series will be uncovering the opportunities presenting themselves in the gold, silver, and copper mid-tier and junior royalty companies focused on the metals arena, and then we’ll broaden out the discussion to include other commodities. There are a LOT more articles still to come in this series, centered around this particular subsector of the resource investing world. We’ll eventually branch out in this conversation to also include royalties from the energy sector (oil, nat gas, lithium, uranium, niche energy metals, and renewable energy sources).

For new readers here, or anyone that just wants a refresher on the main concepts laid out in the first piece in this series; we laid out the big picture value proposition with companies aggregating royalties and steams. Sandstorm Gold (SSL.TO) (SAND) was the highlighted company where we dove a bit deeper into their value proposition. Here is a link to [Part 1]:

https://excelsiorprosperity.substack.com/p/opportunities-with-mid-tier-and-junior

It is important to reiterate a key point that royalty companies are not just about upside growth, but also a means of diversifying one’s risk profile in the very risky commodities extraction sector. In addition to the long-term accretive growth, there is also the reduction of the extreme risks that most individual mining companies are exposed to. The risk reduction benefits stem from these companies having a portfolio approach, and thus, much wider diversification across multiple jurisdictions, multiple operational partners, and multiple commodities.

These royalty and streaming companies have all the blue-sky upside of both exploration optionality and production optionality, and can get paid on commodities production, without having to deploy large groups of people or capital on the ground. Royalty companies don’t have hundreds or thousands of employees in mining camps, or the risk of potential injuries or death in mining operations to their teams. They don’t have to purchase explosives, or the big yellow trucks, or the heavy industrial equipment and chemicals for a mill. They don’t have to physically operate their businesses in challenging natural or geopolitical environments to achieve their potential growth. Royalty companies don’t have to do large earthworks, build roads, build drill pads, build heap leach pads, build ramps down into underground development, or bring in engineering teams for the construction of mines. In a nutshell, royalty companies don’t have to be on the ground taking the operational execution risks.

Additionally, most royalty companies do not have to negotiate the myriad of social agreements nor bring in experts to perform the countless studies required in the ongoing permitting process. There are some royalty companies, operating with a prospect generator model, that may obtain some initial surface disturbance permits to conduct limited exploration programs, before optioning projects off to other operators. In general, the social licensing and long permitting processes are not really in their hands, as their royalty partners operating the projects take all those risks. This means the key risk to the royalty company is having operational partners that may run into problems. That is precisely why they’ve spread their bets around on multiple projects, multiple jurisdictions, and multiple operational partners.

As a result, royalty companies require only a very small staff, compared to individual mining companies, and have the highest net asset value per employee compared to any other companies in the resource sector. This is a huge point and cannot be overstated.

Alright, let’s get into our next specific company update, in the mid-tier and junior royalty space: Metalla Royalty & Streaming (TSX.V:MTA – NYSE:MTA)

Just as an aside before we get started: I keep my ear to the ground in the resource investing space, about as much as anybody can; doing dozens of calls each week with companies and thought leaders in the space over at the KE Report, visiting daily multiple online resource investing chat forums, reading dozens of industry articles and research pieces each week, and then a flood of communicating with resource investors all the time. I find it curious (and strangely intriguing as a contrarian investor) that Metalla gets such a hard go of it from certain vocal influencers, and at times is presented as a bit of a market pariah, in the royalty space. Now, this may be the natural emotional reaction investors have to a stock that ripped up to such high levels a few years back in 2020, and then corrected down hard for the last 3 years with the rest of the PM sector. Maybe it is just lament and anger from investors that were initially excited about the investing thesis here, and then got stuck in a trade that went into the red on them. Who knows?

Personally, I’ve had the good fortune of speaking to the CEO, Brett Heath, periodically for the last 4 years, and have learned a lot about this company, the royalty assets within it, and the longer-term vision of where the company is headed. Maybe that insulates me somewhat from the emotional sentiment swings of investors, who are often superfans of stocks and management teams during uptrends and then pivot to become haters during downtrends. If investors are coming into this with some of these emotionally charged preconceived ideas around either royalty companies or Metalla, then I’d simply suggest that you look at the body of data presented with a fresh set of eyes and consider the value proposition as it stands in the here and now.

