Merger and Acquisition Opportunities In The Mining Stocks – Part 10

Excelsior Prosperity w/ Shad Marquitz (04-22-2025)

We are back with another segment on merger and acquisition transactions within the mining stocks. Early this week we saw 2 notable transactions. One of them was an acquisition of a smaller portfolio royalty company, that we have discussed in the past, and the other was the acquisition of a gold/copper development-stage asset in Ecuador.

It is nice to see more M&A deals in the mining space, and it has been puzzling why we aren’t seeing a dozen transactions a month at this point.

Consider that we’ve seen the many winter and spring mining conferences concluded, with very few transactions announced overall - especially after all the barrage of meetings and glad-handing between executives at so many events.

There were all those deals which were part of the competitive bidding process for the non-core mines and assets that Newmont was divesting. From reports we heard there were 20-30 companies in those data rooms bidding on each asset.

Clearly most companies walked away empty-handed, so we have been expecting to see them turn their gaze upon other quality production and development-stage assets.

We’ve also had a gold price that has repeatedly made a series of all-time highs for the last year and a half, and the market has also maintained quite respectable silver and copper prices.

Some of the base metals and uranium stocks have been on deep clearance, so we’d even expected to see more predatory moves there by the larger companies scooping up the smaller and distressed companies. Still waiting…

We’ve seen an increase in deals over the last 2 years, but not to the degree one would expect; with this perfect storm of factors overlaying one another. There is definitely room and should be pent up interest from producers for more deals.

With all of that said, we did get 2 more M&A deals this week to dive into:

• Triple Flag Precious Metals Corp. (TSX: TFPM, NYSE: TFPM) is acquiring Orogen Royalties Inc. (TSX.V: OGN, OTCQX: OGNRF) for their 1.0% NSR royalty on the Expanded Silicon Project, and spinning out the rest of the assets into a new Orogen Spinco.

• Lumina Gold Corp. (TSXV: LUM) (OTCQB: LMGDF) is being acquired by CMOC Singapore Pte. Ltd., a Singapore entity and a subsidiary of CMOC Group Limited (HK:3993).

So, let’s get into it…

Let’s take a look at the Orogen Royalties Inc. (TSX.V: OGN, OTCQX: OGNRF) transaction first. This is yet another portfolio position here that is being acquired by a larger company. Orogen has been a true junior royalty success story.

Looking back through the archives here, it occurs to me now that we haven’t really discussed this company in detail since the very first article in this series. In that article I mentioned Orogen was held in my portfolio, and included a brief synopsis of Orogen’s value proposition.

Opportunities With Mid-Tier And Junior Royalty Companies – Part 1 (03-15-2024)

https://excelsiorprosperity.substack.com/p/opportunities-with-mid-tier-and-junior

