Merger and Acquisition Opportunities In The Mining Stocks – Part 9

Excelsior Prosperity w/ Shad Marquitz (04-08-2025)

We are back with another segment on merger and acquisition transactions within the mining stocks. It is also worth noting that this M&A deal is, once again, happening within the small universe of stocks we cover here in this Excelsior Prosperity channel. It is stunning just how many of the companies we’ve showcased here on this channel that have been involved in legitimate M&A deals in just the last 2 years.

In this update we are going dive into the details of the news announced to the market on April 1st (and no… it’s not a joke) by Endeavour Silver Corp. (NYSE: EXK) (TSX: EDR), where they are acquiring Compañia Minera Kolpa S.A. (“Minera Kolpa”), and its main asset, the producing Huachocolpa Uno Mine (“Kolpa”), operating in Peru.

Readers here will know we had just featured Endeavour Silver last month in [Part 7] of the series on growth-oriented silver producers; because of their pipeline of organic development projects that would be raising their production profile over time. Those points are all still valid and can be reviewed here:

Opportunities In Growth-Oriented Silver Producers – Part 7

https://excelsiorprosperity.substack.com/p/opportunities-in-growth-oriented-724

Endeavour surprised the markets with this takeover news. Most investors following this company are well aware that they are currently commissioning their flagship Terronera Mine in Mexico here in Q2 of 2025, and then will be moving towards commercial production in Q3. Because of the massive efforts by their team to get this large mine up and running, most resource investors were not expecting them to acquire yet another producing mine in a different jurisdiction, at the very same time that they were reaching the finish line on bringing Terronera into production.

We’ve discussed Endeavour being a standout growth-oriented silver producer, and they are demonstrating that in spades by increasing their production with construction of a new mine, in tandem with the takeover of a producing mine that will add more profitable silver equivalent ounces to the mix. That makes the balance of 2025 and heading into 2026 a very busy and transformative time for this company.

So, let’s get into it….

Endeavour Silver Announces Expansion into Peru with Acquisition of Minera Kolpa, Copper Stream and Bought Deal Financing - April 1, 2025

https://edrsilver.com/news-media/news/endeavour-silver-announces-expansion-into-peru-wit-10017/

“Endeavour Silver Corp. (NYSE: EXK; TSX: EDR) is pleased to announce it has entered into a definitive share purchase agreement to acquire all of the outstanding shares of Compañia Minera Kolpa S.A. (“ Minera Kolpa ”), and its main asset, the Huachocolpa Uno Mine (“ Kolpa ”), from its shareholders, which are affiliates of Arias Resource Capital Management and Grupo Raffo, in exchange for total consideration of $145 million. The total consideration will be comprised of $80 million payable in cash and $65 million payable in common shares of Endeavour upon closing. In addition, as part of the Transaction, Endeavour has agreed to pay up to an additional $10 million in contingent payments, payable in cash, upon the occurrence of certain events and will also add approximately $20 million in net debt which will remain outstanding and repayable by Minera Kolpa.”

“The cash consideration will be funded through a combination of net proceeds from a new copper purchase agreement on copper produced from Kolpa with Versamet Royalties Corporation, a bought deal financing consisting of Shares, and cash on hand.”

“Pursuant to the terms of the Copper Stream, Versamet will provide a deposit of $35 million as prepayment to Endeavour, concurrent with closing of the Transaction… Once 6,000 tonnes of refined copper have been delivered, Versamet agrees to purchase 71.85% of produced copper from the Stream Seller. Once 10,500 tonnes of refined copper have been delivered, Versamet agrees to purchase from the Stream Seller 47.9% of produced copper.”

“…In 2024, Kolpa produced approximately 2.0 million ounces (“oz”) of silver, 19,820 tonnes of lead, 12,554 tonnes of zinc and 518 tonnes of copper, approximately 5.1 million silver equivalent ounces (“AgEq oz”). In 2024, the operating cost was approximately $133 per tonne, with cash costs on a by-product basis of $12.58/oz Ag and all-in sustaining costs (AISC) of $22.80/oz Ag. The land package remains underexplored with only approximately 10% of the claims worked to date with multiple targets identified for future exploration by Minera Kolpa exploration geologists.”

“The 2024 Technical Report provided a preliminary economic assessment study and also outlined a mineral resource estimate, which was updated by Minera Kolpa as of October 2024 with an effective date of August 31, 2024. The economic analyses presented in the 2024 Technical Report and the Kolpa Technical Report are not considered current, are not being relied upon by Endeavour and should not be considered as representing the expected economic outcome under Endeavour’s ownership.”

“Power is supplied by high voltage transmission lines with backup generator systems. Water treatment plants are located on site to treat water for recirculation or permitted local discharge. On site camps have the capacity to house up to ~1,700 workers year-round.”

