We’ve Already Seen 10-Baggers And 20-Baggers In Uranium Stocks – Is There More Juice To Squeeze?

Excelsior Prosperity – Shad Marquitz - 01/13/2024

I’m writing this special report to subscribers about the Uranium sector here on this rather chilly Saturday morning for a couple different reasons. Most importantly, after considering the way a number of the charts were unfolding, and after watching this sector finish the week on such a surge higher on Friday; then it seemed only right that the U-stocks needed their own feature article.

This is also a bit too much information to include in the upcoming Week-In-Review article for space concerns, and my plan is to get into more gold and copper opportunities in that particular upcoming issue.

So, rather than trying to cram all this information and these charts on uranium stocks into the end of that piece; it seemed more appropriate to have a little more runway here to expand upon this commodity which has definitely been in the limelight lately. So let’s focus today on the other yellow metal and nuclear fuel… U308 yellowcake and the uranium miners.

Most of you reading this likely noticed that yesterday morning I sent out an editorial to subscribers that was mainly focused on critical minerals like lithium, cobalt, and copper. However, that missive did also have a short blurb on uranium stocks performance over the last 4 years towards the end of the article.

This piece also featured a fantastic interview we conducted with Nick Hodge over at the KE Report a few days ago. Nick spent the middle part of that discussion outlining why he has been and still remains constructive on the bull market in uranium and the uranium stocks, that is continuing to unfold. I’m including that interview again here, for anyone that missed it: This time with a hotlink that should take listeners straight to the timestamp at 9:37 on the uranium sector.

Nick Hodge: Fed Policy Expectations, Select General Equities, The Uranium Surge, And Thoughts On Copper Stocks

Uranium has been on an interesting journey for the last 7 years after bottoming in late 2017, and it has been in a breakaway bull market for the last 4 years coming out of the March 2020 pandemic crash lows. The uranium stocks have had huge moves coming out of those lows, with many stocks up 10x or 20x.

I posed the question in the title of this article: “We’ve Already Seen 10-Baggers And 20-Baggers In Uranium Stocks – Is There More Juice To Squeeze?” That is the question I want to dig into and explore further here. It will be instructive to also showcase some of the prices moves on the charts in some of the key uranium ETFs, along with some select uranium stocks that I hold in my personal portfolio.

In this particular article, the point is not to get bogged down too granularly into the long list of fundamental reasons why the uranium price is taking off (the spot markets have less secondary supply; the spot markets have been bought up and mopped up over the last 2 years by the Sprott Uranium Trust, Yellow Cake, and a half dozen uranium developers and producers; or all the points about the aggressive reactor builds, and many reactor restarts or life extensions; improving sentiment towards nuclear energy, not to mention a new contracting cycle with utilities and mining companies, etc…).

There are plenty of other interviews and articles that have been out circulating for years that extol the fundamental reasons that uranium price should have been much higher years ago and that back up the recent price rise we’ve seen in Uranium up through $50, $60, $70, $80, $90, recently (and even briefly up through $100 this last week).

If readers here were hoping to get a little more color on this fundamental side of the nuclear sector and uranium fuel markets, then let me also include an interview I conducted with Justin Huhn, of Uranium Insider, last month that touches upon a lot of these basics:

Justin Huhn – Comprehensive Update On The Uranium And Nuclear Fuel Sector

Looking back on where prices have rallied from over the last 7 years… It was plain as day to any thinking person that the double-bottom lows in the Uranium spot-price in the $17-$18 range in late 2016 and then again in late 2017, had gotten down to simply ridiculous levels.

Remember a few year’s back when oil futures traded down to $10 a barrel, and then briefly went negative on the futures markets? Well a $17-$18 per pound uranium price in late 2016 & 2017 was one of those kinds of moments in the U308 space. There were a number of us back then commenting on various platforms and forums, that those insane prices were divorced from any rationality, and that we would not be witnessing those again in the foreseeable future. Most projections at the time were that prices needed to go up 3 to 5 fold to get the sector moving again.

It should be noted that the price to incentivize new uranium production back in 2017 was around $60 per pound (when it was actually trading at sub $20 prices), and now due to inflationary pressures and rising costs to mining companies, this price incentive for new production is north of $70.

