Merger and Acquisition Opportunities In The Metals Resource Stocks – Part 6

Excelsior Prosperity w/ Shad Marquitz (11/16/2024)

Let’s dig into a few more recent M&A deals to look for the rationale, synergies, and opportunities behind these upsized pro-forma companies. In the next article in this particular series we’ll also review a gold development company that could be a solid acquisition target for a larger company. We just have too many transactions to get through in this article to introduce yet another speculative thesis on a future takeover target. There are a few companies like that to be highlighted soon in this series though...

As far as investing in junior resources stocks, it should be pointed out that this is one of the riskier subsectors of equity investing and far less certain than investing in the precious metals directly. Riding these equities through bull markets and bear markets is definitely not for the faint of heart, and the stock price action can be wildly volatile. This, of course, also means that with that kind of volatility comes multiple waves of price rises and then price declines to potentially capitalize on for either swing-trading or position-trading. This volatility also provides ample opportunities to accumulate positions for the longer-term investor, by layering into a position over several buying tranches. This layered approach to scaling into a position, via multiple partial purchases, is a great way to smooth out the volatility, while building a good cost-basis over time.

With all of that said, let’s get into it…

2024 has actually been a very active year for company mergers and acquisitions in the metals space; especially in the gold, silver, and copper stocks. We have also seen M&A transactions in the more niche uranium, lithium, and rare earth projects.

Some of these announcements have been big transactions in the resource sector.

For example, just last month on October 9th we saw a massive acquisition in the lithium space when Rio Tinto (LSE: RIO) (ASX: RIO) (NYSE: RIO) announced it was taking over Li juggernaut Arcadium Lithium (NYSE: ALTM) (ASX: LTM) in a $6.7billion cash deal.

Rio Tinto to acquire Arcadium Lithium

Another large M&A deal of note happened 2 months back in September; where AngloGold Ashanti (NYSE: AU) (ASX: AGG) leap-frogged up to the 4th largest gold mining company on the planet, when it announced the acquisition of Centamin PLC (TSX: CEE) (OTCPK: CELTF) in a $2.5Billion merger. This puts another solid asset into AngloGold’s portfolio with the addition now of Centamin’s Sukari gold mine; Egypt’s largest and first modern gold mine, as well as one of the world’s largest producing mines.

AngloGold in $2.5 bln deal for Centamin, targets 'Tier 1' assets

By Nelson Banya and Aby Jose Koilparambil - Reuters - September 10, 2024

https://www.reuters.com/markets/deals/anglogold-ashanti-buy-centamin-25-bln-deal-2024-09-10/

This deal is so important to both companies that they’ve created their own micro-site to review all the moving pieces of this merger in the works.

https://www.anglogoldashanti.com/investors/centamin-offer/

Both of those deals came on the heals of the significant acquisition of Osisko Mining Inc. (TSX:OSK) by major gold producer Gold Fields Ltd. (JSE: GFI) (NYSE: GFI) announced in August of this year for C$2.16billion, and for roughly a 55% premium. That’s one of the larger premiums we’ve seen on a gold development-stage asset in a while. This got the animal spirits going with other gold developers.

Gold Fields to Acquire Osisko Mining for C$2.16 Billion

https://www.osiskomining.com/gold-fields-to-acquire-osisko-mining-for-c2-16-billion/

Now those kinds of transactions are too large for us to dig into deeply in this series on M&A in junior mining, but we can note the continued consolidation of quality companies and projects by the big boys. This is a trend that has been picking up steam over the last couple years.

Conversely, on the smaller side of junior M&A deals…. On October 11, 2024 we did see Greenridge Exploration Inc. (CSE: GXP | FRA: HW3) take over ALX Resources Corp. (TSXV: AL) (OTC: ALXEF), merging the companies into a pro-forma company that will have:

“…interests in sixteen (16) uranium exploration projects that total approximately 220,000 hectares across renowned Canadian uranium districts including the Athabasca Basin, Thelon Basin and Elliot Lake. The combined entity will have interests in an additional thirteen (13) lithium, nickel, gold and copper properties across Canada.”

