Opportunities In Growth-Oriented Silver Producers – Part 7

Excelsior Prosperity w/ Shad Marquitz – 03/12/2025

I’m happy to report that we are continuing on with this series on growth-oriented silver producers. With silver pricing punching back up into the low to mid-$30s again for most of 2025, the margins for these companies that are pulling the metal out of the ground and selling it are getting even wider and even more profitable.

Thus far in this series, we’ve reviewed a handful of junior and mid-tier silver producers: Avino Silver and Gold Mines (TSX:ASM – NYSE:ASM) in [Part 1], Guanajuato Silver (TSX.V:GSVR) (OTCQX:GSVRF) in [Part 2], SilverCrest Metals (TSX:SIL) (NYSE:SILV) in [Part 3]… which was recently taken over by Coeur Mining, Impact Silver (TSX.V:IPT – OTCQB:ISVLF) in [Part 4], Sierra Madre Gold and Silver Ltd. (TSXV: SM) (OTCQX: SMDRF) in [Part 5], and then Santacruz Silver Mining Ltd. (TSXV: SCZ) (OTCQB: SCZMF) in [Part 6].

Now it’s time to take another deep dive into a 7th silver mining stock for consideration.

(In full disclosure, I personally have a reasonably heavy weighting inside of my own portfolio in these growth-oriented silver producers that we are covering in this series. I’ve not been commissioned by these companies to write these articles on Substack, but they may sometimes be sponsors over at the KE Report. This is not investment advice, nor am I suggesting that anyone take a position in these stocks. Rather, this is simply an editorial on the value proposition these companies demonstrate to my mind, and why I got positioned in them in my own portfolio.)

As far as investing in junior gold or silver mining stocks, it should be pointed out that this is a risky sector, often having extreme moves to both the upside and downside, compared to the precious metals themselves. Riding these PM equities through bull markets and bear markets is definitely not for the faint of heart, and the stock price action can be wildly volatile. This means that with so much volatility comes multiple waves of price rises and then price declines to potentially capitalize on for either swing-trading or position-trading. This volatility also provides ample opportunities for value investors to accumulate positions for the longer-term, by layering into a position over several buying tranches during pullbacks. This layered approach to scaling into a position, via multiple partial purchases, is a great way to smooth out the volatility, while building a good overall cost-basis over time.

With all of that said, let’s get into it…

In this article we are going to take a deep dive into a 7th silver producer with solid growth on its horizon; Endeavour Silver Corp. (NYSE: EXK) (TSX: EDR). It is odd that it has taken this long to get to this company within this series, because this is a stock I’ve been following for over a decade now and that I have traded dozens of times. This stock is a dual-listed stock, so it has much more liquidity than some of the smaller stocks we’ve covered, and it is featured in a number of ETFs. That makes this more of a household silver name in that sense; and in fairness, I’m trying to mix it up a bit in this series between both the smaller and mid-tier silver producers.

I’ve also been holding back on covering this stock for later in this series, because I wanted to see them make more construction progress on their huge Terronera development project (while watching out for any potential challenges or cost overruns in getting it built). In a press release yesterday, the company announced that the overall project progress at Terronera has reached 89.4%, and is on track for wet commissioning in Q2 of this year (which in mining timelines is just right around the corner). As a result of the progress that has been made on this key flagship project, I feel that now is the time to really dig in to the specifics for Endeavour Silver.

My personal thesis is that there is a multifold rerating setting up in this stock as they increase their production profile in a meaningful way, and lower their costs which will improve future financial results. {This is not investing advice… just my own perceptions and personal investing thesis}.

Let me back up and provide some context as to why I’m personally so bullish on Endeavor Silver to keep having strong share price performance over the next 12-18 months. I’ve been following this company for a long time…(since 2013). 2013-2015 were very volatile years in the PM equities, where one was forced to trade counter-trend rallies in an overall sideways to down market. By late 2015, when most precious metals investors were throwing up their hands in disgust, it was becoming increasingly obvious to people that had been observing the markets for while, that the precious metals sector was getting washed out to the point where either all mining stocks were going out of business or there was going to need to be a tidal shift. I remember in November and December of 2015 joking with fellow posters on the blog that it was “time to hold our noses and buy the stinking stocks in the sector” because surely a rerating was long overdue to more sane valuations.

At that time, I was focused on accumulating the most beat up stocks and higher cost silver producers like Americas Gold & Silver, Endeavour Silver, Santacruz Silver, and in early 2016 I’d also find Impact Silver. The reason I was seeking out the higher cost producers was that those are the companies that have the most margin improvements when metals prices turn, and thus the most upside torque. We actually see that same kind of environment now where the higher-cost producers can really rip, so I have a similar strategy at present.

