Copper Sector Update – The Good Doctor Is Just Taking A Breather At The Dance

Excelsior Prosperity w/ Shad Marquitz 10-12-2024

It’s been a while since we’ve just focused on the copper price action and related copper equities. There have been some key updates and bigger picture takeaways on the charts for Copper, as well as for the ETFs COPX, COPJ. We noted earlier in the year that Dr. Copper had put on his dancing shoes, and the copper sector did dance up until May of this year. However, it has rolled over some since late spring, but the larger macro trends and charts show that this is likely just the good doctor taking a breath, but the larger dance still has a lot of moves left.

So, let’s get into it…

Let’s kick things off with the outlook for the red metal itself. I’ve actually been busy the last 2 months researching and writing up some articles on the longer-term copper supply and demand fundamentals, in articles that will eventually be featured by Banyan Hill publishing to their Grey Swan Investment Fraternity division. (but no spoilers here) For folks that want to join that community here is the link.

https://banyanhill.com/grey-swan-investment-fraternity/

In this article, we’re not going to get into the myriad of research that is pointing to the massive growth trajectory for copper demand emanating from the energy transition policies around the buildout of renewable energy, or electric vehicle adoption, or the massive infrastructure needed for all the proposed artificial intelligence data centers. There is already a colossal pile of hard data, consolidated research, and demand projections circulating freely in a multitude of publications, for anyone doubting this eventuality to educate themselves on the topic. Anyone that spends the time to dig into this, and does the basic math, will quickly conclude that we are going to need orders of magnitude more copper over the next decade.

I will quickly share that the largest publicly traded base metals mining company, BHP Group Limited (NYSE: BHP), recently released a fantastic summary of the trends they are seeing in both growing demand, and the limited ability for a meaningful supply response from the mining industry, in their research piece put out September 30th: “BHP Insights: How Copper Will Shape Our Future.”

This image below, from the BHP piece linked above, does a good job of highlighting the basic demand growth areas for copper.

Since this channel is focused on resource investing trends, it is more germane for us to review the potential opportunities in the copper equities. However, upon review of the existing crop of aging copper mines, that are continually depleting their reserves through mining, it is clear that they simply cannot increase production in any meaningful way. Some may push their mines even deeper, or look for satellite deposits to supplement mines on their land packages, but many will decide to grow through acquisition of up and coming derisked deposits.

The hitch in the get-along here though is that when we further contrast all this projected demand for this commodity with the actual supply reality from any new mines slated to come online, and the ongoing challenges getting many other copper mines into production; then it is abundantly clear that we have a big supply/demand mismatch setting up for many years into the future.

It is glaringly obvious that the majority of politicians and manufacturers banging on the table for all this technological innovation have spent little to no time actually assessing where all this copper, and a slew of other critical minerals (tin, nickel, silver, cobalt, rare earths, etc…) is going to come from to turn their dreams and initiatives into manifest reality. As I quipped in a recent article for the Grey Swan Investment Fraternity, “The elephant in the room for the energy transition is energy transmission.” People need to wake up from the energy transition dream, and realize it will remain just that… a dream; unless we can source meaningful amounts of the resources from the ground necessary to make those dreams into a physical reality.

Copper is the conduit for all this electricity, and most applications that require copper in power lines, or EV engines, or semiconductor chips simply cannot be practically or easily substituted with other metals like aluminum or silver. So, substitution is clearly off the table. The reality is that we are going to need to see the mining industry produce more and more copper output, but in a backdrop where less and less discoveries are being made, where development costs for new mines have skyrocketed, and where permitting the buildout of new mines has become more and more challenging.

This means that there is huge opportunity for investors to position themselves in the quality copper producers, developers, and explorers that are moving forward with projects of merit in good jurisdictions, that can actually supply the world hungry for more of this critical metal.

Now, to be clear: This is not a tomorrow, or next week, or next month type of trend; but rather one that is going to be ramping up over many years to come. Most investors are actually very near-sighted, suffering from recency bias, and thus they are quite impatient, missing the forest for the trees. This highlights the reality that there are actually few legitimate value investors left in the world – with almost everyone else having become short-term speculators, looking for multi-bagger returns over increasingly shorter time frames. If they don’t see dramatic recent evidence of a trend in motion, then then shrug it off to go chase the next shiny object, piling on with the rest of the herd into whatever the flavor of the month is.

