Kicking Off 2025 With The Resource Conferences In Vancouver - Part 2 (VRIC)

Excelsior Prosperity w/ Shad Marquitz (01-25-2025)

We are continuing on with [Part 2] of the kickoff to the resource conferences for 2025 in Vancouver, Canada over the last week. As covered in [Part 1] of this series:

The festivities, networking, and knowledge sharing began on Friday January 17th at the Metals Investor Forum (MIF) over 2 full days (and evenings), then transitioned over to the Vancouver Resource Investment Conference (VRIC) starting on Sunday January 19th for 2 more days (and more late evenings), followed by the AME Roundup which started on the 20th and ran through the 23rd. Many people were still there in Vancouver at the tail-end of this wild week.

Personally, I attended both the MIF and VRIC over all 4 days; and then many of the associated evening event dinners, organized analyst mixers, cocktail parties, and impromptu meetings. These conferences are always intellectually and financially rewarding, and the information shared often shapes one’s investing approach or even the companies to be positioned in for the year to come.

As previously mentioned, there is really no way to effectively capture and transfer the whole experience to others in written form, or even in photo or video form; but for those that were unable to go, I’m going to share some of the key investing nuggets that I pulled away from the conferences. Hopefully it is a value add for readers here.

For those that missed [Part 1] on the Metals Investor Forum – here it is for quick reference:

Kicking Off 2025 With The Resource Conferences In Vancouver - Part 1 (MIF) (01-22-2025)

https://excelsiorprosperity.substack.com/p/kicking-off-2025-with-the-resource

Now we turn our attention to the Vancouver Resource Investment Conference.

So, let’s get into it…

It is always exciting to descend the escalator in the Vancouver Convention Centre West heading down into the heart of the VRIC conference. Once one checks in to get their lanyard, and then heads onto the convention floor, there is an eruption of noise and people and booths and lectures that fills the air, and it usually doesn’t take more than a minute or so to bump into a friendly face and kick off the networking.

I typically have a list of companies that I want to visit with at their booths, and number of lectures and panels I want to sit in on; so there is a general strategy going into the event. Granted, these best laid plans are often upended by the randomness of the present moment, and so one needs to be nimble and yield to the opportunities that present themselves in the fluid evolving sea of humanity.

We’ll check in on some of the companies and talks that were of high impact, but first, I want to give readers here the opportunity to hear from the host of the conference, Jay Martin, (a little over a week out from the event), where he does a fantastic job of encapsulating what attendees could expect. This will give folks that have been in the past an update, or those that are considering going to VRIC next year a 20 minute synopsis of the key benefits of this conference.

Jay Martin – Key Benefits Of Attending The Vancouver Resource Investment Conference January 19-20th

Alright, with that VRIC primer out of the way, let’s blast into the event itself, and unpack the investing themes that resonated, and also check in some of the speakers and companies that were presenting. I’m not going to weigh in on the geopolitical discussions and panels from the event, as that is not really the focus of this channel; but they were both entertaining and informative.

As far as the precious metals, it was very a very similar takeaway to the comments made about the MIF event… the VRIC speakers and companies in attendance were highly animated by the precious metals. Gold does have (and has had) a lot of macro and geopolitical tailwinds at it’s back, so most VRIC speakers were expecting higher prices again this year in the yellow metal. (No surprises there…)

As we’ve noted many times here on this channel, both fundamentally and technically gold has been strong for the last 2+ years, and there isn’t any indication, at this point, that the party is over.

Still, it does make me concerned when there are hardly any bearish comments on a given sector, and when the whole herd is moving the same way thinking nothing can derail their thesis. Just a thought…

