Silver Stocks Have Been Leveraging The Move Higher In Silver, But They Have More Work To Do

Excelsior Prosperity w/ Shad Marquitz 06-19-2024

In a recent article sent out to subscribers of this channel, I added in some additional information after emailing it out. (Just as a heads up: I often do add additional passages and graphics to articles, after sending them out, because of the email length limitations applied to a Substack article). The email had already gone out to so many people before I added in those comments, that I felt it would be helpful to unpack those thoughts a bit further in a separate article, and provide some specific stock examples.

The additional comments dealt with how the silver stocks have not come back up anywhere close to the levels seen when silver was last up around the $30 level. There does seem to be a compelling opportunity setting up for being positioned in the quality silver companies or even the silver mining ETFs like (SIL) or (SILJ) for a further rerating higher. The sentiment will eventually swing back to more bullish again in the precious metals sector, and the silver stocks have a penchant for surprising resource investors, when they do suddenly blast much higher than people are expecting. Typically it starts with a short squeeze, but then it switches over into momentum buying, and the moves can come on fast and furious.

Just recently we did see this pattern play out again, with some solid moves higher in the silver stocks from late-February into mid-May, and they absolutely did leverage the moves in the underlying silver price. During this timeframe, Silver went from a low of $21.98 in February, to a high of $32.75 in May, for a solid 49% move higher.

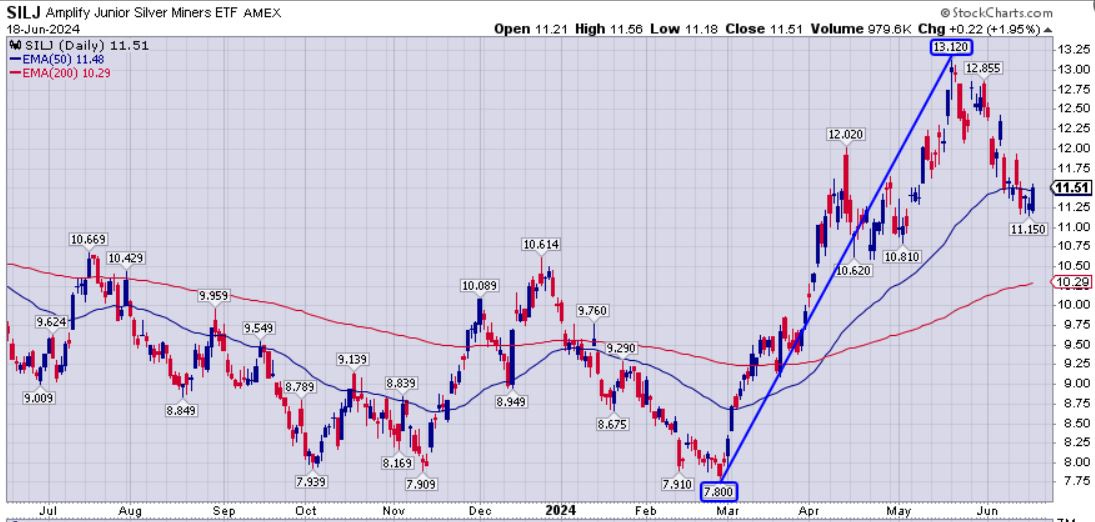

When viewed through the lens of the Amplify Junior Silver Miners ETF (SILJ), over the same time period, pricing moved from a low of $7.80 in late-February to a high of $13.12 in mid-May for a 68% move higher. People that keep saying the miners didn’t even keep up with the moves in the metals in this recent rally are simply misinformed. Clearly a 68% move in (SILJ) is larger than the 49% move in Silver over the same period. Still, that move higher in the silver stocks seems underwhelming when people ideally want to see a 2-3x move in the PM equities to any move in the underlying metals.

The reality is that SILJ, just like GDXJ, is really not a collection of the true junior explorers or developers in the traditional sense. Really the SILJ is made up of a bunch of producers and even royalty companies and gold companies, and only some of the smaller weighted producers would fall into the “junior” camp.

