Portfolio Company Update With A Growth-Oriented Gold Producer – Mako Mining

Excelsior Prosperity w/ Shad Marquitz (05-03-2025)

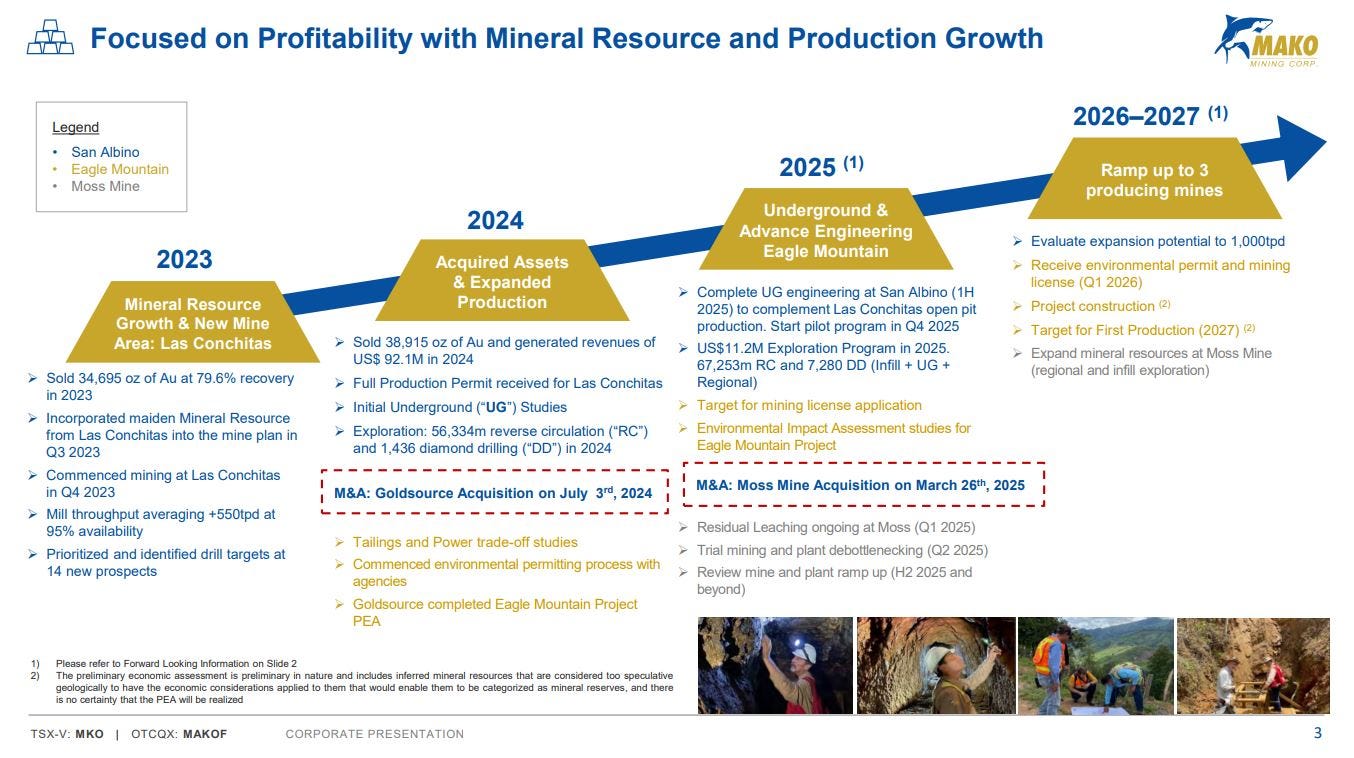

From time to time, if there are enough substantive updates to a company that we’ve covered in the past on this channel, then we’ll consolidate all that additional information down into another update. Today we’ll do that for Mako Mining (TSX.V:MKO – OTCQX:MAKOF), which we initially covered in the latter part of Opportunities With Growth-Oriented Gold Producers – Part 7, about a year ago back on April 10, 2024. Mako was also featured in a couple of the articles on Merger and Acquisition Opportunities In The Mining Stocks, because they announced 2 different transformative transactions last year to acquire both:

1. Goldsource Mines in Guyana for their Eagle Mountain Project - Mar 26, 2024

https://makominingcorp.com/news/index.php?content_id=348

2. On the very last day of the year, news broke about acquiring the Moss Mine in Arizona out of bankruptcy receivership from Golden Vertex, a subsidiary of the failed Elevation Gold.

https://makominingcorp.com/news-media/press-releases/index.php?content_id=695

This acquisition transaction closed on March 26th, 2025

Apparently March 26th is the date for M&A announcements – both 2024 & 2025

So much has changed for this company over the last year, and there are so many developments at all 3 of their projects now. This seemed like a good time to update readers here on Mako Mining; especially while it was still fresh in my mind after chatting with the CEO, Akiba Leisman on Wednesday.