So back then, it wasn’t a matter of “If?” but simply a matter of “When?” we would see U308 pricing get back up above those price levels once again. So if that was crystal clear that it was only a matter of time, then why in the world didn’t everyone start accumulating the uranium stocks for the eventual payoff when prices ran higher? Well, that is what makes a market.

First of all, many still were not convinced that nuclear power would ever recover. For those that did understand the fundamental realities, they just couldn’t reconcile the divergence in projected demand and the depressed price of U308 and the low valuations in the mining stocks. They assumed something must be wrong, or that the whole thesis was wrong. It reminds me of the old trading adage that states “The markets can stay irrational longer than you can stay solvent.”

In the uranium price there was a gradual creep higher from late 2017 through late 2019, but nothing like we’ve seen recently, and it was a pretty slow slog in the uranium equities. Sure, there were some volatile fits and starts that offered opportunities, and there were some really nice multi-month tradable rallies with uranium mining stocks, but these rallies lacked follow through, sustainability, and conviction.

In speaking with many investors at the time, and asking why they were not accumulating uranium stocks into the depressed company valuations, it mostly came down to uber-bearish sentiment. The truth is that many resource investors still doubted the prospect of higher prices, after having been beaten down for so long in the dismal few prior years. These investors were extrapolating their recent experiences out into the future for perpetuity.

It’s an important lesson to remember in all markets, bull or bear, that no trend last forever, and the only constant is change. It is often the most beaten down sectors that then turn to be the clear out-performers after that, and the sectors that lead the most that then rollover and underperform for the period after a parabolic move higher.

Additionally, back then, many resource investors incorrectly thought that nuclear power would just keep getting phased out by countries pursuing renewable energy policies, even when all the data on nuclear energy reactor growth projections showed the exact opposite trajectory. Well as the saying goes “Truth will out.”

The last few years have seen a definite sea change in sentiment towards nuclear energy, not just from commodity investors, but also from environmental lobbyist groups that previously opposed such powerplants, and even substantial changes seen in national policies. There were some pretty big prognostications from this year’s COP 28 conference, with commitments made by many countries to increase their exposure to nuclear power.

Let’s focus on the action in the uranium stocks though. Since that 2020 pandemic low, we’ve seen a solid 4-year run in the uranium equities. Yes, it was admittedly a long time coming, and many (including me) were a bit too early, but it was still inevitable. Better to be a bit early in getting positioned, but catch most of the ride, than to not be positioned and miss the ride completely. Yet most investors, armed with the full knowledge this was going to happen, sat out this meteoric rise in the uranium stocks on the sidelines and missed some of the best gains in the resource stocks the last few years. (Why? Doubt, Inaction, Analysis Paralysis, Ambivalence… take your pick) “You can lead a thirsty horse to water, but you can’t make it drink.”

Let’s take inventory of where we are in the cycle now, and how the risk/reward opportunity is currently set up. Look at the huge runs in U-stocks since they rocketed up higher out of their March 2020 pandemic lows through present day. There are plenty of company examples that could be highlighted, but I’m just going to post a few charts from uranium stocks that I’ve personally been positioned in. These charts more than demonstrate the meteoric rise in price action we’ve see for the last 4 years. (For charting purposes, the more liquid US tickers are generally used, unless noted as Canadian tickers).

