Opportunities In Growth-Oriented Silver Producers – Part 2

Excelsior Prosperity w/ Shad Marquitz – 06/17/2024

We are continuing on with this series on growth-oriented silver producers, after having laid out the key points in [Part 1]. For those readers that missed that article, it is worth reviewing to properly set up the right investing mindset for this series.

Opportunities In Growth-Oriented Silver Producers – Part 1

https://excelsiorprosperity.substack.com/p/opportunities-in-growth-oriented

> We’ve also expanded on many similar points in the parallel series on growth-oriented gold producers, so it seems redundant to keep restating them. Those articles are easily found on my Substack channel. It makes the most sense to just move along to silver company #2.

So let’s get into it…

The next growth-oriented silver producer that I’d like to dig into for this series is Guanajuato Silver (TSX.V:GSVR) (OTCQX:GSVRF), for it’s pattern of increasing growth since going into production in 2021, ongoing optimization of operations and metals recoveries at their 4 primary mines in Mexico, and the exploration discovery upside across their portfolio of projects.

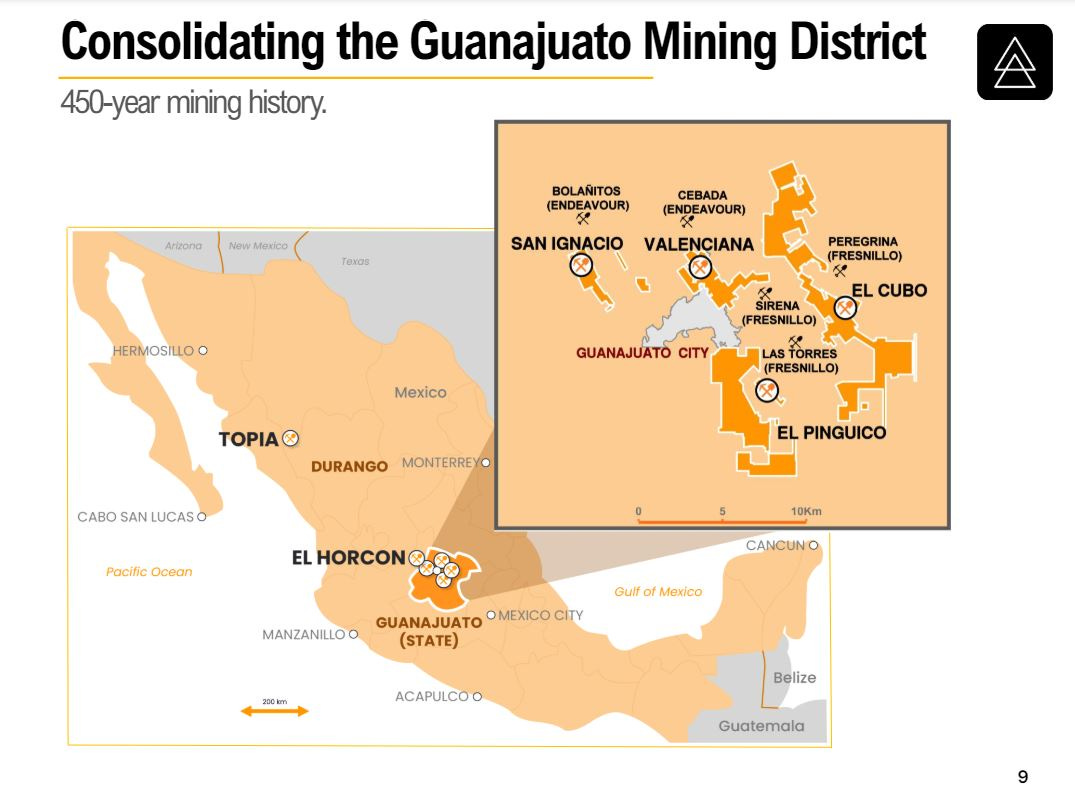

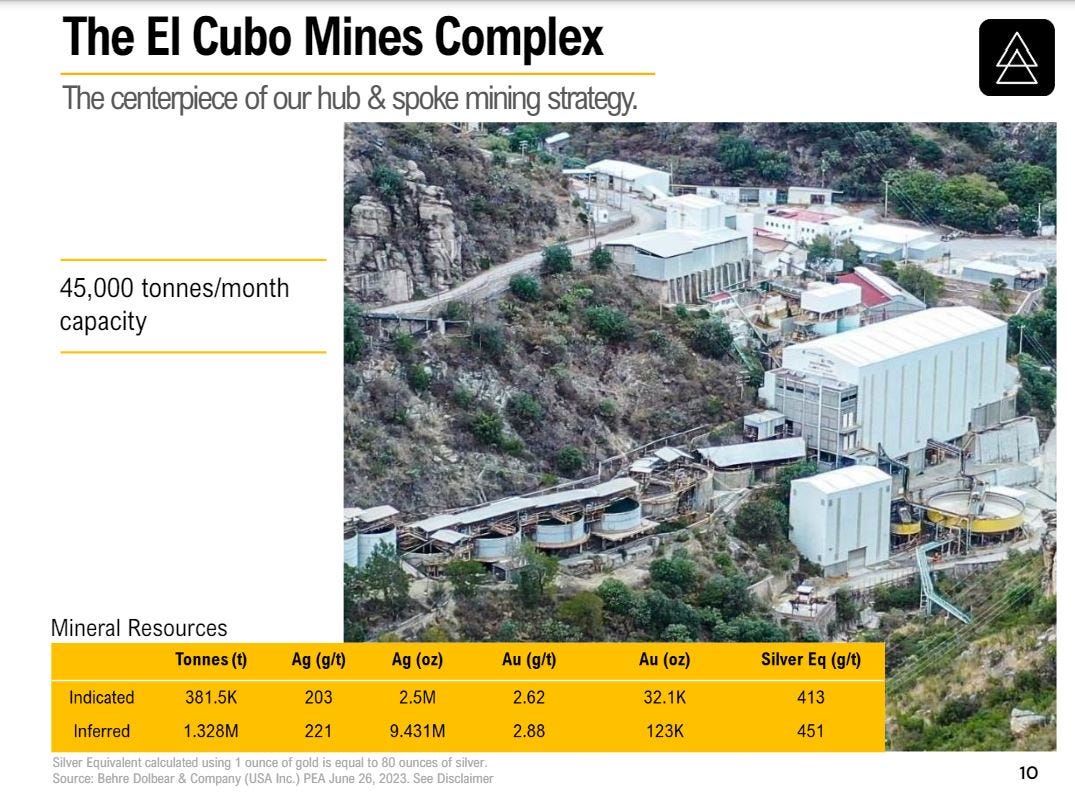

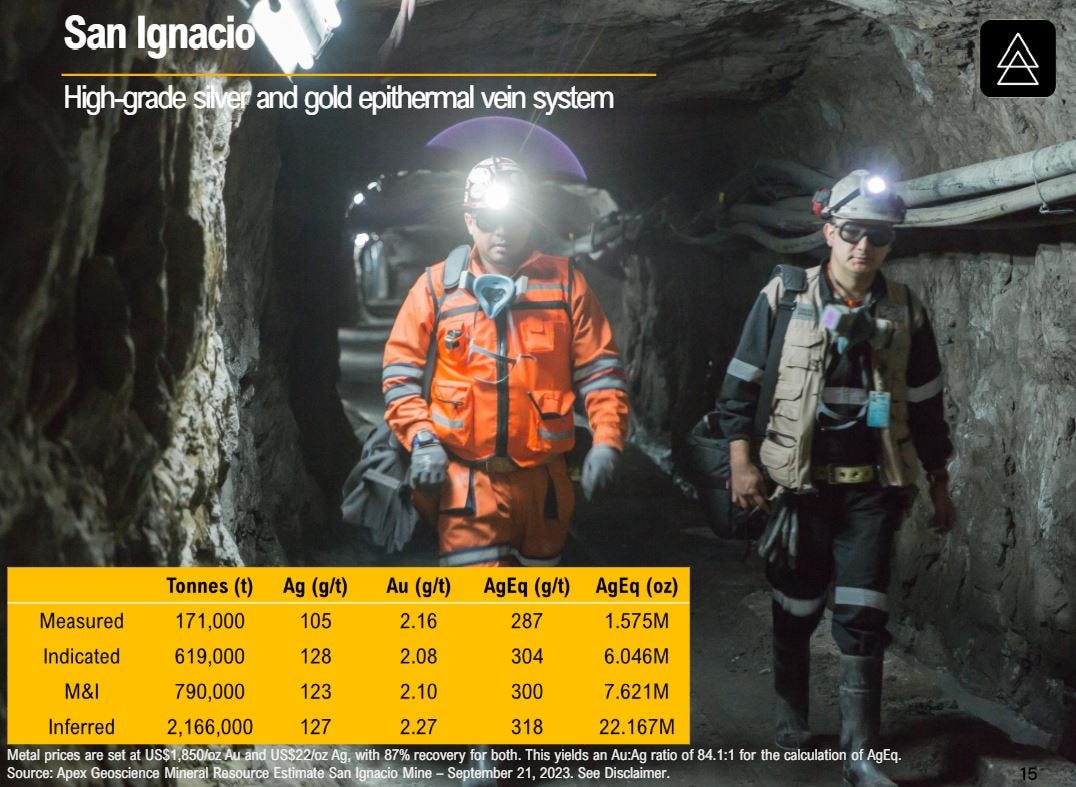

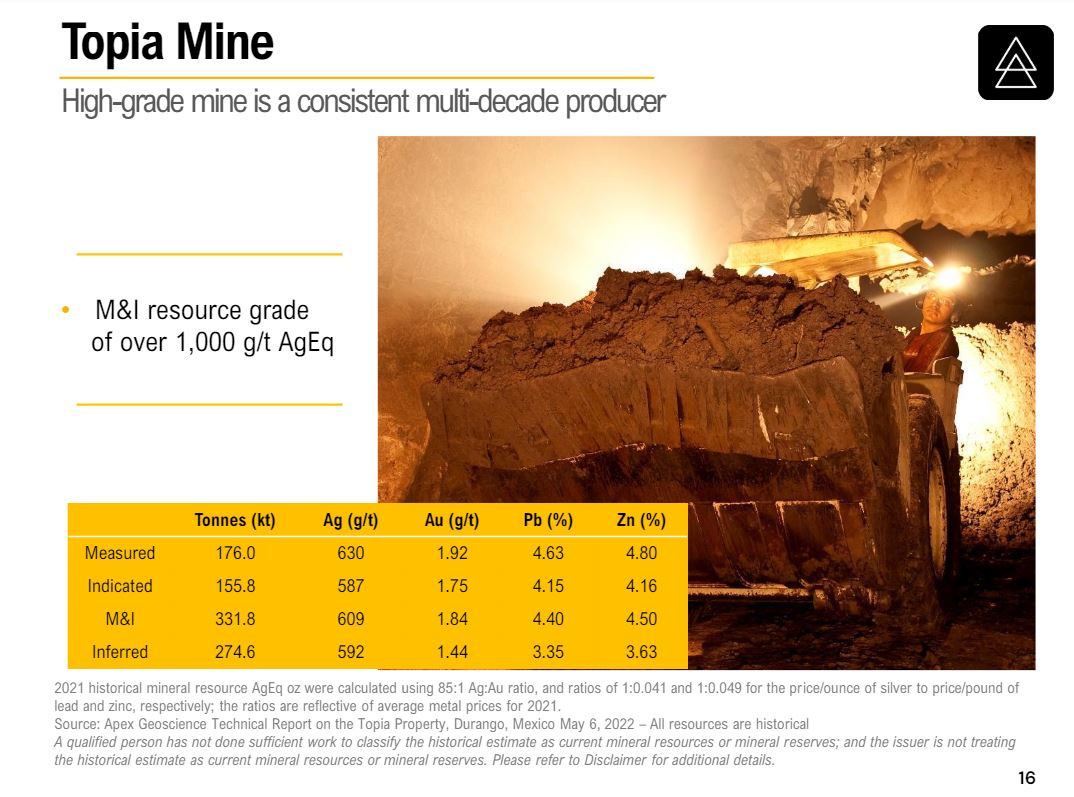

The Company produces silver and gold concentrates from the El Cubo Mines Complex, Valenciana Mines Complex, and the San Ignacio mine; all three mines are located within the state of Guanajuato, which has an established 450-year mining history. In addition, the Company produces silver, gold, lead, and zinc concentrates from the Topia mine in northwestern Durango. Additionally, the company has 2 other development projects that are historic prior-producing mines, El Horcon and Pinguico. These have seen surface stockpiles that have been brought over to the processing center at El Cubo, and they may play a more important role in augmenting mine feed in the future.

