Opportunities in Copper Explorers and Developers – Part 3

Excelsior Prosperity w/ Shad Marquitz – 06/20/2025

I’m happy to report that we are going to dive back into another update on potential opportunities for investing in the copper explorers and developers. We’ll look into recent newsflow, key upcoming catalysts, and also include some recent interviews with the management teams.

It’s been a while since we’ve done an update here in this small corner of the commodities space, so we’ll have a brief refresher of the companies covered thus far in the first 2 parts of this series.

Arizona Sonoran Copper Company (TSX:ASCU) (OTCQX:ASCUF)

Surge Copper (TSX.V:SURG – OTCQX:SRGXF)

Faraday Copper (TSX.V:FDY – OTCQX:CPPKF)

Metallic Minerals (TSX.V:MMG – OTCQB:MMNGF)

Cascadia Minerals (TSX.V: CAM) (OTC: CAMNF)

Opportunities In Copper Explorers And Developers – Part 2

Arizona Sonoran Copper (TSX:ASCU – OTCQX:ASCUF)

Regulus Resources (TSXV:REG) (OTCQX:RGLSF)

Aldebaran Resources Inc. (TSXV:ALDE)(OTCQX:ADBRF)

Faraday Copper (TSX.V:FDY – OTCQX:CPPKF)

Magna Mining (TSX.V: NICU) (OTCQB: MGMNF)

That’s a good crop of juniors working hard on copper exploration targets, and I still like all of those companies and believe they are doing good work to continue advancing their projects. We’ll provide some updates on a few of them here in this article, as well as introduce a new company.

First though, let’s check in on the copper price action. Here is a 2 year pricing chart of copper futures:

We’ve seen a whipsaw copper pricing market the last couple years, but there were 2 new consecutive all-time highs achieved --> $5.199 in May of 2024, and then $5.346 in March of 2025. It is always significant when any market makes new all-time highs, so we can definitely put this trend in the bullish category.

Copper has been in a general uptrend since the October low of $3.52; and we can see this in the gently upsloping red 200-day Exponential Moving Average (EMA).

Copper pricing closed this week at $4.83, above both the 50-day EMA (currently at $4.74) and the 200-day EMA (currently at $4.53). That keeps copper in a bullish posture, but it has been testing the 50-day EMA as support.

With regards to the ETFs: I find it interesting that both the (COPX) and (ICOP), both full of the larger copper producers, peaked last year in sympathy with that May peak in copper prices, but have been trending sideways to down since then, and didn’t really respond much to the peak in March to an even higher level to an all-time high in copper.

In contrast, the action in the Sprott Junior Copper Miners ETF (COPJ) has really come to life over the last 2 months in May and June, and just tagged a new 52-week high at $25.50 earlier this month, albeit, still lower than the May of 2024 peak at $26.43.

It is still bizarre that the copper stocks only had a muted reaction though to that big surge in copper to all-time highs in March of this year.

Some of the recent outperformance of the (COPJ) over the senior producer copper ETFS (COPX) and (ICOP) points to some of the copper juniors getting a bit peppier recently.

This is also reflective of the ~40 copper equities included and their associated weightings within this portfolio. https://stockanalysis.com/etf/copj/holdings/

Some of the companies we’ve discussed in this series like Regulus, Aldebaran, Arizona Sonoran, and Faraday Copper are included in COPJ. (so it has juniors)

The (COPJ) also has a small weighting to Hot Chili Limited (ASX: HCH) (TSXV: HCH) (OTCQX: HHLKF), which I’m not going to take a deep dive into in this article, because I already camped out on this company for a while in the whole middle section of the article covering the Vancouver Metals Investor Forum in May. Hot Chili is a copper explorer/developer that I’m keenly interested in though, and still considering getting into a position in it.

For those that missed that aforementioned May MIF article, here’s a quick link to it:

The Hot Chili discussion starts in the middle and features some additional insights and interviews from my friend and colleague, Brian Leni, and the value proposition of their water rights in Chile, in addition to their copper resources.