[In full disclosure, yes, I’m a shareholder of Mako Mining at the time of this writing and may choose to buy or sell shares at any time. This is not investing advice, and I was not compensated or even asked by the company to write this article on Substack. I’m merely sharing my own investing thesis and outlook on this company and discussing what I’m doing within my own portfolio; so I’m biased in that sense. Do your own due diligence.]

So, let’s get into it…

Before we get into the nitty gritty of the production and development assets, or the exploration upside in Mako Mining, let’s have a quick look at the pricing action on the (MKO.V) chart.

Ever since mid-2023, the company really got their mining strategy dialed in. Profitable production was ramped up to 550-600 tonnes-per-day (tpd) at their San Albino Mill in Nicaragua.

They also restructured their balance sheet back in mid-2023, with the help of partners Wexford and Sailfish Royalty, and that set the company up for success with more working capital and a consolidated share structure.

In Q4 of 2023 they also ramped up mining production from their Las Conchitas deposit, which has remained a solid contributor to production at San Albino.

The stock price appreciation over the last 2 years reflects those improvements to the company fundamentals from mid-2023 to late-2023. The trend has been “up-and-to-the-right” on the chart since then; which is what you want to see.

Both acquisition announcements on March 26th and December 31st of 2024 are highlighted with blue ellipses on the chart above, showing that the market responded favorably afterwards to both transactions (which isn’t always the case with M&A deals).

From a technical perspective, pricing has spent more time above the 50-day Exponential Moving Average than it has below it, and pricing is still well above it as of Friday’s close at $4.43. (the 50-day EMA is currently at $4.17).

Technically, the company has been in and remains in a bullish posture.

Fundamentally, with underlying higher gold prices rapidly expanding their production margins, and new production slated to start ramping up at the Moss Mine over the next few months, this should underpin growing revenues and earnings.

One observation we have mentioned a few times now in other articles is that the market has been rewarding precious metals producers that are stepping on the gas and choosing to grow, either organically with their existing projects or through acquisitions. Mako Mining has been growing in both regards.

From a big picture perspective, these 2 recent acquisitions of the Eagle Mountain Project and Moss Mine represent a step-change in future production growth for this company.

When the ~40,000 ounces of annual gold production from their current operations at San Albino in Nicaragua is combined with the anticipated ~40,000 ounces of annual gold production from the Moss Mine in Arizona (likely by full-year 2026), and then augmented by the buildout of Eagle Mountain in Guyana in from 2026 into 2027, for a full year of production in 2028 that is projected to be ~66,000 ounces; then it is easy to see the trajectory for the company to go from 40K, to 80K, and then to 146K of gold ounces in annual production over the next 3 years.

That is a lot of production growth on tap, but there are also other potential areas for expansion beyond that if the company can deliver on its exploration and development initiatives. Let’s dive under the hood at all 3 projects to better understand where that future growth can come from.

