Uranium Sector Update – My Cup Runneth Over

Excelsior Prosperity w/ Shad Marquitz – (05/24/2024)

It has been on my mind for the last few weeks to crank out a Uranium sector update, and the recent “cup & handle” potential pattern breakout on URA and URNM has forced my hand. It’s time to buckle in and look into some of the U-stock charts, and the fundamentals developments in the sector. This article also includes a few exclusive interviews from the KE Report with Director of Stocks at Simpler Trading, TG Watkins, Uranium Insider, Justin Huhn, publisher of Wealth Megatrends, Sean Brodrick, and the co-owner of Digest Publishing, Nick Hodge; along with some recent interviews with junior uranium exploration companies.

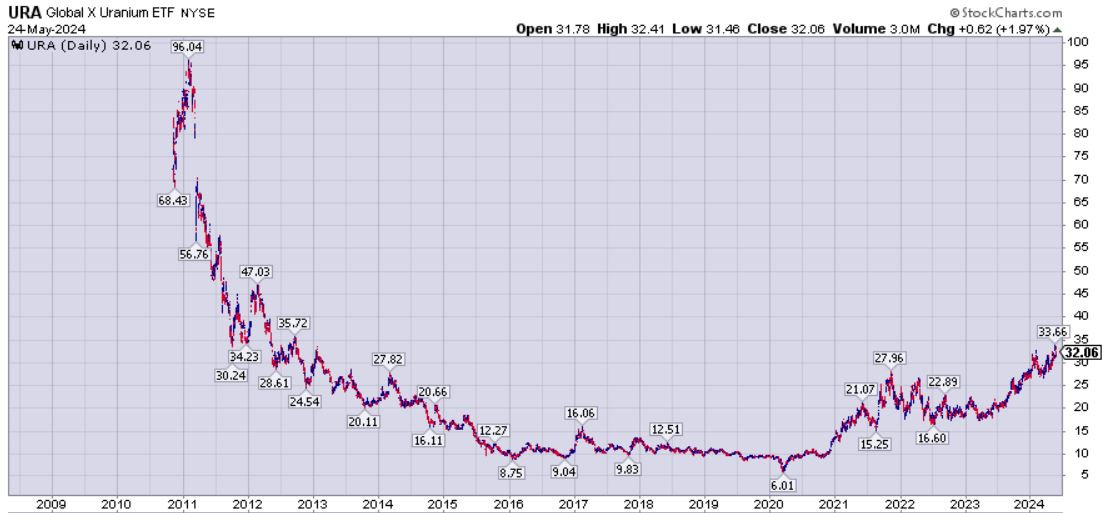

Let’s start off with a daily chart of the Global X Uranium ETF (URA) to dial in on the price action coming out of the double cup and handle pattern popping up and then dropping back down with regards to the neckline.

So while we are not fully breaking up out of the double cup & handle pattern here, it is a very bullish set up, building energy that typically resolves into an upside breakout. Of course, Mr. Market can be cruel, and right when uranium investors were getting all jacked up for the move, we’ve seen uranium stocks drop in mid-week trading sessions, dashing our hopes and dreams once again… Still, the pricing action this year has amounted to nothing more than a consolidation period, and the probabilities are for a blast higher versus a crash lower. There are no absolutes, and patterns can break down, but this one still looks strong despite the recent sector weakness the last few trading sessions.

We’ve also discussed a few times, with regards to these uranium stocks, how many of them respect the 50-day Exponential Moving Average (EMA). Look at how the 50-day EMA (blue squiggly line) was support all of last year, then became resistance through most of February and March of this year; but then it became support again in April, and then prices lifted off from there. Pricing bouncing of the 50-day EMA and staying well above it is another bullish signal for the intermediate-term, that bodes well for this cup and handle breakout to have some upside oomph. Of course, anything is possible, and a price break back below the 50-day EMA would shift the posture, but a break higher is the most probable move that many technicians are reading with this setup on the uranium charts.