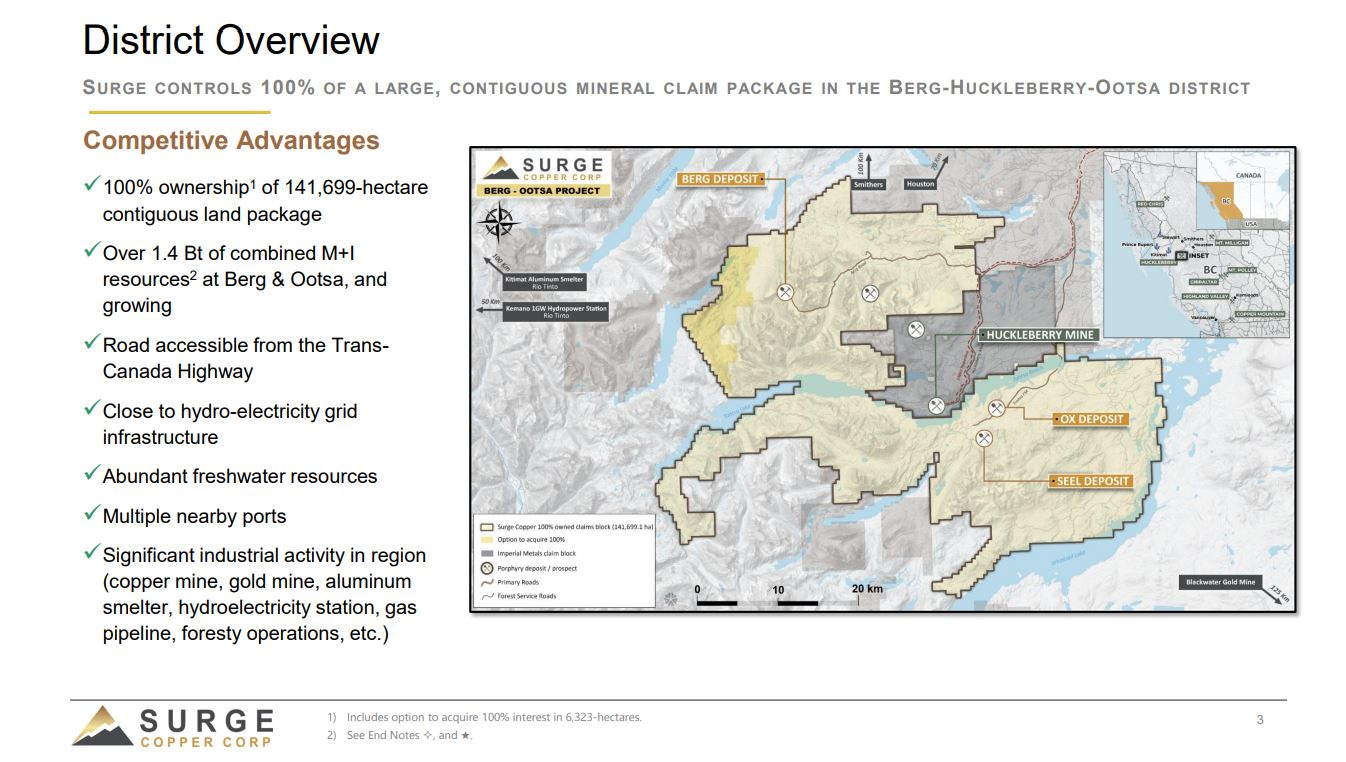

Leif Nilsson, CEO & Director of Surge Copper (TSX.V:SURG – OTCQX:SRGXF), joined me over at the KE Report on June 17th for a comprehensive update on all derisking work and development work that is building towards a Pre-Feasibility Study (PFS), including the excellent metallurgical results released today at their flagship copper-molybdenum-silver-gold Berg Project in British Columbia.

Surge Copper – Excellent Metallurgical Results and Further Derisking Work Advancing Towards The Pre-Feasibility Study At The Berg Project

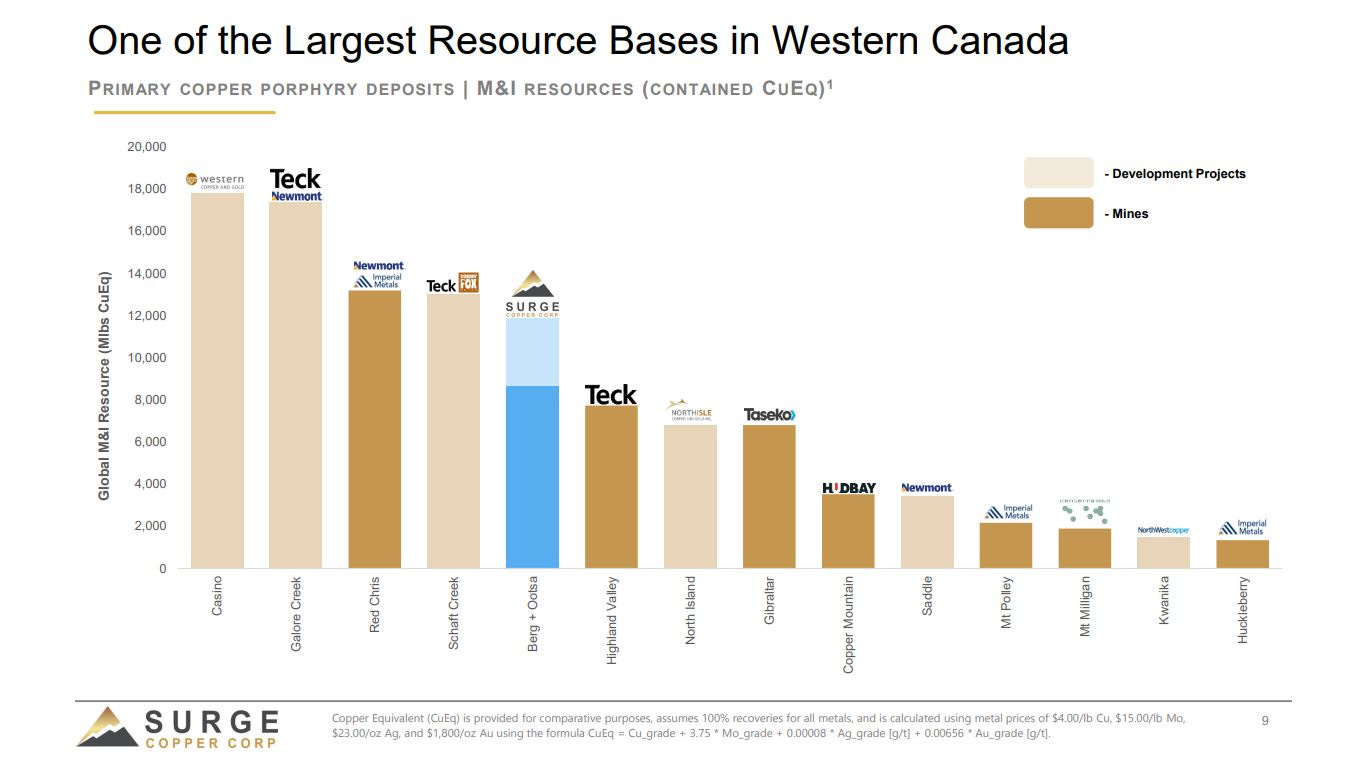

We started off reviewing the resource size and different metals contributions as well as the key economic metrics from the Preliminary Economic Assessment (PEA) released in June 2023. The updated Mineral Resource Estimate includes combined Measured & Indicated resource of 1.0 billion tonnes grading 0.23% copper, 0.03% molybdenum, 4.6 g/t silver, and 0.02 g/t gold, containing 5.1 billion pounds of copper, 633 million pounds of molybdenum, 150 million ounces of silver, and 744 thousand ounces of gold, plus an additional 0.5 billion tonnes of material in the Inferred category.

