Gold To All-Time Highs - Mexican Silver Stocks Rally

Excelsior Prosperity w/ Shad Marquitz 02-01-2025

We all just had a quite a wild week in the gold and silver stocks, for a bevy of fundamental reasons, paired with significant technical pricing action. Let’s not spend much time on a big macro preamble here about tariff ramifications, inflation, central bank buying, physical supply, geopolitics, etc… We actually have a lot of other things to review in the precious metals sector in this update.

So, let’s get into it…

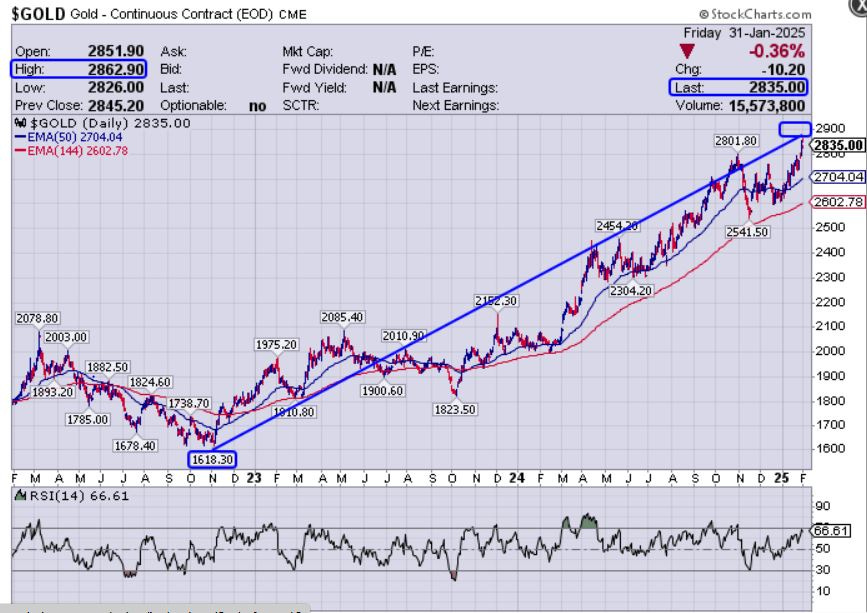

Gold broke out to new all-time highs this week (once again)…

Daily, Weekly, and Monthly Records were set on January 31st.

Gold went up and tagged a new all-time high on Friday at $2,862.90, before reversing course and heading down a bit to close the week and month at $2835.00. That just happens to be the all-time highs on the weekly and monthly charts as well. Any way one slices it… this was a record week for the yellow monetary metal. We’ve been all over this bullish trend in gold ever since it began many years ago.

That reminds me: I keep hearing and reading crazy statements like “this gold bull market just got started less than a year ago” or “it is still early on in this gold bull market.” What in the world is all this nonsense that people are spewing?

Look the bull market in gold started in December of 2015, when gold put in a Major Low of $1045.40, and since then has nearly tripled in price. The period of time and pricing action on the chart since then was surely not a bear market. We are now over 9+ years into the gold bull market. This should not be a controversial data point.

The gold and silver stocks mostly bottomed a month later on January 19th 2016, and we’ve not seen lower lows in the major precious metals ETFs since that time period. So yes… the PM mining stocks also confirmed this.

Whether some market pundits like it or not, that is when the sector bottomed. We are definitely not “in the first inning” of any PM bull market at this point in time.

Does the chart above (you know, the factual pricing data) look like the bull market in gold is just getting started?

Folks, there are a lot of hucksters out there that made bad calls, so they are trying to rewrite history. There is also a lot of nonsense percolating around on the internet and on blogs and podcasts. One of the most basic truths is that Gold has been in 9+ year bull market. Anyone that would look at that gold chart above and try and seriously insinuate that gold has not been in a bull market since that major low at $104.54 back in December of 2015, is full of hot air. They are ignoring the obvious pricing data that anyone can see with their own eyes.

Yes, I know there are also some people that believe we need to break out in “real terms” versus the US equity markets to be considered in a “real” bull market. I welcome that day, but let’s be real here: There are no other markets or charts where technicians judge whether or not it is in a bull market by the intermarket relationship between the asset and US equity indexes. Why the exception here?

