Opportunities With Growth-Oriented Gold Producers – Part 5B

Excelsior Prosperity w/ Shad Marquitz - 03/03/2024

We are going to dive right back into reviewing the newsflow from the remaining 3 companies out of the 4 that have been discussed in this series on growth-oriented gold producers. Additionally, I want to bring up a 5th growth-oriented gold producer that has become a total market pariah over the last 2 years, and especially in the last 2 weeks; which could be presenting a contrarian opportunity.

As a head up to those readers that have not yet perused Part 5A: In that article we reviewed the importance of having the right value investing mindset and trading strategy around these gold producers. One of the key points to reiterate when diving into the rest of this piece, is the concept of having the right investing time horizon to allow these growth initiatives to have the necessary runway to play out. The second half of the prior issue, was using i-80 Gold Corp (IAU) (IAUX) as a case study into how there can be a divergence in share price performance and the underlying company performance.

Opportunities With Growth-Oriented Gold Producers – Part 5A

https://excelsiorprosperity.substack.com/p/opportunities-with-growth-oriented-fb0

With most of these companies, their plans to grow production and resources are only going to be after a number milestones are achieved first, and after the company work programs have the time to incrementally grow their profiles, and lower their overall costs. This will take a number of quarters to track the exploration, development, and production improvements, while being cognizant that in the short-term there can be temporary news setbacks or wider sector pressures that can lead to short-term corrections. This will equate to noise over the duration of this journey, and the key is to focus on the longer-term investing thesis and keep the main thing… the main thing.

