Opportunities With Mid-Tier And Junior Royalty Companies – Part 9

Excelsior Prosperity w/ Shad Marquitz – (07-08-2025)

Welcome back to another update where we’ll be reviewing the opportunities in the mid-tier and junior royalty companies. In the first 8 articles in this series, we established the key value drivers, diversification advantages, risk mitigation advantages, and opportunities for accretive growth over time found in the royalty and streaming companies.

Thus far we have highlighted 9 mid-tier and junior royalty and streaming companies:

Sandstorm Gold (SSL.TO) (NYSE: SAND)

Metalla Royalty & Streaming (TSX.V:MTA – NYSE:MTA),

Elemental Altus Royalties (TSXV: ELE) (OTCQX: ELEMF),

Vox Royalty Corp (TSX:VOXR) (NASDAQ: VOXR)

Trident Royalties (AIM:TRR – OTC:TDTRF) (has been acquired)

Triple Flag Precious Metals (TSX: TFPM) (NYSE: TFPM)

EMX Royalty Corp (TSX.V: EMX) (NSYE: EMX)

Ecora Resources (TSX: ECOR) (LSE:ECOR) (OTCQX:ECRAF)

Empress Royalty (TSX.V:EMPR – OTCQX:EMPYF).

👉 For those that missed the last one, it was way back in September of last year, and inside of [Part 8] is a link to [Part 7], that has links to the first 6 articles.

[how’s that for a wild royalties rabbit hole to go down?]

In [Part 9] of this series, we’re going to review a few different exclusive interviews and key news updates on portfolio companies, as well as introduce a 10th royalty and streaming company (It is a bit larger, but it’s high time we flagged it for a job well done).

Truth be told, I’ve started and abandoned this article about a half dozen times over the last couple months, and had to keep pulling out and purging older news, interviews, and information that got stale-dated. Every time I’d sit down to knock it out, life would happen, distractions would come in, and I’d utter those words we all have so many times -- “Tomorrow...”

Well, tomorrow came and went, and the precious metals royalty space has just been abuzz with newsflow and has been humming right along lately. We’ve had 2 different high-profile M&A deals, a crypto stablecoin come in take a large strategic shareholding in a royalty company, royalty partner updates on key projects, and record Q1 margins and revenues almost across the board.

It was curious that for much of the current leg of this gold and silver bull market that a number of the junior and mid-tier royalty companies were just not getting a consistent bid, despite the higher underlying precious metals prices, and their improving company metrics over the last few quarters. However, over the last few months royalty companies are very much back in the spotlight with investors that have been seeking out their leverage to gold and silver, and a diversification of risk across multiple operators, jurisdictions, and even ancillary commodities.

This article could easily be broken up into 5 separate articles, and in the future we’ll definitely take deeper dives once again into more of these companies on a case-by-case basis. For now though, let’s just do a big royalty mashup article and cover some of what has been going on within this tiny corner of the resource sector.

So, let’s get into it…

One of the issues with having waited this long to put out a royalty and streaming company update, is that I missed the window with all my prior words written (but that were never published) praising a particular company... and now it’s a really moot point. This company had previously been a sector laggard for years, but it was working a strategy that was starting to get traction. One could see their financial ship slowing turning around, fueled by record margins, and it was making solid progress on paying down the debt on their balance sheet.

Unfortunately, for investors (like myself) that were excited about the trajectory it was on and going to be on for the next few years, this company just announced today that it was being taken over…. I’m talking about Sandstorm Gold (SSL.TO) (NYSE: SAND); the very first company we ever covered in this series.

Royal Gold to Acquire Sandstorm Gold Royalties and Horizon Copper, Forming Large-Scale, Industry-Leading Streaming and Royalty Company – July 7, 2025

This news really caught me and many other resource investors by surprise Monday morning, as M&A deals often do. I can’t say that I was thrilled to see this news, as I believe the multi-fold future gains and substantial market cap appreciation that was in store for Sandstorm Gold over the next few years was just stolen from it in an instant, with the announcement of this transaction. There are some M&A deals that I really like as a shareholder, and some that are more confusing, but this one is just downright disappointing.

