Opportunities in Silver Explorers and Developers – Part 6

Excelsior Prosperity w/ Shad Marquitz (12/14/2024)

We are moving along to the next company to review in this series on opportunities in Silver Explorers and Developers, and taking a closer look at Aftermath Silver. Up until now in this series, we’ve reviewed 5 advanced silver explorers / developers that I personally hold in my portfolio and have been following for years: AbraSilver Resource Corp., Dolly Varden Silver, Blackrock Silver, Vizsla Silver, and Silver Tiger Metals. Now, I do have a handful more of these silver stocks in my person portfolio to unpack in future articles (like Discovery Silver, GoGold Resources, Kootenay Silver, Defiance Silver, etc…), as well as even more prospects on my watchlist.

While I don’t personally hold a position in Aftermath Silver, I feel the need to unpack the value proposition for readers here that I see in this company as a legitimate advanced stage silver-manganese-copper deposit going through the derisking process of development. This is a project of merit, it is on my close watch-list, and it is likely a company I’m going to be positioning in at one point soon for the remainder of the precious metals bull market.

(In full disclosure, I have a reasonably heavy weighting inside of my own personal portfolio in many of these silver advanced exploration / early-stage development stocks that we are covering in this series. I’ve not been commissioned by these companies to write these articles on Substack. This is not investment advice, nor am I suggesting that anyone position themselves in these stocks. Rather, this is simply an editorial on the value proposition these companies demonstrate to my mind, and why I got positioned in them in my own portfolio.)

As far as investing in junior pre-revenue silver stocks, it should be pointed out that this is one of the riskier subsectors and stage of resource stocks within the precious metals sector. Riding these equities through bull markets and bear markets is definitely not for the faint of heart, and the stock price action can be wildly volatile. This, of course, also means that with that kind of volatility comes multiple waves of price rises and then price declines to potentially capitalize on for either swing-trading or position-trading. This volatility also provides ample opportunities to accumulate positions for the longer-term, by layering into a position over several buying tranches. This layered approach to scaling into a position, via multiple partial purchases, is a great way to smooth out the volatility, while building a good cost-basis over time.

With all of that said, let’s get into it…

Aftermath Silver Ltd. (TSXV: AAG) (OTCQX: AAGFF) is a Canadian junior exploration company focused on silver and critical minerals, with 2 key projects located in Peru and Chile respectively. I have come to believe that their Berenguela Silver-Manganese-Copper Project in Peru is a project of significance in both the silver space and the manganese space, with a solid copper kicker, and that this is a project that will get developed into future mine. [That is simply my personal opinion and NOT investing advice; but I will unpack my thesis and supporting data behind it in the balance of this article.]

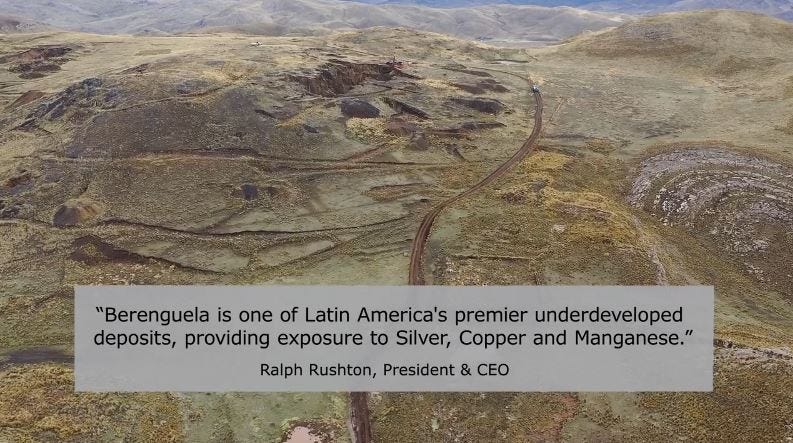

Berenguela Silver-Manganese-Copper Project is the company’s flagship property, located in the Altiplano of south-eastern Peru. It is an epithermal polymetallic carbonate-replacement deposit, and the mineralization is present from surface to a depth of about 100 meters. It is at a relatively high elevation of 4,200 meters, approximately 50km southwest of the city of Juliaca and 6km northeast of the town of Santa Lucia. It has good infrastructure with power, road, and rail nearby.

