Kicking Off 2025 With The Resource Conferences In Vancouver - Part 1 (MIF)

Excelsior Prosperity w/ Shad Marquitz (01-22-2025)

Well, it’s that time of year again… At the end of last week thousands of resource investors, capital markets opportunists, institutional funds, junior mining company management teams, service providers, and sector thought leaders all made the annual pilgrimage to Vancouver, Canada, for the triple-header conference kickoff in the mining sector.

The festivities, networking, and knowledge sharing began on Friday January 17th at the Metals Investor Forum (MIF) over 2 full days (and evenings), then transitioned over to the Vancouver Resource Investment Conference (VRIC) starting on Sunday January 19th for 2 more days (and more late evenings), followed by the AME Roundup which started on the 20th and still ongoing through the 23rd. Many people are still there at the tail end of this wild week.

Personally, I attended both the MIF and VRIC over all 4 days; and then many of the associated evening event dinners, organized analyst mixers, cocktail parties, impromptu meetings, and even a hockey game that had many companies in attendance (thanks again Silver Tiger team for that invite).

It was 4 full days with the pedal to the metal in a myriad of speed-dating meetings and bump-into conversations. I sat through (and stood through) dozens and dozens of company overviews and pitches, catching up with old friends, making new friends, and hearing from some of the biggest names in the sector and many retail and institutional investors on how they were looking at the macroeconomic, geopolitical, and commodity trends for 2025. Both events were really well done, and it really was a great way to kick off the year!

These conferences are always intellectually and financially rewarding, and the information shared often shapes one’s investing approach or even the companies to be positioned in for the year to come. These events are also overwhelming. So much information is shared that it is like drinking from a firehose with the steady stream of macro or investing data and marketing promotion. There are moments where most participants feel that their “sponge is already too full,” where any additional information is just no longer being absorbed. However, after small breaks and intermissions, most attendees will get their second, third, or fourth wind and dive back into even more investing conversations, swapping trading secrets, hearing about company insights, parsing out industry scuttlebutt, and then doing even more networking making and getting introductions.

There is really no way to effectively capture and transfer the whole experience to others in written form, or even in photo or video form. Like so many live events such as music concerts, comedy clubs, or sporting events… people just need to be there in all the hustle and bustle to emerge with their own unique experiences and takeaways. Having said that, for those that were unable to go, I’m going to share some of the companies that caught my attention and some of the key investing nuggets that I pulled away from the conferences. Hopefully it is a value add for readers here.

Part 1 will be on the MIF, and Part 2 will be on VRIC.

So, let’s get into it…

There were a lot of great newsletter writers and thought leaders in the space speaking at the MIF; like Rick Rule (Rule Investment Media), Brien Lundin (Gold Newsletter), Joe Mazumdar (Exploration Insights), Eric Coffin (HRA Advisories), Jeff Clark (Paydirt Prospector), Garrett Goggin (Golden Portfolio), John Kaiser (Kaiser Research Online), Chen Lin (What is Chen Buying? What is Chen Selling?), Peter Krauth (The Silver Stock Investor), Robert Sinn (Goldfinger Capital), and Brian Leni (Junior Stock Review).

I’ll confess to having missed a number of their keynote presentations at the event, opting instead to spend more quality time with company management teams and investors that were in attendance out near the booths. Having said that, I definitely popped into the lecture hall each day to hear a few of the talks and associated company presentations from the stage, and ran into a number of the speakers at the event to catch up and get their thoughts and sentiment at present.

For those curious about the companies that each newsletter writer invited to the event, then a quick scan down the conference agenda will be quite instructive:

Also, the Metals Investor Forum does a great job of reposting their key note addresses and company presentations and newsletter writer interviews on their YouTube channel. I’ve personally been going back through the talks to fill in the gaps on what I missed when tied up on the conference floor, and recommend people spend some time here over the next week or so digesting some of the content. Check out the videos of the MIF here:

https://www.youtube.com/@MetalsInvestorForum/videos

The Metals Investor Forum is well-organized and it is a fairly contained event on just one floor of the Fairmont Pacific Rim hotel. As a more boutique conference, it is also more digestible with 48 companies presenting, and a few hundred people in attendance at any given time. My guesstimate is that maybe 500-600 people in total wandered through the MIF at one point over the full 2 days, but again, not all at the same time. For this reason, it was less hectic than larger conferences, and much easier to get into quality 5-20 minute conversations with fellow attendees and dig deeper wells of connection or understanding. It’s a great way to ramp up into the larger VRIC event and is definitely worth getting to town early to be a part of.

