Opportunities With Growth-Oriented Gold Producers

Here at the end of the week, my typical process is to review my portfolio performance on the weekly close, and also to review a number of stocks on my watchlist and different sectors. I keep coming back to the stunning low valuations we are seeing in many of the gold and silver equities. These valuations are low in relation to where these stocks have traded at similar or even lower metals prices in the past, with regards to how ounces in the ground are being valued, and all while we’ve seen inflation costs moderating and coming down sharply all year long.

It seemed like a good time, as many are preparing to unplug for the upcoming long holiday weekend, to send out this editorial on the big opportunity I still see in getting positioned in growth-oriented producers. For this missive, my plan is to put a little more color around some of the opportunities I see in the gold producers with a solid growth wedge, and in the future we’ll also circle back around and put out some thoughts on the growth-oriented silver producers… but one step at a time.

In one of my prior Week-In-Review articles I already had teased this topic a little bit. I had noted that there are consistent emails coming into my inbox, asking me what types of precious metals stocks that I like for the coming bull market. In my trading account, that is focused on resource stocks, I have a fairly balanced portfolio across a number of commodities. History shows that not all commodities run at the same time, and there are different times where some get their moment in the sun. With that in mind, at this particular point in the commodities landscape, my portfolio is a little less diversified than in years past, and is now very heavily over-weighted to the precious metals sector. This is because of the opportunity for outsized gains with gold and silver stocks, that I personally anticipate over the next 1-2 years.

Within a specific commodity, like gold stocks, I also diversify across different stages of mining stocks, from royalty companies, to producers, to developers, and to advanced explorers (I don’t personally hold very many earlier-stage pre-discovery drill plays). Of those different stages of mining stocks, my portfolio is most heavily weighted towards the PM royalty companies and mid-tier to smaller growth-oriented producers. I’ve noted in the past that there is a time and place for holding positions in the optionality “beta” plays, because they have traditionally had higher torque to rising prices. This is also a good period to accumulate those as well.

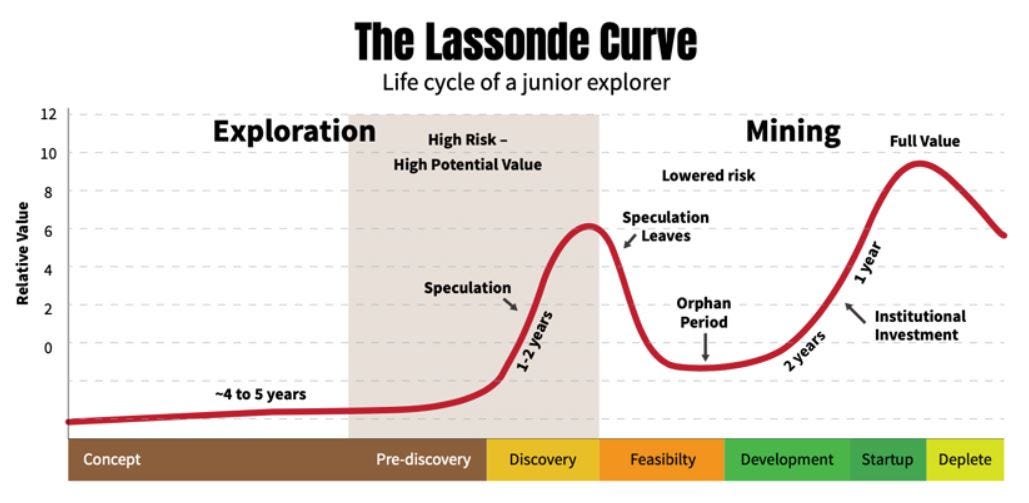

Right out of the gates though, when talking about gold producers, we must also dispel a silly notion that pervades the gold mining stock investing sector. Many retail investors maintain the erroneous belief that once a company becomes a “producer” that it is then “fully valued” and at the end of it’s journey as an investable asset, setting up for depletion and closure. This erroneous belief system is due to a misinterpretation of the Lasonde Curve, where retail investors just parrot back to one another that the only 2 places to make big gains are in the speculative discovery stage, or in the pre-production sweet spot where institutions get invested. Folks, pease don’t mention that to Hecla Mining that has been in business over 125 years, or Newmont Mining that has been in operations for a half dozen decades at this point, with both companies growing and continuing to build value during different phases and market conditions along the way.