When the oil price was up breaking out from 2020 - 2022, nobody on The Street cared if it was in “real terms.” It was a new bull market in oil, clear as day…

When the oil producers, represented in the oil ETF (XLE), continued up to blast higher and make new all-time highs in 2024, nobody held it’s bull market in contempt because of its relationship to US equity markets. Sure, it’s interesting to look at intermarket analysis, but that is clearly NOT what qualifies as a bull market. Price action going up in an impulsive way is what determines it.

When Bitcoin just went up and made new all-time highs at $109,358, nobody questioned how it was trending in relation to US equities to determine whether or not it was in a bull market. The price breakout on the chart tells the story.

That position that gold is not really in a bull market yet because it hasn’t broken out against US equities is simply describing it in relative terms, and is only a nuanced point of view based on ratio charts; [but clearly not the definition of whether or not an asset class is in a bull market. Full stop.]

Even for those that refuse to admit to their readers or listeners that gold bottomed at $1045.40 and started trekking higher over 9 years ago: They can still look back far longer than just 1 year and easily see that that next intermediate leg of the gold bull market actually started at the false breakdown to a triple-bottom (in the $1621 - $1618.30 range), from September - November of 2022.

If people recall, this is where the long-held $1672-$1680 support broke to the downside. This freaked out so many pundits and technicians, that they then started calling for retests of $1450, or $1375 gold, etc… (clearly that didn’t happen either, and instead gold had a snapback rally, trapping the shorts on the wrong side of the trade).

What did happen, in fact, is that since the November 3rd Intermediate Low from 2022, at that $1,618.30 trough, we’ve seen a huge blast up for over a 2+ year rally in gold, and then up to new all-time highs this week/month to close at $2,835. {Gold has tacked on $1,217 and moved up 75% over this next intermediate leg of the bull cycle in just over 2 years. That is amazing bullish action for the currency of last resort or un-currency}.

Sorry to burst some people’s bubbles claiming March 1st was the start of the gold bull market. For anyone that spends just 1 minute looking at the charts, it is factually evident that the gold bull market did not start on March 1st last year.

For goodness sakes, gold first broke out to new all-time daily closing highs 5 years ago back in 2020, eventually heading up to the peak at $2089.20. That was a clue that despite the swan dive down we saw in all markets in March of 2020, which interrupted the rally gold had been in since October of 2018, that the bull market in gold was still well intact and had made another new high. That was another bell ringing.

Then, on last closing day of November 2023, gold made another new all-time monthly high, followed by an all-time daily and weekly high close on December 1st to $2089.70

Yes, it was only a higher close by $0.50, but hey, if we are doing real technical analysis, then these things absolutely count to proper technicians. That was technically a new all-time monthly high in November, and technically a new all-time daily and weekly high on December 1st, 2023.

That November 2023 ATH monthly close followed by the December 1st ATH daily and weekly close, were the next 2 bells clearly ringing and the clue that the next leg of the bull market was officially well underway as pricing was continuing to break out to new levels.

I felt so strongly about this pricing close and further breakout in gold back after that week ending in the first day of December 2023, that it is what encouraged me to write my very first article here at Substack (which only 35 people read. At present, this channel has grown to over 1,300 subscribers in a little over a year, and I’m very grateful to all the readers here.) Here’s that article for quick reference.

.

Excelsior’s Week In Review [Episode 1] – Gold Puts In The Highest Daily, Weekly, And Monthly Closes Ever - December 03, 2023.

https://excelsiorprosperity.substack.com/p/excelsiors-week-in-review-episode

.

It was curious to me at the time that so few people seemed able to hear the next bell ringing. I distinctly remember my frustration when pointing this technical achievement out to so many supposed experts and technicians, but then having them brush these all-time highs aside as not big enough or significant.

Hat tip to both Craig Hemke and Dave Erfle that were the only 2 people I remember that would even acknowledge how positive this was to the gold price technically. Obviously we know how things unfolded after that… with more higher highs in pricing right around the corner…

Literally the next trading session on Monday December 4th, 2023, we saw an even higher price point tagged in the gold futures in the very early morning in overseas trading at $2,152.30, but then it reversed sharply in a huge fall down to open much lower in the main North American trading session, and then to keep falling even lower, closing lower than the open, with a long red candle.

This so quickly overshadowed the $2089.70 all-time high from the first day of December, that people have blocked out that important technical step completely, and it doesn’t show up on pricing charts when highs are labeled. Even though a higher intra-day price was clearly made on December 4th, it didn’t hold onto it on a closing basis, so many technicians discarded it. Still, the bell was ringing, once again, that higher gold prices were clearly coming.

