Key Takeaways From The Natural Resource Stock Expo In Atlanta – Part 2

Excelsior Prosperity w/ Shad Marquitz (06-01-2025)

We are continuing on here with more coverage from the Natural Resource Stock Expo 2025 earlier this month from May 14th-16th in Atlanta, Georgia. This is the second part of this article series, as the content had swelled up too large for just one update. Below is a link to Part 1 for those that missed it.

We left off in that prior article smack-dab in the middle of the 1-on-1 meetings with new companies not currently in the portfolio. So let’s move on to the next companies:

Denarius Metals Corp. (Cboe CA: DMET) (OTCQX: DNRSF) – I caught back up with Michael Davies, Chief Financial Officer for Denarius Metals, after having met up with him for dinner in Beaver Creek last September. I’d also sat down with Serafino Iacono, Executive Chairman, and Alessandro Cecchi, VP of Exploration, at the Top Shelf partners conference in Fort Lauderdale back in October; so this was more about getting an update on this company.

I’d actually jumped into the stock for a brief period of time for quick swing trade at the end of last year and into the beginning of this year, but am now considering getting into position here for the longer-term company strategy. (at the time of this writing I do not have a position in place)

➤ First off, before getting into the projects, I think it is important to highlight the strength of the management team and board here. These are the same guys that were behind Gran Colombia Gold Corp (which later changed their name to GCM Mining Corp) (TSX: GCM) (OTCQX: TPRFF) and were then acquired by Aris Mining Corporation (TSX: ARIS) (NYSE-A: ARMN) in September of 2022. Aris Mining actually has a 10% stake in this company as well.

