Opportunities in Silver Explorers and Developers – Part 7

Excelsior Prosperity w/ Shad Marquitz (06/18/2024)

I’m happy to report that we are moving along to review the next company in this series on opportunities in Silver Explorers and Developers. Up until now in this series, we’ve reviewed 6 advanced silver explorers / developers that I personally have as positions in my portfolio and I’ve been following them for many years. In addition to them being sponsors over at the KE Report.

(So yes, I’m biased in that sense with regards to the companies covered and am talking my book. However, none of the companies I discuss in this channel have ever commissioned me to write about them here on Substack, or even asked me to do so. It is something I do here to discuss what I’m doing with my own money in my own portfolio. Obviously, none of this should be considered investment advice and is for entertainment purposes only.)

💡 The companies we’ve covered thus far in this series have been:

AbraSilver Resource Corp. (TSX: ABRA) (OTCQX: ABBRF)

Dolly Varden Silver Corporation (TSX.V: DV) (NYSE American: DVS)

Blackrock Silver Corp. (TSX.V: BRC) (OTCQX: BKRRF)

Vizsla Silver Corp. (TSX: VZLA) (NYSE: VZLA)

Silver Tiger Metals Inc. (TSX.V: SLVR) (OTCQX: SLVTF)

Aftermath Silver Ltd. (TSX.V: AAG) (OTCQX: AAGFF)

Those companies have all continued to have positive news catalysts towards further value creation; and I’m happy to have been holding them as Silver has started to wake up again the last 2 months.

[click on the image above to expand]

Here are some recent interviews with management over at the KE Report, or key newsflow for those aforementioned companies.

AbraSilver Resource – Early Phase 5 Drilling Intersects 31.0 Metres Grading 10.0 g/t Gold For The Best Gold Intercept To Date At Diablillos – May 20, 2025

Dolly Varden Silver Commences 2025 Drill Program with Four Drill Rigs at the Kitsault Valley Project - May 28, 2025

“Two diamond drills commenced in early May at the Moose Vein and Red Point exploration targets. The four drills are now focused on the Wolf Vein step outs on the southwest side of the deposit where the vein is widening with indications of higher temperature mineralization and alteration.”

“Total meterage of approximately 35,000 meters planned for the 2025 drill program will be split approximately 60:40 between the Dolly Varden Properties to the south, including the Big Bulk copper-gold porphyry, and the Homestake Ridge Property to the north, along the Kitsault Valley trend.”

Blackrock Silver – Final Batch Of M&I Conversion Drill Results Demonstrate Higher Silver And Gold Grades, More Up-Dip Mineralization, And Continuity At The Tonopah West Project

– June 18, 2025

Vizsla Silver – Resuming Field Work and Acquiring The Santa Fe Claim Package, Including A Producing Mine - May 21, 2025

Silver Tiger Metals – Eric Sprott And A Syndicate Of Long-Only Institutional Funds Participated In Recently Closed $15 Million Bought Deal Financing - April 15, 2025

Aftermath Silver Continues to Intersect High Grade Silver, Copper and Manganese at Berenguela, Peru - June 9th, 2025

“Aftermath Silver is pleased to provide the final assay results from its Phase 2 diamond drill program at the Berenguela silver-copper-manganese deposit located in the Department of Puno in southern Peru.”

“Results are included for 12 holes from the initially planned 60-hole (4,600m) program of diamond core drilling which the company increased to 82 holes (5,329m of core) due to positive geological results. Hole AFD139, on the most easterly section of drilling, returned a significant copper intercept indicating that the mineralisation remains open to the east.”

Highlights of the current drilling include:

AFD144 intersected 13.8m @ 558g/t Ag + 3.16% Cu + 15.06% Mn from 23.2m down hole, including 5.6m @1053g/t Ag + 2.85% Cu + 15.80% Mn from 31.4m down hole;

AFD139 cut 68.9m @ 78g/t Ag + 1.19% Cu + 6.03% Mn from 6.4m down hole

Today we are going to discuss a 7th silver exploration company that had key news out to the market this week, and that I had a conversation with today over at the KE Report, Kootenay Silver (TSX.V:KTN – OTCQX: KOOYF). More on that a little later…

This is, once again, a company I’ve been following for a very long time (about a decade now since late 2015). I had sold out of my most recent trade in Kootenay Silver back in April of 2022, and didn’t get into a new position again until September of 2024, and then topped up again in March of this year, based around the successful drilling I’ve been seeing at their newer Columba Project.

