Key Takeaways From The May Metals Investor Forum In Vancouver

Excelsior Prosperity w/ Shad Marquitz (05-17-2025)

Even though I already had a hectic week of meetings planned from May 10th-16th in Fort Lauderdale, Florida and Atlanta, Georgia at 2 other mining conferences (which I’ll unpack in future upcoming articles); I decided last-minute to drive up from Seattle, Washington to Vancouver, British Columbia on May 9th to attend the Metals Investor Forum (MIF). The event went late into the evening at the Osteria Elio Volpe restaurant, and then I drove back across the Canadian-US border, getting home about 1:00am, packed my bags until 2am, slept 2.5 hours, woke up and headed down to the airport to fly out to Florida. Ah, the things we do as crazed resource investors!

Most sane people may not have crammed in yet another mining conference and deprived themselves of sleep going into a cross-country trip with a full slate off meetings already set up on the other coast. However, I’ve been impressed by prior MIF events, and ended up being really happy to have made the trek up to this 1-day conference. It was good to catch up with some of the newsletter writers and showcased mining companies, along with taking the temperature of investor sentiment for those folks in attendance. I’ll share some good sector takeaways and embedded videos for readers here.

So, let’s get into it…

First off here is a list of the presenting newsletter writers who delivered keynote addresses. They then invited some of their featured portfolio companies to attend the MIF event and present their stories to investors.

Overall, the keynote speeches anticipated higher gold prices and commodities prices moving forward; even if we do continue in the current corrective move a bit longer before starting the next leg up.

In general, there was an optimism from the speakers that wasn’t totally matched by the conversations I had with individual investors or investor reactions to questions fielded live to the audience from the stage... which was an interesting divergence in outlooks. It also seemed to stem from many attendees having missed out on the moves up in gold producers, being heavily exposed to pre-revenue junior drillplays.