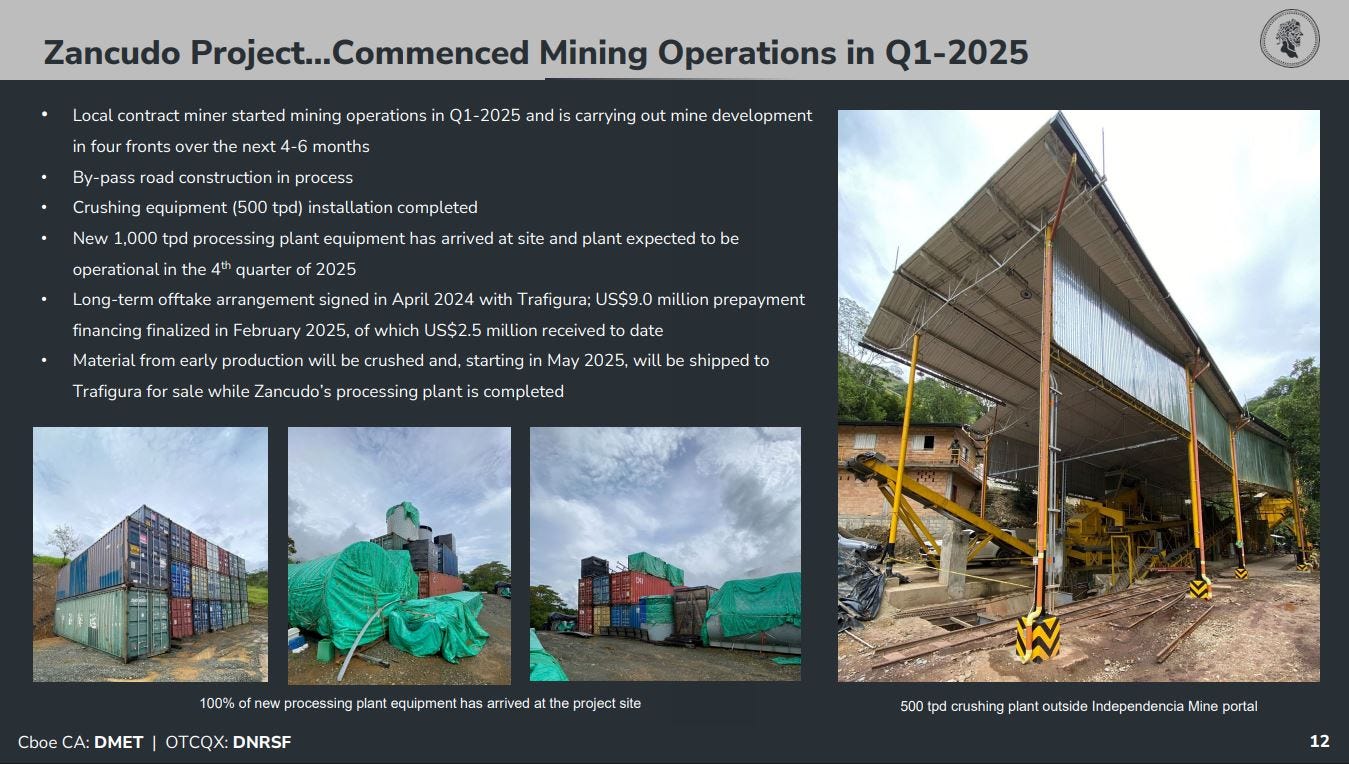

Their experience as gold producers in country is very germane, because they are currently putting their Zancudo Gold-Silver Project into production in Colombia at this very moment. They have already been mining at the project there, and then are crushing down the mineralized ore and shipping this material to Trafigura for processing in the interim, while the Zancudo’s processing plant is being completed.

The plan is then to move forward with developing their 3 polymetallic Projects in Spain: Aguablanca, Lomero, and Toral.

Their Aguablanca Project is the next project in the cue moving towards production. Importantly, on May 15th, during the conference, they received their final permits to be able to commence with development work and dewatering of the old mine over the next 6-9 months, and then plan to be into production within the next 12 months.

Denarius Metals Announces Receipt of 20-Year Water Concession and Now Has All Required Permits to Re-Start Operations at the Aguablanca Project in Spain - May 15, 20205

https://denariusmetals.com/denarius-metals-announces-receipt-of-20-year-water-10128/

🔹 As an investor, I personally really like and tend to gravitate to the strategy of a junior company getting into production quickly, to start generating revenues that fund a big portion of their exploration and development work on other projects. This gives the company access to a different class of investors, a better valuation multiplier and better cost of capital, and does so without diluting the existing shareholders down into the ground with overly excessive repetitive financings.

💡 We’ve talked in this channel about numerous other portfolio positions excelling at this very same business model like Integra Resources, Heliostar Metals, Magna Mining, Cerrado Gold, Sierra Madre Gold and Silver, Minera Alamos, Mako Mining, Thor Explorations, and Discovery Silver. In my mind this is a superior approach to exploration and development, funded by organic revenues from production.

To be clear, smaller-scale production rarely covers all the expenses, and those companies will still need to raise money from time to time, or set up a loan facility for future larger development project builds. It just helps the cause…

Regardless, I love seeing some of those revenues start coming in from small-scale production to stave off needing to dilute as often at the equity level; at least to the same degree that 99% of junior companies will do. Most junior pre-revenue companies will perpetually steal the opportunity from their longer-term investors from the value creation in the company through excessive dilution.

The real wins in the 2nd phase of the Lassonde curve then get offered to the people that get into position right before finally going into the construction phase (unless those investors kept participating in private placement after private placement multiple times along the journey, which most retail investors are not privy to).

Over the last few years, many advanced exploration and development companies got stuck in the boring “orphan phase” of project derisking and development ,and thus have been dead money. This created a noticeable “opportunity cost” for investors that could have instead been positioned in producers that were actually monetizing and benefitting from the higher underlying metals prices.

Small-scale producers of gold, silver, or copper at today’s metals prices have very fat margins, which will allow those juniors to step on the gas as far as upping their exploration and development efforts at other key projects. This is far more preferable, to my mind, compared to the typical pre-revenue junior stock journey… ie, getting stuck in the hamster wheel of small financings, followed by mediocre work programs, that don’t really get much traction in the market, and then doing another raise at similar or lower levels. Rinse and repeat.

👉 I’m aware that a few vocal pundits in the sector will trash talk small mining operations, preferring to position only in the largest producers or tier 1 development mine builds. In listening to them, they make it seem like problems only happen to small miners, and that only upside surprises happen to the larger projects and miners. This is simply not true. Keep in mind though, that those comments should also be taken with a huge grain of salt. This really is a very nuanced discussion, and each investor should know their risk tolerance levels and balance those against the type of gains they’d like to make.