Greenridge Exploration Enters into Binding Arrangement Agreement to Acquire ALX Resources Corp.

In the prior 2 articles in this series we’ve also unpacked the 2 big acquisitions in the silver space with Gatos Silver, Inc. (TSX: GATO) (NYSE: GATO) being taken over by First Majestic Silver Corp. (TSX: AG) (NYSE: AG), and then more recently Coeur Mining (NYSE: CDE) making a move to scoop up SilverCrest Metals Inc. (TSX: SIL; NYSE American: SILV). These were 2 of the best single-asset silver producers that have now been taken off the junior mining gameboard for investors.

Merger and Acquisition Opportunities In The Metals Resource Stocks – Part 4

This particular article is going to be focused on the value proposition present in Skeena Resources Limited (TSX:SKE)(NYSE:SKE), as a prime takeover target for a larger producer to acquire and bring into their development pipeline. We’ll get to that later in this article…

https://excelsiorprosperity.substack.com/p/merger-and-acquisition-opportunities-75f

Merger and Acquisition Opportunities In The Metals Resource Stocks – Part 5

On Friday, when the news dropped about SilverCrest Metals Inc. (TSX: SIL) (NYSE American: SILV) getting bought out by Coeur Mining, Inc. (NYSE: CDE), my jaw dropped… Wow!

https://excelsiorprosperity.substack.com/p/merger-and-acquisition-opportunities-562

Now let’s pivot over to a couple gold M&A transactions in the junior space, and take a deeper dive into both deals, and also hear directly from management about the rationale and opportunities behind these mergers.