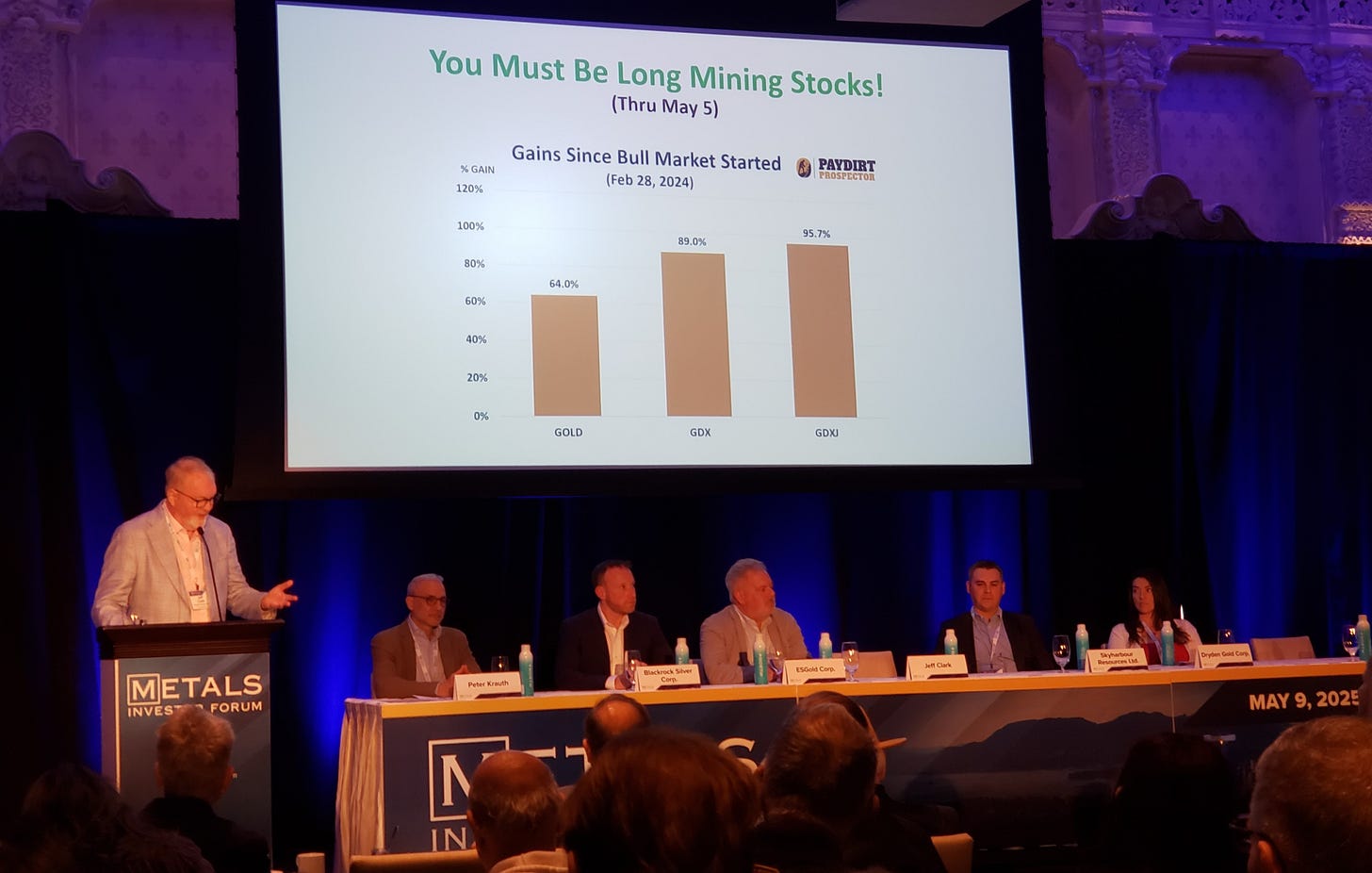

Below is a picture I snapped of Jeff Clark presenting on why people need to be long mining stocks. Many attendees in the audience were surprised when he asked initially which asset class had done best since leap day of last year. Jeff pointed out that the next leg of the bull market kicked off after Feb 28th, going into Feb 29th, of 2024 and that the GDX and GDXJ have actually outperformed in that same advance which the gold price has visibly made to the upside.

With so many bemoaning the performance of their personal gold junior equities, it remains important to do facts based analysis over sentiment and feelings from investors; which seem to believe the bull market for equities hasn’t started yet.

As the saying goes: “Documentation beats conversation.”

It was really great catching up in face-to-face discussions with friends and colleagues like Brian Leni, Robert Sinn, Peter Krauth, Jeff Clark, and Don Durrett. (Jordan Roy-Byrne is also a friend and we’ve regularly had him on the KE Report for many years now, but I never saw him at the event for some reason – maybe next time buddy!)

As an ardent silver bug, I wanted to share this video presentation from the MIF with Peter Krauth. He always does a bangup job pointing out the investing thesis for both silver and the silver equities, has interesting companies he is following, and points out the future tailwinds that will be at the back of this sector.

"Words Cheapest Asset" Peter Krauth presents at the May 9th Metals Investor Forum in Vancouver

My buddy Robert Sinn (aka Goldfinger) always has interesting insights to share with resource investors, and he mixes in good macroeconomic data points, technical analysis, sound investing principles, and ties some of this in to his stock picks. He is mostly focused on gold and copper porphyry stock picks, but I think he does a good job weaving in the important psychological trading aspects and a balanced approach to analyzing the fundamental and technical risk/reward setups.

"Goldfinger Collection" Robert Sinn presents at Metals Investor Forum on May 9, 2025

One other newsletter writer and PM investor that I’ve enjoyed for almost a decade now is Don Durrett. In his MIF presentation I appreciated how he deals in the real, and dispels a number of bad inclinations that early investors have to this space. Don shared why after investing in hundreds of stocks over 20 years in this sector that he has learned to have small allocation to the explorers, a medium allocation to the developers, and the largest allocation to the producers in his portfolio. [I know a lot of investors take different investing approaches, choosing to go exclusively with explorers, or only developers, but this is where my personal strategy and approach aligns closely with Don’s, and we talked about that briefly while at this MIF event.]

"Analyzing Gold & Silver Mining Stocks" Don Durrett at Metals Investor Forum on May 9, 2025

One of the benefits for those attendees of the Metals Investor Forum events, is that these newsletter writers are circulating around the event and are very kind and approachable to attendees. Often times, we’d have little circles or groups of resource investors standing around all sharing trading ideas, macroeconomic themes, past successes or learning lessons, or airing out the latest sector scuttlebutt.

Those kinds of in-person conversations can be quite valuable because people in those discussions may highlight important news events that recently happened or draw attention to specific details within the news that many overlooked – both on the positive and negative side. This can give those focused on that information early an investing edge over the masses, which may take more time to fully catch on.

Small group discussions can also be great sounding boards to bounce ideas or investing theses off sharp people actively investing in the sector. Quite often there are unrealized red flags that are causing other participants to stay away from a particular company/commodity/jurisdiction, or yellow caution flags that they are monitoring, or even unrealized green flags that may not have been picked up by other analysts or the retail investors yet.

Unfortunately for readers here, I’m not going to share those private discussions as they were communicated in confidence and that is something that should always be respected.

With that said, I invite more people to get out to these conferences and get into the mix and be part of the action and discussions. You’ll pick up things in conversations that you simply can’t get just by reading over the company news releases or their corporate presentations.