Well, as anyone that was investing in this sector back at that time vividly remembers, sentiment was terrible, and gold put in its Major Low at $1045, in December of 2015. This marked the end of the precious metals bear market, (right after the Fed started its first rate hikes in over 8 years). The worm finally turned in the PM mining stocks several weeks later on January 19th, 2016. From there we saw a 7-month blistering move higher in most PM stocks through August of 2016.

With Endeavour Silver, that move was essentially a 6-bagger from $1.00 from its Jan 2016 low up to its August 2016 high of $5.95. Not too shabby… granted not as impressive as some tinier junior silver stocks that went up 8x, 10x, or even higher during that epic surge. Still it presented contrarian investors with a better return in 7 months than many generalist investors get in 17 years…

The question is: In a big move up to $50 silver or higher, does (EXK) still have the torque to make another 6-fold move like that from today’s share price level? The truth is that nobody really knows, but it is something that is much more probable with this stock, that will have substantially improving margins, than in many PM equities that people are off chasing that don’t even have any silver in the ground.

Now, let’s back the EXK chart up in time, and get a sense for what is possible on the big impulse moves higher.

We can see that coming out of the Great Financial Crisis lows in late 2008 at $0.80 that EXK did climb up 16-fold to the 2011 peak of $13.10.

For those that remember, that was that was the last big move and blow-off top that we saw in the PM sector in the last cycle; and really it was the final extension of the larger bull cycle move that started back in 2000 or 2001 in precious metals coming out of the Dotcom bubble bursting. I’ve never seen a mania in the PMs like during that period of time coming out of the 2008-2009 G.F.C. It seemed at the time like the financial world was ending, and the narrative behind precious metals had more mass appeal. {In 2008, I was doing insurance, banking, and retirement planning and got so affected by what I saw that I bough my first stacks of silver coins… I wouldn’t find the silver stocks until 2010.}

I’m rehashing that move in EXK because that may have been a special situation where the PM stocks moved up more in a couple years than they typically will. Obviously the GDX, GDXJ, SIL, and SILJ ETFs are nowhere near those price peaks respectively, even today with gold prices vastly higher than the 2011 peak of $1923. However, nobody really knows… some folks believe we may have an even larger financial event than the 2008 G.F.C or the 2020 “pandemic crash”. If someone reading is in that camp, then Endeavour Silver is likely a good stock to hold in one’s portfolio. As as dual-listed silver/gold stock, it will respond to a PM surge.

Speaking of the Pandemic Crash move in 2020, we saw EXK rally from a low of $0.99 up to a high a year later in 2021 to $7.76, so a 7.7x move and almost an 8-bagger.

Then last year we saw a move in EXK off the Feb low of $1.42 up to the October peak at $5.67 for a 4X move.

So, history shows us that Endeavour Silver has had a 16-bagger, then a 6-bagger, then an 8-bagger, and then a 4-bagger, from troughs to peaks on the big sector moves. To have a thesis of more multi-bagger returns is grounded on past results.

Now, at the current shareprice level of $4.52, if silver spikes back up to $50 and (EXK) just goes back up to the $13.10 level it hit the last time Silver hit $50, then it would be 289% gain… so almost a 3-bagger. That seems like a reasonable speculation to me personally.

Having said that, I believe (EXK) could go even higher than $13 this time because Terronera will be in production and the company will have a larger production profile and better costs. This could bring in larger institutions and funds and more ETF buying to where its valuation eclipses anything we’ve seen previously. So maybe it could be a 5-bagger from here in that kind of scenario.

Now before folks turn up their noses at the potential for a 300%-500% gain in a couple years, (just because it isn’t a 10-bagger by next month…) Please keep in mind that there is also an element of safety to a more established silver producer that is still growing. It still has execution risk at getting Terronera ramped up properly, and at it’s other 2 mines, but, it isn’t going to run the risk of not finding any silver like an explorer, or imploding like a tiny junior company still could.

The biggest risk to this thesis is if some major problem rears its head when Endeavour Silver puts Terronera into production or if there is a cost overrun or something is wrong with the resource modeling, etc…. Then the second biggest risk to this thesis is if a larger silver producer took over Endeavour Silver once they get Terronera up and running and this would truncate the potential move higher. If that second scenario plays out, then I’d sell on that takeover news, lock in the gain, and rotate those funds into some other mid-tier silver producer with an element of safety paired with growth.

Alright, this was all a bit of 4D chess on the technical outlook for Endeavour Silver and what could be possible, (at least to my way of thinking), in a bullish silver environment. Let’s now delve into the fundamentals for the company, and look at the 2 currently producing mines, the big mine under construction, and the pipeline of development and exploration projects that will be the future organic growth for the company.

The 2 producing mines, Guanacevi and Bolanitos, have been the backbone of Endeavour Silver for many years, and will remain so this year in 2025. Terronera will still be in ramp-up mode most of this year. So let’s quickly review both of these mines that are generating the revenues at present.