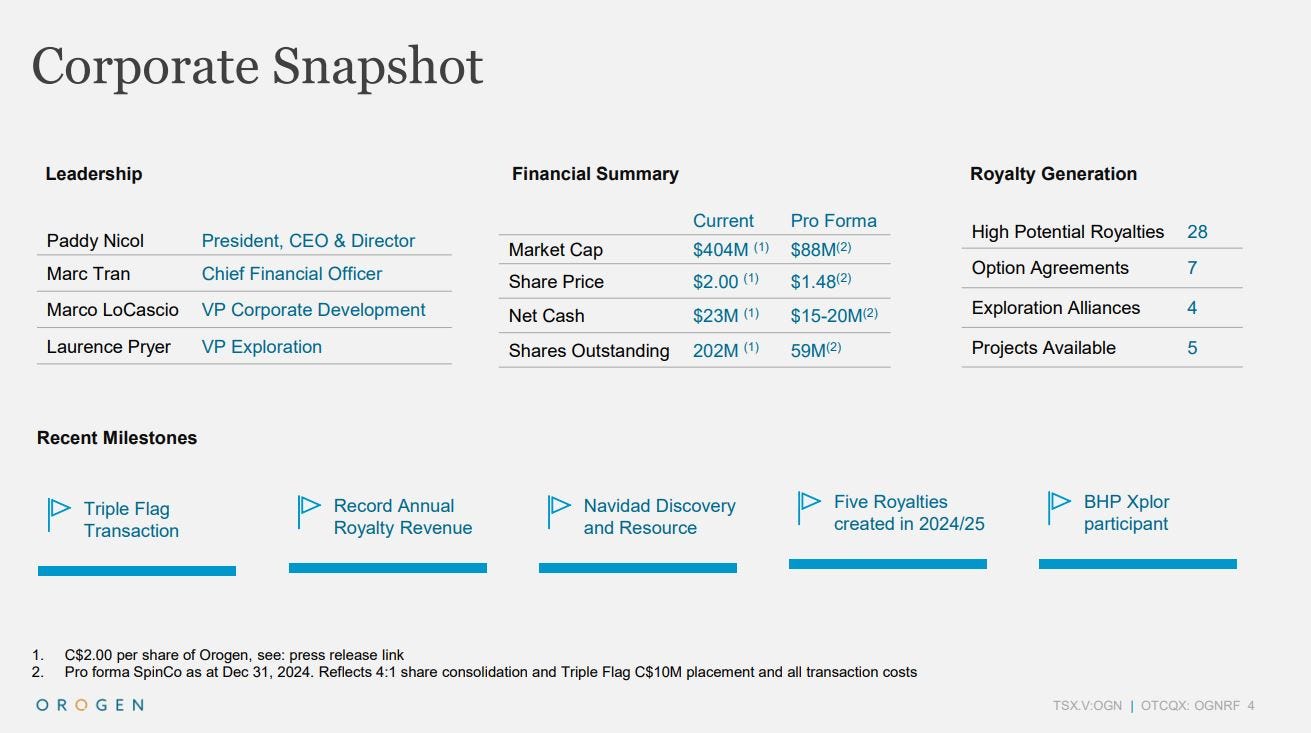

Also embedded inside that article was an exclusive interview over at the KE Report where I was joined by Paddy Nicol, President and CEO, and Marco LoCasio, VP of Corporate Development at Orogen Royalties.

This is still a very relevant conversation, because it highlights both the Expanded Silicon Project royalty that Triple Flag is now purchasing in this acquisition, as well as the other royalties that are going to be spun out into the new Orogen SpinCo. Some of those other royalties that will be in the new SpinCo include the producing and cash-flowing Ermitaño West project, held by First Majestic, the acquisition of the La Rica copper royalty in Colombia, the royalty on Kodiak Copper’s MPD Project and Headwater Gold’s Spring Peak Project…

Orogen Royalties – Comprehensive Update On Key Cornerstone Royalties And Royalty Generation