With a market cap just north of CAD $400Million, and a pipeline of 100+ royalties and streams, 5 producing assets, and 3 assets under construction for near-term production; MTA will be emerging from a junior company into a mid-tier company over the next 2-3 years. The company has predominantly been focused on acquiring precious metals royalties for the last 8 years, but also made a key acquisition last year of Nova Royalty, bringing in fairly significant exposure to copper royalties in their portfolio and future growth trajectory. (more on that later)

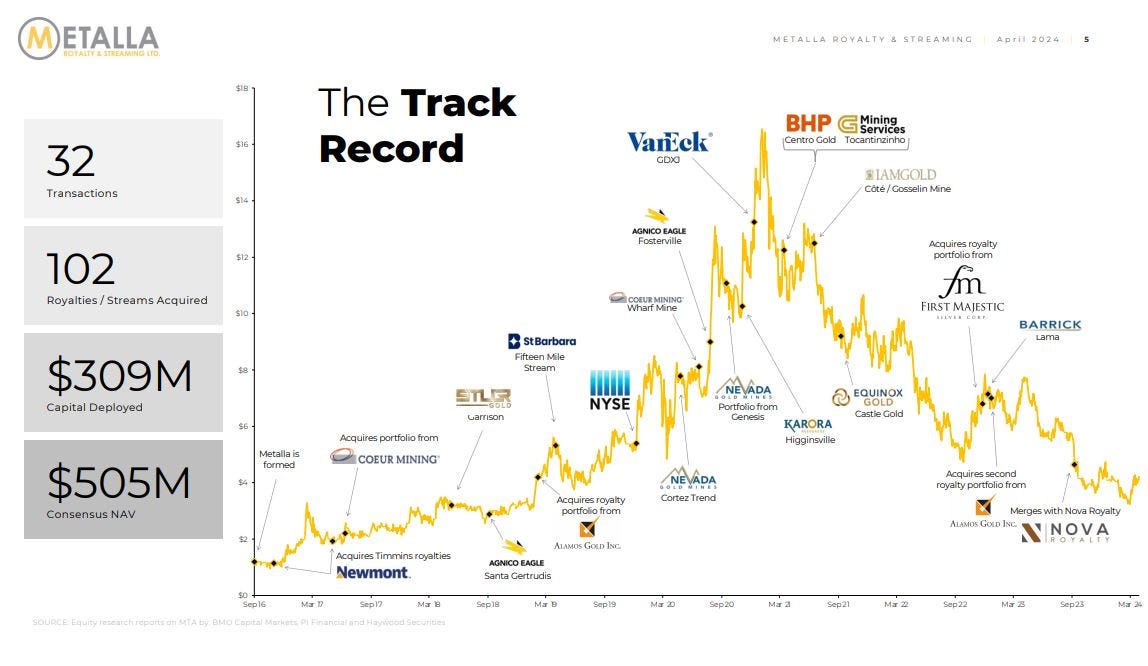

The graphic below, from their corporate slide deck, shows a history of accretive transactions, going back to 2016, and it’s worth highlighting the quality of their operational partners is a key distinguishing factor within the Metalla portfolio. Note that they have projects operated by some of the largest and most successful mining companies on the planet, and that matters for development and production execution.

