Commodities Update - Week In Review And The Week Ahead – Part 14B Energy Commodities

Excelsior Prosperity w/ Shad Marquitz - (08/04/2024)

We just covered an update on the precious metals complex in [Part 14A]:

https://excelsiorprosperity.substack.com/p/commodities-update-week-in-review-e09

Now in [Part 14B] we are going to spend some time reviewing the energy commodities like oil, natural gas, and uranium. (I don’t really follow the coal markets that closely). I also wanted to get into copper for it’s role in energy transmission, but feel it really deserves it’s own update sometime soon, where we can also dive into the copper stocks as well… so stay tuned for that coming down the road.

Before we dive into the charts on the individual commodities, just a few words about these legacy “non-renewable” energy sources, and many people’s misconceptions about the ongoing Energy Transition debate, the unrealistic policy initiatives, and the harsh realities in the energy sector and power generation for the planet.

While global policy makers may go to sleep at night with visions of sugarplum fairies, endless solar and wind farms sweeping across the countryside, and a society running purely on electric-powered vehicles, boats, planes, and trains; at this point that vision remains a cartoonish dream.

This energy transition dream envisions a major structural change to transform all energy supply over to purely renewable sources, and the consumption of energy within a system of reduced to zero carbon emissions to curb the projections and computer models of runaway climate change. This is all still within the broad initiative to also bring electricity to the 800 million citizens of planet Earth, that still do not even have access to electricity (not to mention the millions with only intermittent access to electricity).

At face value, it seems like a pleasant dream and simple enough concept to just swap out all the internal combustion engines with electric modes of transportation, and then shut down coal, natural gas, and nuclear power plants and simply replace them with large arrays of solar panels and windmills. However, waking up from the dream, and dealing with the real world requires a more practical outlook and phased approach. These are complex systems and politicians, non-government organizations, and activists cannot expedite swift change in these systems with just will and words alone. Entire competing industries hang in the balance, and economic forces, as well as the supply of the raw materials required, still present major hurtles to their dream.

Over 25 years ago the projections were that by 2020, we’d have substantially phased out coal, oil, and natural gas as dirty carbon-producing fossil fuels, and have mostly transitioned the world over to renewable energy sources. Clearly that didn’t happen... not even close. Then the United Nations Agenda 2020 date was pushed back to Agenda 2030, but as time went on, it was clear models of change and adoption were not happening fast enough according to their plan. Also the world didn’t end in 10 years as people have been warning about since the 1990s.

The green mask of climate change activist policy was then taken off entirely, and is now hiding in plain sight at their annual COP World Climate Action Summits and World Economic Forum (WEF) conferences. In their perceived wisdom, these titans of government, industry, and media have now moved their date out even further for when the world must succumb to their carbon-free policies to the year 2050.

The challenge has been and remains today, that the nations of the world (both developed and developing) are nowhere close to being ready to give up their dependence on coal, oil, or natural gas. In fact, the nations of the world have actually expanded their use globally year after year.

According to the Energy Information Administration (EIA), the United States produced more oil last year in 2023 than it ever has at record levels. Then, there are multiple Liquid Natural Gas (LNG) terminals being built in both the U.S. and in Canda to export our domestically cheap nat gas to energy-starved Europe and Asia. Many countries face multi-fold higher prices for their methane gas, and will be happy to import cheaper North American natural gas, because this isn’t just a want - it’s a need.

This would be a good place to look at the Oil pricing chart for how it is trending:

WTIC Oil closed last week down at $73.52, below it’s 50-day Exponential Moving Average (EMA), and has been in a corrective move since putting in a peak in early July at $84.52. It is getting somewhat oversold on the Commodity Channel Index (CCI) down below at -130, and is neutral moving towards oversold on the RSI above.

This corrective move has happened despite all the geopolitical friction in the Middle East with Israel and Hamas, which has confounded some energy traders. Supply inventories have been building and demand weakness in many OECD economies has not been robust enough to mop up this extra supply. China has been struggling in their real estate markets and manufacturing, so oil refiners have been cutting their processing rates due to high inventories. Russia is also producing oil at all-time highs to fund their conflict in Ukraine, and to combat many global sanctions on other export goods.

