Uranium and Nuclear Sector Update – Was The Recent Rally Just A Spring Fling?

Excelsior Prosperity w/ Shad Marquitz (06-28-2025)

Uranium stocks and nuclear stocks had a nice pop over the last few months, after bottoming in April, post Liberation Day selloff along with the market tariff tantrums. We saw a lot of V-shaped recoveries in most markets, and so it begs the question with regards to the resurgence of nuclear and uranium stocks: “Was this just a spring fling?”

It is an interesting question to ponder. So, let’s get into it…

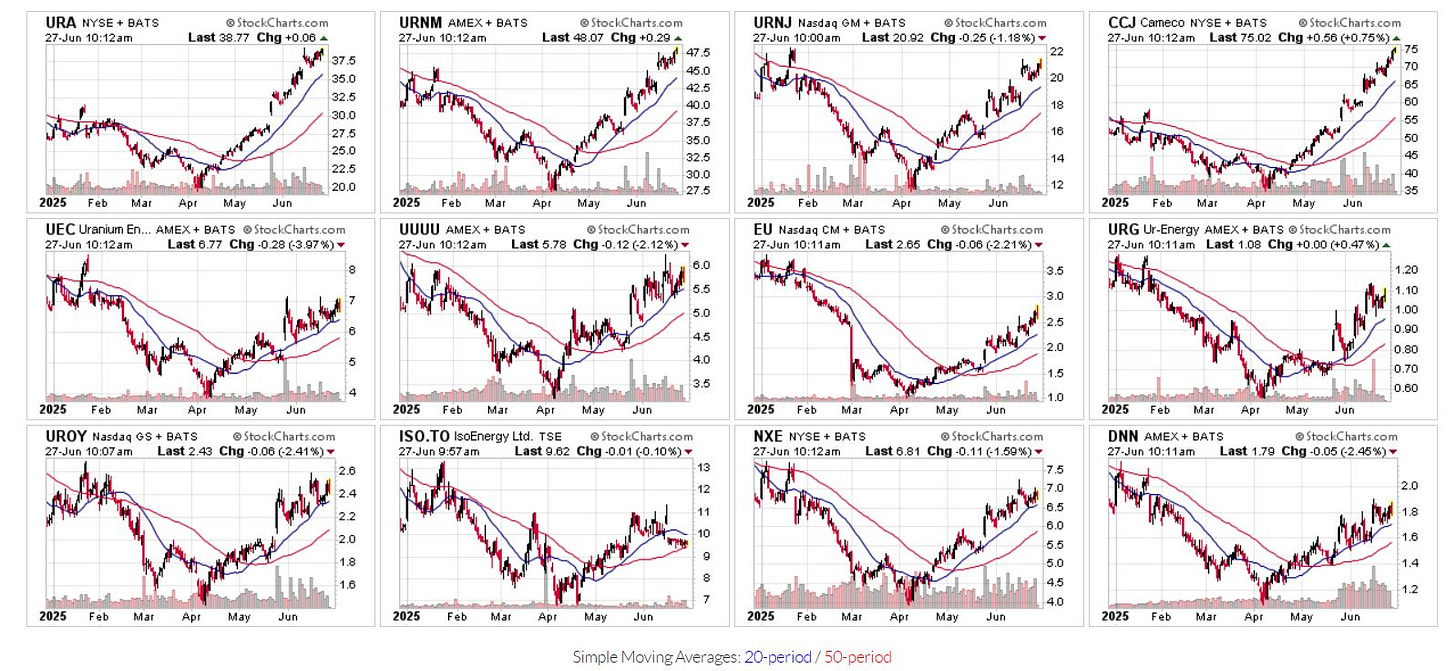

For starters, just have a look at this dirty dozen of uranium equities on their 6-month candle-glance charts.

We can clearly see that nice V-shaped recovery and rally into the Spring, where many of them have nearly doubled off their April lows.

{Click on the chart above to expand it}

Looking at the nuclear stocks, they have also had big rebounds and significant moves higher up off their April lows.