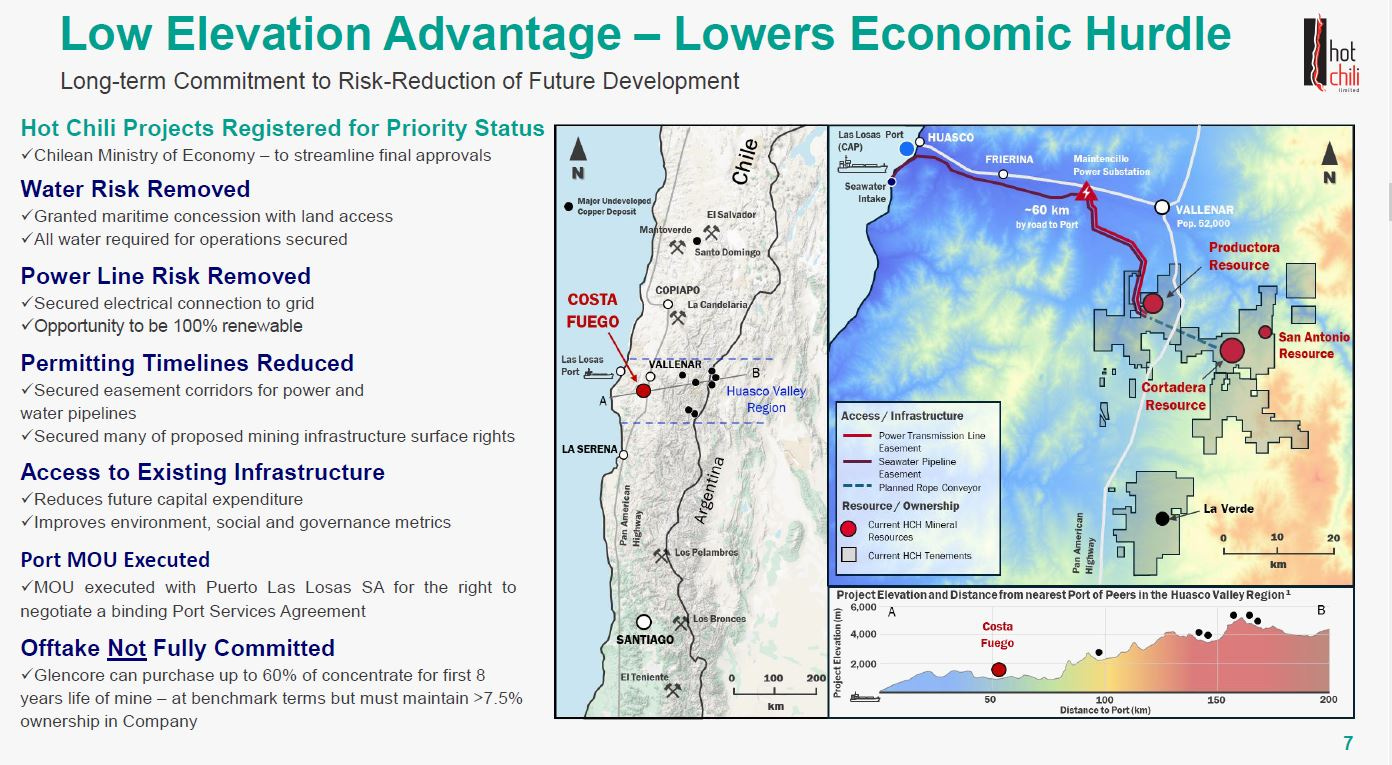

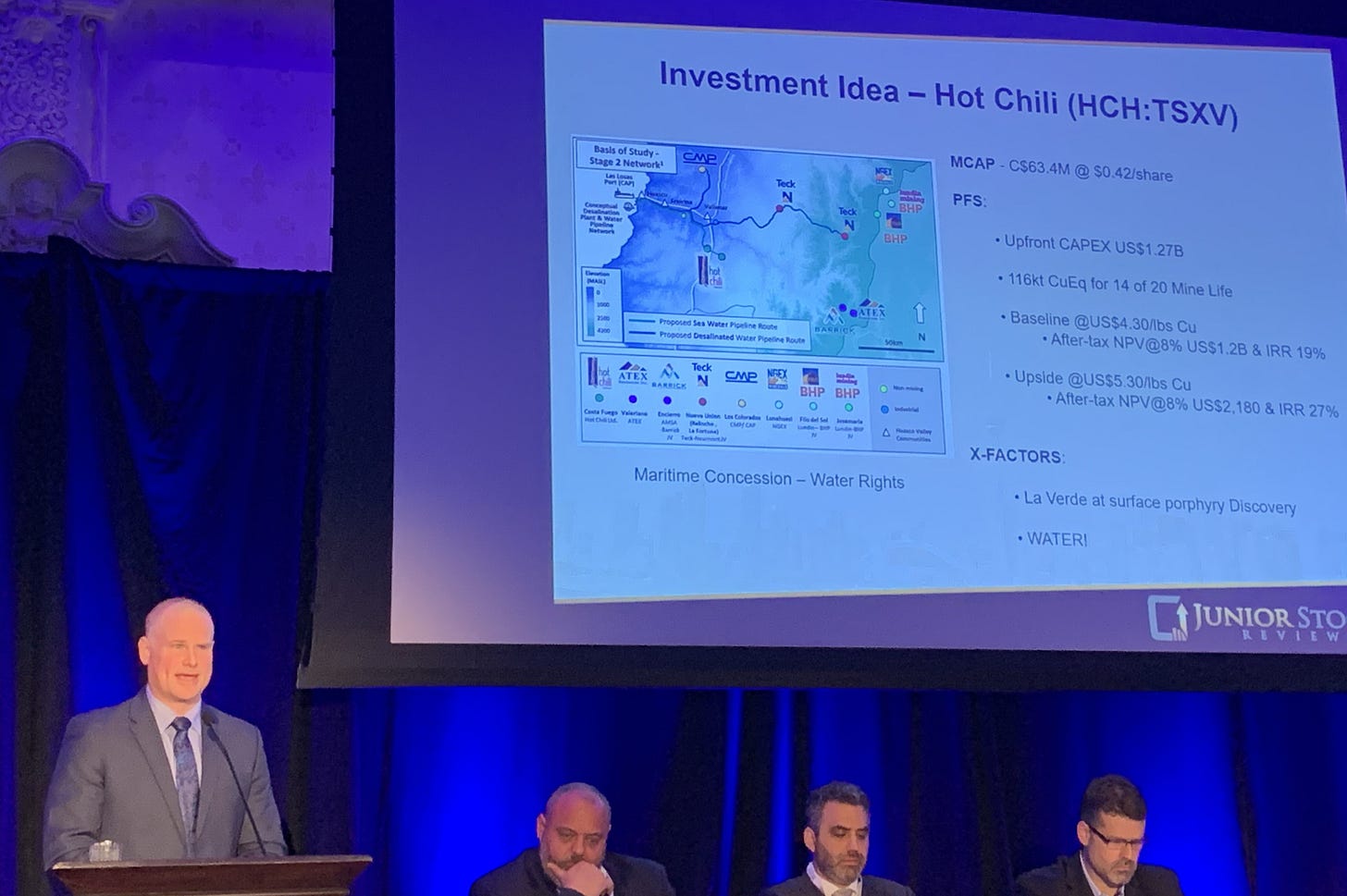

I will share one example though that came up in a friendly chat with Brian Leni. This is something that he discussed publicly at this MIF, and has already reviewed with his subscribers over at Junior Stock Review, in addition to on our show over at the KE Report. It deals with his view of the importance of the maritime concession water rights that Hot Chili Limited (ASX: HCH) (TSXV: HCH) (OTCQX: HHLKF) has as an X-factor to assist other copper companies in Chile, beyond growing copper resources at their Costa Fuego project.

A contributor over at Ceo.ca @goldpan snapped and publicly shared this picture below from the audience of the MIF of Brian reviewing this very point.

Note the X-factors on his slide at the bottom highlighting both the La Verde at surface porphyry discovery (which we also discussed a bit more in our chat) and then his all-caps WATER!

In that private conversation, I was able to dig in with Brian a bit more regarding the specifics here of their Huasco joint venture on these water rights, how that may impact and assist other copper companies in this region of Chile & Argentina. I also found out why he was so jazzed about the potential at their new La Verde discovery, as an additional kicker to their current valuation.

At present, the market is not even properly valuing the company for their Costa Fuego copper and gold resources and economics. These other 2 wildcards of a potential other project of significance at La Verde and their water business could be interesting value drivers, that the market is still asleep on at present.

