Opportunities With Growth-Oriented Gold Producers – Part 7

Excelsior Prosperity w/ Shad Marquitz – 04/10/2024

Once again, key mining sector news hit this week in 4 of the growth-oriented gold producers that we’ve already been discussing in this series. That means here were are with (Part 7), continuing to navigate the opportunities and challenges in this space.

As a refresher to all the new readers here in this channel (and welcome aboard by the way), in the prior (Part 6) of this series, we mostly dissected the big merger news from Alamos Gold (TSX: AGI) (NYSE: AGI) announcing the transaction to acquire Argonaut Gold (TSX: AR) (ARNGF) and their Magino Mine.

https://excelsiorprosperity.substack.com/p/special-alert-opportunities-with

Later on in that article we also had noted that Karora Resources was not moving forward in tying-the-knot with Ramelius Resources. However they had messaged in that press release that they were “currently engaged in exclusive negotiations with a new third party regarding a potential business combination.” Well, we get a resolution as to which company is that “third party” from this week’s news. Additionally, in the last article I teased that Mako Mining would be the featured company in this (Part 7), and noted their news where they were taking over Goldsource Mines in Guyana. (We’ll get into that further down in this article)

The final takeaway was just the sheer amount of M&A deals occurring with these growth-oriented gold producers lately, (also referencing the recent takeover of Marathon Gold by Calibre Mining, another company we’ve discussed). Obviously, this is where the action is, because 4 of the 6 prior companies flagged in this series have been the ones making headlines in the gold sector with M&A transactions. 2 companies did the acquiring, and 2 companies are being acquired.

Let’s kick off the news update portion of this article with a mystery finally solved:

Karora Resources Inc. (TSX: KRR) (OTCQX: KRRGF) and Westgold Resources Limited (ASX: WGX) (OTCQX: WGXRF) are merging. Ultimately Westgold is acquiring Karora, where KRR.V shares will convert over to WGX.AX shares, so all investors that hold through the merger will be part of the new pro-forma Westgold.

As a result of it being more of a merger than a takeover, there is only a 10% premium for Karora shareholders, which upset a lot of long-time investors, hoping for a better takeover premium of 30%-50% from a larger company. However, this really comes down to where people value the new combined Westgold Resources + Karora Resources in the new pro-forma company. There is also a new SpinCo being created, mostly out of the lithium assets that Karora had exposure to, but they don’t seem to be garnering much value or enthusiasm from current shareholders. The proposed transaction has had a mixed reaction, like every merger, but let’s dig into the details.

KARORA RESOURCES ANNOUNCES MERGER TRANSACTION WITH WESTGOLD RESOURCES - April 7, 2024

“Karora shareholders will receive 2.5241 Westgold fully paid ordinary shares, A$0.68 (C$0.61) in cash and 0.30 of a share in a new company to be spun-out from Karora ("SpinCo") for each Karora Share held at the closing of the Transaction. The Offer Consideration represents approximately A$6.60 (C$5.90) per Karora Share based on Westgold's closing share price on the ASX of A$2.28 on 5 April 2024.

SpinCo's assets will comprise Karora's existing 22.1% interest in Kali Metals Limited (ASX:KM1), a 1% lithium royalty on certain mining interests held by Kali, the right to receive a deferred consideration payment due to Karora relating to the on-sale of the Dumont asset and A$6 million (C$5 million) in cash.

The Offer Consideration represents a 10.1% premium to Karora's closing share price on the Toronto Stock Exchange of A$5.995 (C$5.360) on 5 April 2024.

As mentioned previously, any way one slices it, they are growing into a larger story (now as the larger pro-forma Westgold Resources). Again this perfectly aligns with the theme of growth-oriented gold producers we’ve been discussing in this series.

One can see the benefits of consolidating both companies into a larger mid-tier gold producer, focused in Australia. Other’s feel robbed and that the assets inside of Karora were let go on the cheap side. Personally, I’ve not properly evaluated all the assets inside of Westgold to know how they stack up in potential value to Karora shareholders. As a result of feeling mixed myself, on Tuesday I sold half of my Karora Resources position. I kept the other half of the position to either wait for a better exit, or let them convert over to Westgold shares; maintaining exposure to Beta Hunt & Higginsville along with all the other Westgold assets, and also picking up the correlating shares in the lithium Spinco.