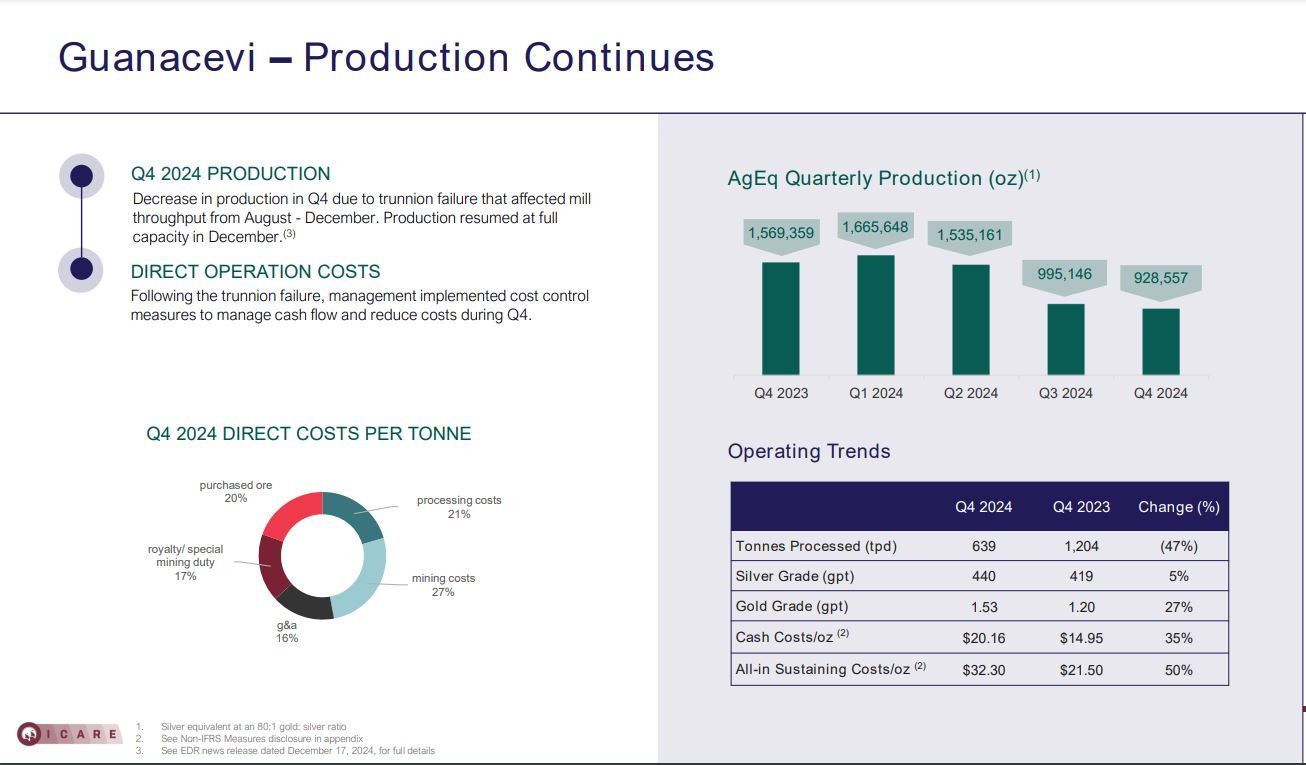

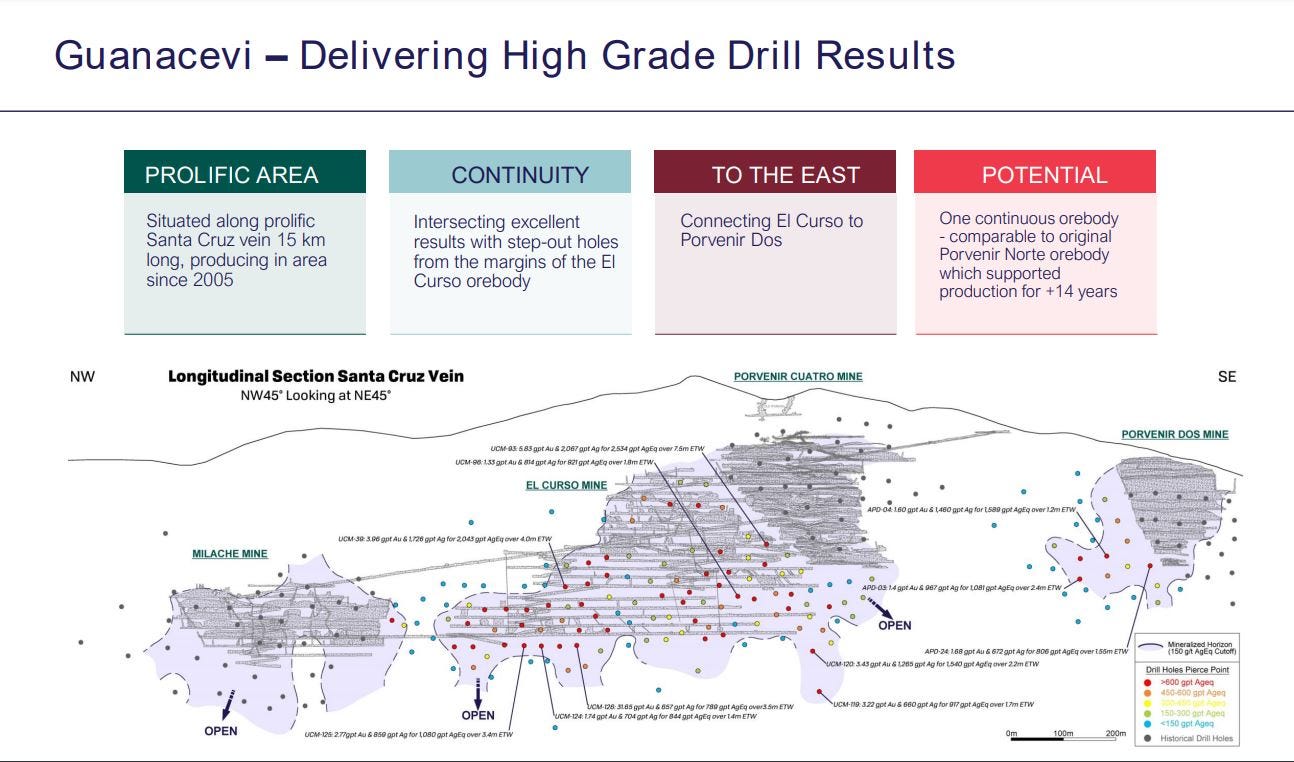

Guanacevi has been a good workhorse for the company for a long time, and is producing around 1 million silver equivalent ounces per quarter. The All-In Sustaining Costs at$32.30 in Q4 2024 were really high compared to most of the industry, and were up substantially over 2023; but there were challenges at the mine and equipment refurbishment costs. I’d assume that the AISC will be back down in the mid $20’s again in 2025, so they may not be getting credit for that yet.

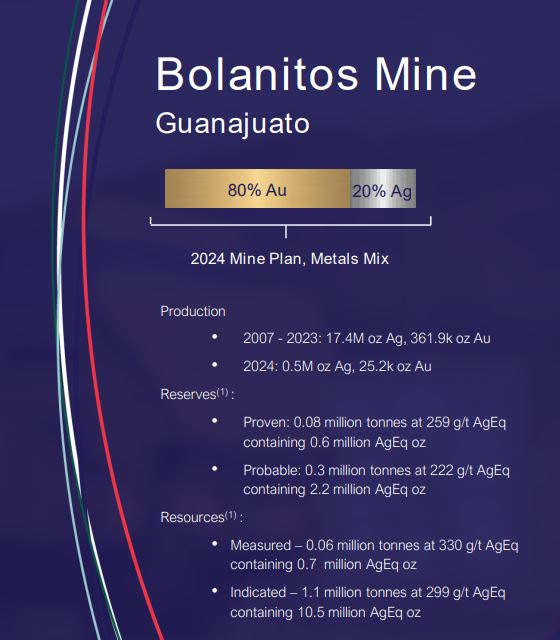

Bolanitos is really providing more torque to gold at present than silver, with an 80%/20% exposure to both precious metals respectively.

Last year 500,000 ounces of silver and 25,200 ounces of gold were produced from Bolanitos.

There are still ample reserves for mining, and resources for expansion at this mine, to continue feeding the beast for years to come.

The company just released its Q4 operations and financials to the market yesterday, on March 11, 20204 and they came out strong.

Endeavour Silver Announces Q4 2024 Financial Results

Production hit the higher end of the revised guidance of 7.3 to 7.6 million AgEq oz produced

Revenue of $217.6 million, from the sale of 4,645,574 oz of silver and 38,522 oz of gold at average realized prices of $27.39 per oz silver and $2,397 per oz gold.

$72.3 million in mine operating cash flow before taxes , compared to $64.4 million in 2023

adjusted net earnings of $8.0 million or earnings of $0.03 per share after excluding loss on derivative contracts

Cash position of $106.4 million and working capital of $78.8 million.

https://edrsilver.com/news-media/news/endeavour-silver-announces-q4-2024-financial-resul-9978/

Now let’s have a look at why the Terronera project will be such a game-changer for the company as it nears completion next quarter.