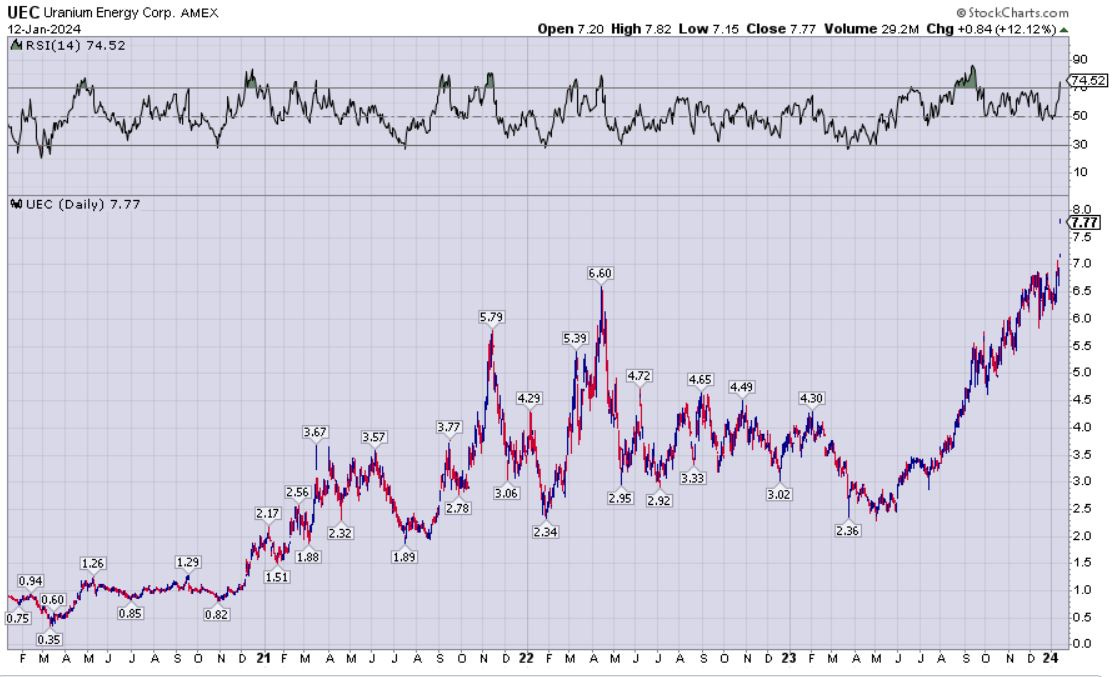

Uranium Energy Corp (UEC) - March 2020 low ($0.35), November 2021 high ($5.79), April 2022 high ($6.60), Jan 12th , 2024 close ($7.77). Friday was an all-time high daily and weekly close in this stock! [22-bagger]

NexGen Energy (NXE) - March 2020 low ($0.50), November 2021 high ($6.50), April 2022 high ($6.56), Jan 12th , 2024 close ($7.84). Friday was an all-time high daily and weekly close in this stock! [15-bagger]

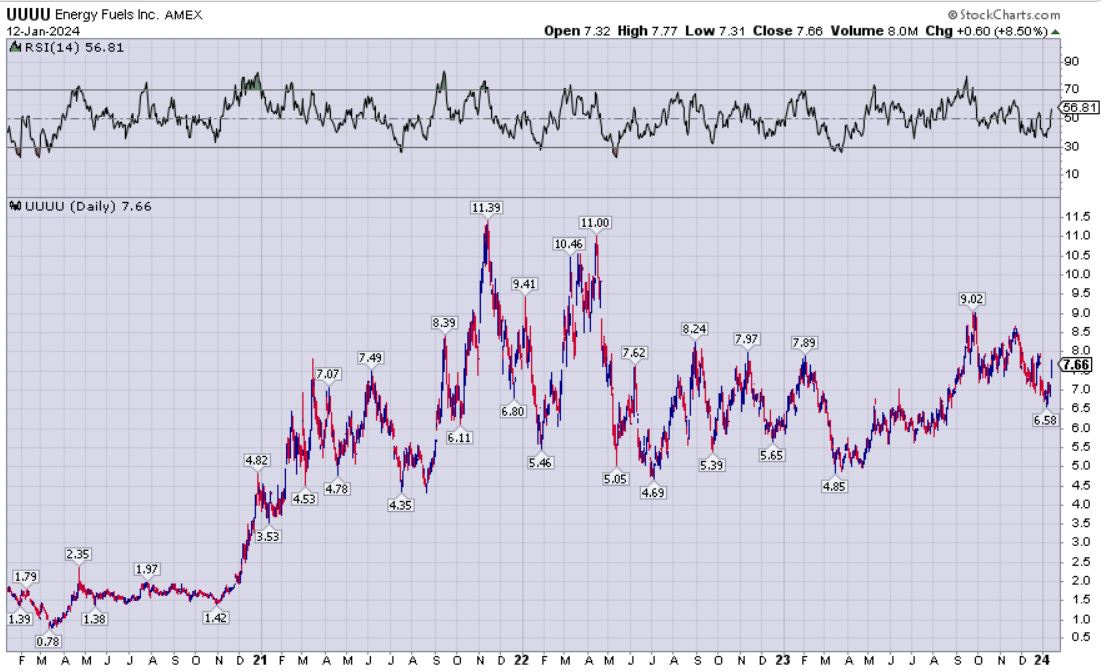

Energy Fuels (UUUU) – March 2020 low ($0.78), November 2021 high ($11.39), [14-bagger] Jan 12th , 2024 close ($7.66). More so than other U-stocks this one has been whipsawing in a price-range, but this has presented many swing-trading and position-trading opportunities. It is also not as overbought on the RSI, and is in a more neutral range compared to many peers.

