Merger and Acquisition Opportunities In The Metals Resource Stocks – Part 4

Excelsior Prosperity w/ Shad Marquitz (09/07/2024)

This particular article is going to be focused on the value proposition present in Skeena Resources Limited (TSX:SKE)(NYSE:SKE), as a prime takeover target for a larger producer to acquire and bring into their development pipeline. We’ll get to that later in this article…

However, this overall series is also about merger and acquisition opportunities, and we’ve unpacked a number of them that were announced both last year and this year. As a result, we must acknowledge the big M&A deal that went down this last week in the silver space, where First Majestic Silver Corp. (NYSE: AG) (TSX: AG) announced that they are going to acquire Gatos Silver (TSX: GATO) (NYSE: GATO).

First Majestic Announces Agreement to Acquire Gatos Silver - 5 Sep 2024

Under the terms of the Definitive Agreement, Gatos shareholders will receive 2.550 common shares of First Majestic for each common share of Gatos held. The consideration implies a total offer value of US$13.49 per common share of Gatos based on the closing price of First Majestic’s common shares on the New York Stock Exchange (the “NYSE”) on September 4, 2024, and represents a 16% premium based on each company’s closing prices and 20-day volume weighted average prices (“VWAP”) on the NYSE ending September 4, 2024. The proposed Transaction implies a total equity value for Gatos of approximately US$970 million. Following completion of the Transaction, existing Gatos shareholders will own approximately 38% of First Majestic shares on a fully-diluted basis.

As readers of this channel will recall, I’ve been a shareholder of Gatos Silver since early 2022, and have discussed this stock in a few prior articles. Two prior articles dealt with precious metals stocks that were diverging from the rest of the sector and outperforming the moves we’ve seen in the underlying metals. In a couple instances we had flagged the steady climb higher that (GATO) had been making on the price chart for the last 2 years, even when many other companies were struggling. Gatos Silver has been more than a 6-bagger from the 2022 low at $2.20 to the 2024 high at $14.45, and has been one of the better preforming stocks in the PM sector for the last couple of years. It’s been a fantastic ride higher, but it has come to an end.

Most recently, in the July 18th article, “Turn-Around Stocks - Snatching Victory From The Jaws Of Defeat,” https://excelsiorprosperity.substack.com/p/turn-around-stocks-snatching-victory I had unpacked the rationale behind scaling into this position during the market carnage from their perceived bad news a couple years back. We had discussed the emotional nature of traders, and that there are often extreme overreactions to news, (both the upside and downside), which can be exploited. In the case of Gatos Silver, it was absolutely an extreme overreaction to the downside in 2022. As a result, I scaled into position for the eventual rerating higher, but now it looks like that chapter is over.

As mentioned in that article: “I decided that this waterfall decline and bottoming and basing valuation was way overdone and started accumulating (NYSE: GATO) in traches throughout 2022 at $2.76, $2.84, $2.92. $2.49, $2.23, $2.54, and $3.16. When I decided to shed some other silver positions, I just kept dumping a few of those funds into GATO for the eventual rerating back up to a more sane valuation. I’ve definitely taken a big chunk of the profits off the table along the way higher, but still have a core position left that is up multi-fold.”

Well…when I saw the news out the middle of this week about the takeover by First Majestic, and the paltry 16% premium, (which is not a very attractive premium on this deal for Gatos shareholders), and then watched (AG) sink on the news, making the takeover premium even less; I decided to ring the register on this trade with my remaining position. Now, it is possible that I’ll miss out if a counter-offer is made by another company to acquire (GATO). After mulling that over, my thought was that there were other compelling risk/reward setups on my radar and on my watchlist. I exited my Gatos Silver position this week to be able to pounce on other deals, because the silver stocks were under pressure across the board.

I reinvested the Gatos Silver proceeds into 2 new positions on Friday: Silver X Mining (TSXV:AGX)(OTCQB:AGXPF), as a growth-oriented silver producer, and got back into Kootenay Silver (TSXV: KTN) (OTC: KOOYF) as a compelling silver explorer.

[yes, both companies will be featured in upcoming articles in their respective series]

This brings up a key point of consideration with M&A deals: They are often the liquidity event and ideal exit from a position, where those funds can then circulate throughout the sector and find their way into new positions. Merger and acquisition deals get investable capital unstuck and moving once again.

