Opportunities In Growth-Oriented Silver Producers – Part 9

Excelsior Prosperity w/ Shad Marquitz – (04/19/2025)

I’m happy to report that we are diving back into more opportunities within the segment of “growth-oriented junior silver producers.” Throughout 2024 and 2025 we covered some very interesting companies thus far in this series, and we will continue delving into many more active companies with catalysts and growth on the horizon.

Of course, we’ll still be keeping tabs on the newsflow, catalysts, and pricing developments from the silver companies already covered thus far. Maybe in the next article in this series we’ll check in on the earnings news from those companies and get a quick technical update on them. In this article we’re going to introduce another standout company to follow, within this small universe of junior silver producers.

In full disclosure, none of these companies are paying me to write them up in these Substack articles. These company writeups here on this channel are simply about the value proposition that I personally see in stocks held within my own personal portfolio, (so yes, I’m talking my book and am biased in that sense).

My goal here is to have these updates be informative and topical for readers of this channel; not just with the specific companies featured, but also in the broader way of thinking about doing due diligence, and the rationale behind positioning in these types of stories within the larger resource investing universe.

Similar types of approaches and key points made within them could also be applied for investing in other stocks within the sector.

So, while I believe these are quality companies, and compelling opportunities in their own right, please don’t get hung up on if you like the specific companies discussed. Instead, consider the broader points of attraction and some of the nuances around investing in this turbulent, complex, and volatile sector of junior mining stocks.

In this article we are now going to take a deeper dive into GoGold Resources, as another growth-oriented silver producer, that also has excellent development projects and compelling exploration upside.

So, let’s get into it…

GoGold Resources Inc. (TSX: GGD) (OTCQX: GLGDF) is a stock I’ve been following for over a decade, but only got positioned in starting in May of 2023; adding more in September of 2023, then more in March of 2024 and again in December of 2024, and then a bit more in January of 2025.

I’m in the green ~18% on my overall cost-basis at this point, but got positioned because I believe it can go up 3x-5x over the next few years from current levels. This premise is based on the value and expansion potential of their Los Ricos South and Los Ricos North Projects, and their pathway into production over the next 5 years; to augment their current production coming from the Parral Tailings Project in Mexico.

Let me back and up the clock, and mention that prior to me starting to get into this stock that GoGold Resources was always on my watchlist, due to their small production of silver and gold that was feeding into their future development growth strategy. While I was aware of their exploration success, and watching from afar, I’d just never pulled the trigger on buying it. Then it went on an epic run. Initially, my thoughts were that I’d already “missed it.” Fortunately, the market often gives investors another chance to get into position, even in quality names or sectors that have already made nice moves.

Unfortunately, I had totally missed out on the massive 20-bagger move in GGD coming off of the $0.19 bottom in late 2018, all the way up to the peak in late 2021 at $3.79. (that was really stunning action)

When I see outperformance like that, based on solid fundamental newsflow and alpha creation by a company, then I’ll keep tracking it looking for opportune times to start accumulating the stock into corrective moves and extended sideways to down periods.

I started buying in mid-May back in 2023, because I thought there was potential for the pricing to double-bottom there to coincide with a prior low back in 2022. When that pattern broke down, then my strategy switched to a gradual accumulation approach, adding 10-20% tranches on pullbacks over the balance of 2023 through the end of 2024 and even early this year again. [noted in blue ellipses on the chart above]

My approach is typically to buy in tranches to establish an initial position and then keep averaging into a good overall cost-basis over the fullness of time. I’ve even considered throwing on one more tranche if we see another corrective move down in the stock.

I do believe the GoGold Resources share price and market cap is now on the gradual pathway higher after making a large rounded bottom over the last couple of years. So, I’ll unpack the value proposition I see at present considering the current fundamental growth on tap the next few years for the company.

Before we get into the nitty-gritty of their projects; right out of the gates, let’s establish their projected growth profile over the next decade.

