Special Alert: Silver And The Silver Stocks Are Finally Starting To Outperform

Excelsior Prosperity w/ Shad Marquitz – 04/03/2024

When I saw the price action today in the precious metals sector, it was above and beyond a normal bullish day; and involved a legitimate breakout in silver and the silver stocks, as well as a blast past another round number in gold. There were some technical levels we’ve been watching, that were just mentioned two days ago in the “Week In Review And Week Ahead” article, that I didn’t expect to see broken quite this soon. Such a big move in the PM sector needed to be addressed properly, after the market close, to appreciate just how significant today’s action was.

Let’s start off with the Silver price action and close today at $27.06. This was quite a move today from the open at $26.26. (cosmic)

It’s already been a stellar week where in 2 trading sessions the silver price has vaulted higher from the low $25’s to clearing $27. For this pricing chart, a nearly $2 move higher is a BIG MOVE. This also looks like a good old fashioned short squeeze, (but it’s unlikely that many tears will be shed for the shorts).

On the silver weekly chart below it is also important to highlight that this close today at $27.06 eclipsed the 3 prior peaks we discussed on Monday (at $26.50, $26.43, and $26.34 – seen in blue ellipses). This is still only a daily close mid-week, and not yet a weekly close, so it will be more germane to see where things close on Friday. Still this weekly candle, at least intra-week, will show a new high was made; and that is very significant.

Now, let’s take a look at the silver stocks via the (SILJ) Amplify Junior Silver Miners chart.

That is a solid move higher from the open at $10.54 to the close on the high of the day at $11.02 for a 5.96% gain. However, also notice that the 50-day Exponential Moving Average (EMA) blue line has started sloping up and is currently at 9.23, above the 144-day EMA red line, and will likely keep bending up to meet and exceed the 200-day EMA. That is what you want to see in bullish breakouts, for the shorter duration moving averages to be on top, and if they are coming from underneath, for them to break up through the longer-duration moving averages.

While that is a very constructive looking daily chart (up above), it isn’t until we look at the weekly chart (down below) that we see what was really so important about today’s price action. The SILJ close at $11.02 eclipsed the 2 prior peaks at $10.67 and $10.61, and the 144-day EMA at $10.44 and even more importantly the 200-day EMA at $10.69. Again, the week isn’t over yet, but at least we’ll see an intra-week high made on the chart above those key resistance levels. This is the kind of action we want to see in this sector.