With that in mind, let’s continue exploring which companies could be next on the acquisition menu, to be gobbled up by larger producers. Back on July 7th in the article Merger and Acquisition Opportunities In The Metals Resource Stocks – Part 2, it was mentioned that we’d eventually get to a piece on Skeena:

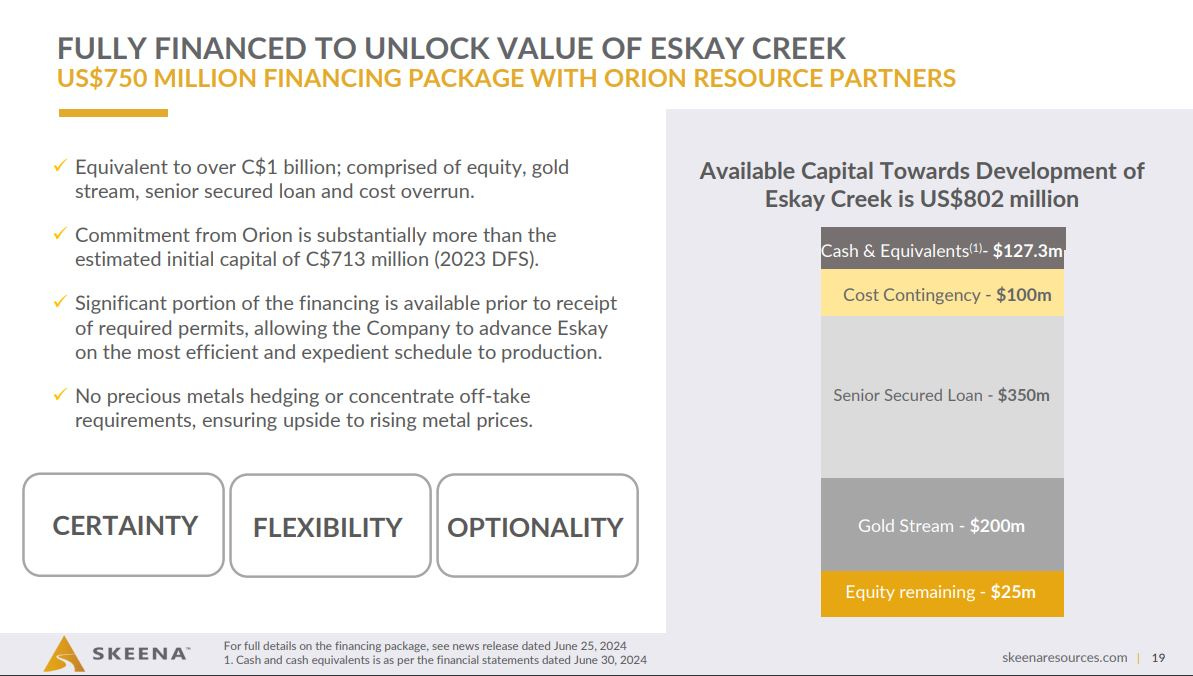

I was actually working on making the next article on “Merger and Acquisition Opportunities” about Skeena Resources (TSX:SKE) (NYSE:SKE), after seeing them release a very attractive US$750 Million Project Financing Package. I had already started writing that article, and wanted to get it out when there was an initial muted reaction to the news release dropping. However, life got in the way, and since then SKE has now shot up higher as more people have digested the good terms in that diversified capital stack. I’ll still highlight some of the key takeaways from that news and more thoughts I have on Skeena as a potential acquisition target in the next article in this series.

Even though I was initially planning to go with Skeena for [Part 2] in this series, at the time there were all those questions around the Silvercorp Metals (TSX: SVM) (NYSE American: SVM) takeover of Adventus Mining (TSXV: ADZN) (OTCQX: ADVZF) that had cropped up. Since the deal was potentially on hold or in danger of not working out, then it had me considering Omai Gold Mines as a good alternate choice for Silvercorp to acquire, should that Adventus deal not go through.

In terms of an update, the deal between Silvercorp and Adventus did finally go through on the last day of July. As a Silvercorp shareholder, I’m just thrilled that (SVM) finally landed an acquisition after 2 previous failed attempts to acquire both Guyana Goldfields and OreCorp.

Silvercorp Completes Acquisition of Adventus – July 31, 2024

https://silvercorpmetals.com/silvercorp-completes-acquisition-of-adventus/

Additionally, I stand by my comments in that prior article where I still think Omai Gold Mines would make another solid acquisition for Silvercorp, or some other larger producer. Over at the KE Report on Friday, I actually just posted an interview with Elaine Ellingham, President and CEO of Omai Gold Mines (TSX.V: OMG) (OTC: OMGGF). Elaine provides an update on all the exploration and derisking work going on at both the Wenot and Gilt Creek Projects across their mineralized gold trend in Guyana, South America. I even floated the idea by her about them being a takeover target…

Omai Gold Mines – Exploration And Development Update On Both The Wenot and Gilt Creek Projects In Guyana