Look, I get the rationale and “market messaging” that management is pushing for the ultra conservative risk-averse investors: The new proforma company will be even stronger and more diversified and derisked, and Royal Gold can rerate up to where the senior royalty and streaming peers are on a price/NAV basis.

OK, great, but I don’t care about that really, and that was not why I was invested specifically in Sandstorm Gold. By the looks of the ‘stream’ of negative and upset market reactions on chat boards, most of the other small, and in the scheme of things… insignificant retail investors, really won’t be able to change the course of this deal even if they all vote no on it. It’s pretty much a done deal…

The board and management are essentially taking their layup growth story with solid upside leverage for the balance of the PM bull market, and plopping it into a much larger, more mature senior vehicle… Royal Gold…. a company that is simply NOT going to have the same type of upside torque in the new pro-forma combined company that Sandstorm was going to have as a standalone company over the next couple years. What is sad is that they didn’t even have to do a bunch of new transactions or much of anything at all. They simply needed to sit on their hands and keep paying down the debt quarter after quarter, and this stock would have ratcheted up soooo much higher in a big rerating.

What stings the most is that the future multi-bagger returns were sacrificed here for a mediocre “21% premium to the 20-day volume-weighted average price (“VWAP”) of the Sandstorm Shares for the period ended July 3, 2025, and a 17% premium to the closing price of the Sandstorm Shares on the New York Stock Exchange on July 3, 2025.”

Talk about a colossal bummer…

This stock would have likely gone up 21% just on the back gold reaching back up and breaking above $3,500 again, without needing to place it into a sleepy senior company. The re-rating in a stand-alone Sandstorm Gold would have run laps around any rerating potential in the new juggernaut of a pro-forma company. Most (SAND) investors would have been happy to keep carrying a bit more execution risk, in lieu of the potential for much fatter gains. I just do not understand the urgency to do this transaction now, along with the co-mingling takeunder of Horizon Copper, which also killed the future value there for Sandstorm shareholders, (but of course, this deal rewards management in real time, with a foot in both companies).

My personal investing thesis in Sandstorm Gold stems back a long time… about a decade. I’ve traded the company dozens of times since then, buying or selling partial positions; sometimes selling out completely, buying back in, and dodging a few bullets from prior decisions along the way.

Many investors jumped ship in Sandstorm over the years, frustrated with some of the prior decisions of management, especially around the Hod Maden stream, and I can understand and empathize with that frustration.

I never got that upset about those decisions, and feel that they listened to their investor base and restructured that deal accordingly a few years into it.

Since we want to skate to where the puck is going, my view has been steadily fixed on the future, and it really looked so very bright for the new and improved Sandstorm Gold.

A couple of years ago, I got more serious about building a position in the company, while still trading around that core position; after watching a series of transactions that set it up to be an epic turn-around story in the making. I was incredibly supportive of a number of their transactions completed in 2022 that would make the years wandering in the dark totally worth the candle. (SAND) has done well over the last year, but it also spent a number of years being a sector laggard, and needed to climb much further, to really reward long suffering shareholders.

Central to this thesis was their restructuring of the Hod Maden deal with SSR Mining and spinning out that ownership and risk to Horizon Copper in 2022.

The acquisition of Nomad Royalty in 2022 (which I loved and was my second favorite royalty company at that time, only eclipsed by Maverix Metals that was also swallowed up by Triple Flag around the same time). At that time, I sold my Sandstorm shares, electing to let my Nomad shares convert over into SAND shares and pick up the arbitrage.

The massive Mara streaming deal option with Glencore, concurrent with the acquisition of BaseCore Metals in 2022 was never really fully appreciated by the market, because it is more of a 2028-2029 thing. However, it was a huge pearl of value waiting to be harvested down the road, and would have meant much more to a stand-alone Sandstorm Gold, than the much larger proforma Royal Gold.