Sure, going into the very biggest and best producers or huge development stories will still do good in these underlying metals prices, and those are great options for more risk adverse multi-year patient capital, (especially if an investor was offered sweetheart private placement deals along the way, with multi-year warrants attached). Remember, many sector pundits are still talking their book in podcast interviews, even when they are talking in general terms!

In a bullish market backdrop though, the performance of the smaller producers will run laps around the bigger companies. (Over the last year would you have rather owned Fresnillo the biggest silver producer or senior gold producers like Newmont or Barrick, or would you have rather owned Avino Silver and Gold or Luca Mining?)

Avino and Luca are “small-scale producers” that many “experts” and generalist investors would have snubbed their noses at as their production is “too small, but those types of plays can give retail investors an edge as they’ll move in outsized ways to smaller victories.

So, it is really a risk/reward spectrum, and the bigger rewards involve taking on a bit more risk in the smaller operators. This approach is not for everyone.

Sure, the smaller projects can have problems, like any development project coming into production; and so can any mine of any size for that matter.

Mining is a brutally tough business (whether the mines are big or small) and there are all kinds of problems that can befall any project. Just look at what happened to Victoria Gold in their unfortunate landslide in the Yukon stopping all production on a “big mine” and giving that jurisdiction a big black eye, or senior operator SSR Mining on the landslide at their “big Tier 1” Copler mine in Turkey in early 2024.

🔹 In one sense, those biggest and best-in-class mine construction projects are generally perceived by many market participants as “safer” than the smaller mines due to their advantages of scale. That is, of course, unless you look at the many misfires we’ve seen over the last couple of years in the big mine builds:

Remember the huge cost overruns and timeline pushbacks at Argonaut’s Magino project (finally acquired Alamos while they were weak), or Iamgold’s Cote’ project which kept costing more and getting pushed back…. or Ascot Resources belly flop into the “big mine” producer swimming pool, with their failure to get their Premier Mine up and running commercially. Look how much longer it has taken than expected and how much more expensive it has become for B2Gold to get their Goose Mine built up in the frigid north.

Even after years of getting ready to get ready, we’ve still seen plenty of pain for investors in the large-scale projects when they move towards production and run into all kinds of snags and setbacks. We’ve heard that surprises in big mines are usually big upside surprises, but in reality big mine builds can be a far cry from rainbows and lollipops.

Remember, bigger is not always better, no matter how many times you hear that proclaimed from stage at a mining conference or on a podcast episode.

To be balanced here, we’ve also seen a slew of smaller development projects working to transition into producing mines fail bigly:

Remember Red Eagle Mining’s series of mistakes and shut down into radio silence from management back in 2018, or Harte Gold’s subpar move into production resulting in a takeover near the lows, or Novo Resources fumble to produce profitably at Beaton Creek, or Pure Gold’s botched attempt at production at Madsen, or Alexco’s failure to get escape velocity at Keno Hill before being taken out of their misery by Hecla?

This discussion above was extended on purpose in the lead up here, because another 1-on-1 meeting I had at the Atlanta conference was with Lion One Metals Limited (TSXV: LIO) (OTCQX: LOMLF). {another junior producer that has struggled to ramp up to the commercial production levels it envisioned about a year ago}

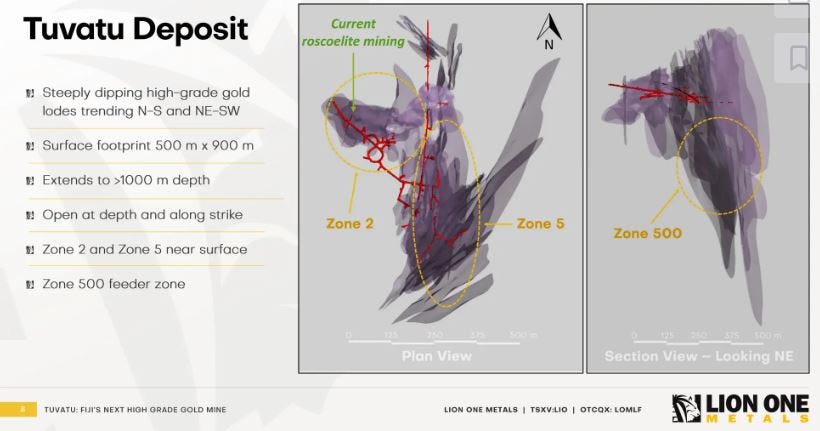

In the past I had a position in Lion One, due the prospectivity of their exploration targets across their alkaline gold system in Fiji, and I initially liked their plan to go into small-scale production to funds more exploration at their Tuvatu Project.