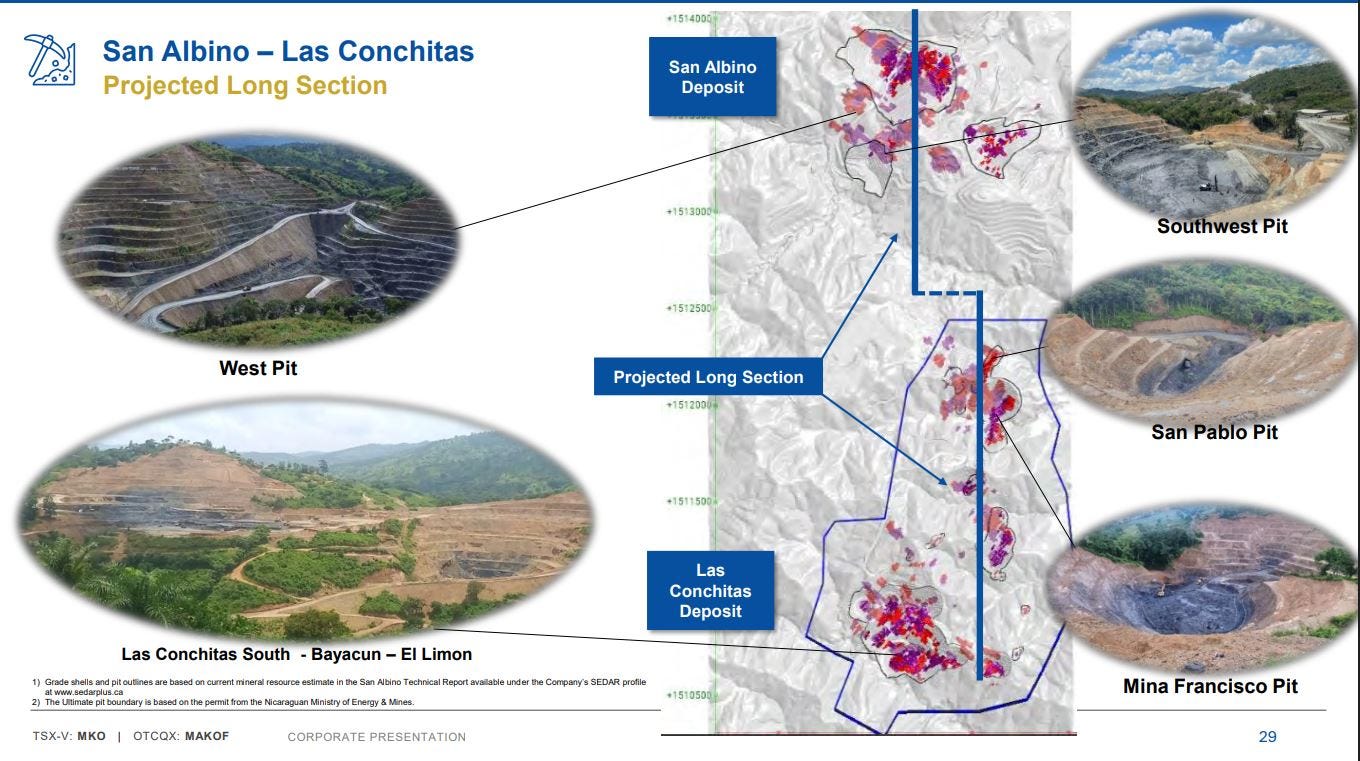

San Albino is already permitted to expand its operations from its current 500 tonnes per day (tpd) mill up to a 1,000 tpd capacity. If the company can supplement their open-pit mining with underground mining and build up enough confidence that it can consistently increase the throughput to fill a mill at 1,000 tpd, then the production from San Albino could double in theory.

The company has actually been running their mill above nameplate throughput more in the neighborhood of 550-600 tpd for quarter after quarter. So, if they do eventually bolt on another circuit in the mill, and run ore throughput at 1,100-1,200 tpd, then production could go from 40,000 up to 80,000 ounces per annum. This could be as soon as 2 years out if the underground drilling and development pans out.

