Opportunities With Growth-Oriented Gold Producers – Part 5A

Excelsior Prosperity w/ Shad Marquitz - 03/02/2024

In this 2-part update, I want to start off by taking a moment to review some recent news updates on the first 4 companies featured in some of the earlier discussions on this topic around the opportunities in growth-oriented gold producers.

First though; I really want to start off by clarifying a few points about investing in gold producers, in this current environment, based on some of the questions I’ve received in from a number of emails and private messages. Much more important than getting a hot tip on a company or reading through fundamental or technical information to further one’s due diligence on a company; it is far more important to get one’s trading psychology and headspace correct for investing in the first place.

It is mission critical to have the right value investing mindset, and trading strategy and approach for this sector first, before diving into the company specifics. People may think they already have that mindset, but poor investing psychology and taking the wrong actions at the wrong times, usually due to runaway emotions, are the very reason so many fail at investing, (especially in the cyclical and volatile resource space).

With regards to the first 4 companies I mentioned over the last few months; i-80 Gold, Calibre Mining, Karora Resources, and Equinox Gold, let’s get clear on the roadmap here. These are not rocket ships scheduled for liftoff tomorrow, or stories that are going to go ripping higher imminently, like the artificial intelligence stocks or cryptos have been lately. Sure they may get a boost from gold closing the week by putting in a new all-time high on the weekly chart closes, but these are value creation stories that are going to take multiple quarters to play out and show the markets their growth plans are falling into place. These stocks are not yet in momentum, which is good news, because we haven’t missed the big moves higher yet.

These gold producers also can be subject to corrective moves along the way, based on short-term news updates or sector pressure, without it changing the longer-term investing thesis in any substantial way. None of them are perfect, and all companies have some hair or warts. Seeking perfection or no red flags is not the game here, and is an illogical pretext to have in the first place. There is no perfect company to invest in, and the very best sector leaders don’t usually have an attractive valuation for entry.

One could argue that in the gold space, even the very best companies have been pummeled, and they’d be correct that everything is on the clearance rack together. However, with these “growth-oriented” gold producers, we’re looking for companies with significant internal catalysts to propel them up higher from their production growth and resource growth plans. This internal value creation should give these companies more “alpha” compared to their peers, and thus allow them to outperform the majors or GDX as a benchmark, as we move into a better sentiment in the precious metals from present through 2026.

Even though in many areas of the resource stocks I’m personally a more active trader, with this group of companies they are not week-long swing-trades, or even several month position-trades, but rather 1-3 year value investments.

These may not be the right kind of investments for certain readers here, (especially if they are impatient and going to be wringing their hands on every blip along the way). If people want a 1-week lottery ticket speculation in the gold stocks, then jump into an exploration discovery drill play right before they release assays on a new target and roll the dice… There is nothing wrong with that, and I love a nice speculative punt on a drill play. However, that’s not the intent or the purpose of this series on growth-oriented gold producers, as these are for value investors that want to see steady progress and accretion over time.

This should be an obvious point, but one needs to give these companies the necessary time to show the quarter-over-quarter and year-over-year growth for goodness sake. Some people have written in to me, freaking out about the temporary moves lower in these stocks or last quarter’s results, when the growth plans haven’t even begun yet in most of them.

The thesis with this type of value investing is about positioning in front of the future growth before the rerating happens and before that gets factored in by consensus at a later date. Most of these companies have internal growth projects underway that take at least a year or two to play out, and for the results to start being reflected in their future metrics. Investors are so quick to rush to judgement on each quarterly report or each news release, extrapolating the past results out to infinity, without keeping their vision on where things are actually going in the bigger picture.

These things are like an oil tanker changing course in the deep ocean, where it takes a lot of effort and energy to start the process of turning the ship around, and it seems like nothing or little is happening at first. Then a little more progress is seen, and then finally as the massive ship adjusts to a new route, and starts heading that new direction, it seems more effortless and builds up so much momentum and force behind it, that it is hard to slow it down from the new course charted.

Many investors do not have the personal fortitude forged from strong belief in their stock selection, just jumping into many stocks on a whim or hot tip, versus doing their own deep dive into a company. Additionally, they lack the emotional maturity to sit in a company that is presently treading water, or worse, going through a correction, while the longer-term growth thesis still well intact because their line of vision is only limited to what just happened or what is happening today.

