Merger and Acquisition Opportunities In The Metals Resource Stocks – Part 3

Excelsior Prosperity w/ Shad Marquitz (08/09/2024)

Here in [Part 3] of this series, we are going to keep delving into the realm of merger and acquisition (M&A) transactions, and look into the details of 2 companies that are combining into a larger proforma company:

Integra Resources Corp. (TSXV: ITR) (NYSE American: ITRG) is taking over Florida Canyon Gold Inc. (TSXV: FCGV) (OTC: FCGVF), which itself was a spinout company from Argonaut Gold (TSX: AR) (ARNGF) during it’s recent takeover by Alamos Gold (TSX:AGI; NYSE:AGI). People following this channel will be familiar with some prior articles that touched on Alamos taking over Argonaut in the series on “Growth-Oriented Gold Producers.” Well, now the saga continues…

Also in the article from July 18th titled: “Turn-Around Stocks - Snatching Victory From The Jaws Of Defeat” we had another update on Florida Canyon Gold in the sector discussing Argonaut’s chart on the acquisition news and finalization of the takeover by Alamos gold. We touched upon the new “SpinCo” – Florida Canyon Gold, and the transaction announced by Heliostar Metals (TSX.V: HSTR, OTCQX: HSTXF), to acquire the Mexican mines and development assets, that used to be with Argonaut from Florida Canyon.

In that article I had quipped:

“Man… the dust hasn’t even really settled yet from this transaction and the assets are already being further acquired. I believe that Florida Canyon Gold will pick up the $5Million on this asset sale, and then retain the Florida Canyon Mine in Nevada. All things considered, I would have preferred if Heliostar had just acquired the whole spinco so I could have had shares in Heliostar… and think $5million is way too cheap to have let those Mexican assets go for, but we’ll see how they monetize this final asset moving forward.”

https://excelsiorprosperity.substack.com/p/turn-around-stocks-snatching-victory

Now, I had no idea that as far as monetizing that final asset… the Florida Canyon Mine; that they’d be doing it so very soon… just 11 days later, by way of a different company acquiring FCGI.