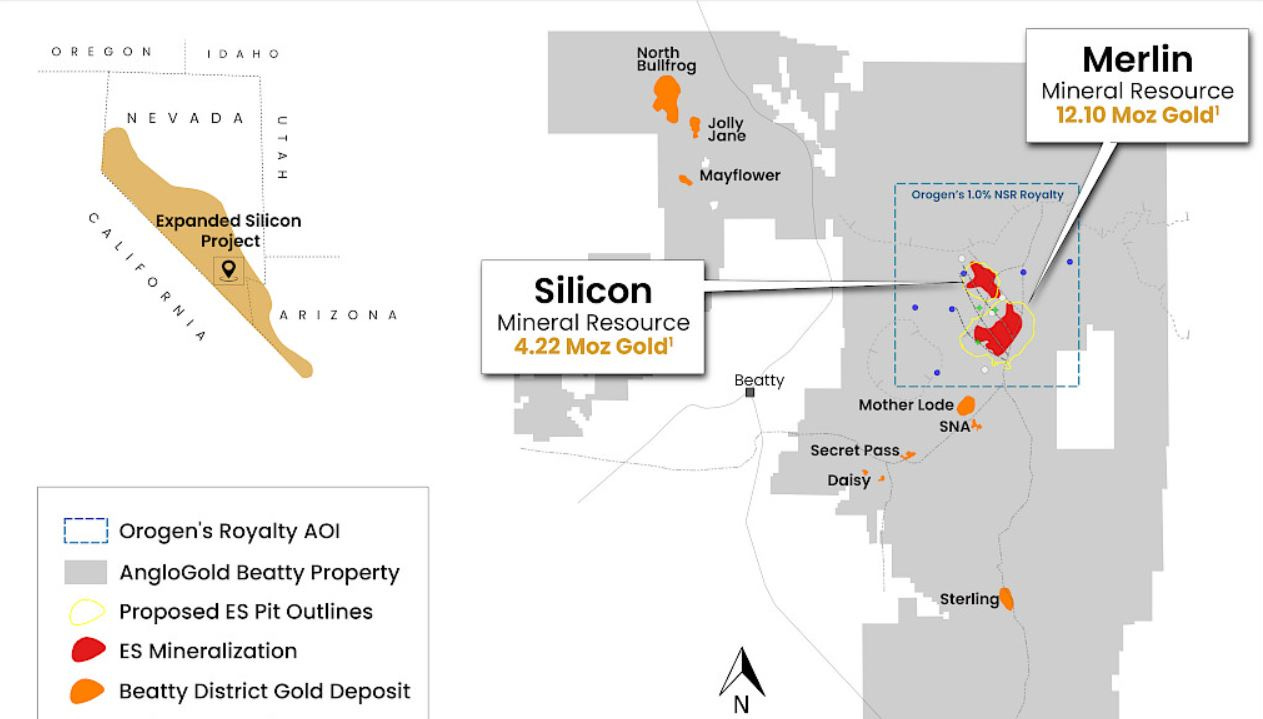

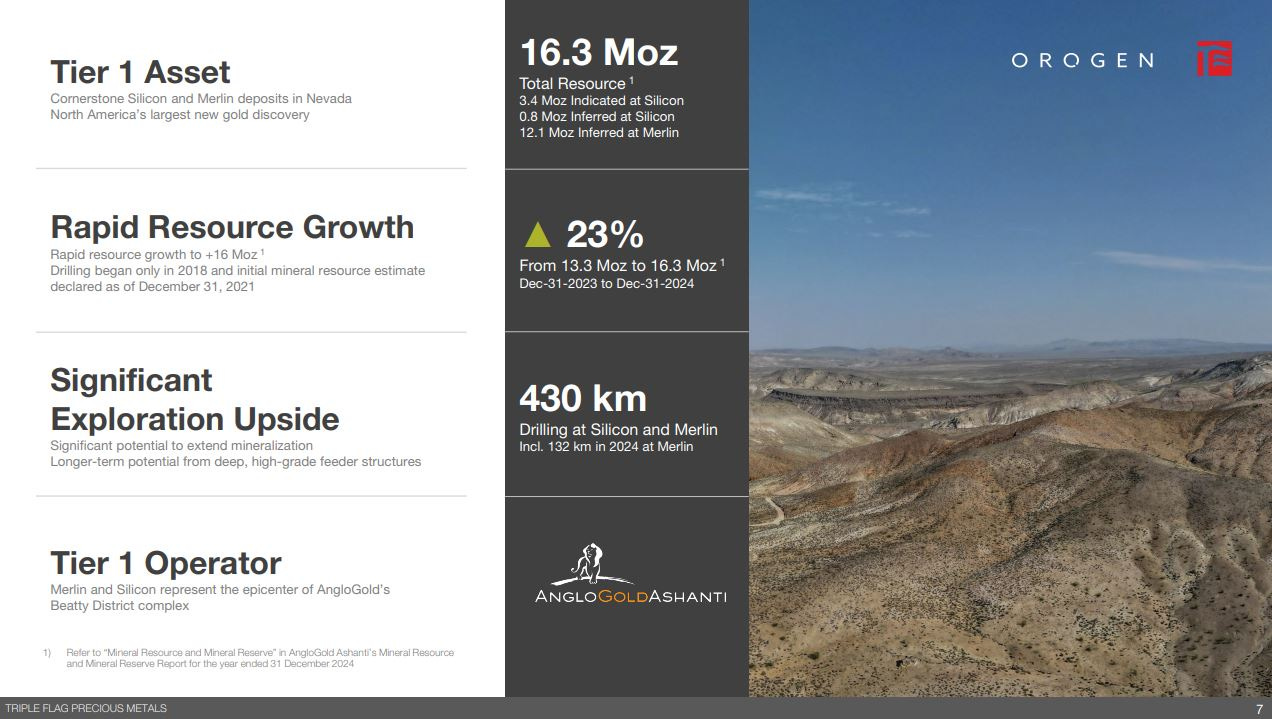

We start off reviewing the key 1% royalty on the Silicon deposit, and the Merlin Zone, (now called the Expanded Silicon Project) which is being explored and developed by Anglogold Ashanti in Nevada. There has been substantial resource growth seen there over the last few years, with a resource update out just earlier this week, making this a flagship royalty asset in development.

Now, let’s get to the breaking news from today on the Triple Flag acquisition of Orogen.

Triple Flag to Acquire Orogen Royalties and Its 1.0% NSR Royalty on the Expanded Silicon Gold Project - April 22, 2025