{Click on the chart above to expand it}

There have been a lot of sector tailwinds lately, in the form of constrained uranium mine supply, ongoing new reactor builds, reactor life extensions, Germany flip-flopping back to being in support of nuclear power again, big tech announcing more partnerships for future nuclear power demand, and then the Trump administration’s 4 new executive orders that are calling for increased focus on domestic nuclear infrastructure, reactor builds, nuclear fuels enrichment, and increased focus on domestic uranium project development and production.

For those reasons, and many more, there is a clear roadmap pointing to a sustained continuation of the multi-year bull market, that has already been underway for some time now.

We’ll get into more of the fundamental factors for the nuclear industry and uranium sector here in a little bit; but sometimes it is helpful to first scan back from the daily noise and shorter-term market signals, and take a look at the bigger picture trends in motion.

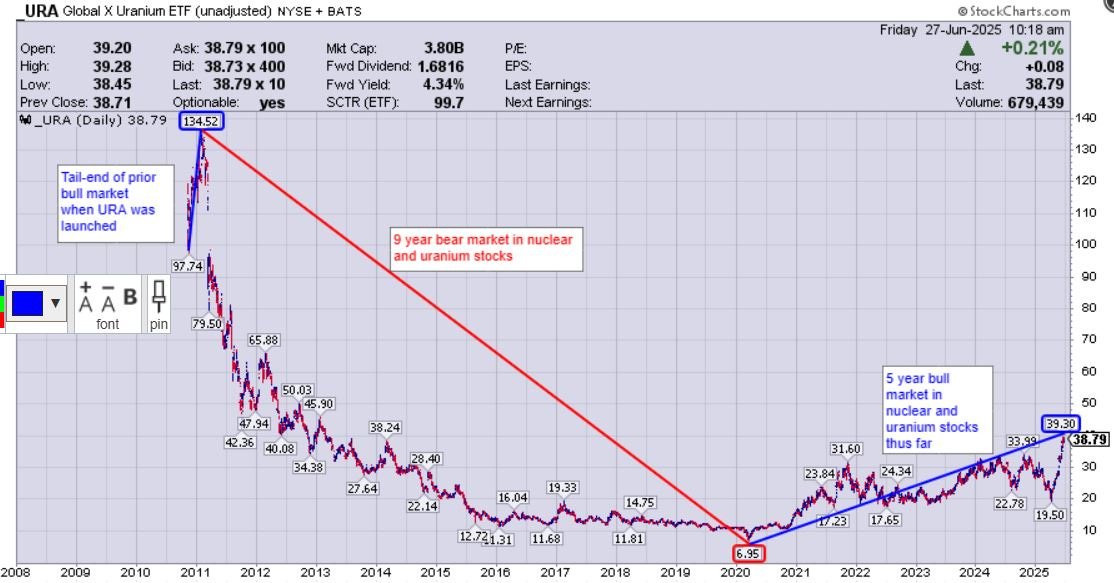

The Global X Uranium ETF (URA) chart does a good job of visually illustrating the big picture trends in the sector over the last 15 years.

On this longer-term chart of (URA) you can see that the launch of this ETF in late 2010 was at the tail-end of the last uranium bull market cycle which ended on March 11th 2011, when the Fukushima nuclear accident occurred in Japan. This interrupted the nuclear renaissance that had been going on the first decade of this century.

I remember this moment distinctly as someone that was enthusiastically investing in uranium stocks back in 2010 and 2011, understanding the benefits to humanity that nuclear power can provide. Unfortunately for humanity, because of a natural disaster of an undersea earthquake followed by a tsunami, and combined with a terrible plant design (putting the backup generator in the basement that flooded, and the spent fuel rods in the attic that heated up with the reactor when there was no backup power), the world back-tracked on the only carbon-free 24/7 baseload power for almost decade, before the inevitable and logical return to development of more nuclear capacity.

From March of 2011 to the pandemic crash of March of 2020, we saw a brutal 9-year bear market play out in the nuclear and uranium equities. This was so much worse and lasted so much longer than the 5-year bear market in PM stocks, that only went from 2011 to the end of 2015 in contrast.