Then Tuesday we had the news out from i-80 Gold Corp. (TSX:IAU) (NYSE:IAUX):

i-80 Announces Upsizing of Previously Announced Bought Deal Financing of Units

“i-80 will now issue 60,607,000 units of the Company at a price of C$1.65 per Unit for gross proceeds of C$100,001,550. Each Unit is comprised of one common share and one-half of one Common Share purchase warrant. Each Warrant will entitle the holder thereof to purchase one Common Share at a price of C$2.15 for a period of 48 months following the closing of the Offering.”

“The Company has also granted to the Underwriters an over-allotment option to purchase an additional 15% of the base Offering, for additional gross proceeds to the Company of up to C$15,000,233, to acquire Units, Common Shares and/or Warrants…”

This brings up a couple of questions in many investors minds regarding this biggie-sized financing. I’ll list some of the recurring ones seen in chat rooms below:

1) Just because there was excess demand, did the company really need to raise that additional money? It is OK and valid to say enough is enough when raising capital. Sure, one can understand the attraction to management, bringing more sustaining capital into the company; however, keep in mind that it is also very dilutive to existing shareholders. There is a balance that must be considered on any raise. The reaction from many investors was that it sure seems like overkill to be raising such big money amounts now with such a low current company valuation.

2) Why did the company do this raise, both at a discount to market, AND offer a half warrant? Yes, we know there needs to be an incentive to those ponying up the financing funds, but usually the discount to the market OR the ½ warrant would be that incentive — so why offer both? (maybe that is precisely why there was “excessive demand” = too good of deal for new shareholders getting in on this financing, but at the expense of existing shareholders being further diluted down)

3) Why even raise this huge amount of money if we are right around the corner from finding out about the capital coming in from the new strategic partner? The messaging for months has been about this strategic partner showing interest in the polymetallic project {Hilltop + Blackjack + FAD Deposit} and in retrofitting the Ruby Hill processing center for base metals. Many current shareholders, (me included), were anticipating a big capital infusion, which would essentially have raised about the same kind of money as this financing just did.

4) Is this strategic stakeholder deal still on, or does this capital raise mean it may not happen now? There was nothing mentioned about it in the press release.

5) If the strategic shareholder deal is still on, then did the team at i-80 Gold really need to raise an additional $100+ million dollars right now, stunting share price growth during a backdrop of gold breaking out to new highs?

Seriously what is going on here?

It is easy to see why investors feel confused by the timing and the size of this capital raise, (as well as the double incentives offered); especially in lieu of this other pending strategic partner news due out in Q2. We’ll keep following along with the company newsflow, and maybe there is a bigger plan afoot, not readily obvious to investors digesting this news at first blush, that will become clearer over the fullness of time.

On Wednesday April 9th, we got a large operations update from Calibre Mining (TSX: CXB) (OTCQX: CXBMF) that was information rich.

https://calibremining.com/news/calibres-q1-gold-production-on-track-to-deliver-f-8187/

Darren Hall, President and Chief Executive Officer of Calibre, stated:

“…the team delivered 61,767 ounces in Q1… We remain on track to deliver full year 2024 production guidance of 275,000 – 300,000 ounces.”

“The beginning of 2024 has proven to be exciting for Calibre with the close of the acquisition of the multi-million-ounce Valentine Gold Mine in Canada, a fourth consecutive year of Mineral Reserve growth, and our inclusion into the Van Eck GDX Index. Since becoming a gold producer during Q4, 2019, Calibre has delivered annual production growth of 28% year on year, with a track record of meeting or beating expectations. We are on a clear and concise path of delivery and growth. With an investment of more than 130,000 metres of resource expansion and discovery drilling in 2024, I am excited to see continued positive results across our entire portfolio of assets.”

“2024 and 2025 will be transformational years, driven by an increase in gold production and significant exploration across the Americas. I am pleased to report the final phases of construction and operational readiness remain on track and fully funded at VGM in preparation for first gold production in H1, 2025…”

Overall, this seems like pretty good news on all fronts from Calibre Mining, however, some shareholders are still fuming about the $100 Million bought deal financing that was announced on March 19th. The messaging from the company had been that they had most of the financing in place post-merger, with ample cash reserves, and a revolving debt facility, in addition to the incoming revenues from mining. Clearly though, they still needed to raise more money to fund construction at the Valentine Gold Mine, in concert with their aggressive drill plans for this year. Things always cost more in mining than initially projected, and mining companies always are hungry for more capital infusions. Still, I remain positive on the management team at Calibre, the quality of projects in Nicaragua, Nevada, and Newfoundland, and believe they have a transformative next 12-18 months in front of them.