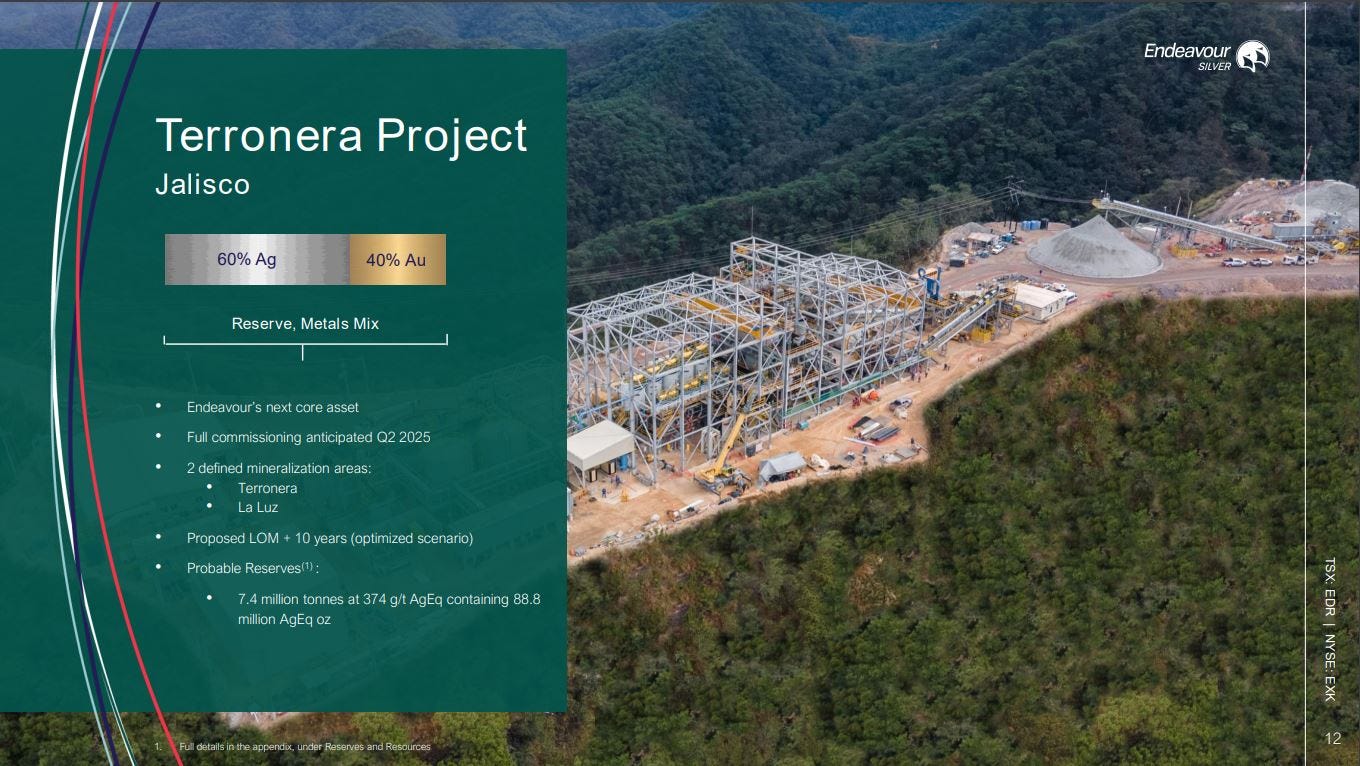

Terronera is the current flagship development project for the company, with reserves of over 88 million silver equivalent ounces, and a 60%/40% split between silver and gold.

There is currently a 10-year life of mine at Terronera.

The commissioning is slated to kick off in Q2 of 2025, so over the next few months we’ll be getting more news to that effect as to just how on track the operations are. This is an exciting point in time for this company’s future.

In a nutshell, Terronera will double the overall company production profile, taking it from 7 million silver equivalent ounces per year last year in 2024, and bolting on another 7 million silver equivalent ounces – taking things up to 14 million ounce of AgEq per year when running at full capacity. Keep in mind that 2025 is going to be a partial production year as things ramp up, so I’m not expecting to see that kind of production profile until 2026 and beyond.

The costs are very attractive at Terronera - negative cash costs of -$0.20 on an AgEq basis, and All-In Sustaining Costs slated to come in around $2.15 per AgEq ounce once up and running at nameplate capacity. This will lower global costs.

The latest update, from news out on March 11, 2025 was that construction of Terronera is now 89% complete. It is nice to see how advanced things have become on the ground at this project.