“The main mining methods at the Kolpa underground operations are sublevel stoping and cut and fill. The underground operations occur primarily at the Bienaventurada vein and at the parallel and tensional type structures associated with it. The Bienaventurada vein is the most important structure of Kolpa. This production is supplemented with ore from the Yen vein and orebodies, which are the second most important structures of Kolpa.”

“The concentrator plant processes the polymetallic ore following a conventional selective flotation process to obtain a first bulk concentrate with subsequent separation of lead-silver, zinc and copper-silver concentrates.”

There is a lot more information in that press release linked above for interested readers to sift through, but I included the passages above that caught my attention and covered the main takeaways. In a nutshell, Endeavour Silver is using a combination of cash and shares, in conjunction with a copper stream from Versamet Royalties to acquire a fully operational polymetallic mine that has great infrastructure in place and produced over 5 million silver equivalent ounces last year.

This is a nice bolt-on mine for Endeavour Silver, and they shouldn’t have much capex needed to invest in it or much development work to do, as they are essentially just going to take over the operations when the transaction closes in a couple months. Of course, there may be a few skeletons in the closet, which appear after taking over the asset, but overall the operations were solid last year.

If they close the deal by June, then that will give them production growth over the 2nd half of 2025, so ~ 2.5 million silver equivalent ounces at an AISC of $22.80/oz Ag.

Let’s discount that down just a bit (because nothing ever goes as planned in the world of mining). If they only get 2 million AgEq ounces at $24 per ounce… it’s still a nice kicker for H2. Then in 2026 we’ll see a full year of production, and their operations team will have had 6 months to optimize the processes.

Just a refresher for readers here on the other production inputs for Endeavour Silver this year:

The Company is guiding for about 8 million silver equivalent ounces from their currently operating Guanacevi and Bolañitos silver mines in 2025.

Terronera will be wet commissioning in Q2, ramping up to commercial production in Q3 and then be in commercial production for all of Q4.

Since Terronera is projected to produce 7 million ounces per year, let’s say they get 2-3 million AgEq ounces produced in the second half of this year, as things ramp up to steady-state production and they work out any initial challenges or bottlenecks. (there are always growing pains on a new mine, so expect it)

That would give them 8 million ounces AgEq from Guanacevi & Bolañitos + ~2 million ounces AgEq from Kolpa in H2 + ~2-3 million ounces of AgEq from Terronera in H2 for a total of ~12-13 million ounces of silver equivalent production in 2025. That is significant this year.

Looking ahead to 2026, Kolpa should kick off the full 5 million ounces of silver equivalent and Terronera should produce ~7 million ounces AgEq. When those ounces get added to the 8 million ounces from the two currently operating mines that will give them a production profile of 20 million AgEq ounces per annum starting next year. That’s impressive growth over the next 2 years.

The other thing to note is that Terronera has a very high average head-grade of 374 grams per tonne and when up and running at full capacity the gold credits carry the silver at negative cash costs of ($0.20) per AgEq oz and very low AISC of $2.15 per AgEq oz. I’m not expecting those metrics to be fully realized in H2 of 2025, but once the calendar rolls over into 2026 they should have things optimized at the mine and processing center to get somewhere in that vicinity. That should bring their consolidated AISC from all mines down into the $mid-teens in 2026.

When I consider just how much the production at Endeavour Silver will be growing from 2025 into 2026, compared to where they were at in 2024 at 7.6 million ounces, and how the revenues will also be growing as the consolidated all-in sustaining costs start to ratchet down in H2 of this year and then in a more meaningful way in 2026; then I see far more future growth on tap then they are getting credit for in their current valuation.