Leif highlighted that there has a been a fair bit of infill drilling completed over the last 2 years; where more ounces will be moving from the inferred category and into the measured and indicated category when the resources gets updated along with the coming PFS.

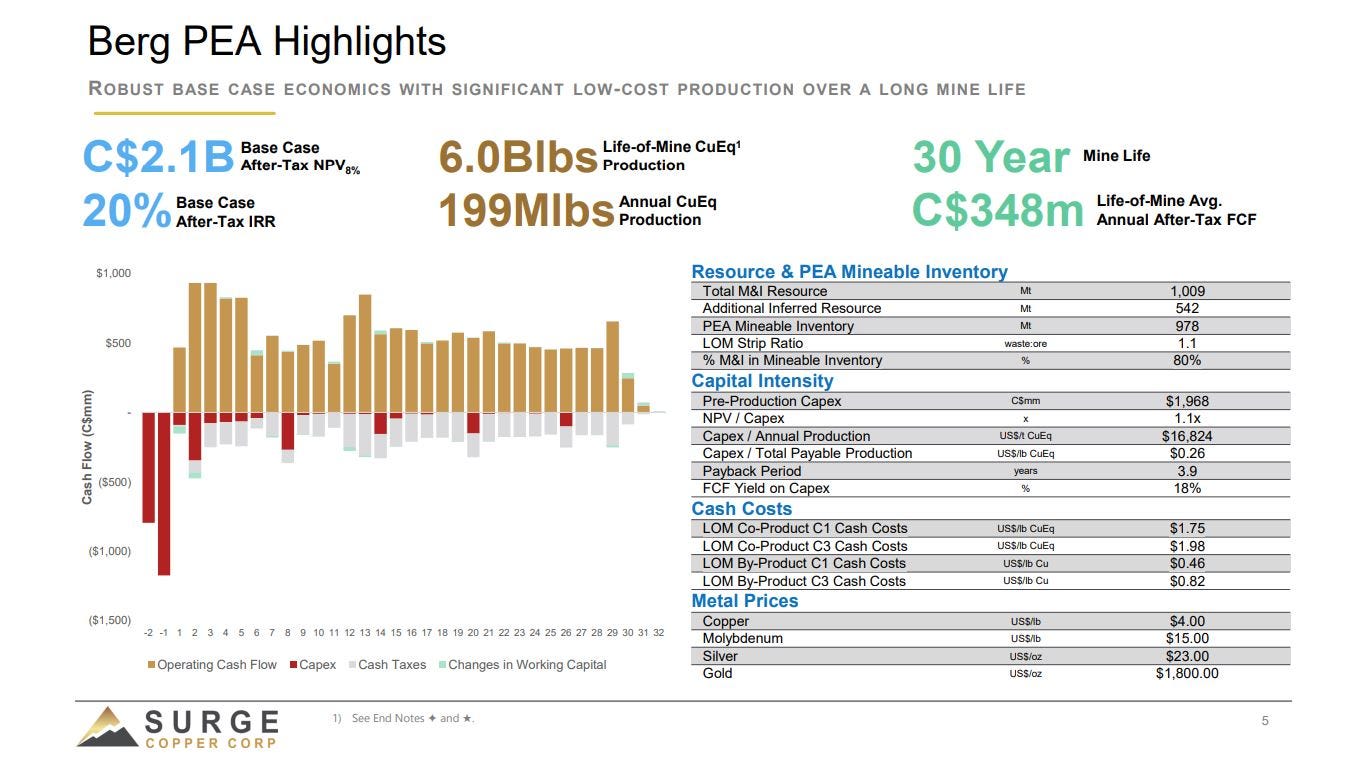

The 2023 PEA outlined a base case after-tax NPV8% of C$2.1 billion and IRR of 20% based on long-term commodity price assumptions of US$4.00/lb copper, US$15.00/lb molybdenum, US$23/oz silver, and US$1,800/oz gold plus foreign exchange of 0.77 USDCAD. There is a projected 30-year mine life with total payable production of 5.8 billion pounds (2.6 million tonnes) of copper equivalent (CuEq), including 3.7 billion pounds (1.7 million tonnes) of copper.

Leif outlined that these economic metrics will see marked improvements in the upcoming PFS, based on a few different factors.

The larger amount of resources in the measured & indicated category will be a key factor.

The geotechnical drilling showing the potential for steeper pit walls, and the inclusion of mineralization previously below the pit shell from that 2023 study will be another positive factor.

The conversation then shifted to the recent successful metallurgical tests that demonstrated improved recoveries for copper and molybdenum into the bulk concentrate, as well as the separation into the separate copper and moly concentrates.

Surge Copper Reports Excellent Metallurgical Results Supporting Pre-Feasibility Advancement at Berg Project - Jun 17, 2025

Highlights of the metallurgical testing:

27 variability composites tested, covering all major rock and alteration types spatially distributed across all areas and depths of the proposed open pit

Over 60 flotation tests conducted to optimize parameters and improve recoveries

Locked cycle testing achieved up to 90.7% Cu and 93.0% Mo recovery to bulk concentrate grading 29.7% Cu

Excellent copper-molybdenum separation confirmed, with Mo recoveries of 94.6% and 95.6% from bulk concentrates across the main hypogene and supergene composites respectively

Wrapping up we discussed a number of factors from what the permitting process will look like, the potential for government funding for critical minerals projects in British Columbia and Canada, the strategic partner they have in African Rainbow Minerals Limited (“ARM”) assisting the Project both financially and technically, and an overall sense of, and how the size and scale of the Berg stacks up to other large copper development assets in Canada.