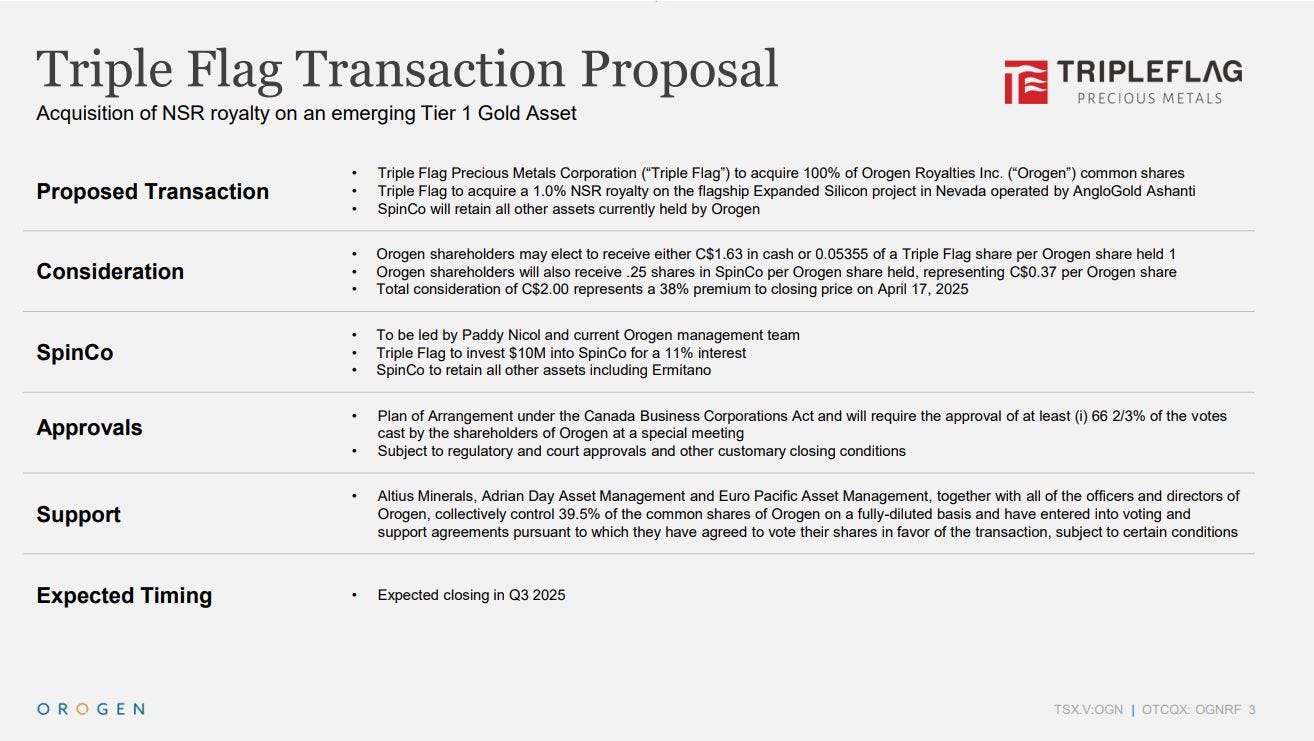

“Triple Flag will acquire all of the issued and outstanding common shares of Orogen pursuant to a plan of arrangement for total consideration of approximately C$421 million, or C$2.00 per share. The total consideration consists of approximately C$171.5 million in cash, approximately C$171.5 million in Triple Flag shares, and shares of a new company (“Orogen Spinco”) with an implied value of approximately C$78 million. Orogen Spinco will be led by Paddy Nicol, CEO of Orogen, and will hold all of Orogen’s mineral interests except for the 1.0% Expanded Silicon NSR royalty. Upon Orogen Spinco going public, Triple Flag has agreed to separately invest C$10 million to obtain an approximate 11% interest in Orogen Spinco.”

In a nutshell, Triple Flag just wants that 1.0% net smelter royalty on the Expanded Silicon Project, and rightly so. However, they are still going to have an 11% stake in the new Orogen SpinCo, that retains all of Orogen 1.0’s portfolio of royalties and properties.

We hear about “Tier One” assets all the time in this sector, but this Expanded Silicon Project actually is one of these rare deposits. So far they have delineated over 16 million ounces of gold, between the Merlin and Silicon resources, but there is plenty more exploration upside. That is an absolute monster of a combined project.

This area is also part of a prolific mineralized trend along the Walker Lane Trend in Nevada, that AngloGold Ashanti has gobbled up over the last few years.

On that map above to the south you can see that “Sterling” deposit, which is a brownfields site that I had initially gotten exposure to back in a junior called Northern Empire, which was then acquired by Coeur Mining (another portfolio position). Then Coeur sold that “Crown Sterling” project to AngloGold Ashanti back in 2022. So there’s a lot of prior M&A action right there…

Coeur Completes Sale of Southern Nevada Holdings for Upfront Cash Consideration of $150 million

https://s201.q4cdn.com/254090064/files/doc_news/CoeurMining/2022/11/nr_20221104.pdf