– July 29, 2024

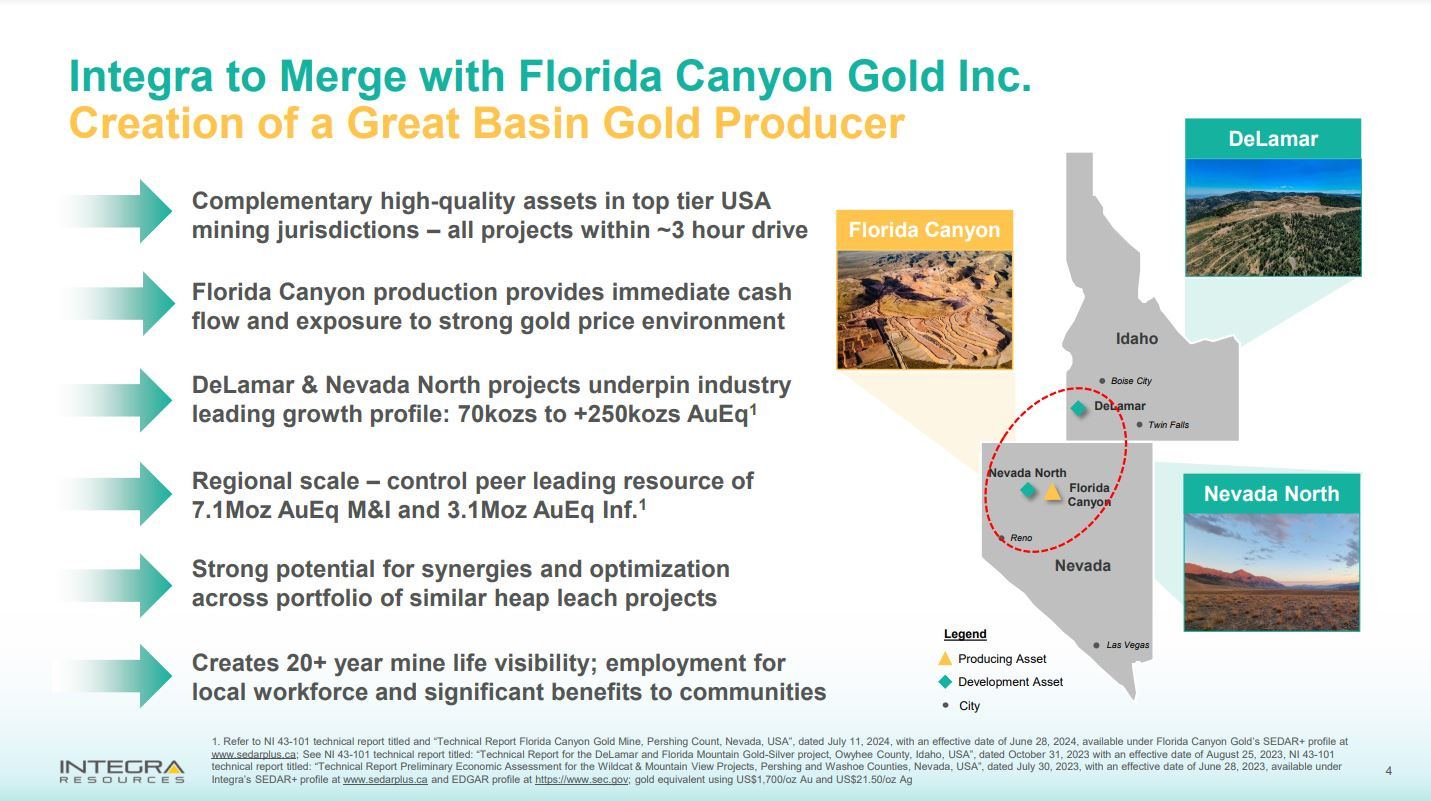

“The Transaction will create a diversified, Great Basin-focused gold and silver producer with immediate gold production of approximately 70 thousand ounces of gold equivalent per annum from the Florida Canyon Gold Mine, coupled with a built-in growth pipeline of high-quality development stage assets including the DeLamar Project and the Nevada North Project.”

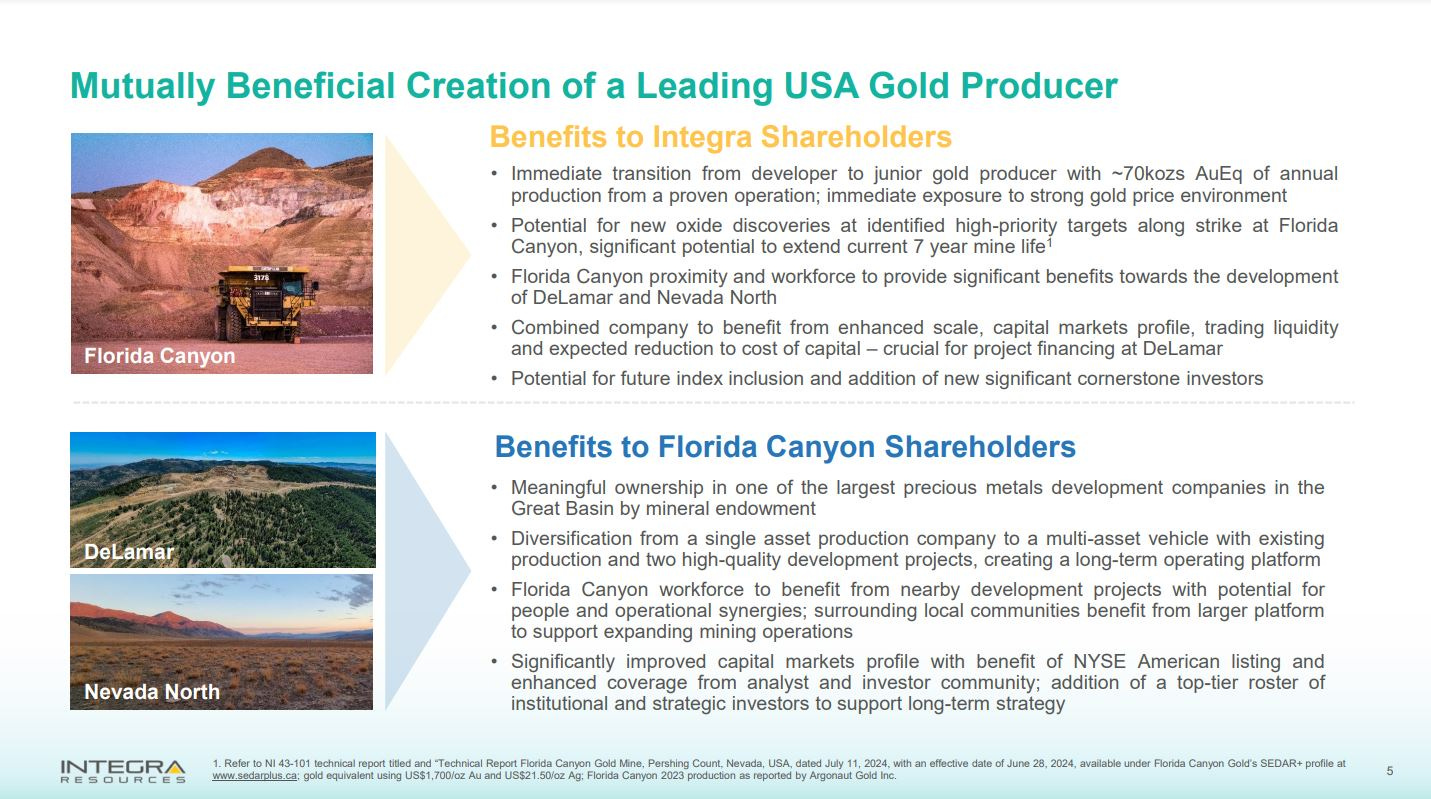

“Under the terms of the Transaction, FCGI shareholders will receive 0.467 of a common share of Integra for each common share of FCGI held. Existing shareholders of Integra and FCGI will own approximately 60% and 40%, respectively, of the outstanding Integra Shares on closing of the Transaction.”