My plan was to run with Skeena Resource for [Part 3] in this series, but then Integra Resources surprised me with the announcement that they were acquiring Florida Canyon Gold. As an Integra Resources shareholder, and prior Argonaut/Florida Canyon Gold shareholder that was too big of news to pass up on. We’d had a few interviews over the KE Report where guests had weighed in on that transaction, and then also had conducted an interview with Jason Kosec, the CEO of Integra. That acquisition deal is still ongoing, and certain days there still are arbitrage opportunities for getting future shares of Integra by way of Florida Canyon Gold. Here’s a link to that article for quick reference:

Merger and Acquisition Opportunities In The Metals Resource Stocks – Part 3

https://excelsiorprosperity.substack.com/p/merger-and-acquisition-opportunities-2fe

A couple of weeks back, I also had a great discussion with my friend and colleague, Erik Wetterling, about recent sector M&A deals. While the whole conversation is very much germane to this article series on merger and acquisitions opportunities, we actually got into the Integra Resources / Florida Canyon Gold deal, so I’ll put a hotlink to that conversation here for readers and listeners.

One of the points we made earlier in that podcast was that companies like Skeena Resources got a solid bid in sympathy with another recent higher profile acquisition of Osisko Mining Inc. (TSX:OSK) (OTC: OBNNF) by Gold Fields Limited (NYSE: GFI) for a 55% premium. We don’t have time in this article to dissect that deal, but a key takeaway is that multiple companies with advanced resources and derisked projects, like Skeena, saw a spike up in their shareprices on the back of that transaction being announced. While a number of companies didn’t have news out that day, they still gapped up and rerated higher in valuations, reflecting on how the ounces in the ground for Osisko Mining were being valued in that transaction with Gold Fields. It is clear that when the market considered what other companies and projects could be next in the field of M&A candidates, that Skeena Resources was one of the companies of focus.

So with all of that said, and before any other M&A deals are announced and interrupt things once again, let’s get into it…

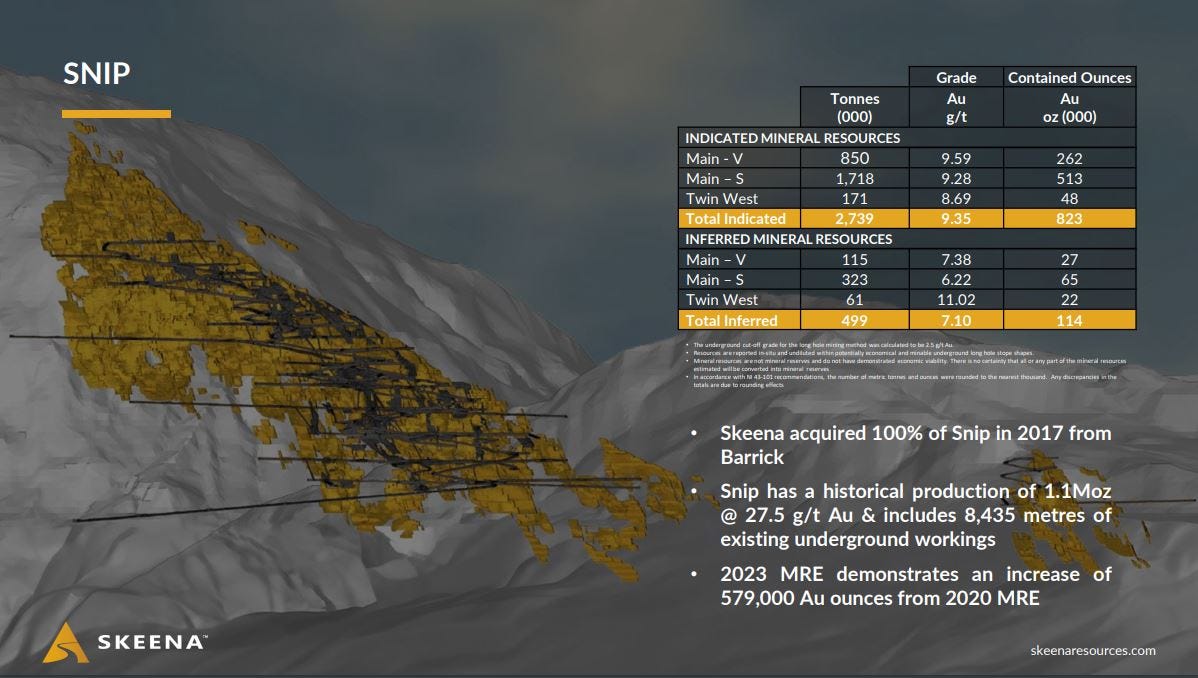

My personal journey with Skeena Resources began in 2016 through a prospect generator named Eros Resources (TSX.V: ERC). They had an outsized weighting in Skeena shares; (if memory serves they had close to $7Million in shares). This was a different kind of back-door exposure to the story, due to their interest in the historic Snipp mine, but it is what got me following the Skeena story.