Aftermath completed a first-stage drill program in May, 2022 with 63 diamond core holes for a total of 6,168m of drilling, and has been busy exploring it ever since. This project has now had 386 holes drilled over the last 20 years, and approximately 42,650m of reverse circulation (RC) & diamond drilling has been completed at Berenguela. With all of this data in hand, their team has a really good grasp on how the mineralization ties together into a resource, and they did update the market with a resource update last year.

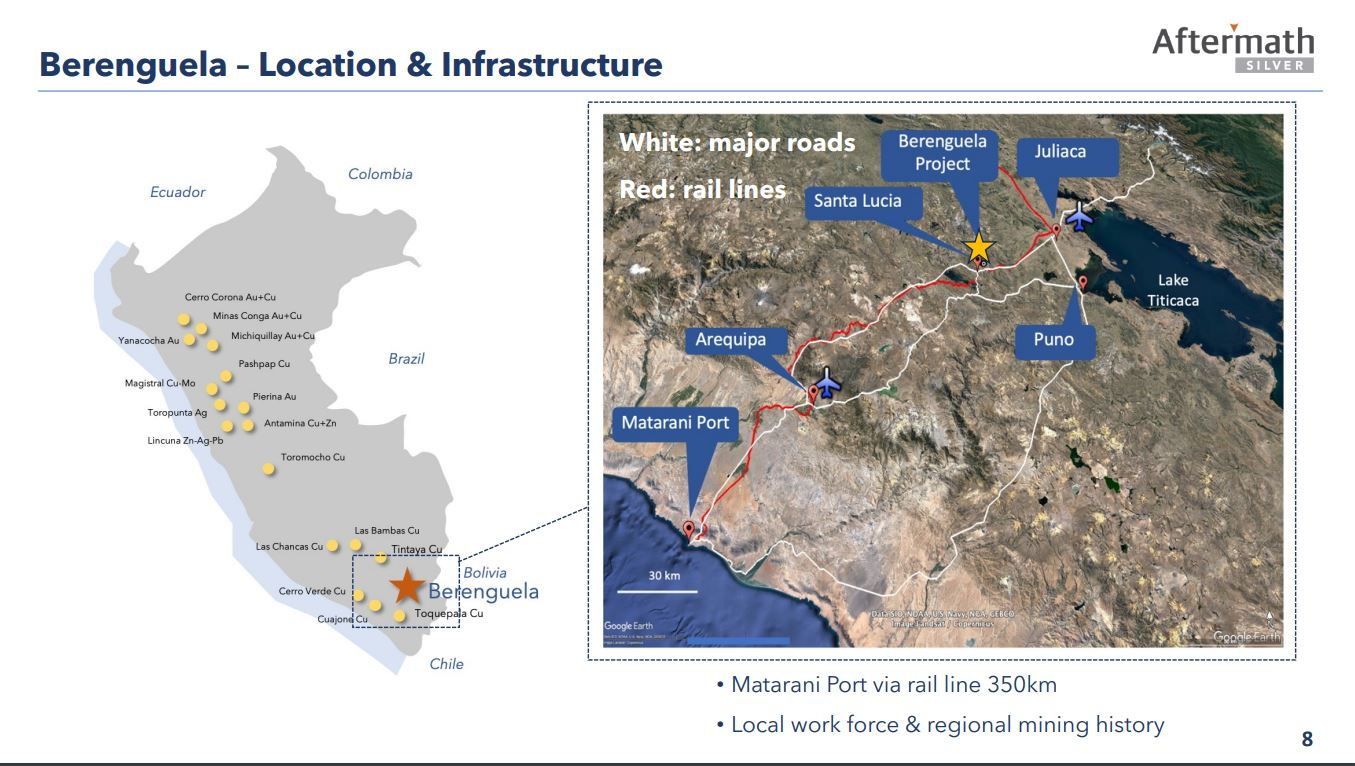

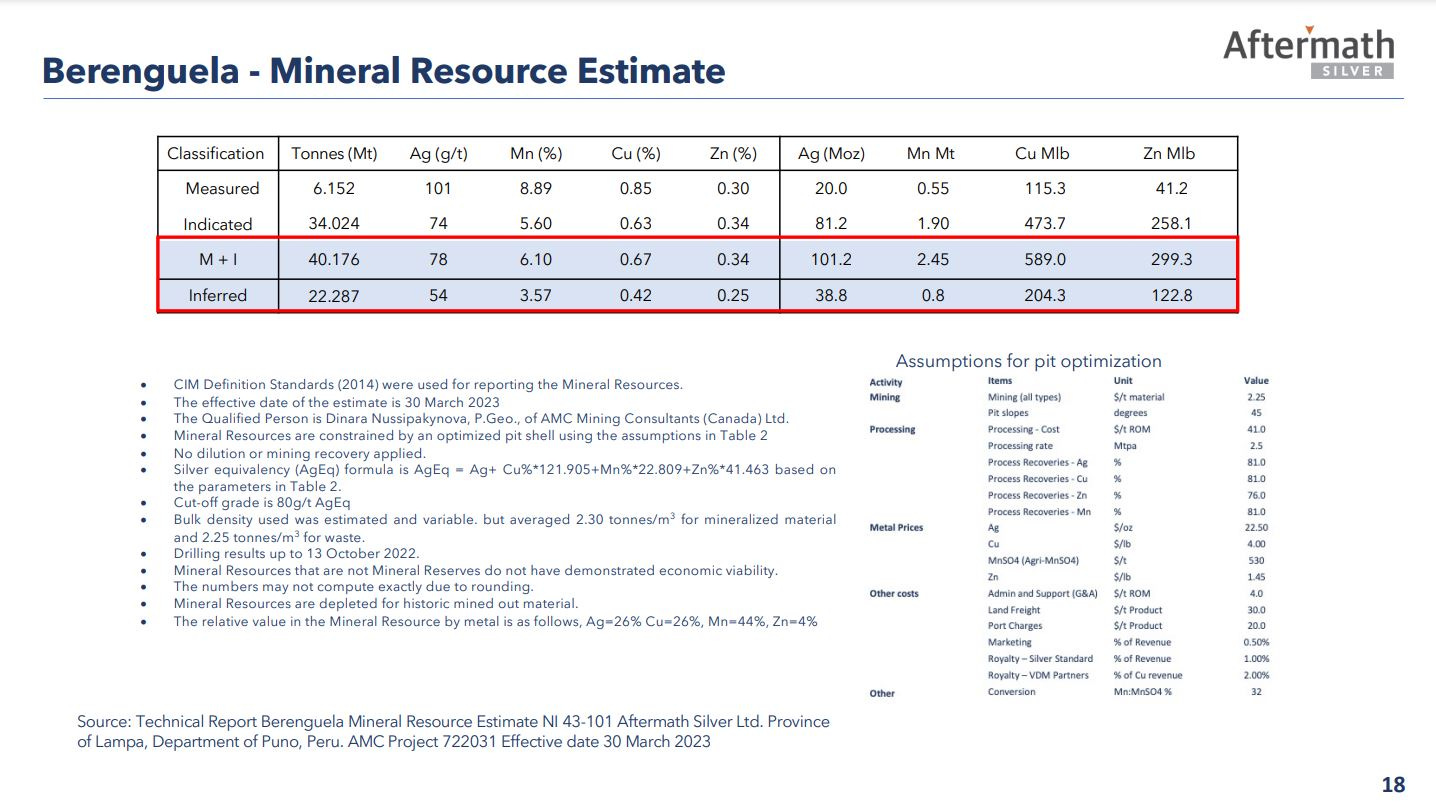

The Mineral Resource Estimate report filed on March 30, 2023 outlined 140 million ounces of silver, 3.25 million tonnes of manganese, 793 million pounds of copper, and 422 million pounds of zinc (in all categories = M&I + Inferred).

That is a significant amount of silver, as there are few exploration companies that can boast more than 140 million ounces of contained pure silver (with most peers needing a silver equivalent number to get up over 100 million ounces).

For the handful of silver companies that do have more than 100+ million ounces of even silver equivalent, much of it is made possible due to the contributions from gold, zinc, lead, and copper, etc… A key point is that just the silver optionality here in this project alone is worth sitting up and paying attention to.

Then the manganese and copper are also very robust future economic contributors, and give the Project that critical minerals component that is attractive to both governments and manufacturers to see it move forward into development.