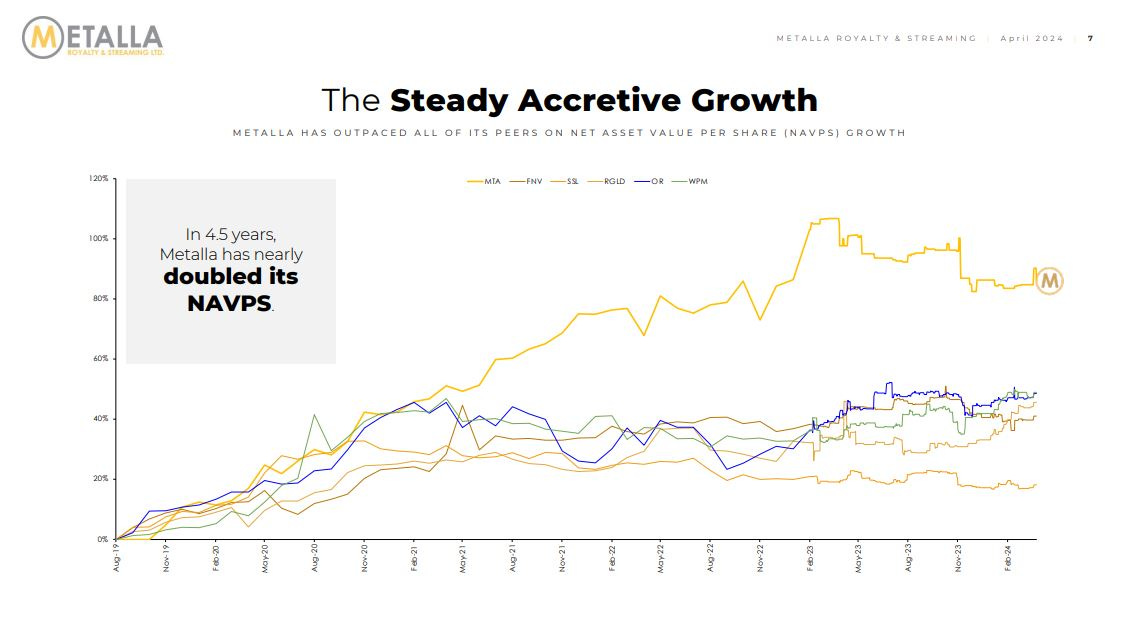

Another positive trend the company has highlighted for some time, and rightly so, is how it has outpaced many of the major household names in the royalty and streaming space, on a Net Asset Value (NAV) per share equivalent for the last half dozen years. In fact, I’d point out that the current valuation of CAD $405Million, based on last week’s close has them valued at less than their NAV, much less trading at par with it, or a multiple of near 2x their NAV (like many of their major peers enjoy). In my mind that speaks to more potential upside as they get rated higher moving into the mid-tier category over time.

We spoke earlier in this article of the critical advantages that royalty companies have not just diversifying across multiple operators and commodities, but also across multiple jurisdictions. While Metalla definitely fits that description of diversification in assets, operators, and locations, they still have an overall focus on royalties in the Americas – with the largest number of assets in Canada and the USA, and the balance in Central America and South America (a few of note in Australia too).

Clearly for the sake of time and attention in this article, we don’t have time to go into over 100 royalties and streams, or even the top dozen. However, I am going to highlight 3 of the several key cornerstone assets in the company, many of which are just now set to ramp up into commercial production over the next 1-2 years. These are significant long-life and generational assets, that will be generating revenues for their operators and for Metalla for well over a decade, (and in some cases – decades). There are some nuances as to when the mining sequences of the mine get into certain portions of mineralization that MTA holds royalties on, (and we’ll actually let the CEO Brett Heath discuss that directly in an interview we had with him last week further down in this article).

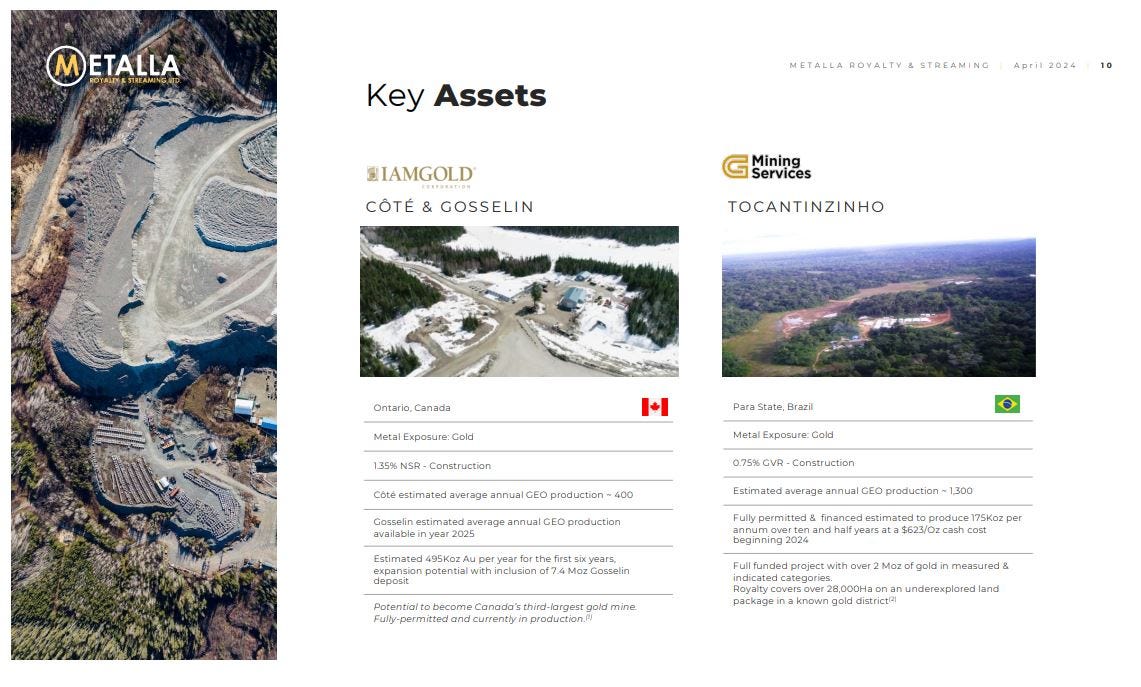

First up are IAMGOLD’s Côté & Gosselin Projects and mines. Metalla holds a 1.35% net smelter royalty of big portions of both these adjacent projects, and Côté is anticipated to become the 3rd largest permitted gold mine in Canada, with 495,000 ounces of gold equivalent production on average for the first 5-6 years. With the inclusion of the Gosselin deposit (over 7 million ounces of gold and still growing) the odds of them expanding or extending mine life over time is looking pretty good.