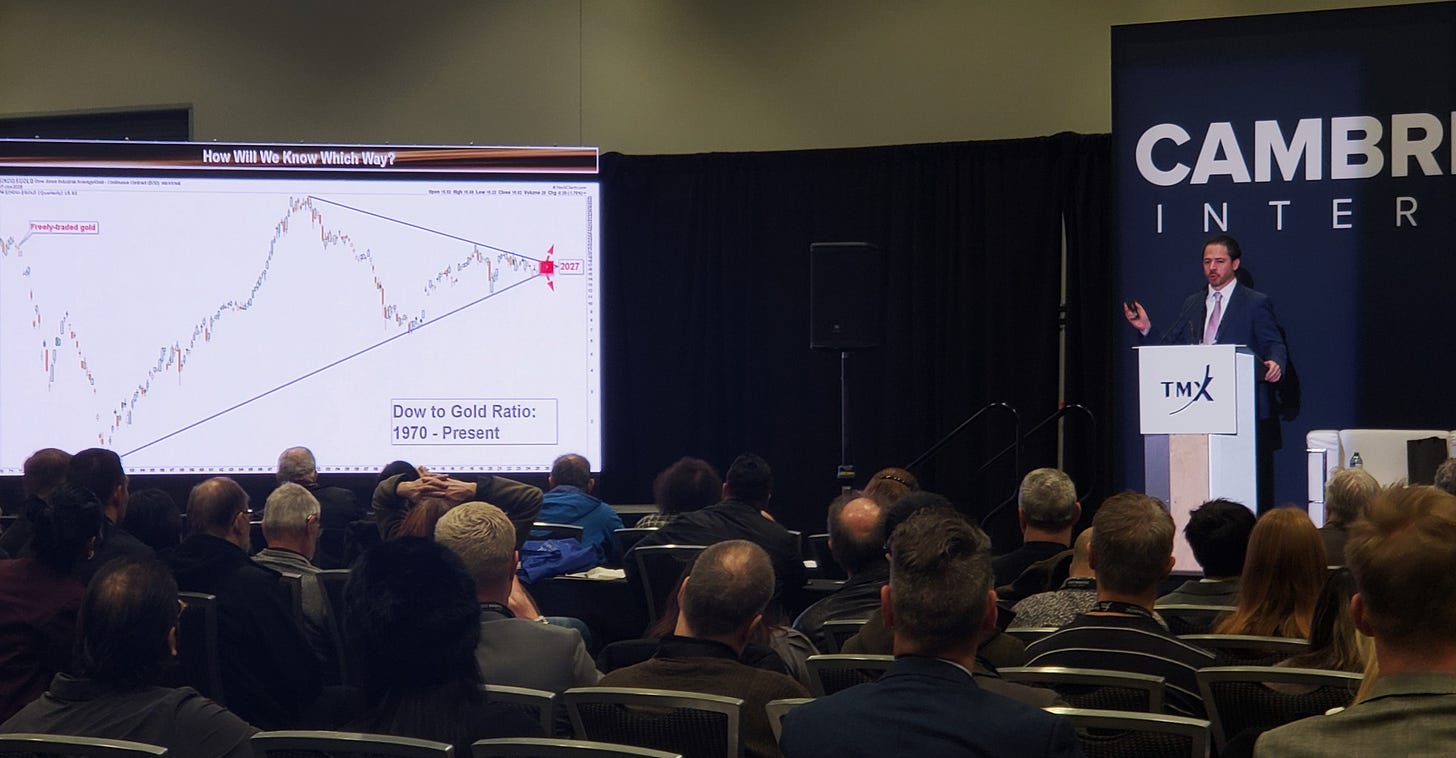

One of the few lectures I attended where a speaker dared to question the future trajectory of the precious metals, was with my friend and colleague, Christopher Aaron, publisher of iGold Advisor. He offered a compelling take on where gold was relative to the DOW Jones Industrial index on a very long-term ratio chart. It was one of the very few contrarian viewpoints that I saw at the conference with regards to gold going to the moon as it tempered it with the tipping point we are approaching in the tug-of-war between US equities and gold prices.

For the last few years there has been almost an 85% correlation between general US stocks (as represented by the DOW, but we could just as easily use the S&P 500 or Nasdaq) and the price action of gold in US dollars, both moving in tandem.

This is a huge reason why we have not seen generalists rotating into gold equities in this bull cycle like we have in prior cycles. Because of the large gains they have been making in mega-cap tech stocks like the “Magnificent 7” or Artificial Intelligence stocks, or quantum stocks, or space stocks, or crypto stocks and ETFs, etc… there has been no reason to look elsewhere.

What is the incentive for generalist investors to rotate into XYZ gold company, when things are going gangbusters on Wall Street?

As Christopher Aaron so eloquently pointed out from the podium, the DOW:Gold ratio chart has been in a huge compression triangle since the 1980 peak in PMs on the bottom ascending trendline, and the 2001 bottom in PMs on the top descending trendline. After decades of consolidating into a tighter and tighter range, this is eventually going to break one way or the other in the next 2+ years (and likely sooner, as rarely do these patterns ever reach the apex of the triangle).

