Opportunities In Growth-Oriented Silver Producers – Part 1

Excelsior Prosperity w/ Shad Marquitz – 05/25/2024

For this series on growth-oriented silver producers, it will be similar and run parallel to the series on growth-oriented gold producers; as we dive into some of the opportunities in the junior and mid-tier silver producers with a solid production growth wedge, paired with exploration upside.

Within a specific commodity, like silver stocks, my strategy is to diversify across different stages of mining stocks, from royalty companies, to producers, to developers, and to advanced explorers (I don’t personally hold very many earlier-stage pre-discovery drill plays but will take a punt on a few from time to time). Of those different stages of mining stocks, my portfolio is most heavily weighted towards the PM royalty companies and mid-tier to junior growth-oriented producers.

I’ve noted in the past that there is also a time and place for holding positions in the optionality “beta” plays, with large defined ounces in the ground, because they have traditionally had higher torque to rising prices. This is also a good period to accumulate those as well, and many will have those ounces rerate higher. As the bull market in precious metals unfolds, and then really starts building momentum, then the exploration companies will have the most upside torque, but of course, those types of companies come with the most associated risk.

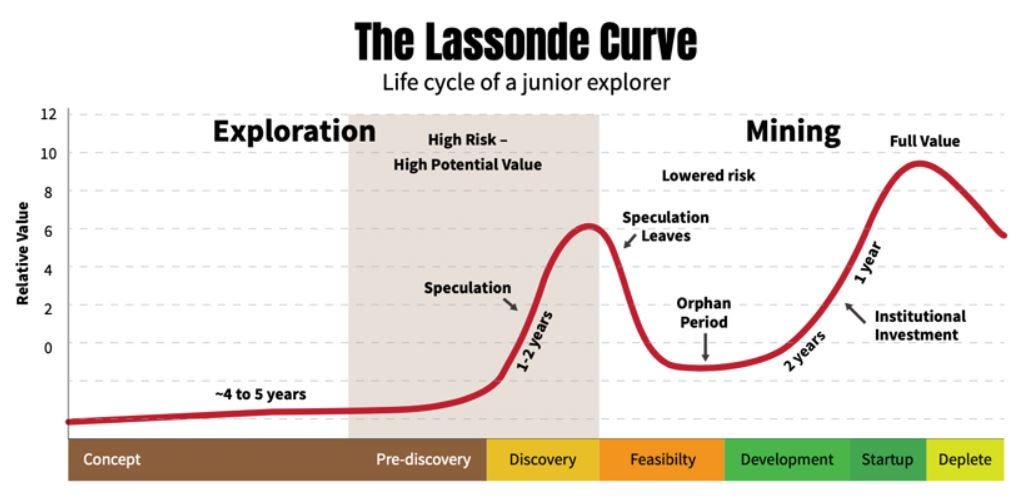

Right out of the gates though, when talking about silver producers, we must also dispel a silly notion that pervades the precious metals mining stock investing sector. Many retail investors maintain the erroneous belief that once a company becomes a “producer” that it is then “fully valued” and at the end of it’s journey as an investable asset, setting up for depletion and closure. This erroneous belief system is due to a misinterpretation of the Lasonde Curve, where retail investors just parrot back to one another that the only 2 places to make big gains are in the speculative “discovery stage” of explorers, or in the “pre-production sweet spot” (dubbed by Lobo Tigre) of developers, where institutions get invested.

Folks, please don’t mention that once a company has “first pour” that they are then “fully valued” to Hecla Mining (HL), that has been in business over 130 years, that has continued growing and continuing to build value during different phases and market conditions along the way. There is money to be made with explorers in the discovery phase, with developers in the pre-production sweet spot, AND with producers that are growing their production organically or through acquisitions (or both), and that also have exploration upside to keep expanding resources and mine life.

This notion that producers are all fully valued and at the end of their journeys at first pour is, of course, complete rubbish. There a plenty of times in this more recent PM bull market that started when Gold bottomed in December of 2015, and miners bottomed in January of 2016, where it was actually the small to mid-tier gold an silver producers that had the biggest percentage gains as a collective group of stocks.