Initially I thought that when Florida Canyon Gold was spun out, that it would simply retain both the Mexican assets and the Florida Canyon Mine, as that would take them back to being a gold producer on par with what Argonaut was pre-Magino. That is why I hung onto my Argonaut shares to let them convert over to Alamos, while also having the Florida Canyon Gold shares spun out to me as an accretive value kicker.

I mentioned the likelihood of ringing the register on the trade, and did sell my Alamos shares last week. It’s a great company, that I’ve called the “king of the mid-tiers,” multiple times, but I believe it is more fairly valued than many peer gold and silver producers. As for Florida Canyon Gold, I decided to sell it this week into all the market carnage to be able to backstop other portfolio positions with those funds.

Then, mid-week, I interviewed my friend and colleague, Jayant Bhandari, over at the KE Report, and he went on to share with me how he had done the exact same thing, selling both Alamos and Florida Canyon Gold after everything had settled, but that he was aggressively buying back his (FCGV) position, for the approximate 12% arbitrage trade he was capturing, for once it converts over to shares in Integra Resources.

Jayant Bhandari – Value Arbitrage In Florida Canyon-Integra, Silvercorp, Hess, Aztec, and Irving - Aug 7, 2024

I lamented to Jayant after the interview that: “Darn, I should have just sold down my Integra position, and held onto my Florida Canyon Gold for that arbitrage conversion.” He agreed, and I got off the phone with him and did sell a big chunk of my Integra, leaving some position in place in case the deal doesn’t go through, and then used those proceeds from shares sold to buy back into Florida Canyon Gold.

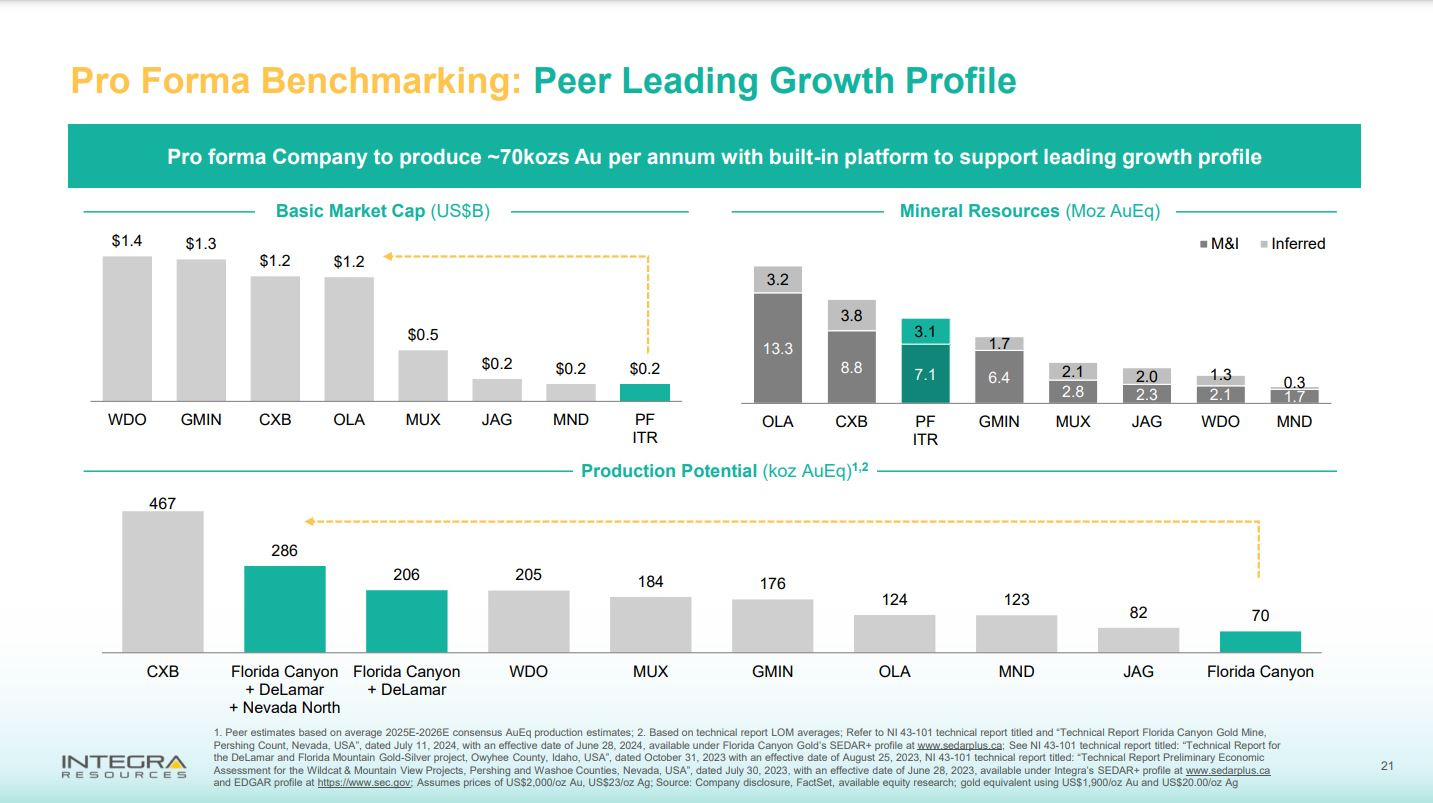

I already liked Integra before this deal to acquire the Florida Canyon Mine, but really like it now considering that the new proforma company will be endowed with over 10 million ounces of gold from all projects, and more importantly will be a producer with better valuation metrics.

