Opportunities With Growth-Oriented Gold Producers – Part 3

Over the last 2 weeks, I’ve put out some articles that highlight the big opportunity still seen in the growth-oriented producers for the coming bull market cycle; which is setting up to unfold in the year to come. We’re going to continue on with this theme here in week 3 and Part 3 of this series.

For those that may be wondering, my plan is still to cover Silver stocks, Uranium Stocks, Copper stocks, Nickel stocks, Oil & Nat Gas Stocks, Royalty Stocks, and other sectors and topics in the future; outside of comments in my “Week In Review” articles. However, as we kick off 2024, I wanted to still keep the focus here on the gold stocks as having one of the more attractive value propositions. All indications technically and fundamentally point to 2024 being a breakout year in the precious metals, where gold will be leading the charge first and the gold equities will start to play catch up. So we are plowing forward with the growth-oriented gold producers again in this update.

Just as a quick recap for those just joining this channel, the first week’s article was more general in nature, on why this subsector within the gold stocks is so compelling for both alpha value-creation paired with beta optionality, and included a specific example highlighting i-80 Gold Corp (IAU.TO) (IAUX).

https://excelsiorprosperity.substack.com/p/opportunities-with-growth-oriented

Then Part 2 of this series picked up from there, and showcased some of the key value drivers for Calibre Mining (CXB.TO) (CXBMF).

https://excelsiorprosperity.substack.com/p/opportunities-with-growth-oriented-20e

Here in Part 3 of this series, we are going to be diving under the hood of Karora Resources (KRR.TO) (KRRGF), as another standout in the growth-oriented gold producers category. Over the last few years, Karora Resources has combined operational growth with more ounces being produced, along with improving average head grades, which has resulted in better economics and revenue growth. Karora also falls into that “Holy Grail” category of gold stocks that has paired production growth along with substantial exploration growth over the last few years and is projected to keep doing so moving forward. So let’s dive in!

Over the last few years, I’ve had the good fortune to meet with the management team at Karora Resources on Zoom calls, prior virtual conferences, and even face-to-face at the most recent Beaver Creek conference, to get regular updates on the company. We also produce periodic interviews, on the KE Report, with Oliver Turner, VP of Corporate Development for Karora Resources; where we can hear directly from the company on their operational progress and exploration success at various targets and projects. Further down in this article there is an embedded link to the most recent interview Oliver and I recorded this last week, that is a great way to catch up on the work completed in 2023 and the plan moving forward in 2024.

First off though, let’s lay the basic groundwork for the key operational and development projects of Karora Resources in Western Australia. Then, later in the article, we will take a deep dive into a number of the promising gold and nickel exploration targets that the company has been drilling.

The main flagship project over the last few years has clearly been Beta Hunt Mine and surrounding exploration targets, with it contributing in the biggest way to annual production and receiving the lion’s share of the exploration budget. It should be noted that in addition to key focus at Beta Hunt, there has been steady contributions in production throughput from the Higginsville Gold Operations (HGO) Central Mine, and last year the Spargos Mine operations kicked in to the overall production mix. While the HGO Mine and Spargos Mine will continue to play their part in the years to come, moving forward about 80% of the production profile and resource growth will be weighted to the Beta Hunt mining complex. So for the majority of this write up, we’ll stay more focused on the developments and milestones that have been achieved at Beta Hunt, and what is on tap for 2024 and 2025.

It should also be noted that the company now has 2 processing mills in place, the Lakewood Mill with 1 million tonnes per annum capacity, and the Higginsville Mill with 1.6 million tonnes per annum of capacity. Part of the growth story in Karora over the last few years has been growing towards filling up that mill capacity, and there is a lot of solid work the exploration teams and operations teams have executed on to start filling up these mills and “feeding the beast” as the saying goes.

After having personally had a position in Karora for the last few years now, and following along quarter after quarter with operations results, it has been a textbook case for measurable production growth. One of the key drivers was adding in the HGO mill back in 2019, and being able to process ore from 2 mills, and compliment their multi-mine hub and spoke approach.