Key Bigger Picture Takeaways:

Once again, most MIF speakers and companies in attendance were highly animated by the precious metals, with a little copper mixed in. That suited me fine, as I’m also quite animated by gold and silver companies, and also have some copper stocks mixed into my personal portfolio. There was very little to no discussion on other commodities like uranium, nickel, PGMs, oil, nat gas, etc…. at the MIF. [there were more conversations and other companies in those commodities featured at VRIC].

Gold does have (and has had) a lot of tailwinds at it’s back, so most MIF speakers were expecting higher prices again this year in the yellow metal (just like they do every year – Haha!). Overall though, they were very bullish on gold and gold stocks.

As we’ve noted many times here on this channel, both fundamentally and technically gold has been strong for the last 2+ years, and there isn’t any indication, at this point, that the party is over. Still, it does make me concerned when there are hardly any bearish comments on a given sector, and when the whole herd is moving the same way thinking nothing can derail their thesis. Just a thought…

Silver still had it’s fan boys and girls (I’m also a big fan of silver and silver stocks personally), but overall the sentiment and expectation for silver was more muted. This is likely due to the hybrid nature of silver being part precious metal, and a larger part as an industrial metal. If gold keeps trekking higher, then it should drag silver higher along for the ride. However, if the economy does start to roll over later in 2025 or early 2026, and isn’t as robust as current market expectations, then that could pressure silver’s industrial exposure.

That comment on the potential headwind of an economic contraction also applies to how folks were looking at copper in the medium-term, despite its bullish longer-term fundamentals.

Speaking of silver… One of the better sessions I sat through was the silver lecture and company panel that Peter Krauth hosted.

Peter featured the following companies as his newsletter pics for the MIF. [from left to right]:

Andrew Pollard,CEO of Blackrock Silver Corp. (TSXV: BRC) (OTCQX: BKRRF), Galen McNamara, CEO of Summa Silver Corp. (TSXV: SSVR) (OTCQX: SSVRF), Shawn Khunkhun, CEO of Dolly Varden Silver Corporation (TSXV: DV) (OTC: DOLLF), Brad Langille, CEO of GoGold Resources Inc. (TSX: GGD) (OTCQX: GLGDF), and Scott Emerson, CEO of Kingsmen Resources Ltd. (TSXV: KNG) (OTCQB: KNGRF)

Each company had key news that was released to the market leading up to this conference:

Blackrock Silver Drills 4.7 Metres Grading 714 g/t AgEq (379 g/t Ag and 3.72 g/t Au) and Reports Multiple +1 Kilogram Per/Tonne AgEq Intercepts at Tonopah West

- 16 Jan 2025

Summa Silver Announces First-Ever Mineral Resource Estimates on its Two American High-Grade Silver Projects - Jan 16, 2025

https://summasilver.com/summa-silver-announces-first-ever-mineral-resource-estimates/

Dolly Varden Silver's 120 Meter Step-Out at the Wolf Vein Intersects 379 g/t Silver over 21.69 Meters, Including: 1,804 g/t Silver over 1.67 Meters - Jan 7, 2025