One more news release to cover here is for Equinox Gold (TSX: EQX) (NYSE: EQX) and the big milestone achieved of commissioning and first gold pour next month from the Greenstone mine. The market has been waiting to see how things would turn out with their Greenstone mine build, and if it would be on time and on budget, as the company had messaged it would be. It appears that the operations team at Equinox has nailed it on the development timeline, construction, with ore being put through the mill and first gold pour slated for May. Very well done!

This stands in stark contrast to how things had gone at other large mines in Canada that had huge cost overruns and timeline overruns like Magino for Argonaut Gold, or Cote’ for IAMGOLD, or the Premier Gold mine at Ascot Resources. Those experiences for investors the last 2 years, caused almost everyone to doubt the timelines and cost estimates for all mine builds moving forward. To be fair, there were a lot of inflationary pressures and continued supply chain issues for these companies to work through. To all of those companies’ credit, they all did finally get their mines built and all of them have also had first pour and are running ore through their processing centers, even if it’s a “day late and a dollar short.” Hopefully this painful chapter in Canadian gold mine building history is now in the rear-view mirror, as these big mines are finally built and producing, and now with Equinox Gold actually delivering on their cost estimates and timelines, possibly starting a new trend of accountability with the Canadian miners.

Equinox Gold Commences Processing Ore at Greenstone Project: First Gold Pour on Track for Q2 2024 - April 9, 2024

“Equinox Gold (TSX: EQX, NYSE American: EQX) is pleased to provide an update on commissioning progress at its Greenstone Project in Ontario, Canada. The Greenstone Project is being developed as a 60/40 partnership, respectively, by Equinox Gold and Orion Mine Finance Group and will be one of the largest gold mines in Canada, producing approximately 400,000 ounces of gold annually for the first five years and more than five million ounces of gold over its initial 14-year mine life.”

“Ore was introduced into the grinding circuit on April 6, with first gold pour expected in May. More than 1.5 million tonnes of ore have been stockpiled and 70,000 tonnes of low-grade ore has been pre-crushed to use for early commissioning feed. Progressively higher-grade ore will be fed into the mill as production ramps up toward planned throughput of 27,000 tonnes per day, with commercial production targeted for Q3 2024.”

>> Greg Smith, President & CEO of Equinox Gold, commented: “Following 2.5 years of construction, Greenstone is on schedule to commence gold production in the first half of the year, as planned. This is a significant achievement and a testament to the experience of the Greenstone team. Greenstone is a world-class asset, and reaching production will be a pivotal milestone for Equinox Gold. Once operating at full capacity, Greenstone will be our largest and lowest cost-mine. We look forward to first gold in May and continuing to advance the project to commercial production.”

Alright, now it’s time to dig into the featured company here for (Part 7) of this series - Mako Mining (TSX.V:MKO – OTCQX:MAKOF).