Another one of the key value drivers that we’ve been tracking for the last 2 year in discussions and interviews with the management team, from proposed idea to successful execution, has been the development and build out of their twin decline into a different area of the Beta Hunt Mine. This gives the mining operations another way in and out of their Beta Hunt mine, reduces congestion, improves the throughput, and provides other opportunities for underground exploration. Now that they’ve completed getting more ventilation down into that part of the mine during the 2nd half of 2023, they’ve set themselves up for a good production increase in 2024 and 2025.

It should also be noted what a boon that the average price of gold has been since 2019, as the yello metal continued to march higher in US dollar terms through the present. This higher underlying metals price, is one of the things that makes gold producers attractive, as they can immediately monetize the higher metals prices. In the case of Karora resources, they were also able to raise the overall throughput and grade of their operations, as well as bring into production the Spargos Mine, so they had more ounces produced into that higher gold prices. What also separates Karora from the hundred other smaller and mid-tier gold producers in the sector, is that relatively speaking, their costs have not been nearly as effected by inflation as a number of other gold operators we see in the space.

In 2022, Karora Resources produced 134,000 ounces of gold equivalent ounces with an average All-In Sustaining Cost (AISC) of US $1100-$1200 per ounce for the year. In 2023, we don’t have all the numbers in for the 4th Quarter yet, but the annual guidance has been maintained all year for 145,000-160,000 ounces of gold equivalent and for the costs to be roughly in the same ballpark at US $1,100-$1250 per ounce. The Company has yet to put out the price numbers for this year, but in recent interviews have mentioned that operations are on track to support a growth goal to annualized production throughput rate of 2.0 Mtpa during 2024 and a target of 170,000-195,000 ounces of annual production.

We’ll see how things wrap up once we get those Q4 and year-end results in the next month or two, but we can look into how things have been progressing through Q3 metrics and year-to-date through the 3rd quarter ending in September.

Key Q3 and Year-to-date Operations and Financial Metrics:

Production of 39,547 gold ounces increased 3% from 38,437 ounces in the third quarter of 2022, with year-to-date 2023 production of 120,197 ounces increased 24% from 96,578 ounces for the same period in 2022. The Company ended the third quarter well-positioned to achieve full-year 2023 production guidance of 145,000 – 160,000 ounces.

Q3 2023 cash operating costs and all-in sustaining costs (“AISC”) per ounce sold averaged US$1,062 and US$1,196, respectively. Year-to-date costs have averaged US$1,083 and US$1,188, respectively

Revenue in Q3 2023 of $107.1 million increased 32% from Q3 2022, and 41,278 gold ounces were sold at an average realized gold price of US$1,931 per ounce.

Year-to-date 2023 revenues totaled $314.5 million, 42% higher than $220.2 million in YTD 2022 mainly reflecting a 30% increase in gold sales and a realized gold price that was US$89 per ounce higher than comparable period in 2022.

Cash flow provided by operating activities in Q3 2023 of $45.3 million, up 60% from $28.3 million in Q2 2022, and YTD 2023 cash flow provided by operating activities of $100.6 million was almost double from $51.7 million in YTD 2022.

Net earnings of $6.9 million ($0.04 per share) compared to net earnings of $4.4 million ($0.03 per share) in Q3 2022. Adjusted earnings of $14.0 million ($0.08 per share) compared to $6.6 million ($0.04 per share) in Q3 2022

Net earnings for YTD 2023 of $10.6 million ($0.06 per share) compared to net earnings of $0.3 million ($0.00 per share) for the same period in 2022; Adjusted earnings totalled $32.8 million ($0.19 per share), a 164% increase from $12.4 million ($0.08 per share) reported for YTD 2022.

________________________________________________________________________

While those metrics included all 3 mines at Beta Hunt, Higginsville, and Spargos, let’s put the focus again back on the main engine of growth for the company at Beta Hunt, and talk about how the resources there are expanding. Oliver Turner has mentioned to me in multiple meetings and interviews that while all their operations have been important to the production profile of the company, that it became clear a few years back that really their lowest cost discovery ounces, and most economic ounces to mine and process have been at the Beta Hunt Project.