Value investing opportunities are not imminent or obvious to most drive-by speculators, because it requires having a vision of where the future is headed by doing research. When most investors see the red paper losses on their trading account screen, they end up reacting emotionally instead of rationally, filled with fear, uncertainty, and doubt (FUD). People’s minds jump right to thinking something is wrong, and so they often sabotage their longer-term investing thesis at precisely the wrong times (corrective moves), due to what really equates to short-term turbulence and noise.

In the case of all these companies already discussed, or yet to discuss…. I think it is important to outline key concepts like one’s investing time horizons, setting reasonable expectations and targets, reviewing the potential risks to the thesis, and keeping focused on the coming milestones over the next 1-3 years that will transform these companies, and likely their valuations. We don’t have time to get into all of those things in every company in this article, but suffice to say, many comments I receive in are investors raising concerns because of what happened over a several day or several week period of time, without keeping their eye on the prize and the main thing – the coming growth in production and improvement in extracting economic ounces.

- One should consider why they are buying any stock or ETF, what the investing thesis is, and how high the pricing target or valuation could reasonably move on this trade.

- One should consider how long (time-horizon) they think this will realistically take to play out and then not get spooked out of the trade if the stock corrects at different periods during that timeline; nor should one sell too soon if the stock rockets higher earlier than anticipated when most of the thesis has still not played out.

- One should identify before even placing the trade what milestones or data they will be looking for to see if the investing thesis is playing out as anticipated, and if they haven’t happened yet, then it makes little logical sense to dither over short-term gyrations in the share price.

- One should also consider what risks should be anticipated ahead of time (delays in operations or permitting, missed production guidance, cost increases, cost overruns, exploration targets that don’t hit, etc…) and then decide ahead of time how they will react if those happen, instead of panic selling in an emotional episode with the rest of the herd.

It is also impossible to proceed with any of this analysis on gold companies without acknowledging the really poor sector sentiment we have been in the last few years and are still in at present time. That sour sector sentiment is causing the vast majority of company newsflow, [yes, even the very good company newsflow], to be disregarded and the shares to keep sliding downwards regardless of the value creation on display.

Just because a company is sold off after putting out more drill news, or resource news, or operations numbers, or future guidance, does not mean all that news was bad, and it is usually quite nuanced and must be parsed accordingly. Over time we as investors need to look at both the pros and cons inside of news, and not freak out if there are some challenges embedded if the company has a plan and strategy around overcoming them, or get into the mindset that of assuming everything is a red flag and running for the exits every time there is a setback. These companies are slow-moving entities, that have all kinds of turbulence in the short-term, as they continue to make progress on the longer-term journey.

Now sometimes there legitimately is bad news, that may affect a company for a period of time, and you’ll know it when you see the fishing line selloffs, and that is a different kettle of fish. We’ve got a great example of that to share and review in those regards in the upcoming part 5B. It is important to note though, that the market loves to overreact to both the upside and downside, and this can create opportunities for those savvy investors paying attention to accumulate into weakness.

Alright, so with those points in mind, and with the proper mindset for the time horizons necessary for an investing thesis to play out, then let’s review some of the recent news from the first four companies we’ve been looking at objectively; irrespective of the recent trend in share prices that whole sector and related ETFs have been seeing.

With regards to i-80 Gold, let’s just take a look at all the news this year from the drill bit from multiple targets in their stable of projects.

i-80 Gold Announces High-Grade Results from Hilltop Drilling at Ruby Hill

January 17, 2024

- East Hilltop Zone – 9.5% Zn, 0.3% Cu & 12.6 g/t Ag over 114.3 m incl. 17.7% Zn, 0.4% Cu & 10.2 g/t Ag over 36.6 meters

- Upper Hilltop Zone - 2.1 g/t Au, 514.8 g/t Ag, 3.1% Zn & 23.4% Pb over 10.0 meters