Let’s take a brief look at the timeline for Guanajuato Silver acquiring these various mines to then mass up into the company that we see today. When I first came across this company, they only had the exploration and development opportunities at the El Pinguico prior-producing mine. They did a step change though when they acquired the El Cubo Mines Complex from Endeavour Silver (EDR.TO) (EXK). Then a little over a year later, they acquired the Valenciana Mines Complex, and the San Ignacio mine, and the Topia Mine out of receivership when Great Panther (GPR) ran into financial concerns and went into credit protection. Now they are producing from all 4 mines.

A little backstory: I’ve been chatting with the CEO of Guanjuato Silver, James Anderson, for years… since back when the company was called Vangold Mining (the name change took place in June of 2021, to better reflect the Mexican region that they are principally producing in, and they brought Silver into the name… which is their primary metal of focus). Ever since our first encounter, his candor and transparency has always been a strong character point that I’ve respected. James is a straight-shooter, deals in the real, and presents the most realistic path forward. He’s fallen on the sword before to take the blame, even when it was the operations team members that needed to improve processes. He’s quick to give praise to his team when they are executing and having success. That is what a good leader does.

Over the years in conversations with literally hundreds of CEOs and management teams, there is this persistent need for many company bosses to act impenetrable and always be blowing sunshine up investors rear ends, and to try and paint the picture that their companies are squeaky clean and perfect. This is not real life. In real life neither people nor the companies they run are perfect.

James has always been humble enough to admit when there were challenges and areas for improvement. More importantly, he has always been willing to share what the plan was to address those areas for improvement, and what the strategy will be moving forward. Nobody really expects perfection in precious metals mining. (it’s a very tough business plagued with challenges and surprises). However, people do want to know that there are company initiatives in place to course correct and get back on track, as well as optimize and improve. Honestly, this is a much more important quality that I’m personally looking for in management teams, rather than the chest beating about their past successes that we often get.

Let me provide an example: Guanajuato Silver, in their Corporate Presentation has the tagline – “Mexico’s Fastest Growing Silver Producer.”