Since 2022, Sandstorm took a lot of heat and analyst criticism for the debt that they added to the balance sheet to be able to complete those acquisitions of Nomad and BaseCore. However, anyone that looked at the projections a few more years out knew this was going to make waiting out the prior rough years so very worth it. They were going to pay down all that debt (and had actually been doing a bang-up job of that the last few quarters), and by 2027 were going to be a beast of a cashflow machine… even at much lower gold prices.

Then last year the gold price moved up substantially, and escalated the revenues, and ramped up their margins to over $2,000 per gold equivalent ounce for a 2024 annual average, almost $2,400 per gold equivalent ounce in Q4 of last year, over $2,500 per gold equivalent ounce in Q1, (and I’m guessing even higher in Q2 that we just closed last week). These insanely large margins were speeding up the timeline to debt repayment, and moving forward the potential for other initiatives, and a growing realization of a coming market rerating, even earlier than anticipated.

Sandstorm was on the cusp of becoming a wild cash generating machine as soon as next year if things kept trending like this with gold prices and their margins. Now all of that is going to be buried inside of a much larger company, Royal Gold (NASDAQ: RGLD).

That is great for the new Royal Gold, but it robbed the future value appreciation for Sandstorm Gold shareholders, which was the whole reason many of us were positioned and had hung on for so long during subpar performance periods.

Sandstorm shareholders are now at a crossroads, either forced to find another royalty vehicle with better upside torque to invest in, or they can hold their shares and let them convert over to Royal Gold and be satiated with the mild rerating higher, that is more in alignment with other senior royalty and streaming companies. The better 3rd option would have been to have left Sandstorm Gold alone, continuing as stand-alone company.

Sure, RGLD will rerate up more in line with peers like Franco Nevada, Wheaton Precious Metals, or Triple Flag, but I didn’t own Royal Gold or those other seniors, because they don’t have enough torque to peak my interest. I don’t really care that if shareholders hang onto their shares that they may be able to squeeze out a 50%-75% premium over time in the new pro-forma company. To most market observers, Sandstorm already had that easily lining up in their future. Personally I could see the investing thesis for it going up 3x-4x over the next few years, and just blowing investors’ minds in the process.

Now that is all off the table.

The company published a video Monday featuring CEO Nolan Watson (someone I’ve always admired from afar as a young go-getter CEO), but it just fell really flat for me when I watched it. This deal just doesn’t excite me personally.

Royal Gold to Acquire Sandstorm Gold Royalties and Horizon Copper

Sandstorm shareholders that let their shares convert will own 23% of the new combined company

The proforma company will be 89% precious metals with the combined gold and silver royalty and streaming exposure, with the balance being 9% copper, and 2% other metals.

I could see where this would be attractive to risk-averse buy-and-hold value investors, but they took what would have been a Mustang and placed it inside of an Oldsmobile. Even if “this is not your father’s Oldsmobile”… it just lacks the torque and horsepower that Sandstorm Gold would have had in 2026 and 2027 to go much faster and improve much more on a percentage basis.

As a result, I sold most of my Sandstorm Gold shares on Monday, to rotate into other PM names, and raise more cash in front of any potential market turbulence with the reciprocal tariffs coming off in the weeks to come.

Personally, I’ll be selling the remaining smaller amount strategically, over the next few weeks, on any further strength in the share price.

The combined proforma Royal Gold still has upside to capture, so there is nothing wrong with those investors that want to hang on and let their shares convert over. To my thinking there are just PLENTY of other royalty companies to position in for potentially bigger rerating moves in this bull market cycle.

There was another recent acquisition deal announced in the royalty space back in April, (that we’ve discussed briefly in this channel previously), and that I actually liked quite a lot. It was far more shareholder friendly. Orogen Royalties’ (TSXV:OGN)(OTCQX:OGNRF) 1% royalty interest in AngloGold Ashanti’s Silicon/Merlin deposits (the Expanded Silicon gold project) in Nevada, is being scooped up by Triple Flag Precious Metals (TSX: TFPM) (NYSE: TFPM).

Since Triple Flag just wanted that high-value royalty, the rest of the assets inside of Orogen are being spun out into Orogen 2.0. That’s a solid transaction.

I’m holding onto my Orogen shares to let them convert over to Triple Flag. I want those spinout of shares with the rest of their portfolio of assets as a kicker.