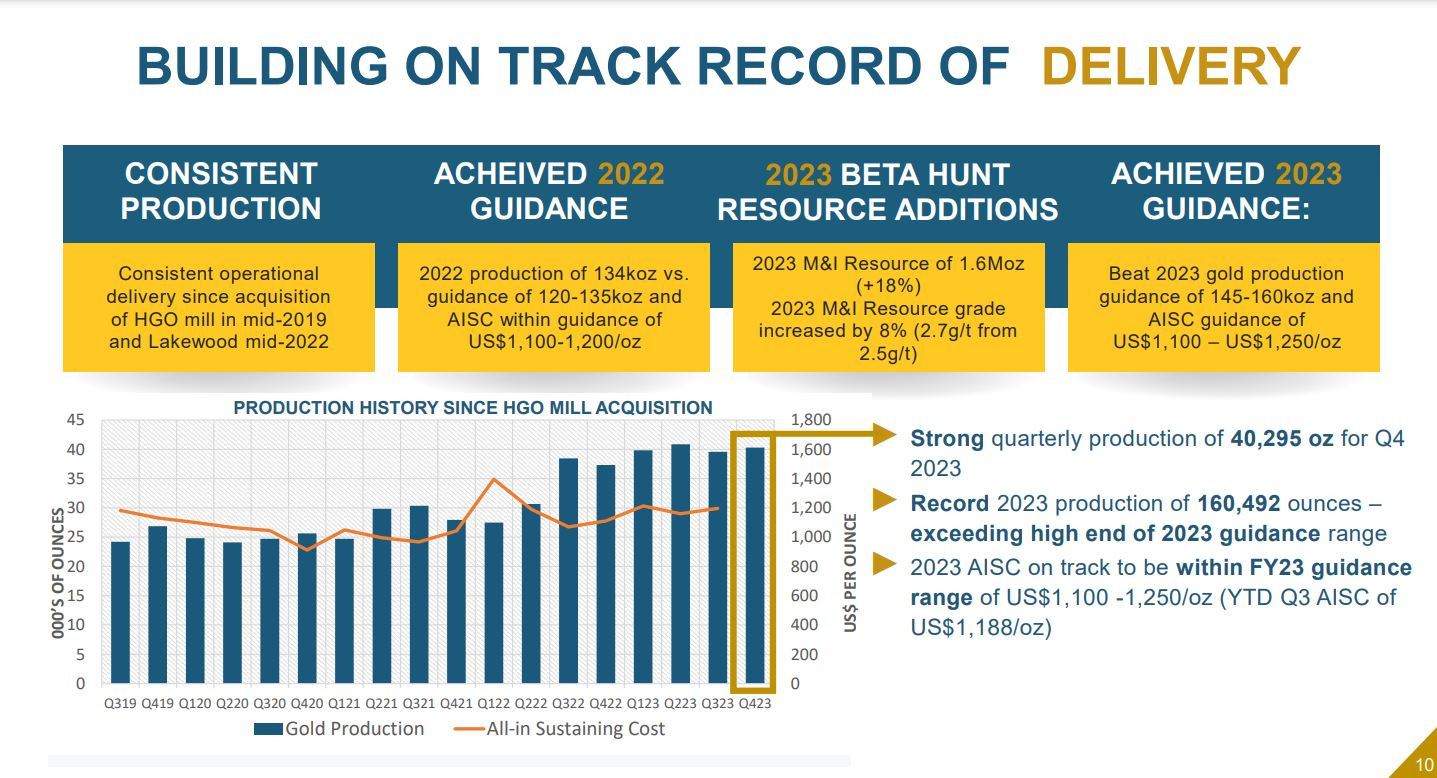

Here is some recent newsflow from Karora Resources (TSX: KRR) (OTCQX: KRRGF) in 2024:

Karora Exceeds High End Of 2023 Gold Production Guidance With Record Annual Gold Production Of 160,492 Ounces And Record Gold Sales Of 157,034 Ounces - Jan. 15, 2024 http://tinyurl.com/32zythpj

Karora Resources Signs Long-Term Power Purchase Agreement And Announces Plan To Achieve A 20% Reduction In Greenhouse Gas Emissions By 2030 - Jan. 16, 2024 http://tinyurl.com/53knrvj5

Karora Resources Announces New Fletcher Zone Gold Drilling Results of 3.8 g/t over 33.0 metres and 34.6 g/t over 2.0 metres at Beta Hunt - 22 Feb 2024 http://tinyurl.com/bdzhw6cv

Karora Resources Drills 13.7% Ni Over 2.6 Metres, 12.0% Ni Over 2.9 Metres, And 15.4% Ni Over 0.6 Metres Further Demonstrating The High-Grade Potential Of The Open-Ended 50C Nickel Trough - Feb. 26, 2024 http://tinyurl.com/2fwwchzu

Despite the despondency from some folks on various chat boards, or blaming management for the share price action, I’m just not seeing the negatives here on any of the news from this year. Most of this news has actually been incredibly positive, and augers for resources expanding along with production. Yes, that has not stopped the share price from sliding down for most of 2024, (albeit with a nice pop on Friday in the constructive gold price move to all-time highs on the daily/weekly chart closes). The share price action does not mean there is “something wrong” or that the news was subpar or worrisome.

Investor sentiment always follows price action, and so despite a string of positive press releases, the takeaway from the retail hordes is that this company is going the wrong direction. Of course, they don’t have any concrete things that they can point to the management is failing at, and that is because really this company is continuing to fire on all cylinders, for exploration, development, and production.

Alas, we are and have been in very strange times and ridiculous valuations in the gold mining space. I continue to hold a larger weighting to Karora Resources in my own portfolio, not just for the potential for continued upside from the gold side of the business, but also for the nickel side of the business. Their exploration team continues to find more high-grade nickel, and every time under that nickel, they also find more gold. It’s hard to see what’s not to like about the resource expansion and increased production profile with this emerging mid-tier gold company. (This is not investment advice though, and I’m not in the remotest way suggesting anyone else should do the same thing. There is tons of risk investing in mining stocks and everyone should consult their own financial advisers and do their own due diligence).

Checking in on Calibre Mining (TSX: CXB) (OTCQX: CXBMF):

There has been so much positive newsflow out of Calibre, from exploration success on making new discoveries and expanding resources to the year-over-year production growth, that I can’t even fit all of 2024’s news into this article. For this editorial we’ll just pick it up on Jan 24th with the completion of their transformational acquisition of Marathon Gold, and the Valentine Gold Mine and project, which we have discussed in prior parts of this series.