In a discussion earlier this week with TG Watkins, Director of Stocks at Simpler Trading and editor of the Profit Pilot website, I asked him about the 50-day moving average and the potential of the cup & handle breakout, and he offered these technical thoughts on the uranium stocks. Starting at the (8min:35sec) mark.

For those investors that think this bull run is about over, or maybe that are curious, or doubtful, or just jaded about where the uranium stocks could head in a really extreme bull market… then I submit this longer-duration URA chart that goes back to the last prior peak in 2011 (pre-Fukushima). URA got up to $96, while today it closed to end the week at $32.06.

In a strong rally, with the bullish fundamental backdrop for uranium demand, couldn’t it be possible that URA could double from here to $64, or triple again and test the all-time high in this ETF of $96? I’m sure there are some people don’t think that is possible. OK, fair enough. Could the prices at least go higher looking at the current setup? With a chart price range from $96 down to $6, and then up to $32 at present, is at least possible for URA to go up from here? (is it in the realm of possibilities, and more importantly probabilities, to consider URA going from $32 into say the high $30s, $40s, $50s?)

If that does seem probable, then there is a trade set up and investing opportunity. Keep in mind that many folks believe this uranium cycle may get even more stretched to the upside due to macro fundamental drivers in the economy, in power demand from a growing global fleet of nuclear reactors, and the duration of this demand need paired with the inability to quickly ramp up enough production supply. As a result, some participants are still looking towards new all-time highs in the uranium stocks before this cycle concludes. I don’t know what is going to happen, and there is no way for anyone else to know what is going to happen either. Having said that, the preponderance of data points to higher prices, even on the back of experiencing the sector rise higher for several years now.

Sure, the uranium equities in URA have had a great move so far from $6 at the 2020 pandemic crash low, to around $32 today. That’s a 5x move off the bottom! Consider though that uranium spot prices got down to $17 in late 2016 and again in late 2017, and then just made it up to $106 earlier this year. That is a 6x move in the uranium spot price off the bottom, and yet the URA only went up 5x during all this time. Typically, the equities will leverage the price of the underlying commodity, and in this case, they’ve just barely kept pace with the move up in the underlying commodity price moves over the last 6 years.

Do we really need to see a 3x in the spot uranium from $100 up to $300+ just to get URA back up to $96 again? (The uranium price was nowhere close to that back in 2011).

Is it conceivable that the uranium mining stocks still have a lot of catching up to do, and that they could keep trekking higher, even if uranium prices just hovered in the $80-$100 range for a while? It would be unwise to rule out that potentiality.

To be clear, I’m not predicting that URA will ever get back up to $96 again, but a tripling in price in the uranium stocks from $32 presently to $96 in the next leg of the bull market doesn’t seem that far-fetched. All things considered, a doubling in value from $32 to $64 seems pretty tame. Now think about the prospects of the S&P 500 or the DOW doubling from their current lofty levels. Which asset class seems more probable for a potential to double one’s investable capital? Just food for thought…

Personally, I started trading uranium stocks back in mid-2010 and watched them blast up higher a year later in mid-2011. The fall from grace in the uranium equities and sector overall was brutal and unforgiving. Gold and silver investors bellyache about how bad the precious metals bull market was from 2011- December 2015 in the gold price, and Jan 2016 in the equity’s prices. However, the PM bear market was nowhere close to the extreme bear market carnage that was seen in the uranium sector from 2011 to 2017.

Clearly some uranium stocks, kept generally sliding lower for 2018 and 2019 even after the spot price of uranium had already bottomed and started the long climb back up higher. So would it really be that unimaginable for the converse to also play out; where the stocks keep climbing higher even after prices top or plateau? (and most people that follow the sector don’t believe U308 prices have come anywhere close to topping yet).

So now let’s circle back around to where we started this article, which is merely considering the premise of a technical breakout higher from a cup & handle pattern.

Next let’s look at the Sprot Funds Uranium Mining ETF URNM for a similar chart pattern set up.