Overall, oil prices are right in the middle of that trading range they’ve been in between the mid-$60s and mid-$80s for most of the last few years; (with the outlier year being 2022 when Oil spiked up well north of $100 for a period of time, when the Ukraine war really got heated up). There have been a few isolated spikes up over $90 since then, but they were short-lived, and mostly oil has traded in the $60s, $70s, and $80s for the last 4 years. There doesn’t seem to be anything on the horizon to cause oil to break below $60 or back above $90 again anytime soon, but these are reasonable prices for the commodity, for manufacturers, for transportation companies, and for the oil producers. The world will be happy to keep consuming oil for it’s over 2,000 applications for years and decades to come, so those that think oil is being phased out are indeed…dreaming.

Let’s also have a look at the chart of Natural Gas:

Natural Gas prices are always a rollercoaster and volatile, and the trading in 2024 thus far has seen that playing out in spades. Nat Gas dove down to $1.52 in February, then doubled in price spiking up to $3.16 in May, and now has corrected and consolidated back down below the 50-day EMA and below 2 buck to close last week at $1.97. Similar to oil, the CCI (below chart) is oversold now ay -130, and the RSI (above chart) is at 34.74 so lower neutral and approaching the oversold reading at 30 or below. It would not be a surprise to see a little more bottom basing here that brings in the energy for the next pop higher in methane gas prices. I’m considering adding in more gassers or oil companies with good nat gas exposure to my portfolio and will write about that in the weeks/months to come.

We’ve talked to a number of energy sector exports over at the KE Report including Dan Steffens of the Energy Prospectus Group, Sean Brodrick of Weiss Ratings and Wealth Megatrends, Darrell Fletcher at Bannockburn Capital Markets, and somewhat recently, Josef Schacter of the Schacter Energy Report and Eye On Energy. Across the board, they are expecting higher nat gas prices in the second half of the year as demand grows with A/C usage here in the hot summer months , and then heading into a winter that is likely not going to be a mild as last year’s heating season was.

Here is a recent KE Report video hot-linked to the discussion we had with Josef Schachter getting his thoughts on the oil and natural gas markets:

Bottom Line: Oil and Nat Gas prices are not in nose-bleed territory to the upside, nor are they falling out of bed to the downside. Both have been weaker the last few weeks, and they’ll always be volatile and choppy, but there is going to be steady and ever-growing demand on the global stage for some time to come. This recent corrective move is starting to open up opportunities to scale into oil and gas stocks. [In the future I’m going to share some ideas for what seem to me like good accumulation points in both the ETFs and individual companies in this corner of the commodity markets.]

While many nations and their political policy makers, may virtue signal about “going green” and “sustainability,” the reality is that the energy grids underpinning their societies are far from sustainable on just renewable energy sources alone. One has to look no further than the failed and bungled energy policies out of Germany, for the last 14 years, to see how their energy transition dream turned into an energy reality nightmare.

The historical backdrop takes us to right after the 2011 Fukushima Daiichi nuclear accident in Japan. This accident was brought on by a unique combination of 2 natural disasters; a deep-sea earthquake, which was then followed by a tsunami. The impacts from these twin natural disasters were compounded by a terrible plant design and the layout at the Daiichi facility. The backup generators were underground and flooded as the tsunami waters came in. Then their spent energy rods were in the equivalent of their “attic,” and became problematic when the power plant could no longer cool itself and overheated causing them melt down through the roof.

This was clearly a one-off event, where natural disasters were the triggers, and poor human plant design was the accelerant. While it was tragic, the world fleet of around 440 nuclear reactors did a coordinated review and overhauled their plants or made any necessary safeguard changes accordingly since then. If anything, the global nuclear fleet has never been safer than after that event, as a result of all those inspections. However, human emotions are not always compatible with reason and logic, and many still fear nuclear power.

Many people would be surprised to learn that nuclear energy actually has the safest track record and the least fatalities of any other base load power generation source, along with cleaner air pollution metrics than all other power sources other than solar. There is no perfect energy solution, but if the world wants both safe and clean energy production, then nuclear power is one of the best options; especially because it can run base load power 24/7, unlike solar or wind.

https://ourworldindata.org/safest-sources-of-energy

Well, none of those factors about how nuclear is both safer and cleaner even mattered to Germany at the time or since then. They wanted to virtue signal to the world how “green” they were moving in their energy policy initiatives, hoping to be the poster child for the new age in renewable power generation. They decided to take that moment in history, with the backdrop of a very unusual outlier situation playing out at one nuclear complex in Japan, to grandstand on the global stage. Germany swore off nuclear power moving forward, and then began the process of phasing out their reliable nuclear reactors.

Instead, they beat their chests about going all-in on the renewable energy sources of solar and wind power generation, encouraging other nations to follow their lead. The major problem is that it is not always sunny or windy in Germany, and thus, their electricity prices surged up multiple-fold. Additionally, their carbon footprint began expanding in the wrong direction, as they started shutting down their carbon-free nuclear reactors, and were forced to accept other forms of power substitutions.