I continue to see Surge Copper as vastly undervalued compared to many peer development-stage companies, and based on the resources that have already been delineated and even based on the economics from 2 years ago.

When the PFS comes out incorporating all the infill drilling, steeper/deeper pit shell, and improved metallurgical recovery rates, it should get the markets attention and shine a light on how undervalued this company is at present.

Technically, it looks like we just saw a bit rounded bottom in Surge Copper, similar to the one we saw from the summer of 2023 to spring of 2024, where it then scorched up much higher to tag that $0.24 level.

At that time, I felt like the copper stocks were just starting to get revalued more in alignment with the copper pricing, but the junior part of the sector has been selling down ever since May of 2024. I see this latest rounded bottom from September 2024 - June 2025 in Surge as having the potential to really punch up higher and retest that prior peak, and then blast past it…providing we see copper prices stay up in the high $4’s and possible get back on top of $5 per lb. again.

{That is NOT investment advice, and I’m not an investment adviser, so do your own due diligence. I’m merely sharing my person investing thesis and the constructive technical risk/reward setup on the pricing chart. Nobody has a crystal ball though, and if we see the US tariff’s cause another market crash in July then all bets are off as to what happens across many markets, copper included.}

Shifting over to one of my favorite junior copper developers, Arizona Sonoran Copper Company Inc. (TSX:ASCU | OTCQX:ASCUF), they closed a whopper of a bought deal financing just today. It is nice to see this project getting the traction in the marketplace that it deserves.

Arizona Sonoran Announces Closing of C$51,750,000 Bought Deal Public Offering of Common Shares - June 20, 2025

