Opportunities In Growth-Oriented Silver Producers – Part 3

Excelsior Prosperity w/ Shad Marquitz – 07/12/2024

We are continuing on with this series on growth-oriented silver producers, after having laid out the key framework and investing considerations for this niche of the mining stock sector in [Part 1].

So far we’ve reviewed 2 companies in this series, Avino Silver and Gold Mines (TSX;ASM – NYSE:ASM) in [Part 1] and Guanajuato Silver (TSX.V:GSVR) (OTCQX:GSVRF) in [Part 2].

Opportunities In Growth-Oriented Silver Producers – Part 1

https://excelsiorprosperity.substack.com/p/opportunities-in-growth-oriented

Opportunities In Growth-Oriented Silver Producers – Part 2

https://excelsiorprosperity.substack.com/p/opportunities-in-growth-oriented-235

At the onset here, it’s important to point out that this 3rd silver producer that we are going to dig into is going to differ somewhat in their growth strategy from both of the prior companies covered in this series. Avino and Guanajuato both forecast ongoing growth over the next few years by bringing more development projects into production and also by optimizing existing mines and processing centers. This 3rd silver producer has been growing in value by being a debt-free low-cost producer in a rising metals price environment, but also by holding more precious metals, (both physical silver and gold), on their balance sheet as a corporate directive. In addition, this company has the potential for organic growth via all the exploration upside present on their district-scale land package, and is also actively considering growing through acquiring other concessions or projects.

So, let’s get into it…

The company alluded to above is none other than SilverCrest Metals (TSX:SIL) (NYSE:SILV).

I like to refer to SilverCrest Metals, as “Silvercrest 2.0,” because this company’s flagship Las Chispas Project along with their Cruz de Mayo Project and few other mineral concessions, were spun out of SilverCrest Mines Inc. back in late 2015. Personally, I’ve been investing is this company since 2014, before that former company iteration “SilverCrest 1.0” was acquired by First Majestic Silver Corp. (NYSE: AG) (TSX: AG) for their Santa Elena Project; {which is still a fantastic producing mine for them today}.

The CEO of SilverCrest Metals, Eric Fier, and the board of directors at the time were very wise to negotiate keeping a few of their prospective other precious metals projects in Mexico, instead of letting the First Majestic team acquire the whole enchilada with SilverCrest Mines. I confess to having sold out of the First Majestic shares once the takeover was completed, and then waited a little while after getting my spinout shares but then initially sold my new SilverCrest Metals position in late 2015, to rotate into other beat-up silver stocks at that time.

Keep in mind that initially in late 2015 and into early 2016, they were pursuing and considering the Cruz de Mayo Project to be the key mineral property, but it just didn’t animate me as much as Santa Elena had in the prior Silvercrest 1.0. Then their exploration team did a limited drill program on their Huasabas property, but the results were not that exciting. In March of 2016, they moved on to the Las Chispas Project, which was a brownfields exploration project at the time. Things didn’t start getting more interesting on the exploration front until the spring of 2016, where they started doing some channel sampling around the historic mine, but this timed out with the whole precious metals sector just going bananas by April and May, so it was hard to focus on any one catalyst at that particular time in the sector.

I did notice that the SilverCrest shareprice kept climbing and so got a small stakeholding position back in place in late April, but didn’t get more serious about reallocating to my position in SilverCrest Metals until August 2nd of 2016, when they put out a press release stating they had hit bonanza grades of up to 18.55 gpt Au and 2,460 gpt Ag or 3,851.3 gpt AgEq. I was like “holy moly! They’ve hit it big again.” I also realized it likely would have been better if I had not sold all my spinout shares a few months prior…but this is a volatile and unpredictable sector. So after beefing up my position some in August, we all now know (in hindsight) that a few weeks later in August, the PM sector rolled over and consolidated the big surge higher for the balance of 2016 through October of 2018.