Looking back to the action we saw in the 8-month surge in 2016, from January to August, there were many producers up 300%-1000%. Or how about the double-digit or triple-digit gains in silver and gold producers from the fall of 2018 to summer of 2020, for nearly a 2-year period of appreciation in PM stocks (with some wild corrective swings down in early 2019 and early 2020 during the pandemic crash). Then there was the early 2021 #SilverSqueeze phenomenon, isolated mostly into the producing silver/gold companies, and not really heading down the foodchain to most of the developers or explorers. Then, once again, in late September of 2022 through the banking crisis of late April of 2023, we saw big moves in the junior and mid-tier producers for a nice 7 month rally with many up double-digits and even triple-digits while juniors lagged. The last few months we’ve seen the same pattern once again.

In fact, many junior explorers or developers barely budged during those prior epic moves higher, whereas many producers shot up high double-digits to solid triple digit gains each time. So are producers already fully valued? Clearly that answer is no.

The obvious point is that a revenue-generating company can then use those funds to keep developing the optimization processes for the first mine to lower costs and improve margins. They can use these revenues to increase development and run higher throughput of ore into their processing center. Other companies have also plowed those revenues into seeking out higher grade areas of the deposit to then mine, or into methods for increasing recoveries and improving processing metrics. Keep in mind that this is all just on the initial mine they have, and doesn’t account for the value creation from companies that then go on to develop more mines organically, or that bolt on additional mines through acquisitions for better size, scale, efficiencies, cost of capital, stock liquidity, and so on.

Lastly, a company with revenues can then fund part of or all of it’s exploration through the ATM machine of it’s mine or mines. This self-funded exploration can thus expand the company resources, leading to either increasing production output or extending the mine life. Even the larger senior companies use some of their revenues to take strategic stakes in junior explorers, to leverage and gain exposure to those junior companies exploration campaigns and growth.

All of these different ways to generate more value and “alpha” can lead to a given company seeing it’s valuations and share price heading much higher for a period of time, or even longer stretches of time in a good metals price and sentiment environment. The setup we have now with silver finally starting to play more catchup to gold, and with prices having recently blasted above $30 resistance, is going to give silver producers the most immediate leverage as they are able to immediately monetize these higher prices with expanding margins.

We are entering a period of time where most of the silver stocks should do well, so having a basket of silver stocks for the next leg of the precious metals bull market should be richly rewarded. Amongst the silver producers, the largest seniors like Fresnillo, Hochschild, Pan American Silver, SSR Mining, etc… can still have really nice moves, but overall during the prior bullish impulse periods it was really the mid-tier to junior producers that outperformed the rest of the pack. These smaller producers, that could grow their production profile, lower costs, see the biggest percentage increase in their margins, and also grow resources through exploration, had the most upside leverage… so those are the ones we are going to focus on in this series.

These smaller to intermediate operating mining companies are clearly not without risks. Having said that, someone investing in them is not taking the same kinds of risks as they are piling into a junior drill-play that is hoping to make a discovery, or that is working to prove that they’ve discovered enough quality ounces to make a significant economic resource that could actually be mined one day. Simply put most junior explorers will fail, whereas most producers will survive and for periods thrive. Very few explorers hit it out of the park with a legitimate discovery that becomes an economic mine, whereas, conversely, very few producers fail, and when they do, other successful producers acquire them to run the mine more profitably.

To be clear, I love speculating on drill plays or optionality plays with developers as much as the next punter, but do strongly believe that risk mitigation is an important part of the investing journey. Personally, I am more comfortable having a higher portfolio weighting to the more leveraged producers to ride out any bull market cycle, and anticipate making the lion’s share of my portfolio gains being positioned early in growth-oriented producers with opportunities to also make discoveries with the drill bit.

So with all that said to properly set up the right investing mindset for this series… Let’s get into it with the first company to review!