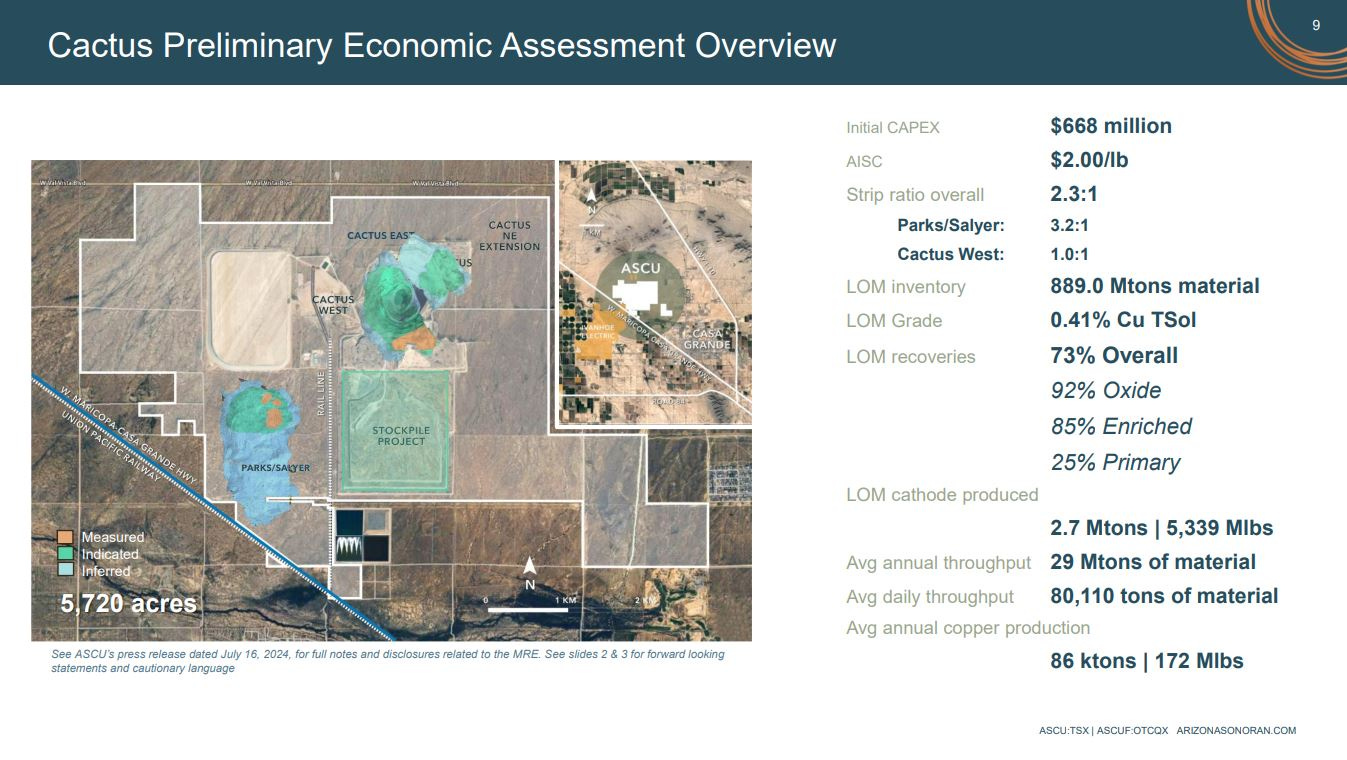

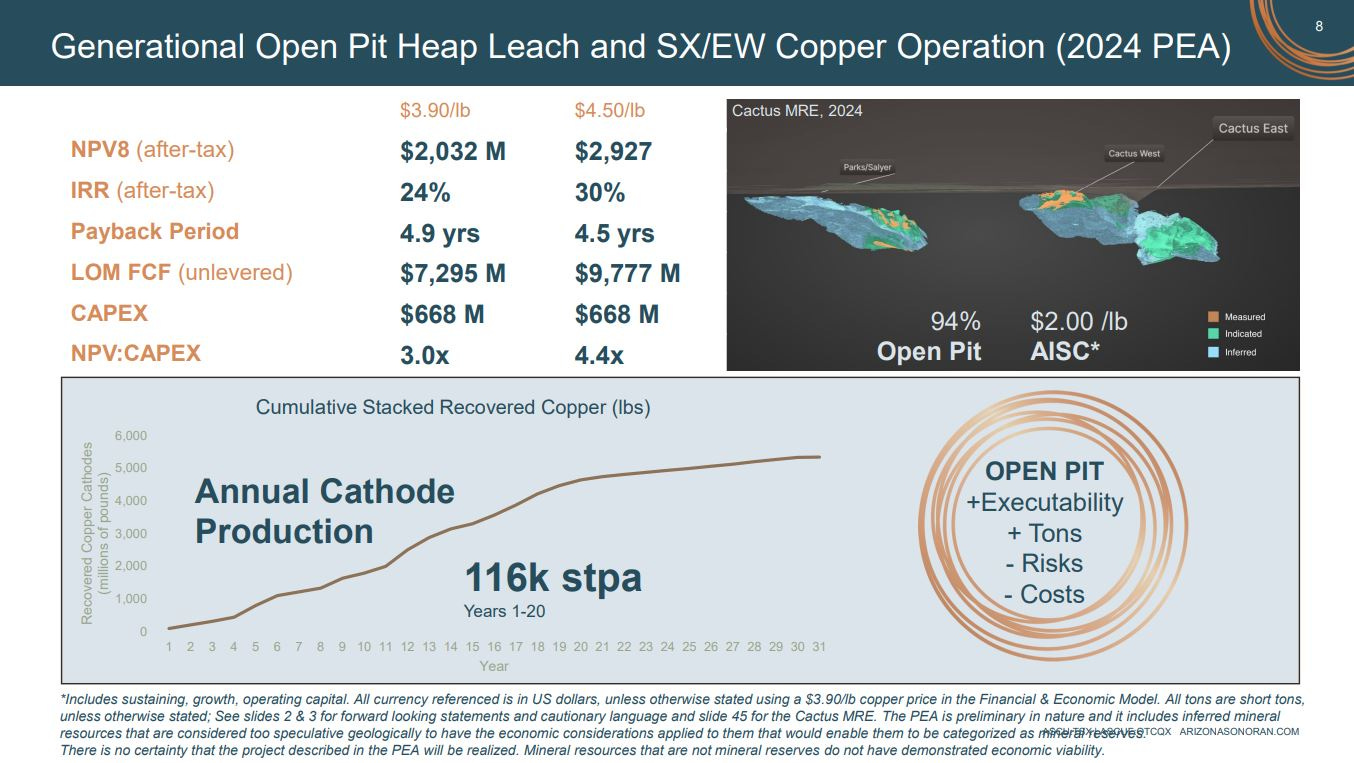

A couple of months back on April 1st, George Ogilvie, President and CEO of Arizona Sonoran Copper, joined us over at the KE Report to outline the ongoing derisking work building towards a Pre-Feasibility Study (PFS) on the Cactus Project in Arizona, as the next key company milestone. The overall Cactus Project now contains over 11 billion pounds (“lbs”) of copper in all categories – 7.3 billion lbs of copper in measured and indicated, and 3.8 billion lbs in the inferred category.

Arizona Sonoran Copper – Derisking Work Building Towards A PFS On The Cactus Project, Update On Exploration, Envisioned Mine Plan, Permitting, And Strategic Stakeholders

We started off having George share how the incorporation of the MainSpring area into the larger Parks-Salyer deposit, has allowed for a shift from underground mining over to an open-pit mining method.

They are reviewing moving the center of the open pit more towards the high-grade portion of the Park-Salyer deposit, and infill drilling is showing it expanding towards that direction, which should present better economics and a faster payback period in the upcoming PFS.

We discussed that there was no royalty on the Mainspring property area, and that in January the Company has bought back 1% of the of the Bronco Creek Exploration net smelter royalty (“NSR”) for a cash payment of US$500,000, reducing the NSR from 1.5% to a remaining 0.5% NSR near the high-grade area of the Parks-Salyer deposit. This gives investors more upside to the project at present, but also presents an area that can be renegotiated with companies when assembling the capital stack down the road.

In February a subsidiary of Royal Gold Inc. (RLGD:NASDAQ) has purchased an existing 2.5% NSR on a portion of the Cactus Project for cash consideration of US$55 million from Tembo Capital. ASCU has the right to buy back 0.5% of Royal Gold’s aggregate 2.5% NSR for US$7 million, by July 10, 2025. This demonstrates the value that Royal Gold sees in the project.

Additionally, on January 31st Arizona Sonoran announced that it closed its private placement with Hudbay Minerals Inc. of 11,955,270 common shares at a price of C$1.68 for gross proceeds to the Company of C$20,084,853 million. Additionally, Nuton LLC, a Rio Tinto Venture, exercised its pre-emptive rights in respect of the Hudbay Placement, pursuant to the terms of its investor rights agreement, to maintain its 7.2% equity interest in the Company for gross proceeds of C$1,562,210.

Seeing strategic shareholders like Hudbay Minerals, Royal Gold, and Rio Tinto involved demonstrates a strong vetting process and validation of the importance of the Cactus Project.

Do you think these Majors have more knowledge and experience for vetting this company than we do? (of course they do and they got positioned in a big way with this Cactus Project).