This notion that producers are all fully valued and at the end of their journeys is, of course, complete rubbish. There a plenty of times in this more recent bull market that started when Gold bottomed in December of 2015, where it was actually the small to mid-tier producers that had the biggest percentage gains as a collective group of stocks. Looking back to the action we saw in the 8-month surge in 2016 from January to August, there were many producers up 300%-1000%. Or how about the double digit or triple digit gains in silver and gold producers from the fall of 2018 to summer of 2020, over a 2 year period of appreciation in PM stocks (with some wild corrective swings down in early 2019 and early 2020 during the pandemic crash). Then there was the early 2021 #SilverSqueeze phenomenon, isolated mostly into the producing silver/gold companies, and not really heading down the foodchain to most of the developers or explorers. Even if we look back to last year’s lows in the PM stocks in late September of 2022, we saw some of the best collective appreciation the gold and silver producers all the way through the banking crisis of this year in late April of 2023. In fact, many junior explorers or developers barely budged during those epic moves higher, whereas many producers shot up high double-digits to solid triple digit gains.

To suggest a company is fully valued once it does first pour and graduates to a legitimate revenue generating business is utter nonsense. Clearly that revenue-generating company can use those funds to keep developing the optimization processes for the first mine to lower costs and improve margins. They can use these revenues to increase development and run higher throughput of ore into their processing center. Other companies have plowed revenues into seeking out higher grade areas of the deposit to then mine, increasing recoveries, and improving production metrics. Keep in mind that this is all just on the initial mine they have, and doesn’t account for companies that develop or bolt on additional mines for better size, scale, efficiencies, cost of capital, stock liquidity, and so on.

So as just mentioned, in addition to optimizing an initial mine, a new or existing producing precious metals company may then opt to grow organically by using those mining revenues to bring another mine into production in it’s development pipeline. Another option for more value creation is to additionally grow through acquisitions and by picking up other producing or development-stage projects from other distressed companies, or simply non-core projects to larger companies.

Lastly a company with revenues, can then fund part of or all of it’s exploration through the ATM machine of it’s mine or mines. This self-funded exploration can thus expand the company resources, leading to either increasing production output or extending the mine life.

All of these different ways to generate more value and “alpha” can lead to a given company seeing it’s valuations and share price heading much higher for a period of time or even longer stretches of time in a good metals price and sentiment environment. Those familiar with the gold production space can think back to how Newmarket Gold/Kirkland Lake were transformed by a massive discovery at depth at the Fosterville Mine in Australia. Another example would be the transformative discoveries that both Wesdome and K92 Mining made that showed they had far more growth and value creation in front of them, than when they initially made first gold pour.

So for the reasons just outlined, some of my highest conviction plays, investing in the precious metals stocks, tend to be revenue-generating companies that can monetize higher metals prices through their production, and expanding margins, and reinvest those revenues into growing the business. However, not all producers will have the same percentage growth in production year over year, or the same improvement in margins as a result of higher grade ore or higher mill throughput. Not every producer is as aggressive with exploration either, with some doing very little exploration, with the model of preferring to replace ounces through acquisitions and mergers.

My favorite gold and silver stocks are the ones that are aggressively growing their resources and development profile with solid exploration work each year, in tandem with higher expected production output. These types of growth-oriented production companies that also have substantial exploration programs to expand resources and find new mine areas, are what my buddy, Jordan Roy-Byrne has dubbed – “The Holy Grail” of gold stocks.

Earlier this week, over at the KE Report, we released an interview with Jordan Roy-Byrne, where he makes a number of cogent points on why he also likes gold-oriented producers, and I agree wholeheartedly with some of the key areas he focuses on for stock selection.