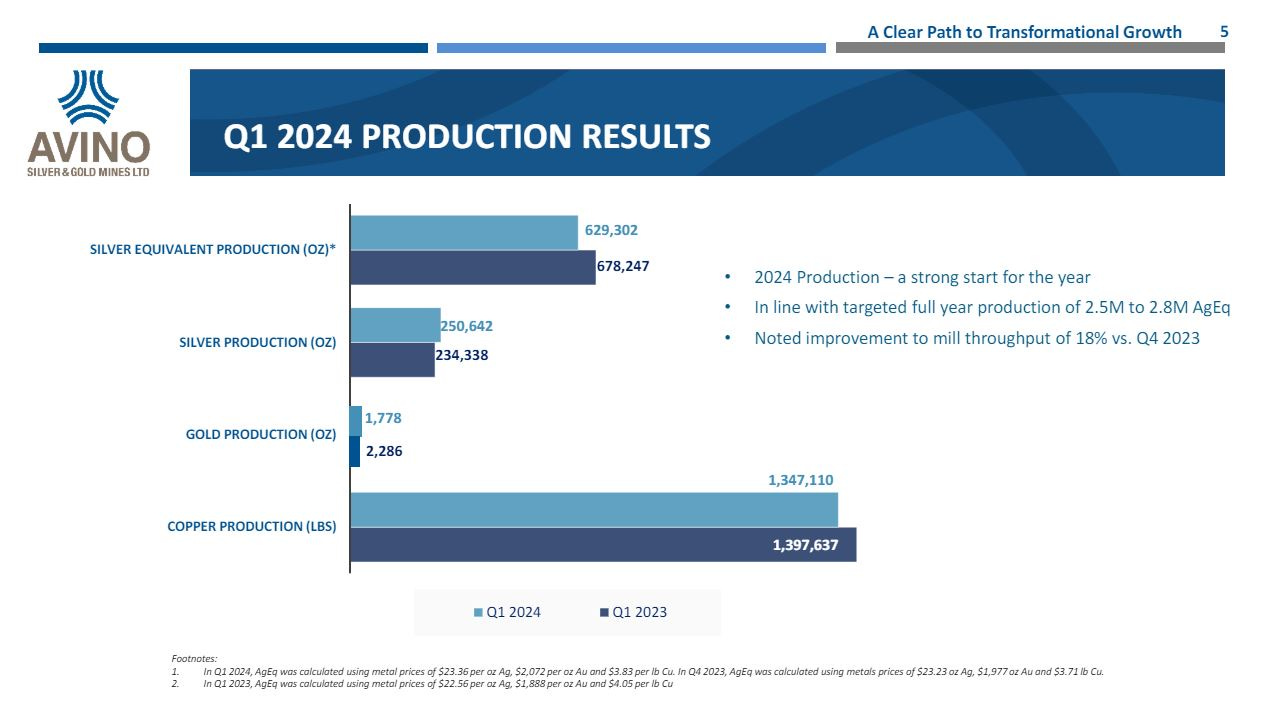

On Friday, over at the KE Report, I interviewed David Wolfin, President and CEO of Avino Silver and Gold Mines (TSX;ASM – NYSE:ASM), where he recapped the key takeaways from the Q1 2024 financials and operations. We then take a deeper dive into the Company’s 5-year production growth plan, to become an intermediate silver producer, in Mexico. I want to kick things off here with this interview as a quick primer on the company, because in 16 minutes of listening, anyone that is reading this article can get a comprehensive overview of the whole opportunity directly from the CEO of the company.