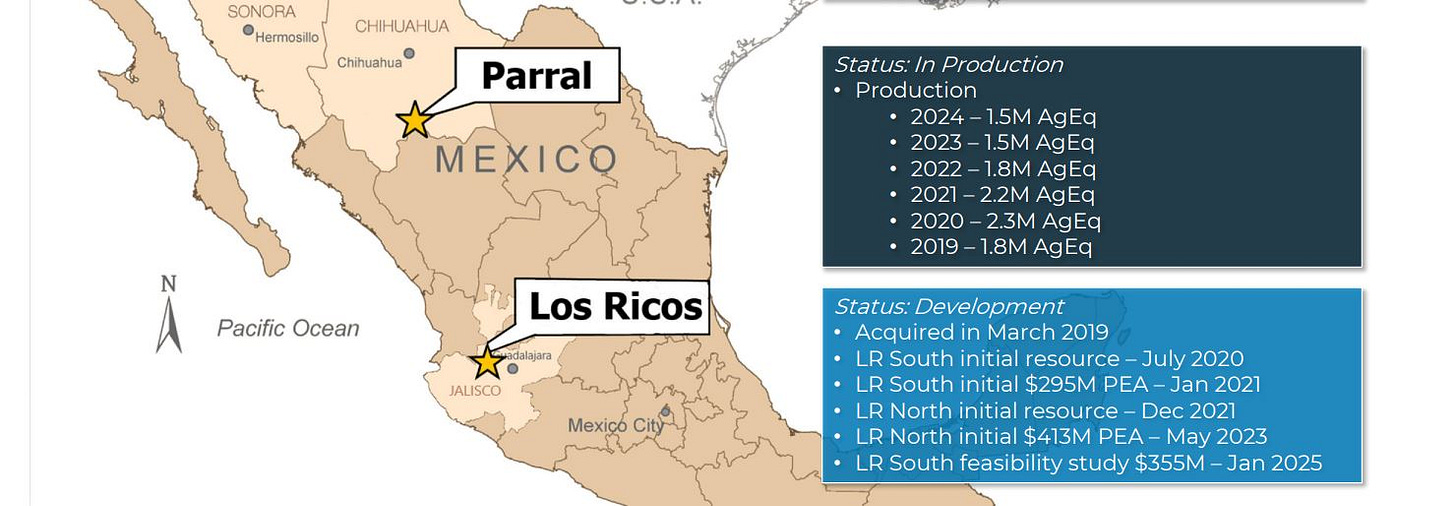

This means first assessing their current production asset - the Parral Tailings project, and then looking at the additional production from Los Ricos South by the end of 2027, and then Los Ricos North by 2030. Bringing on each Los Ricos project creates 2 massive step-changes in production growth for this company.

It is this pathway to expanding production the next few years, that makes GoGold Resources a standout in the growth oriented silver producer space.

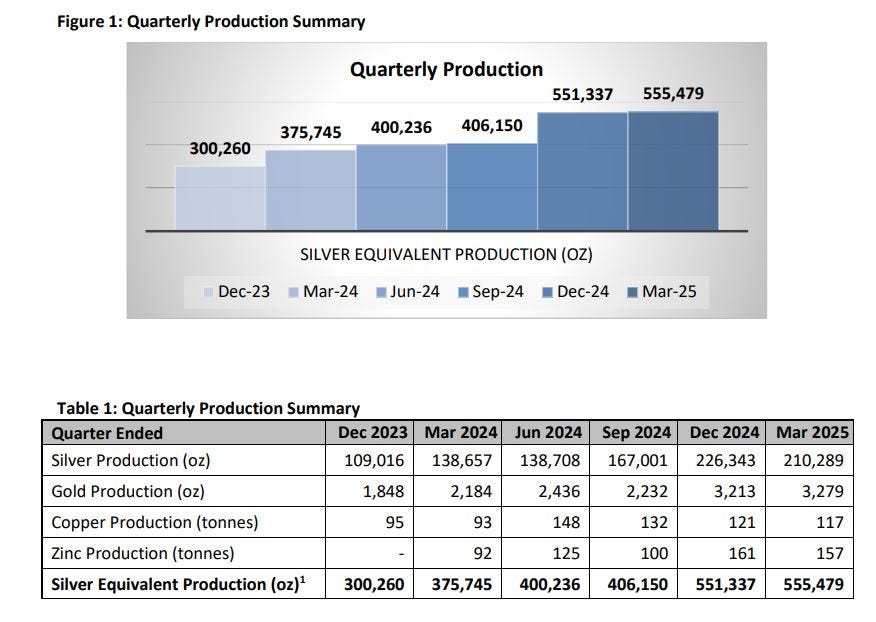

Let’s home in on the Parral Tailings project first, where the last 2 quarters have seen over 550,000 ounces of silver equivalent (AgEq) production. There has been quarter after quarter production growth at Parral ever since late 2023. If the Company can maintain roughly the current level of production, then they’ll be back up around a 2 million ounce per annum AgEq producer; and there is good reason to believe they can keep this production output going.

The ongoing production at Parral is mostly silver and gold, with a few zinc and copper co-credits. This quarterly number may still grow even further in 2025 after the commissioning of a new zinc circuit in January of 2025.