2 weeks back in late June, shareholders approved this transaction.

Orogen Shareholder's Overwhelmingly Approve Plan of Arrangement with Triple Flag Precious Metals at Annual General and Special Meeting - June 27, 2025

“On April 21, 2025, the Company and Triple Flag signed a definitive arrangement agreement, whereby Triple Flag agreed to acquire all of the issued and outstanding common shares of Orogen pursuant to a plan of arrangement for total consideration of approximately $421 million, or $2.00 per Company Share. The total consideration consists of approximately $171.5 million in cash, approximately $171.5 million in Triple Flag shares, and shares of Spinco with an implied value of approximately $78 million.”

“Orogen and Triple Flag have also agreed to the formation of a generative exploration alliance in the western United States, whereby Triple Flag will provide funding to Spinco for generating gold and silver targets considered geologically similar to the Expanded Silicon project.”

Next up to bat, and initially the piece of news I initially wanted to lead this article with… Crypto embraces PM royalties:

One of my larger royalty company portfolio positions, Elemental Altus Royalties (TSX.V:ELE) (OTCQX:ELEMF), stunned the precious metals universe, with news that the crypto stablecoin company Tether, was coming in and unseating La Mancha (and soon Alphastream) to become their largest cornerstone investor.

Now there is some positive and possibly transformative news for the royalty sector and crypto sector alike, that I don’t think anybody was expecting.

Elemental Altus Is Pleased To Announce Tether Investments As New Cornerstone Shareholder- June 12, 2025

“Tether completed the acquisition of 78,421,780 common shares of Elemental Altus from La Mancha Investments S.a.r.l. at a price of C$1.55 per share, representing approximately 31.9% of the issued and outstanding common shares. When combined with the 4,360,511 shares already owned by Tether, Tether will now own an aggregate of 82,782,291 common shares, representing approximately 33.7% of the issued and outstanding shares in the Company.”

“Tether has further announced that it has entered into an option agreement with AlphaStream Limited, and its wholly-owned subsidiary Alpha 1 SPV Limited, pursuant to which Alpha 1 granted Tether the option to acquire, subject to certain conditions, an aggregate of 34,444,580 common shares owned by Alpha 1. On exercise of this option, Tether would own 117,226,871 common shares, representing approximately 47.7% of the issued and outstanding common shares.”

I’ve been following the success that the team at Elemental Altus Royalties has had for many years now; back when they were just Elemental Royalties (before acquiring Altus). It is really nice to see them getting noticed now on the international stage for this very unique transaction. All that hard work from Fred and Dave and the rest of the Elemental Altus team is finally getting recognition.

Over at the KE Report on June 29th, Fred Bell, CEO of Elemental Altus Royalties, joined me to unpack the transformative news where Tether Investments just positioned as their largest strategic shareholder and cornerstone investor. We discussed what this deal means for the precious metals and royalty sector, where a crypto company can deploy such large sums of capital, and more importantly what it means for future deal flow and acquisitions for Elemental Altus Royalties.

Elemental Altus Royalties – Transformative Transaction With Crypto Stablecoin Company Tether Investments, Coming In As The Largest Strategic Shareholder

Fred and I discussed the rationale behind Tether positioning in both dollars and gold in their 2 stablecoins, but that this recent strategic stake in Elemental Altus was them positioning using their Teather Investments vehicle for longer-term appreciation. One aspect is that they were very keen on the lower risks and high revenue per employee ratio of royalty companies for acquiring more exposure to future gold equivalent ounces of production.

The mandate that they reiterated to the management team of Element Altus Royalties was to keep growing the business in a responsible and efficient manner, and Tether has the financial firepower/strength to be a great ally to (ELE).

We also touched on the news out on June 24th, where Gleason & Sons LLC announced it had acquired nearly one million common shares of Elemental Altus Royalties via ongoing open market purchases. The rationale from Stefan Gleason was that the Company has paid off all debt, booked its most profitable quarter ever in Q1, and streamlined its governance structure.