So I went from takeover hero to a bag-holding zero all in the span of a few months with SilverCrest. I spent that consolidation period in the sector occasionally averaging down in my SilverCrest position, as they were undeniably hitting something special in a market that didn’t really care. This is also an example of “betting on the team,” where I just felt more confident backing Eric and the Silvercrest team again, because they’d already proven they could go the distance from exploration success, to development, to production, to takeover win. During a sideways consolidation period like we saw after the initial “baby bull” of 2016, my strategy was to bet on companies that had solid teams and catalysts, and so I didn’t mind averaging down in my Silvercrest position and getting a better overall cost-basis in place.

Over the years, I’ve actively position-traded around a core holding in (SILV) dozens of times with partial position trades (trimming or adding 25%-50% of total position) over multi-month pops and drops. Silvercrest is a nice dual-listed stock that has good daily volume, and there are no trading fees on most US-based trading platforms for big board listed stocks.

Well, fast-forward to present and Las Chispas has turned into an absolute beast of a flagship project for SilverCrest Metals, and it is now a profitable producing mine, that is literally printing money in the form of silver and gold. It only took 7 years from first discovery in 2016 to first pour in 2023, and was on time and under budget, which is a stunning timeline to production for any mining company.

Processing plant at Las Chispas.

Dry-stack lined tailings at Las Chispas

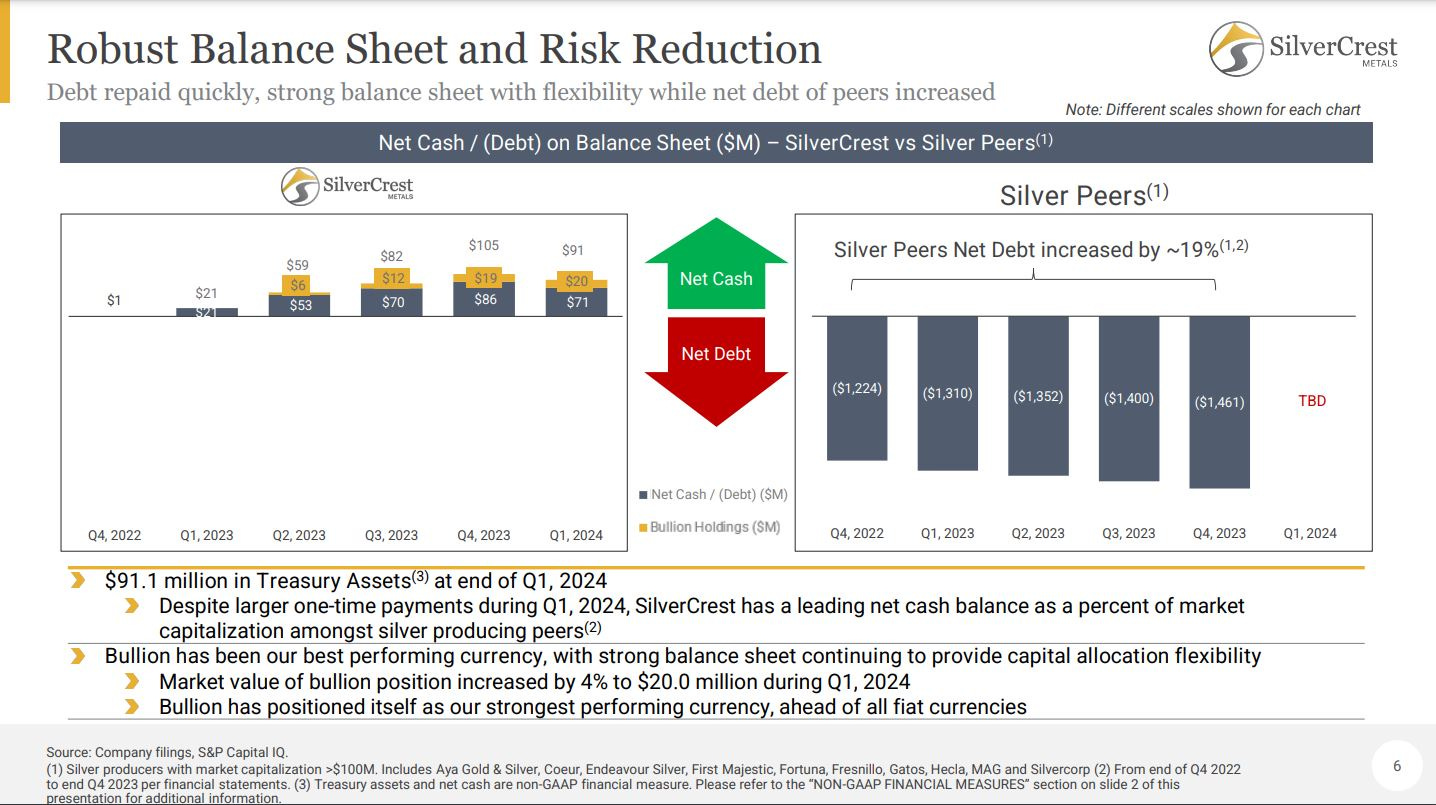

Unlike so many explorer/developer companies that then move into production, and hit a number of snags, the team at SilverCrest has, once again, done a fantastic job of getting the project built and producing profitably. Over at the KE Report, we speak to the President, Chris Ritchie, about once a month to get updates. I was stunned when we’d check in during 2023 at how quickly they got things turned on and ramped up to commercial production. They then paid off all their debt in just 7 months, which I’d never seen any other company do before so quickly. Much of that is due to their very low costs and really fat margins, as a best-in-class producer.

Once they’d paid off the debt, the decision was made by the management team and board of directors to hold physical gold and silver on the balance sheet, instead of just converting the metals that are so difficult to get out of the ground right back into devaluing fiat cash. The precious metals that investors want exposure to has been growing in value much more than cash on the balance sheet would, as the metals prices continue to appreciate higher. This is one of their unique areas of growth, that I wish more producing companies would emulate.