Calibre Completes Acquisition of Marathon - 24 Jan 2024

https://calibremining.com/news/calibre-completes-acquisition-of-marathon-7572/

Calibre Continues to Intercept Bonanza Grade Drill Results Along the Multi-Kilometre Panteon VTEM Gold Corridor at the Limon Mine Complex; Drilling Intersects Include 111.92 g/t Gold over 4.1 metres and 33.60 g/t Gold over 2.6 metres - 30 Jan 2024

https://calibremining.com/news/calibre-continues-to-intercept-bonanza-grade-drill-7785/

Calibre Reports Positive Drill Results One Kilometre Southwest of Valentine Gold Mine Resources Demonstrating Strong Discovery Potential Across the 32 Kilometre Shear Zone, Newfoundland & Labrador, Canada; Drilling Intersected 3.14 g/t Au Over 14.8 Metres - Feb 6, 2024

https://calibremining.com/news/calibre-reports-positive-drill-results-one-kilomet-7795/

Calibre's Ore Control Drilling Intersects High-Grade Gold Outside of Reported Mineral Reserves Adding Additional Tonnes At The Valentine Gold Mine, Canada; Results Outside Mineral Reserves Include 46.53 g/t Gold Over 5.3 Metres and 17.16 g/t Gold Over 7.0 - Feb 14, 2024 (Happy Valentine’s Day indeed!!)

https://calibremining.com/news/calibres-ore-control-drilling-intersects-high-grad-7811/

Calibre Exceeds the High-End of 2023 Production Guidance, Increasing Gold Production in 2024 to 275,000 - 300,000 Ounces With Significant Future Growth Coming From the Multi-Million Ounce Valentine Gold Mine in Canada - Feb 20, 2024

https://calibremining.com/news/calibre-exceeds-the-high-end-of-2023-production-gu-7833/

Calibre Intercepts High Grade Gold Mineralization at the Limon Mine Complex, Proximal to the Limon Processing Plant; Drilling Intersects Include 68.72 g/t Gold Over 2.0 Metres and 18.68 g/t Gold Over 6.0 Metres - Feb 26, 2024

https://calibremining.com/news/calibre-intercepts-high-grade-gold-mineralization-7847/

As the late comedian Chris Farley used to scream into the SNL cameras “Good lordy bigordy!” what more do people want here? The Calibre Mining team are executing like junior gold mining ninjas out there, and it is worth noting that unlike most gold stocks, their share price has been starting to move higher over the last couple months. (CXB.TO) did go down to $1.18 in mid-January, retesting that areas seen in November of last year at $1.155, but it clearly is a long way off it’s bottom put in during October of 2022 at $0.52 (after the over-reaction and misinterpretation of any impacts from US sanctioning Nicaragua). As we’ve seen before and will discuss later in this piece, often it is those big over-reactions that mark major lows in a stock, and provide a contrarian buying opportunity.

On February 23rd, I spoke with Ryan King, Senior VP of Corporate Development and IR at Calibre Mining, to get an overall update for the KE Report. Here is that most recent interview for anyone that missed it:

Calibre Mining – 2023 Operational & Exploration Review - 2024 Guidance and Growth Strategy

Equinox Gold Remains Under Pressure From Investors Looking At The Past Instead Of Into The Future

Since I recently did a deeper dive into Equinox Gold (TSX: EQX) (NYSE: EQX) in Part 4 of this series, I’m not going to rehash most of that in this update, but will hone in on the news that came out 2 weeks ago that sent the stock correcting downward in the recent past. While the market is quick to sell first and possibly ask questions later, we must take a more nuanced approach to dissecting the news and looking for both the good and bad contained within.

Equinox Gold Reports Q4 and Fiscal 2023 Financial and Operating Results, Provides 2024 Production Guidance of 660,000 to 750,000 Ounces of Gold

21 Feb 2024

Greg Smith, President and CEO of Equinox Gold, commented: “Equinox Gold finished 2023 with its strongest quarter of production at the lowest cash costs for the year, bringing full-year production to 564,458 ounces of gold at all-in sustaining costs of $1,622 per ounce. Greenstone was a significant focus during 2023. After 2.5 years, construction was substantially complete at year end, which is a huge accomplishment for the team. The focus at Greenstone has shifted now to hot commissioning and operations ramp up with first gold on schedule for the first half of 2024.

“Looking forward, we expect to produce between 660,000 to 750,000 ounces of gold in 2024 with cash costs of $1,340 to $1,445 per ounce and all-in sustaining costs of $1,630 to $1,740 per ounce. We started 2024 with $360 million in total liquidity which, along with cash flow from our operating mines and marketable investments currently worth about $100 million, leaves us well funded to achieve our 2024 objectives and advance Greenstone to commercial production.”