The Cactus PEA released last year envisages an average 86k short ton (172 million pound) per annum open pit copper heap leaching operation over a 31-year life of mine. In total, 5.3 billion lbs or 2.7 million short tons of LME Grade A copper cathodes is detailed for production directly onsite via solvent extraction and electrowinning hydrometallurgical processing.

We discuss how the plan to produce high-purity copper cathodes domestically, presents distinct advantages in light of the new US copper tariffs. There will be more challenging effects on other companies that need to send copper concentrates over to Asian smelters and then will be subject to those tariffs.

George outlines how 40,000 meters of drilling will mainly be infilling areas in the MainSpring property from inferred to measured and indicated, as well as further defining and expanding the resources at the Park-Salyer main area.

There is also more metallurgical work to prepare for incorporating these areas into the upcoming PFS, projected to come out in the Fall of 2025. The company is also looking at acquiring more adjacent private land that will assist with optimizing the site layout for development. George highlights the strength of the infrastructure in place, the access to power, and the benefits of their brownfield Project.

George also provides some updates on permitting for the project, and the importance of it being on private land to help expedite the process, and that they should be submitting their applications later this year for administrative acceptance by early 2026, and then approval 6 months later. This will time out well with their Bankable Feasibility Study and the capital stack coming together for a construction decision late next year.

Let’s introduce another junior copper and gold developer to this series…

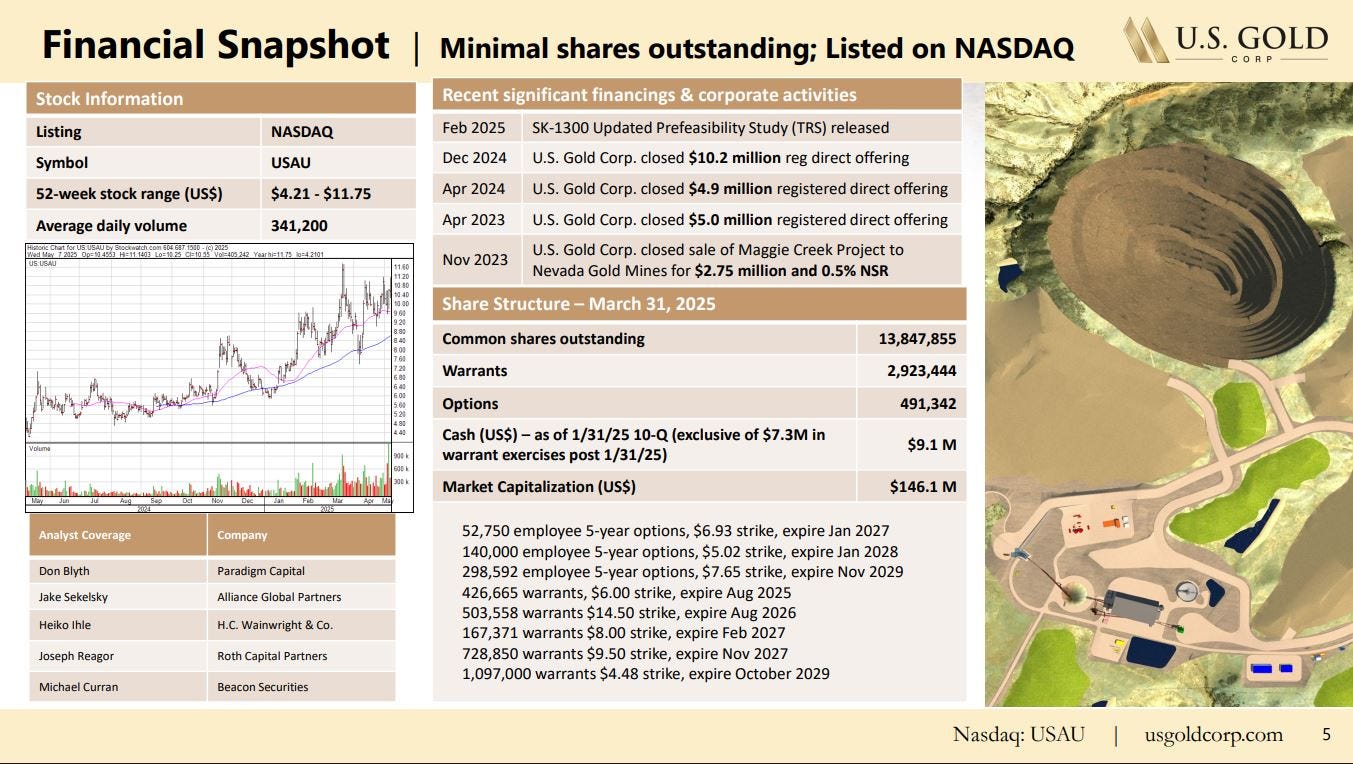

Luke Norman, Co-Founder and Chairman of US Gold Corp. (NSADAQ:USAU), joined me over at the KE Report today to reintroduce the value proposition at the Company’s flagship, fully-permitted, and shovel-ready CK Gold-Copper Project in Wyoming, the upcoming catalysts, as well as the significant underappreciated value in their secondary Keystone Gold Project in Nevada.

