Merger and Acquisition Opportunities In The Mining Stocks – Part 11

Excelsior Prosperity w/ Shad Marquitz (05-15-2025)

We are back with another segment on merger and acquisition transactions within the mining stocks. I meant to have this article out a couple days ago, but have been on the road traveling and am now knee-deep in attending the 3rd mining conference in just the last week. We’ve been going sun-up to long after sun-down at these events, and I’ve barely had time to sleep or spend much time consuming industry news or digging out of email inbox hell. So, this conference and meeting overload is why there has been a small gap in publishing new articles on this channel… but stay tuned, because I return back home late Friday night and then will be cranking out a lot of articles starting this weekend and over the next few weeks, including a recap of these conferences.

With all of that preamble out of the way, it is nice to see more M&A deals in the mining space, and as noted previously, it has been puzzling why we aren’t seeing a dozen transactions a month at this point with metals prices where they are. This article will kick off reviewing the recent takeover of MAG Silver Corp. (NYSEAM:MAG) (TSX:MAG) by Pan American Silver Corp. (NYSE: PAAS) (TSX: PAAS). It was anticipated that a larger company would move on MAG soon, but there are more broad implications for what this deal means for the precious metals sector, and in specific how the choices for future M&A deals in primary silver producers are dwindling at an alarming rate.

So, let’s get into it…

First of all, let’s just say that this MAG takeover was not a surprise. Readers here might remember that this likely probability of a MAG Silver takeover was mentioned in this channel way back in October of last year, in:

Merger and Acquisition Opportunities In The Mining Stocks – Part 5:

https://excelsiorprosperity.substack.com/p/merger-and-acquisition-opportunities-562

“So in addition to Gatos being scooped up, and now with SilverCrest taken off the playing board, that really only leaves MAG Silver Corp. (TSX / NYSE American: MAG) and Aya Gold & Silver Inc. (TSX: AYA; OTCQX: AYASF) as the last 2 remaining high-grade, high-margin single-asset silver producers. In the spirit of speculating on M&A transactions, it would not be a surprise to see the larger to mid-tier producers go after those companies in the not-so-distant future.”

So, one of those are down, and one to go… (more about this later in this article)

Let’s kick things off with the big acquisition news that broke earlier this week:

Pan American Silver Announces Agreement to Acquire MAG Silver Corp - May 11, 2025

https://magsilver.com/2025/pan-american-silver-announces-agreement-to-acquire-mag-silver-corp/

“MAG is a tier-one primary silver mining company through its 44% joint venture interest in the large-scale, high-grade Juanicipio mine, operated by Fresnillo plc, who holds the remaining 56% interest in the Juanicipio joint venture.”

“Under the terms of the Transaction, MAG shareholders will receive total consideration of approximately $2.1 billion representing $20.54 per MAG share, based on the closing price of Pan American’s common shares on the New York Stock Exchange on May 9, 2025. Consideration will be comprised of a mix of cash totaling $500 million and 0.755 Pan American shares per MAG share, subject to proration as detailed below. The consideration represents premiums of approximately 21% and 27%, respectively, on a prorated basis to the closing price and the 20-day volume weighted average price (“VWAP“) of MAG’s common shares on the NYSE American ending May 9, 2025. Following completion of the Transaction, existing MAG shareholders will own approximately 14% of Pan American shares on a fully diluted basis, benefiting from participation in a larger, diversified, and growth-oriented silver and gold producer.”

Exposure to Pan American’s diversified portfolio of ten silver and gold mines across seven countries and a proven track record of success in exploration, project-development and mining operations.

Strengthens Pan American’s position as one of the world’s premier silver producers: Juanicipio is forecasted to produce between 14.7 Moz and 16.7 Moz of silver in 2025 (6.5 Moz to 7.3 Moz on a 44% basis).

Further solidifies Pan American’s position as holding the largest silver reserves and resources amongst silver mining companies: Adds 58 Moz of silver to Pan American’s proven and probable mineral reserves, 19 Moz of silver to Pan American’s measured and indicated mineral resources, and 35 Moz of silver to Pan American’s inferred mineral resources.

From a Pan American Silver perspective I like that adding in MAG’s 44% interest in the Juanicipio Mine will solidify Pan American Silver even further a senior precious metals company with an increased weighting to silver (as it was becoming more and more weighted to gold over the last few years). In Q1 2025, Pan American Silver produced 5.0 million ounces silver and 182,000 ounces gold, with a respective Silver Segment AISC of $13.94 per ounce (net of credits for realized revenues from all metals other than silver) and Gold Segment AISC of $1,485 per ounce.

