It’s time again for a uranium market update. In the last few of these, I mostly focused on the technical setup on the pricing charts (and we’ll definitely to do that here as well). However, in this update we’re also going to consider some of the evolving fundamental factors that are positive tailwinds for nuclear power and uranium demand. Really there has been so much happening, even for people that follow the sector closely, that it has been almost too much to keep up with. In addition, we’ll also hear some market commentary on nuclear energy and uranium demand, along with a company specific interview from a US producer. We’ll also look for the opportunities within these megatrends as investors.

As the old adage goes, “The only constant is change.” A decade ago, or really even as recently as 5 years ago, we saw nuclear energy being shunned on the global stage and a languishing uranium mining sector teetering on the brink of existence. Many investors had given up entirely on the uranium mining sector, and the bear market from 2011 to 2019 (or really down to the March 2020 pandemic crash low) was far more grueling and disheartening than the precious metals bear market from 2011 to December 2015, and yet few metals investors were really paying attention to the value and opportunity on display in this sector.

I distinctly remember in late 2016 and again in late 2017 when the spot uranium price dipped into the $17s thinking, “There is no way this sector can go any lower than this.” That was because even back then the incentive price to bring on more uranium production was in the $50-$60 range, and that figure has ratcheted up even higher since then. While that was correct and U308 prices gradually started clawing their way higher back into the $20s and then $30s in the years to follow, the uranium equities kept drifting even lower as an overall theme.

For the better part of a decade, leading up to the 2020 events where global world trade and supply chains changed in a major way, there had been a constant excess of secondary uranium supply in the markets that kept uranium prices low and below the incentive cost of producing it.

Ever since the 2011 Fukushima incident in Japan, there had been lots of excess Japanese enriched uranium fuel hitting the markets for years, as many of their reactors were still on care and maintenance. There was also the US Department Of Energy’s program dubbed “Megatons for Megawatts” which sold nuclear fuels from decommissioned warheads into the spot markets… (even for years after it was supposed to wrap up). Piling onto those factors, was the steady stream of nuclear fuel that was continually dumped into the spot markets from Russian enrichment underfeeding from their centrifuges needing to keep spinning and squeezing out more uranium product. It felt like an endless group of headwinds blowing against the sector, but rational market participants knew this all couldn’t persist indefinitely. For some reason though, utility companies got the impression, due to recency bias, that conditions would remain like that moving forward.

Leading up to 2019, 2020, and 2021 many of these secondary sources started drying up. Then to complicate matters further, right as secondary supply started tapering down, the primary mined uranium supply also ran into snags. Many producing mines were put on care and maintenance or supply was throttled back, as longer-term offtake contracts with utilities or fuel buyers at higher prices had expired, and there wasn’t an economical way to keep producing at the current spot or term pricing.

Seeing the writing on the wall of how things would need to develop in the future, we witnessed a half dozen uranium mining companies start buying pounds in the open markets to hold in their inventories for future off-take contracts; thus absorbing some of the spot market supply. These companies were then joined by a few physical funds like the Sprott Physical Uranium Trust and Yellowcake that moved into the spot markets purchasing the remaining U308 and essentially mopping up much of the rest of the available supply. For uranium investors paying attention, this was the bell ringing that things were finally changing and we’d seen a turn in these markets. There was only one way pricing could move and that was higher.

The truth is that very few were actually paying attention though, because the energy narratives had taken a turn in a different direction long before all this played out. For years leading up to this time of transition, the world was plowing full-steam ahead with the Energy Transition movement to try and replace all legacy forms of power generation with solar, wind, hydroelectric, and geothermal renewable sources of energy.

Big issues cropped up immediately though… The energy transition dream ran into the harsh reality that hydro and geothermal only work in select locations and come with their own sorts of environmental impact considerations.

Then pivoting over to solar and wind, there is the very basic fact that it isn’t always sunny or windy in most places all over the globe. Both solar and wind generated power are intermittent at best, and they come with big spikes that can overwhelm the electric grid, then followed by periods of vast underperformance leading to decreased contributions to the energy grid, brown-outs, or flat out sustained power outages.

Without adequate energy storage and upgrades to the infrastructure and the energy grid, it is simply impossible to meet the growing energy demands with strictly renewable energy alone.

What the energy grid requires, to be able to feed all of the growing commercial businesses and residential customer demands for electricity, is for 24 hours-a-day and 7-days-a-week baseload energy. That is precisely why the world has not weened itself from coal, biomass, natural gas, and nuclear sources of energy production. Of those 24/7 baseload power sources, there is only one clean energy source that doesn’t produce carbon: Nuclear power. (and that lightbulb is finally starting to go off in the minds of policy makers and even the most radical environmentalist lobbying groups).