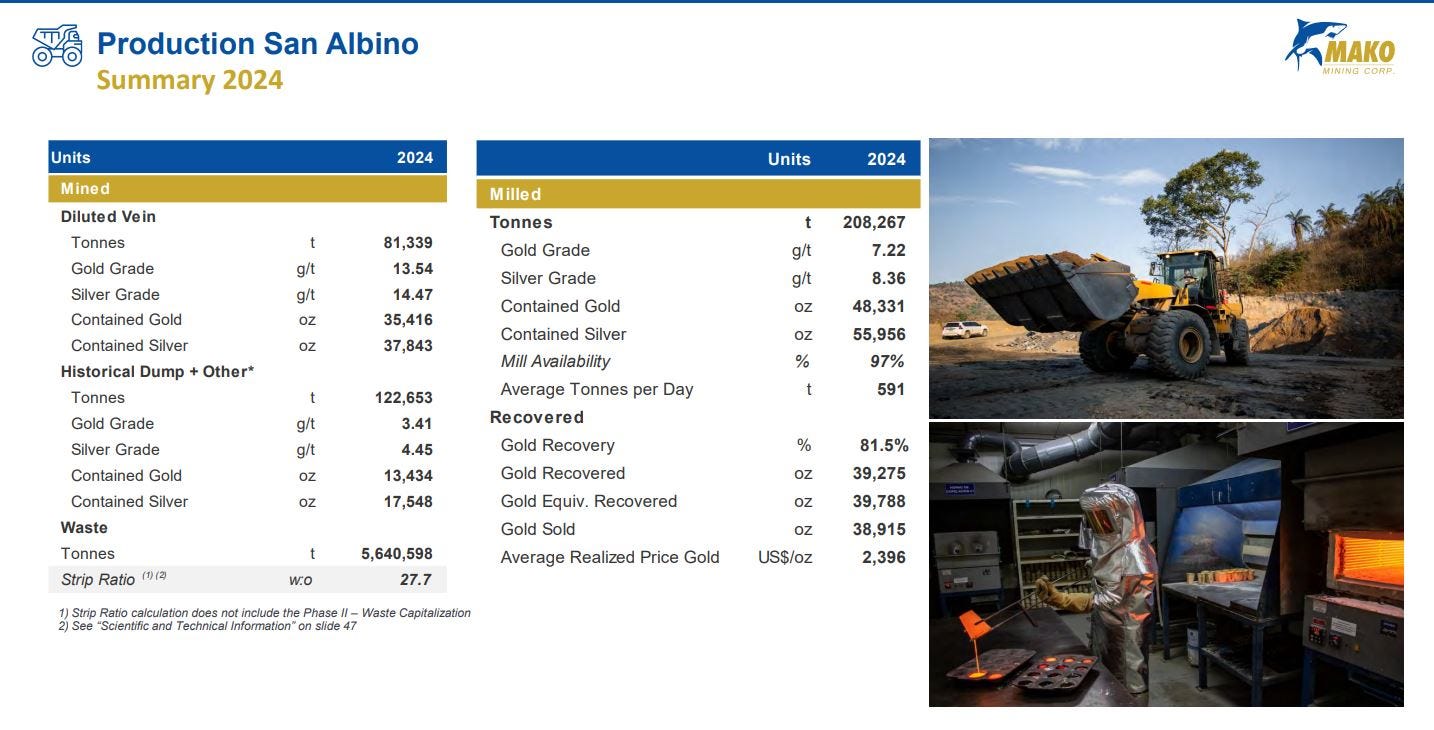

This is already one of the highest grade open-pit projects on the planet. The average resource grade of San Albino is at 10.64 grams per tonne (g/t); however, in practice the diluted vein material that is mined is averaging around 13.54 g/t. This higher-grade material is then blended with lower-grade surface dump stockpiles averaging around 3.41 g/t, which then brings the further diluted head-grade material that is milled to 7.22 g/t. {For reference, most open pits mines are around 1 g/t material. Many open pit mines in Nevada operate profitably at 0.3-0.6 g/t gold. So this open-pit mine is magnitudes higher grade than almost any other one in production.}

At the San Albino Project, there is currently mining going on from both around the San Albino Deposit as well as from their Las Conchitas Deposit. The company is also exploring the potential for underground mining at San Albino, which should start complimenting the open-pit mining later this year and moving into next year.

The company has been executing on underground exploration at San Albino, and through near-mine exploration around San Albino or Las Conchitas. If they can find even higher-grade material, then they could increase production simply through growth in grade. This potential to lift the average grade even higher will be an area to watch for in future exploration results.

The exploration team at Mako Mining believes there are considerable more gold ounces stored in the vault of the ground there, but because of the nature of Orogenic gold systems, it takes a lot of drilling to provide the density of data and close spacing to show enough continuity for an NI 43-101 resource estimate. The company has elected (wisely) to focus on production results, versus drilling their property to Swiss cheese, just for the sake of boasting bigger resources.

However, this is also a negative in the minds of some market participants and financial lenders, because they just can’t get past the smaller official resources and shorter number of years of mine life; at least as it shows up on paper.

For those that understand these types of gold systems though, they’ll realize there are likely still millions of ounces of gold on their land package.

For the sake of prudent capital allocation, the company will just keep operating consistently and perpetually moving out their shorter estimated mine life, but over a very long mine life.

There is always ongoing drilling, but there will never be a huge stated resource. It would be cost prohibitive and unnecessary to do that amount of drilling just for optics sake. This company is not drilling to market potential… they are drilling to profitably mine these resources.