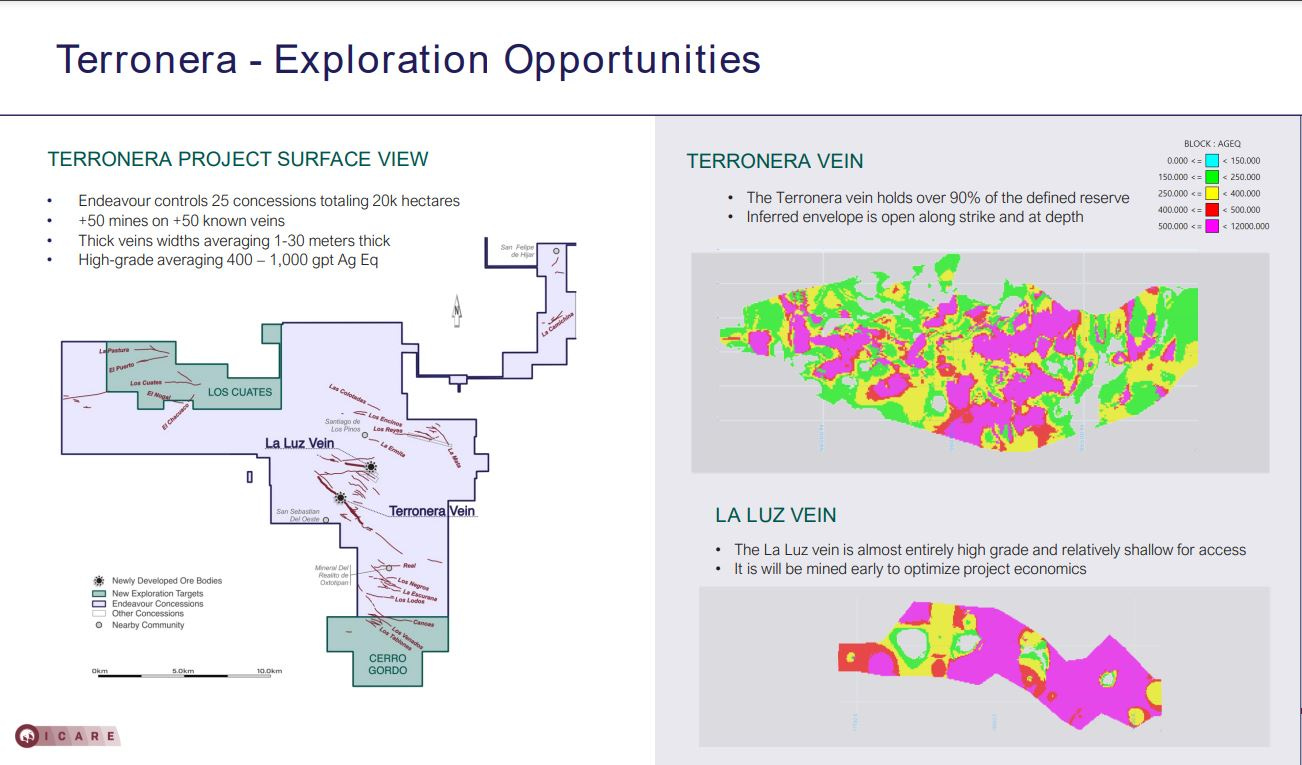

Another aspect of growth for Endeavour Silver, beyond just the production and revenue growth, is the massive potential at Terronera to keep expanding the resources through exploration. This is a big project, with big resources, to there is still big upside here if they can plow organic revenues back into the drill bit.