In fact, Germany’s energy production deficit forced them to ironically start importing nuclear energy from their neighbors in France, which many observers felt was pretty hypocritical. Simultaneously, they then opted for generating or importing far dirtier coal power to back up their intermittent solar and wind power, that had struggled to meet their base load demands.

Higher energy prices also hit their manufacturing sector every bit as hard as it did their average citizen’s energy bill, causing even higher prices and lower profits for German industry. Eventually German policy makers tried to tame their skyrocketing energy prices by sealing a deal with Russia to pipe in natural gas for cheaper power; carbon emissions be damned! Well… we all know how putting all their eggs in that basket worked out the last few years, once the Ukraine war commenced.

While this ongoing energy transition dream envisions advanced economies fueled by only renewable energy sources, the harsh reality is that the energy grid in any nation requires reliable 24 hours a day 7 days a week base load power. Going 100% solar or wind or hydro or geothermal remains just a dream for most nations, and it is not as if those power generation methods are without their own flaws. For better or for worse, base load power still mainly comes from coal-fired power plants, natural gas power plants, and nuclear power plants. The irony in the failed energy saga of Germany, is that out of those 3 choices, nuclear power was the only carbon-free reliable baseload power source. When they shut those nuclear power plants down, they greatly magnified their carbon footprint and their air pollution, going against their own stated goals. This was not a really well-thought-out plan, and yet many other nations were considering a similar path... that is, until recently.

Each year a few dozen UN countries convene on the COP World Climate Action Summit to debate initiatives for fighting climate change. Last year at the COP28 conference in United Arab Emirates (UAE), 25 countries put into motion the Declaration to Triple Nuclear Energy.

Regardless of someone’s views on the ongoing climate change debate, it is clear that this global initiative is a huge boon to the nuclear power industry. These 25 nations have put in place a goal of tripling nuclear energy capacity on the planet by 2050 and to also encourage lending support to the nuclear power sector. That is a lofty goal, but there are also many action steps in place to make this renewed focus on nuclear power development a reality for the countries involved: United States, United Kingdom, United Arab Emirates, Ukraine, Sweden, Slovenia, Slovakia, Romania, Poland, Netherlands, Morocco, Mongolia, Moldova, Republic of Korea, Japan, Jamaica, Hungary, Ghana, France, Finland, Czech Republic, Croatia, Canada, Bulgaria, and Armenia.

In the framework of the Declaration to Triple Nuclear Energy, it recognizes many realities as it relates to their stated goals on carbon-reduction, and the flat-out need for nuclear energy to be part of the energy mix if they are going to phase down fossil fuels. 2 realities specifically addressed in this declaration are:

“Recognizing that analyses from the OECD Nuclear Energy Agency and World Nuclear Association show that global installed nuclear energy capacity must triple by 2050 in order to reach global net-zero emissions by the same year.”

“Recognizing that new nuclear technologies could occupy a small land footprint and can be sited where needed, partner well with renewable energy sources, and have additional flexibilities that support decarbonization beyond the power sector, including hard-to-abate industrial sectors;

It was surprising to many energy experts and media outlets to see so many countries, even some that were more hostile to nuclear power in the past, suddenly do an about-face and embrace the carbon-free aspect, long multi-decade reactor lifespans, and most importantly the reliable base load power benefits of nuclear power. Surprised or not… it’s happening.

The energy needs of the world are already stretched, and it would tax the energy grid of almost any nation to the breaking point, if all the vehicles currently running on oil and gas were suddenly swapped out with vehicles that needed to electrically charge lithium batteries each day. Then, if we layer in the additional demands for electricity from more cryptocurrency mining operations and all the proposed artificial intelligence data centers, then that just further spikes the punchball of power demand.

Where is all that electricity supposed to magically come from?

The reality is that the growing energy demand in the world is going to continue to need a balanced mix of power generation, and those that thought nuclear power was in its sunset years are sorely mistaken. If nations legitimately want to wean themselves from coal power plants, to begin making a dent in reducing carbon emissions, then the phased approach to reliable base load power substitution is going to mean even more natural gas power plants and even more nuclear power plants. While renewable energy sources are definitely growing in adoption, their contributions will simply augment the energy grid as an appetizer, but they are not the main course.