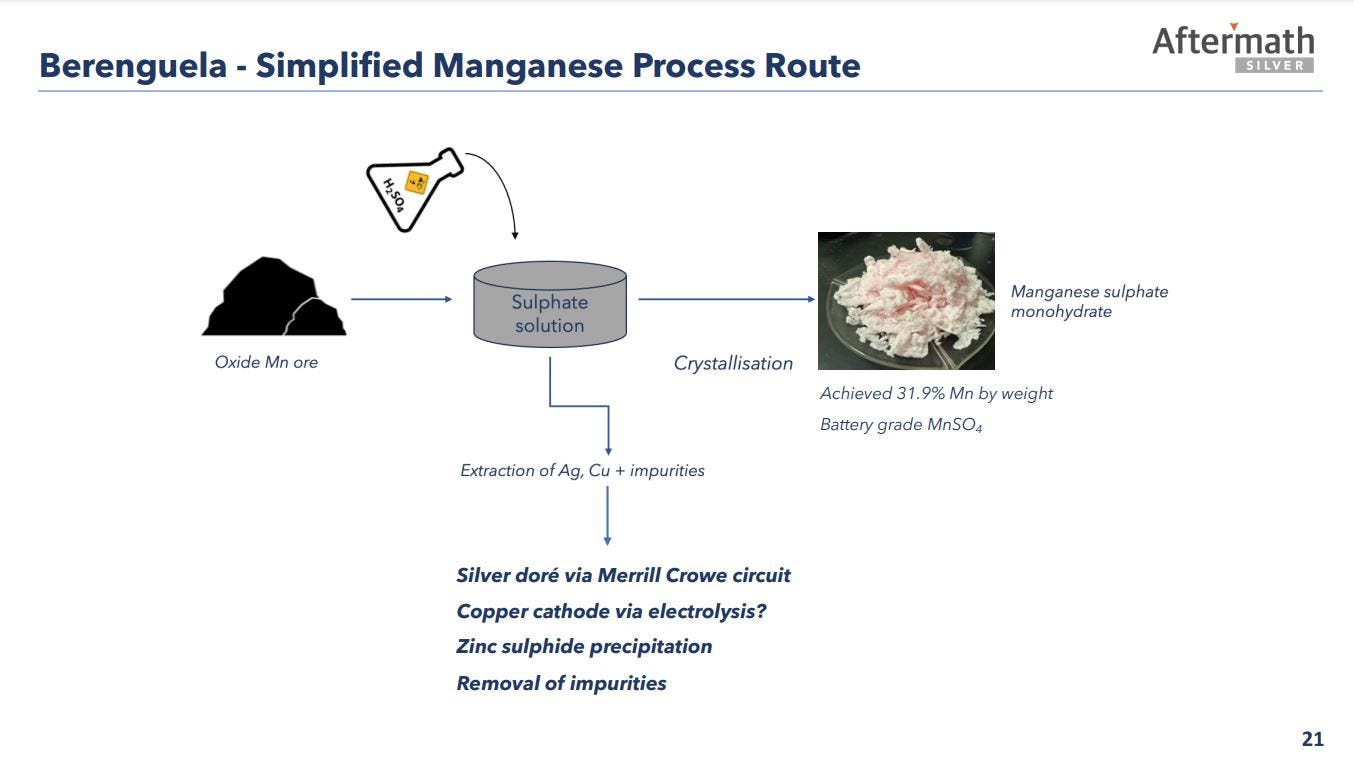

I had heard others critique Aftermath Silver for years, suggesting that the metallurgy and separation of the silver, manganese, copper, and zinc could be a big stumbling block for the company. In my first discussions with management I went straight into this topic, wanting to get more clarity on if they had cracked the nut of the metallurgy yet. The good news is that after ongoing and rigorous testing, it appears that there is a viable process for metallurgical separation and good recoveries in each metal category.

In a nutshell…

They’d use a standard Merrill Crowe circuit to pull out the silver and produce a doré bar.

Then they would use electrolysis to produce the copper cathodes for sale.

