Silver, Copper, Multiple Mining Stocks Continue Blasting Higher

Excelsior Prosperity w/ Shad Marquitz (07-13-2025)

There have been a lot of fireworks in the commodities and resource stocks as of late, and so we’ll dive into some of those notable takeaways in this market update. There are a few new company profiles I’ve been working on to get out to readers here, but have been slammed here in early summer. I was holding down the fort over at the KE Report last week, as Cory took some well-deserved time with his family, and then I’m actually traveling with my family at present and through the balance of the week to come. Stay tuned though, because the following week I’ll be back and have a lot of company-specific articles and one or two trading strategy articles that will be coming out in rapid-fire sequence.

This weekend update will be a bit lighter than normal, but there were some key developments in the resource space that are simply too important to gloss over, and that we need to review.

So, let’s get into it…

Silver ripped to new 52-week highs on Friday, going up and tagging $39.22 in afterhours trading, and put in a new recent high on the weekly close as well, wrapping things up at $38.95 for the week. Wow!

Over the last 48 hours we’ve seen a flurry of interviews and articles out proclaiming that “the silver bull market has just begun!” (Uhmm… No).

This silver bull market has been underway for some time now ever since silver put in its low back in September of 2022 at $17.40.

Does this chart above look like silver just NOW started a bull market? (clearly not… Anyone can look at this chart heading solidly up and to the right for the last 3 years and ascertain that the bull market didn’t just get started)

Multiple resistance levels had already been cleared last year adding further confirmation, which were also the telltale technical data-points of more milestones achieved within the ongoing bull market.

Silver has more than doubled in price since the $17.40 lows in September of 2022, right in front of the rest of the PM stocks also bottoming at that time. That has been clear bull market action any way one slices it.

Silver cleared $30 a long while ago… back in the Spring of last year. Things had been bullish for a while in the silver space and with silver stocks, but that was a key line in the sand crossed, confirming this bull move would have some legs.

Then silver knocked its head on $32-$33 resistance a few times, and then cleared that resistance level over a year ago now during last Summer’s surge.

Then the more important $35 resistance was breached 3 times over the last year, starting in October of 2024, then in March of 2025, and then again in June.

Not to mention, silver already definitively cleared $35 on the daily & weekly charts in $36s and $37s in June.

Silver put in it’s second highest quarterly close ever in June at $36.10.

All of those factors and solid upwards-and-to-the-right price action, and clearing all those resistance levels was clear bull market action for anyone paying attention. How many more bells ringing did traders need to see to admit the pattern that had been established for a long time now?

Just because silver closed up above $38 on Friday does not in any way mean that silver just now “started a new bull market…” Again, silver has been in a solid bull market for the last 3 years now with a very visible pattern of higher highs, higher lows, and a series of resistance levels being cleared to the upside.

Having said that, silver has noticeably entered an acceleration phase of the ongoing bull market. The next overhead pricing resistance, going way back to 2011 and 2012, comes in at the $41-$42 level. After that $50 is in the cross hairs.

The silver mining stocks have been laggards compared to how they’ve reacted to similar silver prices in prior cycles, but they have still been in undeniable uptrends and bull markets.

For example, the Global X Silver Miners ETF (SIL) put in an intermediate bottom in September of 2022 at $20.58 (which was a higher low than the March 2020 pandemic crash low of $14.90, which was higher than the January 2016 Major sector low of $13.07), and it has continued to put in a pricing pattern of higher highs and higher lows since then. Silver stocks have been in a bull market trend higher.

Now obviously, individual silver stocks will vary, and some of them actually bottomed in late 2023 or in early 2024. Regardless, the point remains that the silver stocks have been in bull market pricing action for at least a year and half, and some have been in uptrends for years now. (so the bull market did not just get started, and the time to “buy low” was a long time ago)

The other curious characteristics of silver stocks, is that they’ll lag, and frustrate investors, but then will suddenly surge higher making up huge amounts of ground in big catchup trades and rerating events.

Here are a few examples of portfolio silver stocks that we’ve discussed on this channel for a long time now rerating higher:

Avino Silver and Gold (ASM) has gone up 10x so far from the Nov 2023 low at $0.40 to the current level at $4.22 in a year in a half.

So did Avino’s bull market just get started last week when Silver eclipsed $38? Clearly not…