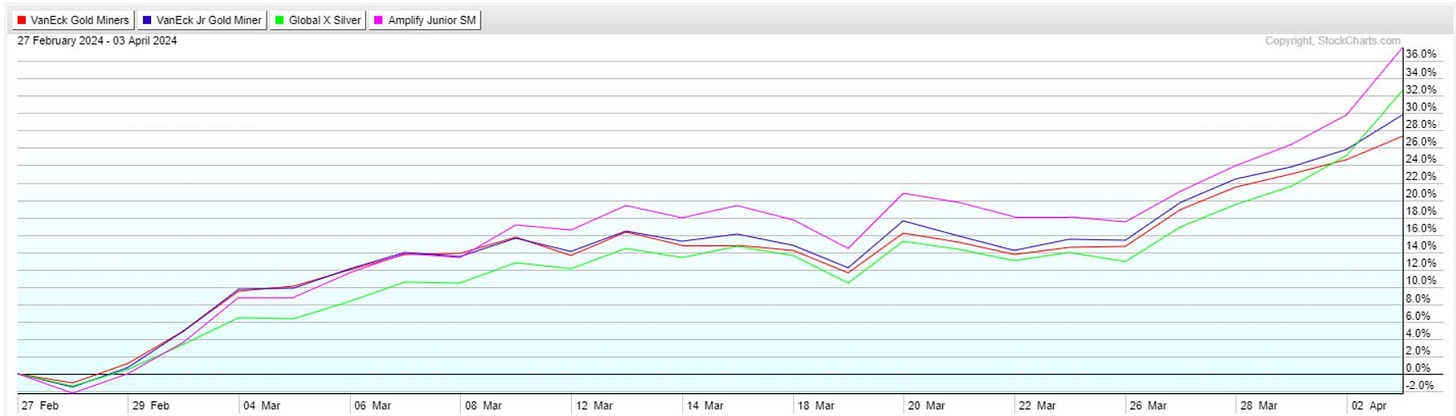

Something else we need to point out on the 4 primary PM stock ETFs performance chart below… Since the gold and silver stocks bottomed in late February on the 27th-28th, it is (SILJ) pink line that has outperformed to the upside up over 36%, compared to (SIL) green line up over 32%, (GDXJ) blue line up about 30%, and (GDX) red line up about 27%. Again, this is exactly what we want to see where the silver and gold juniors are outperforming the seniors, and where the silver stocks are outperforming the gold stocks. That is what precious metals bull markets do when they really get going.

That isn’t to take anything away from the gold ETFs either, as they have been outperforming most other market sectors over the last month, and have been putting in some important new levels on today’s pricing action as well.

Just look at the close today in (GDX) at $33.14, popping up above that slew of prior peaks and troughs in the $32’s. That hasn’t happened since last May when GDX got up to $35.67. That makes that peak and lateral price action the next overhead resistance. The moving averages are all really close together at present, so in the weeks and months to come, it will be a solid confirming signal to see the 50-week EMA break even higher and start sloping upwards decisively above the 144-week and 200-week EMAs by a buck or two.

GDXJ closed today at $41.10 and it pierced through the pricing level resistance of those 3 recent peaks at $40.86, $39.41, and $39.82 respectively, which again is more bullish breakout action. There are still some other prior peaks at $41.67, $42.86, and $43.03 to work through, but the big resistance line in the sand for GDXJ is going to be taking out that $43.57 peak from last April. It’s definitely getting within range, especially if the mining stocks keep getting inflows of new capital.

Gold also had a rip-roaring good day as well, closing the day at $2315, which is another all-time high close on the daily chart, and thus far on the weekly chart. Just stellar action in the yellow metal. Not bad for “Boomer Rocks.” :-)

A few days back we noted that gold weekly RSI had breached the 70 reading for the first time in several years, and it closed today at 75.05. It is in mildly overbought territory here, but on legitimate bullish impulse legs higher pricing indicators can get more overbought than normal and stay there, which is much different that what we see in bear market counter-trend rallies higher. That is the key distinguishing point here.

Today we actually had a great chat with our friend Jordan Roy-Byrne, editor of The Daily Gold, about the technical set up in gold, silver, the gold stocks and the silver stocks, where we pointed out that investors need to start looking at overbought conditions on a breakout move from a multi-year consolidation as a very bullish signal. We also discussed the psychological shift investors must make from a bear market playbook, to a bull market playbook, and how he is managing his portfolio of gold and silver stocks accordingly.

Jordan Roy-Byrne – Focus On Buying Value In PM Stocks With Gold Above $2300 and Silver Above $27

April 3rd, 2024

As for the individual mining stocks there are just too many to cover or list, with many up with gains in the high single-digits or double-digits on the day. Since today was most notably the silver stocks time to shine, then lets just stick with those winners up on the day.

We get sector messaging so often that for the really big pops and outsized gains one has to be positioned in the explorers, and on the Lassonde Curve that producers are “fully valued.” However, clearly the silver producers are showing that they can really move in big ways too, and these are legitimate revenue generating companies actually pulling the metals out of the ground. (a novel concept)