Granted, there are some “investors” in multiple megatrends that have also been many years too early into that given trend. Essentially, that is the same thing as being wrong, due to the opportunity cost of other trends that could have been exploited during that time frame. Still better early than late…

For example, some people (me included) were way too early getting positioned into lithium and uranium equities, even though the evidence was overwhelming that both commodity rises were a “when?” story, not an “if?” story. Sure, many would argue that when the lithium stocks and uranium stocks finally went up 5x, 7x, 10x, 15x, 20x, over the last few years, that it was eventually worth the long wait. To that point, people will do mental gymnastics to amortize out the gains over longer stretches of time to postulate that it was worth the long wait. However, the reality is that it would have been better to have avoided the years of pain, and show up closer to lift-off in those sectors to simply reap the gain. Still… the key is to be in before the megatrend plays out, ideally after the initial shots across the bow have been fired in that sector.

This seems very much like where the copper markets were at over the last decade. CEOs of copper companies and research analysts have been banging on the table for so many years now about the coming copper shortages, but most were way too early with those calls. People got animated multiple times only to see a muted response followed by deep corrections. The last few years though, really since the world changed coming out of the pandemic global shutdowns, has seen a larger realization of the challenges to the supply chain show up in commodities. We’ve also seen a huge policy push into the energy transition, into more EVs, and AI data center buildouts, and so now when the supply constraints are set to finally show up, then it falls on deaf ears with many resource investors.

It is very much like “The Boy Who Cried Wolf” children’s story. People are initially concerned about the wolf, until they hear it cried out from the boy over and over again, only for them to get repeatedly duped. Then when the wolf really does show up, and the boy sounds the alarm, people are apathetic to the warning and the wolf eats up the town. People are caught off guard because they’ve become desensitized to the message or even the eventuality of the wolf showing up.

That’s where the copper market and copper junior resource stocks are today. The demand is set to spike higher in the years to come, precisely when mining supply is set to go sideways to down, and yet the investing townspeople are now in disbelief. Even otherwise savvy thought leaders in the resource space are starting to make ridiculous vocal statements doubting that the supply/demand fundamentals for copper are going to have a meaningful impact on copper prices or copper stock valuations. Of course, nobody knows the precise timing of everything, but the math is the math, and there is a huge mismatch in the fundamental economics of this commodity and sector, that will resolve through an increase in prices and valuations.

With all of that preface laid out, let’s just have a look at some of the key charts in this sector and see what story the price action has been telling those with the eyes to see it. The beauty of charts and looking at price history is that it is the sum total of all fundamentals, narratives, expectations, and buying by all participants.

We’ll kick things off with the chart of copper itself.

If we look at the copper chart over the last decade, we can see where pricing double-bottomed at the $1.94 and $1.97 levels in 2016 and 2020 respectively. Coming out of that 2020 pandemic crash low, we’ve definitely seen Dr. Copper put on his dancing shoes, and shoot up over $5 twice now in both early 2022 to a peak of $5.04, and then again the first 5 months of this year in 2024 up to a peak of $5.20. Those are the highest copper prices we’ve ever seen, and yet some folks are still in utter disbelief that we are starting to see a pricing response to the supply/demand mismatches.

These were very much the 2 first shots across the bow in the copper sector, and yet many market participants are still shrugging those moves off with an Alfred E. Newman “What, me worry?” type of reaction.

If a commodity, or really any market, makes a new all-time high, and then proceeds to do it again in relatively short order to an even higher level, then it should never be dismissed or shrugged off nonchalantly. New all-time highs on a chart is called a clue…

Well, let’s see how the larger copper producers responded over that same time period via the Global X Copper Miners ETF (COPX).