Also noted on the image above is the 0.75% gross value returns royalty on the Tocantinzinho Project, operated by G Mining. This project is nearly done with construction and slated to come into production in the 2nd half of this year. The project has over 2 million ounces of gold defined so far, but with a huge land pace of 28,000 hectares, and is expected to produce at around 175,000 ounces of gold equivalent for the next 10+ years, with very low costs, and run by an exceptionally talented team of mine operators with a string of successes under their belts.

There is also the Amalgamated Kirkland, operated by Agninco Eagle Mines, coming into production in 2024, as another revenue driver for the years to come.

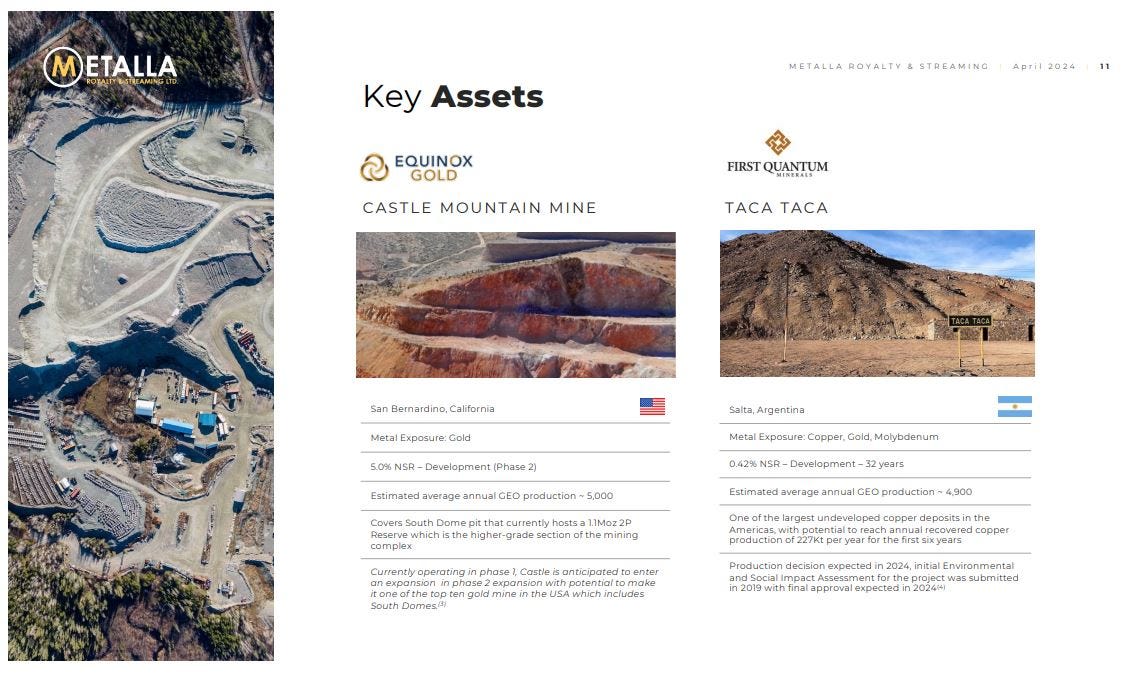

Another key cornerstone asset, that I’d like to highlight, and that Brett discusses briefly in his interview with us from last week, is First Quantum’s Taca Taca copper, gold, molybdenum project in Salta, Argentina. Metalla holds a 0.42% net smelter royalty on this long-life asset, expected to produce for over 3 decades, and is expected to reach a production decision this year (with final ESIA approval also anticipated this year).

Let’s also briefly discuss the transformative acquisition in 2023 of Nova Royalty (TSXV: NOVR) (OTCQB: NOVRF) by Metalla Royalty. This merging of assets brought in a portfolio of royalties on a significant proportion of the next generation of major copper projects, located in 1st-tier jurisdictions, and being advanced by the world’s premier mining companies, which include First Quantum, Lundin Mining, Newmont, Hudbay, Anglo American and Glencore, among others.