Ur-Energy (URG) - March 2020 low ($0.27), November 2021 high ($2.15), [8-bagger], Jan 12th , 2024 close ($1.73).

Denison Mines (DNN) - March 2020 low ($0.19), November 2021 high ($2.14) [11-bagger], Jan 12th , 2024 close ($1.98).

Uranium Royalty Corp (UROY) - March 2020 low ($0.56), November 2021 high ($5.95), [10-bagger], Jan 12th , 2024 close ($7.66). It is interesting to note how much leverage even a royalty company in this space can have. It is not as overbought as many of the individual miners at this point, and had a harder correction prior to the recent surge back higher again, so it may have more room to run still to catchup other equities.

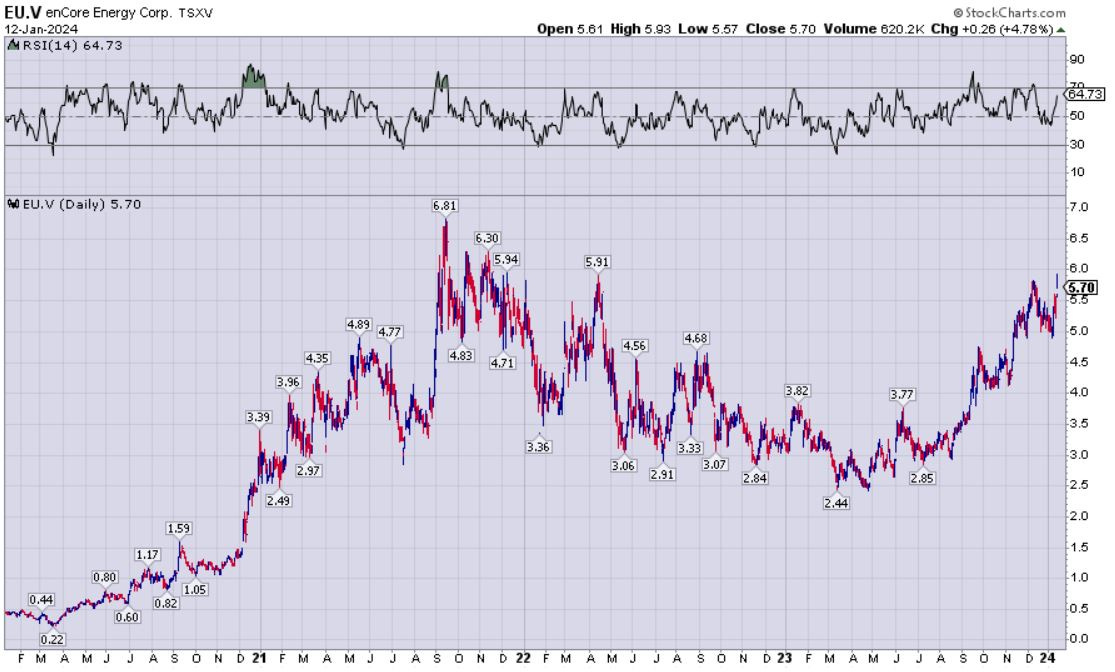

enCore Energy (EU.V) - March 2020 low ($0.22), September 2021 high ($6.81), [31-bagger], Jan 12th , 2024 close ($5.70). Of all the U-stocks in my portfolio this one had the biggest range. To be clear I’m not implying I caught the bottom or top in these, but simply showing the spread available to investors from the lows to the highs.