US Gold Corp – Value Proposition At The Fully Permitted Shovel-ready CK Gold-Copper Development Project in Wyoming and Keystone Gold Project in Nevada

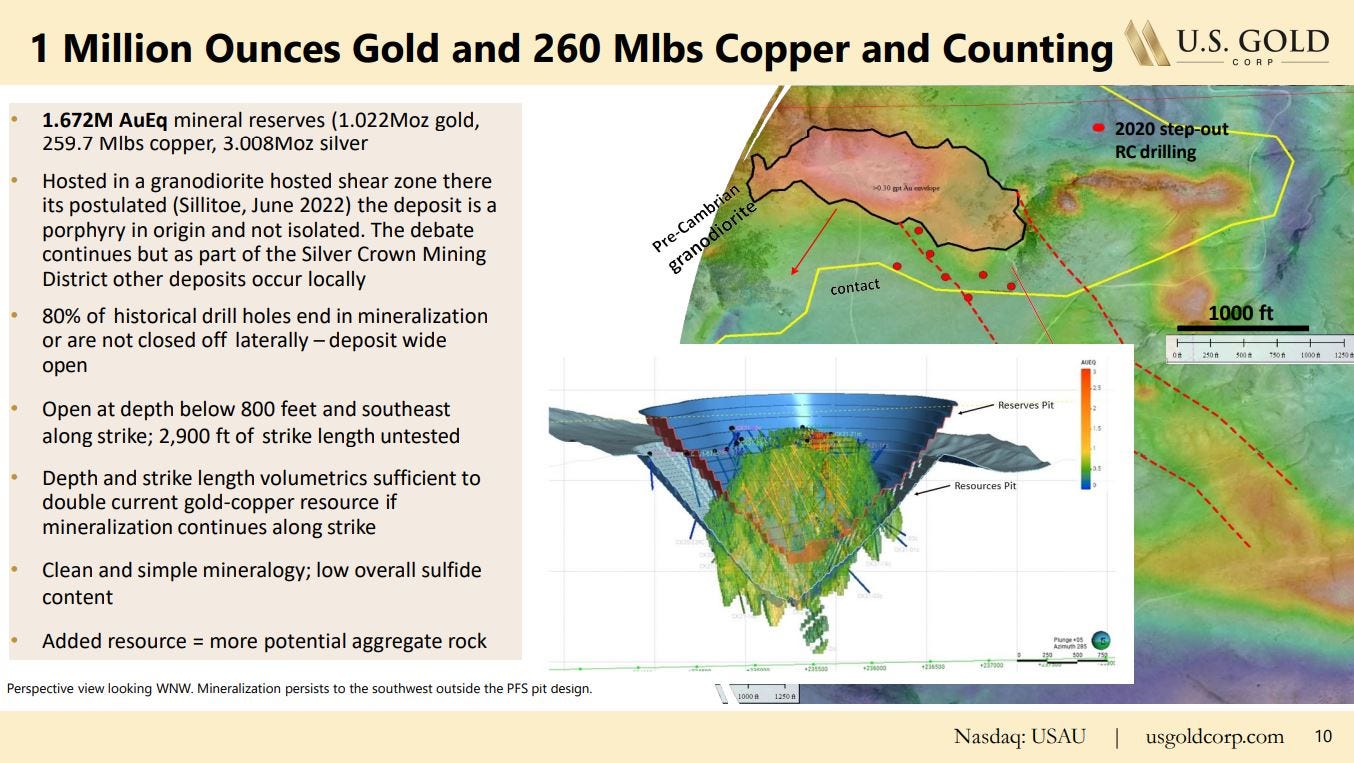

We start by discussing the 1.6 million gold equivalent ounces of resources, broken down into roughly 1 million ounces of gold and 260 million pounds of copper. They company is in the process of working towards their Definitive Feasibility Study where they’ll demonstrate to the market improved metrics over the prior versions of their Pre-Feasibility Study (PFS).

We discussed though that based on the existing PFS, using just a $4.30 copper price and $2,500 gold price that the after-tax NPV of the project is $532Million with a 39.4% IRR and a payback period of 1.63 years. As it stands today there is a10-year mine life, projecting to produce an average of 110,000 gold equivalent ounces per annum, with an All-In Sustaining Cost of $937, an upfront capex of $277Million, and sustaining capital of $13Million per year. Those metrics will all be getting updated in the DFS due out in Q4.