Brian is always quite candid in interviews, in discussions, and with his subscribers, but I personally found it incredibly instructive to hear his unfiltered investing thesis, his process of ascribing future value, and what could go wrong or right in these additional scenarios.

This chat we had at the MIF was also above and beyond what we had recently discussed when he was our guest over at the KE Report on May 1st.

Brian Leni – A Deep Dive Into Hot Chili: Copper-Gold Development Potential with a Strategic Water Advantage

After that recent discussion with Brian at the MIF, I went to the company’s website and dug into this point a bit more…. and saw this article, that further unpacks the value proposition for this Huasco JV on the maritime water concessions.

Hot Chili says it can solve Chile’s water problem for large industrial projects in the Huasco Valley region and bank US$447m over 20 years in free cash by getting into the water supply business using its giant Costa Fuego copper play as a foundation off-taker.

“The company recently tabled a pre-feasibility study on its 80 per cent owned Huasco Water project in Chile that makes use of its hard won permit to supply sea water to Chile’s Huasco Valley region. According to management, the Huasco joint venture holds the only active maritime license in the Huasco region – a feat that it says took 10 years of regulatory burden to achieve.”

https://www.hotchili.net.au/hot-chili-chases-us447m-free-cash-flow-from-chilean-water-business/

[In full disclosure, I do not have a position in Hot Chili at the time of this publication, but it is a company I am considering getting positioned in. To be clear, this is not investing advice, I am not an investment advisor, and I’m merely providing examples of the nuggets of wisdom that one can extract from these kinds of conferences and from conversations with savvy investors like Brian Leni.]