For those that want all the specific details on this acquisition of Nova Royalty, and the financing partners, Beedie Capital, then check out the news release linked below:

METALLA AND NOVA COMBINE TO BUILD THE NEXT INTERMEDIATE ROYALTY COMPANY - September 8, 2023

https://metallaroyalty.com/_resources/news/2023/MTA-News_Release_NOVR_Acquisition-FINAL-09-08-23.pdf

The advantages I personally saw at the time last year, as a shareholder of Metalla, was that it brought in another cashflowing asset, from their 1% NSR on the producing Aranzazu copper/gold/silver mine in Zacatecas, Mexico, and also some really beefy long-life quality copper assets that are back-dated to production later in this decade (2027-2030 and beyond).

I remember talking briefly with Brett, after seeing him at the Beaver Creek conference last year in September, right after this news had broke to the marketplace. I probed for his thoughts and feedback on why it was getting such a mixed reaction from investors at that time, and he was incredibly candid and balanced in his response. I left that interaction feeling pretty good about the long-term future as a Metalla shareholder, and we had him on the KE Report shortly thereafter to discuss further.

He had remarked that, over the fullness of time, more investors would see the rationale for the staged growth trajectory of the new pro-forma company. The gold and silver assets would have their time to shine in 2024-2027 as many larger development projects came into production, right in time for a PM bull market that seemed around the corner (and now has finally recently arrived). Then as the slower developing boom in copper prices picked up speed later this decade, they’d have all the Nova Royalty copper assets coming into production into what likely will be a true copper mania in the few years.

Let’s wrap things up here with Brett Heath, President and CEO of Metalla Royalty & Streaming, where he joined Cory Fleck and I over at the KE Report, to recap the 2023 Financial Results, where the Company exceeded top end guidance for attributable gold equivalent ounces received. The major focus however is on 2024 growth from royalties within the existing portfolio moving towards production, and the potential of new larger royalty acquisitions, as they move towards a mid-tier company.

Metalla Royalty & Streaming – 2023 Financial Results, Organic and Acquisition Growth Plans For 2024 - April 5, 2024

Well, I guess one more thought before we wrap up our review of Metalla Royalty, and that is the price action the last 5 years and the current valuation. {In full disclosure, I’ve been a MTA shareholder for years now and have traded around the core position, buying dips and selling rips for a long-time, but am admittedly currently underwater in my position on it, and starting to average down. So I’m biased in that sense.}

When I saw the meteoric rise, post-pandemic crash in March 2020 through the end of 2020, I did question openly whether Metalla wasn’t getting a bit over their skis in valuation; especially in relation to other royalty companies (based on their revenues and gold equivalent ounces of production at that particular point in time). Maybe the buying surge was from investors looking for more certainty in an uncertain world, or E.B. Tuckers series of promotional interviews across the resource sector, or maybe just the desire for PM investors to get more serious in positioning in royalty and streaming companies. There were a few influential voices in the resource investing space suggesting Metalla was way too over-valued back to kick things off coming into 2021… and maybe they were at the time. That was then and this is now….

However, as one can see on the chart below, the stock has dropped in price and market cap for all of 2021, 2022, and 2023, but looks like it finally found a bottom (at $2.32) here in 2024 and could be finally turning higher to engage with the next leg of the precious metals bull market. (MTA) closed last week at $3.23, just below it’s 50-week Exponential Moving Average (currently at $3.48). When it can finally blast above the 50-week EMA, and then eventually the 200-week EMA, then the bulls will finally be back in control. It isn’t in a bullish posture yet, but we’ll be watching to see how the next few months unfold technically.

Nobody has a crystal ball on if we’ll see a reversal back to breaking higher on the pricing chart; but our job as investors is to assess the risk/reward set up at any point in time. My personal thesis favors the probabilities for a rerating higher in Metalla share prices, now with elevated gold, silver, and copper prices, and several new mines coming into production in the MTA royalties portfolio over the next 1-2 years.

Here in April 2024, it has many more royalties in it’s stable than it did in 2020’s epic surge, including all those copper royalties from the Nova acquisition last year, and better future expected gold equivalent ounce production and revenues. I’ve mostly been just holding steady for more than a year now, but just recently have shifted back to accumulation mode in MTA shares on any future price weakness. (that is definitely not investment advice… but just sharing what I’m doing personally in my own portfolio).

OK, that wraps us up for this [Part 2] in this series on opportunities in junior and mid-tier royalty and streaming companies. There are so many more companies and even other commodities that we are eventually going to get to in this series, so stay tuned for the next one. Also, keep a watch out for my “Week In Review and The Week Ahead” mashup review of the commodities sector that will be out in the next 2 days.

Thanks for reading and may your trading and life be prosperous!

- Shad