For PAAS their silver production is now going up from ~21M ounces of silver production per annum and tacking on ~7M ounces of silver from MAG for ~28M ounces of silver production per year. This transaction also adds in 39,000 ounces of annual gold production from MAG to the annual mix targeting ~750,000-800,000 ounces of gold for 2025. MAG has had the lowest quartile production costs with an AISC $5.54/oz Ag sold in 2024.

At first glance I didn’t see any info on the new combined cost estimations so here is a crude calculation for the new combined AISC: (21M ounces silver x $13.94 = $292.74M) + (7M ounces silver x $5.54 = $38.78M)… So, $331.52M / 28M ounces silver = $11.84 All-In Sustaining Costs for a full year of production. Even if that is not achieved in 2025, (with this only being a partial year of production from MAG added into the mix), it at least demonstrates that this acquisition helps PAAS lower their AISC on silver production quite significantly.

Now, that doesn’t also take into account what will happen to the gold AISC with the addition of the 39,000 ounces from Juanicipio production, but one would expect that overall consolidated figure will only marginally impact the near 800,000 ounces of gold produced by Pan American Silver’s existing mines.

This deal newsflow then touts the benefit to MAG Silver shareholders as gaining “exposure to Pan American’s diversified portfolio of ten silver and gold mines across seven countries and a proven track record of success in exploration, project-development and mining operations.”

That is absolutely true, that shareholders will now have a wider breadth of projects to spread the risks over. However, by default they also aren’t going to have as much upside torque in a larger diversified vehicle with higher comparative costs than they would have had to rising silver prices in MAG as a standalone focused vehicle with best-in-class costs

Regardless, Pan American Silver is a “blue chip” name in the precious metals sector and does hold an impressive portfolio of projects.

One good thing for both sets of shareholders is the potential optionality of silver growth at the La Colorada Skarn, and the wildcards of Escobal & Navidad. (Personally I’ve been avoiding Guatemala for a long time and have watched both Escobal and Cerro Blanco sit on the vine there for so many years now. In that sense, the market is on target thus far to attribute little to no value to Escobal until something major changes in that jurisdiction. They do seem constructive that something will happen in the next year so, and if that happens they will deserve a big rerating. For now that remains a show-me asset and story though.)

Bottom line: This appears to be a good transaction for both Pan American and MAG Silver shareholders, and the new proforma company will be a precious metals juggernaut. The diversified portfolio of assets will compliment both sets of shareholders, smooth out the risks, and make the overall costs come down across a much larger resource base and production profile. I believe most investors will vote yes on this transaction and hang onto their shares in the new proforma company. Pan American Silver will continue being a go-to name in the silver and gold producers category.

Now, while both of these companies are really too big in size and market cap to normally be covered in this channel, I still thought it was an instructive M&A transaction to feature in this series, because of what it means for the silver space; and what it means for the pool of available silver-forward companies for future merger or acquisition deals. So, let’s get into that next.

In the same prior October article that was linked above from Merger and Acquisition Opportunities In The Mining Stocks – Part 5, there was another passage right after the point earlier about MAG and Aya being the “last 2 remaining high-grade, high-margin single-asset silver producers.” Here was the passage that came next from that prior piece:

“After those 2 are acquired, there are still the higher-cost intermediate silver producers like Santacruz Silver and Endeavour Silver; and then after that the smaller, higher-cost, and multi-mine silver producers like Avino Silver and Gold, Americas Gold & Silver, Guanajuato Silver, Impact Silver, Andean Precious Metals, and Silver X. None of those seem like big contenders for imminent takeovers though, at this point in the cycle.”

“This also puts investors looking for leverage in the PM sector at a slight disadvantage, as we have lost some of the best-in-class high-torque producers which would have had great leverage, now that Gatos Silver and SilverCrest Metals have been plucked from the field of choices. Granted, their production profiles should be a big boost to both First Majestic and Coeur Mining respectively, so maybe those new combined companies will still see some of that torque. The field of silver producers was already a tiny sector, and now it just got compressed even further.”

Reflecting back on that passage now, the situation from 7 months ago is still very much the same. The addition would be that I would now also include Sierra Madre Gold and Silver into that crop of companies, since they have now moved into commercial production in 2025. Somebody also messaged me that I’d left off Kuya Silver from that list (apologies, yes it should also be included, and it’s possible I’m missing a few Aussie silver producers as I don’t follow the Australian producers very closely). To be clear, my intention is not to skip any companies on purpose, but it is hard to follow the dynamic and ever-changing large mass of junior pre-revenue companies and keep tabs on when some finally graduate up to become revenue-generating producers.