Their first year trying to ramp up into production did not go well at all. In full disclosure, I sold out of my Lion One position last year, picking up a tax loss credit of around -38% to wash out other gains that were taken in 2024. That really didn’t leave a good taste in my mouth.

I could tell by the middle to end of last year, when capital raise after raise after raise was happening that it wasn’t going to stop; especially when paired with the near radio silence many months into ramp-up and then the very low production numbers when news finally did post on the first quarterly operations report. It was clear they were not going to hit guidance, and were struggling with too little operating capital, so I sold out to avoid further pain.

Fast-forward to today, and I’ll say after the 1-on-1 meeting, where I got candid and encouraging answers to challenging concerns raised and difficult questions broached, the potential for a turn-around in operations here is growing.

They have now purchased new equipment (as the old equipment they initially had was wearing down or not functioning as needed), so that is a plus.

They’ve also drifted down into a highly mineralized panel in the Ura Lodes (that was previously unknown through exploration and a pleasant upside surprise for a small miner). Apparently it looks as interesting as the high-grade 500 feeder zone.

Ronan Geoghegan of Lion One outlined in our meeting that in addition to the new mining equipment, and the new higher grade material found at the Ura Lodes, in concert with other material from Zone 2 and Zone 5, that they should see increased production numbers over the next few quarters.

Additionally, the company is working to expand the plant capacity for additional processing, which should translate into even more production about a year out.

If they can execute on the plan and quit raising so much money, since they’ll be producing gold and generating revenues, then I think this mine could start becoming the ATM machine to fund the other exploration initiatives.