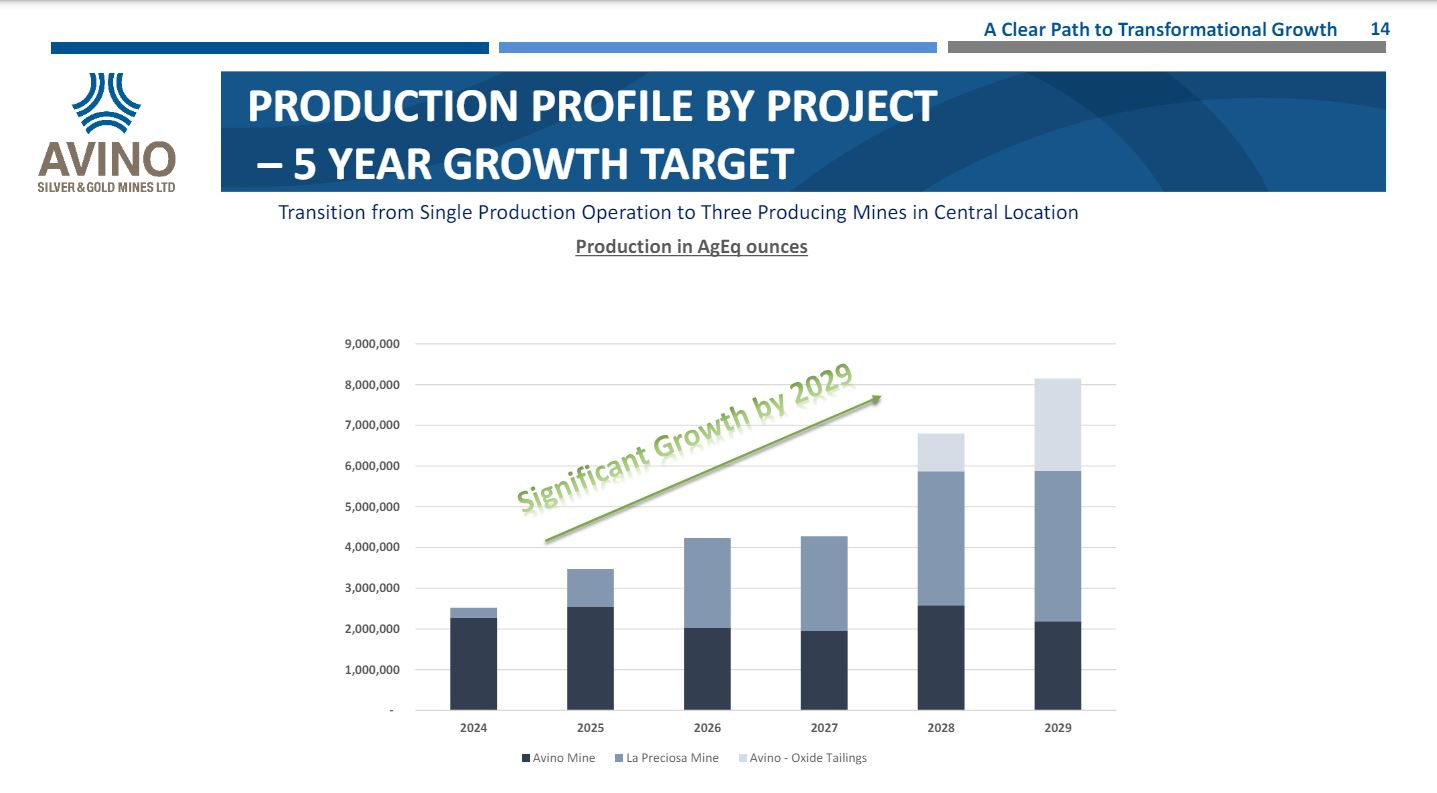

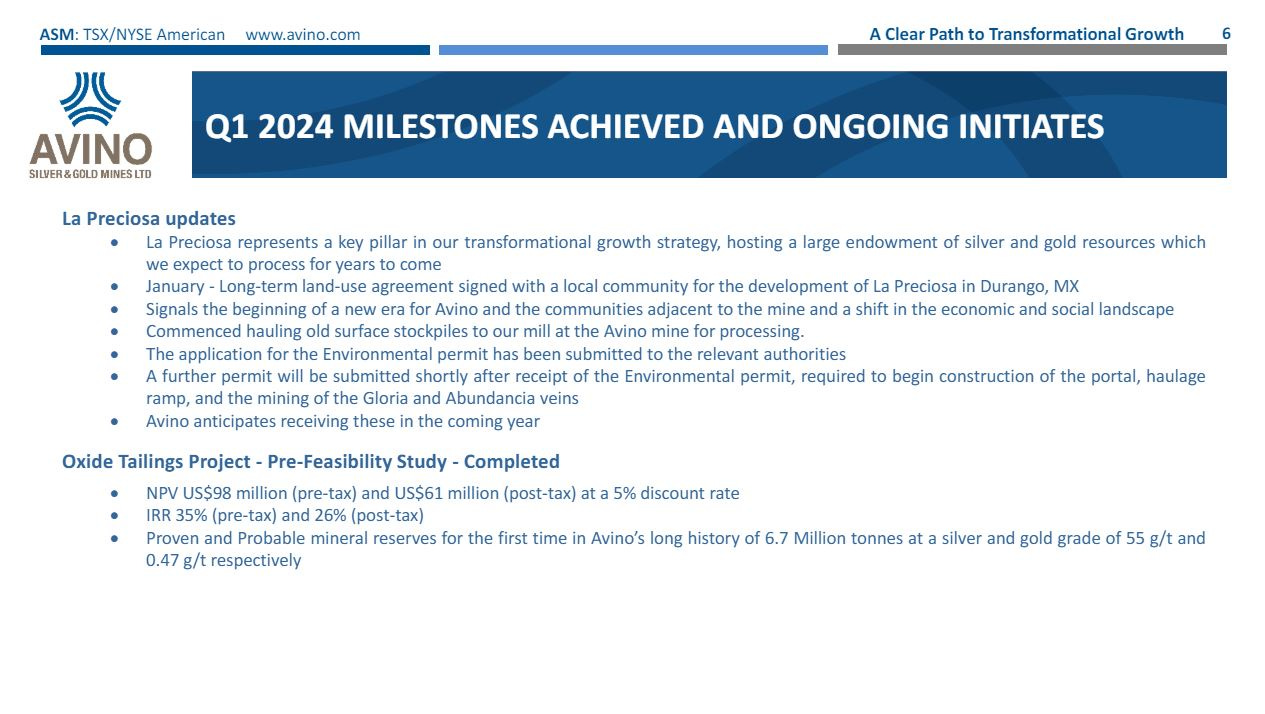

David outlines the consistent silver, gold, and copper production coming from the Avino Mine, the upcoming development of the La Preciosa Project later this year, with commercial production expected early in 2025, and then the Oxide Tailings Project a few years out that all contribute to the 5-year production growth plan. We spend some time having him outline all the historic drilling, met work studies, community engagement, and scoping work that has already been completed on La Preciosa, making it shovel-ready now. The Company is simply waiting on the final permits later this summer, to then begin putting in the decline at La Preciosa, and several months after that to start mining ore and shipping it over to the Avino processing plant. We also discuss the exploration upside at both the Avino Property and at La Preciosa for further potential to expand resources and mine life.

Avino Silver and Gold – Recapping Q1 2024 Financials and Operations, Looking Ahead To 5-Year Production Growth Plan - May 24, 2024

So now that folks have the basic strategy, milestones awaiting the company, and timeline; we can dive into some of the specifics on Avino Silver and Gold. This is a stock I’ve been personally following and trading off and on since mid-2010, and it has had big torque to both the upside and downside, depending the metals pricing trends and sector sentiment. So with silver, gold, and copper prices all perking up recently along with improving investor sentiment, it’s a name I expect to do very well in the next leg of this PM and commodities bull market.

What really caught my attention enough to reposition again in (ASM) again last fall (Sept-Nov of 2023 accumulation period in multiple tranches from $0.59 to $.50 to $0.47) was catching up with David at the New Orleans Investment Conference [hosted by our buddy Brien Lundin of Gold Newsletter each year]. When we chatted, and I learned about all the production growth on tap over the next 5 years, it really got my wheels spinning on where this valuation could go as the La Preciosa Mine kicked on, followed by the oxide tailings project coming in to supplement production further a few years after that.

The Company projects to go from 2.5 million ounces of silver equivalent production this year, to over 8+ million ounces of silver equivalent production by 2029. I’d say that qualifies as a “growth-oriented silver producer.”

As a result of the leverage that the higher number of ounces produced should garner, especially with a silver price north of $30, then I see the potential of a 5x move in the company valuation to become a billion dollar market cap company and legitimate multi-mine mid-tier producer that attracts a higher multiplier in the sector over the next 5 years. It’s not there yet though, and that growth profile that is still in front of the company is what I see as being a magnifier for the company performance relative to peer producers in this bull market.