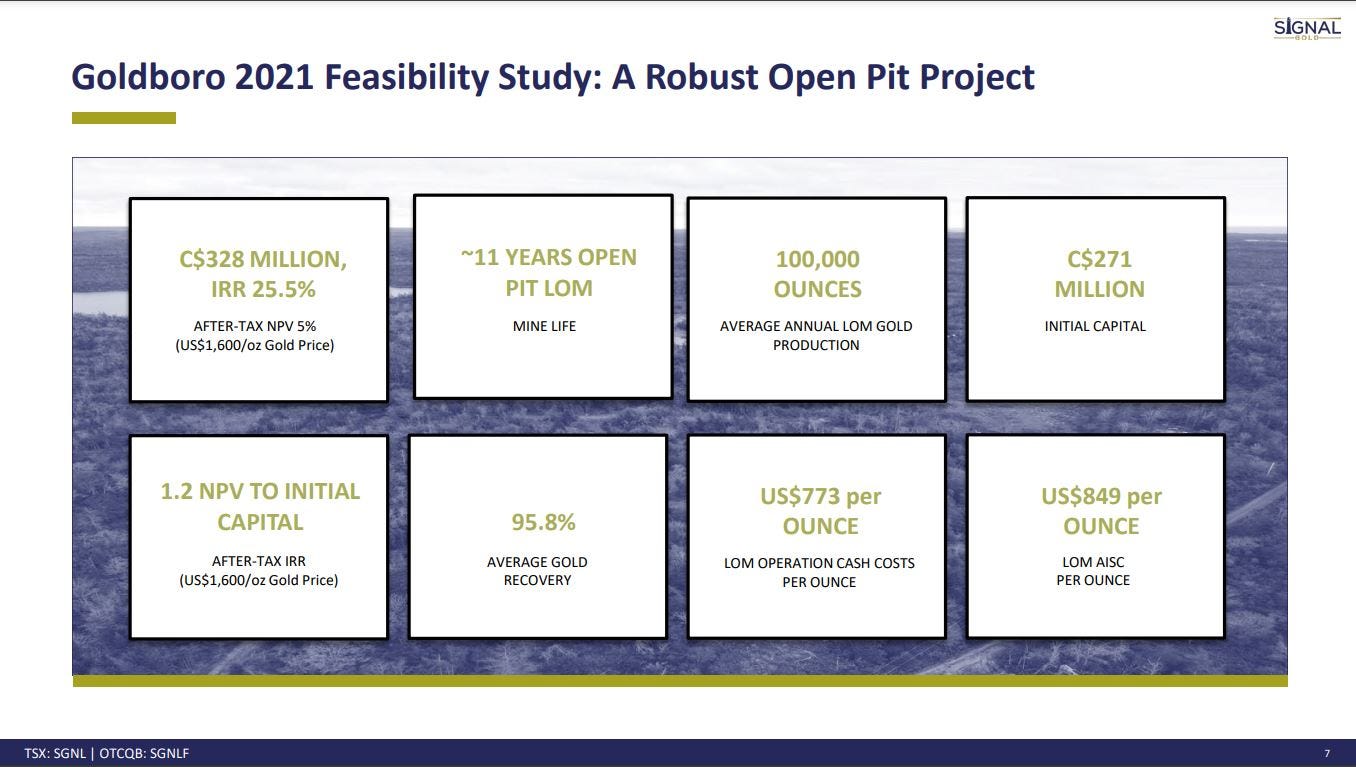

On October 10, 2024 NexGold Mining Corp. (TSXV: NEXG; OTCQX: NXGCF) announced it was merging with Signal Gold Inc. (TSX: SGNL; OTCQB: SGNLF), effectively doubling up their resource inventory and company size by merging 2 advanced gold development projects under one roof. This combines NexGold’s Goliath Gold Complex Project in Northern Ontario, (which has about 3 million ounces of gold) with Signal Gold’s Goldboro Gold Project in Nova Scotia (which also has about 3 million ounces of gold).

NexGold and Signal Gold Announce Merger to Create one of Canada’s Most Advanced Near-Term Gold Developers with a Combined 4.7 million Gold Ounces of Measured and Indicated Resources and a Plan to Achieve 200,000+ ounces of Annual Production

While the headline focused on the higher-confidence combined 4.7 million gold ounces of Measured and Indicated Mineral Resources, it should be noted that there are an additional combined 1.3 million gold ounces of Inferred Mineral Resources between both projects. So the pro-forma company has 6 million ounces of gold. After speaking with both management teams in person at the Commodities Global Expo in Fort Lauderdale last month, and since then via Zoom calls, the messaging from management is that it really has come down to a race between the 2 advanced projects to see which one gets permitted first, and it will be the first one to get built.

The company actually does have a 3rd asset in the Niblack Project, a copper-gold-silver-zinc project that was the flagship of Blackwolf Copper & Gold before it merged with Treasury Metals to form NexGold earlier this year.

On October 30th over at the KE Report, Morgan Lekstrom, President of NexGold Mining joined us to provide more information on the merger with Signal Gold. The management team believes this merger is set to create one of Canada’s most advanced near-term gold developers. For readers here, this brief discussion is a great way to hear directly from management and quickly get up to speed on the potential paths forward for the company and future value proposition.

Nexgold Mining – Merger With Signal Gold; The Roadmap To Advancing Both The Goliath Gold Complex and Goldboro Project