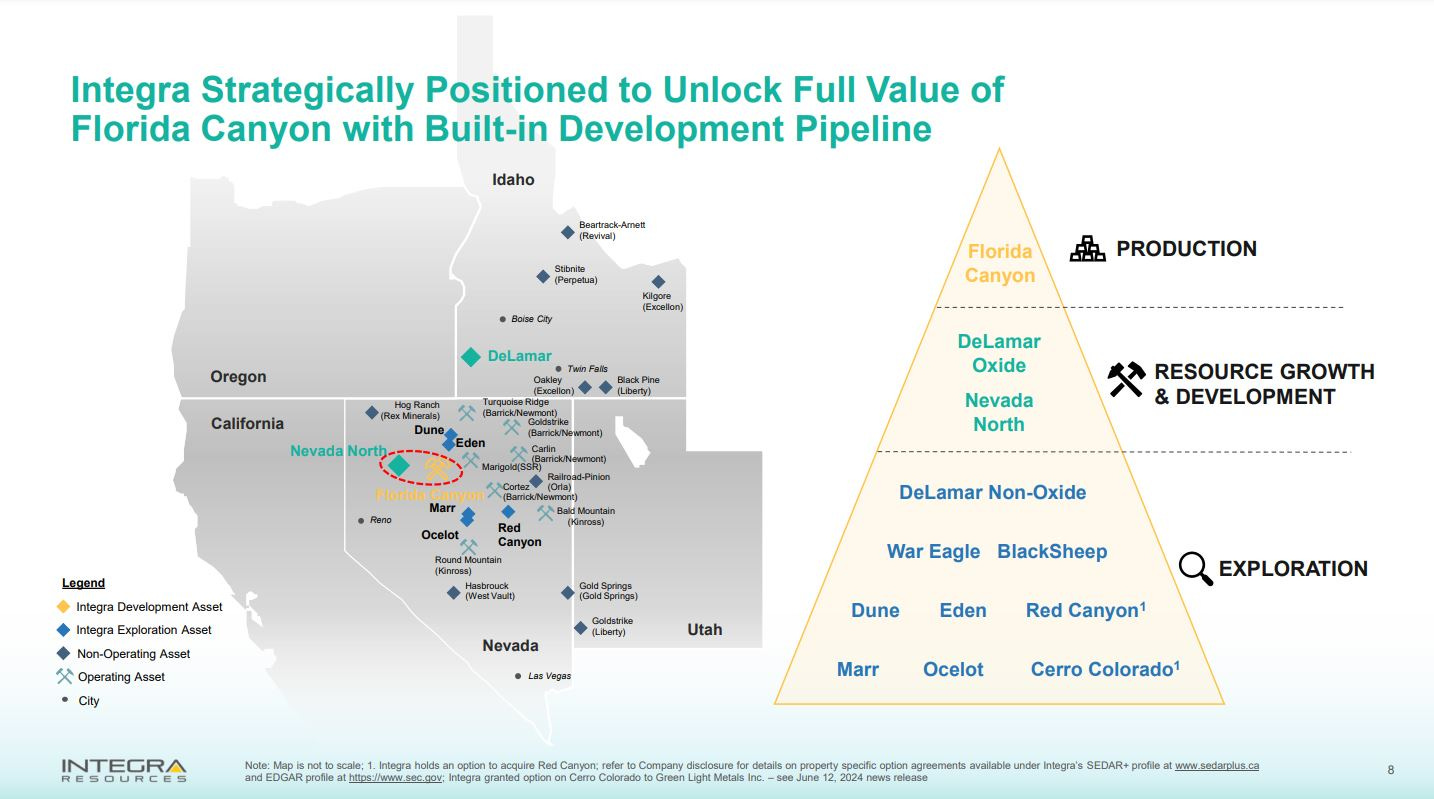

The Transaction will create a diversified, Great Basin-focused gold and silver producer with immediate gold production of approximately 70 thousand ounces of gold equivalent per annum from the Florida Canyon Gold Mine, coupled with a built-in growth pipeline of high-quality development stage assets including the DeLamar Project and the Nevada North Project.

I’m not going to restate all the benefits to shareholders of both companies, as they have clearly outlined the advantages on the slides posted above. If anyone can’t see those then just click on this link that takes you over to their corporate presentation.