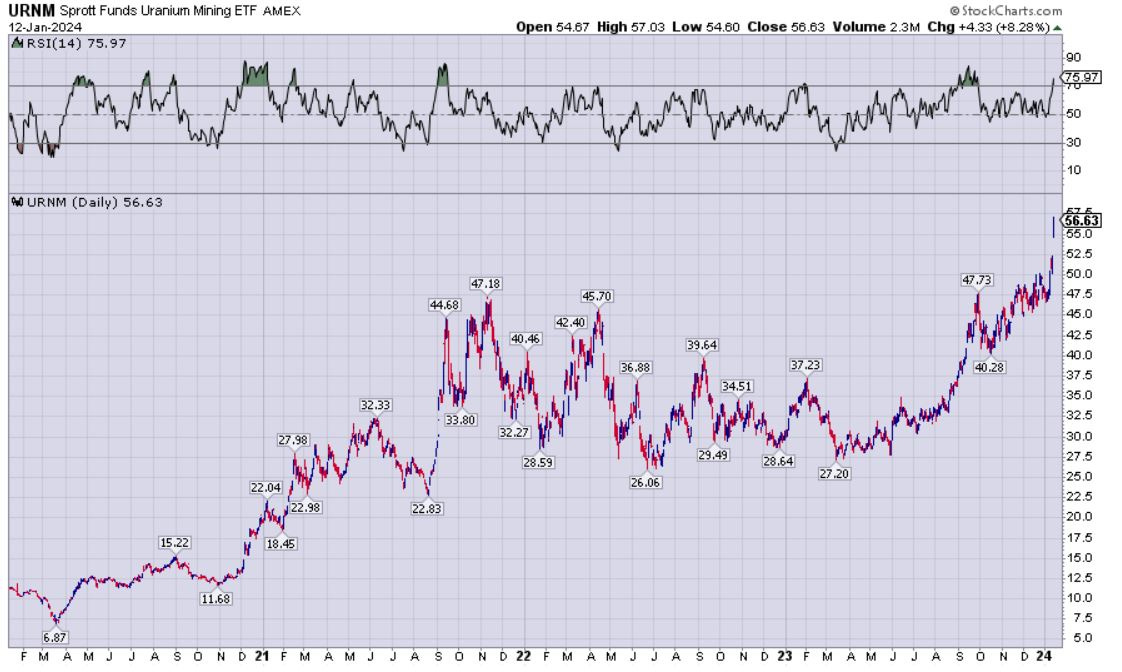

Even so far in 2024, Uranium stocks have been off to the races to even higher levels as evidenced by the EFTs (URNM) or (URNJ).

I remain a nuclear energy bull, and thus am still bullish on the uranium equities for the medium to longer term. So, there is likely still more room to run in this sector before it crests and comes back down over the next few years. Having said that, the biggest swell in the wave and the easiest money has been made at this point. This is how commodity sectors work, and the commodities and related equities need to be surfed and traded.

In the short term, I sense a lot of charts in the uranium stocks starting to get a bit overbought, but sometimes that can be a healthy thing in true bull market action. Maybe there is enough juice for these stocks to keep surging up high single-digits or double-digits day after day, but at one point soon these stocks are going to need a rest and a “pause that refreshes.” There are also some gap ups that may need to get filled.

One could make the point that we just saw that pullback and pause in December of 2023, but after the big moves just the last few weeks, it has me getting just a little bit more cautious. Another key consideration is that valuations in the U-stocks are still lower for most than where they were in that 2021 or early 2022 run, yet the uranium spot price is substantially higher. Room to rerate higher?

Personally, I’ve rung the register and pulled in some profits over the last week, reducing down position-sizing in most of my U-stocks by 20-30%. I had considered doing this in a bigger way after US Thanksgiving, and did trim a little bit of enCore Energy (EU) on Dec 1st , but decided I didn’t want the tax ramifications of trimming the rest last year. As a result, I waited until this last week to trim back other positions, so that those capital gains would be realized in 2024 and not paid until 2025. [this is not tax advice, just sharing why I did what I did personally]

I’ll be on the bid adding back those 20%-30% positions sold to my core positions on any big sector pullbacks, but will also be thrilled with the 80%-70% positions still in place if the sector just keeps ripping higher. Honestly, nobody knows how next week, next month, or this next year will go, but the preponderance of evidence has me in the camp that the probabilities are the sector can go much higher than where it is currently. Having said that, we’ve seen a blistering move higher over the last few weeks, and so a little backing and filling corrective move would be healthy at this point and part of a normal bull market move.

Maybe that is a good point to end this piece on. As an investor, you want to get a cost-basis built, and manage position-sizing and your dry powder on the sidelines in such a way, where you are happy whichever direction a given markets goes. If you have a core position in place and the market heads higher, then great and you’ll enjoy the further advance in valuations. However, if the markets correct by 15%-30%, then great, because you can deploy funds quarantined to the side into buying into that weakness and picking up a better overall cost-basis.

I wish for all readers here prosperity in their trading and in their lives.

Shad