OK, there was some definite good news in there from Greg – regarding their 4th quarter results being the strongest quarter of production at the lowest cash costs for the year, and with regards to the construction at Greenstone being mostly completed after 2.5 years of work… However, all of this was overshadowed by the All-In Sustaining Cost (AISC) being $1,622 per ounce for last year and the projection of cost creep in the 2024 AISC to be $1,630 - $1,740 per ounce. With so many investors ripping on the majors for letting their AISC get up into the $1300-$1400 zone, this mid $1600’s to $1700s number 2024 guidance for Equinox caused some investors to hit the sell button on the stock after this news broke.

As mentioned in the prior breakdown of Equinox Gold here in this series, EQX has always been a higher cost gold producer, so I’m not sure why the market was so surprised or disappointed by these cost numbers. It’s possible many thought 2024 would see a reduction of costs as Greenstone started to produce, but it isn’t slated to do first gold pour until later in Q2, and will still be in ramp up mode in the 2nd half of this year. What will be far more germane is what the 2025 guidance for AISC will be, once the company has 6-7 months of initial ramp up production under their belts, and has a sense of how things are going to trend as far as costs in 2025.

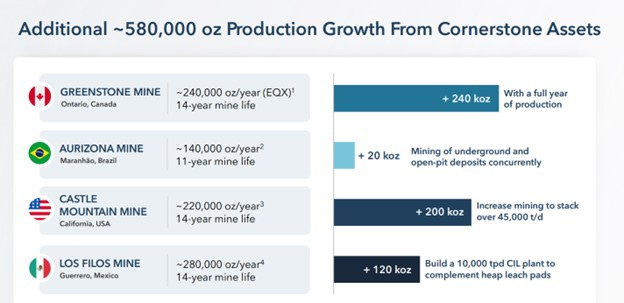

Look, I can actually understand some investors bailing on the story until they see proof that all the work leading up to bring Greenstone through development and construction will have been worth the candle, but nobody should have been expecting spectacular results from 2023’s numbers or the 2024 guidance until this business strategy has the time to get their ship turned around. It’s actually a multi-year plan that involves multiple mines. That is the whole significance of the expanded production profile that could add upwards of 580,000 ounces per year or gold production by bringing on Greenstone into production, commissioning the underground mining at the Aurizona Mine, expanding production from the Castle Mountain Mine, and if terms are agreed to the CIL plant expansion at the Los Filos Mine.

There was actually a lot of other metrics embedded within the recent news release that was net positive as it relates to earnings, cash flows, the strength of the balance sheet, ESG initiatives, a reduction in injury frequency, and the developmental progress at Greenstone, Aurizona, and Castle Mountain, but again, that would involve investors looking out into the future, and all they can see are the high costs here and now and for the balance of 2024.

Again, since I am viewing this investment thesis through the lens of 2-3 years out, and what it will mean as Equinox transitions from a higher-cost mid-tier gold producer to a much larger major gold producer, with a roadmap to doing over 1 million ounces of annual production by 2027; then I’m not thrown off-course by the recent selling and weakness in the share price action.

Of course, nobody likes to see a market tantrum and the shares to be sold down further in an already tough PM market backdrop. However, I’ll personally be using any further weakness to accumulate a little bit more if this persists. I’m still up around 37% on my most recent position initiated @ $3.20 on the US NYSE ticker back on November 28th, 2022, and with EQX closing on Friday at $4.38. It would have to drop a lot before I even got into the red on this trade, but I’d consider “averaging up” and increasing my overall cost basis if it dropped down in the high or mid $3’s once again. Other than that, I’m just giving this one time to execute on a number of projects over the next 2+ years and am in the position for larger transformation I see going on by late 2026-2027.

If that recent weakness and 2-3 year timeline and trajectory with Equinox makes anybody nervous, then you may want to brace yourself for this next stock being covered in this series on “growth-oriented gold producers.” The warning I’ll give early on here is that this 5th company was one I was planning to get to eventually in this series anyway, but later on in the batting order. However, it has experienced some serious challenges that have created such a stir over the last 2 weeks; absolutely cratering the share price and market cap in valuation to become a “run for the exit doors” scenario. For that reason, it simply must be addressed with fresh eyes and fresh take on a risk/reward adjusted basis, and it won’t necessarily be a fit for everyone – nothing is.