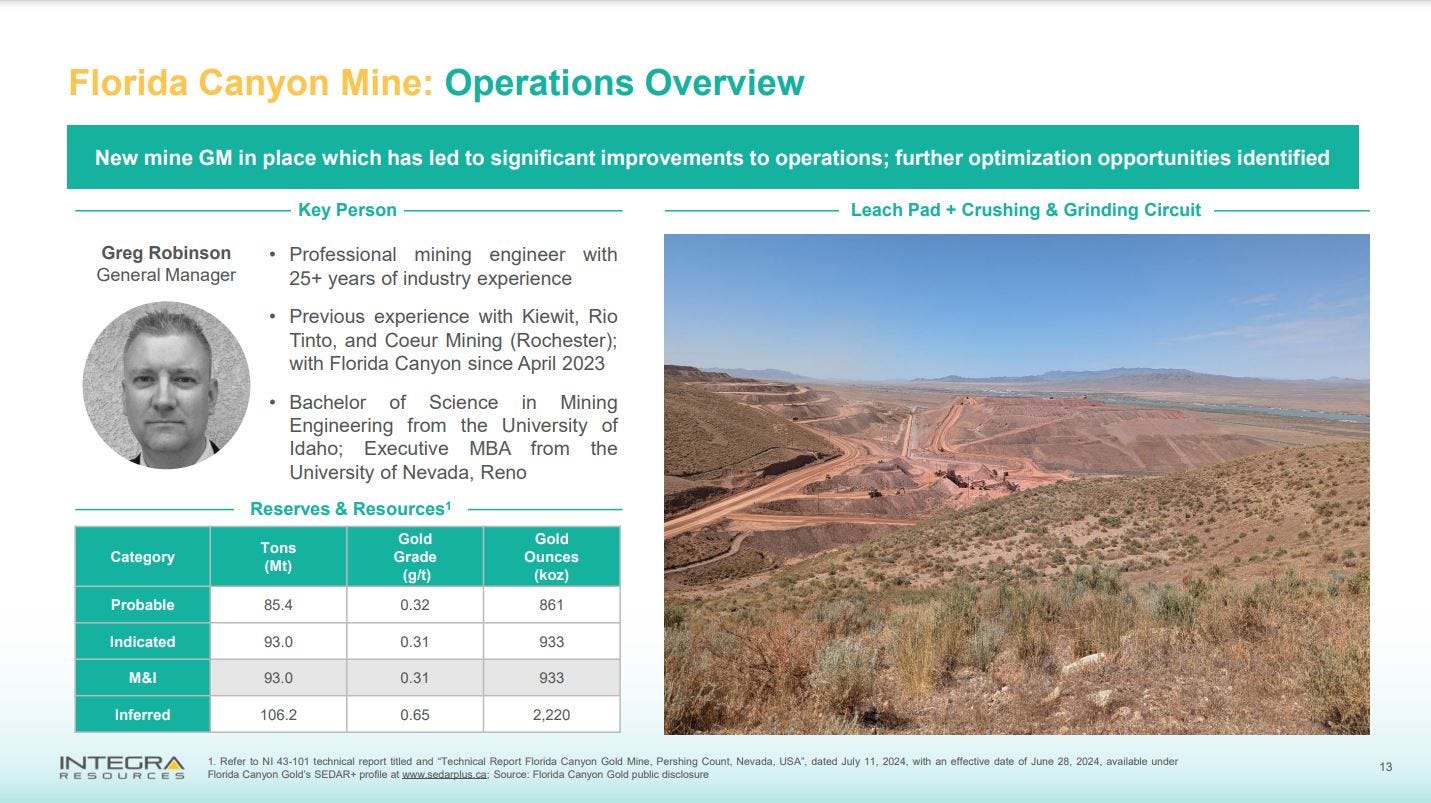

One thing I do really like is that Argonaut already spent upwards of $50 million to optimize the Florida Canyon Mine and just got those improvements finished up most of the work a couple of months ago. Integra still has to spend about $1.5 million to finish up the pad expansion and truck refurbishment, but the lion’s share of sustaining capital was already invested into the mine by Argonaut prior to this takeover. Also all the same team remains in place, with Greg Robinson staying on a General Manager.

Integra did do one last capital raise to prepare for this transition into production at the Florida Canyon mine, for the development of Delmar, and for exploration and derisking at Nevada North.

“In connection with the Transaction, Integra announces a concurrent bought deal private placement financing of Subscription Receipts (as defined below) for gross proceeds of approximately C$20 million (the “Offering”). The net proceeds from the Offering will be used to fund mine optimization opportunities at Florida Canyon, for continued advancement of DeLamar and Nevada North, and for general corporate purposes.”

The expectation from company management is that the company should not have to go back to the market for any more money moving forward, (barring the capital that will eventually be need for building DeLamar), because their gold production will fund future G&A and ongoing exploration and development at all 3 projects in the interim.