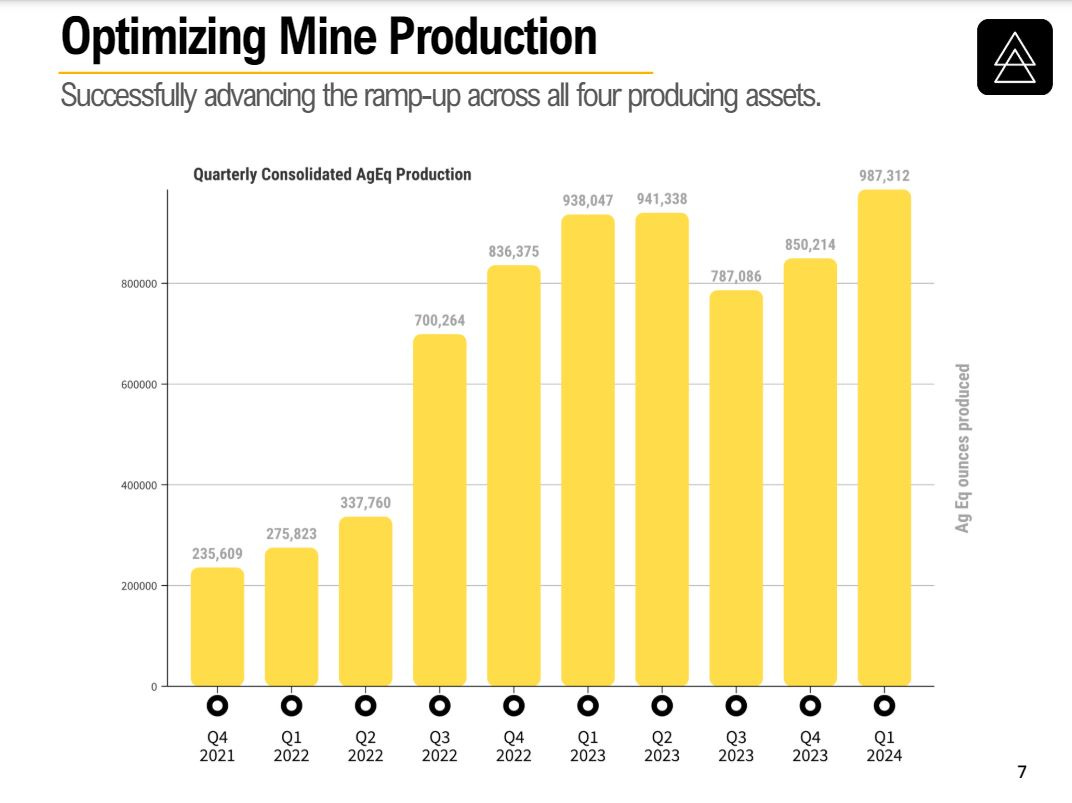

The reason the company has that tagline is because for quarter after quarter, since going into production in 2021, they have steadily grown production, during a tough period of time when many companies floundered around or were stagnant. From a growth standpoint, they really stood out (and still very much do) as a growth-oriented silver producer… Hence their inclusion in this series.

Having said that, they did run into a few challenges in Q3 of 2023 that spilled over a little bit into Q4 of 2023. As to be expected, some investors got very agitated by these growing pains and were vocally disappointed in the stock last summer when production was not going to be as much as guided, and overall costs had increased. When I would discuss this company amongst newsletter writers, fund managers, and investing peers, many people loved to pick apart their financials, or the recent slide in production, and would make hyperbolic statements like “that company is insolvent and may not even exist if they don’t get their act together.”

Personally, I always take comments like that with a grain of salt, because most investors lack the vision of where a company is headed, due to recency bias, and they have a tendency to extrapolate out into the future projections based on what happened most in the immediate past. They are not skating to where the puck is going… This is also why most investors do not buy low, and snub their noses at each good buying opportunity, and instead prefer chasing hot stories only when they are “safe bets.” This is also why many investors struggle to make money investing, and why so many that think they are “contrarians” are really nothing more than herd animals and trend followers, that end up being the proverbial bag holders.

I remember going to the conference in Beaver Creek, CO last year in September, and discussing with other investors what companies we were all going to be meeting with. When I mentioned Guanajuato Silver, many investors were either completely unfamiliar with them, or had a dated understanding of the company assets and production profile, or they were disgruntled shareholders grumbling about how they were disappointed in operations and stock performance.

That particular meeting was unique for me in that instead of it just being the normal one-on-one, it was with about 6 other high-net-worth investors, and a few of them had losses and concerns. One of the guys asked me ahead of time, how do you feel about this company? My response was that I like the management team, and like the assets, and simply want to hear what the move-forward strategy is to get out of this funk. This investor countered with, aren’t you upset or worried. My reply was, “No, but I’ll be asking for and listening very carefully to what the plan and strategy is going to be moving forward, and will call bullshit if I hear it.”

In the meeting, some of the investors present voiced their frustrations or concerns, and I also asked some tough and direct questions. James, along with Hernan Smith, Chief Strategy Officer, addressed everyone’s concerns and questions point by point, very thoroughly. They admitted that the results hadn’t been up to their standards, resulting in temporarily higher costs, and they didn’t blame the markets or investors or the metals. Instead, they discussed the changes in personnel, changes in mine strategy, reviewed the capital reinvestment being put into the mines, and laid out a clear path forwards that was honest, achievable, and clear. Upon leaving the meeting, that same investor asked me what I thought… My response back was they had answered my questions and everyone else’s questions or concerns with genuine tact, real answers, and I believe that they are not only aware of what can be done to improve operations, but they also have a plan in place to put capex to work towards improving their mines. That’s all I wanted to hear.