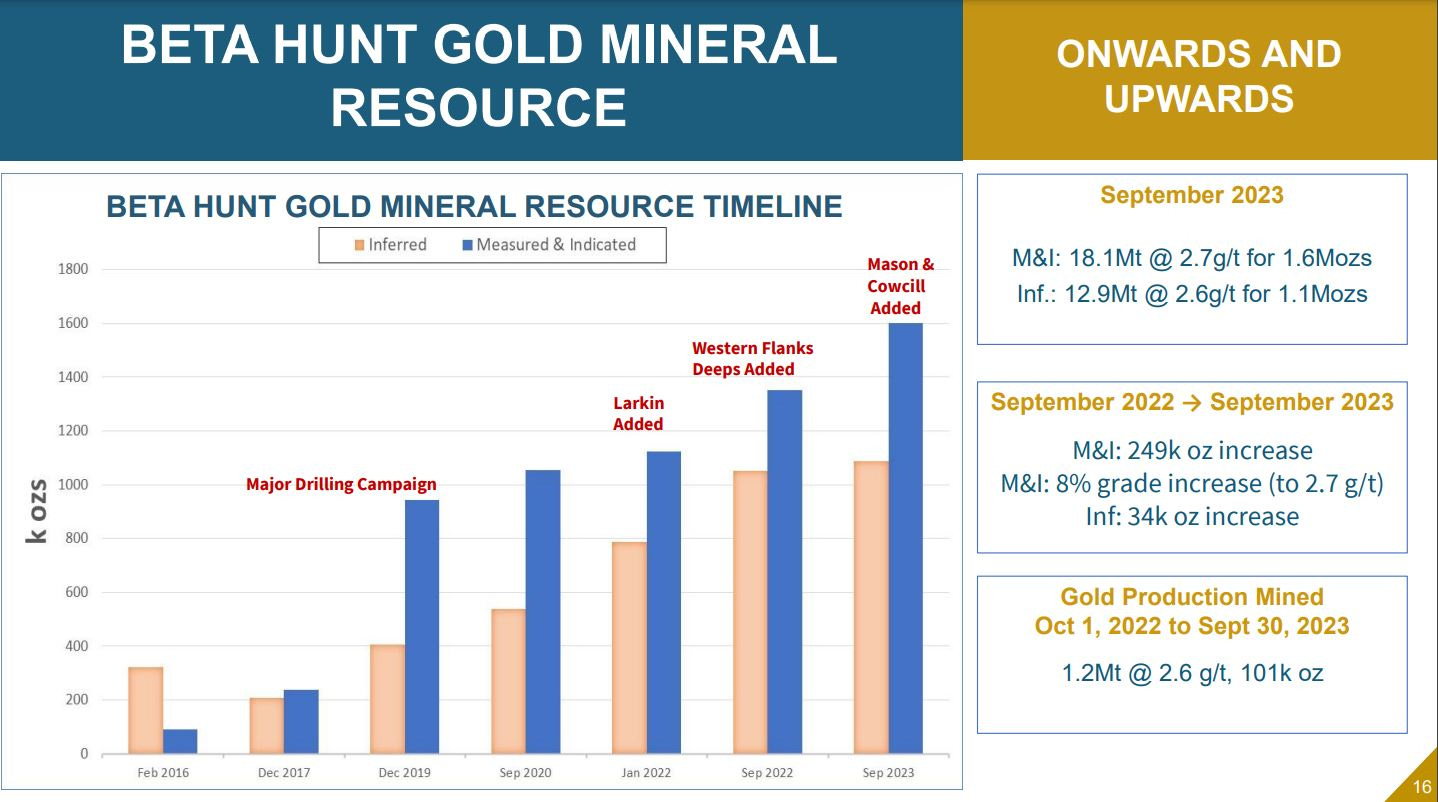

Resource Expansion And Ongoing Exploration at Beta Hunt:

For the last few years the main workhorses of the Beta Hunt mine were the kingpin Western Flanks area and the A Zone area of the deposit; and they are definitely still key contributors. In fact, the company keeps hitting paydirt at a newer area called Western Flanks Deeps, that has added substantially to the mineralized resource there in 2023.