Once again, we saw the copper producers in (COPX) double-bottom in early 2016 and during the pandemic crash of 2020, and then take off like scalded cat. We saw the big surge higher from the $9.62 low of March 2020 shoot up 488% to $46.96 in early 2021 when supply chain concerns dominated the headlines. Then (COPX) popped up even higher in early 2022 to $47.22 on the back of the Ukraine/Russia conflicts. Then earlier this year (COPX) made a clear all-time high in May up to $52.90 as the A.I. awakening started playing out in the US stock markets, and it started dawning on a few folks that “Hey, we’re going to need a lot more copper in the near future.” (Yep…)

It is abundantly clear that that the copper producers had amazing runs the last few years, and they’ve been able to hold onto most of those gains, which shows this move higher has been sticky and lasting. For those of us that were following these trends the last few years, there was plenty of money to be made in the copper producers. Those skeptics standing around scratching their heads, wondering where the market response will start, simply have not been paying attention to what has been playing out on the charts of copper or the copper producers coming out of the changing supply chains, ever since the pandemic global lockdowns.

Again, new all-time highs on any chart should not be casually ignored, and it’s a bell ringing for anyone paying attention. [maybe folks doubting that we are going to see a pricing response in copper and the copper miners have had their bell rung up top too hard, if they can’t see the recent price moves showing up in the prior 2 charts].

Along this line of thinking, where some folks still believe that these copper supply/demand forecasts are overblown: Over at the KE Report, we had an interesting discussion earlier this week with Matt Badiali, Editor of The New Energy Investor published under Mangrove Investor. He joined us to discuss the complexities surrounding the supply and demand of critical minerals like copper, nickel, and tin. The conversation delves into the increasing demand driven by industries such as EVs, A.I., and renewable energy, contrasted with the slow response in mining supply due to outdated systems and social challenges related to mining.

Matt examines the future implications for mineral prices, drawing parallels to past oil market behaviors, and highlights potential investment opportunities in critical minerals, especially in companies with significant deposits and those represented in ETFs.

Matt Badiali - Critical Minerals, Is The Supply/Demand Imbalance Overblown?

Oct 9, 2024

While there is an overwhelming consensus that we are going to continue to see higher copper prices and higher copper producer valuations in the years to come; thus far, the junior copper stocks (developers and explorers) have been sleepier and more sluggish, compared to the copper producers. This may explain some of the disconnect and realization of the move that has been playing out in the copper sector the last few years in both the copper price and the copper senior producers.

Many retail resource investors have a myopic tendency to view everything through the lens of their personal junior picks, while ignoring the larger trends in the sector. We are seeing the exact same thing play out in the gold and silver sector right now, where the metals and seniors have moved, but the juniors have been more muted. This puts an odd sentiment over the copper sector with retail investors pining for higher prices of their portfolio picks, or whining that their juniors haven’t moved yet, but missing the fact that copper and the COPX ETF comprised of the senior copper producers, has already been moving higher for the last 4 years.

It's worth reiterating that it is always the producers that are the first movers when we see a turn in a commodity sector, and it is to them that people should look for clues first. This makes logical sense because the producers can immediately monetize higher metals prices through expanding margins, and that is where the capital flows to first, when there is a turn in any commodity. It doesn’t matter if it is oil, or lithium, or uranium, or gold, or copper; the sector turn and the sector move higher starts in the producers. As noted above, we’ve clearly seen some big 4x-5x surges higher in the senior copper producers since the move began coming out of the spring 2020 pandemic.