This also means there will be further opportunities presenting investors in both natural gas and uranium stocks in the years to come. Companies that can bring more of these energy commodities into production are poised to do quite well in a rising price commodities demand environment. After more than a decade of underinvestment, the energy sector is finally seeing new life breathed into it, and the spoils will go to the contrarian investors positioning before this megatrend becomes more obvious.

If we look at the uranium stocks by way of the Sprott Funds Uranium Mining ETF (URNM) it is clear that they’ve been in a consolidation phase the last few months. They sold off hard the very end of last week on the announcement by Kazatomprom that they’d be producing more U308 than initially expected, which caught many by surprise.

As ugly as the last few weekly candles have been, with URNM pricing breaking decisively below the 50-week EMA, and then heading down close to the 144-week EMA, it would seem much of the pain has already been experienced.

I don’t personally put much stock in Elliot Wave analysis, but the concept of a 5-wave bullish cycle, where waves 1, 3, and 5 are up and waves 2 and 4 are down, may be at play here. If the move from $7.78 in March of 2020 up to $52 in November of 2021 was Wave 1, and then correction down to $27.04 in June of 2022 was Wave 2, and the bullish impulse leg up to $60.17 this May was Wave 3, then what we have seen the last few months in this correction is likely Wave 4. Obviously the good news for investors is that, if that is what we are seeing play out as a pattern, then there is still that final Wave 5 impulse leg higher that will make new all-time highs moving in to 2025. [This is not investment advice, but rather just my personal investing thesis, that these corrective moves will prove to be buying opportunities in the fullness of time.]

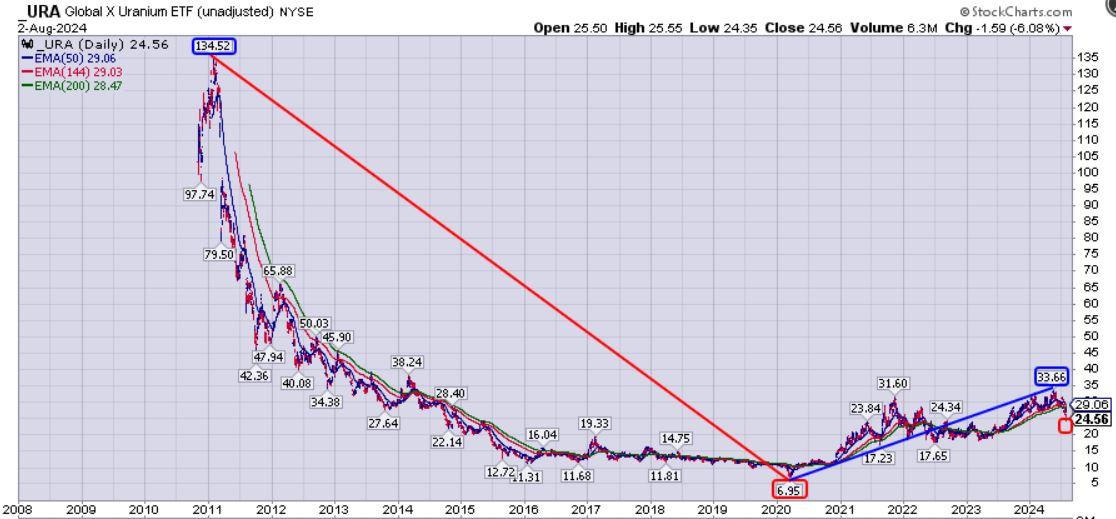

I think it is important to occasionally zoom out though for perspective. If we review the Global X Uranium ETF (NYSE: URA) from the lofty peak in 2011 pre-Fukushima at $134.52, down to the pandemic crash low of $6.95 in March of 2020, we can note just how destroyed the uranium miners were in valuation for the whole prior decade.

For a number of reasons we just reviewed on the demand side of the question, and plenty factors we’ve not even discussed on the mining supply side of the equation, the first few years of this decade have seen uranium stocks start lifting off from rock bottom, and start gaining traction and upwards momentum in the market. The sector has crawled it’s way higher the last few years, but this megatrend still has legs to it and a long way to run. There are 60+ reactors currently in construction, and several hundred reactors that are both planned and proposed that will keep moving demand higher. The nuclear renaissance that is currently gripping the globe, is going to need vast supplies of new uranium from the vault of the Earth, and uranium equities offer a risky but leveraged way to position accordingly.

That’s all for this review of the energy commodities sector, and stay tuned for future updates on the copper sector, an expanded look at the uranium sector, and opportunities in oil and natural gas stocks.

Thanks for reading and may you have prosperity in your trading and in life!

- Shad