Next they would use a sulphide solution precipitation to extract the zinc and remove the other impurities

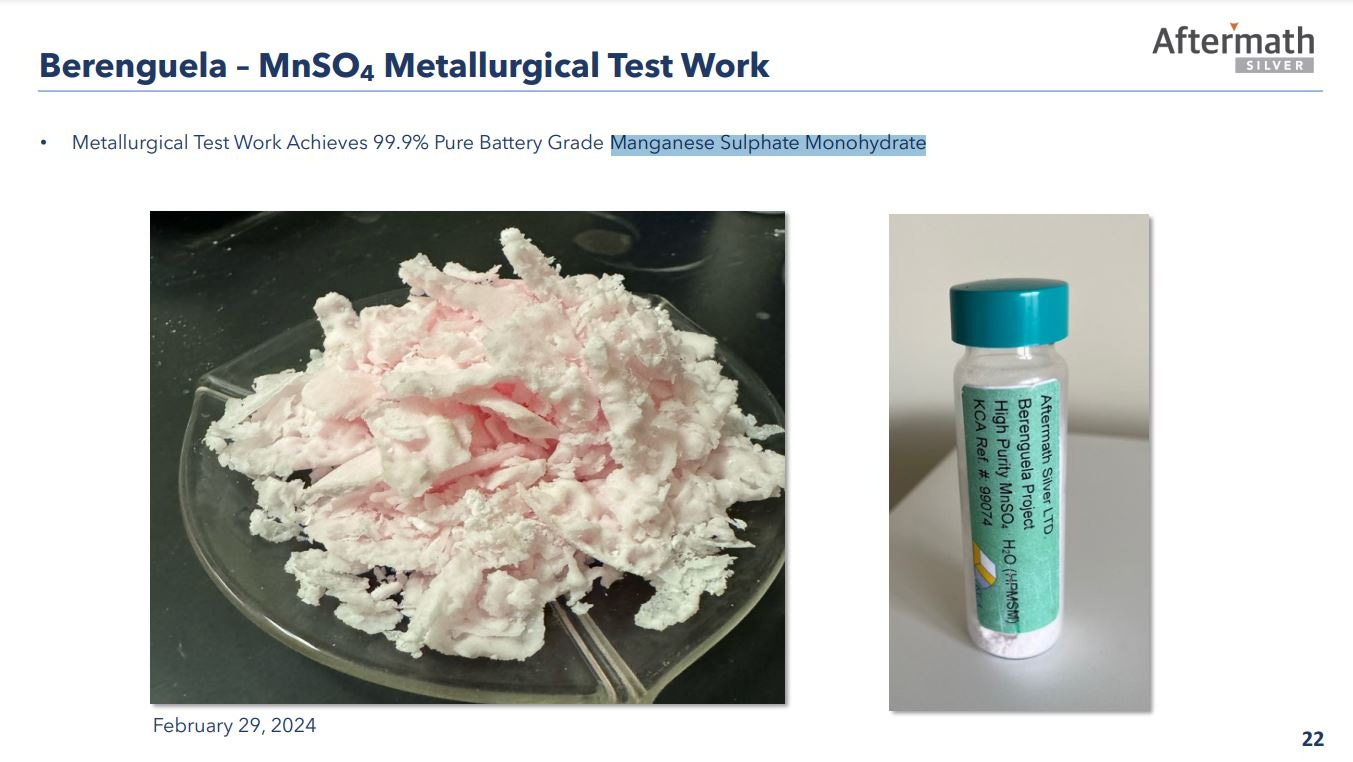

Lastly they crystallize the manganese so that it is 99.9% pure manganese sulphate monohydrate

One of the other interesting elegant solutions that their team has been working on is that due to their altitude, and the complications with boiling the mineralized slurry under pressure at the mine site requires it to be moved down to a lower altitude for processing. They are conveniently located by roads and a rail line, where the materials can be transported via train down to larger urban centers for separation, and thus avoiding any potential social pushback on doing anything like that at mine site, within proximity of the nearby rivers that feed into Lake Titicaca. Shipping the material before separation is an ESG win, and it just makes economic sense to do it at a lower elevation, so that is a true win-win.

The exploration team is currently drilling to increase confidence in the mineralization and move some of it up in categories from inferred into indicated in the upcoming update to the Resource Estimate slated for Q1 of 2025.