- Upper Hilltop Zone - 0.6 g/t Au, 332.9 g/t Ag, 8.8% Zn & 18.8% Pb over 32.0 meters

https://www.i80gold.com/i-80-gold-announces-high-grade-results-from-hilltop-drilling-at-ruby-hill/

i-80 Gold Reports High-Grade Drill Results from the FAD Deposit at Ruby Hill

January 25, 2024

- 9.0 g/t Au, 92.4 g/t Ag, 12.2 % Zn & 1.0 % Pb over 14.6 meters

- 3.9 g/t Au, 185.6 g/t Ag, 11.1 % Zn, & 3.6% Pb over 25.4 meters

i-80 Gold Announces High-Grade Drill Results from Granite Creek

February 7, 2024

- Highlights 28.1 g/t Au over 4.4 meters, 10.6 g/t Au over 9.4 meters & 13.6 g/t Au over 5.2 meters

https://www.i80gold.com/i-80-gold-announces-high-grade-drill-results-from-granite-creek/

i-80 Gold Announces High-Grade Results from Underground Drilling at Cove

February 13, 2024

- Results from the Helen Zone Include 14.4 g/t Au over 20.2 m, 12.7 g/t Au over 24.4 m and 14.3 g/t Au over 8.0 m

https://www.i80gold.com/i-80-gold-announces-high-grade-results-from-underground-drilling-at-cove-3/

There were plenty of stellar exploration results in these press releases above, that any individual drill play explorer would be doing cartwheels in the aisles if they were able to release anything close to similar results. However, the company’s share price continued to slide lower and lower, sometimes even selling down on the day or day after the great news hit the market.

- Does that make any logical sense? (No)

- Does it mean the drill results weren’t exemplary? (No)

- Does it mean the projects are not working out as anticipated? (No)

- Well… Then why in the world did the share price keep selling off after a string of juicy drill results from Hilltop/Ruby Hill, FAD, Granite Creek, and Cove? (2 words – sentiment & money)

The sentiment in the sector has created an environment where it doesn’t matter if the drill results are consistently good (or even great in some of those intersections above), because the whole sector is in a “sell the news” mode when liquidity shows up. ETFs are being sold, regardless of the internal newsflow in the companies they have in their portfolios. Sour sentiment has investors questioning everything they think they know about what good results are, and assuming something must be wrong. None of that makes logical sense, but as the old saying goes, “The markets can stay irrational longer than you can stay solvent”.