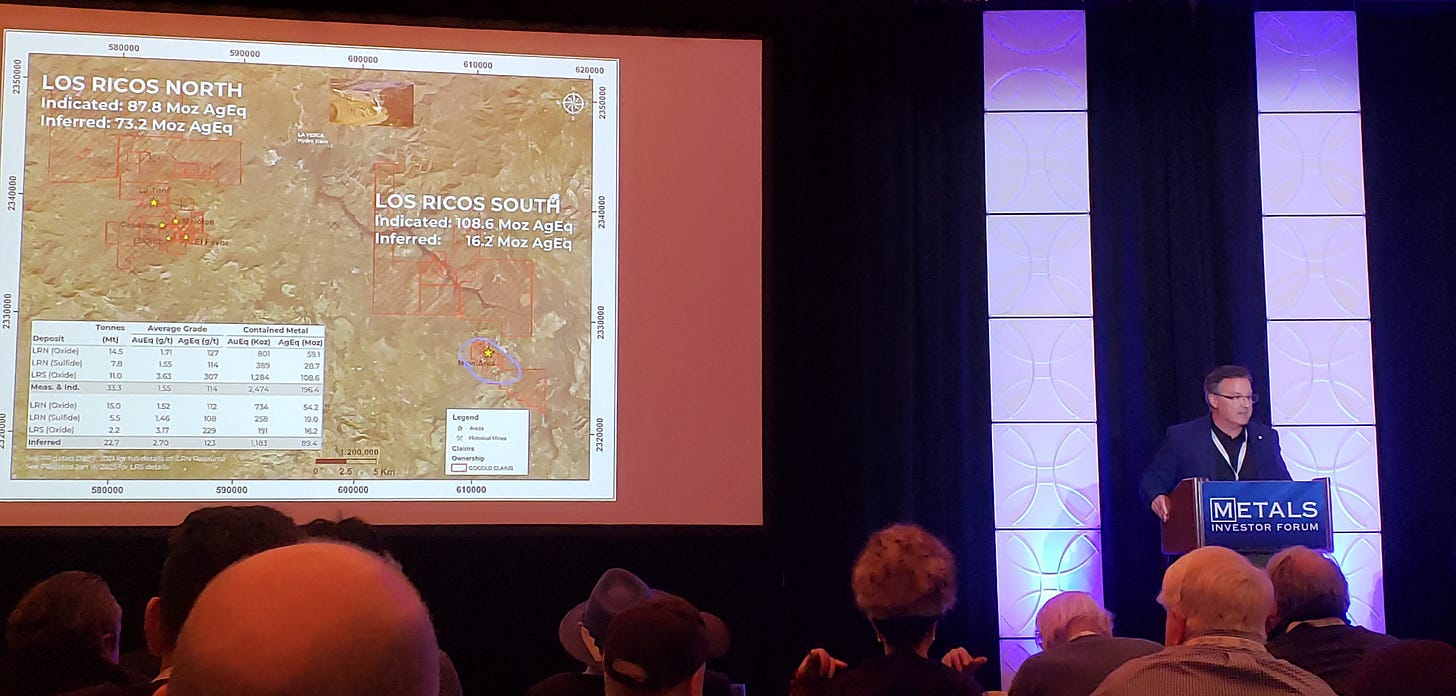

GoGold Announces Results of Los Ricos South Feasibility Study with After Tax NPV of US$355M - Jan 16, 2025

https://gogoldresources.com/images/uploads/files/2025_01_16_LRS_Feasibility.pdf

Kingsmen Commences 2025 Las Coloradas Exploration - 8 Jan 2025

https://www.kingsmenresources.com/post/kingsmen-commences-2025-las-coloradas-exploration

Another nice feature of the Metals Investor Forum is that after the newsletter writer and their panel of companies speak on the main stage, then they also have a secondary room for an extended Q&A period. Attendees can probe deeper into specifics on each company or have several companies address a common question. I decided to keep on learning with these silver stocks and attended this session.

In full disclosure, I have positions in Blackrock Silver, Dolly Varden Silver, and GoGold Resources at the time of writing this article, and may choose to buy or sell shares at any time.

Hopefully that gives readers here a sense of how the MIF format works. It is also worth noting that that sometimes one or multiple newsletter writers will also interview the companies in attendance and those videos will also be posted on the MIF YouTube channel.

A lot of the newsletter writer speakers could not help weighing in on geopolitics, especially around expectations and projections for the new US administration, and the possibility of political change in Canada. From a macroeconomics perspective that makes sense.