Skeena had continued to put out a series of drill results in both 2017 and 2018 from both their Snipp and Eskay Creek projects with large double-digit gold grades that seemed really significant to me at the time with lots of 10 g/t, 20 g/t, 40 g/t, and even 90 g/t gold intercepts over 2 meters to up to 40 meters. It wasn’t clear to me how they all tied together, but I could see the team at Skeena consistently hitting paydirt over and over again, and this is something I look for in a post-discovery exploration company = consistency. Any drill play can put out a zesty drill intercept one or two times and wave their arms about it, but when a company just keeps going back to the well and dipping into economic grades/widths over and over again, then the odds are they have found a mineralized deposit of significance.

Then at the tail end of summer in 2018, Skeena put out their initial resource on Eskay Creek. It wasn’t huge, and I think some investors were a bit let down it was still under a million ounces in all categories. In my experience, the first pass at putting out resources is always a sobering moment in a company’s journey, because prior to that market participants have their heads in the clouds with all that “blue-sky upside” and so they almost always have targets way higher than where the resource comes in. Those are times of a bifurcation within investor perceptions, where I like to start scaling into positions. When a company has done really solid work exploring and derisking a project, but then market has a tantrum because it is never good enough for some people, I like those kinds of risk/reward setups a great deal.

Skeena Announces Maiden Resource Estimate for Eskay Creek - September 17, 2018

The pit constrained Indicated resource includes 207,000 gold equivalent ounces within 1.09 million tonnes at an average gold equivalent grade of 5.9 g/t. The pit constrained Inferred resource includes 589,000 ounces within 4.26 million tonnes at an average gold equivalent grade of 4.3 g/t.

https://skeenaresources.com/news/skeena-announces-maiden-resource-estimate-for-eskay-creek/

Well Skeena took it on the chin post MRE, where the stock dropped significantly in later Sept, Oct, Nov, Dec of 2018, and so I took the plunge and scaled into a position and became a Skeena shareholder. At this point I’ve been trading around a core position for the last half-dozen years, increasing and then reducing down the portfolio weighting in this stock, based on the changing cycles within the precious metals complex.

The management and operations team at Skeena Resources has continued to expand the resources and derisk both projects over the years, and fast-forward to today, and they have now grown things to the point where Eskay Creek Project is one of the most solid development-stage precious metals projects on the market today, and Snipp will be a solid contributing satellite deposit. Very importantly, they’ve also recently raised their capital stack to build the project (which was a major milestone), and this has helped the company rerate higher over the last couple of months.

While the current management team at Skeena may opt to still build this project on their own, my investing thesis is that a larger company is going to swoop in over the next 12-18 months and acquire Skeena. Either way, it is a project of significance that is going to become a future producing mine in the heart of the Golden Triangle region, of British Columbia, Canada.