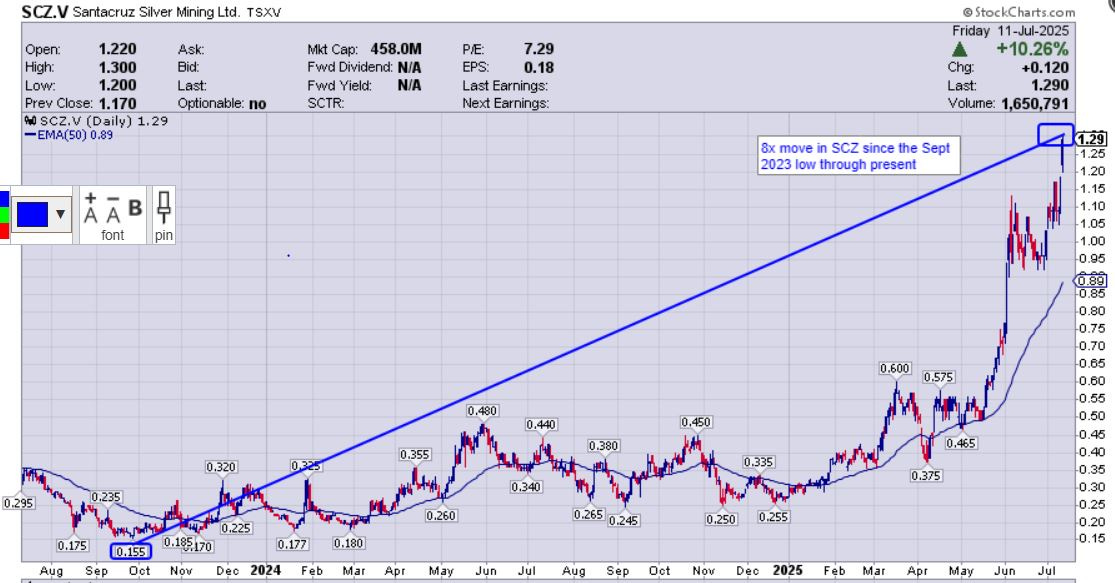

Santacruz Silver (SCZ.V) has gone up 8x so far from the September 2023 low at $0.155 to the current level at $1.29 in a year in a half.

So did Santacruz’s bull market just get started last week when Silver eclipsed $38? Clearly not…

Gatos Silver (GATO), {long before it was taken over}, surged up 9x from its September 2022 low of $2.20 to its October higher of $20.31, and that was way before this last week’s action.

Clearly the bull market in silver stocks did not “just get started.”

Coeur Mining (CDE) surged up 484% from its November 2023 low of $2.00 to the recent June 2025 peak of $9.69. Did it’s bull market just get started last week when silver breached $38? (clearly not)

It hasn’t just been the silver producers that have been running for years now either… Quality junior developers have also been in bull markets for a while now, despite narratives to the contrary.

Aftermath Silver (AAG.V) has gone up 6x from its October 2023 low at $0.145 to the present level of $0.88.

Yeah, it had a really nice pop last week on the underlying silver pricing surge, but this stock was already up 5x over the last 18 months, before the recent higher silver prices. It’s price action has been all bulled up for a long time now.

AbraSilver (ABRA.TO) has gone up 4.4x from its January 2024 low at $1.30 to the present level of $5.77.

Yeah, it had a really nice pop last week on the underlying silver pricing surge, but this stock was already up 4x over the last 16 months, before the recent higher silver prices. It’s price action has been all bulled up for a long time now.

I think the point has been sufficiently made that the bull market in silver and silver stocks absolutely did not “just get started.”

People should not take ridiculous proclamations from pundits like that lightly, as it really is disinformation and doesn’t serve investors knowledge or strategy.

Not only do those vocal calls that announce to the world that the bull market just got started in silver or gold or copper completely ignore the current bigger picture trend that has already well in motion, (by trying to reframe it as “new”), but they also show just how completely out of touch their outlook is and has been with the reality of what has been playing out for a long time now.

Anyone that actually was invested in the quality stocks within this sector over the last 18-24 months, knows that they have been running for a long time now.

That does not in any way imply that all traders bought the low and rode it all the way up to the highs, because most did not do that. The point illustrated above was to show the overall range of potential from low to high; but also outline how long in duration these bullish trends higher have already been in motion.

It is also interesting how silver, seems to have been more synched up with copper on this recent rise, than gold; because it straddles the line between them with a foot in the precious metals world and foot in the industrial metals world.

Very similar to silver popping up above $35 three times before advancing higher, we’ve seen copper pop above the $5 level three times, before blasting up into new all-time highs.

Copper put in its highest monthly close in June, extending this trend.

On Tuesday July 8th the copper futures price soared up to $5.8955 a pound intraday; and put in a daily close that day of $5.6845. Investors should sit up and take notice when all-time highs are achieved in any asset class.

From a technical pricing chart perspective, it actually makes no difference “Why?” the copper price runs up or falls down; merely that pricing levels are achieved. (this is the beauty of technical analysis – it scrubs away all the narratives and noise and market rationalizations).

Copper was technically set to break up to a new higher-high on this next 3rd break above the $5 psychological level regardless of the narrative or catalyst; and we had mentioned that here on this channel, well in advance of it happening.

We previously discussed that when copper blasted up well above $5 for the 2nd time, and eclipsed the $5.199 level from May of 2024, going up to $5.346 (and really almost up to $5.40 on the actual futures daily action) back in March of this year. The thesis was that the next blast up above $5 was going to be a 3-times-a-charm moment; where the market finally starts getting more used to the red metal having a $5 handle on it. This last week we saw that play out as anticipated.

Having said all that, it is hard to ignore that Trump’s comment about potentially putting a 50% tariff on copper played a big part in the recent spike higher.

Trump Says He Will Impose A 50% Tariff On Copper Imports

CNBC – Tue, Jul 8 2025

President Donald Trump said he will impose a 50% tariff on copper imports and suggested more steep sector-specific duties are on the way.

“Today, we’re doing copper,” Trump said during a Cabinet meeting. “I believe the tariff on copper, we’re going to make it 50%.”

https://www.cnbc.com/2025/07/08/trump-tariffs-copper-trade.html

As a reminder for context though, the move to $5.20 copper first happened in May of 2024, long before Trump was in office, or the effects of tariffs had even entered traders’ minds. People need to remember to separate the trading signal from the market and media noise, and technical analysis is tool that does just that.

The financial media, and many traders, really love to latch onto simple narratives to help explain things and justify to their minds why something is happening. That is just human nature. For all of human history people have felt comforted by the stories and narratives they weave to help explain the world around them; but that doesn’t mean it serves us as traders. As investors, it is far more helpful NOT to get too caught up in all that noise, and instead focus on what the charts are telling us, and then trade those trends accordingly.

Thanks for reading and may you have prosperity in your trading and in life!

Shad