Personally, I spend very little time digesting or prognosticating about such political topics when they veer away from macroeconomic impacts. Speakers that camp out in geopolitics, while gazing out upon the world or society through their own personal biases can be entertaining, but decades of experience has taught me that almost everyone ends up being wrong or getting surprised about political trends or the specific policies that get enacted (or the ones that never get enacted).

It is far more time efficient (and much less stressful) to just note any ACTUAL jurisdiction policy changes when they happen definitively. Then one can react accordingly in their portfolios, and skip all the preamble, bias, and noise. At some of these talks the speakers get way off into the weeds with their global outlook or assessment of their own countries flaws and weaknesses, instead of focusing on what actually matters – the financial sectors, stocks, and attractive pricing entry or exit points that can make investors money.

My portfolio is invested in companies that are operating globally (not just in the US or Canada), so I care much more about the actual companies themselves. I find many conference attendees also love discussing politics, but unless it is specifically about permitting mining projects or taxation, then it rarely matters.

It is far more important to focus on the price action in the underlying commodities, the specific company work programs, the quality of the management teams, the financial health of the companies, and the unique technical pricing risk/reward setups.

Key Company Takeaways:

At every conference there are a couple stocks that have put out recent news that then capture the attention and imaginations of audience members. Sometimes these flavor-of-the-day companies end up just being flashes in the pan (and there are dozens and dozens of company roadkill that were the talk of the town years back in investing circles that blew up or had slow grinds down). I’m not going to get into all the examples, as it is unkind to talk poorly of the dead. Conversely, sometimes these key news events (typically a splashy drill hole result) can launch a company into the mainstream, in a rare trajectory higher that just keeps going all the way into a legitimate economic deposit that becomes a future mine.

We already know the odds are not in the favor for exploration projects to find something that ultimately matters -- Only 1 in 3,000 exploration targets actually make it all the way across the finish line to become economically viable producing mines. Las Vegas has much better odds…

A huge swath of resource investors just love to position in front of greenfields assay results, or even post-assay results if they are solid, because of the volatility that can be captured on some of these “lit matches.” After a big discovery hole is announced that really catches people’s attention, then these junior exploration stocks can rip higher suddenly producing outsized gains. {Lottery tickets}

Well for the MIF, and even carrying over to the VRIC, there was a clear standout winner in this department – Amarc Resources. They were definitely the talk of the town, and had just put out some very encouraging copper/gold assays at their JOY copper-gold district in the Toodoggone-Kemess region of north-central British Columbia, in cahoots with their earn-in partnership with Freeport. Several dozen people asked me point blank – “Did you see those drill results from Amarc? Wow!!”

Well… for inquiring minds… here is the press release discussing those drill results.

Amarc Announces New High Grade “AuRORA” Copper-Gold-Silver Deposit Discovery in Collaboration With Freeport at the Joy District, British Columbia

- January 17, 2025

They are impressive initial results. To be clear, I’m definitely not suggesting to people reading this that they should run out and pick up shares, nor am I suggesting for people not to pick up shares. I’m simply reporting back that both the MIF & VRIC were ablaze with speculation about Amarc, along with other nearby “close-ology” companies in the Toodoggone of B.C. Attendees were “all jacked up on Mountain Dew” as far as these recent drill results. Honestly, it was fun to see people genuinely excited about drill assay news again. Man does our sector need some more excitement!

In full disclosure, I do not have a position in this stock, and also do not have an opinion on it at this time. I’m just reporting back that it was THE STOCK that everyone was talking about, and wanted readers here to be well informed.

This struck me as quite similar to how everyone was discussing Hercules Silver back in Oct/Nov of 2023 after their copper discovery hole surprised to the upside. It was also reminiscent of how Argenta Silver had captured everyone’s imaginations when Frank Giustra announced he was one month out from launching it as a new company, while we were all attending the Beaver Creek PM Summit last September. This January it was clearly Amarc Resources… (Wishing all these companies great success.)

