Key Takeaways From The Natural Resource Stock Expo In Atlanta – Part 1

Excelsior Prosperity w/ Shad Marquitz (05-29-2025)

This article took a lot longer than expected to release here in this channel, because I’ve been holding off publishing until after broadcasting a few company interviews that will be embedded throughout the article. All of the points made within this review are still timely with regards to investing in the resource sector and the information reviewed on specific stocks mentioned are all still quite germane.

In fact, I’ve kept adding so much to this article while waiting to publish it that it has swelled up into a 2-part episode. So, buckle up because we’re going to recap the Natural Resource Stock Expo 2025!

From May 14th-16th in Atlanta, Georgia the management teams from 24 resource companies and about 60 vetted investors poured into The Whitley Hotel, for an insightful 3 days of networking, 1-on-1 company meetings, keynote presentations and panels, and evening company dinners all geared around investing in junior mining and energy stocks.

My goal here is to give readers the main takeaways and investing insights that I gleaned from this quality event, provide updates from catching up with portfolio company positions in attendance, while also introducing a few new potential company ideas for consideration.

This was the first year for this conference, but I had attended the 2 prior Top Shelf Partner events in Fort Lauderdale, with essentially the same conference format. Those events had benefitted me greatly as an investor, by being able to take deeper dives into the value proposition of portfolio companies. It helped to get repeat exposure to the same people several different times throughout this more intimate boutique event; compared to the limited moments in time one typically gets to experience with a given company at most other conferences.

In addition, this conference was a great opportunity to get introduced to new companies, and learn about their flagship projects and key upcoming catalysts. It is always helpful to look management teams in the eyes and ask them pointed questions. Additionally, these types of events help one size up whether to add new positions into one’s portfolio, or at least add them to a close watchlist of stocks that could be potential future positions. This event 2 weeks back achieved those exact same goals, and I’ll do my best to distill these ideas down into this article for readers here, along with embedded images, recent news updates, and related KE Report interviews.

So, let’s get into it…

The event kicked off with a networking mixer the evening of May 14th, that was then followed by a long networking dinner. This “soft start” to the conference gave attendees the chance to meet fellow resource investors and company executives that would be presenting at 1-on1 meetings or panel discussions for the following 2 days. Unfortunately, I don’t have any photos of either the mixer or dinner, as I was tied up in conversations the entire time and it didn’t dawn on me to snap a few action shots of the networking until after the festivities were over.

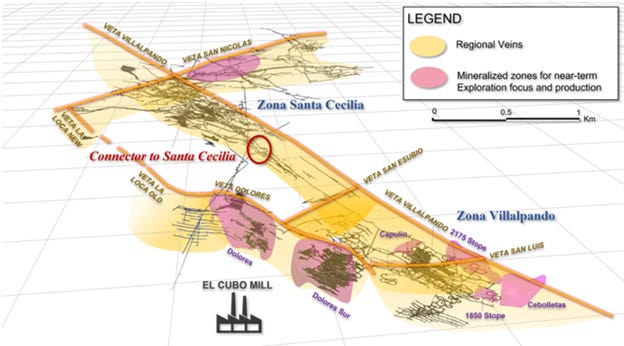

This was a good night for catching up with friends and colleagues in the sector. One conversation I thoroughly enjoyed was with James Anderson, CEO of Guanajuato Silver Co. (TSXV:GSVR)(OTCQX:GSVRF). We discussed how 2024 wrapped up for the company, along with some of the recent exploration success that had recently been announced to the market leading up to the conference.

Guanajuato Silver Provides Exploration Update

We also chatted in a general sense about the G-Silver Q1 financials that were going to be coming out to the market soon in the last week of May. James mentioned he felt that the company was at an inflection point coming out of Q4 and heading into Q1, and was even more animated about how things were setting up for Q2 and the balance of 2025. Those Q1 results have since been released to the market, and were received favorably.

Guanajuato Silver Posts Positive Mine Operating Income of US$4.8M in Q1, 2025

>> Selected Q1 2025 Highlights:

Record mine operating income of $4,845,773 was up 82% over the previous quarter; the Company’s mining operations have now successfully generated four consecutive quarters of positive mine operating income.

Record revenue for the quarter of $21,330,483 was up 12% over the previous quarter. Guanajuato Silver is a primary precious metals producer with over 90% of the Company’s revenue derived from the production and sale of silver and gold.

Operating costs continued to improve over the quarter; cash cost of $19.19 per AgEq ounce was 3% lower than the previous quarter; All-In Sustaining Cost (“AISC”)* was $23.41 per AgEq ounce – a 6% improvement over Q4, 2024.