Even if the peak in URA from February at $58.96 connects all the way over to the recent peak at $60.17 to form an even larger cup, and even if we still correct down for a month or two to make a consolidation handle on a larger cup, it still is going to have the disposition to break out in a bullish fashion, after the consolidation period of the handle has completed. So, even in a short-term bearish corrective scenario, the probabilities still favor an upside breakout in the medium-term and beyond.

If we do get any more weakness in a scenario like that, then I’ll be accumulating with any remaining capital that I plan on deploying to the uranium sector during that period of time. Conversely, if the sector is lifting off now, then my portfolio has plenty of exposure with 9 U-stocks (enCore Energy, UEC, Energy Fuels, Ur-Energy, Peninsula Energy, Denison Mines, NexGen Energy, Standard Uranium, and Cosa Resources) to ride the bull higher. It is important to get one’s position sizing and cost basis in a stock or sector exposure to the point where you have a strategy in either a breakout or breakdown scenario. I’ll be buying future dips, and hanging on longer to future rips, but eventually selling into them.

I have just recently been adding to both Standard Uranium and Cosa Resources as earlier-stage explorers, and am considering adding a few more earlier-stage uranium explorers like, Forum Energy, Baselode Energy, Stallion Uranium, Kraken, and Atha Energy to name a few on my short list. I am sizing these riskier exploration positions much smaller than the producers and developers aforementioned.

Over at the KE Report, I’ve interviewed 3 of these companies in the recent past, as well as met with some of the teams in person at the Energy Transition Metals Conference in Washington D.C. in early May. For folks looking for some ideas with the earlier-stage companies I’ll post those interviews below so you can hear directly from company management teams as to their value proposition and work programs for this year.

{To be clear - None of these companies have paid me a dime to write them up in this Substack article... They are just companies that I find interesting that are doing substantive work, and I’m just sharing that information with folks here. People ask me all the time which uranium companies I like? So, there they are… Sometimes I personally have a position in the stocks discussed here, because I’m mostly reviewing what I’m doing in my own personal portfolio. However, often times I also write about companies I don’t have a position in at all, but that I think are still worth following. None of this should be construed as investment advice, because it is definitely not, and everyone should make their own decisions and talk to a professional about any investments they make.}

Standard Uranium – A Project Generator With 11 Uranium Exploration Projects Around The Athabasca Basin With Drilling On Multiple Projects In 2024 - May 9, 2024

Jon Bey, CEO and Director, and Sean Hillacre, President and VP of Exploration, for Standard Uranium (TSX.V:STND – OTCQB:STTDF), both join me for a reintroduction of the Company’s 11 uranium exploration properties around the Athabasca Uranium District of Saskatchewan. We also review the advantages of their project generator approach, which allows for working on multiple projects and multiple exploration and drill targets with partner capital inflows. Standard Uranium has successfully completed four joint venture earn-in partnerships on their Sun Dog, Canary, Atlantic and Ascent projects totaling over $31M in work commitments over the next three years from 2024-2026.

The company’s winter drilling at the Atlantic Property was completed between March – April, and the next drill program just commenced this week on the Canary project. After that the Sun Dog property will get drilled this summer, and then in the second half of the year the drilling focus will shift to their 100% owned Davidson River Project. Additionally, there will be some earlier-stage exploration work on the ground at 2 of the newer projects Corvo and Rocas. There will be a steady stream of exploration newsflow as 2024 unfolds.

We wrap up discussing the bench of knowledge in the management team, technical advisors, and a particularly strong geological team led Sean. Jon then breaks down the financial strength of the company, reiterates the incoming capital from partner companies to fund the project exploration, and breaks down the share structure.