The next key milestone after that will be the Preliminary Economic Assessment (PEA) slated for later next year, where it will incorporate economics around all the metallurgical testing, engineering and mine planning, and the updated resources.

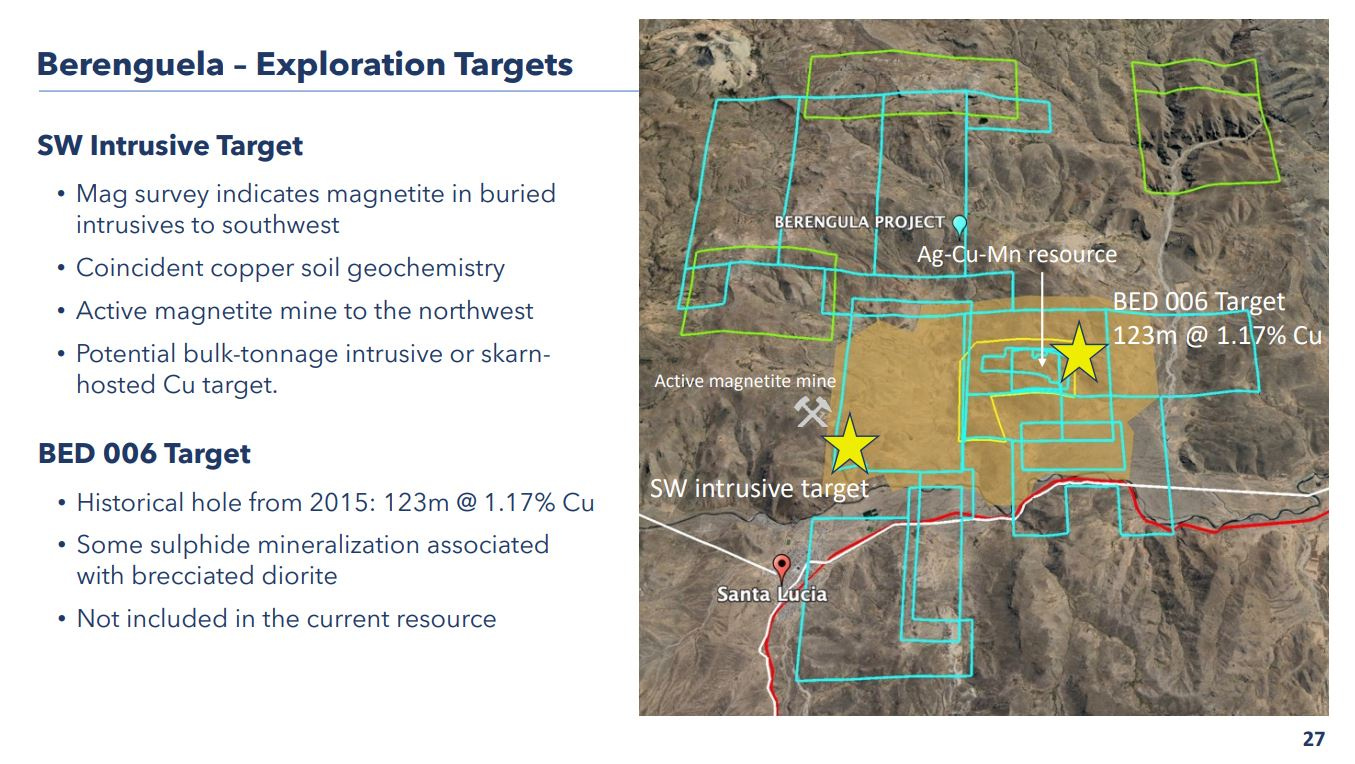

Berenguela has had a lot of exploration work done on it, but there is still plenty of blue-sky upside to keep expanding the mineralization with the drill bit. The 2 priority areas for more drilling are at the SouthWest Intrusive Target and the Bed 006 Target.

In addition to all the value drivers at the Berenguela Project, Aftermath Silver has an often overlooked secondary project with more embedded optionality.