Production for the quarter was 738,006 silver equivalent ounces (“AgEq”), which was a 1% increase over the previous quarter. Production consisted of 380,406 ounces of silver, 3,347 ounces of gold, 699,294 pounds of lead, and 909,029 pounds of zinc.

Adjusted EBITDA was up 135% over the previous quarter to $4,104,669.

We then drifted into a spirited conversation with other investors present about silver, gold, macroeconomic news, resource stocks that we like. I really enjoy hearing other investors talk about the companies on their radar screens and why they like them.

James also shared a little bit about their Guanajuato bullion store, which is selling beautiful silver coins and 10-ounce bars. [some folks present had no idea that they sell coins and bars on their G-Silver store, and some of those coins were raffled off at the event]. https://store.gsilver.com/

In full disclosure, Guanajuato Silver is a portfolio position (which I was just adding to last Friday and mentioned that in prior article here on this channel), and they are sponsors over at the KE Report {so I’m biased in those regards}. However, none of theses companies which show up in these articles ever ask me to discuss them in articles, nor do they specifically commission or pay me to write about them here on my Substack channel.

When I bring companies up here, it is simply to share with readers my own investing thesis and what I’m doing in my own portfolio with my own money. If there is interesting updates or news then this is my outlet for sharing my unvarnished take on things.

Post-conference, James and I did record and update interview together on this Wednesday May 28th over at the KE Report, recapping their Q1 financials, once those specific metrics were released to the marketplace earlier that morning.

The next day had a networking breakfast where the conversations kept going, and then everyone rolled into a full schedule of 1-on-1 meetings between companies and investors. Even though there were a handful of portfolio companies that we have discussed before in this channel present at this event like Guanjuato Silver, Metallic Minerals, Stillwater Critical Minerals, Scottie Resources, and West Red Lake Gold, there was plenty of time to catch up with most of them throughout the course of the event. I had just spent time with some of those company management teams at the Fort Lauderdale event a few days earlier, but continued to pick up new nuggets of information as we chatted in small groups.

On that note though, I did get a chance to briefly chat with Gwen Preston, VP of Communication at West Red Lake Gold Mines (TSX.V:WRLG – OTCQB:WRLGF). Similarly, we had just talked a week prior to this event on March 7th to review their news out about the positive reconciliation results from the bulk sample program at its 100% owned Madsen Mine located in the Red Lake Gold District of Northwestern Ontario, Canada.

West Red Lake Gold – Diving Into The Positive Reconciliation Results Of The Bulk Sample Program

This successful bulk sample was a major milestone for the company, and it should go a long way to quieting down the disbelievers and doubters of whether or not the WRLG team is going to be able to effectively mine at Madsen.

Their results matched (and even exceeded) expectations on grade and metals recoveries. They also demonstrated that they could mine from 3 different areas and produce gold successfully (which brought in near $8 million dollars).

Above Brad Rourke, CEO of Scottie Resources (TSXV: SCOT) (OTCQB: SCTSF), is unpacking their recent Maiden Resource Estimate and flagging their upcoming Preliminary Economic Assessment (PEA) due out in a couple months at a 1-on-1 meeting with investors.

This economic study from Scottie will look at utilizing the Direct Shipping Ore (DSO) model, where they’ll upgrade the grade of their open pit ore using an ore-sorting machine, and then combine it with the high-grade underground ore and ship it over to Asian refiners for a saleable product.

Scottie Resources Announces Maiden Mineral Resource Estimate for the Scottie Gold Mine DSO Project

For my 1-on1 meetings, just like in Florida, I elected to go with sitting down with mostly new companies that I was not currently positioned in, such as:

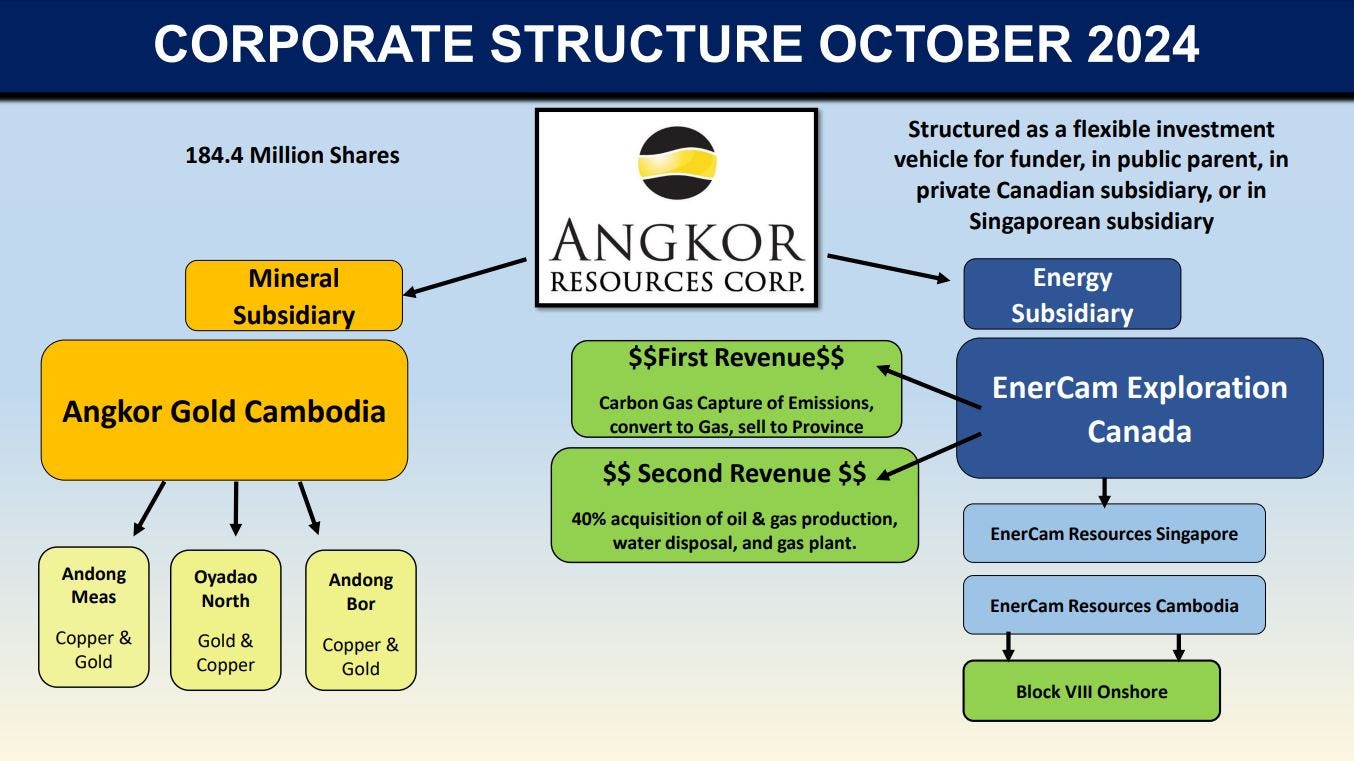

Angkor Resources Corp. (TSXV: ANK) (OTC: ANKOF) – An interesting hybrid play of gold/copper and then also oil production, via a subsidiary EnerCam Resources Corp. from Cambodia.

CEO Delayne Weeks unpacked how they are looking for option partners on the metals projects, as their focus is on their oil and gas production and exploration projects in Cambodia and Canada.