Now, maybe the stock price could move even more than 5x if the metals prices in silver, copper, and gold keep climbing even higher, but I don’t like outlandish hyperbolic calls. So -- could it 7x or 10x in the next 5 years… Sure, who knows? (To be clear this is not investment advice… just me speculating in my personal portfolio). I’m just making the point I think ASM could go up multiple-fold from here in valuation just based on the expected increase in production output, and that would be a big move for a producer with more certainty than in participating in the bull market through the unknown factors around a drill play.

There is also plenty of exploration upside for Avino at both their Avino Project and La Preciosa Project, but that is harder to quantify for most, but absolutely does factor into my thesis as well. I guess bottom line: There is so much growth on tap here over the next 5 years that it raises my personal confidence that the company can have an outsized move compared to many peer producing companies.

Another thing that catches my attention, with regards to Avino Silver and Gold Mines, is that in addition to the precious metals, they also have a reasonably nice exposure to copper production. In resource world clamoring for more copper production, here it is hiding in plain sight with over 1.3 million lbs of copper produced just in Q1 of this year. Yes, I realize that isn’t anywhere close to where the copper majors are, but keep in mind, that this exposure to copper prices going higher, only helps out the Silver Equivalent ounces, just like the gold co-credit does as well.

Another way that companies can increase their torque and grow is by increasing their margins. This is typically seen through metals prices rising, but can also be companies being proactive on implementing better mining practices, increasing throughput, increasing recoveries, and wise tweaks to the overall mining sequencing or processing. One has to tip their hat to the management team and operations team at Avino Silver and Gold for a pattern of bringing down their cost profile the last few quarters, in a difficult stickier inflation macro backdrop.

With regards to continuing to bringing down the All-In Sustaining Costs (AISC), this also ties in to the importance of both La Preciosa and the Oxide Tailings project coming into the production profile over the next few years. David has mentioned publicly, and did so again in our interview on Friday, that they can see a pathway to getting their AISC down to the $12 or lower through this 5-year growth plan, which obviously is more margin expansion and revenue growth. So not only will they be growing their production profile, but they’ll be bringing down costs to grow cashflows at the same time. So even if metals prices just hovered sideways the next 5 years there is significant growth on tap. Now, if other people believe like I do that silver, and copper, and gold prices are likely to head even higher, then that is just a magnifier of this growth strategy.

If people pull up a longer-term chart of Avino Silver & Gold, they may look at it and see the periods of time when ASM shot up over $3 in prior peaks, or even up to $2.82 on that #SilverSqueeze mania day in early 2021. However, $3 is only a 3x move from the $1.07 price close that we had on Friday. So why the 5x expectation this time?

Well all of that chart history demonstrates how the pricing moved with the company having only the Avino Mine in production; and it didn’t include the incoming La Preciosa or Oxide Tailings production planned for the next few years. Again, going from a 2.5 million silver equivalent ounce production profile to an 8+ million silver equivalent ounce production profile is going to be game-changing growth, and really moves the company up to eventually get rerated higher like a mid-tier producer with a better multiplier. Currently, that is not being priced in… hence the upside opportunity that presents itself and why I see the share-price eclipsing prior peaks. Let’s say some readers here can’t see that happening… well, can the case at least be made that the share price will go up a lot higher than a buck to possibly 2 bucks or 3 bucks? Would that still be a good trade on a producer with decades of experience at the helm?

So let’s wrap up with what key news and milestones were completed so far this year and what ongoing initiatives remain moving forward, at both the La Preciosa Project and the Oxide Tailings Project:

We’ll be following along here with the newsflow and developments at Avino Silver and Gold (and Copper). It seems like the next really key catalyst for the Company will be receiving their permits in a few months for putting in their decline at La Preciosa to start mining the ore and trucking it to the Avino mill for processing. Once that permit comes in, it will be go time, but until then operations are humming right along.

Well that wraps us up for this [Part 1] on growth-oriented silver producers, and thanks for reading.

May you have prosperity in your trading and in life!

- Shad