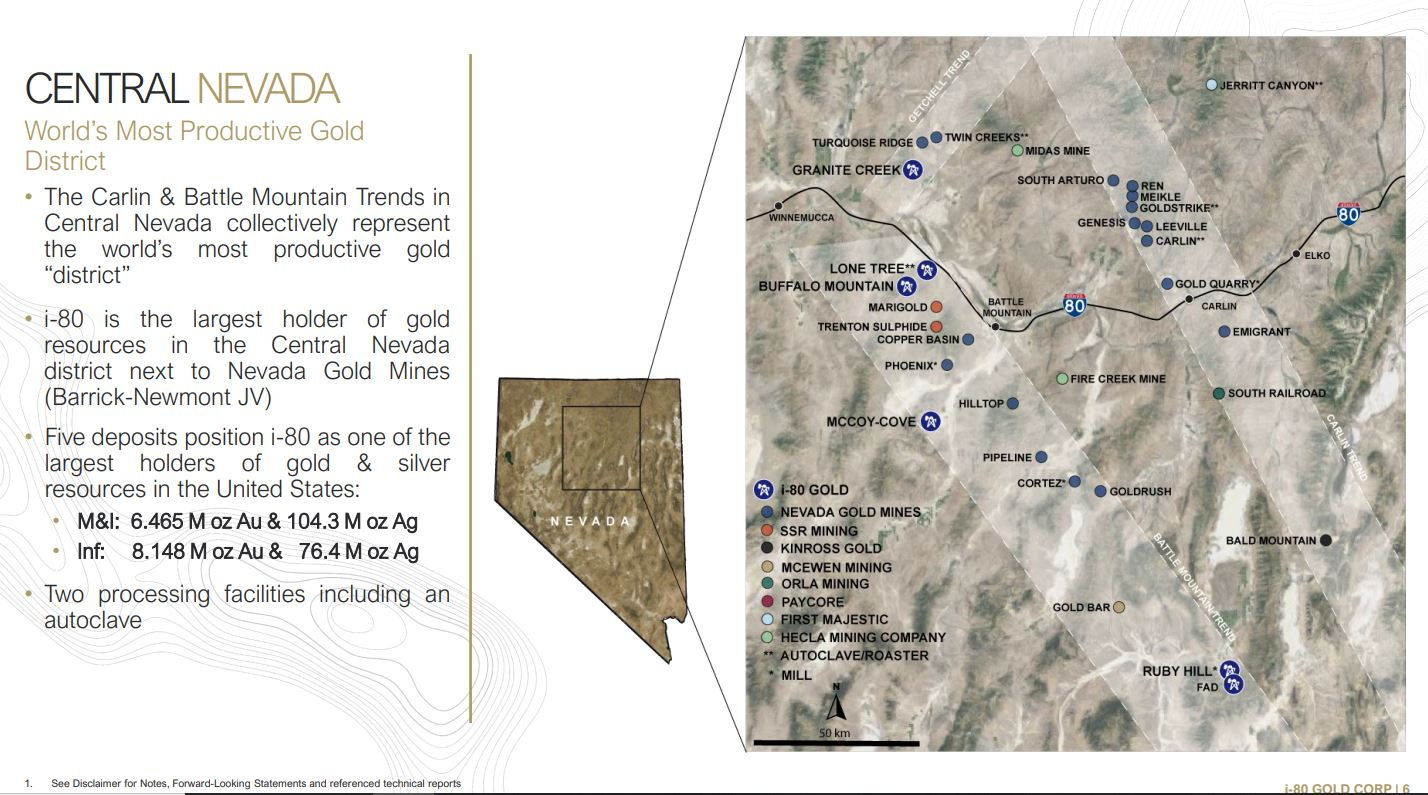

Speaking of solvency, the other wet blanket holding i-80 down is the financial side of their equation. Investors know they have capital needs to pay for projects, pay for drilling, pay for salaries, and to fund the work to keep derisking their 3 gold projects and larger polymetallic project for their master plan to come together. While there are some revenues starting to come in from the initial mining of Granite Creek, and their ore selling agreement with Nevada Gold Mines, it is still smaller scale production at this point and not nearly enough to fund all the initiatives going on.

So the market has shrugged off positive news story after another from an exploration team that has been hitting it out of the park in Nevada at all the projects, because they want to know about where the money is going to come from.

Well, as the company has press released on November 7th, and as CEO Ewan Downie has discussed multiple times now on multiple platforms (including with me over at the KE Report), they have a key announcement coming in the 2nd quarter with regards to a strategic partner on Ruby Hill. The Company has “entered into a non-binding term sheet in connection with a potential joint venture with an arm’s length third party pursuant to which such potential partner will acquire a minority interest in the Company’s Ruby Hill Property…”

This is where the larger money is coming from, and yet it seems the market is totally asleep on this or what this minority interest will do to bring in capital that is not equity dilutive, but alas, we’ll need to wait until there is an official announcement in a couple of months to know how much capital it will infuse the company with.

i-80 Gold Signs Non-Binding Term Sheet for the Joint Venture of the Ruby Hill Property

7 Nov 2023

In the interim, there was private placement announced last week, that is dilutive, and does raise $23.5 million to keep the wheels spinning, and of course, the market snarled and hissed at this, but it was oversubscribed and biggie-sized from the initial $18 million announced, and unlike most other companies, i-80 showed it still had access and interest from the capital markets to fund this growth story.

i-80 Gold Announces Closing of Oversubscribed Non-Brokered Private Placement

21 Feb 2024

- The Private Placement was oversubscribed due to strong investor demand, and the Company raised gross proceeds of C$21,580,567.20 through the issuance of 11,989,204 common shares at a price of C$1.80 per Common Share.

- In addition, the Company has also received subscription agreements to purchase an additional 1,075,000 Common Shares under the Private Placement for additional gross proceeds of C$1,935,000

- Upon closing of these subsequent tranches, the Company expects to raise aggregate gross proceeds of C$23,515,567 under the Private Placement.

The shares closed on Wednesday 02-28-2024 at $1.68 ($0.12 below where the private placement is being done), and after shrugging off yet another press release with more substantial drill intercepts from Ruby Hill. However, by Friday’s close at $1.82 the market took up the shareprice to just above where the capital raise took place, as gold closed the week at a new all-time high in US markets.

i-80 Gold Provides High-Grade Results from Drilling at Ruby Hill

February 26, 2024

- 13.7% Zn, 0.6% Cu, 17.5 g/t Ag Over 57.8 meters

https://www.i80gold.com/i-80-gold-provides-high-grade-results-from-drilling-at-ruby-hill/