When PM investors would belly-ache over the years about how bad the bear market in gold and silver stocks was from 2011-2015, I’d remind them that it paled in comparison to how bad the bear market in uranium stocks was; which went longer and deeper. However, because many of them were not invested in the sector and it didn’t touch their portfolios personally, then it was easy for them to shrug it off as a “that sucks for you” type of situation.

A savvy contrarian investor though, would be eyeing that compelling risk/reward opportunity in place in this sector, understanding that the market loves to go to emotional and often illogical extremes (to the upside and downside). The point of investing is to make money, not to fall in love with any given sector. There has definitely been money to be made in the uranium stocks, whether someone loves it or not, and there is plenty of money to still make as this cycle unfolds. That is what is germane for readers here.

It’s hard to see on the chart, but there were actually a few good tradable rallies in early 2016, early 2017, and early 2018, as the spot and term uranium price started to bounce off extremely low levels. However, these were short-lived counter-trend rallies, and overall the nuclear and uranium equities held inside of the (URA) were mostly still basing during this period in a sideways-to-down pricing trend.

Coming out of the March 2020 pandemic crash in the markets, where the URA got down to $6.95, the sector has now been in a 5-year bull market, going up over 565% to the recent peak of $39.30.

Many individual uranium stocks greatly outperformed this URA ETF, going up 10X, 15X, even 36X just on the first initial big surge higher from 2020-2021.

Those types of outsized returns are what attract investors to this very volatile subsector, of an already volatile and cyclical commodities sector.

While we have seen some nice multi-bagger moves, like the ones documented above on the charts of some of those US uranium producers for the last handful of years in the nuclear and uranium sector… that really was only the first course of the meal.

Yes, some popular pundits have mused that “The easy money was already made in uranium stocks during that period of time.” Sure, that is true because it was so easy to be buying at those insanely depressed prices, with the certainty that prices would rise epically and they did so. (I for one was actually buying Energy Fuels, UEC, UR-Energy, Denison, and NexGen in March& April of 2020, with the vantage point that the world was not ending, and that these companies had to persist and eventually blast higher or else the nuclear reactors won’t have the fuel to run).

Having said that, it was clear to me at the time, and even over the last 5 years of this bull market, that most investors, including most uranium & nuclear bulls have been underinvested in this sector the entire time. Their capital hasn’t even entered the sector yet in mass, and the generalist investors are starting to beat the resource investors to the punchbowl.

Let’s keep things in perspective: Looking back up at that chart of URA over the last 15 years, one can see that the recent peak we had at $39.30 is a far cry from that prior 2011 cycle top at $134.52.

We’d need to see this ETF go up another 342% from the present valuation, just to get back up to that level again, and this cycle we are likely heading much higher than that.

Well-selected individual stocks, like always, will outperform the ETFs. Opportunity is knocking for those that can hear it.

For those resource investors that are concerned that they may have “missed it” in this uranium cycle, technically there is a long way things could run just to even retest that former high, even if we don’t blow right past it in this cycle.

As previously stated, my personal journey investing in the uranium sector started in late 2010, at precisely the same time as the creation and inception of that (URA) ETF. So, I’ve closely followed this sector for the whole period depicted on the chart posted above, not just from a technical perspective, but also from a fundamental perspective.

After 15 years of following the key macro sector developments and newsflow, I’ve never seen as many bullish fundamental tailwinds stacking up as we have at this moment.

Over the years I’ve had people continually ask me in casual conversation – “So, Shad, are you still bullish on uranium and uranium stocks?” To be crystal clear, I’ve been bullish on uranium and uranium stocks ever since the spot price of U308 double-bottomed in late 2016 and again in late 2017 in the $17s, and said so publicly and quite vocally at that time on the KE Report and over at Ceo.ca. Back then we’d get periodic several-month tradable rallies up 50%-200% in the equities, but nothing that sustained itself. It was obvious to any thinking person that the uranium pricing was laughable at those levels, and that it needed to go up north of $60-$70 at a minimum in term pricing just to incentivize any new production.