Also on that map above, to the northwest you see the North Bullfrog, Jolly Jane, and Mayflower deposits, and closer to the main action the Motherlode deposit, which all used to belong to Corvus Gold Inc. (TSX: KOR, OTCQX: CORVF), before they were also acquired by AngloGold Ashanti.

As a personal anecdote, and because it is appropriate for an article dealing with M&A in the mining sector, I had the good fortune of getting into Corvus a couple of months before that takeover happened, specifically because I believed they’d get taken over by AngloGold Ashanti.. and they did.

Here is a brief passage from Ceo.ca back in 2021 discussing the high potential of more M&A in this district:

#kor, 6 May 2021, 14:14 @Excelsior – “I’ve been waiting to see if would be AngloGold Ashanti or Coeur that started to make their move on $KOR Corvus, as they are all exploring there together in #Nevada right next to one another, and all 3 companies seem to have some stunning results going on. Coeur and Anglo have been more muted about their exploration results though, and not telegraphing them as much.”

“I bet Corvus will be a #TakeOver before the end of the year, and it is looking like AngloGold Ashanti just stepped up their game… By having Corvus abstain from any material transactions for 90 days, it seems like the writing is on the wall now.”

https://ceo.ca/kor?id=b978a297ed0b

#kor, 24 Jun 2021, 15:48 @Excelsior – “Well, I’m sure AngloGold Ashanti’s mouth is watering when they keep seeing Corvus hit long economic intercepts like this. By the end of this year I’m guessing that Corvus is taken over by AngloGold Ashanti, but until then I plan on enjoying the ride…. 🙂”

Corvus Gold Receives Non-Binding Offer from AngloGold Ashanti Ltd. - 13 July 2021

https://ceo.ca/@GlobeNewswire/corvus-gold-receives-non-binding-offer-from-anglogold

I bring up Sterling/Coeur and NorthBullfrog & Motherlode/Corvus deposits to demonstrate for readers here, just how prolific the M&A has been along this trend for the last few years now. Importantly, the major gold producer AngloGold Ashanti has swallowed up the whole area, because this clearly is a critical development focal point for their future. This can actually be considered a true district-scale mineralized trend, and out of all of it, the Expanded Silicon Project is the grown jewel.