Symbol - Silver Producers - Daily Change %

BCM.V Bear Creek Mining Corporation +18.37%

AG First Majestic Silver Corp. +16.61%

FSM Fortuna Silver Mines Inc. +13.68%

CDE Coeur Mining, Inc. +10.79%

USAS Americas Gold and Silver Corporation +10.49%

IPT.V IMPACT Silver Corp. +9.26%

HL Hecla Mining Company +8.55%

GATO Gatos Silver, Inc. +8.31%

GSVR.V Guanajuato Silver Company Ltd. +8.16%

EXK Endeavour Silver Corp. +7.72%

ASM Avino Silver & Gold Mines Ltd. +7.28%

PAAS Pan American Silver Corp. +6.97%

MAG MAG Silver Corp. +6.72%

SVM Silvercorp Metals Inc. +6.52%

GGD.TO GoGold Resources Inc. +5.43%

APM.V Andean Precious Metals Corp. +4.65%

AYA.TO Aya Gold & Silver Inc. +4.58%

AGX.V Silver X Mining Corp. +3.95%

SILV SilverCrest Metals Inc. +3.81%

FRES.L Fresnillo plc +3.66%

SCZ.V Santacruz Silver Mining Ltd. +2.68%

HOC.L Hochschild Mining plc +1.54%

SSRM SSR Mining Inc. +1.05%

Here is a list of daily performance of silver developers & explorers with green on the screen. Keep in mind that some of these are exploring for various metals and silver may not be their primary, but it was significant enough to warrant inclusion on this list.

Symbol - Silver Developers and Explorers – Daily Change %

ZAC.V Zacatecas Silver Corp. +37.93%

RYO.V Rio Silver Inc. +33.33%

SBMI.V Silver Bullet Mines Corp. +31.25%

SVE.V Silver One Resources Inc. +29.79%

SLV.CN Silver Dollar Resources Inc. +27.27%

VIPR.V Silver Viper Minerals Corp. +26.32%

AAG.V Aftermath Silver Ltd. +26.09%

BRC.V Blackrock Silver Corp. +24.56%

SWLF.V Silver Wolf Exploration Ltd. +22.22%

VML.V Viscount Mining Corp. +21.87%

SNG.V Silver Range Resources Ltd. +21.43%

SVG.V Silver Grail Resources Ltd. +20.00%

SSVR.V Summa Silver Corp. +19.54%

AUMN Golden Minerals Company +19.50%

EQTY.V Equity Metals Corporation +18.92%

SLVR.V Silver Tiger Metals Inc. +17.14%

CMB.V CMC Metals Ltd. +16.67%

DV.V Dolly Varden Silver Corporation +15.56%

KUYA.CN Kuya Silver Corporation +13.51%

REX.V Orex Minerals Inc. +13.33%

RSLV.V Reyna Silver Corp. +12.90%

SILV.V Silver Valley Metals Corp. +12.50%

APGO.V Apollo Silver Corp. +11.76%

OCG.V Outcrop Silver & Gold Corporation +11.63%

ABRA.V AbraSilver Resource Corp. +11.27%

DEF.V Defiance Silver Corp. +10.81%

BBB.V Brixton Metals Corporation +10.53%

GRSL.V GR Silver Mining Ltd. +10.53%

VAL.AX Valor Resources Limited +10.00%

BML.AX Boab Metals Limited +9.38%

SAE.V Sable Resources Ltd. +9.09%

EXN.TO Excellon Resources Inc. +9.09%

IVR.AX Investigator Resources Limited +8.89%

DEC.V Decade Resources Ltd. +8.33%

BHS.V Bayhorse Silver Inc. +7.14%

ARD.AX Argent Minerals Limited +6.67%

SSV.V Southern Silver Exploration Corp. +6.67%

TUF.V Honey Badger Silver Inc. +6.67%

MASS.V Masivo Silver Corp. +6.67%

NUAG.TO New Pacific Metals Corp. +6.10%

SVL.AX Silver Mines Limited +5.56%

EMO.V Emerita Resources Corp. +5.13%

MMG.V Metallic Minerals Corp. +4.76%

SVRS.V Silver Storm Mining Ltd. +3.85%

VZLA.V Vizsla Silver Corp. +3.68%

SM.V Sierra Madre Gold and Silver Ltd. +3.33%

TM.V Trigon Metals Inc. +3.13%

KTN.V Kootenay Silver Inc. +1.57%

AZS.V Arizona Gold & Silver Inc. +1.28%

Well, that wraps things up for this “Special Alert” on the precious metals pricing action moves today. As the saying goes “One day doesn’t make a market,” but today’s price closes were very significant for silver, gold, SILJ, GDX, and GDXJ; so it was worthy of highlighting that for readers here on this channel. We’ll probably get some backing and filling after such a big rip higher, but those chart moves mattered.

Thanks for reading and may you have prosperity in your trading and in life!

Shad