As more and more policy makers, NGOs, and energy consortiums did the math, they quickly realized that the power generation mode that they had most demonized for 2 decades, (nuclear energy), needed to be a meaningful part of the solution. In fact, more prominently utilizing nuclear is actually the only legitimate path forward for meeting their carbon reduction goals, while providing nations with the reliable, safe, and affordable means of ensuring baseload power to the energy grid.

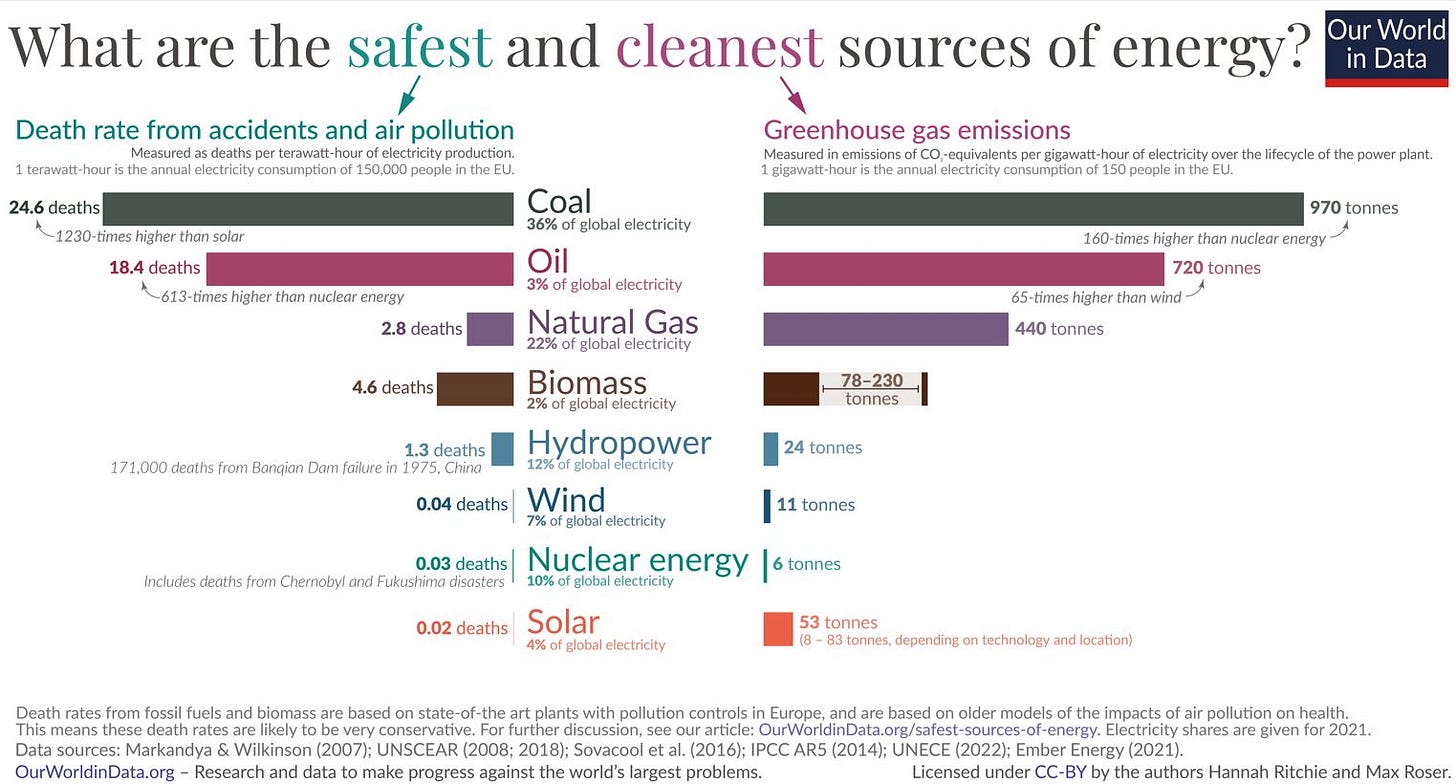

Nuclear power has had a bad rap in the media based on the emotional (and often illogical) biases of those trying to push a fear-based narrative around their past opposition to it. However, the reputation and discussion around nuclear energy is now changing and evolving in a positive direction. When one looks at the actual data and considers the facts over prior narratives, nuclear energy is actually one of the safest and cleanest forms of power generation we have as a human family.

https://ourworldindata.org/safest-sources-of-energy

Now let’s fast forward to the present day reality for the energy sector, here at the tail end of 2024.