When I got home from that conference, I added a little bit more to my position, because I was so impressed with how they fielded those questions and how they were navigating a tough time period as a company. It’s easy to host meetings and answer questions when everything is going gangbusters, but people really reveal their characters during challenging time periods (when it would be easier to quit or curl up into a ball and avoid even meeting with emotional investors). I share this story, simply to illustrate what matters to me personally when speaking with management teams, and when analyzing companies that face the inevitable hurtles and hiccups along the investing journey. I look for management teams that find solutions, and turn their frustrations into fuel, to emerge stronger than they were before. That is what I believe the team at Guanajuato Silver has done over the last year or so.

I’ve had a number of conversations with James since that meeting a year ago, and am happy to report that they, as a management team and company, did every single thing mentioned they would do. They made some personnel changes on the board level and in the operations team, identified the areas to improve the mine sequencing and recoveries, and they are still investing in more equipment from flash flotation cells, to a new filter press, and even ore-sorting equipment. Q4 was better than Q3, and Q1 of this year was better than Q4. Production in Q1 was another record, and the company is back on track to quarter over quarter production growth once again.

Let’s take a look at the 4 primary producing assets of the company:

Now one thing I find interesting (and underappreciated by the market) is that the company has a lot of spare capacity at their El Cubo Mill, and so they’ve been supplementing it with aboveground stockpiles from their El Horcon Mine, and other 3rd party operators in Guanajuato. One of the wildcards that could represent more growth is if the company puts in place a plan to start developing their Pinguico Project into a mining scenario once again. It has a rich history of production and gets almost zero value at present, so that could be another area of growth hiding in plain sight. They also still have plenty of exploration upside at each of their projects.

James Anderson, CEO of Guanajuato Silver, joined me again last week, over at the KE Report, to provide a review of the key metrics from their Q1 2024 financials, along with a comprehensive operational and exploration update from their 4 producing silver-gold mines and 3 processing facilities in central Mexico.

James highlighted the consistent quarter over quarter growth in the Company since beginning operations in 2021, discussed how they calculate their AISC more inclusively than many companies, and the different initiatives the company has at each mine to keep bringing costs down in the quarters to come. We also discuss the capex investment into new flash flotation cells, ore sorting equipment, and a new filter press to continue to optimize their mining operations and improve efficiencies and costs.

Q1 2024 Highlights

Record metals production during the quarter of 987,312 AgEq (silver equivalent) was up 16% over the previous quarter; AgEq ounces derived from 428,279 ounces of silver; 5,384 ounces of gold; 879,242 pounds of lead; and 922,297 pounds of zinc.

Tonnes milled increased 20% over the previous quarter; a total of 165,079 tonnes were processed among GSilver’s three production facilities.

Both all-in sustaining cost (“AISC”) of $20.19 per AgEq ounce, and cash costs of $16.55 per AgEq ounce were 6% lower than the previous quarter

Record revenue of $17.8M was 7% higher than the previous quarter; net loss decreased by 3% in Q1 to $7.3M compared to $7.6M in Q4, 2024.

Realized average metal prices for the quarter of $23.37 per silver ounce, and $2,068 per gold ounce sold.

Next we review the augmenting of material at the El Cubo mill from 3rd party sources, as well as surface stockpiles from their El Horcon mine, with the potential of looking at starting to develop their Pinguico Project to ship more mineralized material to El Cubo down the road. We wrap up with the exploration upside still present across their properties and a quick review of the key strategic shareholders.

Guanajuato Silver – Highlights From Q1 Financials And A Comprehensive Review Of All 4 Mines - Jun 14, 2024

That’s for this update on G-Silver and growth-oriented silver producers in [Part 2].

Thanks for reading and may you have prosperity in trading and in life.

Shad

(In full disclosure, I have a reasonably heavy weighting inside of my own personal portfolio in a few of these growth-oriented silver producers that we are covering in this series. I’ve not been commissioned by these companies to write these articles on Substack. This is not investment advice, nor am I suggesting that anyone position in these stocks. Rather, this is simply an editorial on the value proposition these companies demonstrate to my mind, and why I got positioned in them over the last couple of years.)