Since those lows in the spot uranium price in the $17s, I maintained it was never an “If?” thing, with regards to whether uranium prices and uranium stocks would need to blast substantially higher. It was always more of a “When?” eventuality. This was based strictly on the existing demand from the global nuclear reactor fleet, as well as the growing number of new reactor builds. The tipping point seemed like it would occur when there were constraints on the spot market, forcing utilities back into dialogue with uranium companies to setup longer-term contracts for U308. While there were some green shoots from 2017-2019, the real sea change started to happen later in 2020 and has not let up ever since.

Granted, this market has taken some wild turns along the way…

The 2020 global pandemic and lockdowns interrupting supply chains and were a reset of many markets and commodities.

Then in early 2021, a half dozen uranium developers and producers started buying up inventories of uranium off the spot markets and warehousing them to prepare for the coming contracting cycle (I hadn’t seen anyone predicting this buying from uranium companies, and it was the bell ringing for those paying attention).

Then we saw the advent of the Sprott Physical Uranium Trust in July 19, 2021, and Yellowcake Fund in November 20201 that soaked up even more uranium from the spot markets, leaving very little short-term supply. (2 more bells ringing)

Then after the Russian and Ukraine war began in 2022, it led to the sanctioning of Russian nuclear fuels in 2023, and eventually Russia retaliated with export bans to the US and parts of Europe in 2024.

Utility companies should have been sitting up wide-eyed at this point, and yet they remained very complacent about all of this, and still are to a large degree. Nuclear fuel buyers only know a world where enriched uranium fuel has always been readily available, and yellowcake has always been there to supply to the front-end of the process to enrichers and processors… but that is starting to change)

Then in 2023 & 2024 the Biden administration earmarked funds in a few US bills for the development of more nuclear infrastructure, more nuclear fuels enriching capabilities, and assistance towards domestic uranium development and production.

Then in 2024 the general markets got Artificial Intelligence mania, and tech companies signaled that they wanted to embrace nuclear power as a solution to their massive energy requirements.

Then in 2025 the Trump administration has issued 4 different executive orders focused on beefing up nuclear power, the domestic nuclear fuels cycle, and fast-tracking more uranium development and production.

It is curious, and a bit off-putting, how many resource investors and even well-known sector pundits discuss the larger ongoing uranium bull market that has been underway for 5 years now. They’ll suggest it had (past tense) a nice run in 2020-2021 or in late 2023-2024, but then they act like that was it and now it’s over. (Huh? What data are they looking at that leads them to that conclusion?)

In many cases, upon further probing into their holdings or past exposure, it will become clear that they didn’t participate in either of those big rallies at all, (when those fundamental setups were some of the most obvious in the commodities sector over the last handful of years). They’ll also fail to see that the larger rally has had fits and starts but has been steadily climbing the wall of worry for many years now, and is not just isolated to those narrow time frames.

Those folks will minimize the importance of the prior runs in the sector as the early shots across the bow for the larger trend, either due to sour grapes; or in many cases they are just oblivious to the macro fundamental drivers that have been at the back of the nuclear power industry for many years now and don’t fully grasp the massive supply shortfalls in the uranium mining sector.

Then they’ll go on to say they aren’t really that animated with uranium stocks at this time, because their focus has shifted over to the more obvious bull market in precious metals… and besides… uranium has already made its run. (Oh really?)

These resource investors (mostly corralled with the rest of the herd into only the PM stocks) speak of the uranium bull market like it is already over, and was just another niche commodity bubble that popped last year. They view it as more akin to what we saw in the temporary price spikes in lithium or nickel a few years back, or what we are currently seeing in antimony, tungsten, or germanium.

That is simply not a good framework for looking at this sector, and I know of no commodity sector that has had or still has a more robust fundamental setup than uranium does. Not gold, not silver, and not even copper. The supply/demand mismatch for uranium is the most acute, and the corresponding price rally to correct this imbalance will likewise be the most extreme.

This uranium bull market is projected to go well through the end of this decade, based on all the supply/demand fundamentals and well-researched outlooks from those analysts that follow this sector in earnest.