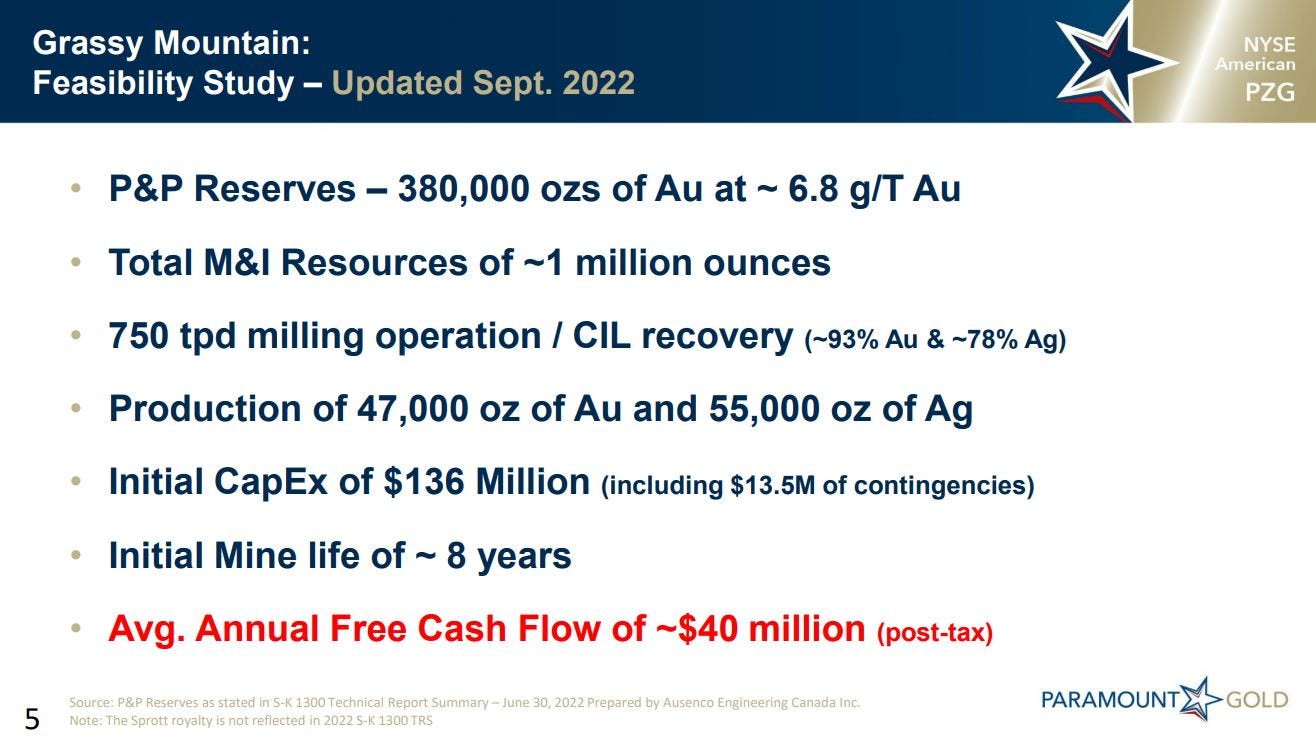

Paramount Gold Nevada Corp. (NYSE American: PZG) – CEO Rachel Goldman overviewed their high-grade Grassy Mountain gold project in Malheur County, Oregon; which is at the Feasibility Stage.

Of course, there aren’t many mining projects based in Oregon, so I asked about what the permitting landscape is like. Their Grassy Mountain project has been selected for inclusion in the federal government’s FAST-41 program. FAST-41 covered projects are entitled to comprehensive permitting timetables and transparent, collaborative management of those timetables on the Federal Permitting Dashboard as stated in a press release issued by the White House.

The company also has intriguing optionality with their past-producing Sleeper Gold Project in Nevada. I got the impression during the meeting that the focus was on the Grassy Project, but that Sleeper could potential be worked by a JV partner or monetized if the right offer came in from another company.

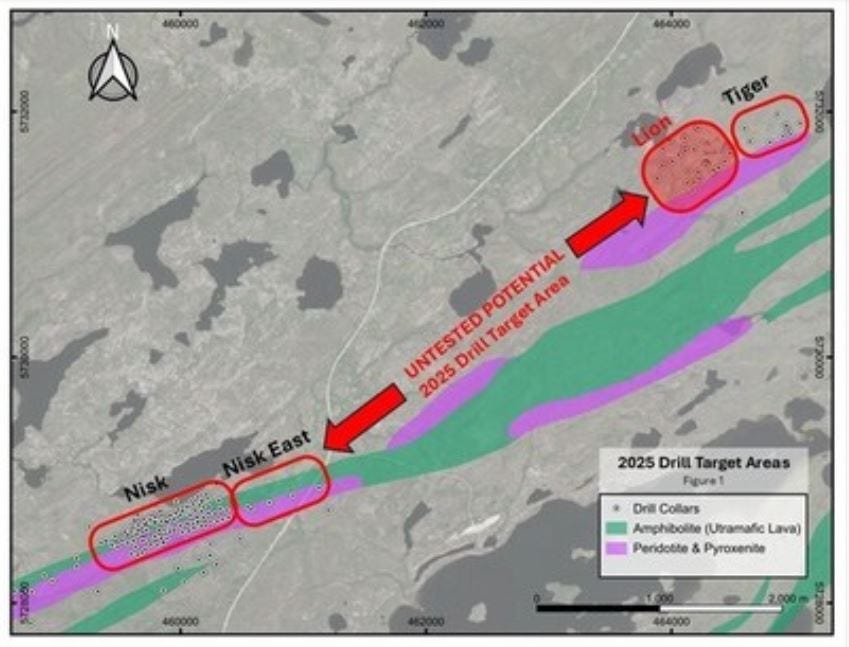

Power Metallic Mines Inc. (TSXV: PNPN) (OTCBB: PNPNF) - Even though I’d just seen CEO Terry Lynch in the flesh in Fort Lauderdale in the days leading up to this Atlanta conference, we were supposed to connect virtually via a call to review things, but because he was traveling the scheduled time was unable to work out). However, not to worry as I was able to get a nice update from Terry along with my partner Cory Fleck over at the KE Report the following week.

Power Metallic Mines - Fully Funded 100,000m Drill Program Underway at NISK Project

The company has an ongoing 100,000 meter drill program to test the areas between the Nisk/Nick East Zones and Lion/Tiger Zones, and has confidence that more discoveries of high grade polymetallic pipes will be found.