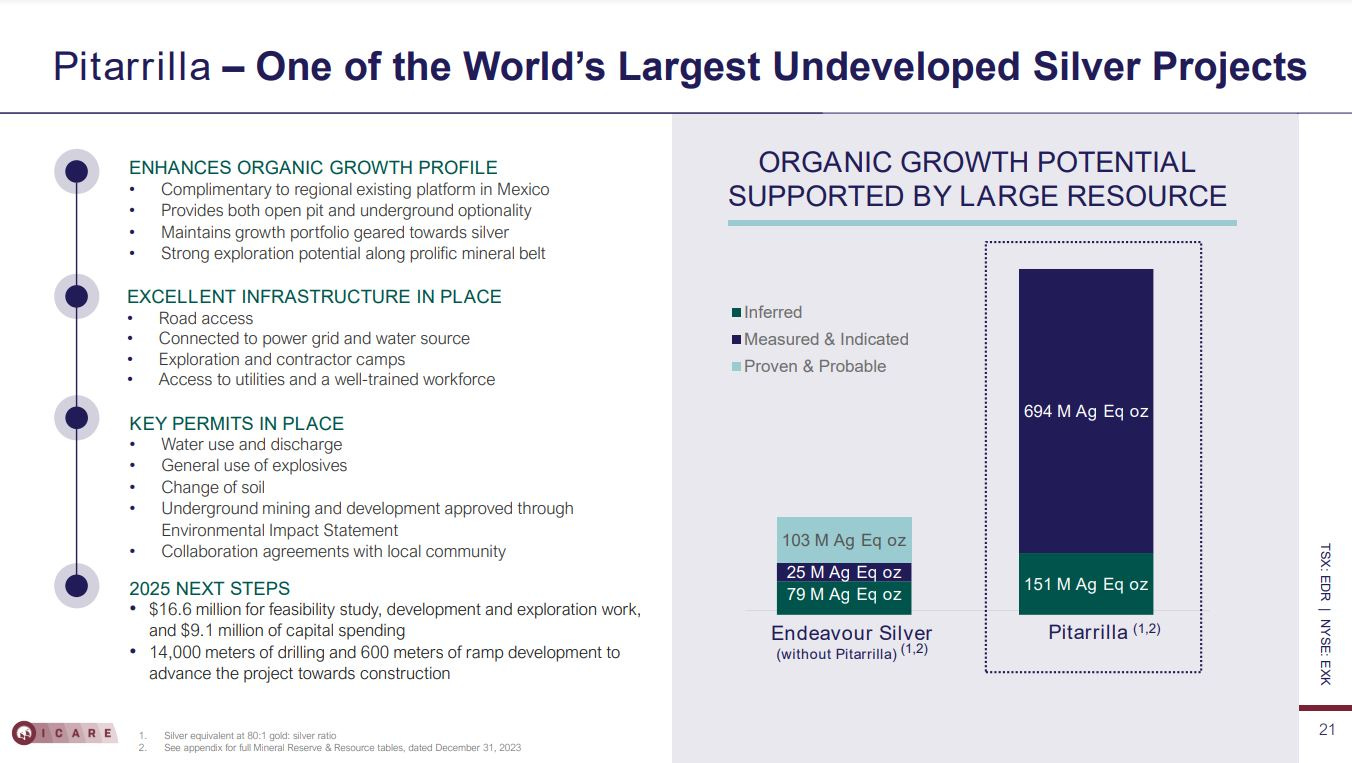

In addition to the exploration upside at Terronera, the company also has a healthy pipeline of exploration and development projects that will be the future growth of the company. Let’s have a look at Pitarrilla, where the company has defined a simply huge silver project for their next mine build.