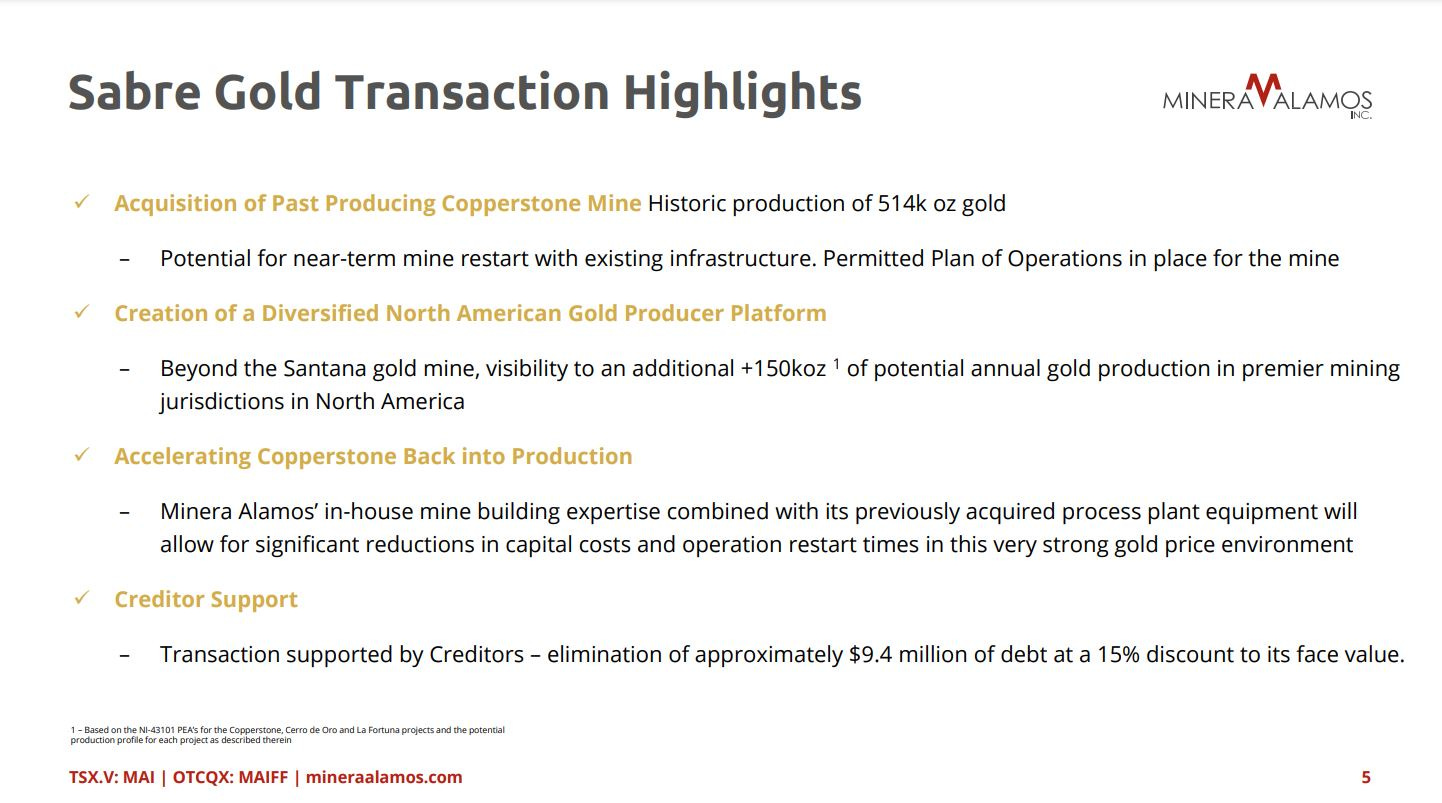

There was another key M&A deal that caught my attention recently in the gold junior mining space, [as a current shareholder in this company]. It was the news announced on October 28th, 2024 from Minera Alamos Inc. (TSXV: MAI) (OTCQX: MAIFF) that it was acquiring Sabre Gold Mines Corp. (TSX: SGLD) (OTCQB: SGLDF), to bring into their portfolio the past producing Copperstone Mine in Arizona.

On November 14th (published November 15th), Doug Ramshaw, President of Minera Alamos, joined us outline the key takeaways from the news announced on October 28th about the acquisition of Sabre Gold Mines Corp. He unpacks the potential of dual-track development for both the Copperstone Mine in Arizona and the Cerro De Oro Project in Zacatecas, Mexico.

Minera Alamos – Acquisition Of Sabre Gold, Dual-Track Development Of Copperstone Along With Cerro De Oro

Doug points out that this acquisition creates a more diversified North American platform for gold production. Beyond the currently producing Santana gold mine operations (Sonora, Mexico);=, and with the addition of Copperstone (Arizona, US), in concert with Cerro De Oro (Zacatecas,Mexico); these next 2 mines can be developed in tandem, using a dual-track approach. The Fortuna mine is still waiting in the wings as mine #4, after the first 3 mines are all steadily in commercial production.

I’ve got much more to write about this transaction, but am out of space. A deeper dive into Minera Alamos will be released in the next article on “growth-oriented gold producers.”

In this series, we’ll keep following along with the M&A deals in this sector, and digging in to the companies that could be next on the acquisition menu.

Thanks for reading and may you have prosperity in your trading and in life!

- Shad