Christopher pointed out that if this triangle breaks in the direction of gold’s favor, then it will finally set up that “to the moon” rally to $5,000 or maybe even $10,000 gold (that so many PM pundits have been predicting every year for the last 20 years). I think most readers here would love to see that play out.

However, if this compression triangle breaks in favor of US equities, then that actually portends to a slow grind down in PMs for likely over a decade(s), in favor of investors piling into the future of humanity’s expansion into tech, AI, biotech, quantum computing, and even space exploration. That scenario would NOT bode well for gold and silver exploration. Just something to ponder…

He believes this is the MOST IMPORTANT CHART for all investors to keep tabs on over the next 2 years, to see how this ratio breaks, and then invest accordingly.

Christopher and I caught up at the conference for a bit, and also at the D6 cocktail mixer on Sunday night, and he really cares about protecting investors and giving an unbiased assessment of what he sees on the charts. We talked more about this bigger picture moment of reckoning coming in the next 2 years, and how few gold bugs were even considering the longer-term ramifications if it broke in favor of the US equities… Of course, we both agreed that it would be much better for our businesses and portfolio if things broke in the direction of gold!

Here is an interview we had, over at the KE Report back in late October on this very topic, and it was very similar to the talk Christopher gave at VRIC for those that want to hear it straight from the man himself:

Christopher Aaron – Are We In The Final Phase Of The Gold Bull Market That Started 9 Years Ago?

I wanted to kick off the VRIC coverage with that sobering take on gold and the related gold stocks, because much of the focus of the conference was on big picture macro and geopolitical themes that can shape the commodities investing world. Curiously, there was hardly a peep uttered about this epic tipping point between the DOW:Gold ratio and the longer-term ramifications of it for the resource sector coming from any of the big-ticket headline speakers on the main stage.

Sure, some noted the strength in US equity markets, and then weighed in on their prognostications of what the new incoming Trump administration could mean for global trade and equity markets. However, nobody else was seriously considering the possibility of a 10-20 year market where gold and gold stocks could severely underperform the US equities. Again, I personally hope that is not what plays out, but I thought it was worth giving this idea a little daylight as a contrarian viewpoint. Trust me, there was PLENTY of bullish commentary on gold, silver, and precious metals stocks… which of course is more fun to digest for those in attendance (including me as someone holding a basket of over 40 gold and silver stocks and royalty companies).

Another more sobering panel discussion on the stage at VRIC, included commentary from the great Rick Rule (well, many of the panel discussion featured Rick – Haha!). In this particular conversation, he pointed out that most investors underappreciated the value of CASH, and the means with which individual investors could use it as a tool in their own portfolio management. He also expanded the conversation to outline the importance of companies that knew how to properly deploy cash or raise cash in their respective businesses, and that sadly many failed to have good financial stewardship.

I noticed some squirming in the chairs when he savagely called out bad management teams and bad investing philosophies, but he also gave investors and companies the clear vision of how things can be done better, and hopefully it didn’t fall on deaf ears.

Sticking with panels that featured Rick Rule, another one I really appreciated, as an avid supporter of nuclear power and the compelling supply/demand metrics for uranium, was the panel on uranium investing. Jesse Day, (Commodity Culture and the VRIC Media channel) did a fabulous job hosting the panel and had great questions to keep the discussion moving (he’s a very sharp interviewer and I told him so at the event). He had a solid panel of guests including Rick Rule (Rule Investment Media), Jordan Trimble (Skyharbour Uranium), and my friends and colleagues Nick Hodge (Digest Publishing) and Fabi Lara (The Next Big Rush).

Everyone had great comments, but I felt Nick Hodge offered some of the best practical advice for investors in attendance, highlighting that the uranium sector does have well-constructed ETFs with good allocations like (URNM) and (URNJ), for those that don’t want to take the individual company risks. He also highlighted the advantages of being in the more liquid dual-listed companies like enCore Energy (EU), Energy Fuels (EFR.TO) (UUUU), Uranium Energy Corp (UEC), Denison Mines (DML.TO) (DNN), or NexGen (NXE). For most investors, this is a much less risky way to play the moves in the uranium stocks; instead of just camping out in only earlier-stage exploration stocks, that are still looking for economic uranium deposits.

We had Nick on the KE Report back in early January, and while we covered a lot of ground in the macro and gold and copper sectors, here is the hotlink to the part of that discussion specifically dealing with opportunities in the uranium stocks.