"From Allocation to Exit" Brian Leni presents at the Vancouver Metals Investor Forum on May 9, 2025

Alright, now here is a snapshot of the companies that were presenting and that booths set up at this May MIF.

Let me start off by saying, that since these companies are vetted by the newsletter writers, then most demonstrate intriguing investment potential

Note that Hot Chili that we just spent some time on wasn’t even physically there in attendance, so not all of the best ideas need to come from the stage or booth.

There are also company executives based in Vancouver that will show up just to connect with friends and peers, so sometimes those are some interesting pick-up conversations as well. You never know who you may bump into.

There are 3 portfolio positions that were at the event that I caught up with briefly and watched them present: Blackrock Silver, Dryden Gold Corp, and Thesis Gold Inc.

I also had good conversations with either the management teams or key stakeholders in 1911 Gold, Almadex Minerals, ESGold, Onyx Gold, San Lorenzo Gold, and Skyharbour Resources.

(both Blackrock Silver and Dryden Gold are also sponsors of the KE Report, but they don’t pay me or even ask me to write about them here on Substack. I do so for readers here because I legitimately like their projects, work programs, and value propositions and I’m discussing the decisions made in my own portfolio)

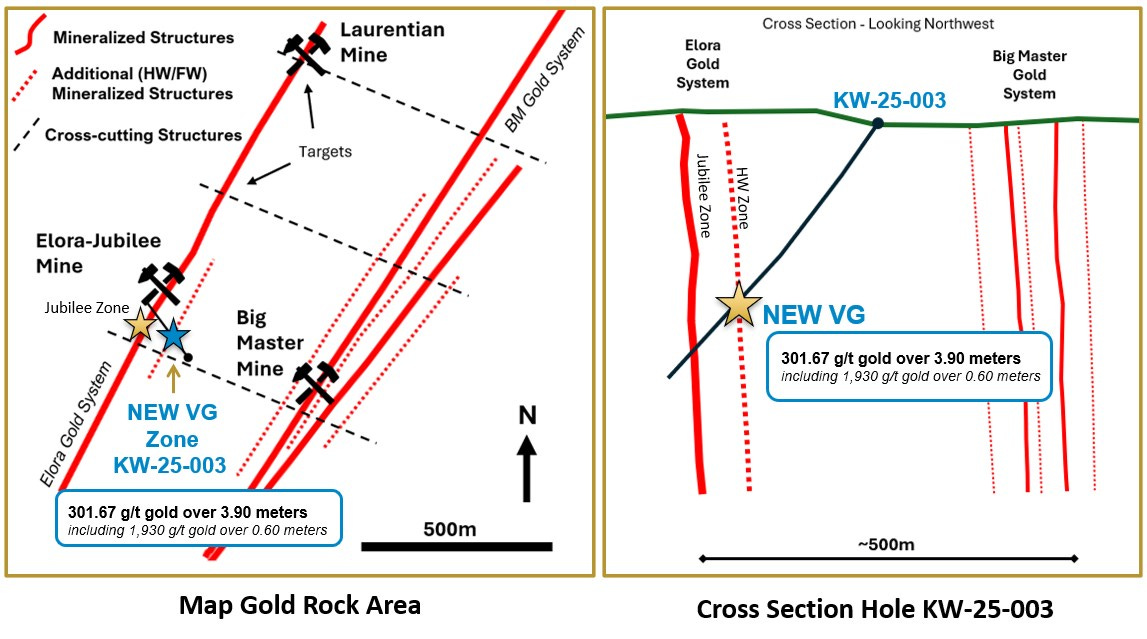

I’ve already discussed in prior articles the potential new understanding that the team at Dryden Gold (TSX.V: DRY) (OTCQB: DRYGF) has made on a third faulting structure dubbed the D3, and the President of Dryden, Maura Kolb, did an excellent job overviewing the value proposition for the 15,000 meter exploration program currently underway.

Maura Kolb of Dryden Gold Corp. presents at Metals Investor Forum in Vancouver | May 2025

I swung by their booth and was able to speak with the whole management team: CEO Trey Wasser, President Maura Kolb, CFO and Director Scott Kelly, VP of Exploration Anna Hicken, and Investor Relations Ashley Robinson.

It was very helpful to be able to ask targeted questions and get different elements of information from each member of the team. Again, this highlights the benefits of attending these conferences in person.

I’d actually just interviewed Trey on the Thursday before the MIF, and had posted that interview on the KE Report right before heading up on that Friday.