Gleason & Sons Increases Its Holdings in Elemental Altus Royalties After Tether's Investment, Expanded Revenues - June 24, 2025

https://ceo.ca/@accesswire/gleason-sons-increases-its-holdings-in-elemental

We spent the balance of the discussion talking about what this means for future deal flow and acquisitions. Fred highlighted the size and scale of potential future deals with their already strong balance sheet, cash on hand and free cashflow generation on tap for this year, and their revolving credit facility, giving them upwards of $80 million in funding for deals moving forward; before Tether even got involved.

Additionally, about a month ago on June 3rd, over at the KE Report, David Baker CFO of Elemental Altus Royalties, joined me to review a few different royalty partner project updates, development growth on tap in their portfolio of royalties, his take on the Q1 2025 financials and coming one-off payments, and looking ahead to future acquisitions.

Elemental Altus Royalties – Partner Project Updates – A$250m Laverton Acquisition, Hercules Maiden Reserve At SKO, Cactus Advisor Selected For Project Financing

We kicked things off with recent announcement by Focus Minerals Limited (ASX: FML) reporting the sale of their Laverton assets in Western Australia, to A$5 billion Australian miner Genesis Minerals Limited (ASX: GMD) for A$250 million. Elemental Altus holds an uncapped 2% gross revenue royalty over a significant portion of the project, and their management team is thrilled to see a senior producer taking over the project which can fast-track it back into production. Genesis Minerals noted in the announcement the clear potential for Laverton to supply open pit and underground ore to their operating 3 Mtpa Laverton mill approximately 30 km away, after conducting more infill and extensional drilling and internal scoping studies.

Next we pivoted over to the recent announcement by Northern Star Resources Limited (ASX: NST) reporting a maiden Mineral Resource and Ore Reserve Estimate at the Hercules Discovery of 916,000 ounces of gold. This Hercules deposit is part of the South Kalgoorlie Operations (“SKO”) in Western Australia, where Elemental Altus holds a A$10 per ounce production royalty. In addition to the royalty, Elemental Altus also has a A$1 million Discovery Bonus over a significant portion of the project, for each new ore body with production and/or Reserves greater than 250,000 ounces of gold, so that will be an added one-off payment.

We also touched upon the recent news from Arizona Sonoran Copper Co. (TSX:ASCU | OTCQX:ASCUF) where it was announced by the Company that they’ve appointed H&P Advisory Limited as its debt financial advisor for the Cactus Project, a copper cathode development project in Arizona. H&P will work closely with the management team to provide complete and proactive support in all aspects of the project financing process for the Project, acting as the primary interface with lenders. It is expected that Arizona Sonoran may buy back a part of this royalty in a one-off payment later this year, but Elemental will still have good royalty exposure to this project, and it will supplement the copper payments coming in from their Caserones copper royalty down the road.

Turning to the financial strength of Elemental Altus, Dave highlighted with the roughly $20 million in cash on hand, the expected revenues over $30 million this year, a number of additional incoming $13-$15 million in one-off payments, and the $50 million credit facility on hand, that the company is in a great position to keep reviewing accretive acquisition transactions in the year to come.

Another royalty company turn-around, that we’ve covered in this series before, is Metalla Royalty & Streaming (TSX.V:MTA & NYSE:MTA). I had put some words to paper trying to highlight the improving future financial picture for this company, but then I read a recent article on Substack from my friend and colleague, John Rubino. He did such a great job of covering it, that I’m just going to post a link to it his article for readers here:

“The general story is that this company spent a lot of money on promising royalty/streaming deals, but was way too early. Many of its mines progressed, but not all the way to production. So revenue was inadequate and losses mounted, causing the share price to fall despite gold’s historic bull market.”

“Now, though, some of those too-early royalty deals are on the verge of paying off. One is going into production and may become the company’s largest source of revenue in 2026. Another just attracted a massive $1 billion investment from a sector giant, implying good things for the near future. And yet another is close to entering production on an asset with a possible 40-year lifespan.”

“The stock has recovered a bit on all this promising news. But it’s way below where it will be if 1) the above properties pan out, and 2) the commodities bull market persists.”