Then later in month on December 28th a new all-time closing high near $2,091 was achieved, followed by another new all-time intraday high on December 29th (during normal North American trading hours) up to $2098.20. Those were 2 more bells ringing…

Then as 2023 wrapped up we saw the highest annual close on record, along with the highest annual average gold price on record. 2 more major bells ringing…

Those 2023 price point triggers were all part of the lead up to the March 1st 2024 blast up to even higher highs, and yet I rarely hear any prominent pundits or technicians admit that or discuss all the highs the end of 2023that had already transpired well before 2024’s next leg higher. Legit technicians would not discard these important breakout levels, on the way to the next breakout.

I mentioned repeatedly over at the KE Report in interviews and on the blog during that whole time period that those late 2023 technical pricing triggers were the bells ringing that the next intermediate leg of the rally was already underway. When the breakout to even higher highs came on March 1st, it was not a surprise.

It important to also note that what helped solidify things for some folks was that we saw a corresponding breakout in the physical markets to new all-time highs on March 1st, and so that was another corroborating data point, and another shoe to drop. I remember texting with my friend and colleague, Christopher Aaron, that day and he was jazzed that both physical and the futures were singing in harmony. Exiting times!

Again, it is important to note that all those technical price advances were definitely not the start of the bull market either. Bull markets don’t begin at price peaks — they begin a Major Lows. A bear market ends at a Major Low when it finally stops going down for long-durations of time (many years).

Let’s clear this up once and for all. Gold put in its Major Low at $1045.40, where it bottomed and stopped going lower, ending the bear market, back in December of 2015. That was the tipping point where the bull market began.

—> Hopefully, we can finally put this point to bed now.

People that tell you otherwise are ignoring the most basic pricing chart data, and are twisting themselves into pretzels to try and finagle a scenario that makes it seem like “things are just getting started!” This is 100% B.S. and our goal here is to deal in the real. Some may not like how long gold bull market has dragged on but that’s reality.

Apologies for belaboring this point for those that can see the obvious pricing lows and highs on a chart, and the obvious bull market in gold that has been underway for many years now. It just that I’ve heard a number of recent interviews, and have read a number of recent editorials that are making wild-ass claims about the “gold bull market that is just getting starting,” and it just makes me cringe to see that happening in this sector. Enough said…

The key takeaway from last week is that the gold bull market showed, once again, that it still had legs to run.

Putting in an all-time intraday-high, or an all-time daily closing high is always worth noting; however, putting in an all-time high on both the weekly and monthly charts is incontrovertible.

Over at the KE Report on Friday, we had a great interview with Dave Erfle, Editor of the Junior Miner Junky. He recapped the strong breakout move in gold, to a lessor degree silver, along with gold and silver stocks. We started off by highlighting gold’s strong performance blasting up to a new all-time high above the $2,850 mark. Dave provides his insights on the precious metals and the impact of macroeconomic factors like inflation and GDP growth. We then transition over to the Mexican silver stocks.

Dave Erfle – Gold & PM Stocks Recap: Gold Breakout, Discovery Silver Major Acquisition, Permits In Mexico - January 31, 2025

The conversation transitions to recent developments with mining permitting in Mexico, where Dave explains how this impacts stock in that jurisdiction, especially for juniors waiting for permits and struggling with liquidity.

Then we shift over to the big news this last week with Discovery Silver Corp. (TSX: DSV, OTCQX: DSVSF) significant US$425 million acquisition of the Porcupine Gold Complex from Newmont Corporation (NYSE: NEM, TSX: NGT, ASX: NEM). We also explore why some silver companies are diversifying into gold, and how this strategic move could affect leverage and volatility in the market.

Dave then shares his insights on investment strategies, emphasizing optionality plays and the importance of being positioned in small-cap growth-oriented producers and later-stage developer and advanced explorers. Finally, the discussion touches on the potential for increased M&A activity as companies seek growth opportunities amid a bullish market.

Now, I’ve been saving Discovery Silver for one of the future articles in the series “Opportunities In Silver Explorers and Developers,” because I’ve been trading it within my portfolio for many years now. This recent transaction is so transformative that it has forced my hand in commenting, at least briefly, upon this recent news.