This new zinc circuit improves the precious metals and base metals recoveries at the processing center, producing a saleable zinc and copper byproduct and speeding up the leaching cycle. This means that more metals could flow per quarter moving forward and we could see current levels maintained or grown.

Additionally, there is a recycling and conserving of the cyanide within the leach cycle. This is important because the cyanide is a key cost input.

🔑 A key factor in the Parral production operations is how important the cleanup of the historic tailings has been to the local community over the last decade. These initiatives also resonate in a broader sense, from a social license standpoint in Mexico.

Now let’s pivot from the Parral operations in Chihuahua state, down to the flagship Los Ricos Project in the Jalisco state of Mexico.

The overall project is split into 2 deposits and future mining areas; Los Ricos South and Lost Ricos North.

The Los Ricos South project is waiting on the permit to begin construction of an underground mine, and the Los Ricos North project has a larger mineralized deposit defined, but is at an earlier stage of economics, and has flexibility to be advanced as either and underground or open-pit project.

Los Ricos South – 108.6 million ounces AgEq Indicated + 16.2 million ounces AgEq Inferred

Los Ricos North – 87.8 million ounces AgEq Indicated + 73.2 million ounces AgEq Inferred

Los Ricos South is shovel-ready, has a Definitive Feasibility Study in place, and is just waiting on the permit to begin construction. There is a 24-month build, and then 6 months of ramp-up production estimated to get to full commercial production. The Feasibility Study (using a base case silver price of US$26.80/oz, gold price of US$2,330/oz and copper price of US$4.00/lb) outlined an after-tax net present value (“NPV”) (5%) of US$355 million with an After-Tax IRR of 28%. Using a metals price assumption of silver at $30/oz and gold at $2,608/oz, NPV (5%) of US$469 million with an After-Tax IRR of 34%.

The Net Present Value has now grown beyond any metals price assumptions used in the DFS. When calculated using today’s spot prices at $32 Silver and $3,300 gold, that would give it a NPV 5% of over US $600 million. So, clearly this is an economic project to build that has been significantly growing in value throughout 2024 and 2025 with the rising underlying gold prices.

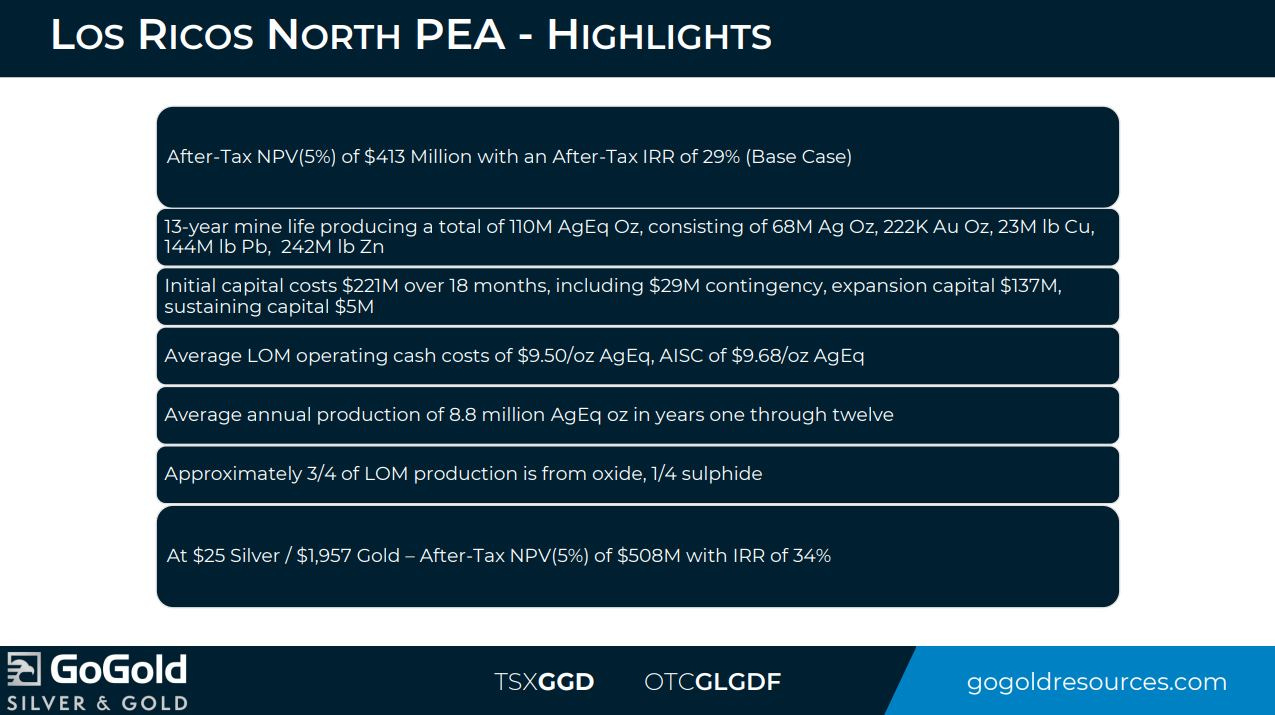

Shifting to the Los Ricos North project we see the same potential for increased NPV in lieu of the much higher gold and silver prices than used in the base case assumption or even the higher metals price assumptions in the past.