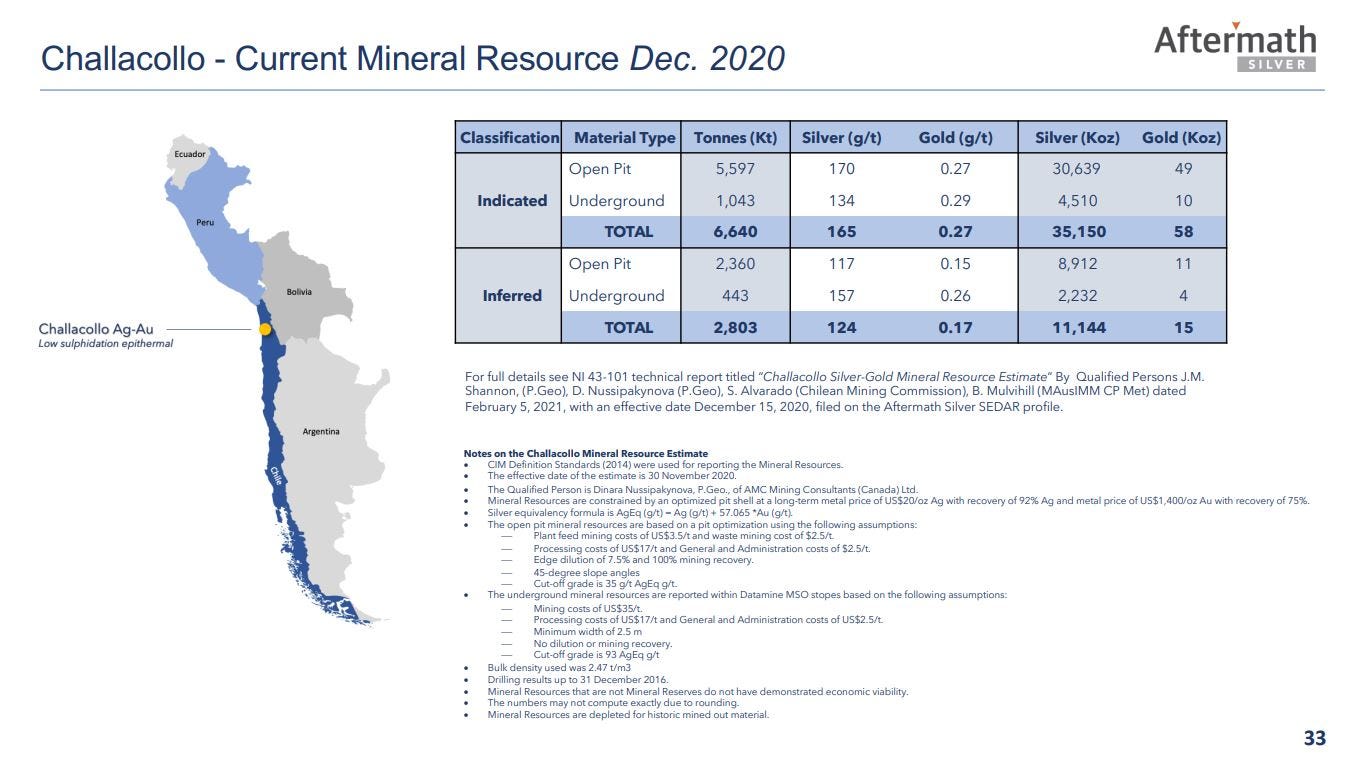

Challacollo Silver-Gold project. This is the secondary project that the Company owns a 100% interest in, containing a substantial amount of contained silver mineralization, with a small gold co-credit. The NI 43-101 Mineral Resource, which was released on December 15, 2020, points to over 35 million ounces of silver in the indicated category and over 11 million ounces of silver in the inferred category, for more than 46 million ounces of silver in all categories.

The Company is currently completing environmental permitting in anticipation of an upcoming drill program, and still believes they have a lot of optionality to rising silver prices with this project and it will benefit from some additional exploration work in the year to come.

Backing up for a moment before we move forward… I just want to share my due diligence journey with this company, that culminates in a fantastic comprehensive company overview with management at the very end of this article.

Aftermath Silver is a company that I’d watched from afar for the handful of years due to it’s volatility and torque with rising and falling silver prices. Some of the upside runs it had gone on, like the 8x move from 2020 into 2021, followed by the crash back down, but then rallies and corrections after that really interested me as a more active trader of resource stocks. Additionally there were a few newsletter writer friends that were keen on the stock over the years, and so it was on my radar, but not something I had actually jumped on in my own portfolio.