Readers of this channel or those that listen to the KE Report know I love the precious metals sector (and hold several dozen PM stocks in my personal portfolio). However, after following this resource sector for the last 15 years, one starts to pick up on an underlying form of elitism that stems particularly from gold investors. Old-school gold bugs, which happen to be the people who populate most of the speaking positions at resource conferences, or that run most of the newsletters, or who are the popular guests on most podcast shows, have this pervasive belief that they have the only asset that matters. They focus on gold almost at the exclusion of all other asset classes (and some even shun silver in many cases because it isn’t a monetary metal anymore).

That human allure for shiny gold has lasted for millennia, so it is understandable in a sense; but there are far more opportunities in the commodities sector than just gold or gold stocks. Don’t tell the much larger pool of oil and gas investors, or the die-hard copper bulls, or all those manufacturers that are clamoring for domestic supplies of a long list of critical minerals that all that matters is gold.

Then conversely, there are also the new breed of nuclear power enthusiasts (welcome to the party), that just had their light bulbs switch on in the last year or so.

For example, it has been hard to ignore the political focus around the world that has finally woken up to the reality that nuclear power needs to remain a key component of our energy future.

Then there has been the deluge of narratives around all the mega-cap tech companies focused on powering their AI futures with small modular reactors.

It is curious that many of these new investors in nuclear SMR stocks and ETFs like (URA), (URNM), (URNJ), (NUKZ), etc… are generalist investors, that follow the tech stocks very closely. They simply couldn’t dismiss that Google/Alphabet, Meta/Facebook, Amazon, Microsoft, etc… have all come out endorsing the need for more nuclear power as the carbon-free baseload power source for expanding into the future.

As a result, you’ll read or hear all these proclamations online from baby bulls in the nuclear sector that the uranium bull market is [wait for it…] “Just getting started.”

Look, I’d agree with drive-by casual observers, not in the trenches every day or looking at things with a broader perspective, that there were very nice acceleration phases of the uranium equities bull market in during those aforementioned windows of time in 2020-2021 and mid 2023-mid 2024. Additionally, I’d also agree that the biggest acceleration phase of the bull market is still in front of us and the euphoria and market awareness about the mismatches in the nuclear fuel cycle is still yet to come. (which is good news for readers here because it means you haven’t missed the most exciting leg of the bull market in U-stocks). However, on the whole we’ve actually been in a bull market in most quality uranium equities ever since coming out of the pandemic crash of March 2020.

Therefore, this bull market is not “just getting started.” The next leg of this bull market is gearing up thought…

The question posed in the title was if this was just a “spring fling” from April-mid-June, or is there is going to be some longer legs to this trend? My belief, admittedly as a biased bull, is the later… that there are going to be some legs to this rally. That personal thesis {which is not investment advice}, is based on the undeniable fundamentals for this sector.

This is Economics 101. When you have growing demand, and under-supply, it needs to be resolved through the mechanism of higher prices.

There are around 440 nuclear reactors in the global fleet, and all those reactors will need to refuel. Many utility companies have to make a decision to acquire more uranium in the next 2-4 years.

There are ~68 reactors under construction or planned to begin construction in the next few years. When a reactor starts up it requires approximately 3x the normal amount of fuel to commission the reactor.

There are nuclear power plant life extensions being filed all over the globe (there have been about 15 motions filed for plant extensions just in U.S. alone in past 2 years)

All of this demand from the growing global reactor fleet has underpinned the need for higher uranium spot prices and term contract prices for years now. Most analysts modeling the uranium demand have done so on this setup alone, without even factoring in the future demand from Small Modular Reactors.

Future uranium and nuclear fuels demand from SMRs just further pinches a market that is already extremely production constrained.

In the US most of the producers have struggled to ramp up their production to their guidance from 1-2 years ago. Some commentators point out that the overall US production is still quite small compared to juggernauts like Cameco or Kazatomprom. Sure that is fair, but there has also been guidance from these companies that they can and will produce more, but… like always seems to be the case with mining companies… they are behind schedule and producing less than expected. This also keeps them buying in the spot markets to fulfill contractual obligations, and keeps that market very tight. The US has the largest nuclear fleet of any nation, and has many initiatives in place to source nuclear fuels domestically.