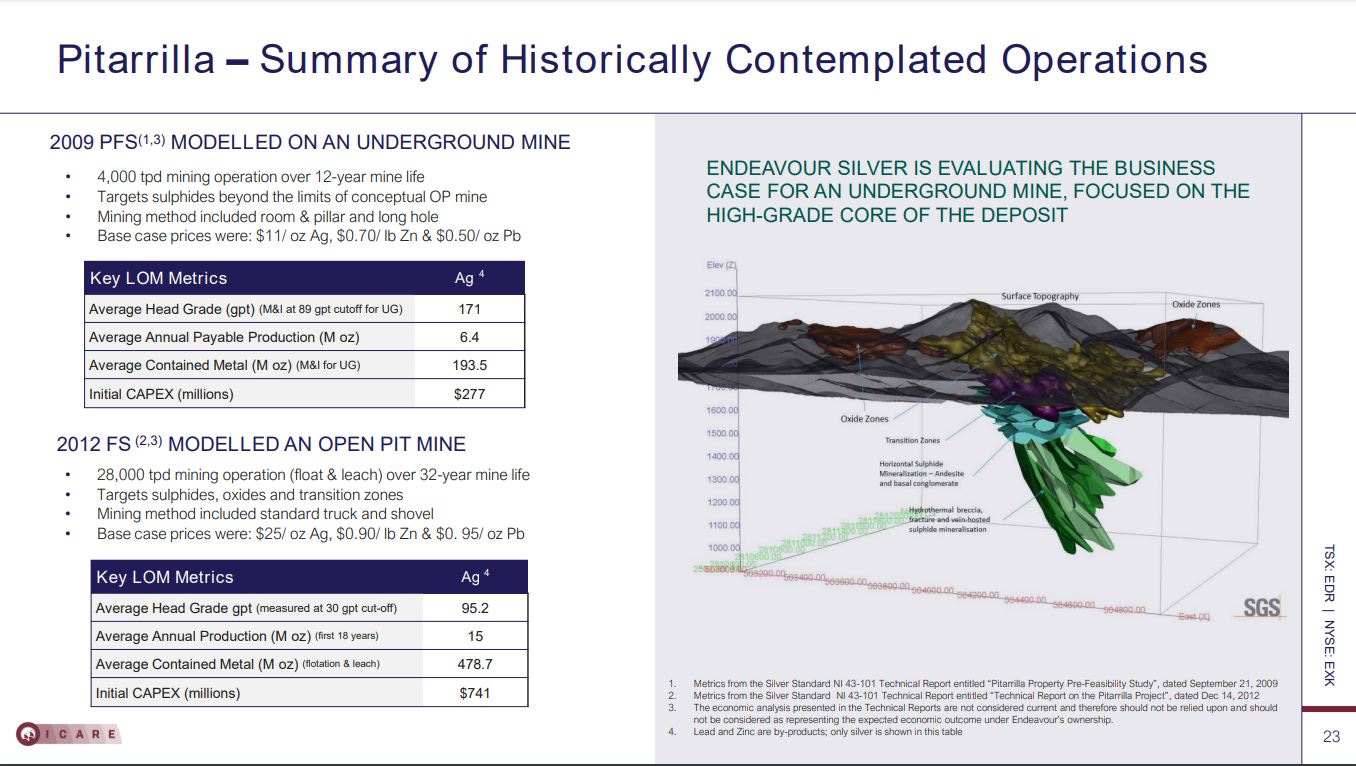

This Pitarrilla Project does have 2 historic economics studies, reviewing both a Pre-Feasibility Study on an underground mining scenario and a Feasibility Study on an open pit mining scenario. Clearly, at this point, those capex costs, base case metals assumptions, and specifics are well out-of-date and will have to be totally reworked. Also, there is still the lingering concerns on open pit mining in Mexico, so maybe they’ll opt for the underground option. The company is working towards putting out a Feasibility Study this year, so we’ll know much more about how it shakes out soon enough. The project is going to be substantial either way. For now, it is instructive to review the basic assumptions from those prior reports on the grades, production profile, and general approaches considered.

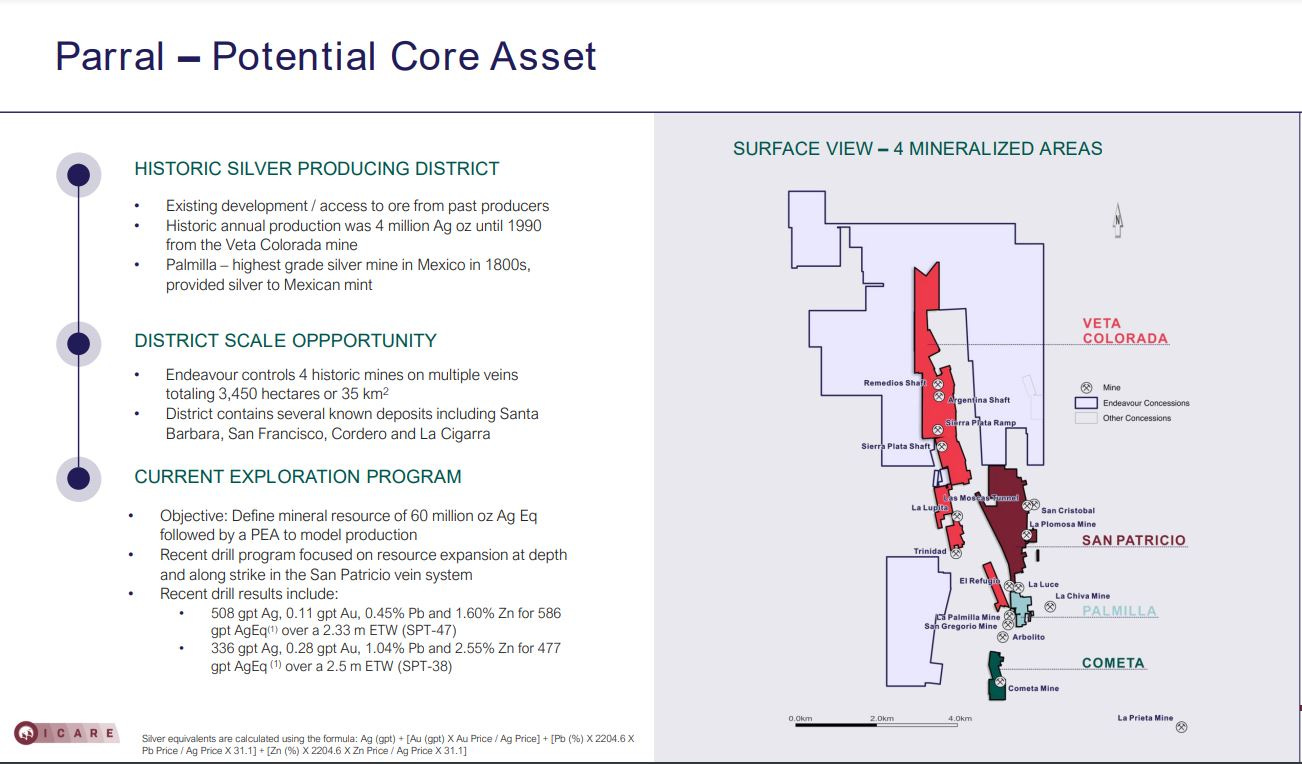

Lastly we should mention that waiting in the wings after Pitarrilla is the Parral Project, that the company picked up from SSR Mining almost a decade ago.

Over at the KE Report, we used to bring the prior CEO, the late great Brad Cooke, on the show and sometimes we would all just chat for a bit before recording an episode. Brad was always genuinely excited at the potential for Parral to be a nice supplementary contributor to the company’s development initiatives down the road. It’s no Terronera or Pitarrilla, but still it could be a nice silver and base metals mine one day in the company’s portfolio, and also has exploration upside.

Well, that wraps us up for this review of Endeavour Silver as another growth-oriented silver producer.

Thanks for reading and may you have prosperity in your trading and in life!

Shad