I think it surprised most market participants when they announced they are now graduating up to become a mid-tier gold producer, and buying a whole complex of mines and development projects in the Timmins Area. First let’s look at the news itself, for those readers that haven’t reviewed it yet:

Discovery Announces Transformational Acquisition of Newmont’s Porcupine Complex - January 27, 2025

- “Establishes Discovery as a growing Canadian gold producer with large Mineral Resource base in a Tier 1 jurisdiction with significant upside potential, targeting ~285 koz/yr in gold production”

- “Attractive acquisition with base case NPV of $1.2 billion using analyst consensus gold prices (including a long-term (“LT”) gold price of $2,150 per ounce); and $2.3 billion at a +23% sensitivity case using LT gold price of $2,650 per ounce”

- “Consideration at closing of $275 million, including $200 million of cash and $75 million of equity, with additional $150 million of deferred cash consideration starting in late 2027”

- “Attractive $555 million financing package provides substantial financial strength”

- “Brings to the Porcupine Complex a management team, led by Tony Makuch, with a solid track record for value creation within the industry and significant experience working in the Timmins Camp”

- “Discovery launches C$225 million(approximately $155 million) subscription receipt bought deal public offering as part of the financing package”

This is a quality group of assets in Timmis, and I really like this acquisition. Discovery Silver is making a bold move, at an opportune time in the markets. This is the kind of transaction that I want to see now… at the right time, in the right place, and with the right management team that truly has the experience to execute.

We have seen this same strategy and company approach, on a smaller scale, by junior developers like Integra Resources, Heliostar Metals, Sierra Madre Gold & Silver, and Magna Mining; where they decided to acquire recently or currently producing mines, quickly moving them into the new category of producer. There are execution risks as producers, but also the immediate benefits of revenue generation, and receiving a better cost of capital for future development projects. Producers also get more institutional investing interest and participation from sophisticated investors, that simply won’t invest in pre-revenue companies.

Precious metals projects and the market caps of the associated PM companies are still very undervalued for ounces in the ground and production output. Concurrently, there is a backdrop of very high prices for gold and silver, making this the fattest margins we’ve seen in the industry ever. It is a very strange disconnect between where the producers are being valued and where the metals prices are; especially when contrasted against where we’ve seen producers’ valuations in prior periods, when the margins were much lower than they currently are. It’s the kind of disconnect between margins, production, and PM prices that will eventually return to at least equilibrium, but also potentially fetch a future premium valuation for producers.

The market also really liked this deal that Discovery Silver struck with Newmont, because the share price has rocketed up from under a buck, to close on Friday up to $1.54 (after making and intra-day high up to $1.62). Epic move!

On a short-term basis Discovery is technically overbought. The RSI has an overbought reading over 86, and the Slow Stochastics with a reading up over 87. There may be a little corrective action for technical backing and filling that is due in (DSV.TO), which would be normal and healthy after a move up over 60% at one point just this week alone. However, this would be within the longer-term consideration that the current pricing and market cap is actually still way undervalued.