Other investors may be appalled to even consider it, (preferring only to buy things in scorching uptrends – good luck finding many of those in the gold stocks right now) or maybe they’ll scrunch up their noses in disgust… However, I’m going to take the other side of that discussion and trade, and will unpack my reasoning for doing so. From my perspective, the market is overreacting once again, (not a surprise) and thus it is presenting a contrarian opportunity – one that keeps getting strangely more compelling the more this company is taken out behind the woodshed and beaten to a pulp.

After more than dozen years of switching my trading focus to the resource stocks, (having been a generalist investor prior to that), I can report back that some of my best percentage gains have come from positioning in companies or sectors that were being kicked to the curb and discarded by the herd of consensus. Looking back on some of my better wins in the past, and even some of my more recent wins (like Gatos Silver, Galiano Gold, and Calibre Mining), it often was NOT a result of buying into the strength of momentum or trend buying. Often what gave me a big edge in my trading account was accumulating companies at peak pessimism; when most others were giving up in despair or raging out about the management doing this to them personally as they screamed up into the clouds for justice.

There are so many times where either extended slow painful drips downwards, or even better -- big selloffs, can actually be the very times to sit up and take notice for accumulation. It is so important to really evaluate the severity of the sell-off in percentage terms in share price, and thus the correlating market capitalization, in lieu of the challenge and actual impact of the news that was announced.

Often times, there are opportunities to be had in buying corrections caused by missed production guidance when it is due to isolated issues (weather, staff availability challenges, machinery underperformance, ore blending, etc..).

Some of my best gains have been in positioning in botched resource calculations that were sold down far too hard on the news, only to eventually climb back higher over time as more clarity was brought to the situation.

Sometimes investors start freaking out about a specific jurisdiction and the selling becomes exaggerated, where the weakness can be exploited.

Other times, challenges to a mining method are addressed openly by the company, and they are slaughtered for this transparency in a big selloff. If there is a plan for addressing it, and then if the company does rectify the situation, it doesn’t always have to be a deal killer, and may just be a flat out deal for acquiring.

There are some exploration results that are not eye-popping or that are misinterpreted, and when people sell first before asking questions and understanding how the company is interpreting them, and more importantly how they’ll be following up, then again these can often be contrarian opportunities in disguise.

Bottom line: Overreactions can give contrarian investors an edge.

OK. Time for the next company in this series. After already having a really tough 2 years prior, and becoming the poster child for cost overruns and missed timelines, this company has been severely punished for it’s sins. However, when more news broke about challenges with selective mining, 5-10% lower grades expected for throughput, lower anticipated ounces in guidance, and the reality that they’ll need more money… the share price was further chopped in half. I’m talking of course about Argonaut Gold (TSX: AR) (OTC: ARNGF). (Yes, that’s right, I said Argonaut Gold).

Please… before you throw pies and rotten tomatoes at me though, at least suspend passing judgement on this provocative and likely polarizing selection, until you read Part 6 in this series where we’ll unpack together the good, the bad, and the ugly about Argonaut Gold. I’m happy to freely share my thinking and rationale behind the decision to accumulate more shares this last week into the recent weakness and market carnage. I also acknowledge that while this is definitely risky, it may not be as risky as it is being currently perceived (especially after the recent waterfall decline).

Yes, their key new mine, Magino, has been a complete mess getting developed and constructed for the last 2+ years, with more problems surfacing again 2 weeks back. We’ll get into the big picture view of where things are going, and address some specifics in that recent news announcement that has led to the stock being essentially chopped in half in market cap valuation, once again, over the last 2 weeks.

That aside, Argonaut Gold is going to be a legitimate growth-oriented gold producer at the end of this saga. It is run by a much more solid management team and board now than in the past, and Magino is absolutely still going to be transformative to the company, in a similar way that Greenstone is going to be transformative for Equinox. These things take time to play out though, and we’ll discuss warts and all in the next Part 6 of this series, so stay tuned for that down the road.

However, next up will be an update on the broader macro picture and a number of individual markets, and then a special edition piece coming out focused on the royalty companies.

Thanks for reading and wishing everyone prosperity in their trading and in life. Ever upward!

- Shad