Dryden Gold – Bonanza-Grade Gold Intercepted In New Hanging Wall Discovery At The Elora Gold System

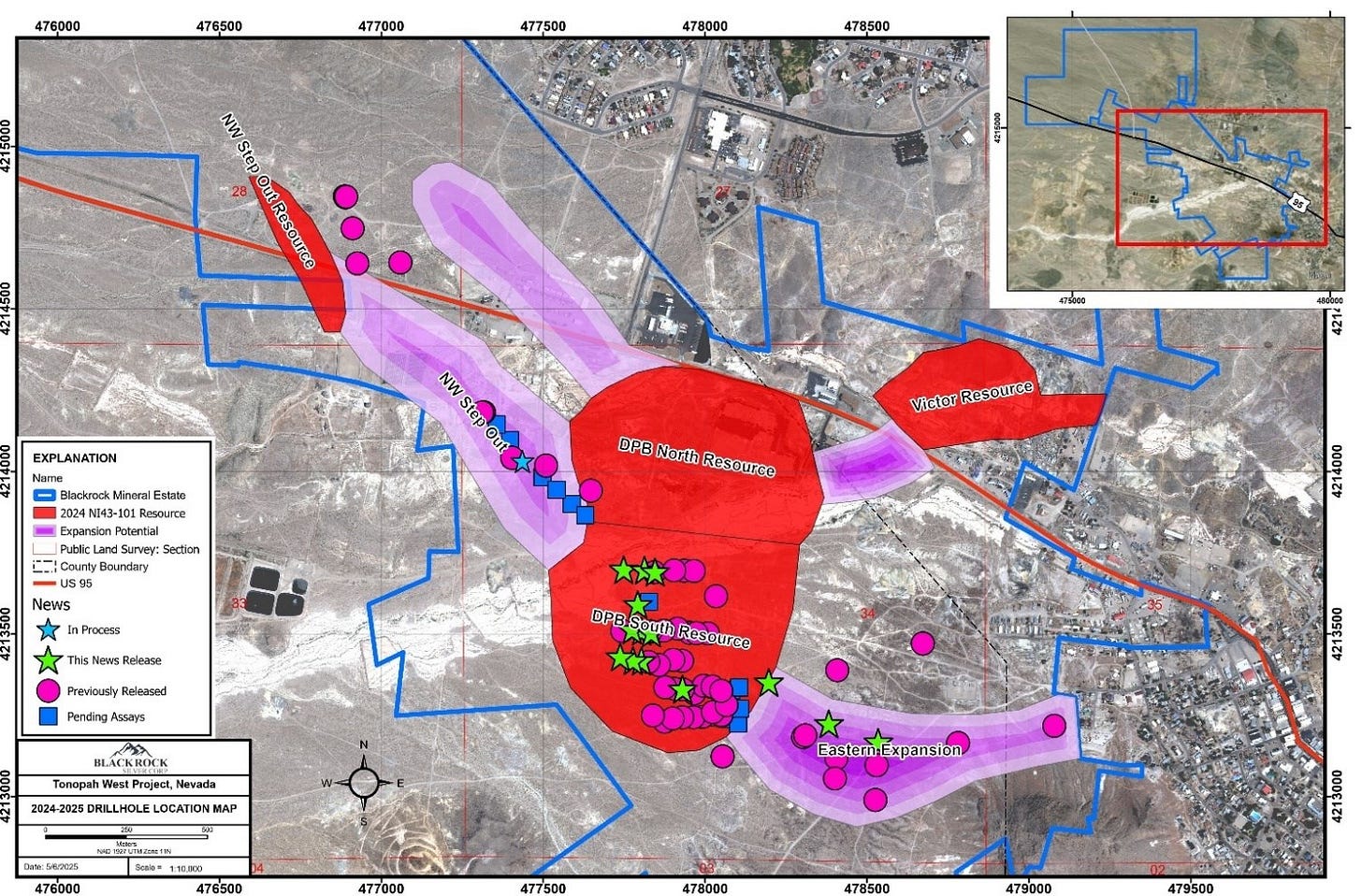

At the MIF, I caught up briefly with Andrew Pollard, President and CEO of Blackrock Silver (TSX.V:BRC – OTCQX:BKRRF). Again, we had just talked they day before on May 8th. He came on the KE Report to discuss their next batch of 9 drill holes that returned more high-grade silver and gold assays from their ongoing M&I Conversion drill program on the 100% owned Tonopah West Project in Nevada, United States.

Blackrock Silver– Next Batch Of High-Grade Silver Assays Up to 3,182 g/t AgEq At Tonopah West

One other nice aspect of the MIF process is that it conducts interviews at the event with the newsletter writer that invites their respective portfolio companies to the conference. Then they post them over at their YouTube channel a few days later.

Peter Krauth, of Silver Stock Investor, is a friend of the KE Report and regularly occurring guest on our show about every month or two. It was nice to see him interview Andrew from Blackrock Silver and it’s worth the 10-minute watch.