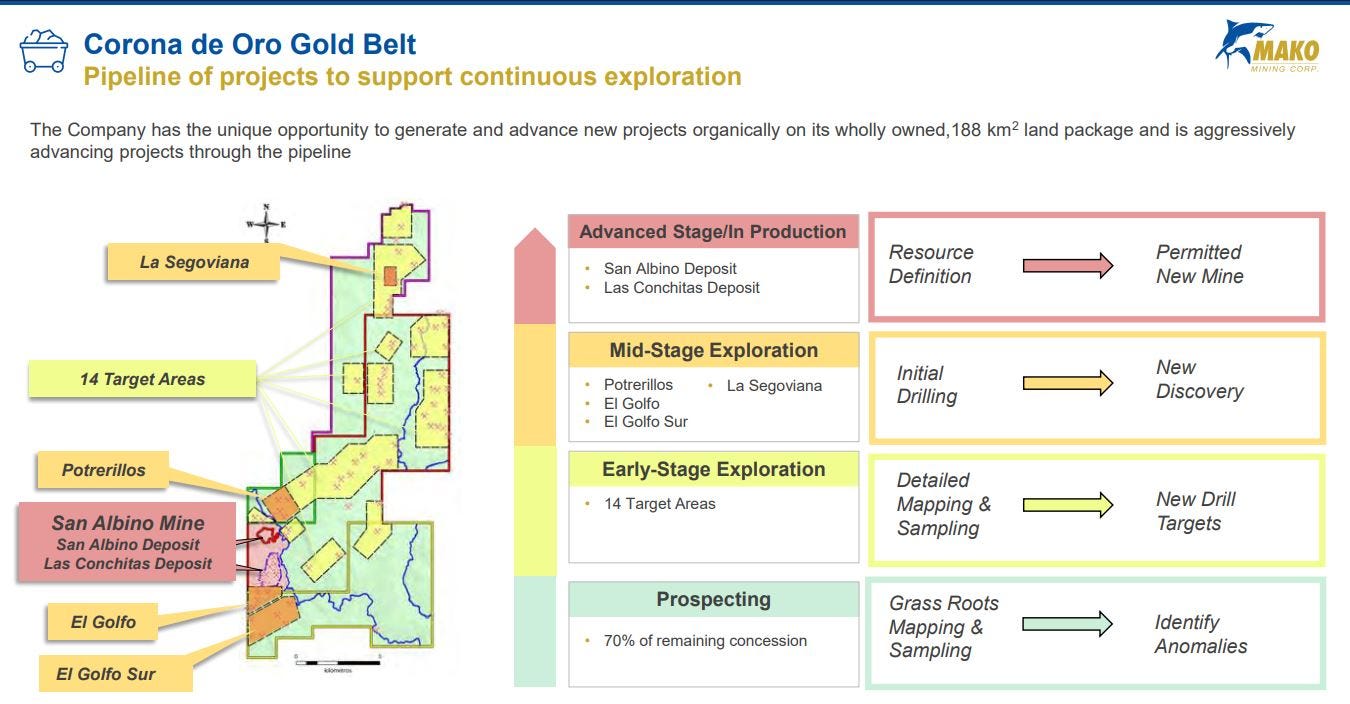

There are also regional opportunities for higher grade material at El Gulfo, Potrerillos, La Segoviana. Additionally, 14 other earlier-stage targets that have been identified across their land package in Nicaragua.

Just at the end of last year, the company worked out an agreement with local landowners to get surface access to start drilling and exploring El Golfo. The management team at Mako Mining has long believed that El Golfo is a compelling exploration target, possibly more prospective than San Albino. The challenge to date was getting access to it, and now they have it. In an interview I hosted with the CEO, Akiba Leisman, a couple of days ago, he mentioned that they have rushed to the assay lab both the 1st and 2nd hole drilled at El Golfo, and he made the point in a post over at Ceo.ca that this is not the norm for the company.

My curiosity is piqued to see how these El Golfo assays come back from the lab, but the company is not going to make or break this area with just 2 drill holes anyway. El Golfo needs a lot of drilling to test it adequately, but it is pretty close to the San Albino mine. So, if this area can provide similar or even higher-grade material, then there is an area of future growth for the company.

The initial drilling at both Potrerillos and La Segoviana has been encouraging as well. In the fullness of time there could still be compelling discoveries to be made at both those target areas. Mako is a gold producer, but they are also proficient gold explorers.

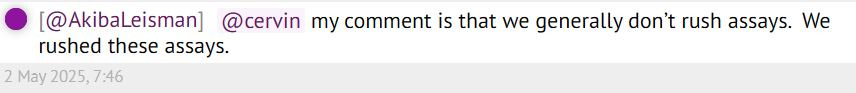

Let’s review their recent acquisition of the Moss Mine in Arizona.

The market has reacted mostly favorably to this transaction. Many resource investors will remember that Elevation Gold Mining (ELVT) became an insolvent business when operating this mine; and that left a bad taste in many people’s mouths regarding this asset. However, I have infinitely more confidence in the operations team at Mako Mining to make the Moss Mine work, compared to the operation team that was at Elevation Gold. Mako is also financially strong.

Some punters may have scratched their heads on why any company would want to pick up a lower-grade and higher-cost gold mine when it was announced on New Year’s Eve of last year. However, with the rising gold prices, it is looking like a very smart transaction. The key is the very low price paid for this producing mine.

It has been totally lost on most of the wider gold investing universe just how cheaply the Mako team picked up this asset for.

Check out this passage below from a recent press release announcing the closing of the transaction:

Mako Mining Completes Acquisition of Moss Mine in Arizona - March 27, 2025

https://makominingcorp.com/news-media/press-releases/index.php?content_id=1054

“The aggregate purchase price for the acquisition was US$6.49 million, paid in cash, reflecting Wexford’s approximate acquisition and closing costs of US$4.9 million plus US$1.59 million of equity contributions made by Wexford to cover initial operational costs at the beginning of January 2025. This equates to the approximate cost basis of EGA’s investment in GVC. Since December 31st, 2024, a total of 1,593 ounces of gold and 11,023 ounces of silver have been produced for a value of approximately US$4.8 million, generating net cash of approximately US$3.0 million. Furthermore, Trisura Guarantee Insurance Company has agreed to release approximately US$1.5 million of the US$3.0 million held as collateral for various environmental bonds held at the Moss Mine. The two aforementioned cash inflows have effectively reduced Mako’s net cash acquisition cost to approximately US$2.0 million, which is a small fraction of Mako’s current monthly cash flow.”