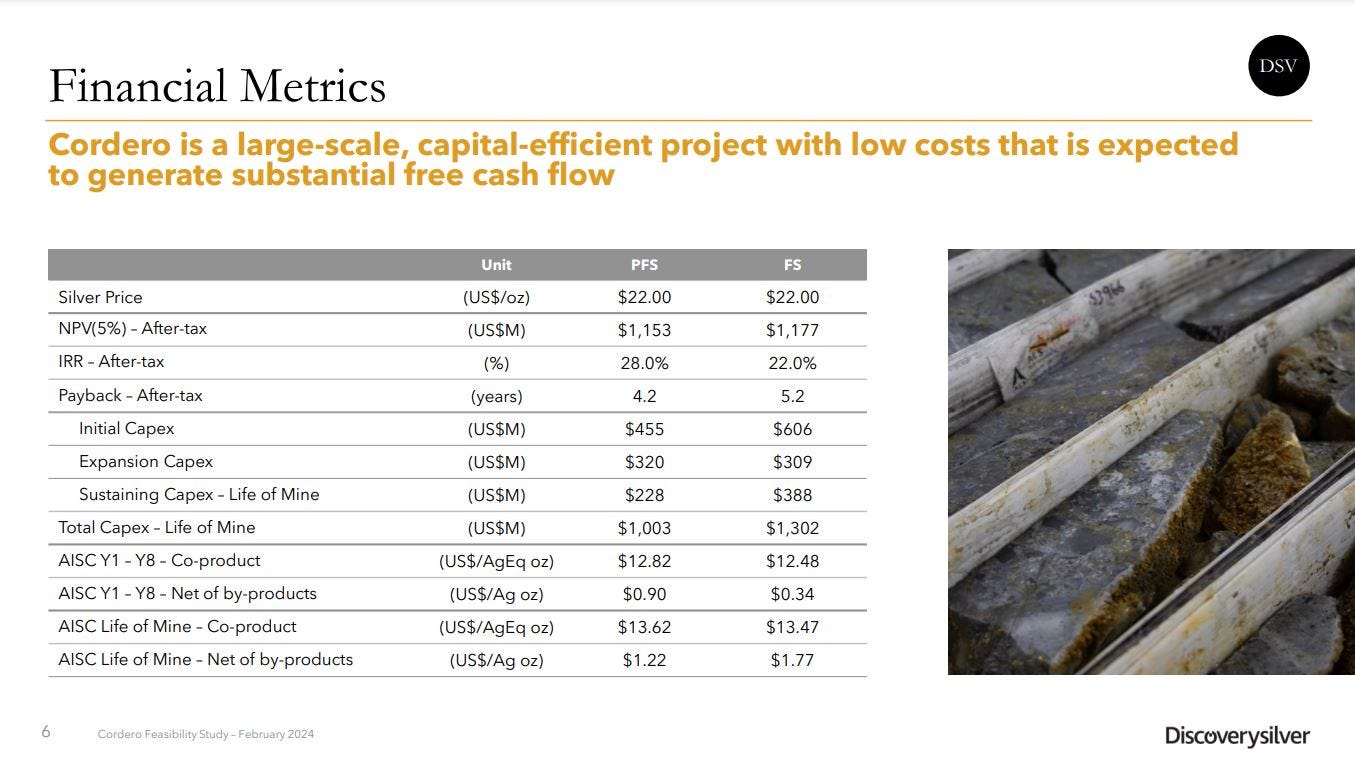

What seems to still be lost in the shuffle, within the current market cap of CAD$616 million, isn’t just how undervalued it is relative to the producing mining complex it is acquiring, but also how undervalued it is just considering their Cordero development project. The Cordero Project boasts the world’s largest undeveloped silver reserve, and an even larger silver equivalent resource. Even in the realm of producing companies, there is only operator, Pan American Silver, that has higher reserves (well, at least until Coeur’s merger with Silvercrest is finalized).

My investing thesis in (DSV) has always included Cordero’s potential leverage to rising silver and base metals, and hence it’s “optionality” opportunity; which will pay off bigly if silver runs into the mid to high $30s, and especially in the $40s.

There are dozens of PM developers that are also very undervalued considering the current metals backdrop and the economic value of their flagship projects. Discovery Silver has just been one of many PM developers trading far below the intrinsic value of their resource ounces in the ground or based on their economic studies metrics. Considering that we saw a nice lift in silver prices this week, in tandem with the big moves higher in gold, all those ounces in Cordero just got a lift in value as well.

Keep in mind that the economics presented below are at $22 silver.

Silver futures closed yesterday, on Friday January 31st at $32.26!

One of the factors that we’ve talked a lot about over at the KE Report, with regards to silver stocks, is that the lion’s share of public companies have some exposure to Mexican projects. Mexico is the #1 jurisdiction for silver production. Period.

Mexico had a very combative and vocally opposed President and government, with regards to the mining sector, for the last 4-6 years. On October 1st, when Claudia Sheinbaum became the 66th President of Mexico, the political tide turned a little more favorably towards their domestic mining industry. Pundits and companies were optimistic that as the calendar rolled over from 2024 to 2025 that we’d start seeing permits related to the mining industry finally start to get issued.

Well, this outlook has rung true, because so far in January we’ve seen Grupo México and Avino Silver and Gold receive key permit amendments in Mexico. As a shareholder of (ASM), I was pretty excited when Avino announced that they were moving to commence development at their La Preciosa Mine on the back of receiving all further mining permits.