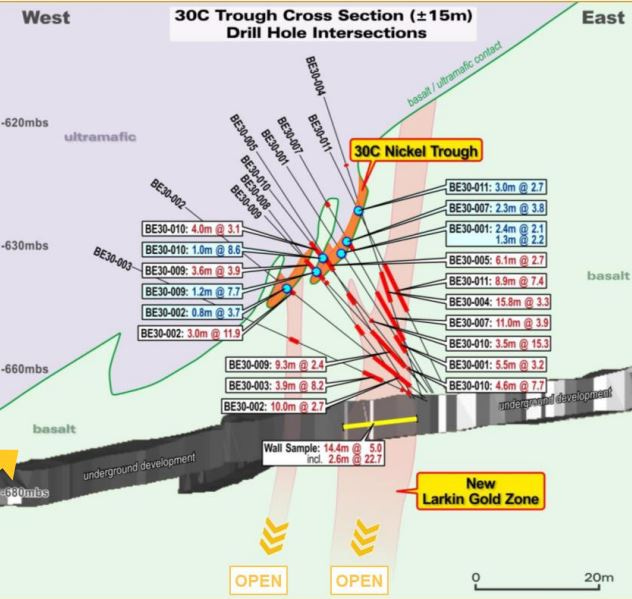

What has been impressive to watch though, has been how the company explored, defined resources, and then brought into production the Larkin Zone, (right under the high-grade nickel trough at 30C), in just 18 months. That was an astonishing turnaround to go from discovery into production; (especially in relation to the time needed for other gold projects to make that same journey).

In addition to the exploration success the team has had at Larkin, there have also been 2 other new areas at the Mason Zone and Cowcill Zones that have been explored, where mineralization was defined and now brought into the current resource model. There will be additional exploration at both the Mason and Cowcill zones in 2024 to keep growing these resources.

All of that said about Western Flanks, A Zone, and Larkin…. Over the second half of 2023, what has me even more animated about the future growth coming from the Beta Hunt Mine and surrounding complex, has the been the exploration success the company has been seeing at yet another new area called the Fletcher Shear Zone.

The Fletcher Shear Zone is a structural analogue to Western Flanks, which as previously noted is Beta Hunt’s largest and most prolific gold zone. Also from a mine plan and development angle, the southern extent of Fletcher Shear Zone is only 230 meters from their existing nickel development south of the AIF area, and only 150 meters north of Larkin Mineral Reserve aforementioned.

Recent exploration results from August and September 2023 at the Fletcher Shear Zone include:

- BL1730-04AE: 6.5 g/t over 26.0 m

- BL1730-04AE: 46.5 g/t over 7.0 m

- BF1730-24AE: 15.9 g/t over 6.0 m

- WF405ACC-48AE: 4.8 g/t over 32.0 m

There is obviously more drilling that needs to be done at Fletcher to keep defining this mineralized zone, and the company has mentioned that it is going to receive a big part of the exploration budget in 2024. If the exploration team at Karora can prove it is quite analogous to the Western Flanks Zone, then it could be a key area of focus for a long time to come. Then if their team can define and outline resources on it, with the goal to move it into development anywhere close to how quickly their team did so at the Larkin Zone, then I believe this Fletcher Shear Zone could really be a big boon to production in late 2025 or maybe early 2026, further spiking the production punchbowl.

But wait… There’s more… “A Nickel Mine Within The Gold Mine”

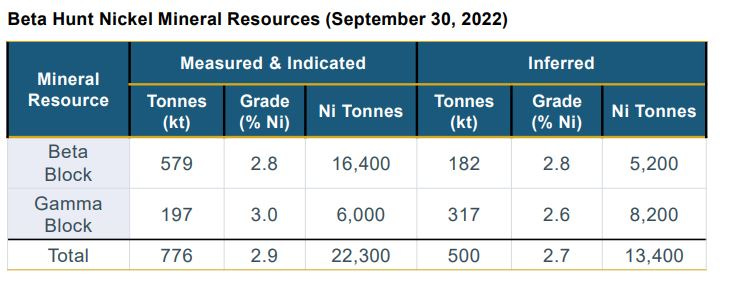

Nickel Exploration Success at the 30C Alpha Block, 40C Beta Block, and 50C Gamma Block:

In addition to all the success the Karora exploration team has had on the gold side of the business, they have also continued to nail it will the drill bit, defining a number of high-grade nickel zones at 30C, 40C, and 50C. Some may recall that prior to being called Karora, this company was called RNC Minerals, which alluded to it’s name before that of Royal Nickel Corp. Historically, about 66,000 nickel tonnes was mined at Beta Hunt, so there has always been a nickel component to the mining here, before the operations shifted over to more of a gold focus over the last 5-6 years.