With the realizations and limitations of various energy generation methods, paired with the environmental considerations of lowering the carbon output, it has shifted the global focus back to nuclear power.

Nuclear energy has now burgeoned into a full-blown renaissance. Nuclear is being embraced the world over in a radical U-turn in policies and perception over just the last 5 years, at precisely the same moment that all of the supply/demand imbalances finally reached their tipping point… sending prices substantially higher.

Last year at the COP28 conference held in the United Arab Emirates (UAE), there were 25 countries that signed the Declaration to Triple Nuclear Energy.

“Recognizing that analyses from the OECD Nuclear Energy Agency and World Nuclear Association show that global installed nuclear energy capacity must triple by 2050 in order to reach global net-zero emissions by the same year.”

“Recognizing that new nuclear technologies could occupy a small land footprint and can be sited where needed, partner well with renewable energy sources, and have additional flexibilities that support decarbonization beyond the power sector, including hard-to-abate industrial sectors…”

This initiative saw a growing commitment by these nations and even more countries are now moving this direction of increasing their exposure to nuclear energy based on the recent COP29 conference that was just held in Baku, Azerbaijan, last month from November 11th-22nd, 2024. At this year’s conference, there were 6 more nations that committed to signing the pledge to triple nuclear energy by 2050: Türkiye Nigeria, Kosovo, Kenya, Kazakhstan, and El Salvador, bringing the total number to 31 countries.

This is not just lip service either from these member nations. Big plans have been announced and set into motion, so the global push into expanding nuclear power has gone… well, nuclear.

US Unveils Plan to Triple Nuclear Power by 2050 as Demand Soars

Jennifer A. Dlouhy – Bloomberg - Tue, November 12, 2024

“Under a road map being unveiled Tuesday, the US would deploy an additional 200 gigawatts of nuclear energy capacity by mid-century through the construction of new reactors, plant restarts and upgrades to existing facilities. In the short term, the White House aims to have 35 gigawatts of new capacity operating in just over a decade.”

https://www.yahoo.com/news/us-unveils-plan-triple-nuclear-094500700.html

Biden-Harris Administration Announces $900 Million to Build and Deploy Next-generation Nuclear Technologies

US Department of Energy – October 16, 2024

US Needs To Triple Uranium Supply To Support 300 GW Of Nuclear Capacity

By The Oregon Group – October 8, 2024

US nuclear capacity needs — and has the potential — to triple from 100 GW in 2024 to 300 GW by 2050, according to a new report by the US Department of Energy.

This would mean a significant increase in uranium supply:

access to 55,000-75,000 MT per year of uranium (U3O8) mining/milling capacity; it currently has 2,000 MT of capacity and procured 22,000 MT

access to 70,000-95,000 MT per year of UF6 conversion capacity; it currently has ~10,400 MT per year of UF6 conversion capacity

access to ~45-55M SWU ( Separative work unit, used to quantify enrichment services) per year; existing US uranium enrichment capability is ~4.4M SWU, while current US demand is 15M SWU

China Could Approve 100 New Nuclear Reactors by 2035

By Tsvetana Paraskova – OilPrice.com – Dec 04, 2024

“China could keep the pace of approving at least 10 new nuclear reactors over the next 10 years, a domestic industry group says, as the country has been accelerating the approval and construction of nuclear power plants over the past few years.”

“China could commit to a ‘realistic target’ of 10 new approvals each year through 2035, Tian Jiashu, deputy secretary-general of the Chinese Nuclear Society, said at the BloombergNEF Summit in Shanghai this week.”

There are news stories just like this emerging month after month all over the planet. Nations are scrambling to invest in new nuclear energy reactor technology, into the processing capabilities to convert uranium into UF6 and then enriched uranium fuel, and then also very focused on sourcing the raw material to make all of this work: U308 - uranium - yellow cake.

This massive demand push to source more uranium supply in safe jurisdictions is going to be a big investment theme in the years to come; especially when the backdrop is a market has already been in a supply deficit of 50 million pounds of uranium annually for the last few years.

Now, if that wasn’t already enough demand swell for more uranium, it just got even more intense. This year we have also seen a flurry of big mega-cap technology giants moving towards traditional nuclear energy, as well as into the entirely new emerging market for small modular reactor technologies. In addition to renewable sources, these companies all recognize they need nuclear energy’s carbon-free baseload power attributes to fuel their power demands for future artificial intelligence data centers.