Here is a link to that interview with Jordan, for those that haven’t heard it yet. This is a good primer on this concept, before we dive into some actual companies on my radar (starting at the 4:14 mark):

Some of the gold companies that I personally hold in my portfolio and see being included in this “growth-oriented gold producer” category, that also have shown compelling exploration upside at various projects are:

- Equinox Gold (EQX.TO) (EQX)

- Karora Resources (KRR.TO) (KRRGF)

- Calibre Mining (CXB.TO) (CXBMF)

- I-80 Gold Corp (IAU.TO) (IAUX)

- Argonaut Gold (AR.TO) (ARNGF)

- Orezone Gold (ORE.TO) (ORZCF)

- Thor Explorations (THX.V) (THXPF)

- Mako Mining (MKO.V) (MAKOF)

- Minera Alamos (MAI.V) (MAIFF)

- Lion One Metals (LIO.V) (LOMLF)*

*I’m including this earlier stage gold producer (Lion One) that is only just starting to ramp up towards commercial production in 2024 in this list of companies, because of the phased approach they are going to take to expanding their mill and increasing production output over the next 2-3 years, in tandem with aggressive gold exploration at depth and across their 7km land package across a whole volcanic caldera in Fiji.

As always, this is article and this list of companies I hold in my portfolio, is not investing advice, and I’m not recommending these for anyone else to purchase. I’m simply sharing my opinion on how I view the gold stock sector, and sharing which companies animate me personally based on the fundamental value I perceive.

Everyone should do their own due diligence, talk to their financial advisors before making any investing decisions, and ultimately make their own decisions on what are appropriate risk speculations and appropriate position sizing. This editorial is simply to illustrate the overriding concepts on why I’ve isolated these types of companies in my own portfolio, and their potential value drivers from my unique vantage point.

In future Substack posts, in the weeks to come, I’ll continue to unpack why I have some of those companies on my list of “growth-oriented” gold producers in more detail. However, for the sake of length in this article already, it seems like a good idea to at least dive a bit deeper into one of the companies in focus.

About 2 weeks back, I expanded in a prior article on one of companies I’ve recently interviewed on the KE Report: I-80 Gold Corp (IAUX) (IAU.TO). From my perspective they fall into this “growth-oriented producer” category quite well. I hold (IAUX) as a position in my personal portfolio, and am biased in that sense, but with the thesis being to capitalize on their projected growth over the next 3 years.

What catches my attention personally with I-80 Gold, is that next year they plan on growing production from their Granite Creek mine, once they access the recently discovered South Pacific Zone in their mining sequence in 2024, while they keep working on developing their Ruby Hill mine, and Cove Mine projects. The larger plan, CEO Ewan Downie shared with me in that interview is that they eventually plan to get to the point where they can bring all 3 gold deposits into production at their Lone Tree Processing center in about 2-3 years. This in concert with their proposed conversion of the Ruby Hill processing center into a base metals plant to produce concentrates from their CRD style polymetallic deposits at Hilltop and their FAD deposit, along with the skarn style polymetallic deposit at Blackjack, should give them a multi-fold increase in production by 2026. The Company has announced an agreement with a potential larger partner company that will bring in a big part of the needed capital to fund the interim development of the Ruby Hill project, if/when the transaction closes in mid-2024.

Additionally, the company has a steady string of news to release to the market over the next few quarters including an initial maiden resource estimate on the polymetallic projects, and updated drill results from a number of the gold and base metals exploration targets, as well as some first pass economics on some of the deposits. It is their potential to ramp up production several multiples higher over the next 3 years, while also expanding resources through the drill bit and aggressive exploration, that has me animated by (IAUX). Whether or not this particular company is of interest to anyone reading, isn’t as important as the concept of looking at other producing gold or silver companies through the lens of how can they grow their production profiles. A key question to consider for each company is what development and exploration “alpha” do they have in store that may be underappreciated by the marketplace, regardless of the moves in the underlying metals prices?

Here is that most recent interview I did with Ewan Downie, CEO of I-80 Gold for more information:

Again, stay tuned for future updates here on Substack where I dive under the hood on some of these other growth-oriented gold producers, and my take on what separates them from the rest of the pack.

I’ll also have an update out this Sunday with my recurring “Week In Review” summary of key events from this last week. May everyone that celebrates have a happy holiday season and fantastic long weekend with families and friends. Wishing for you all good trading and for life be very prosperous.

Also if you haven’t come over to check out all the interviews we post over at the KE Report, then please come visit us throughout the week and weekend at:

https://www.kereport.com/

Thanks for reading and Ever Upward!

Shad