To be honest, I initially shrugged it off… because I’m not a huge fan of Peru or Chile as jurisdictions, due to some past political and social license issues I witnessed at other projects. Having said that, I absolutely recognize that both countries are well-endowed with both silver and copper mineralization. Sometimes one just needs to go to where the mineralization is favorable; and then look to see if there is an economic deposit that can be developed by a quality team. The biggest thing was that I’d not really stopped to take a deeper dive and to do some proper due diligence on the key assets or company’s in-country approach.

A little over a year ago, at the 2023 Beaver Creek PM Summit in Colorado, a mutual friend and colleague encouraged the Founder and Executive Chairman, Michael Williams, and I to sit down and get to know one another better. We met up in person at the event for a very brief conversation, I got a 1-minute “elevator pitch” on the company, we exchanged info, and then chatted via text a few times post-event. While it had piqued my interest, the sad truth is that there are thousands of junior mining stocks all waiving their arms for attention, and we both got busy and sidetracked and fell out of touch.

Then earlier this year, from April 29-30th, at the Energy Transition Metals Summit in Washington D.C., I attended a dinner that Michael hosted with a small group of 7-8 other investors. At this event, I got to learn more about what the Aftermath Silver team was working on with both exploration and metallurgical work, and the importance of both the manganese and copper as co-credits along with the silver at their flagship Berenguela Project. I became more impressed with the message he shared with investors there, and we had made plans to follow up post event and do a deeper dive. Life happened… and we bounced some messages back and forth, but our schedules didn’t ever seem to line up.

Then at Beaver Creek this year I saw Michael briefly in passing and joked it had been a year since we first met and that we needed to get him on the KE Report for interview so I could get all my notes updated. We laughed and he said “Yeah… I know…,” and yet we couldn’t seem to dial in a time to reconnect. The straw that broke the camel’s back was when we met up once again in October at the Commodity Global Expo event in Fort Lauderdale, FL and we discussed Aftermath Silver again. I mentioned it was now on my close watch list, that it is a stock I’m considering adding into my own portfolio, and that I’m going to go bananas if we can’t get him on the KE Report for an update. Michael laughed and conceded it was overdue, and that there were a lot of key catalysts coming up, so the timing for investors looking at Aftermath Silver now was ideal.

It pleases me to report that on November 6th, over at the KE Report, Michael Williams, Founder and Executive Chairman of Aftermath Silver Ltd., joined me to introduce the vision behind this exploration company focused on expanding and derisking the silver, copper, and manganese mineralization at their flagship Berenguela Silver-Manganese-Copper Project in Peru, and secondary Challacollo Silver-Gold Project in Chile.

Aftermath Silver – Expanding And Derisking Silver, Copper, and Manganese Mineralization At The Berenguela Project

One key recent news release that was still in flux at the time of that interview above is now a done deal. The Company has now closed the additional $10million private placement with Eric Sprott, which means that when one combines his shares and warrants held, if those warrants gets exercised then he holds 25% of Aftermath Silver. He appears to be quite animated by both the silver and the manganese at Berenguela. It is very encouraging to see a solid strategic shareholder like Eric Sprott in the mix here, and this is a larger percentage stake than he typically makes in many other silver explorers or developers.

Aftermath Silver Closes $10 Million Private Placement with Mr. Eric Sprott

- November 28, 2024

“Mr. Sprott beneficially owns and controls 71,967,630 Shares and 20,253,968 Warrants representing approximately 25.0% of the outstanding Shares on a non-diluted basis and 30.0% on a partially diluted basis assuming the exercise of such Warrants.”

We’ll wrap it up there for today with this coverage of another good value proposition in the silver explorer and developer category with Aftermath Silver. In full disclosure, it is a company I’ll be personally looking to position in near year-end or early 2025, preferably on any further sector or shareprice weakness.

There are still a number of junior silver companies yet to get into with this evolving series, and we’ll also mix in some key updates from some of the prior companies reviewed. There has been a lot of steady newsflow from many of these companies exploration programs over the last few months, as well as key upcoming milestones with resources, economic studies, metallurgical studies, and so much more… So stay tuned!

Thanks for reading and may you have prosperity in your trading and in life!

- Shad