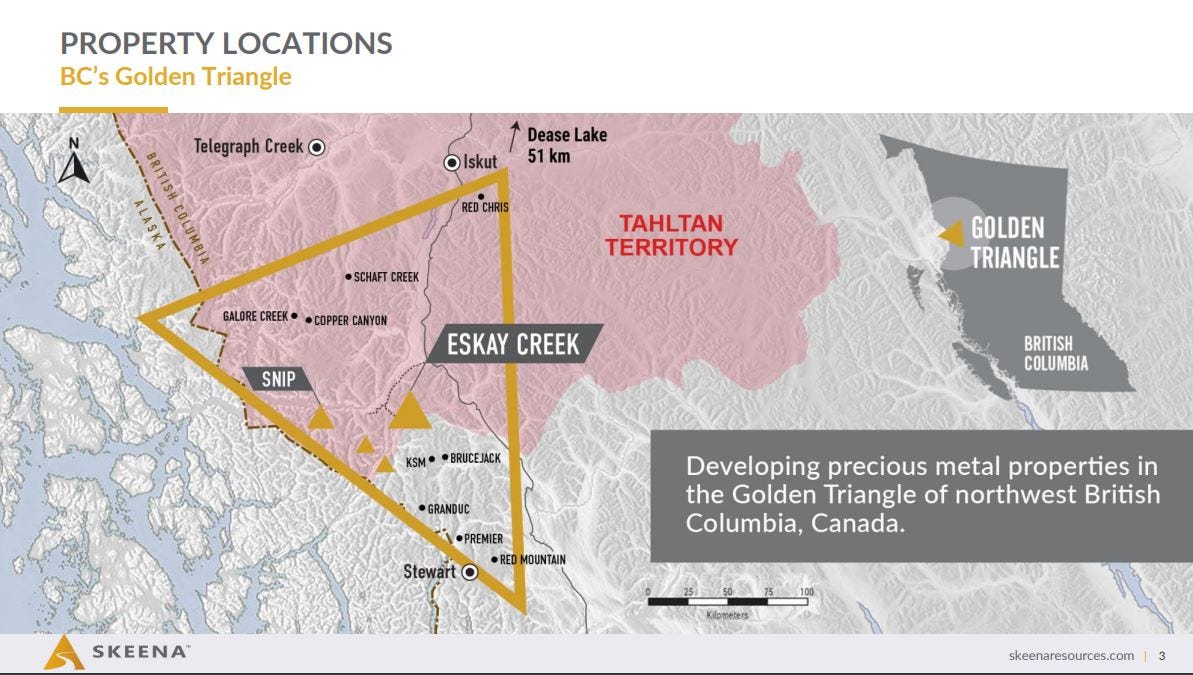

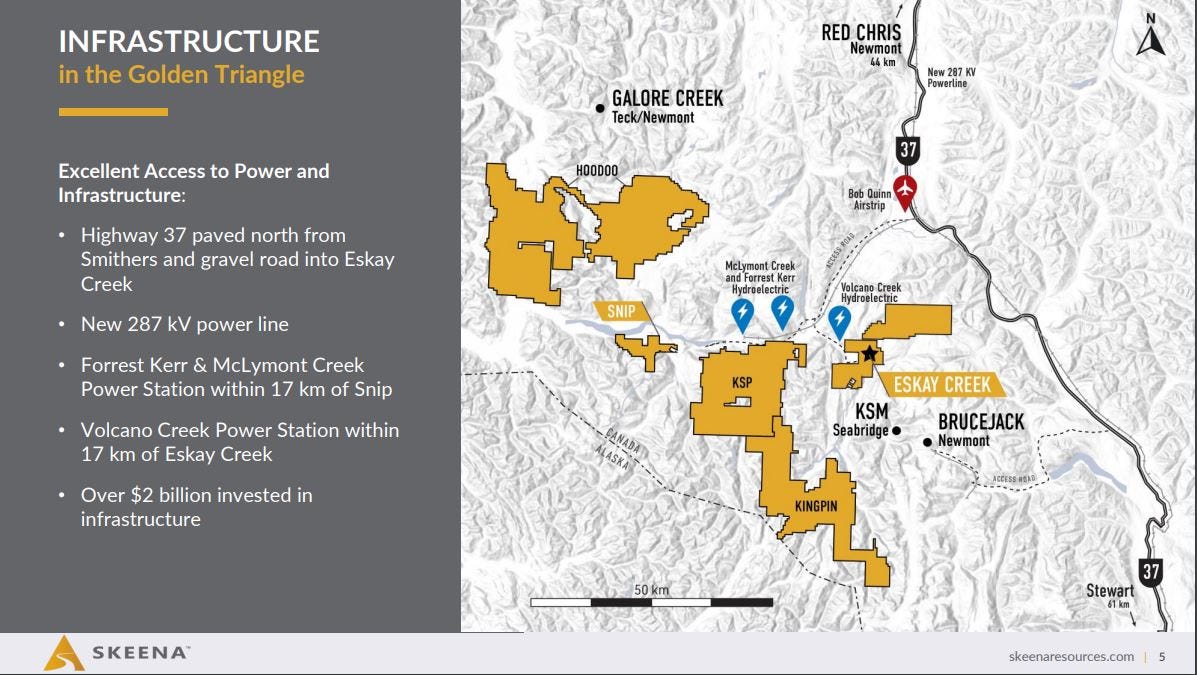

The Golden Triangle is truly a prolific area of geological wonder, and there are a number of famous prior-producing mines (like Eskay Creek and Snip for example) and also recently built mines like Brucejack (initially operated by Pretium and now operated by Newmont) or Ascot’s Premier Mine. Additionally, the Tahltan first nations group are incredibly supportive of mine development and very savvy business partners and local stakeholders. This is very important to highlight because there are other jurisdictions in Canada and all over the world, where indigenous groups use permitting like a hostage negotiation situation, or some groups flat out block new development of extractive industries. Because of the rich history of mining in the Golden Triangle, there are also roads, airports, hydroelectric power, and a trained workforce of with specialized knowledge of exploration, mine development, engineering, and processing. What this means is that the better projects in the Golden Triangle have much better odds of becoming future mines, and by all indications, Eskay Creek is going to go back into production in the next few years.