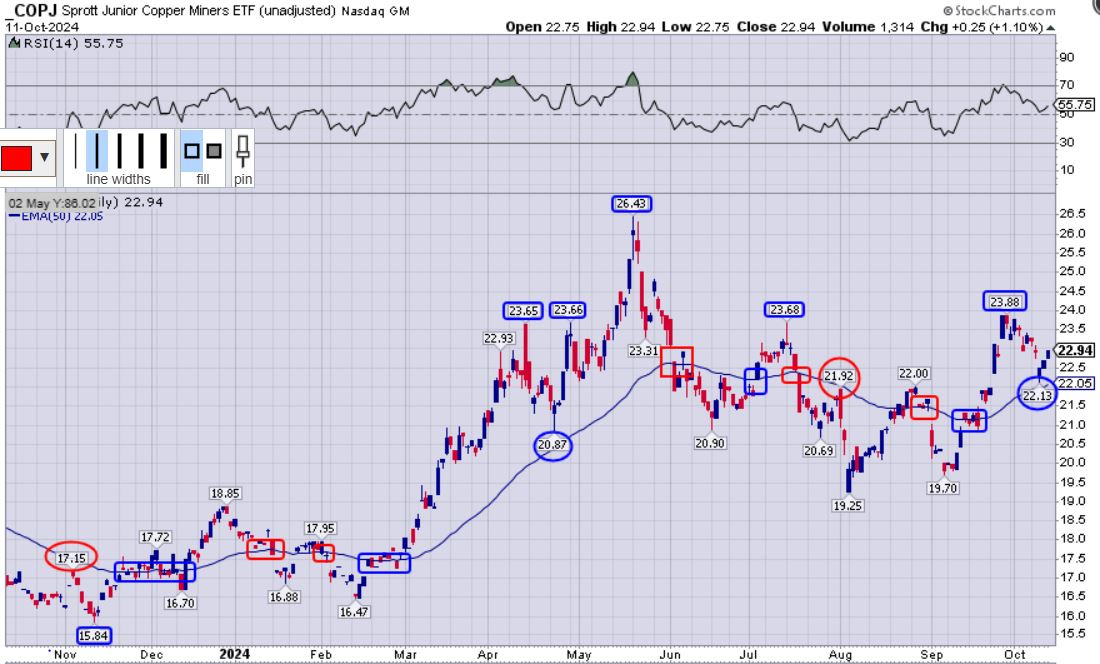

Having said that, there is at least a growing interest over the last 2 years in the quality copper juniors, and there was even a new ETF rolled out about a year and half ago, the Sprott Junior Copper Miners ETF (COPJ). Like many supposedly “junior” ETFs, it still has a makeup of many larger cap stocks, mid-tier and smaller producers, and some of the larger developers; but at least it’s a way of tracking a basket of smaller quality copper stocks, compared to what is found in the (COPX).

Price on this ETF is very reactive to crossing up through or down through the 50-day Exponential Moving Average (EMA), where that crossing can accelerate a move (as noted in the blue bullish rectangles and red bearish rectangles on the COPJ chart above). It has taken a few months for pricing to get decisively back above this level, but the recent break above the 50-day EMA in mid-September kicked off a rally the last few weeks. COPJ bounced near the 50-day EMA earlier this week and then closed up above it this last week to $22.94. Bulls will want to see pricing stay above the 50-day EMA, but a break below it will bring in the 144-day and 200-day EMAs as next support.

Over the last year we can see there was a positive move higher in the (COPJ) coming off the November 2023 lows at $15.84 and moving up nearly 67% to $26.43 in May of 2024. That May peak in (COPJ) coincided with the peak in Copper to $5.20 and the peak in (COPX) to $52.90.

This brings up a larger point: Since May, the copper sector has rolled over a bit and consolidated, but that is a far cry from the larger move being over, or the longer-term thesis being invalidated. Sure, there could still be some prolonged sideways to down basing in Dr. Copper, if we see an economic contraction in the US, or if the Chinese economy continues to wobble. Regardless, most people involved in the copper sector view it as inevitable that we’ll see a $5 handle on copper again to incentivize new copper supply coming online. Many analysts and copper company management teams expect to see a $6-$8 handle on the red metal a few years out. Some longer-term forecasters are even looking at double-digit copper prices by the end of this decade, but let’s take it one step at a time.

If we just see $5-$6 copper prices again in the next year or two, then many copper development projects are going to have numbers that jump off the pages of their economic studies. Explorers that find meaningful copper deposits will continue to be richly rewarded, as the mining industry is hungry for new economic copper deposits. One has to look no further than the trajectory Filo Corp has taken, ever since making a significant copper discovery and building out an attractive resource over the last few years; up until it’s recent takeover by BHP and Lundin Mining, for a 33-bagger move from $1 to $33. Those are the kinds of rewards the resource sector can offer when discovery and development collides with increasing demand.

Filo Receives Court Approval for Plan of Arrangement with BHP and Lundin Mining- Oct 8, 2024

https://filocorp.com/news/filo-receives-court-approval-for-plan-of-arrangeme-122652/

As a result, I’ve personally been getting more interested this year in positioning in the quality copper junior stocks, that have been exploring for and defining what appear to be the next significant copper deposits. We’ll dive into a handful of them in the very next article, set to post later this weekend. (I wanted to include it here with all this other copper information, but there are space limitations to these Substack articles that get emailed out to subscribers). Stay tuned for the next article!

Thanks for reading and may you have prosperity in your trading and in life!

Shad