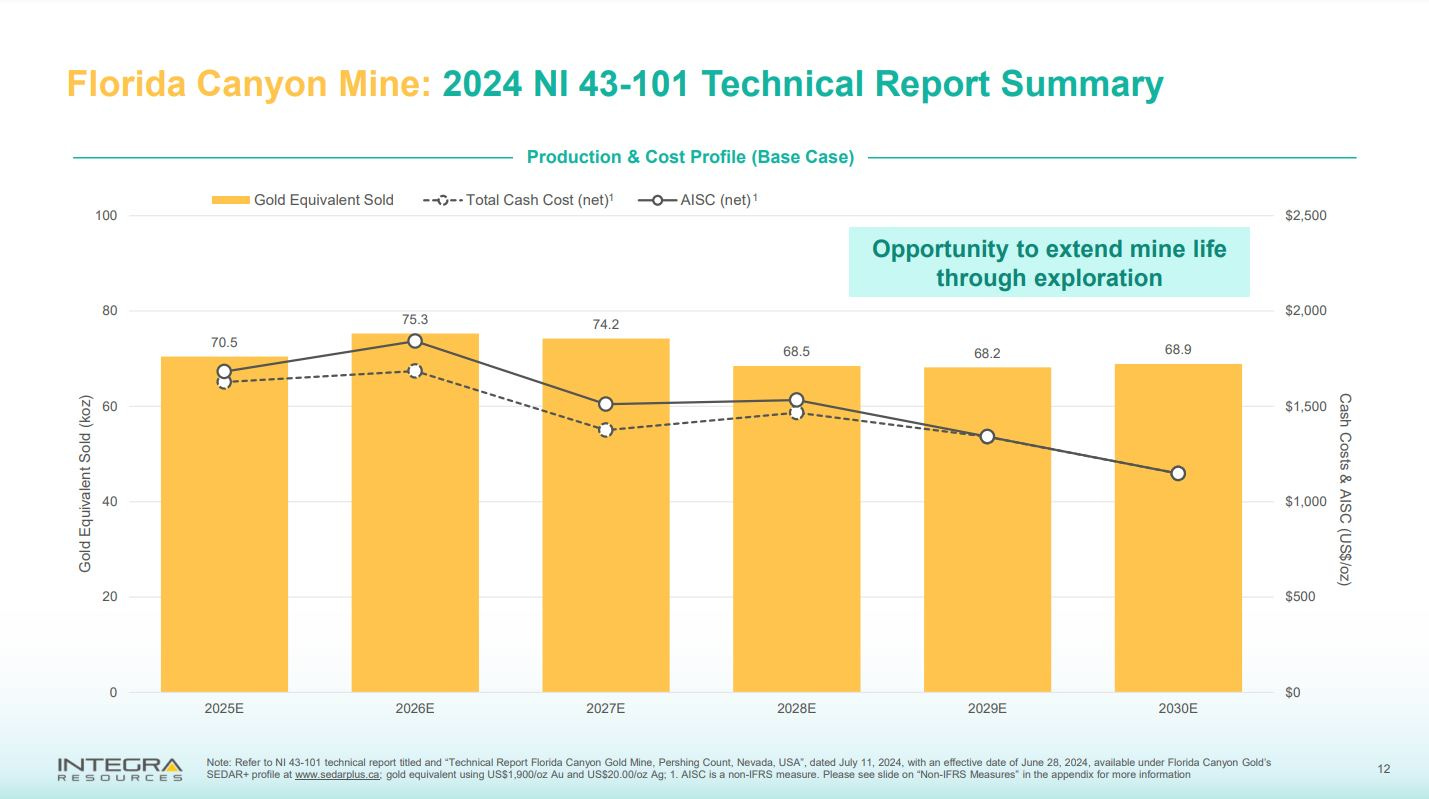

For now, most people’s focus will rightly be on the economics, sustaining costs, mine life, and future revenues expected from the Florida Canyon Mine.

There are some investors that have scoffed at this transaction, noting how high the All-In Sustaining Costs (AISC) are up around $1800-$1900. Granted at a $2400 gold price, there is still plenty of margin there to capture for the foreseeable future. However, many critics have failed to dig in deeper to the strip ratio coming down, and thus costs as well in 2 years, as there will be less mineralized dilution. The AISC comes down to the $1600-$1700 level by 2027 and 2028, and then costs come down even lower in 2029 and 2030. That will help with margin expansion. There is also still plenty of exploration upside around the Florida Canyon Mine, to potentially find more mineralization and further extend mine life.