Another key point that many analysts and investors have yet to fully digest is that wherever they find nickel, they also keep finding more high-grade gold underneath it. Every time over the last few years that a new nickel trough or zone was further delineated, the exploration team followed up at depth to hit gold mineralization. This is precisely where the Larkin gold zone came from under 30C Block, so I anticipate that this nickel atop of gold factor, will continue to further improve the future economics & development of this overall mining complex for a long time to come.

The somewhat newer 50C high-grade nickel zone area known as the Gamma Block is the one part of the project that has been really raising some eyebrows over the last 3 years. This is the area they have dubbed a “nickel mine within a gold mine” and already has defined 35,000 tonnes of 2.7% nickel, with in-situ value around $1.3 Billion at today’s prices.

► Beta Hunt infrastructure advantage allowed 50C nickel to rapidly move from discovery in April 2021 to a maiden Mineral Resource in just over one year. The January 2022 combined Mineral Resource both both the Beta Block and Gamma Block came in at 19,600 nickel tonnes in the Measured & Indicated category, plus an additional 13,200 tonnes in the Inferred category. These resources grew again by September of 2022 to 22,300 tonnes of M&I, and 13,400 tonnes of Inferred.

► 50C has been delineated over a strike length of 650 metres with a potential strike length of 2.6 kilometres to the property boundary

►Nickel resource development drilling in 2023 was focused on upgrading and extending East Alpha Block, 40C in the Beta Block, and 50C / 10C in the Gamma Block

In August of 2022 a Preliminary Economic Assessment (PEA) was released on Nickel Resources:

This PEA demonstrated robust economics and how low production costs would drive an annual average of Australian $80 - $100 per ounce in by-product nickel credits to gold production. There are also nice sensitivities and leverage to the underlying nickel price: where a 20% increase in nickel price drives a 60% increase in project NPV and approximate 130% increase in IRR. The shared infrastructure for both the gold and the nickel development/production allows for very low initial capital investment of around Australian$7 million in first year (~A$18.7 million over initial 8-year life of mine).

Another key point with regards to this growing nickel project is that they don’t’ need to build a nickel concentrator processing facility (which would be fairly costly). All of the Beta Hunt nickel mineralization is trucked over and processed at BHP’s nearby Kambalda Nickel Concentrator (KNC) located only ~4 km away. The nickel ore mined at Beta Hunt by Karora is simply sold directly to BHP with no additional processing required by Karora, and hence the name “A nickel mine within a gold mine.”

For 2024, the rough plan on the nickel side is production going to go from 500 tonnes of nickel in 2023 to about 700 tonnes nickel production this year. This production is converted over to gold equivalent ounces for the sake of reporting to the marketplace, but the point is that these nickel assets are going to help in their overall production profile for years to come, and will provide extra leverage if we see a rebound in the nickel prices in the medium to longer-term.

___________________________________________________________________________

There are actually a number of other blue-sky value drivers I could get into with exploration upside around the Higginsville Mine Operations or at Spargos, or even down the road at Mount Henry, but for the sake of the length of this article, we’ll save that for another day.

The company also has an evolving strategy towards Carbon Neutral production as a key ESG factor in the critical minerals investing landscape, that we don’t have time to get into today, but Oliver does touch upon it in the interview linked below.