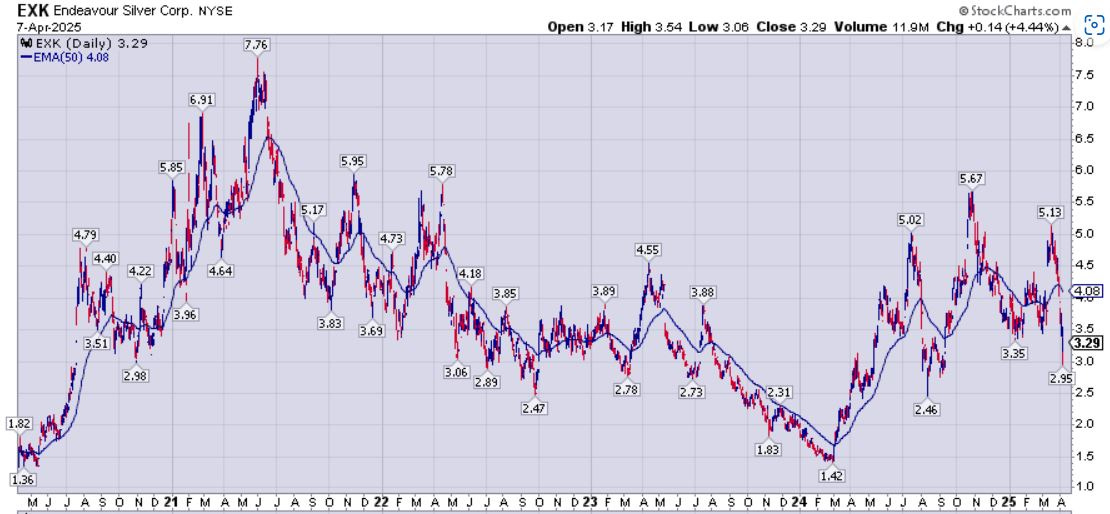

Back in 2021, when they only had the 2 operating mines, EXK got up to a peak of $7.76 at very similar silver prices to what we have today, and at lower gold prices. Now, fast-forward to today’s valuation, and yes, there has been more share dilution, but that was also to develop the juggernaut of a mine Terronera and to just recently acquire the Kolpa Mine. The stock closed on Monday April 7th at $3.29 and there is so much more future growth on tap just a few months out, compared to what there was 4 years ago. I see that prior peak being eclipsed in the next 2 years, and then some… once the larger production profile becomes more evident to the market.

As mentioned in my prior writeup of Endeavour Silver, they also have the further organic growth potential from their Pitarilla and Parral Projects in Mexico. Both Projects are key advanced exploration and development projects in the portfolio that will have ongoing exploration and derisking work programs in the second half of this year, with Pitarilla on deck to be potential Mine #5 a few years out. {As far as I can tell they are receiving no credit at all for these other projects, and Pitarilla is one of the largest undeveloped silver projects on the planet with over 600 million AgEq ounces. Just imagine if that asset was in a stand-alone silver junior developer what market cap it would garner.}

On Monday April 7th, over at the KE Report, we released an interview with Dan Dickson, CEO and Director of Endeavour Silver, that we had recorded the end of the prior week. Dan reviews their Q4 and full year operational metrics at the producing Guanacevi and Bolañitos silver mines, provides a construction update at the Terronera Project in Mexico, unpacks the big announcement of the acquisition of Minera Kolpa and their Kolpa Mine in Peru, and then updates listeners on the future work programs at the Pitarilla and Parral development projects.

Endeavour Silver – Q4 Operations Review, Terronera Wet Commissioning In Q2, Acquisition Of Producing Kolpa Mine, and Pitarilla Development Project Update

For all the reasons outlined in this editorial, I remain an enthusiastic shareholder of Endeavour Silver, and biased in that sense.

Trading Update: Today on Tuesday April 8th I added 2 more tranches to my EXK position at $3.33 and then again at $3.13. The stock closed today at $3.15.

Sure the markets, silver, gold, and PM equities could all just keep dropping like a stone, and this will have been premature buying here in EXK. However, I don’t feel like I’m overpaying in a really big way at these levels for all the aforementioned reasons; but only time will tell. If we see the stock crash back down below $3 then I’ll likely add another tranche in the high $2’s, but that would likely then start approaching a full position for Endeavour Silver in my portfolio.

My time horizon for these investments is with an outlook to holding until Q4 2026 results are reported in the first quarter of 2027. (So roughly 2 years)

As a result, I’m not going to get all hung up in the day-to-day volatility and whipsaw nature of the PM stocks.

I want to give the company the runway to execute on their plan, and in my estimation it is going to take until the end of next year to fully realize all the moving parts at these 4 producing mines.

By that time, in Q1 2027, we’ll have seen a full year of production next year at both Terronera and Kolpa, and a best guestimate of 20 million silver equivalent ounces produced in 2026. I’m playing this for the corresponding rerating.

Without question, there is a great deal of execution risk involved in this trade, because the team at Endeavour Silver needs to deliver on getting Terronera up and running as projected (not an easy task) and simultaneously keep producing at Kolpa in line with what it did last year (a bit easier but not without risk). Additionally, Guanacevi and Bolañitos still need to keep producing as guided. This is the glass is half empty caveat though… Mining is a tough business.

In the glass is half full scenario, there is also the potential that they do actually execute on their strategy and dramatically increase their production profile by Q4 of 2026. In that event, and even if the underlying precious metals and base metals prices just trended sideways, or even a little bit lower, I’d still anticipate this company’s shares to rerate much higher by a factor of 2x-3x by Q1 of 2027. If metals prices are actually higher by early 2027, then I’d anticipate expanded multi-fold returns.

I reserve the right to change my mind, if things go off the rails, or if there are fundamental changes with the company, or in case there are massive shifts in the macroeconomic backdrop that negatively impacts the entire precious metals sector.

[Note: this is not investment advice, and readers here should seek out a financial professional to help them weigh the risks of any investments they make and take personal responsibility for their own decisions. I’m merely sharing what I’m doing in my own portfolio and the thesis behind the decisions I’m making personally. Endeavour Silver did not commission me to write this article on Substack, and I did so freely of my own accord.]

Thanks for reading and may you have prosperity in your trading and in life!

Shad