Nick Hodge – Macroeconomic Themes In 2025 - Opportunities In Gold, Uranium, And Copper Stocks

Fabi Lara reiterated some of these points, and really showcased the edge that the North American domestic uranium stocks can have. Companies exploring in the Athabasca Basin, and in particular the smaller producers and developers operating in the United States are some of her favorite places to be positioned within her own portfolio.

Over at the KE Report on December 5th, Fabi Lara joined me to dig into the major demand drivers and supply disruption news that is underpinning a longer-term bull market for nuclear power and uranium mining. We then pivot over to a nuanced review of the opportunities in the uranium producers, developers, and explorers in the US and Canada.

Fabi Lara –Nuclear Power Fundamentals –Opportunities Abound For Investing In Uranium Stocks (Part 3)

Moving on from uranium to another energy metal – Copper: I know there were some solid panels and discussions on the red metal that I’d hear snippets of as I spoke with companies on the investing floor, but sadly I missed the actual full conversations. I talked to a number of companies exploring for copper or developing deposit with a significant copper credit, but there will be more to say on those stocks in future articles.

I would anticipate some of the video content from the conference showing up on the VRIC Media channel over at YouTube in the not-too-distant future, so here is a link to that for readers here to keep tabs on. {Many of the speakers already mentioned have been featured somewhat recently in other videos, so those are also worth exploring.}

https://www.youtube.com/@vricconference/videos

Pivoting to Silver, it is always one of my favorite sectors to both invest for the long-term and speculate in for the short-term; due to the wild volatility this space always has, and the extreme undervaluation we are seeing in silver equities. I made it a point to be in attendance for the “2025 Silver Forecast” panel; once again hosted by Jesse Day, and featuring Jeff Clark (The Gold Advisor), Peter Spina (GoldSeek), Peter Krauth (Silver Stock Investor), and Glenn Jessome (Silver Tiger Metals).

Jesse, Jeff, Peter S., and Peter K. all had great points, and all shared great companies for investors to consider. I found myself nodding along to their macro commentary and then their discussion delving down into the silver equities, (but in this case they were preaching to the choir). Haha!

I am biased as shareholder of Silver Tiger Metals (TSX.V:SLVR – OTCQX:SLVTF), and they are company sponsors over at the KE Report; but I felt their CEO, Glenn Jessome, stole the show on this particular Silver panel.

Glenn crammed in a ton of information for investors to consider about different stages of silver stocks, the decreasing numbers of active primary silver mines over the last few years, the limited number of future mines coming online and the premium they will receive, the improving politics and permitting outlook in Mexico, and the potential of a re-rating across the board of Mexican gold and silver stocks setting up for 2025.

Additionally, without even taking a breath, he gave a whole overview for both GoGold Resources Inc. (TSX: GGD) (OTCQX: GLGDF) and Silver Tiger Metals in that same answer. Gotta love Glenn when he gets on a roll!

Over at the KE Report on January 6th, Glenn Jessome, President and CEO of Silver Tiger Metals, joined me to recap their key milestones from 2024, and to look ahead to all the work initiatives and company and sector catalysts on tap for 2025, at the El Tigre Silver-Gold Project in Mexico.

Silver Tiger Metals – 2024 Milestones, Resource Update and PFS For El Tigre Open Pit – 2025 Focus Shifting Exploration Deeper, Building Towards Underground Mining PEA

We start off with a brief review the key takeaways from the updated Resource Estimate and Pre-Feasibility Study (PFS) on the open-pit that were released to the market in 2024 as key company milestones. There has been a lot of drilling done to move categories from inferred into indicated, as well as metallurgical testing, preliminary engineering work, permitting, and social licensing.

Then we shift gears into the deeper drilling, from underground, that commenced at the end of last year and will be continuing into the first half of this year; testing the high-grade silver veins, sulphide zones, and shale areas, continuing to mass up underground resources. The strategy is then compile that data with other ongoing derisking work into the Preliminary Economic Assessment (PEA) out on the underground mining second phase, scheduled to be out in the late first half of 2025.

As for all the other companies in attendance not yet mentioned… Look, there were 200+ companies in attendance, and I’d say another 75-100 management teams from companies that didn’t have booths cruising through the event and setting up meetings around it in downtown Vancouver. It was WAY too many to possibly cover in this recap of the VRIC, so I’ll be weighing in on some of them in the year ahead on this Substack channel, taking deep dives into the stories that stood out as opportunities for investors to consider.

Thanks for reading this review of the Vancouver conference season, and may you have prosperity in your trading and in life!

- Shad