Andrew Pollard of Blackrock Silver Corp. talks to Peter Krauth at the May Metals Investor Forum

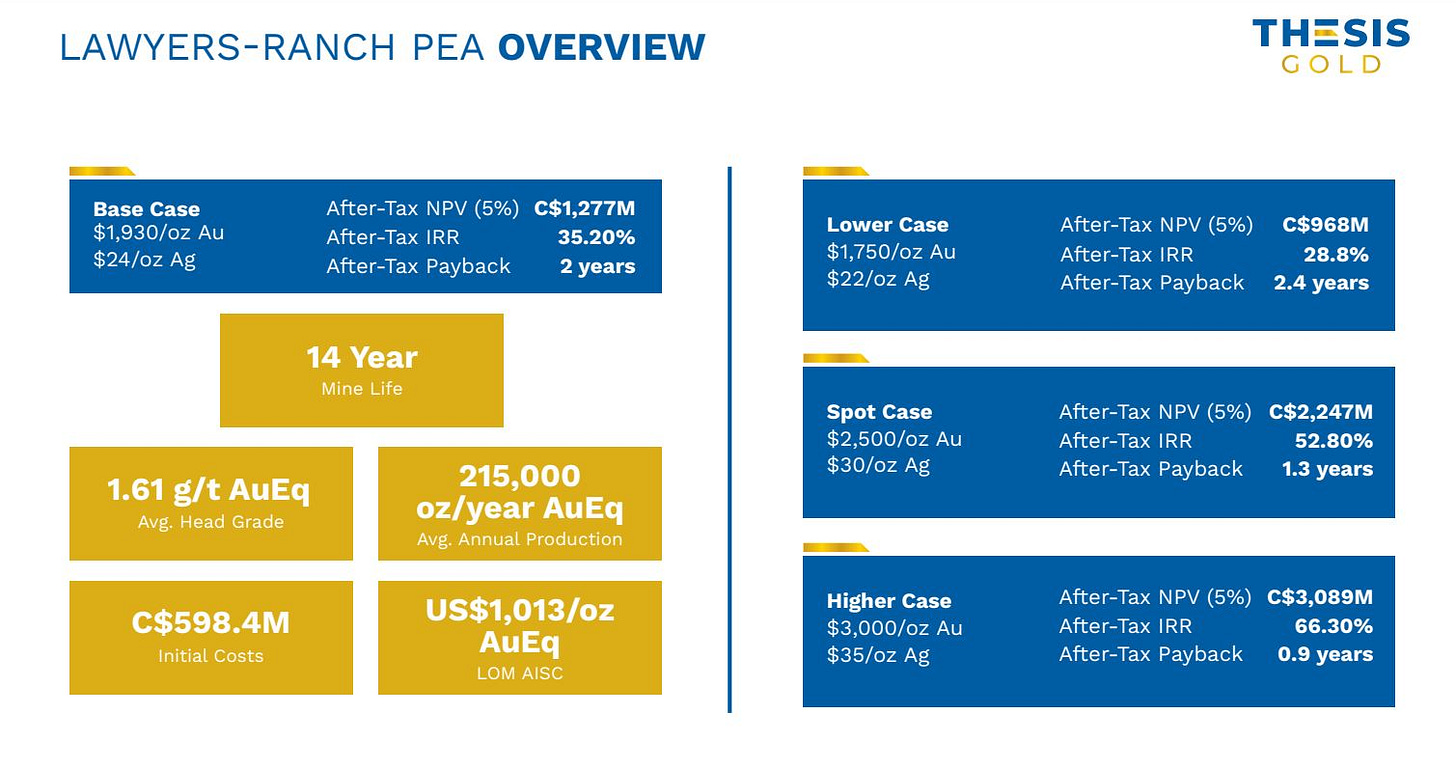

Last, but not least, I caught up with Ewan Webster, President, CEO, and Director of Thesis Gold Inc. (TSX-V: TAU) (OTCQX: THSGF), as my 3rd portfolio position in attendance. We have covered this company here in this channel in a few articles, so I’m not going to belabor the prior points made – other than to say it remains stunning to me where this company is being valued for their 4.7 million ounces of gold in all categories, and the robust economics from their Preliminary Economic Assessment (PEA) released in 2024.

The PEA projects an after-tax NPV (5%) of $1.27 Billion, with an All-In Sustaining Cost (AISC) of $1,013 per ounce of gold, over a 14 year mine life, and yet the company is still valued at $227 Million market cap.

Of course at current spot gold prices over $3,000 gold the project is far more valuable than the assumptions used in that study and is a $3 Billion NPV!

It is likely that through exploration the mine life can be extended for years beyond the 14 in the study.

Also, look at the payback period of under 1 year at $3,000 gold.