Essentially, the point is the same though. With the exception of Aya Gold and Silver, there don’t appear to be any really enticing large high-margin single-asset silver producers of scale left for the bigger producers to bolt on to their existing production profiles.

In full disclosure, I do not own Aya Gold and Silver, and don’t have a dog in that fight, and actually feel they were pretty richly valued last October when writing that prior article. Since then, over the last 7 months, (AYA.TO) has essentially been chopped in half from a $20+ stock down to a $10+ stock. Now that they’ve found gravity, they are more fairly valued, and more ripe for the acquisition picking as an M&A target for larger producers.

Really, I’d like to see Aya taken over and removed from the gameboard - just to get it over with. Many of the big boy producers were asleep at the wheel with Gatos, SilverCrest, and MAG when they were still on the menu. If Aya was acquired, then we’d simply be left with the universe of multi-asset silver producers aforementioned and also the quality development-stage companies for the remainder of this precious metals cycle.

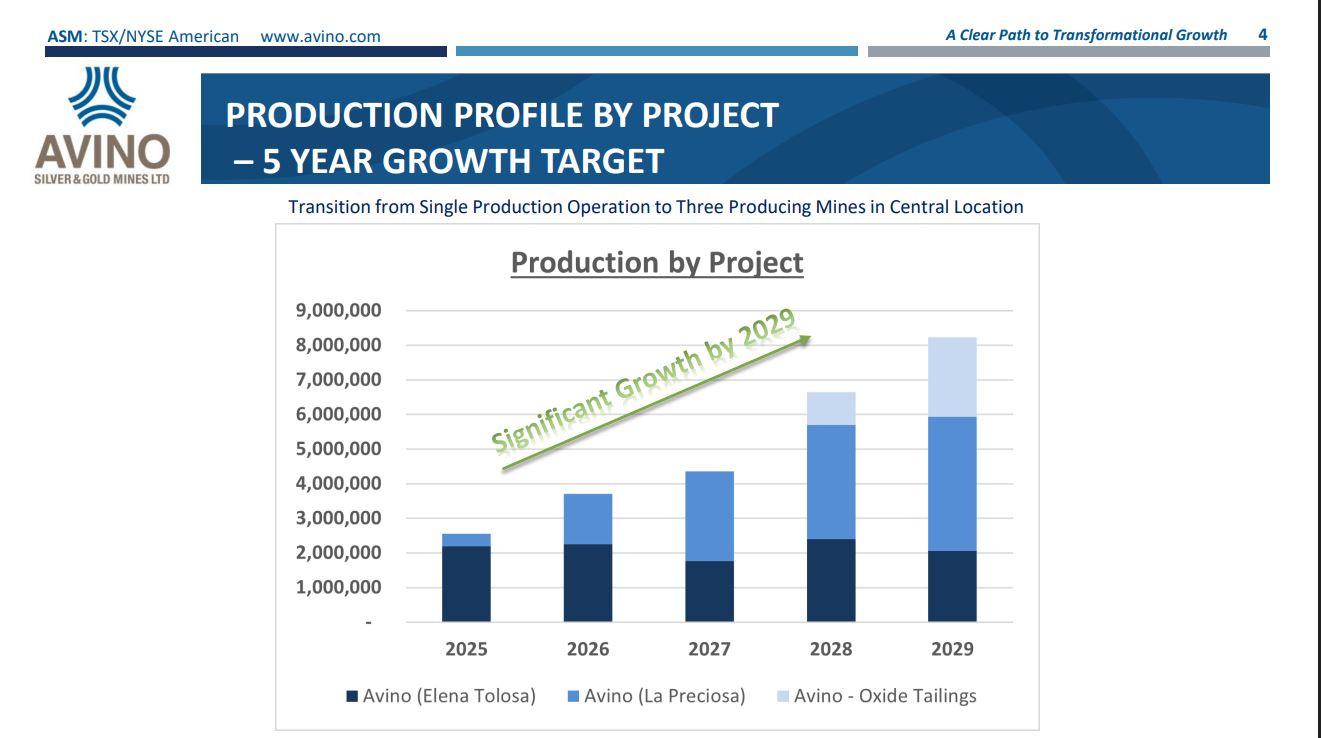

Out of that crop of other junior silver producers, it strikes me that Avino Silver and Gold looks prospective for a future bid. This is because of their growth profile on tap and improving costs over the next few years as La Preciosa comes into production, followed by their low cost ounces to come in after that from their tailings project.