Over at the KE Report on July 2nd, Cory Fleck, had Brett Heath, CEO of Metalla Royalty & Streaming, on the show for a comprehensive discussion on the company’s growth trajectory, asset updates, and strategic financing moves.

Metalla Royalty & Streaming – Revenue Growth, Portfolio Advancements & Long-Life Asset Pipeline

New producing assets:

Toktenzino and La Guitarra came online on time and on budget in late 2024.

Endeavor Mine (Australia) began commercial production; expected to be Metalla’s largest cash-flowing asset by 2026.

Flagship growth catalyst: The Côté-Gosselin royalty, validated by Franco-Nevada’s $1B+ acquisition, could become a tier-one cornerstone asset for Metalla.

Long-term upside: Development-stage assets like Copper World, Wharf, and Amalgamated Kirkland add multi-decade exposure and potential cash flow.

Capital to scale: A new $75M USD credit facility (announced June 25) allows Metalla to pursue larger, accretive, non-dilutive acquisitions.

Last, but not least… We are introducing a new company to this series, but likely not a new company to readers of this channel: Wheaton Precious Metals (TSX | NYSE | LSE: WPM)

Wheaton PMs is really too large to include in this series on junior and mid-tier royalty and streaming companies, but the company is so well run, and we had the good fortune over at the KE Report of interviewing President and CEO of Wheaton Precious Metals, Randy Smallwood, in early Q2… so this is a bonus interview for readers & listeners here.

Wheaton Precious Metals – Growth Plans, Streaming Advantages & What To Expect In 2025