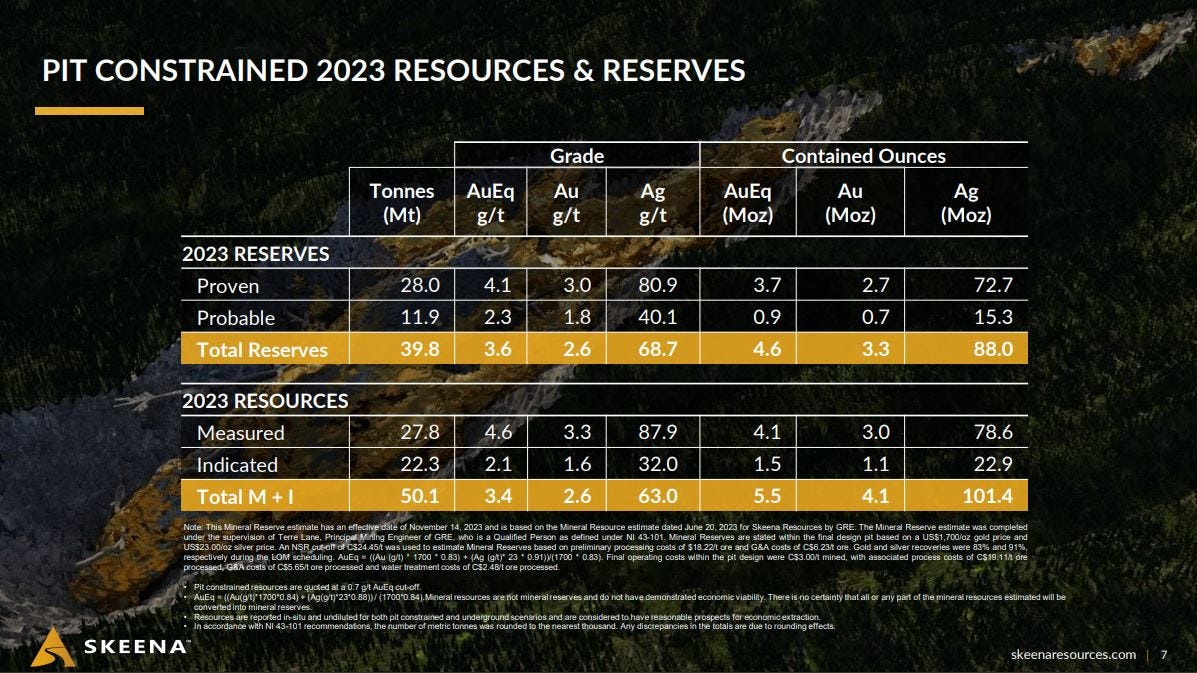

Now even though there have been about 6 million ounces of gold equivalent (AuEq) ounces defined in all categories, the pit-constrained resources at Eskay Creek are 5.5 million ounce of AuEq. This is important because these are the ounces that look like they can be mined in a development scenario.