Let that sink in for a moment – Mako’s net cash acquisition cost for Moss was effectively US $2.0 million… for a producing gold mine. After 15 years of investing in gold stocks, I have never seen such an accretive acquisition of any producing asset! This was the deal of the century, and will be the gift that keeps on giving…

Even if Moss is a lower-grade and higher cost mine, they are still going to be producing gold with respectable margins at current $3,200+ gold prices.

This mine should be processing 10,400 tons per day of 0.4+ g/t average material for around ~40,000 ounces of gold production per year (as soon as next year).

The operations team at Mako is starting up mining at Moss later this month in May, but they are going to ramp-up production and recharge the leach pad with lower-grade material over a few months. As a result, I don’t expect to see better grades and recoveries until later in Q3 or in Q4 of this year. These ramp-ups take time, but they’ll be earning while they are learning at this project.

Then in 2026, we’ll see what a full year of nameplate production out of the Moss mine looks like. Regardless, it will be all gravy, because they’ll have recovered the US $2M spent after very little time in production.

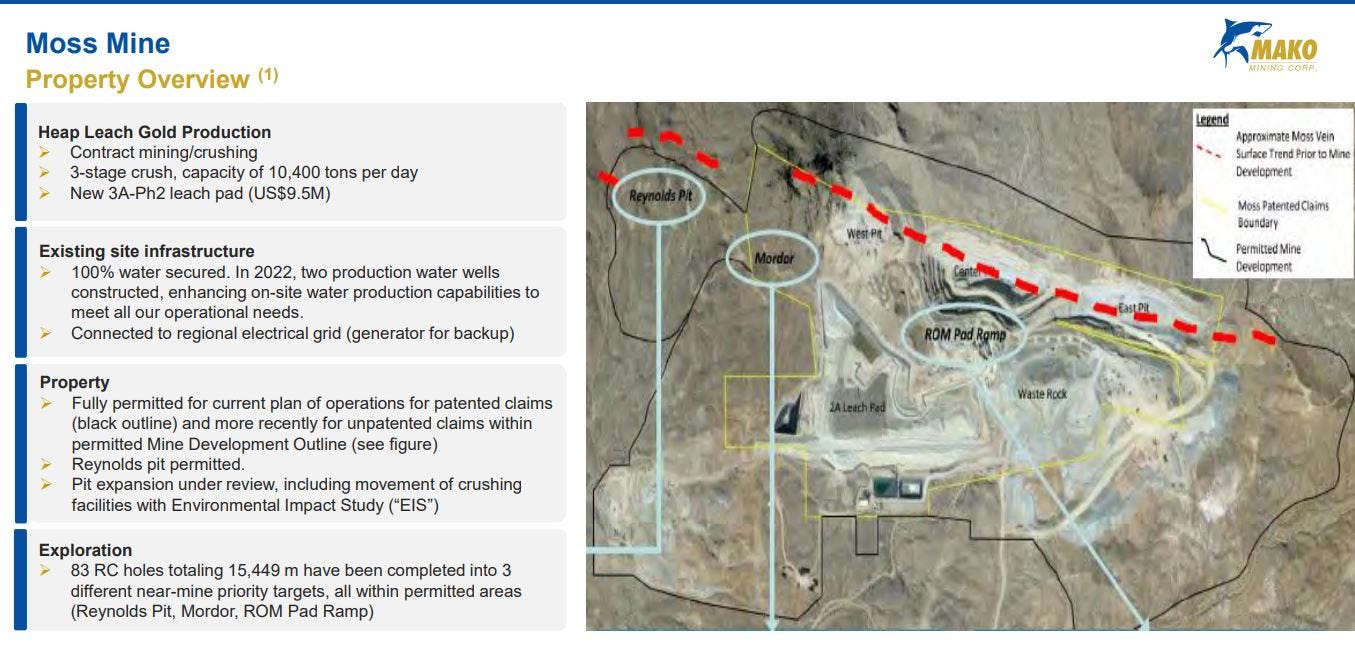

There is also the exploration upside and potential for future growth through the drill bit around the Moss Mine. The prior operator didn’t have the capital to seriously invest in exploration. Mako Mining does have the revenues to deploy, and will be investing in drilling across this land package.