This is precisely why Orogen Royalties has had a better valuation metric than most other royalty companies for some time now, and why Triple Flag is so interested in acquiring this royalty in the news released today.

Personally, I’m happy as an Orogen Royalties shareholder because current shareholders get exposure to a little bit of everything – part in cash, part in Triple Flag shares, and part in shares in the new Orogen SpinCo. What’s not to like?

I’m happy for shareholders of Triple Flag that are picking up a NSR on a true Tier 1 gold asset, and keeping some exposure to Orogen’s portfolio of 28 other royalties, 7 option agreements, 4 exploration alliances, and 5 other available projects.

I plan to let my Orogen shares convert over to cash and Triple Flag shares, and also those shares of the new Orogen 2.0 spinco.

As a result, I’ll likely do another update on Triple Flag in the series on royalties.

The last time I did an update on them was at the bottom of [Part 5] from last June.

Opportunities With Mid-Tier And Junior Royalty Companies – Part 5

https://excelsiorprosperity.substack.com/p/opportunities-with-mid-tier-and-junior-9f8

Now let’s pivot over to the second M&A deal kicking off another Mining Merger Monday this week. I’m not as familiar with this project, and it is not a portfolio position, so I’ll just briefly give my thoughts and key takeaways for the broader sector.

Lumina Gold Announces Acquisition by CMOC for C$581 Million - April 21, 2025

https://luminagold.com/lumina-gold-announces-acquisition-by-cmoc-for-c581-million/

“CMOC will acquire all of the issued and outstanding common shares of Lumina, in exchange for C$1.27 per Lumina Share in an all-cash transaction by way of a plan of arrangement. The Consideration represents total equity value of approximately C$581 million on a fully diluted basis.

The Consideration represents a premium of approximately 71% to Lumina’s 20-day volume weighted average trading price (“VWAP”), and a premium of approximately 41% to Lumina’s closing price as at April 17, 2025, on the TSX Venture Exchange (the “TSXV”).

Here are some key takeaways from this transaction:

It is nice to see a true “takeover” at a nice premium of 71% to its VWAP, instead of some of the low to no premium “takeunder” deals we’ve seen the last couple of years

It is noteworthy that once again that CMOC is a Chinese company, buying this through their Singapore subsidiary. The larger Asian companies have been doing a big part of the bidding on M&A deals the last few years, and they do not mind paying up for quality assets. More so than Canadian, US, or Aussie companies, their boards, and their shareholders of these Asian companies and conglomerates are willing to make big buys at a premium, because they see the future of where commodities are headed.

The Chinese are not adverse to operating in tougher jurisdictions like Ecuador.

This acquisition was made a bit earlier in the project derisking process. The project is at the Preliminary Economic Assessment stage, and was working towards a Feasibility Study stage, but that likely will not come out now that it is being taken off the board.

It is significant that this Cangrejos project has grown over the last decade to become one of the 26th largest primary gold projects globally; with over 20 million ounces of gold, 2.5 billion pounds of copper, 31 million ounces of silver, and 50 million pounds of molybdenum.

It is nice to see another win for longer term shareholders of both companies, Orogen Royalties and Lumina Gold, where they are true takeover deals, happening at high share price levels and company valuations, with solid premiums and strong incentives for the deals to go through. Hopefully the mining sector will serve up more M&A deals like this moving forward, as these are mergers done right.

Thanks for reading and may you have prosperity in your trading and in life!

· Shad