There is always one stock that becomes the focus of investor chatter at any conference, (and sometimes there are 2 or 3 stocks that have the buzz). While some of these herd stocks eventually go on to disappoint, epically crashing and burning… some do go on to become the big winners like Silvercrest, Great Bear, New Found Gold, or Snowline Gold. Only time will tell…

Nobody knows how things will progress for Amarc, but having great results and a major partner in Freeport definitely gave it some well-deserved time in the sun.

With the remaining space I will highlight some of the companies that had my attention at the MIF, as either portfolio positions or companies on my watch list.

Starting with silver companies I hold in my portfolio:

We’ve already mentioned 3 of the silver stocks above from Peter’s panel: Blackrock Silver, Dolly Varden Silver, and GoGold Resources – In addition to their presentations, I also caught up with their management teams at their booths to ask a few of my own questions, and came away happy with my investments in these companies. Another silver stock I’ve written about a few times recently, that I also caught up with at the conference was Silver Tiger Metals Inc. (TSXV: SLVR) (OTCQX: SLVTF). I’m going to feature them a bit more prominently in the next part of this series in Part 2, so stay tuned for that soon.

With regards to gold stocks in my personal portfolio, I caught up with these management teams at the MIF:

Dryden Gold Corp. (TSXV: DRY) (OTCQB: DRYGF), First Nordic Metals Corp. (TSXV: FNM) (OTC: FNMCF), Goliath Resources Limited (TSX-V: GOT) (OTCQB: GOTRF), Heliostar Metals Ltd. (TSXV: HSTR) (OTCQX: HSTXF), Thesis Gold Inc. (TSXV: TAU) (OTCQX: THSGF), and West Red Lake Gold Mines Ltd. (TSXV: WRLG) (OTCQB: WRLGF). I’ve written about Goliath Resources, West Red Lake Gold Mines, and teased Thesis Gold in some articles the end of last year. I’m going to be coming out with deeper dive articles on Dryden, First Nordic, Heliostar, and Thesis so stay tuned.

Here are a few recent interviews conducted at the KE Report with some of those gold stocks:

Dryden Gold – 2024 Recap - 2025 Work Initiatives At Gold Rock Camp, Sherridon, And Hyndman Areas

First Nordic Metals – C$10M Financing To Fund Exploration At Paubäcken, Storjuktan, & Klippen

Goliath Resources – Best High-Grade Gold Intercept Returned From The Surebet And Bonanza Zones

Heliostar Metals - Overview Of The Technical Reports On The Mines And Development Projects In Mexico

West Red Lake Gold Mines – Diving Into The Details Of The Pre-Feasibility Study At The Madsen Mine

There were also a number of watchlist companies that I connected with at the MIF, catching up with management teams to gather more information and keeping me intrigued:

1911 Gold Corporation (TSXV: AUMB), Aztec Minerals Corp. (TSX-V: AZT) (OTCQB: AZZTF), Banyan Gold Corp. (TSXV:BYN)(OTCQB:BYAGF), Founders Metals Inc. (TSXV: FDR) (OTCQX: FDMIF), Kingsmen Resources Ltd. (TSXV: KNG) (OTCQB: KNGRF), Liberty Gold Corp. (TSX: LGD) (OTCQX: LGDTF), Newcore Gold Ltd. (TSX-V: NCAU, OTCQX: NCAUF), Red Canyon Resources Ltd. (CSE: REDC) (OTCQB: REDRF), Scorpio Gold Corp. (TSXV: SGN) (OTCQB: SRCRF), Summa Silver Corp. (TSXV: SSVR) (OTCQX: SSVRF), Vista Gold Corp. (NYSE American and TSX: VGZ), and Western Exploration Inc. (TSXV: WEX; OTCQX: WEXPF). [There were other interesting companies there but I didn’t get to speak with the management teams of them and will have to catch up with them at a later date.]

The Metals Investor Forum put out a 2025 MIF video, which included a cameo shot of me wheeling and dealing at the conference. I was talking with Head of Investor Relations for Western Exploration (and a wonderful person), Nichole Cowles… so I’m throwing in a screen capture of that for readers here as a bonus. Haha!

Hoping to see readers here at these Vancouver events next January!

Thanks for reading and may you have prosperity in your trading and in life!

- Shad