Yesterday, I decided to look at the charts for the silver stocks held in my own portfolio over that same time period; because it seemed like there were bigger moves going on than what I was seeing in the SILJ chart. After looking at a dozen or so charts, my main takeaway was that most of the silver stocks in my portfolio had essentially doubled over that same time period. So while some were up more than that (up 150%-200%) and some were a little less than that (up 85%-95%); on the whole most silver stocks actually gained on the move in the metal about 2 to 1, as they went up over 100% while silver only went up 49%. Some silver stocks were up 150%, for more of a 3 to 1 leverage, but they were the traditionally higher torque stocks. {I’ll include as many company charts for examples further down in this article as space permits}

So, we can dispel the narratives circulating that the silver stocks haven’t kept up with the moves in the metal, and/or that they are not leveraging the moves in silver. Most of the quality silver stocks not only kept up, but more than doubled the gains that the metal itself made.

Having said that, most investors have been expecting more out of the stocks, and would prefer to see a 3x or higher outperformance, considering all the extra risks taken on when investing in individual mining stocks. It is very curious that back in 2016 that the move up in the mid-tier silver companies held inside of this exchange-traded fund caused SILJ to get valued at $18.97, even though silver prices only got up to just above $20 (the peak in 2016 was $21.23). Then in 2020 SILJ got up to $16.89 when silver got north of $26. Then during the #SilverSqueeze of early 2021 it shot up to $18.76, when silver briefly shot up to $30.

It is interesting to note how SILJ has diverged from and dramatically underperformed it’s historic relationship to the silver price over the last few years; really ever since that intermediate bottom in September 2022. Case in point; look at the recent pop up to $32.75 in the silver price (the highest level since 2013), where SILJ only made it back up to $13.12 in response. It’s curious why SILJ didn’t make it up to at least $19+ on this move, and this represents another potential area of opportunity for a future rerating in the silver stocks. Again, if SILJ got up to $18.97 in 2016 at $21.23 silver, then doesn’t it seem odd that at $32.75 silver that SILJ only got up to $13.12 just last month? Surely these stocks still have some catching up to do…

That’s all I really wanted to unpack a little bit further in this article, and won’t belabor the re-rating point any further. However, I do want to reiterate a point made earlier that when these silver stocks start to move, it can be so sudden and so fast and furious, that it is best to just be in position ahead of time, in the stocks one wants to hold in their portfolio. Otherwise, the blasts higher will leave folks behind, or have them chasing the breakouts higher right before inevitable short-term corrections. The reality is that most people witnessing a breakout will feel that the stocks have already moved “too much” and so they won’t chase them and just end up watching from the sidelines. It’s no different than other sectors when they run, and we saw the exact same thing play out over the last few years in lithium stocks, uranium stocks, and senior copper stocks.

The silver stocks are just starting to wake up from a long slumber, and so far they’ve only made the initial doubles or some did 1.5x moves off their recent lows. Really, it’s still early days in this next PM sector move. The good news is that almost across the board, the silver stocks have now pulled back to consolidate over the last month, giving investors another opportunity to get into positions at a lower cost-basis, before then next blast higher.

I’ll post a series of silver stock charts below (and more after the email is sent), from companies held in my personal portfolio, as a representative sample of the kinds of moves we are seeing in this sector. Some of the stocks did actually go up around 150% for a 3 to 1 leverage on the silver price. This also highlights the point on why individually curated portfolios can outperform the larger ETFs (that are weighted to a bunch of larger laggard stocks for liquidity reasons).

Note that many of the stocks have pulled back down around their 50-day exponential moving averages for initial support. This is an area I personally like to nibble at stocks adding to existing positions, but if that support level fails, then the 144-day and 200-day EMAs are other areas where I like accumulating pullbacks in pricing moves.

Thanks for reading and may you have prosperity in trading and in life.

Shad