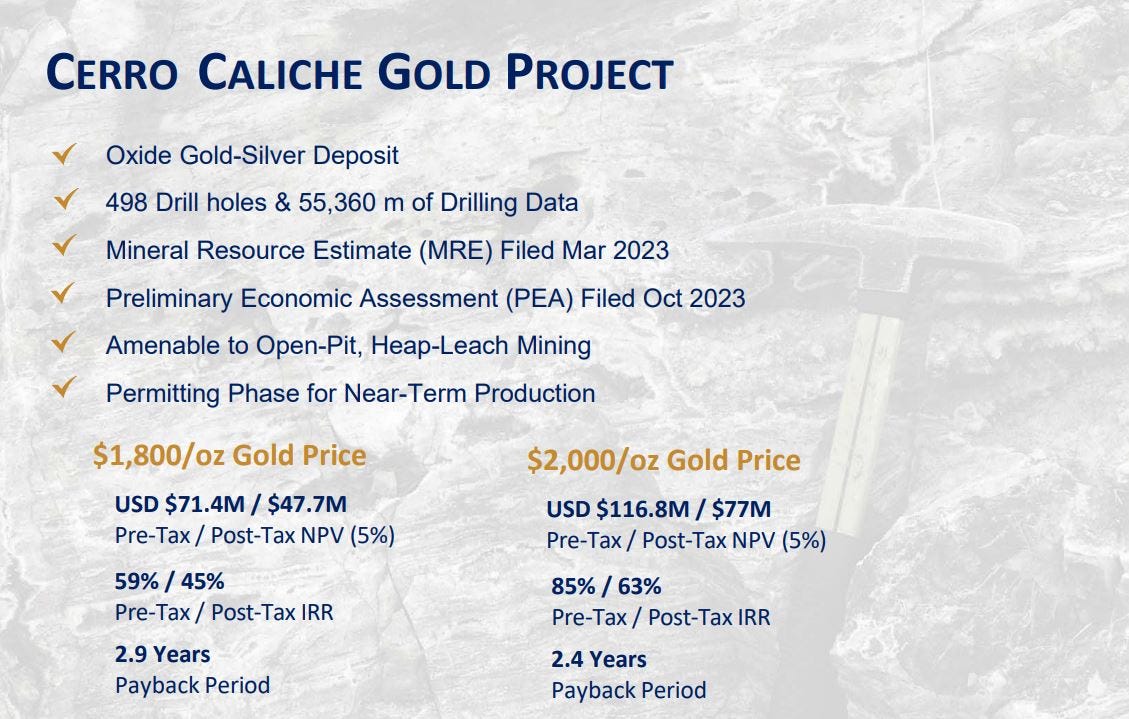

Sonoro Gold Corp. (TSXV: SGO) (OTCQB: SMOFF) – I sat down with Chairman John Darch, and President and CEO Kenneth MacLeod, to get a refresh on this company. This wasn’t a “new” story for me, because we had all first met up in Fort Lauderdale back in October and I’d also invited them on the KE Report last year to introduce the company to our audience. It is helpful sometimes to sit back down with company management teams and revisit the projects and work strategy, getting everything back to top-of-mind awareness.

The company is focused on their flagship development-stage Cerro Caliche Project in Sonora State, Mexico. The plan is to go into smaller-scale production to generate incoming revenues, which can then fund a larger exploration program across their project, without the typical excessive equity dilution seen in exploration stocks. At this time only about 30% of this project has been properly explored, leaving a lot of upside for making new discoveries and expanding resources. The main milestone and catalyst the company is awaiting is their final permits to be able to move forward with development of the open-pit mine and straight-forward heap-leach production.

Someone at the conference snapped a picture of me sitting down with Ken and John from Sonoro Gold in the midst of our 1-on-1 meeting.