One can see from the numbers in the PEA that at metals price assumptions of $25 silver / $1,957 gold there is an After-Tax NPV(5%) of US $508 million, with an Internal Rate of Return (IRR) of 34%. At current metals prices of $32 silver and $3,300 gold, this Project would have an NPV (5%) over US $800 million.

If we consider both the Los Ricos South and Los Ricos North projects value in tandem with current spot metals prices then combined they’d have (US ~$600M + US ~$800M) = US ~$1.4 billion valuation.

That doesn’t even take into account any value for the existing production asset at the Parral Tailings Project.

Now consider that the current market cap of the company is US $428 million. To my eyes it is easy to see a 3X-4X valuation in this company over the fullness of time; once Los Ricos South goes into production, and Los Ricos North is in construction.

Rising metals prices will only expand the potential valuations, and that is if they never find another ounce of silver or gold on their district scale land package.

Let’s talk exploration upside at Los Ricos South.

Recent exploration work has found new mineralization, which was moved by faulting, as well as recent deeper drill holes that have located more mineralization at depth.

While still early days, the footprint emerging could mean a significant body of mineralized material on par with the known resources that have been defined at Los Ricos South.

Note drill holes LRTU-1500F-0028 that intersected 17 meters @ 1,468 AgEq, and LRTU-1500-0052 that intersected 12 meters @ 1,539.6 AgEq. Those are wide intercepts of a kilo and a half material that could prove to be quite significant for expansion of resources.

There are more scout drill holes still pending assays to watch out for. I’ll be keen to see just how much the exploration team can keep growing the Los Ricos South deposit beyond the known mineralization.

Consider that if they have all the sunk cost and mine built for the known deposit, but then find an analog of the same kind of orebody beside and underneath the current one, then it could be another step-change of growth for the company. This would equate to either potentially increasing the annual production or extending the mine life.

There is also exploration upside at Los Ricos North as further blue-sky upside.

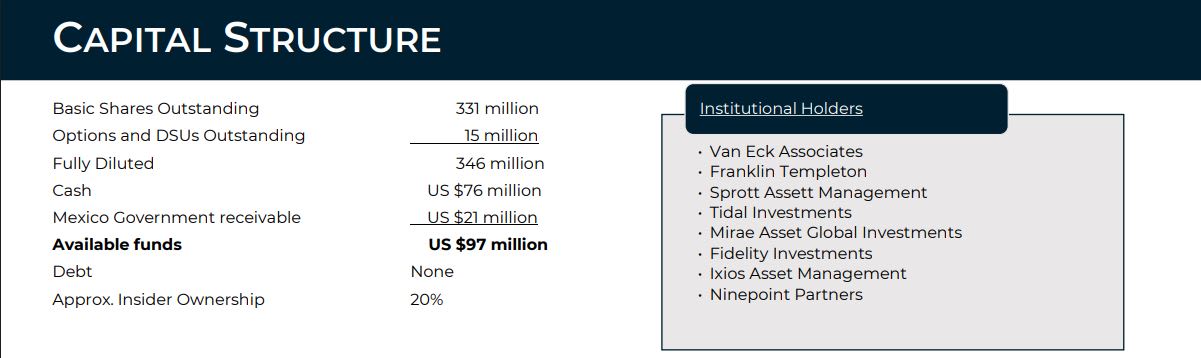

Two other positives worth noting are the strong amount of institutional shareholders, coupled with the strong insider ownership of ~20%.

Brad Langille, President & CEO, of GoGold Resources, joined me over at the KE Report last week for a comprehensive overview of this Canadian-based silver and gold producer focused on operating, developing, exploring high quality projects in Mexico. For those that want to know more, I’d recommend spending the 20 minutes to hear the value proposition directly from Brad himself.

GoGold Resources – Comprehensive Overview Of Their Silver And Gold Production And Development Assets In Mexico

Thanks for reading and may you have prosperity in your trading and in life!

Shad