Microsoft announced teaming up with the utility Constellation to bring 3 Mile Island back into production. Amazon is teaming up with Dominion and Google is teaming up with Kairos power, with both tech giants going in big on building out a number of small modular reactors (SMRs) by the end of this decade. The Nvidia-backed cloud-based firm, Ubitus, is looking to Kyoto, Shimane and Kyushu as potential sites near Japan’s nuclear power generation capacity to fuel their AI supply ambitions. Just this month we saw the tech communication titan Meta/Facebook put out an RFP to the energy industry asking for companies to submit plans for multi-unit nuclear power capacity. They are agnostic to the location, and just need the stable energy generation to build out their future technology platform.

Meta joins the nuclear-powered AI fray

Ben Geman – Axios – Dec 3, 2024

“Facebook parent Meta is seeking developers that can bring nuclear reactors online starting in the early 2030s to support data centers and communities around them.”

“The company just announced a ‘request for proposals’ that targets a large pipeline — one to four gigawatts — of new generation.”

“Meta is joining Amazon, Google and other tech giants in turning to nuclear generation to fuel energy-thirsty AI data centers with zero-carbon electrons.”

https://www.axios.com/2024/12/03/meta-facebook-nuclear-power-ai-data-centers

Over at the KE Report last week, Fabi Lara, Founder and Publisher of The Next Big Rush, joined me to dig into the major demand drivers and supply disruption news that is underpinning a longer-term bull market for nuclear power and uranium mining. We then pivoted over to a review of opportunities in the producers, developers, and explorers in both the US and Canada.

Fabi Lara – Nuclear Power Fundamentals – Opportunities Abound For Investing In Uranium Stocks – Part 3

The main takeaway here for investors is clear: All of this proposed growth of nuclear energy expansion is well underway, and it means a huge demand is being placed for uranium supply from safe jurisdictions, as the raw fuel that will feed this whole nuclear renaissance.

When one considers the additional complication of US sanctions against Russian supplies of uranium and enriched uranium fuel, and the recent export bans to the US that the Russian government has implemented in November; then it means that where the uranium is being sourced from is becoming even more mission critical.

All of this is creating a perfect storm of opportunity to position in domestic North American uranium producers, sourcing the U308 from the US or Canada.

Now the undeniable largest uranium producer in North America is the Canadian energy giant Cameco Corp (TSX: CCO; NYSE: CCJ). Cameco also has purchased a key interest in the Westinghouse Electric Company, in a strategic partnership with Brookfield Renewable Partners to advanced the next generation of nuclear power reactors. With Cameco, investors get exposure to the largest domestic uranium producer, hands down, and exposure to the technology side of the nuclear energy reactor market.

For investors that are open to more volatility and risk, but potentially more rewards, there are a handful of domestic US producers and near-term producers to pick from that will have excellent upside torque to rising uranium prices. There has also been an increased desire from US utility companies to source uranium for enrichment from domestic operations and sign longer-term off-take agreements with these American production hubs. The companies in operation set to supply millions of pounds of uranium to the marketplace in 2025 are: Energy Fuels (NYSE: UUUU) (TSX: EFR), enCore Energy (NASDAQ: EU) (TSX.V: EU), Ur-Energy Inc. (NYSE American:URG)(TSX:URE), Peninsula Energy Ltd (ASX:PEN, OTCQB:PENMF), and Uranium Energy Corp (NYSE American: UEC). These producers will not create enough supply to meet the production deficit globally, but their pounds of U308 produced will be in high demand, underpinning a premium valuation for these domestic producers.

[In full disclosure, Shad holds positions in his portfolio in Energy Fuels, enCore Energy, Ur-Energy, Peninsula Energy Ltd, and Uranium Energy Corp at the time of this article, and he may choose to add more or sell of these positions at any time.]