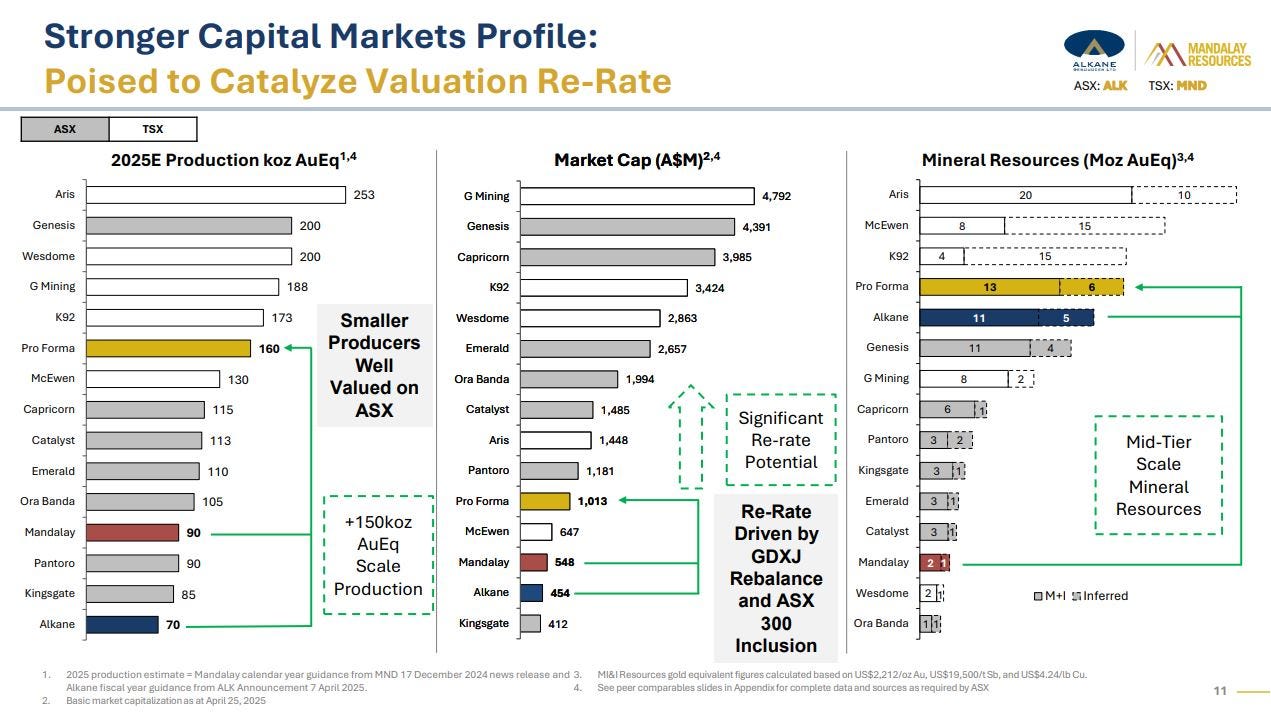

Mandalay Resources Corp. (TSX: MND) (OTCQB: MNDJF) – So here was a blast from the past for me… {I had invested in Mandalay many years ago from 2015-2017, but had exited the position when their Cerro Bayo Mine silver mine flooded back in June of 2017, resulting in a fatality and a Force Majeure on that asset}.

Fast-forward to present times, and I was aware that Mandalay had become back in vogue over the last year or so, due to it’s antimony co-credit along with its gold production at its Costerfield Mine. {About a year ago, all of the sudden antimony had become all the rage in specialty metals, due to the export bans out of China spiking the prices).

Mandalay is still primarily a gold producer and only 1 of their 2 mines has antimony, so I hadn’t really felt like chasing the share-price higher just for that specialty metal kicker. There have been plenty of gold producers ratcheting higher for more than a year now, so this company had been on my watchlist of gold producers and vaguely on my radar, but not really piquing my interest that much.

The vast majority of niche specialty metal bubbles are short-lived and fleeting. If investors don’t catch them on the way up, then they end up buying the top and holding the bag all the way back down. {We’ve seen this movie before with a prior bubbles in rare earths, graphite, scandium, niobium, vanadium, and the series of bubbles in lithium. Remember when nickel was critical a couple of years back where it spiked and then crashed? More recently the critical miners du jour have been antimony, tungsten, and geranium, predicated as always on a restriction in supply from China}.

I view most early-stage explorers in critical minerals with a large element of skepticism; but do believe we are getting into a more multi-polar world where some of these supply disruptions, and higher associated prices, could have more staying power this time around.

At least with Mandalay and other legitimate producers, they are actually capitalizing on these higher critical mineral prices and supplying these strategic metals. As a result, I felt the increase in the Mandalay share price action was somewhat warranted, but still mostly priced in by earlier this year.

However, some wildcard news broke just a few weeks before this conference, where it was announced that Aussie gold producer (and former rare earths developer) Alkane Resources Limited (ASX: ALK) was acquiring / merging with Mandalay Resources to form a larger intermediate gold producer.

Alkane and Mandalay Combine to Create Growing Gold and Antimony Producer

That news got my attention, and so I wanted to take a meeting with Mandalay to learn more about the new pro-forma company.

I don’t really have a lot of exposure to Australian gold producers, after selling out of my Westgold Resources position earlier this year, and thus was open to learning more about the new combined synergies of the 2 companies.

Most of my Australian gold production exposure currently comes from royalty companies like Elemental Altus or Vox Royalty.

As a result, I am open to picking up a stand-alone Aussie gold producer, to add to the portfolio for jurisdictional diversification, and as a play on attractive currency exchange rates for the producers selling into the record high gold priced in the Australian dollar.

Well, I sat down with the Executive Vice President and Chief Development Officer of Mandalay Resources, Scott Trebilcock, and did leave the meeting more impressed than I was anticipating. There isn’t space in this article to expand much on the synergies between these 2 Aussie gold producers. I liked what I saw and am legitimately considering getting positioned in Mandalay and letting the shares convert over to Alkane to pick up the small arbitrage trade in the process. Here’s a slide from their new shared deck highlighting the pro-forma company.

Here is an interesting research piece out this week discussing this merger of Alkane and Mandalay:

Alkane Resources — On the road to Mandalay - 27 May 2025

Written by Lord Ashbourne - Edison

https://www.edisongroup.com/research/on-the-road-to-mandalay/BM-1663/

Well for this [Part 1], we’re going to have to wrap it up here due to the space constraints for sending out these Substack articles by email.

There are still a number of companies to get to as well as key takeaways from the keynote panels and other special guest cameos and conference photos for [Part 2].

At the end of the next article I’ll also be sharing some of the key portfolio management tips and lessons learned through the school of hard knocks as a resource investor, that I shared from the stage on the “Young Guns” panel.

Kitco’s Paul Harris (far right) moderated panelists: John Feneck - Portfolio Manager & The Feneck Metals & Mining Portfolio; Erik Wetterling – The Hedgeless Horseman website; and Shad Marquitz – Co-host of the KE Report and Publisher of Excelsior Prosperity on Substack.

Thanks for reading and may you have prosperity in your trading and in life!

Shad