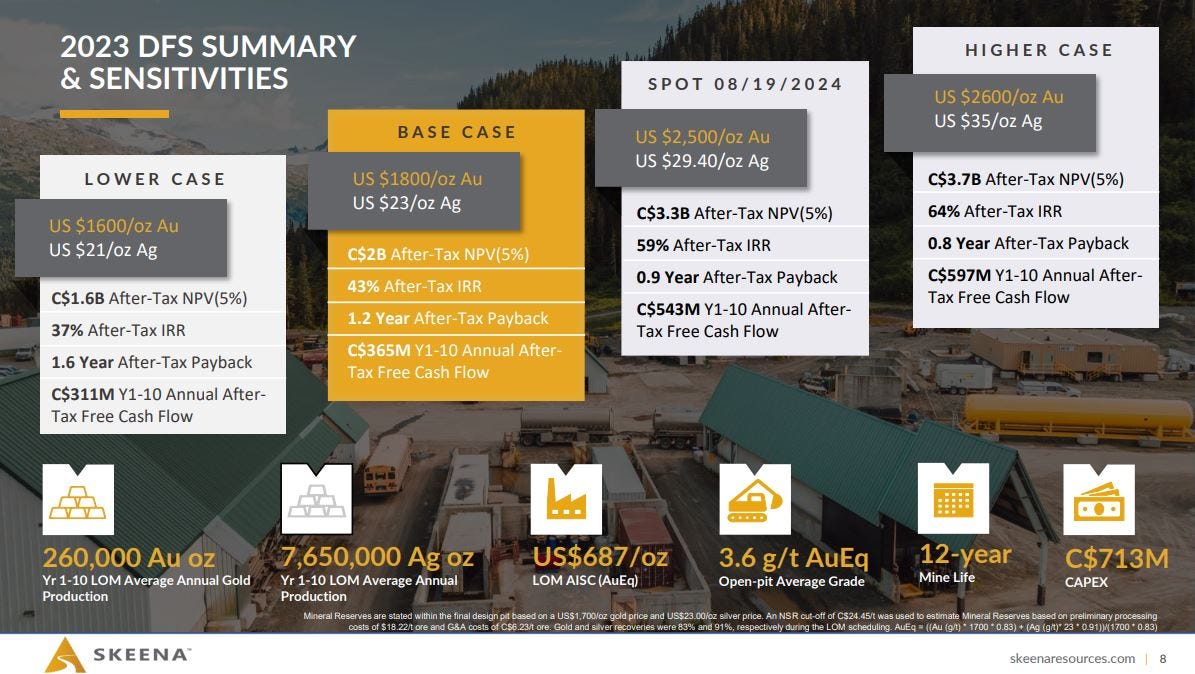

As far as the most recent economic study, the Definitive Feasibility Study (DFS), it points to a very robust project at the metal assumptions that were used of $1,800 gold and $23 silver, where it is a $2Billion after-tax Net Present Value (NPV) using a 5% discount rate (yeah, I know people would rather use a 8% or even 10% discount rate… so do some back of the napkin calculations and it’s still a damn robust project). At those metals prices it has a 43% Internal Rate of Return (IRR) and a 1.2 year payback. Those are really solid metrics. However, if one looks at the sensitivity table and where the project economics stand at somewhere close to today’s metals prices of $2,500 gold and $29.40 silver assumptions, then Eskay Creek balloons out in value to $3.3Billion after-tax, a 59% IRR, and a 0.9 year payback! If people reading believe that silver prices can get back up in the $30s or that gold could run to even higher values over time, then it is pretty clear that would all be some nice gravy on top.

The project is slated to produce 260,000 ounces per year of gold, 7.6Million ounces per year of silver, and have an All-In Sustaining Cost (AISC) of $687 per AuEq ounce. Simply put, that is precisely the kind of project that a senior mining company would be interested in having inside of their portfolio, and why I believe a larger producer is going to acquire Skeena Resources for this Eskay Creek project. As already mentioned, there are lot of jurisdictional advantages to operating in the Golden Triangle, plenty of infrastructure already in place, good local stakeholders and a trained workforce that can all be leveraged in a development and production scenario.