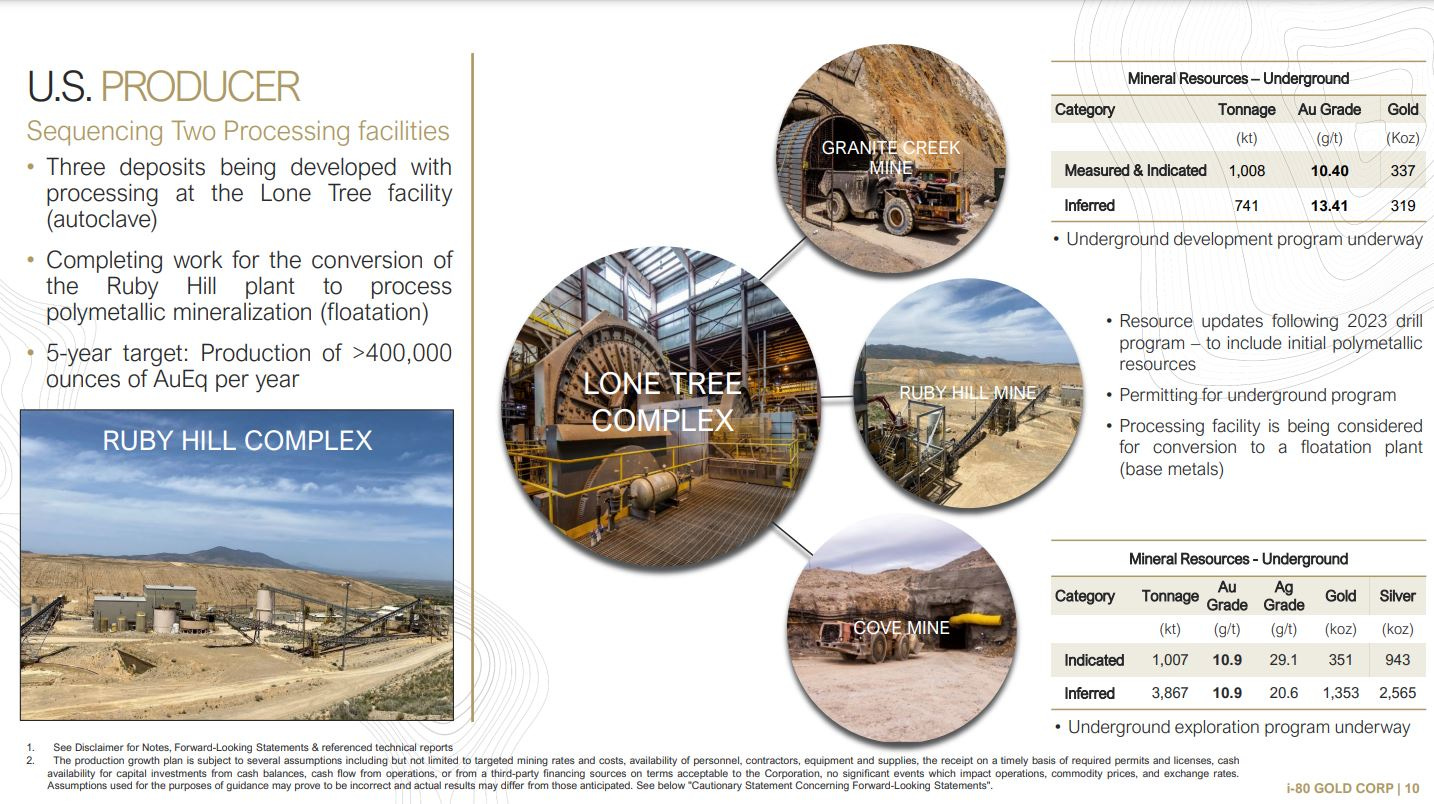

So summing it up with i-80 Gold, we’ve seen nothing but stellar exploration results over and over again all of this year, and really for the last 2+ years. The company has been clear about it’s production growth targets to go from 50,000 ounces this year, to 100,000 ounces next year, to 200,000 ounces – 400,000 ounces by 2026-2028 timeframe (conditional upon moving all 3 gold deposits into production at their fully built and permitted autoclave, in concert with retrofitting the Ruby Hill processing center to handle the polymetallic zinc, copper, lead, silver, and gold from their polymetallic project consisting of Hilltop, Blackjack, and FAD). Please show me some other companies that are going to be growing their production exponentially like that over the next 4 years, because I want to buy them too.