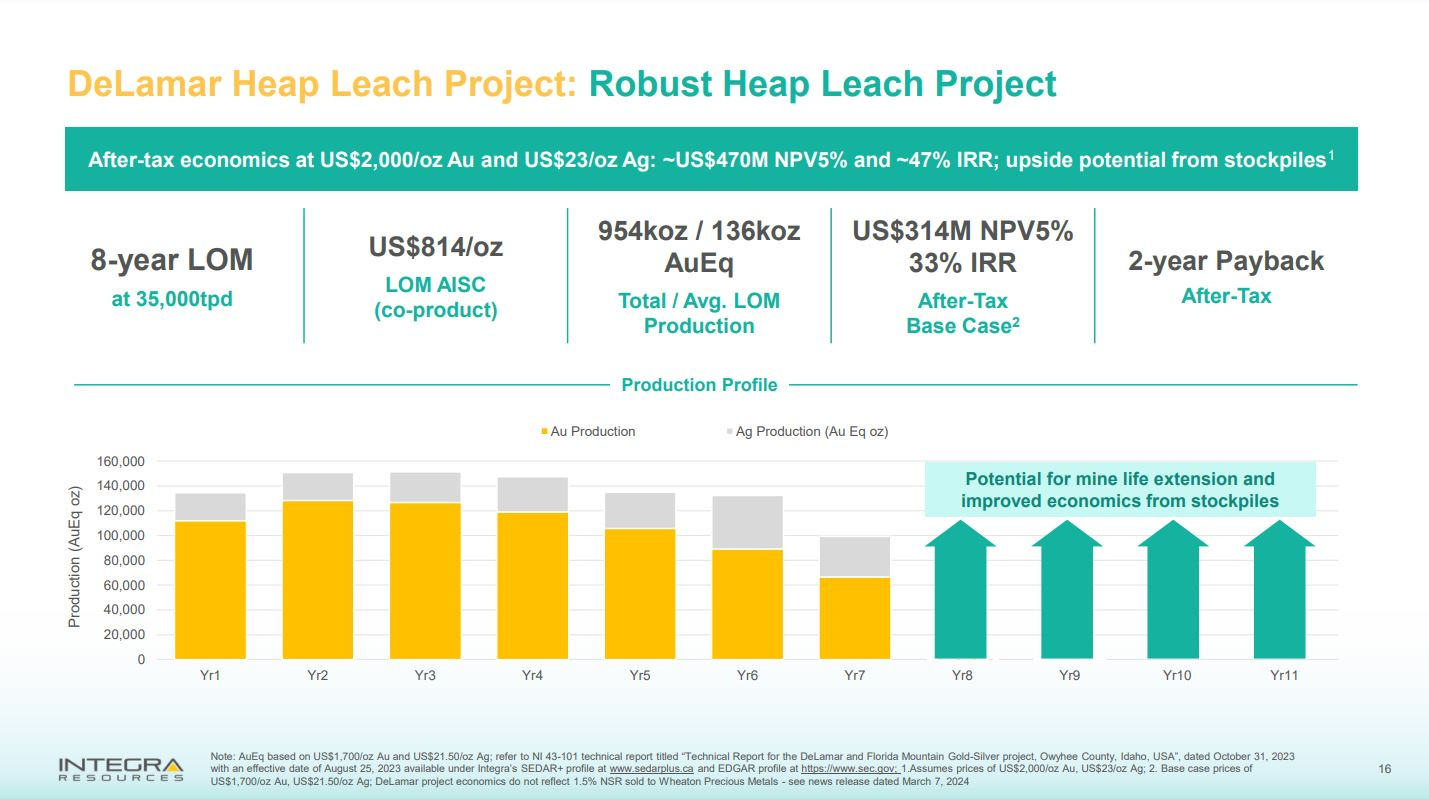

The next project up to bat in the development pipeline is the DeLamar Project, with an initial 8-year life of mine, low AISC of $814 per ounce of gold, and robust economics. The team in Idaho is currently working on further derisking, optimization, and permitting.