Canada’s only uranium producer, Cameco (CCO.V) (CCJ), is not signaling that they are going to ramp up any of their mines enough to fill the supply shortfall. Also, their JV with Kazatomprom missed production guidance last year by 17%, and remains to be seen if they’ll hit guidance this year.

Paladin Energy (ASX: PDN) (OTCQX: PALAF) has struggled ramping up Langer Heinrich Mine operated in Namibia, not meeting stated guidance last year or this year. Paladin also purchased Fission Uranium last year, with a large Triple R- Patterson Lake deposit in the Athabasca Basin of Saskatchewan. They are still nowhere close to bringing this into production for at least several years into the future (if ever, since it is literally under a lake and requires an expensive and complicated development scenario).

Nearby the Triple R – Patterson Lake deposit, in the Athabasca Basin, is the world-class Rook I - Arrow Deposit held by NexGen Energy (TSX: NXE) (NYSE: NXE). While this project is often touted as the potential solution to temporarily (but not permanently) balancing the supply side of the market… keep in mind it’s development and production timelines have been pushed back repeated from 2028, to 2029, and now all they are forecasting for 2030 with “first cake in the can” by 2031. OK, great, if everything goes perfectly (which it rarely does in mining), but then what in the world do utility companies do to find supply between now and 2031?

Denison Mines (TSX: DML) (NYSE: DNN) Phoenix Project is actually slated to be the 2nd and only new producer in Canada. They are working to do insitu mining in the Athabasca Basin, which has never been done at a commercial level there before, so there are still some pundits that question whether it will work as advertised. It is targeting first production by early 2028, but many sector specialists believe this will get pushed back, as often happens in mining projects.

In full disclosure, I’m a shareholder of both NexGen and Denison, so I’m rooting for their success. However, being pragmatic about production, we maybe see some from Denison towards the end of this decade, and won’t see any out of Nexgen until the early part of next decade. In a sense, Canada will not be providing any supply to the markets in the next few years, unless it is from the French state nuclear company Orano, upping production from that region.

In Africa, Namibia is one of the few other areas for potential new uranium supply, but both big proposed open-pit projects, Deep Yellow’s Tumas Project and Bannerman’s Etango Project, have had delays announced.

Boss Energy Limited (ASX: BOE) (OTCQX: BQSSF) is now operating from their Honeymoon Mine in Australia, which was a restart from the mine bought off Uranium One. Other than US production ramping up, this is really the only new production we’ve seen globally the last couple of years.

But wait there’s more…

9 Key Takeaways from President Trump’s Executive Orders on Nuclear Energy

Breaking down the President's plan to usher in a nuclear renaissance and expand America’s Energy Dominance agenda.

Office of Nuclear Energy -US Department of Energy - June 10, 2025

1. Speed up Nuclear Reactor Licensing

2. Add 300 Gigawatts of New U.S. Nuclear Capacity by 2050

3. Lay the Groundwork for Faster Reactor Testing

4. Deploy U.S. Reactors for AI and Military Bases

5. Explore Fuel Recycling and Reprocessing

6. Amp up Domestic Nuclear Fuel Production

7. Bolster the American Nuclear Workforce

8. Assess Spent Nuclear Fuel Management

9. Expand U.S. Nuclear Energy Exports

https://www.energy.gov/ne/articles/9-key-takeaways-president-trumps-executive-orders-nuclear-energy

Sprott Physical Uranium Trust Closes Upsized US$200 Million Bought Deal Financing - 6/20/2025

“The net proceeds of the Offering will be used by the Trust to acquire physical uranium in the form of uranium oxide in concentrates and related fees and expenses…”

New York to Build One of First U.S. Nuclear-Power Plants in Generation

By Ryan Dezember and Jennifer Hiller - Wall Street Journal - June 23, 2025

“New York intends to build a large nuclear-power facility, the first major new U.S. plant undertaken in more than 15 years and a big test of President Trump’s promise to expedite permitting for such projects.”

“Gov. Kathy Hochul said in an interview that she has directed the state’s public electric utility to add at least 1 gigawatt of new nuclear-power generation to its aging fleet of reactors. A gigawatt is roughly enough to power about a million homes.”