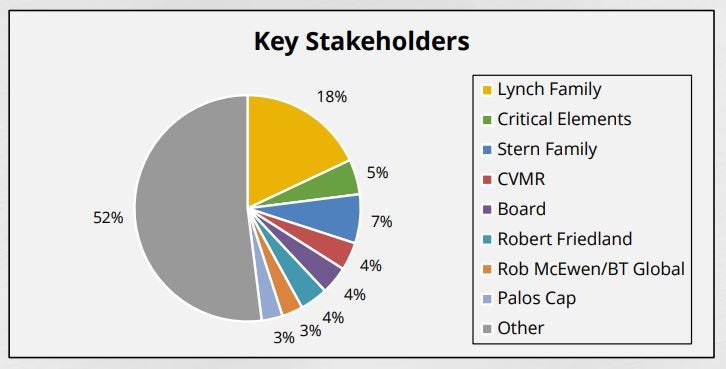

This company has a solid list of stakeholders, which I find impressive and they’ve already vetted the company in a sense.

This stock had corrected by over 40% since peaking out in late February, and so it looked like an attractive place to start nibbling at it at the end of last week. I’ll be adding at least one and maybe two more tranches to the position in the medium-term.

Ashleigh Barry, of Stocks To Watch, interviewed many of the companies present in the weeks leading up to the event, but was also conducting interviews live at the event with those keynote speakers and members of management teams present.

Also a special thank you to Ashleigh and also Kimberly Chesney for handling all the hotel conference event room bookings, scheduling of 1-on-1 meetings, and coordinating the event. All this hard work is often underappreciated by attendees and it takes a good team to pull off making any conference a success. They worked tirelessly to make it great!

Kevin Steuer (above), managing partner of https://stockta.com/ is interviewed by Ashleigh Barry. I got to know Kevin at this event and he is a very sharp investor and has built an interesting site at StockTA, full of technical analysis tools that can help assist investors.

➤ Kitco’s Paul Harris was the event M.C. & moderator; and is one of the best in the sector for doing interviews in my personal opinion. If he’s interviewing a company or a guest on his “Digging Deep” series on Kitco, then I’m generally going to check it out. At these last 2 conferences I’ve had a lot of time to talk about the sector and companies with Paul; and find him to be one of the more well-informed people in the sector, with a balanced grasp of company fundamentals and macroeconomic forces.

Paul Harris (right-hand side) moderated panelists: Saf Dhillon of Questcorp Mining (CSE: QQQ) (OTCBB: QQCMF), and Kevin Bullock of NexGold Mining Corp. (TSXV: NEXG; OTCQX: NXGCF), on the Gold Panel discussion.

Like most of the participants at this conference and the last few conferences, the case was made for higher for longer gold prices, and how this would remain a tailwind for gold equities to play catchup to the moves gold has made.

At this conference, I spent some time getting to know Saf Dhillon, and we connected last week over at the KE Report so he could introduce Questcorp Mining to our audience. Here is that interview:

Questcorp Mining – Exploration Programs About To Commence At The La Union Gold Project In Mexico, And The North Island Copper Property On Vancouver Island

Paul Harris moderated “Young Guns” panelists: John Feneck - Portfolio Manager & The Feneck Metals & Mining Portfolio; Erik Wetterling – The Hedgeless Horseman website; and me, Shad Marquitz – Co-host of the KE Report and Publisher of Excelsior Prosperity on Substack.

We weighed in on portfolio construction, trading best practices, stocks we liked, and even how we may get anchored to a position for a particular investing thesis but then needed to continually evaluate how that may change over time.

When the video is edited and released then I’ll come back and post it here for folks to check out.

We’ll wrap up this article with the qualitative value of new friendships forged or old friendships strengthened, with all of the various mixers, meetings, daily meals, and bump-intos in the hallways or lobby at these smaller boutique conferences.

➤ Just as one example: A group of us went out for a several-hour meal one night, and the conversation covered different companies in the sector, macroeconomic topics, investing tips and pitfalls, industry “war stories” and all with the backdrop of good food & drinks, fun, laughter, and fellowship.

Thanks for reading and may you have prosperity in your trading and in life!

Shad