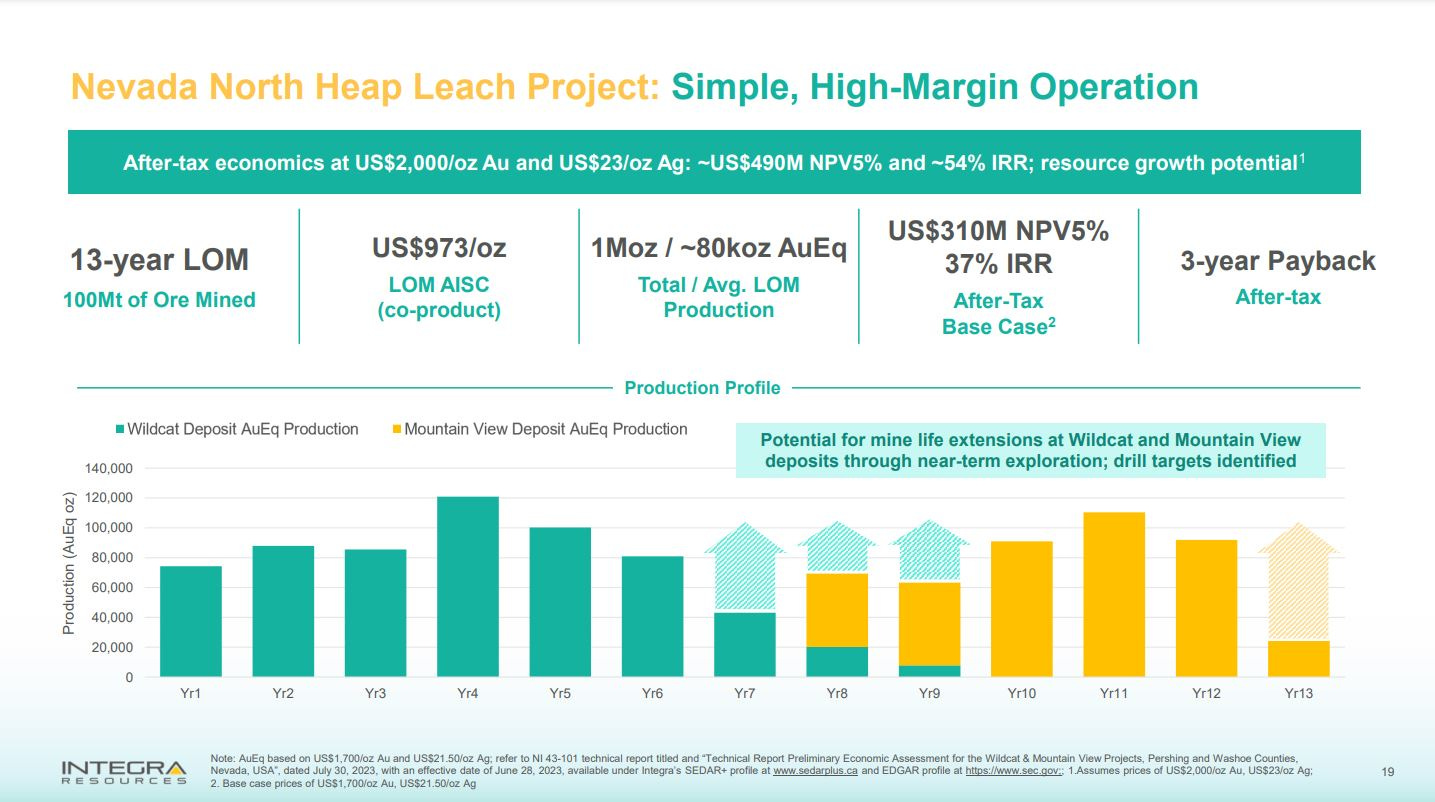

Continuing on in their pipeline of exploration and development projects is the Nevada North Heap Leach Project (combing both the Mountain View and Wildcat deposits). The 13-year life of mine and low $973 AISC generate compelling economics with a 37% IRR. This is about 5-6 years off, but will stack on top of DeLamar.

On August 1st, we had a great discussion with the CEO of Integra Resources (TSX-V: ITR; NYSE: ITRG), Jason Kosec, to discuss their major acquisition and what the pro-forma company will focus on at all 3 projects.

Integra Resources – Transformation Into A Gold Producer With The Acquisition Of Florida Canyon Mine - Aug 1, 2024

Jason walks us through the key metrics and future expectations from the technical report at the mine, and how it will fund their future development initiatives at their other projects, as well as get position them for a re-rating as a producer with a better cost of capital moving forward.

Next we get an update on all the ongoing developmental work at the 4.8 million ounce of gold equivalent DeLamar Project, in Idaho, as the Company prepares for an upcoming Feasibility Study, and continues advancing key permitting milestones.

We also got an exploration update at the Nevada North Project, where the exploration team is about halfway through a 2,000 meter drill program, expanding resources, getting material for metallurgical testing, and to confirm a thesis on how the mineralization controls work and may offer more upside beyond the known 1.4 million ounces of gold equivalent resources.

In addition to the producing Florida Canyon Mine, and DeLamar and Nevada North development projects, one area that is consistently overlooked by investors and analysts following the company is just how prospective some of their exploration targets are. Years ago, in 2021 over at the KE Report we spoke with George Salamis, the Executive Chair, about the prospectivity of the sulphides at depth at DeLamar, along with the Black Sheep and War Eagle targets in Idaho… That mineralization and those targets are all still there for future exploitation.

This one gets into the sulphide mineralization at Delamar and the Black Sheep targets:

This one gets back in opportunities at depth at DeLamar, and more information on the War Eagle exploration target and history.

Then, of course, there are all the other exploration targets in Nevada, like Red Canyon, Dune, Eden, Marr, and Ocelot. Jason has shared with us in prior interview how prospective these various targets still are, and they are all there for future expansion.

In that sense, we could easily have covered Integra Resources in the series on growth-oriented gold producers, and may update readers here periodically in that series as key milestones are reached. One can see in the slide below their plan to stairstep up from 70,000 ounces per year of production at Florida Canyon, up to 206,000 ounces per year when adding in DeLamar, and the spiking up to 286,000 ounces per year when adding in Nevada North. That is plenty of growth on tap over the next 5-7 years.

That’s it for today with regards to the ongoing merger of Integra Resources and Florida Canyon Gold, born out of a different parent merger between Argonaut and Alamos Gold. It’s nice to have wrapped this whole Argonaut chapter up, and now both Alamos and Integra are stronger companies with additional production assets.

Thanks for reading and may you have prosperity in your trading and in life!

- Shad