Apollo To Fund UK's Hinkley Point Nuclear Project With $6 Billion Loan

Story by Reuters - 06/20/2025

“The project, controlled and financed by EDF, is Britain's first new nuclear plant in more than two decades as London seeks to replace its ageing fleet to boost energy security, reach climate targets and create new jobs.”

Centrica set to take 15% stake in Sizewell C nuclear project

Ashley Armstrong, Jim Pickard, and Ian Johnston - Financial Times - June 26, 2025

“All sides are keen to reach an investment decision in July after years of delay and months of negotiations… The final cost of Sizewell — set to be only the second new nuclear plant built in a generation in Britain — could be close to £40bn, the Financial Times reported in January based on assumptions from industry experts.”

https://www.ft.com/content/5e107953-7f93-4a0d-ba73-6f28213e943c

The final cost of Sizewell — set to be only the second new nuclear plant built in a generation in Britain — could be close to £40bn, the Financial Times reported in January based on assumptions from industry experts.

https://www.ft.com/content/5e107953-7f93-4a0d-ba73-6f28213e943c

Germany’s Energy Shift: Chancellor Friedrich Merz Revives Nuclear Power, Expands Gas Plants, and Rejects Russian Gas

by Petar Petrov - Energy Expert and Consultant - March 4, 2025

“In the weeks leading up to his election victory, Merz strongly criticized Germany’s nuclear phase-out, calling it a grave mistake. Labeling the shutdown of safe reactors as ‘madness,’ he signaled his intent to reintroduce nuclear power in Germany and oversee the construction of new reactors. According to the DPA news agency, Merz acknowledged the challenges of reversing past Germany energy policies but emphasized the need for energy security in Germany and self-sufficiency in energy production in Germany.”

Meta becomes the latest big tech company turning to nuclear power for AI needs

By Matt Ott - Associated Press - June 3, 2025

“Meta has cut a 20-year deal to secure nuclear power to help meet surging demand for artificial intelligence and other computing needs at Facebook’s parent company.”

“The investment with Meta will also expand the output of a Constellation Energy Illinois nuclear plant.”

“The agreement announced Tuesday is just the latest in a string of tech-nuclear partnerships as the use of AI expands.”

Oklo moves closer to nuclear power deal with US Air Force

By Reuters - June 12, 2025

“Oklo Inc (NYSE:OKLO), a U.S. company hoping to build micro nuclear power plants, said on Wednesday the energy logistics agency of the Defense Department has issued a notice of intent to award a power purchase agreement for a pilot reactor.”

“Nuclear power companies are seeking U.S. military contracts after President Donald Trump signed executive orders last month on boosting nuclear power.”

Anybody paying attention to those recent headlines above, or other points raised earlier in this article would be hard-pressed to lay out a bear case for nuclear power or uranium equities.

Please also enjoy this interview with my friend and colleague, Justin Huhn, Founder and Publisher of the Uranium Insider, where he joined me over at the KE Report last week for yet another very comprehensive macro update on the supply and demand fundamentals for uranium and the nuclear fuel sector.

Justin shares information on how the longer-term contracting cycle is setting up with utility companies, along with how he is positioning in the uranium equities. This is a longer-format discussion building upon our prior conversations in 2024, because even more key news (including some linked above) and developments have been announced in the nuclear and uranium sector.

Nick Hodge, Co-Owner of Digest Publishing and editor of Foundational Profits and Hodge Family Office, joined us over at the KE Report this last week for a longer-format discussion on and the macro and micro themes that are continuing to create volatility in the general equities, bonds, and commodities market, and how he has been using these moves to position in oil, copper, nuclear, uranium, and rare earths stocks.

I’ll put in a hotlink in that interview to jump readers/listeners to the part of the interview that deals with nuclear power and the uranium sector.

Nick Hodge – Making Sense Of The Macro Market Movers, And Bullish Outlook On Select Oil, Copper, Nuclear, Uranium, and Rare Earth Stocks

Well, that wraps us up for this article on the nuclear power and uranium fundamentals and technical set up.

Thanks for reading and may you have prosperity in your trading and in life!

Shad