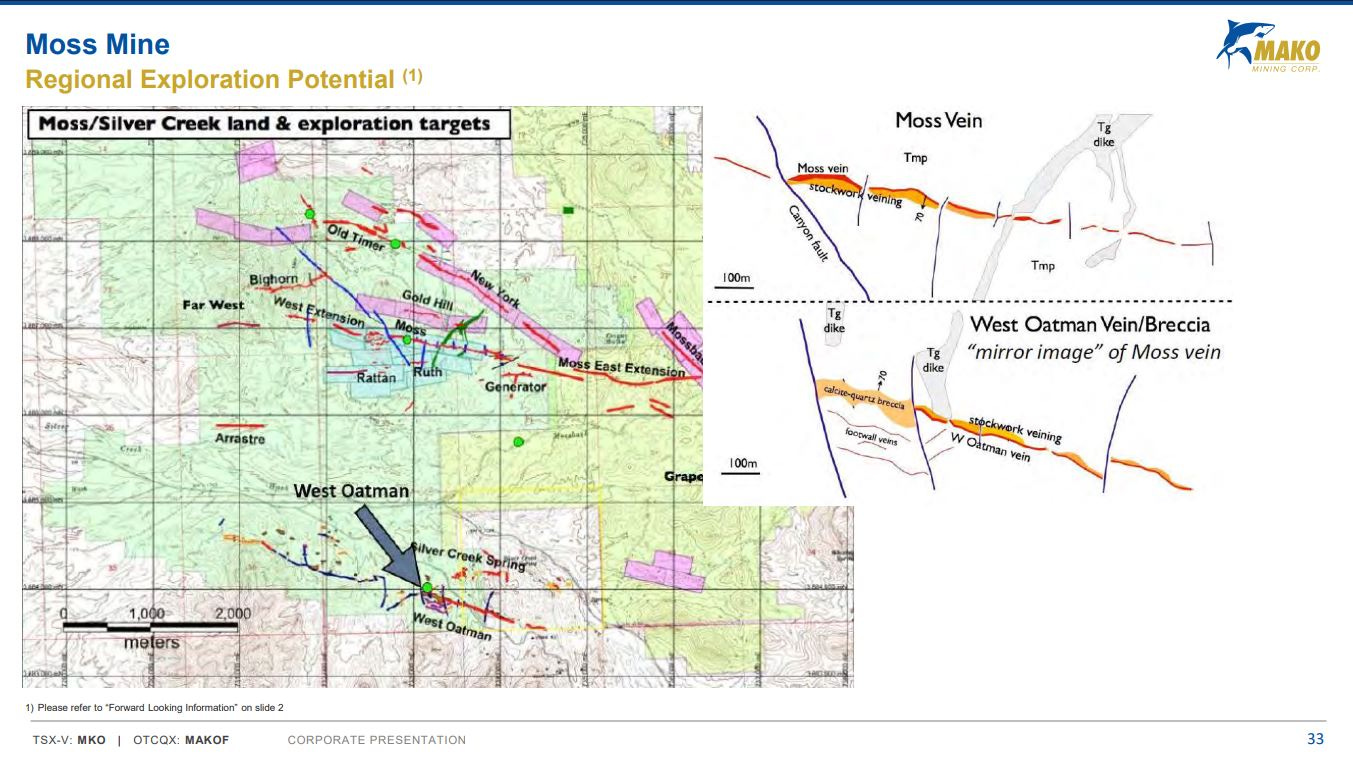

Now let’s briefly review the biggest potential future mine for the company, the Eagle Mountain development project in Guyana:

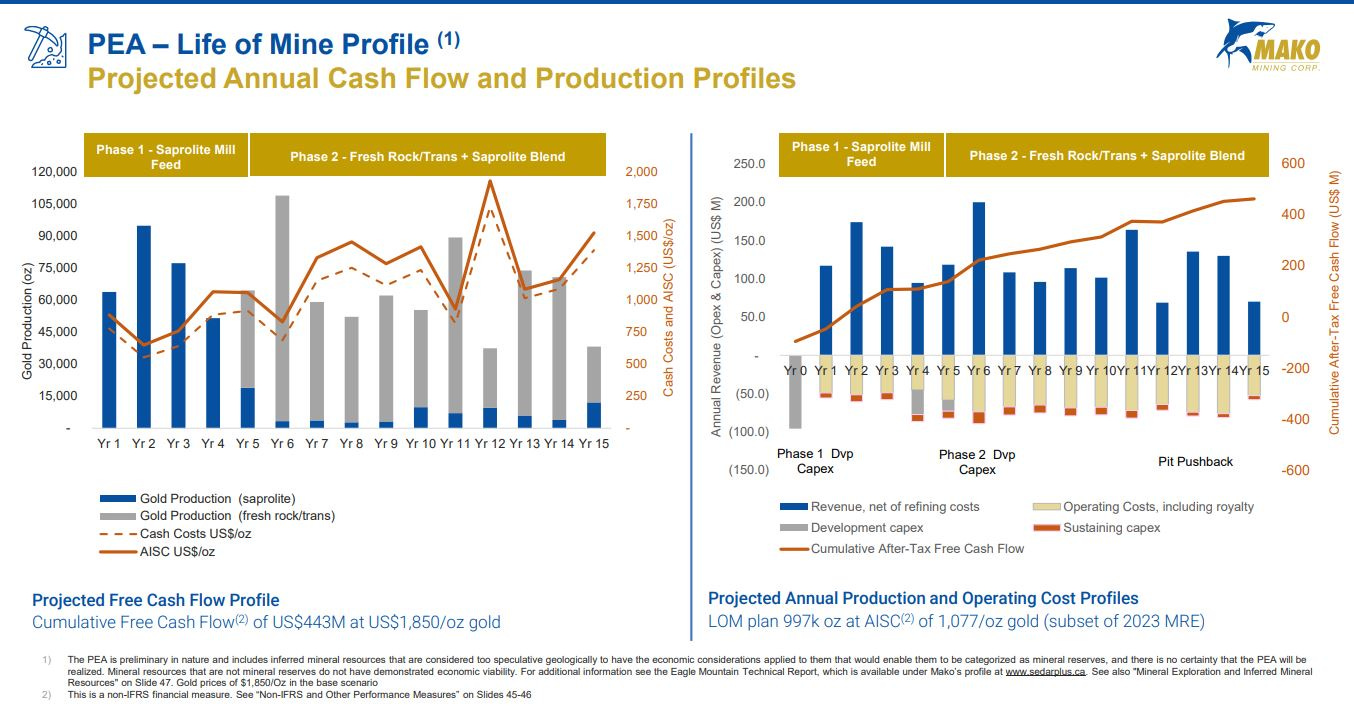

This Project is at a Preliminary Economic Assessment level of derisking

The next key milestone for the Eagle Mountain gold project will be the work on the Environmental Impact Assessment (EIA) permitting process.

After the EIA is received back in about a year, then the company can make a construction decision, and have the mine built in about 11 months.

This puts first production for mid-2027, and Eagle Mountain is slated to produce 66,500 ounces per annum, with a longer 15-year mine life.

Over at the KE Report on Wednesday, I was joined by Akiba Leisman, President and CEO of Mako Mining, to review the Q4 and full-year 2024 financial metrics and Q1 operations results from the San Albino Mine in Nicaragua, along with some residual leaching from the recently acquired Moss Mine in Arizona.

We also unpacked that mining was anticipated to begin at the Moss Mine in late May, and what to anticipate for the several months of ramp up of increased production from the leach pads. Additionally, we delve into the next key steps for derisking and development work at the Eagle Mountain Gold Project in Guyana to be in production there about 2 years out. This is a longer-format interview where we get into many nuances of operations in all 3 jurisdictions. {In full disclosure, Mako is a banner sponsor over at the KE Report.}

Mako Mining – Full-Year 2024 and Q1 2025 Financials And Operations At San Albino, Mining To Commence In May At The Moss Mine, and Key Development Work At Eagle Mountain Project

The Company’s financial results for Q4 2024 reflect record gold sales of $28.9 million, which generated $14.7 million in Mine Operating Cash Flow (1) (4), and $4.7 million in Net Income after accruing a non-current deferred tax liability of $3.2 million due to greater than expected operating income consuming a greater than expected portion of the Company’s deferred tax assets. The Company sold 10,888 oz of gold at an average price of $2,670 per oz with a $1,352 All-In Sustaining Cost (“AISC”) ($/oz sold). Full-year 2024 adjusted EBITDA was US$42.2 million and earnings per share of US$0.27 from 39,001 ounces of gold sold at an average price of US$2,397/oz.

Q1 Mako Mining Announces Q1 2025 Production Results Generating Record Gold Revenue of US$31.5 million - April 21, 2025

https://makominingcorp.com/news-media/press-releases/index.php?content_id=1056

2025 San Albino Operational Highlights

48,813 tonnes mined, containing 11,495 ounces (“oz”) of gold (“Au”) at an average grade of 7.32 grams per tonne (“g/t”) Au and 12,036 oz of silver (“Ag”) at 7.67 g/t Ag

53,551 tonnes milled containing 12,228 oz Au and 12,740 oz Ag grading 7.10 g/t Au and 7.40 g/t Ag.

Q1 2025 Mako Financial Highlights

Mako total gold sales of 10,817 oz Au for total revenue of $31.5 million in Q1 2025

San Albino Mine sales of 9,881 oz at $2,898 per ounce

Moss Mine sales of 936 oz Au from residual leaching activities at $2,997 per ounce (this doesn’t include 605 oz Au sold in 2025 prior to the acquisition of Moss Mine)

Delivered 40,500 oz of silver as part of Sailfish Silver loan for a total of $1.3 million in Q1 2025

Interest payment of $0.3 million to Wexford under the Wexford loan

Tax payment of $4.0 million in cash which was already accrued in Q4 2024

We’ll check in on Mako Mining again down the road, but hopefully this update brings readers here up to speed on this company, and why it remains a compelling junior growth-oriented gold producer.

Thanks for reading and may you have prosperity in your trading and in life!

Shad