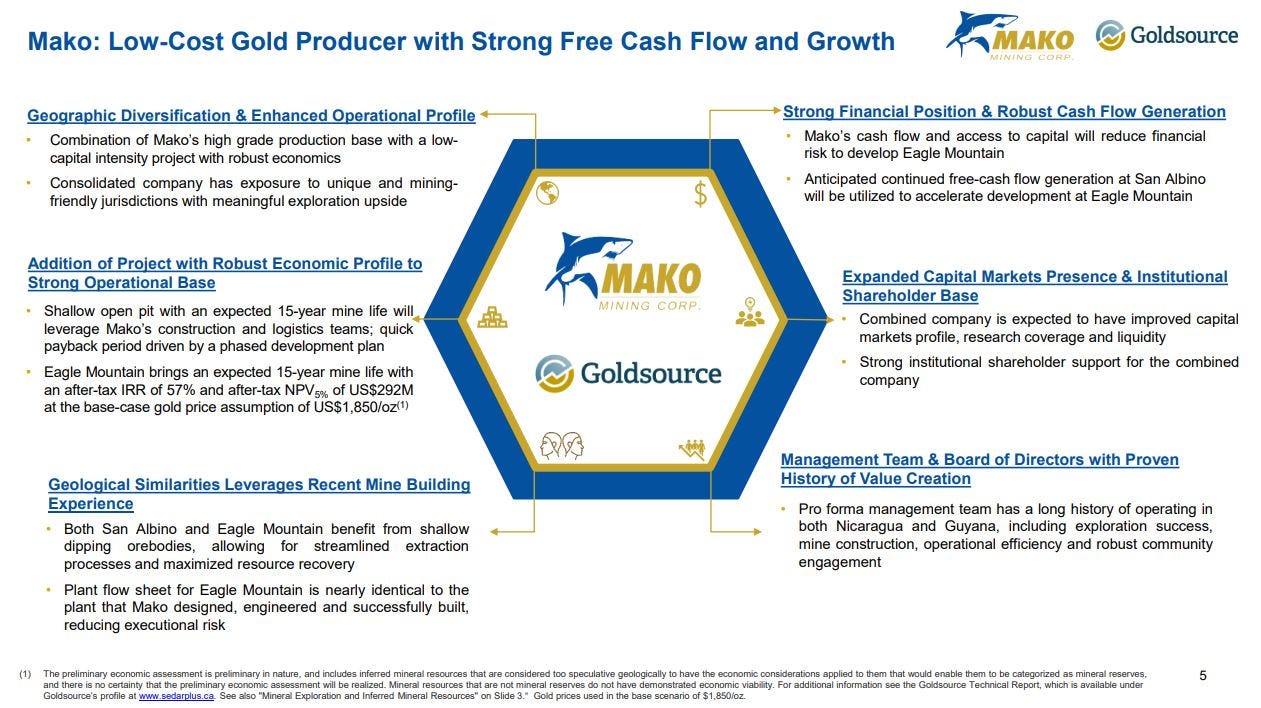

As discussed previously, in late March Mako Mining press released their proposed merger with Goldsource Mines (TSXV:GXS) (OTCQX:GXSFF) for their 100% owned Eagle Mountain Gold Project in Guayana, South America.

Mako Mining to Acquire Goldsource Mines Creating a Scalable Diversified Gold Producer with a Platform for Growth - March 26, 2024

https://makominingcorp.com/news/index.php?content_id=348

Right after that acquisition news broke last month, over at the KE Report, we got on a call to discuss the deal with Akiba Leisman, President and CEO of Mako Mining . We reviewed the key synergies and scalable diversified growth potential with their 100% owned Eagle Mountain Gold Project in Guyana, South America.

We had Akiba outline how the combined company will bring together two experienced management teams, that have worked together as colleagues going back nearly two decades. This is expected to make integration of the two companies more seamless in a true “hand-in-glove” partnership. In addition to the geographical and asset diversification, the district-scale exploration potential in Guyana will enhance Mako’s current growth trajectory and exploration upside already found in Nicaragua.

Akiba mentioned the scalability of Eagle Mountain mine, which is very much a direct analogue to that of Mako’s San Albino mine, and that there are a number of similarities between the two projects, thus highlighting the proven experience that the Mako Mining operations team can bring to the table in Guyana.

This is transformative news for both Mako Mining and Goldsource Mines shareholders alike, and it is important to take a step back and look at the sum of the parts. As these 2 companies come together into a new diversified pro-forma larger company of scale, the management teams believe it is a 1 + 1 = 3 scenario.

Another phrase we hear repeatedly in business is that “Success leaves clues.” The team at Mako Mining has done a bang up job of growing the San Albino project in Nicaragua, on both the operational production level and on the exploration expansion seen across this project the last few years. Their track record of success does leave a breadcrumb trail of “clues” as to why they were likely the best suitor for Goldsource Mines’ Eagle Mountain project. Here’s a quick review from Nicaragua:

Now since this series is all about “growth-oriented gold producers”, then let’s also take a look at how the new pro-forma company envisions things growing this year, and over the next few years, in both Nicaragua and Guyana.

There is a lot more to say about Mako Mining in future parts of this series, especially as it relates to their exploration upside. I’m including another video link (below) post the email going out to subscribers, as the email article length had been reached. This allows Akiba to speak to the recent exploration success their team has had across the San Albino project.

Mako Mining – High-Grade Gold Drill Results At Las Conchitas – Exploration And Operations Update - Mar 15, 2024

Thanks for reading and wishing you all prosperity in your trading and in life!

- Shad