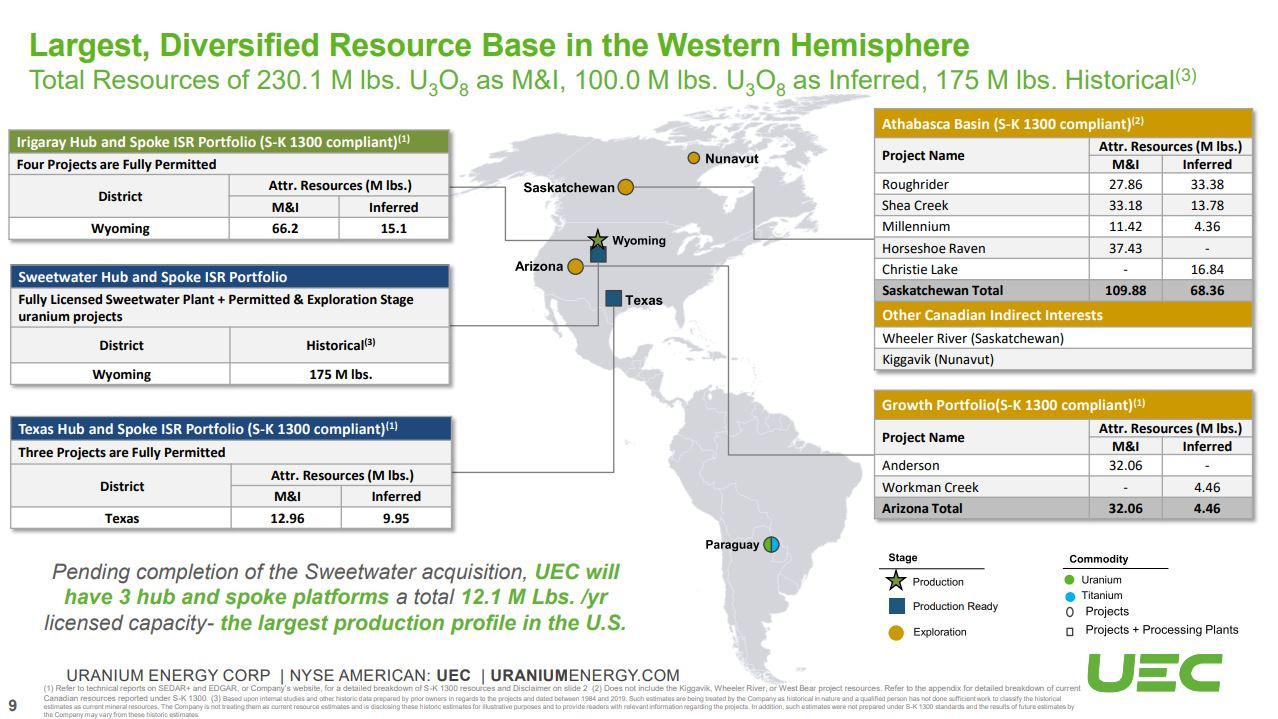

Of all the US producers, Uranium Energy Corporation has the largest reserve base, when one includes both their US and Canadian assets. Two weeks back, on November 29th, Scott Melbye, Executive Vice President of Uranium Energy Corp (NYSE American: UEC) and President of the Uranium Producers of America, joined me for a longer-format discussion on the fundamentals driving the expansion of nuclear power and more demand for uranium, as well as the Company fundamentals for Uranium Energy Corp as they are growing their US production profile and continuing to explore and develop their Canadian portfolio of projects.

Uranium Energy Corp – Nuclear And Uranium Fundamentals – Growing US Production Profile With Canadian Development Portfolio

Scott outlines their anticipated production growth from 1 million to 5-7 million pounds over the next 5 years domestically, and the potential to then ramp that up to about 12 million pounds of production once their Canadian Roughrider project is developed and put into production. Then there are even further development projects of merit within their Canadian pipeline of projects acquired from UEX 2 years back. He breaks down the expansion and development potential at a number of their US and Canadian projects, speaks to the pedigree and experience of their management team, the financial health of the Company, key strategic shareholders, their ETF inclusion, and analyst coverage.

When looking at the chart of (UEC), the pricing really tells the story of the uranium sector, since the last peak in 2011, the lengthy bear market down to the March 2020 pandemic crash low and market reset, and the ascent over the last 4 years as the tailwinds kicked in within the uranium sector.

Look at the run from the low at $0.35 to the recent peak at $8.93 for over a 25-bagger, as one of the better performers in this sector. The big board listing in the US is a big plus and helps with good liquidity in this stock.

When one compares the journey of Uranium Energy Corp to the Global X Uranium ETF (NYSE: URA), it has actually outperformed the sector overall.

This chart really is the best graphic to show where the uranium equities were in 2011, the intensity of the uranium bear market for so many years, and the sector move higher since early 2020 through present. It is easier to envision here just how much further the uranium sector can keep running as this bull market keeps unfolding. {definitely not investment advice… just sharing my own personal thesis}

Well, there is actually a lot more to say on both nuclear power and the uranium mining sector, but we’ll wrap it up here for today. Sometime soon we’ll dive into some of the small modular reactor stocks, enrichment stocks, and then also check into more uranium producers, developers, and explorers building upon solid work programs and presenting interesting value propositions.

Thanks for reading and may you have prosperity in your trading and in life!

Shad