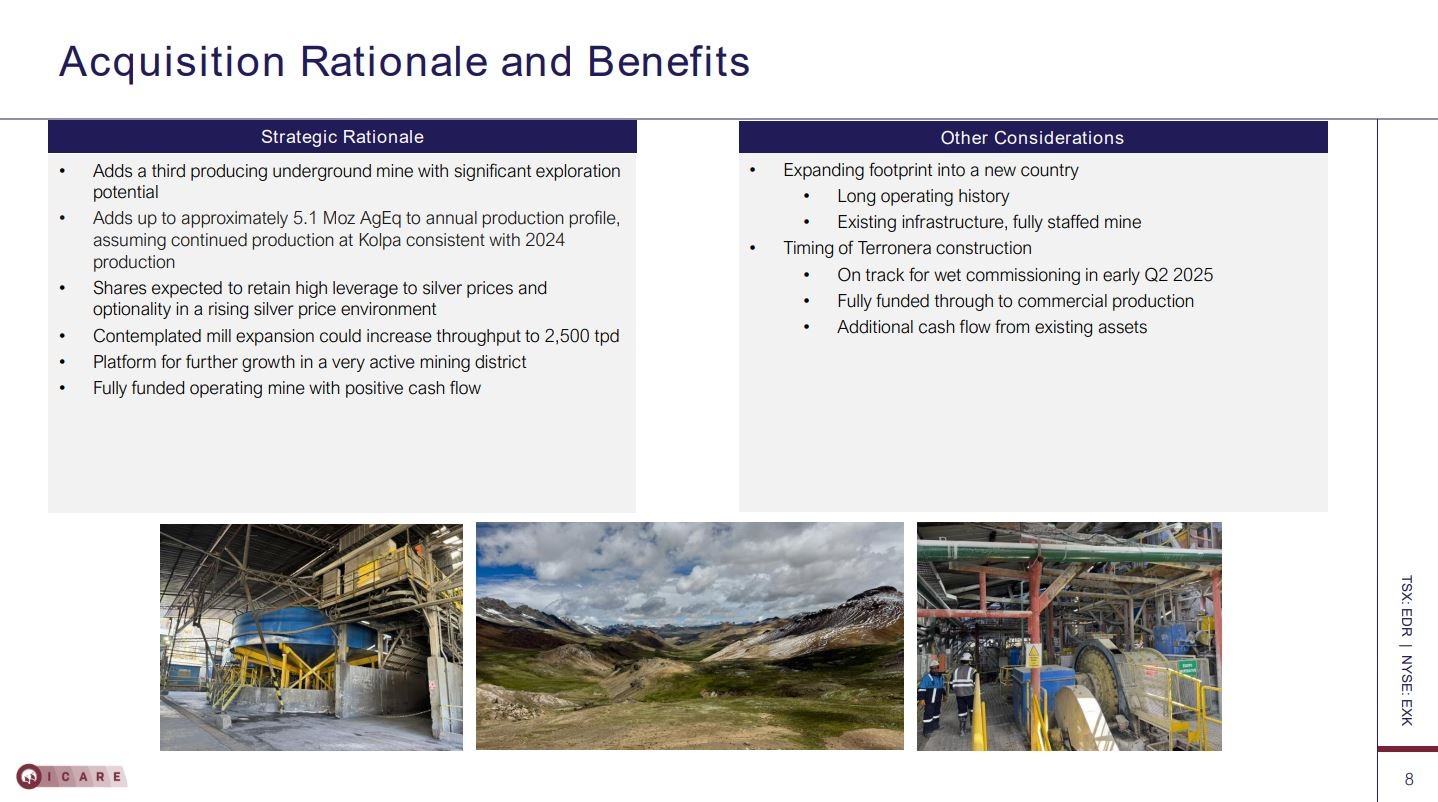

Additionally, as we’ve discussed in prior articles on this channel, Endeavour Silver and Gold is still undervalued relative to their growth profile, as they add in their newly acquired Kolpa Project and ramp up into production at Teronera in the 2nd half of 2025 and moving into 2026.