Fiat currencies will only fall in purchasing power over time, due to their erosion by inflation, whereas the precious metals can buoy the balance sheet by rising over time with inflationary pressures. Think about how in 1971 it would take only 35 US dollars to buy one ounce of gold, and today it takes 2400 US dollars to buy that same ounce of gold. Look… the gold didn’t change… it’s on the elemental table, but the purchasing power of the US dollar has crashed over that time period due to inflation (as have all fiat currencies). This is the key advantage which companies have that can stockpile physical and gold and silver on their balance sheet; and Silvercrest is leading that charge. Other gold and silver producers should take note.

Here is a quick snapshot of the Q1 production and financial metrics for a look into the health of the operations. It is worth considering, just how much higher the Q2 2024 gold and silver metals prices were, and how this is only going to further spike the punchbowl of growth on the balance sheet. Even so far in early Q3 the metals prices are much higher than they were in Q4 of last year or Q1 of this year, and that means even fatter margins, and even more cashflows that can be deployed into exploration, future acquisitions, or adding more physical metals to the balance sheet for deep value accretion.

So, while their corporate All-In Sustaining Costs have crept higher year over year, up to $12.90 in Q1, and guidance was given of around $15 per ounce for 2024… with Silver prices in the high $20s and then low $30s the last few months, then there is a really big spread there for profitability. The fact that Silvercrest is not handicapped by burdensome debt is a huge advantage, but having 1st quartile low costs is an even bigger advantage, to grow and have leverage to rising gold and silver prices.

When I first submitted this article today to subscribers, there were other things pulling at my attention, and it didn’t even occur to me to check the news section at SilverCrest, and they actually just put out a rough snapshot of their Q2 results.

SilverCrest Provides Second Quarter Operational Results and Conference Call Details; Record Revenue, Treasury Assets Increased by 34% During the Quarter

– July 11, 2024

https://www.silvercrestmetals.com/news/2024/index.php?content_id=543

Q2, 2024 Operating Highlights

Recovered 15,303 ounces (“oz”) gold and 1.46 million ounces silver, or 2.68 million silver equivalent (“AgEq”)1 ounces.