Avino Commences Underground Development at La Preciosa

- January 15, 2025

“Avino Silver & Gold Mines Ltd. (ASM: TSX/NYSE American, GV6: FSE) a long-standing silver producer in Mexico, reports that underground development at its 100%-owned La Preciosa Property has commenced following receipt of all required permits for mining operations.”

https://avino.com/news/2025/avino-commences-underground-development-at-la-preciosa/

We’ve reviewed the value proposition in Avino in this channel, early on in the series “Opportunities In Growth-Oriented Silver Producers – Part 1”:

https://excelsiorprosperity.substack.com/p/opportunities-in-growth-oriented

Then over this last week we saw Alamos Gold get awarded their Environmental Permit Amendment in their Mulatos District. That is another big domino falling in the direction of the oncoming permitting wave setting up in Mexico, and great news for the whole swath of Mexican mining companies.

Alamos Gold Announces Receipt of Environmental Permit Amendment Allowing for the Start of Construction on the Puerto Del Aire Project in Mexico - January 29, 2025

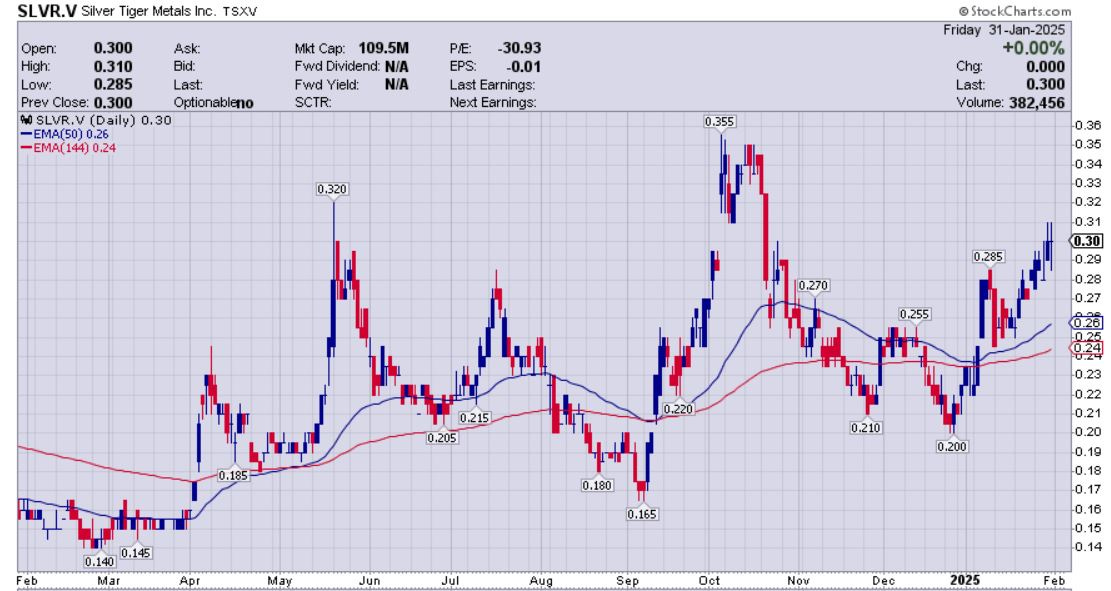

On January 30th, over at the KE Report, Glenn Jessome, President and CEO of Silver Tiger Metals (TSX.V:SLVR – OTCQX:SLVTF), joined me to discuss the positive shift in sentiment from precious metals investors in January, as gold broke out to new all-time highs. We also reviewed the additional mining permits that have been issued in Mexico this month, which is helping valuations in Mexican mining stocks. Lastly we look ahead to all the underground exploration and development work initiatives building towards a Preliminary Economic Study on the underground mining phase, at the El Tigre Silver-Gold Project in Mexico.

Silver Tiger Metals – PM Sentiment Shift, Mexico Mining Permits, & Underground Drilling At El Tigre

On January 31st, over at the KE Report, Peter Krauth, author of the book The Great Silver Bull and editor of the Silver Stock Investor newsletter, joined me for a wide-ranging discussion on the macroeconomic factors continuing to move the precious metal sector, and some pro tips on investing junior silver stocks. We also had a section where we discussed the improving permit situation and optimism on PM stocks in Mexico, during this conversation where we highlighted GoGold Resources and Kingsmen Resources. I’ll hot-link the video of the interview below to that part of the dialogue on Mexican silver stocks.

Peter Krauth – Pro Tips On Investing In Junior Silver Stocks – Blackrock, Summa, Dolly Varden, GoGold, and Kingsmen

Thanks for reading and may you have prosperity in your trading and in life!

Shad