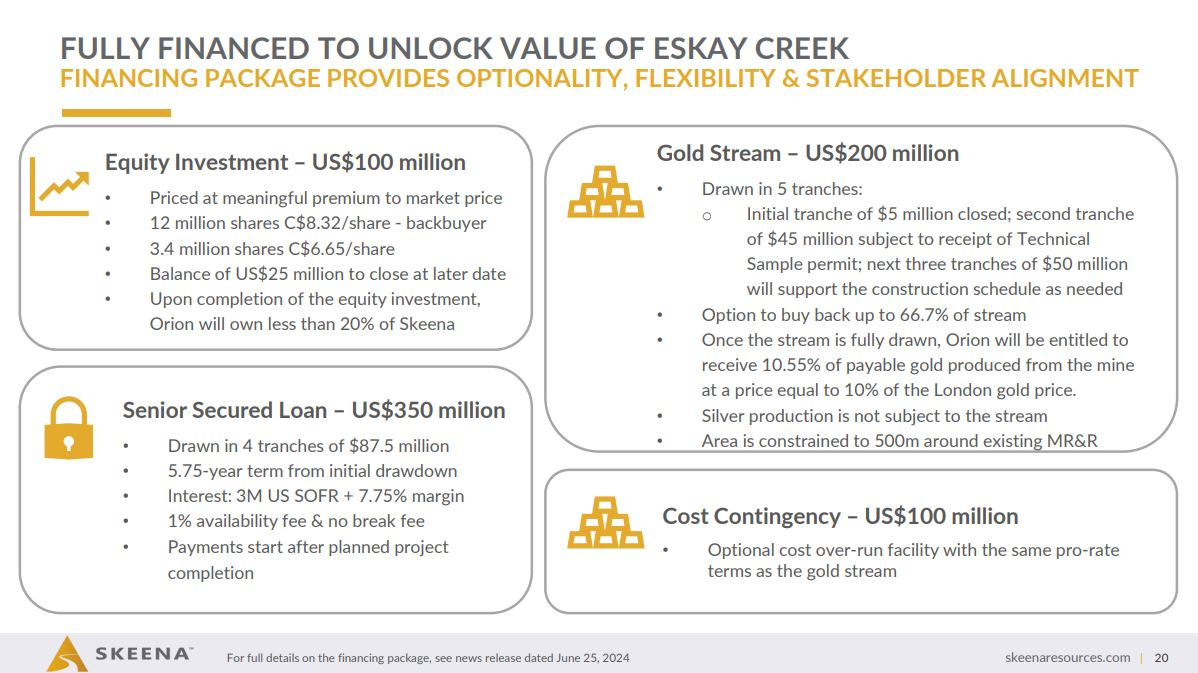

Additionally, this project is fully financed, and that can’t be understated. I believe the capital stack of cash, contingency, debt through a senior secured loan, a gold stream (keeping the stream off the higher torque silver), and a small amount of equity, is the template and model the whole gold sector should be using to get new mines financed and built.

Then I see 2 other kickers that are not even factored into their project upside yet:

1) The contributions from the Snipp Project that has over 900,000 ounces of gold ounces defined in all categories. This could be an excellent satellite deposit to feed a production scenario.

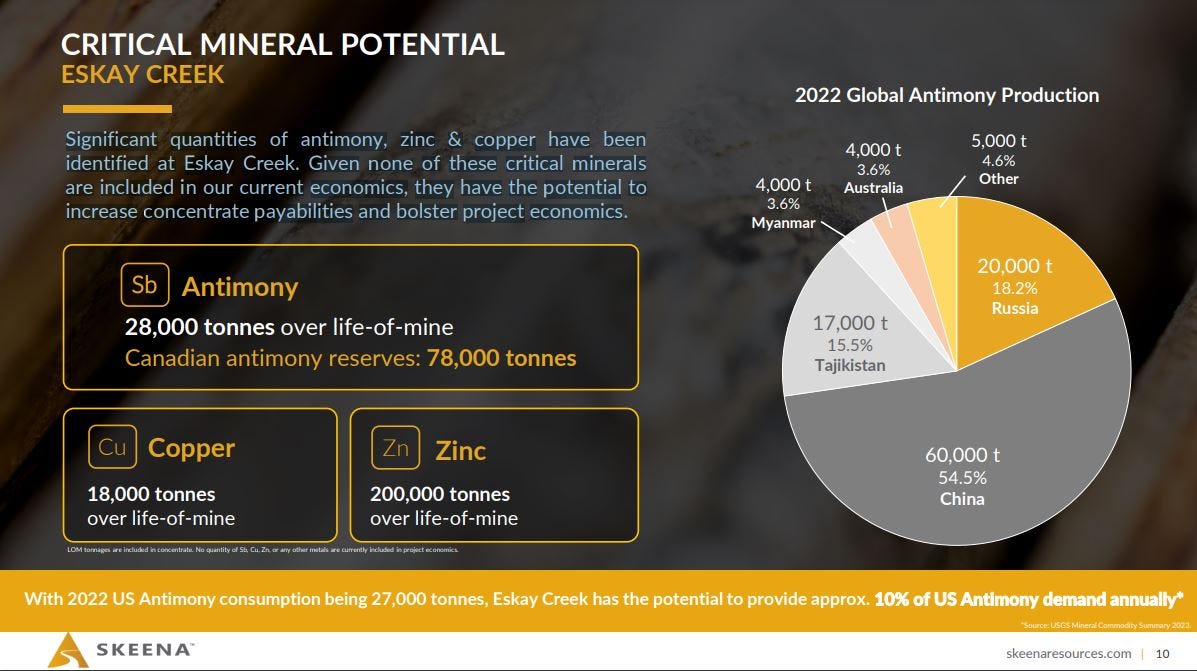

2) As stated on Slide 10 of their Corporate Presentation: “Significant quantities of antimony, zinc & copper have been identified at Eskay Creek. Given that none of these critical minerals are included in our current economics, they have the potential to increase concentrate payabilities and bolster project economics.”

Bottom line: The Eskay Creek Gold-Silver Project is a monster project, in a Tier One jurisdiction, with robust economics, and 2 other kickers in their Snipp Project and critical minerals potential co-credits. This project is going to be developed into a producing mine in Canada, but the current team or by a larger producer, and so it is project that I’m happy to hold onto in my own portfolio to continue getting rerated higher with moves in metals prices to the upside and as they continue down the road to exploitation of precious metals.

Thanks for reading and may you have prosperity in your trading and in life!

- Shad