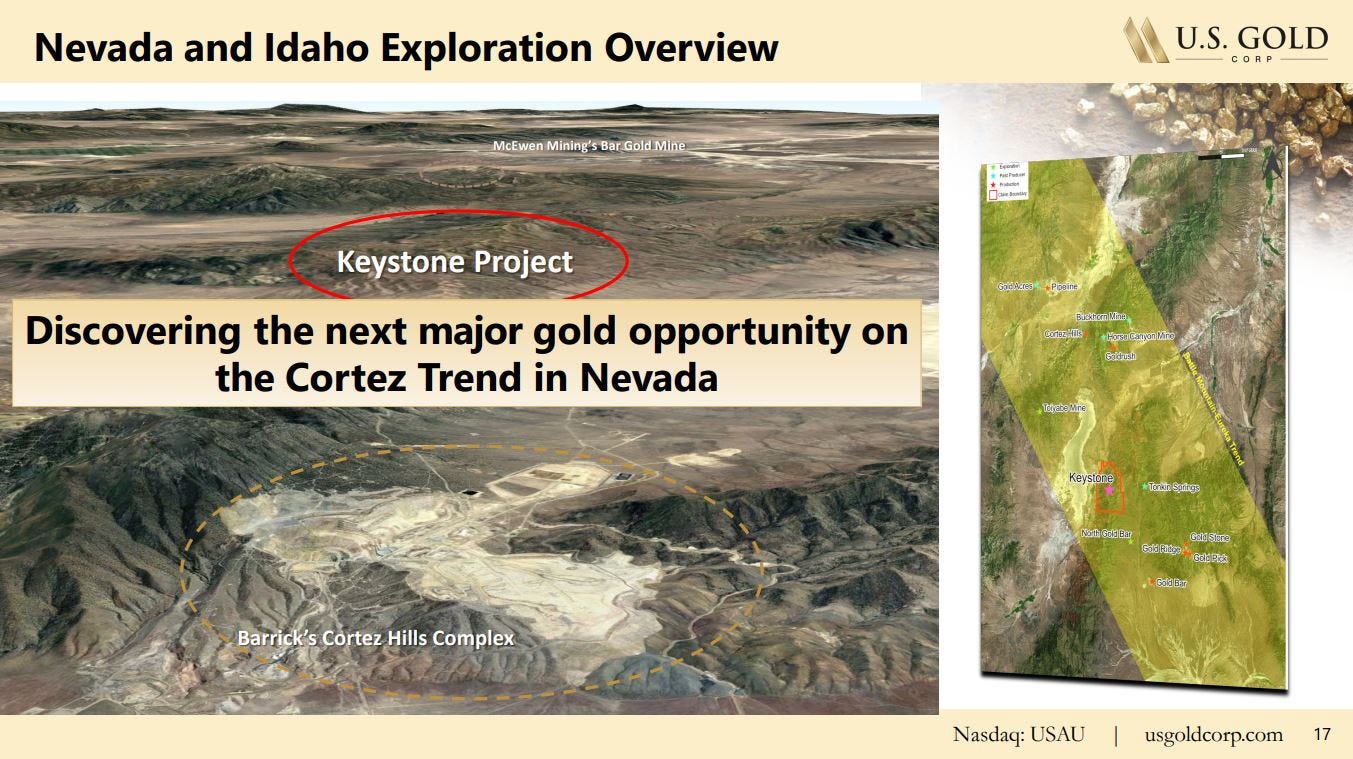

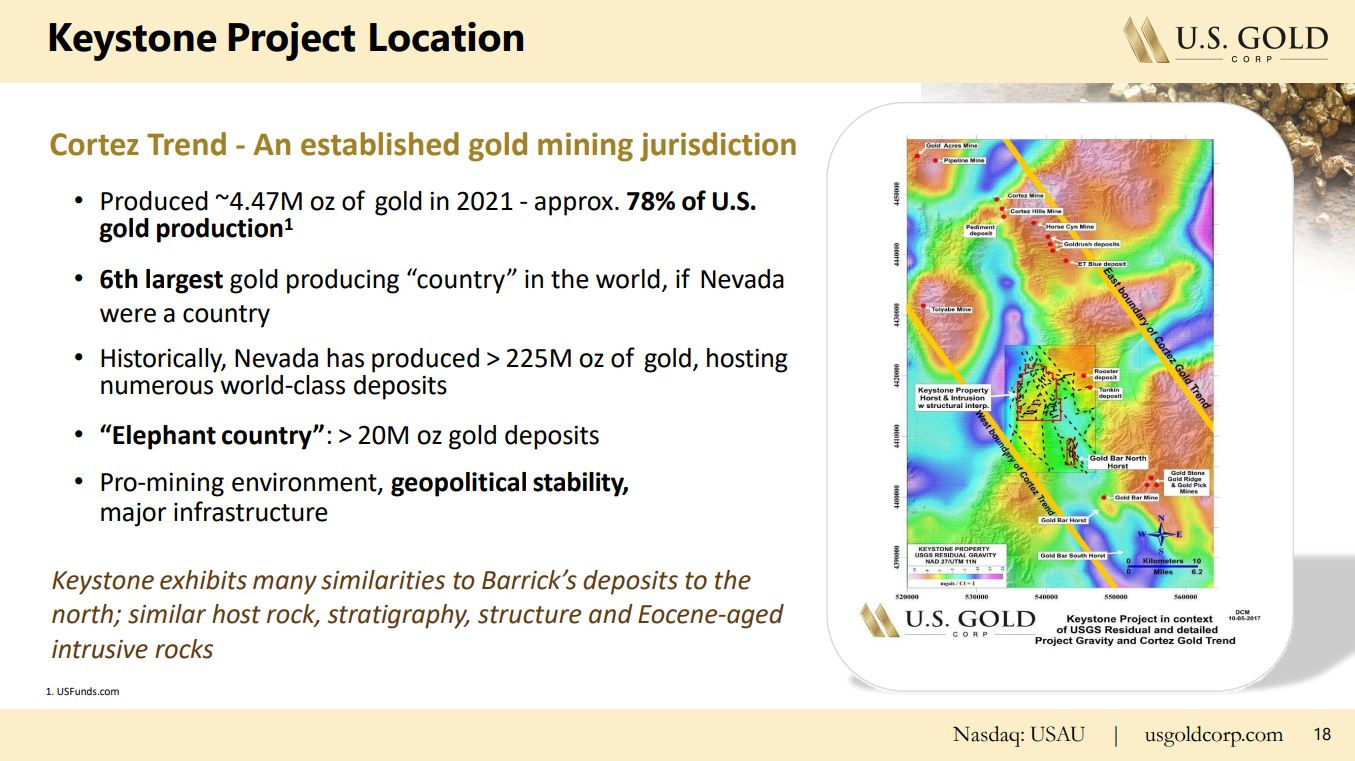

Next we shifted over the value potential of their Keystone Gold Project in Nevada, which is located along the same mineral trend as Nevada Gold Mine’s Cortez Complex. This property has many similarities to this well-endowed district, with the same kind of pathfinder arsenic mineralization with the gold found in these Carlin-gold type systems, as well as the Wenban rock formations. Luke was very constructive of their potential to unlock more value in the project through future exploration.

So while US Gold is clearly a gold exploration company, their flagship project, the CK Project stands for “Copper King” and has a large copper kicker along with the gold. It also had the potential to go after US government funding or loans for critical minerals with regards to both their copper and the gold.

One other positive that I like about this company is the incredibly tight share structure the company has, with just under 14 million shares outstanding. This is quite unique with regards an advanced development company working on building it’s capital stack and working towards a Definitive Feasibility Study.

Well, that wraps us up for this next article in this series on opportunities with copper explorers and developers.

Thanks for reading and may you have prosperity in your trading and in life!

Shad