Baselode Energy – Exploration Update From the Catharsis, Hook, and Bear Uranium Projects

April 18, 2024

James Sykes, President and CEO of Baselode Energy (TSX.V:FIND – OTC:BSENF) joins me for an exploration update from the Catharsis Uranium Project, Hook Uranium Project and Ackio Target, and the Bear Uranium Project; all in the Athabasca Basin, of Saskatchewan. We start off reviewing the unique “Athabasca 2.0” geological approach to exploration in areas along known mineralized trends, which have had limited to no drilling previously.

Next, we focus on the recent drill assays returned from Catharsis with 11 drill holes completed for 2,837 meters covering six different target areas, and where follow-up drilling will be focused. Then we reviewed the 7,500 meters of drilling from last year at the Hook Uranium Project, focused at the Akio Target around Pod 7 and Pod 4, and James outlined that there are 12,000 meters planned for follow-up in 2024 drilling. Additionally, there are 4,000 meters planned for regionally focused drilling on making a new uranium discovery across the Hook Project land package. Wrapping up we looked ahead to the inaugural 1,500 meter drill program at the Bear Project that starts in the next few weeks. There will be lots of drilling news over the course of 2024.

Cosa Resources – Introducing A Uranium Exploration Company Focused On Underexplored Corridors Of The Athabasca Basin

May 16, 2024

Keith Bodnarchuk, President and CEO of Cosa Resources Corp. (TSX-V: COSA) (OTCQB: COSAF), joins us for a comprehensive introduction to this Canadian uranium exploration company operating in northern Saskatchewan. The portfolio comprises roughly 209,000 ha across multiple projects in the Athabasca Basin region, all of which are underexplored, and the majority reside within or adjacent to established uranium corridors.

We talked with Keith about Cosa’s primary focus through 2024 will be drilling at their Ursa Project, which captures over 60-kilometres of strike length of the Cable Bay Shear Zone, a regional structural corridor with known mineralization and limited historical drilling. It potentially represents the last remaining eastern Athabasca corridor to not yet yield a major discovery. Modern geophysics completed by Cosa in 2023 identified multiple high-priority target areas characterized by conductive basement stratigraphy beneath or adjacent to broad zones of inferred sandstone alteration – a setting that is typical of most eastern Athabasca uranium deposits. Initial drilling results from Ursa in winter 2024 were positive and included the intersection of a broad zone of alteration with associated structure in the Athabasca sandstone located 250 to 460 metres above the sub-Athabasca unconformity. Follow-up drilling is planned in the second half of 2024.

We then spent more time having Keith outline Cosa’s award-winning management team that has a long track record of success in Saskatchewan. In 2022, members of the Cosa team were awarded the AME Colin Spence Award for their previous involvement in discovering IsoEnergy’s Hurricane deposit. Prior to Hurricane, Cosa personnel led teams or had integral roles in the discovery of Denison Mines’ Gryphon deposit and 92 Energy’s Gemini Zone and held key roles in the founding of both NexGen and IsoEnergy. We wrapped up with the share structure, key strategic investors, and the financial strength of the company to complete this year’s exploration and have access to capital in the future.

Over at the KE Report, we also interviewed a few different thought leaders in commodities investing that weighed in on why they are bullish on the uranium stocks. We often get into the macroeconomic and fundamental supply/demand reasons why uranium prices and uranium equities are likely still going to see higher levels in the fullness of time.

Justin Huhn – Nuclear Fuels Demand And Supply Factors – Pro Tips On Investing In Uranium Stocks

May 17, 2024 (the whole interview is on the nuclear fuel cycle, uranium, and U-stocks)

Sean Brodrick – A Focus On Uranium, Silver, and Gold Resource Stocks

May 21, 2024 (this should jump to 1 min 03 secs mark)

Nick Hodge – Phase 2 Of Commodities Supercycle Still Constructive For Gold, Copper, And Uranium Stocks

May 8, 2024 (this link should jump to 13 min 20 secs mark)

That’s it for this uranium sector update today, and I hope the technical comments on the charts, the company ideas and interviews, and the market commentary interviews on the uranium sector and related equities were of value to readers here.

May you have prosperity in your trading and in life!

Shad