We’ve already taken a deep dive into the growth on tap for Endeavour Silver over the next 6-18 months, so no need to rehash those points again here, but I’ll put a link to that most recent update here, for readers that missed it:

So Aya is the priority takeover candidate, but Avino and Endeavour could be compelling prospects for a mid-tier producer to bolt on, once the get their respective mines built and into commercial production next year.

For the remainder of the smaller junior silver producers, I actually expect them to do the acquiring by bolting on accretive smaller mines or development projects, and so they may still be active in M&A by adding other assets to their portfolios.

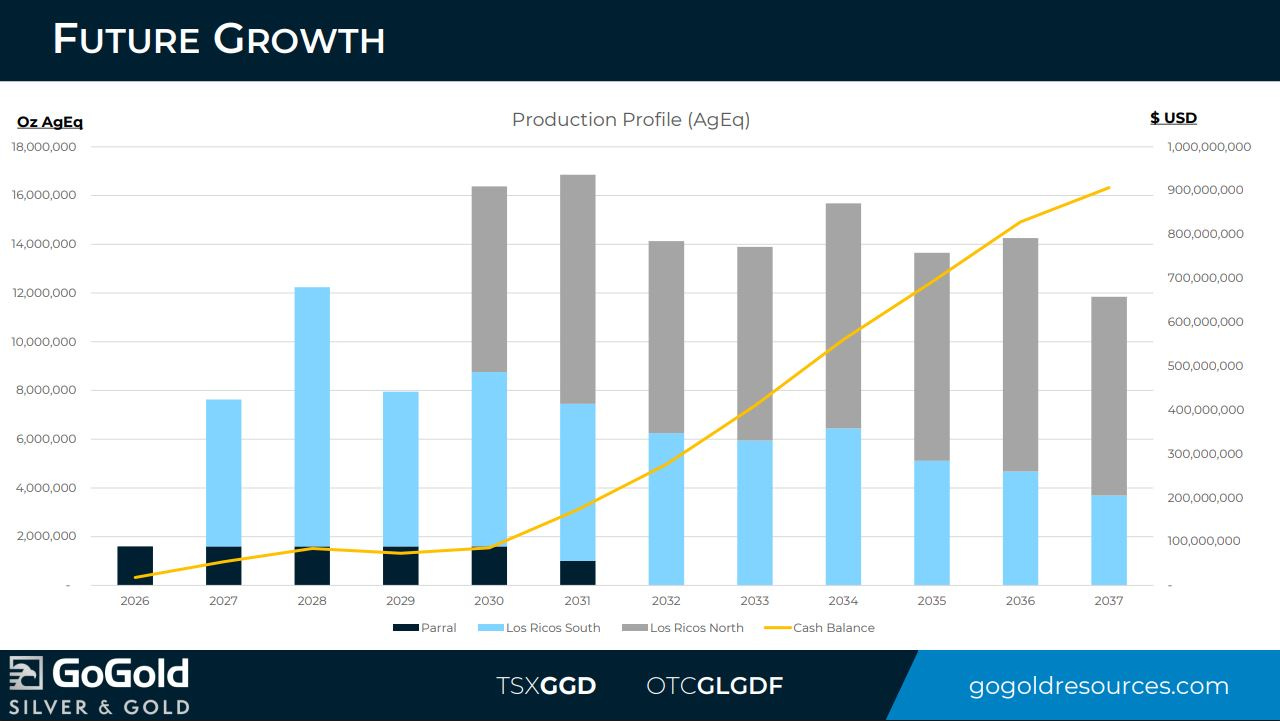

We are then left with the field of silver developers as the next crop of candidates for takeovers. Now in fairness, GoGold Resources is a producing precious metals and base metals company currently, but their big value proposition is their Los Ricos South and Los Ricos North development assets. We discussed this company in detail recently in the piece linked below, and I could see them being nabbed by a larger company (once they get their permits in Mexico to proceed with construction):

It is easy to envision a larger or mid-tier producer being enticed to bring this production growth profile into their companies as a takeover target. That could happen when the company gets close to the end of building Los Ricos South or after it gets that mine into production over the next 2 years.

Other portfolio positions in advanced silver explorers and developers of note would be AbraSilver, Vizsla Silver, Aftermath Silver, Blackrock Silver, Silver Tiger, and Dolly Varden Silver. We’ve talked about all of them before in prior articles, and while all of them are prospective, it still may be that we need to see higher silver prices in the high $30s to low $40s before producers feel compelled to jump down and take these companies over.

For the sake of not drawing this article out too long, we’ll wrap it up there for today.

Thanks for reading and may you have prosperity in your trading and in life!

· Shad