As we reviewed earlier — let’s look at this realistically, look at the milestones to still hit, and assess the risks to all of these stated goals and thus the investing thesis.

- They need to keep exploring at all their projects to show continuity in the ore bodies, and that resources, and eventually reserves, have grown to the right size to make them economic to extract. They’ve been delivering in this department, and there are resource updates slated for later this year that will offer more clarity there.

- Towards the end of this year they are supposed to transition to mining from the new South Pacific Zone, (only discovered over the last 2 years). Because the mining industry traditionally is behind schedule, I’ve moved my expectations to 2025 for first mining from here increasing production from the Granite Creek Project. They still have to execute on that plan, so it is an ongoing risk where problems can still crop up. This additional ore, along with possibly a little gold ore from Ruby Hill is supposed to get the company up to 100,000 ounces of production next year. We’ll reevaluate next year at that time, but the market sure is pricing in zero success for growth at this point.

- We don’t have clarity yet on who the strategic partner is, that wants a minority stake in the polymetallic project. We don’t know what the capital infusion will be, and there is always the risk that the deal doesn’t come to fruition. If it doesn’t work out, that would be a real sucker punch to investors, but the management team feels very confident that things are moving the right direction. Again, the market isn’t factoring this in at all when they rake the company over the hot coals for their future capital needs. This is an unseen value driver (hiding in plain sight), that may provide a boost when more concrete details are announced later in Q2. Ewan has messaged that this money will be focused mainly at Ruby Hill to explore and retrofit the processing center there, but it will also be a boon to the gold development portion of Ruby Hill, and that point also seems lost on most investors where this topic is concerned.

- The biggest risk I see is around the capital that will be needed (maybe through debt/royalty/equity combined in a capital stack) to fund the restart of the autoclave at their Lone Tree Processing Center, and the funding for underground development to start sourcing ore from Granite Creek, Ruby Hill, and Cove all in tandem. This is what will propel the company up to 200,000+ ounces of production per year level. I think 2026 is likely a stretch, but possible. Assuming that everything always takes longer and costs more than most companies think, then my personal investing thesis is that a more reasonable target for this milestone is by 2027. So that is 3 years out from here.

With all of this under consideration, I find it strange that investors keep asking “What is going on with i-80? or What is wrong with i-80?” (Nothing really… it requires more time, more capital, and better sector sentiment)

The team at i-80 Gold has been doing an excellent job exploring and yet getting absolutely no credit for it. They are going to update their resources later this year, and they will definitely be bigger than the 14.5 million ounces of gold and 180 million ounces of silver they already have defined, (which already underpin the market cap of the company as it stands…. As does the Lone Tree Processing Center… not to mention the Ruby Hill processing center).

Yes, they need more money, but they’ve shown they have access to capital in this tough market, and again, the strategic partnership on the polymetallic project is going to be bringing in some capital. If the master plan is still 3 years out to really kick their production up into high gear, then why are so many investors shaking in their boots here at this point in the journey, and selling off the stock and worrying about the price action in early 2024?

If one really has a 3-year time horizon here, then this price action is depressing, yes, but totally misses the vision of where things are headed, providing things unfold according to plan. Even if metals prices stay where they are at $2,000 gold, then this company is vastly undervalued here at present. I’m in it for a 3-bagger from these pricing levels personally… that is my target and I’m giving myself 3 years to make 300% gains. (those are my personal goals and not investing advice, nor a recommendation to follow my actions. Any mining stock can go all the way to $0 and there are tons of risks in exploration, development, and production). I’m just illustrating the point of having a target and thesis and giving it the time to play out. If some believe we’ll see higher gold prices in the next few years, then think about that optionality as icing on the cake and a multiplier effect.

Wow, I really blew my wad there on the i-80 Gold portion of this article, because it’s particular journey the last year or so, combined with investor reactions in this poor sentiment backdrop, really illustrated a number of the points addressed at the onset of this article.

It was at this point that I realized we’re going to need to break this into 2 parts, and I’ll have to streamline the rest of this piece and just do a cursory glance at the other companies like Karora Resource, Calibre Mining, and Equinox Gold, to have room to unpack the contrarian investment thesis presenting itself with growth-oriented producer #5.

Thanks for reading and wishing everyone prosperity in their trading and in life. Ever upward!

- Shad