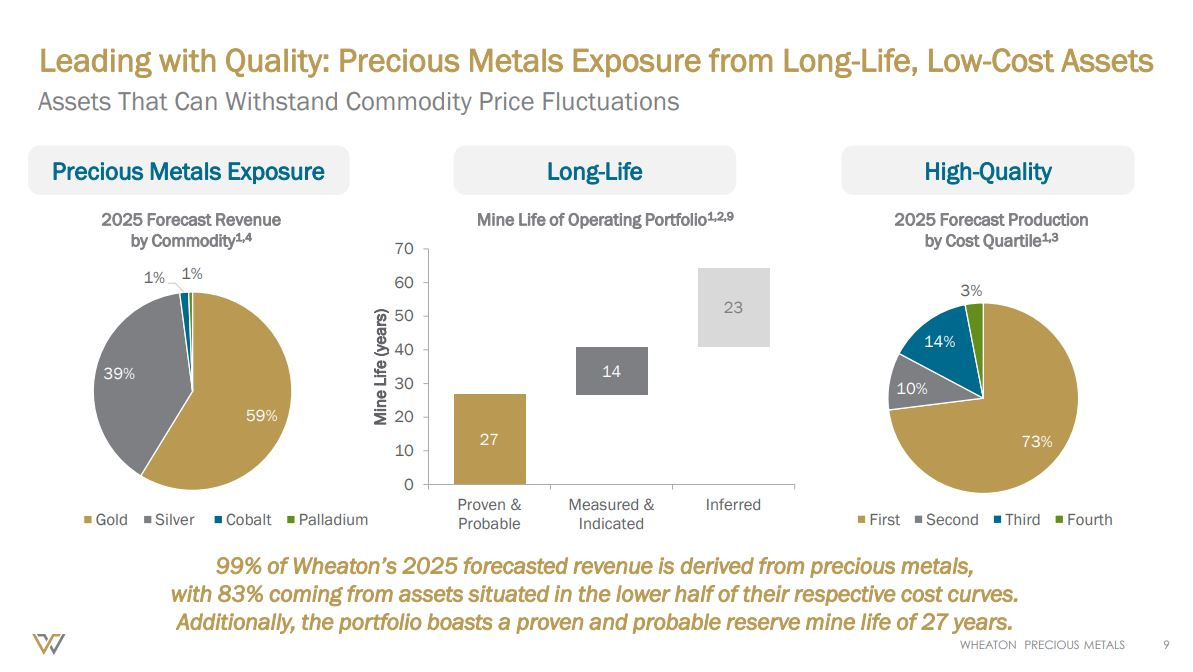

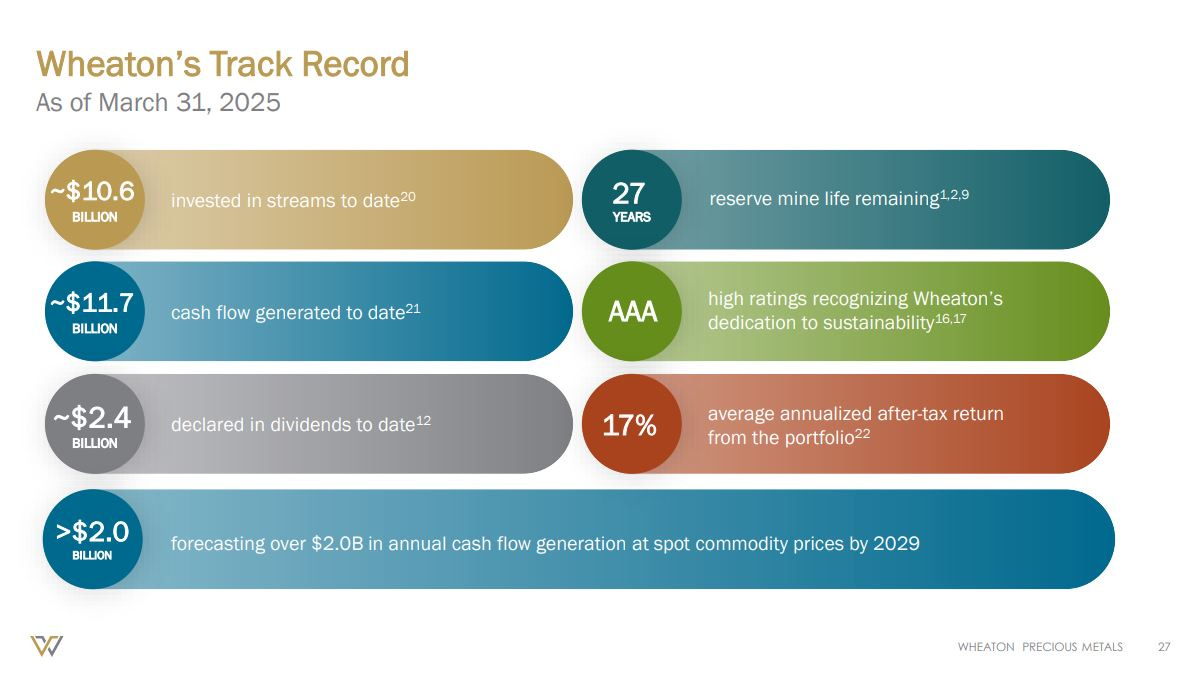

Randy shares the company’s multi-year growth strategy and discusses how their streaming model has uniquely positioned them to thrive in today’s precious metals market. Wheaton is entering a major growth cycle, targeting a 60% increase in production by 2031, supported by a robust balance sheet ($829M in cash, no debt) and four new mines beginning production deliveries in 2025.

Flagship Asset Growth: Updates on Salobo Phase 3 and Antamina, both poised for higher-grade output.

New Production in 2025: Blackwater (Artemis Gold), Goose (B2Gold), Mineral Park, and Platreef (Ivanhoe Mines).

Strategic Leverage: The benefits of streaming over royalty models – especially in a rising gold price environment.

Montage Gold Case Study: How a 100% stream-financed model could reshape single-asset project development.

Jurisdiction & ESG Strategy: How Wheaton manages political and community risks, while recently expanding selectively into Africa.

Investor Sentiment: Rising interest from generalist funds and Western retail investors, especially in silver exposure (~40% of WPM’s revenue).

To wrap things up for this article, we had a good conversation with John Rubino over at the KE Report last week, where near the end I probed to get his take on the royalty and streaming companies in light of the current precious metals environment.

This hotlink should take you right there, to the (31:42 min mark) of the podcast:

Thanks for reading and may you have prosperity in your trading and in life!

Shad