Sold 14,500 ounces gold and 1.45 million ounces silver, or 2.60 million AgEq ounces.

Generated record revenue of $72.7 million with average realized price of $2,237/oz gold and $27.84/oz silver, price increases of 8% and 19% respectively from Q1, 2024.

Ended the quarter with treasury assets of $122.3 million, including $98.3 million cash and $24.0 million bullion.

One of the areas that is consistently overlooked, or at least rarely discussed with Silvercrest from analysts or retail investors, is the growth and upside that they have on tap through exploration of new ounces, at such a low discovery cost per ounce. Over the last 2 years, the exploration strategy has been much more about gaining confidence in the near-term 1-2 year mine plan through definition drilling for mine sequencing. However, now that the company is debt free and printing money, they are finally plowing some capital back into earlier stage near-mine and regional drilling on their land package, with a $12-$14Million exploration budget for 2024.

One of areas we want to look for with “growth-oriented producers” is when there is a significant exploration program in place that can extend mine life, increase surface stockpiles and milling throughput, improve economics, and lead to even more growth. There are a lot of so-called “exploration” companies that have $1-$5Million budgets for this year (or $0 in some cases if they don’t have access to capital). Now contrast that with a $12-$14Million exploration budget at SilverCrest, from a company that doesn’t need to dilute their share equities to raise that money, but is instead funding it internally and organically through their own production. Heck, they are even periodically buying back their shares… not issuing more shares.

And oh, by they way, they aren’t hoping for some other company to acquire and build their project to make their ounces discovered meaningful… they already have the sunk costs paid for with a producing processing center and site infrastructure in place. This means that a producing company, like SilverCrest, can move ounces discovered into the mining plan and monetize them in years, rather than decades. It is stunning that more fans of “exploration” don’t focus on the producing companies that have solid organic exploration strategies. Their drill programs are larger, more relevant, and non-dilutive, and there can still be the thrills of discovery and finding new high-grade zones or satellite deposits for the drill junkies out there.

And finally, there is always the legitimate potential for growth through an acquisition of more mineral concessions, an advanced project, or even another producing company. Over at the KE Report, we regularly get questions from listeners about why SilverCrest Metals isn’t going out and buying other companies with all their revenue creation, pristine balance sheet, and valuable equity paper. We often try and tie down the President, Chris Ritchie, on this very subject. He is always very candid that they are looking for acquisition targets, but that often the projects that they review are not as economic as theirs, nor is that company’s discovery cost as low. As a result, it usually means that it makes more sense to just buy back more of their own shares, or focus on making new discoveries on their own land package.

We did just interview Chris again last week, and near the end of the interview he does reiterate that they are still looking for potential acquisitions, but that in the interim they are going to put a solid exploration focus into this year to grow organically. It really is an informative and nuanced discussion worth investing the 19 minutes of time to hear many of the salient points directly from management. Chris provides insights into SilverCrest's strategy of holding metals, managing inflation impacts, and the balance between expanding organically versus investing in new projects. Additionally, we touch on the potential growth from exploration and regional opportunities, as well as the implications of the recent Mexican elections on mining investments.

SilverCrest Metals - Silver Market Overview, Higher Prices Throughout Q2, Holding Gold And Silver

That wraps ups up for this Part 3 on growth-oriented silver producers.

Thanks for reading and may you have prosperity in trading and in life!

Shad

(In full disclosure, I have a reasonably heavy weighting inside of my own personal portfolio in a few of these growth-oriented silver producers that we are covering in this series. I’ve not been commissioned by these companies to write these articles on Substack. This is not investment advice, nor am I suggesting that anyone position in these stocks. Rather, this is simply an editorial on the value proposition these companies demonstrate to my mind, and why I got positioned in them over the last couple of years.)