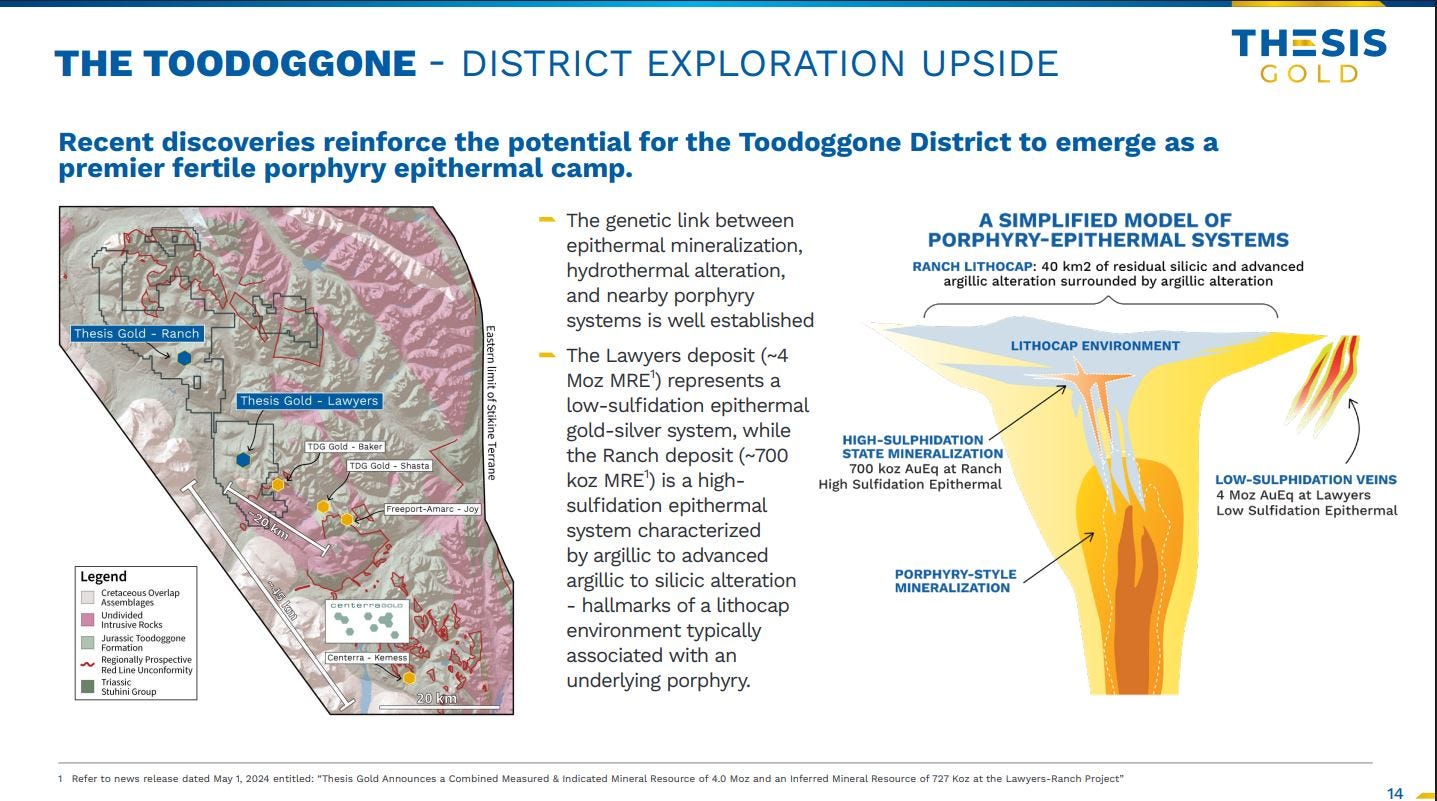

Retail investors flipped out earlier in the year over the drill results from nearby Amarc Resources – Freeport JV at their Joy Prospect, and the close-ology play of TDG Gold at their Shasta Project, in Toodoggone District of British Columbia.

Those companies have great potential, but let’s deal in the real here… they have not defined anything near what Thesis Gold has thus far, and yet I rarely if ever heard Thesis brought up when discussing the prospectivity of that area.

Granted Amarc and TDG are going after copper-gold porphyry targets versus gold-silver targets, and over the fullness of time, after lots of money is raised, and lots of meters are drilled then those could turn into meaningful deposits.

The point is that currently neither company has resources out anywhere close to what Thesis has, and they don’t have PEA studies released with robust economics like Thesis has, but they have market caps in the $128M and $110M respectively.

If they are fairly valued, then clearly Thesis is still way undervalued and still way off most investors radars… which to my thinking is a big opportunity.

Ewan Webster of Thesis Gold Inc. presents at Metals Investor Forum in Vancouver | May 2025

There is more I have to say about the investing sentiment I picked up on from retail investors, and the newsletter writers and company management teams in attendance at the MIF, but that is going to be saved for a summary article once I fully unpack the next 2 TopShelf conferences I also attended last week. Those 2 conferences deep dives are coming soon so stay tuned later this week, where we’ll get into gold, silver, copper, critical minerals like tungsten and antimony, and even traditional oil & gas.

Thanks for reading and may you have prosperity in your trading and in life!

Shad