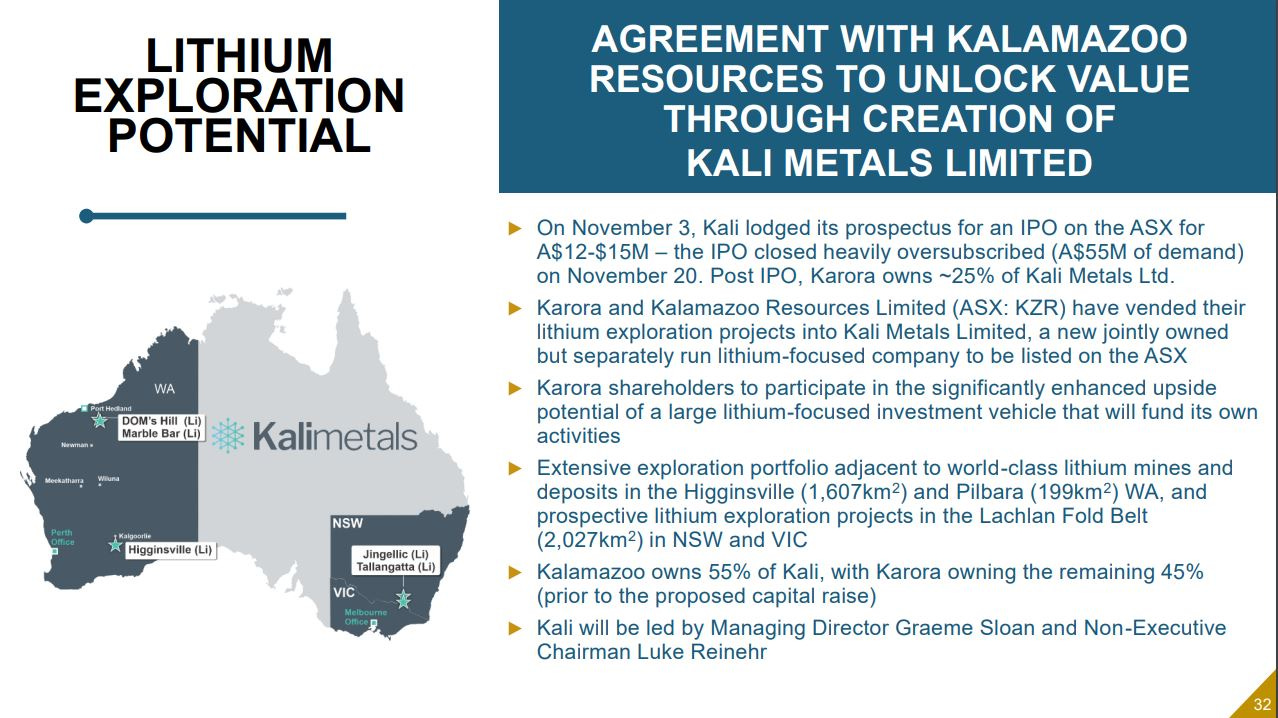

Additionally, he reviews the recent agreement with Kalamazoo Resources Limited (ASX: KZR) to create a lithium and critical metals exploration company called Kali Metals Limited, that will start trading publicly in early 2024. Karora has a 45% stake and Kalamazoo has a 55% stake in this new vehicle. The proposed transaction will allow Karora shareholders to participate in the significantly enhanced upside potential of a larger, combined lithium-focused investment vehicle that will fund its own exploration and development activities while Karora remains focused on growing its gold and nickel production base at both Beta Hunt, Higginsville, and Spargos.

__________________________________________________________________________

Wrapping things up with a recent interview from this last week with Oliver Turner, VP of Corporate Development at Karora Resources.

We discuss the strong production metrics and increased earnings from Q3 2023 and Year-to-date operations through September. He also provides a comprehensive development and exploration update at their Beta Hunt gold and nickel operations and other operations in Western Australia through year end, and the strategy moving into 2024.

As always, the opinions shared in this article and the list of gold companies shared that I hold in my portfolio, is definitely not investing advice. I’m not recommending any of these for anyone else to purchase, but rather; I’m simply sharing my opinion on how I view the gold stock sector, and sharing which stocks animate me personally.

Everyone should do their own due diligence, talk to their financial advisors before making any investing decisions, and ultimately make their own decisions on what are appropriate risk speculations and appropriate position sizing. This editorial is simply to illustrate the overriding concepts on why I’ve isolated these types of companies in my own portfolio, and their potential value drivers from my unique vantage point.

In future Substack posts, in the weeks to come, I’ll continue to unpack why I have some of those other aforementioned growth-oriented gold production companies in my personal portfolio. So stay tuned for future updates here, and my take on what separates them from the rest of the pack. As mentioned in introduction, we will also start exploring resource stock opportunities in other sectors as the year unfolds.

Also, stay tuned tomorrow on Sunday for my recurring “Week In Review” summary of key economic events from this last week. May everyone have a great start to 2024. Wishing for you all good trading and for life to be very prosperous.

Also if you haven’t come over to check out all the daily interviews we post over at the KE Report, then please come visit us throughout the week and weekend at:

https://www.kereport.com/

Thanks for reading and Ever Upward!

Shad