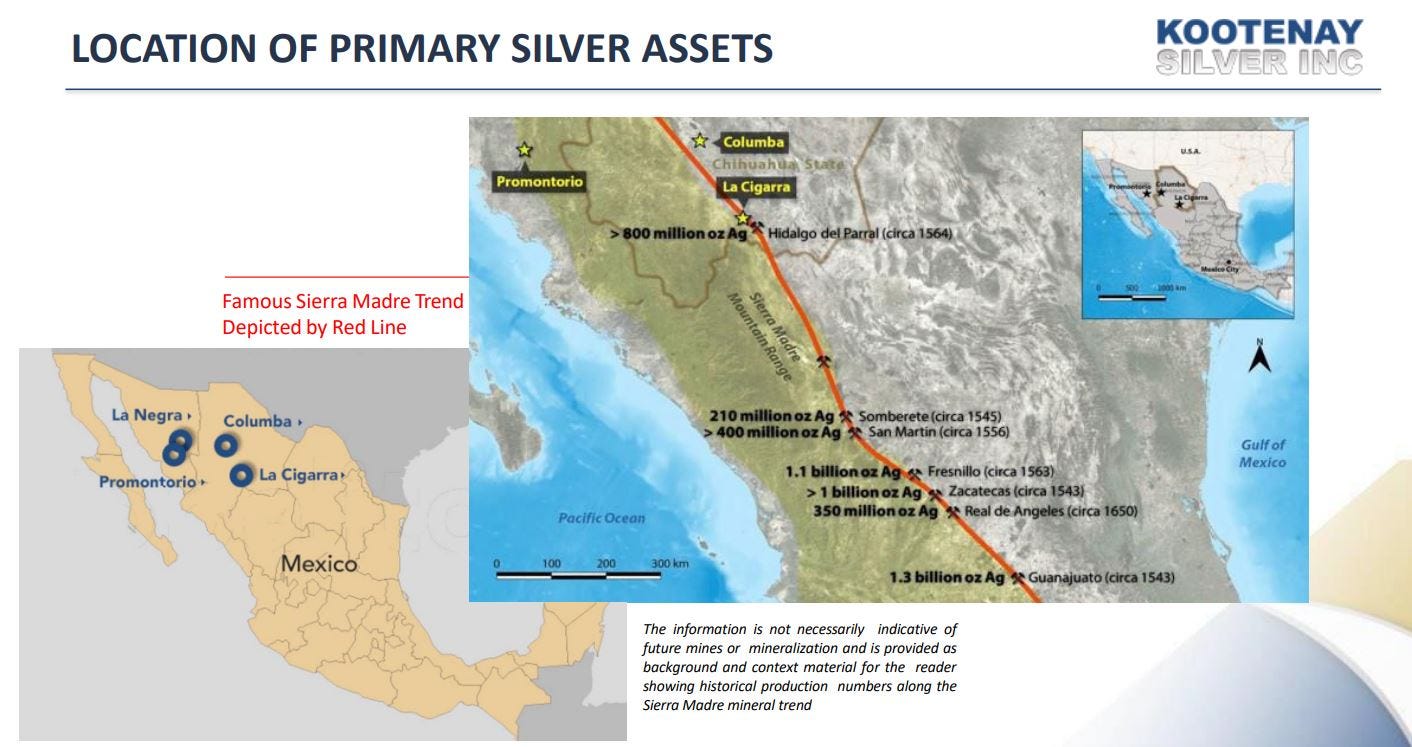

Traditionally, I viewed Kootenay as more of an optionality play on the silver prices, because they’ve held 3 lower-grade, open-pit, bulk tonnage style of silver and base metals projects in Mexico for many years now. The trading thesis up until recently was that during more bullish silver price moves, that the couple hundred million ounces of silver equivalent resources that have been delineated would be rerated higher.

Silver had made big moves higher in 2020 and 2021, but then by early 2022 I bailed on a number of the optionality plays as it appeared that the technical momentum had been lost in the silver sector, and I used the spring uptick in Mar/Apr to exit positions into that bounce. With regards to exiting Kootenay Silver at that time, it was the right call, as the share price started selling off into a further downtrend for the balance of 2022, 2023, and 2024.

I kept tabs on the company, and met up with the management team at the Beaver Creek PM Summit in September of 2023, and invited them on the KE Report to introduce the company value proposition back in October of 2023, when they had just updated their resource estimate at Promontorio and La Negra Project in Sonora Mexico. Meanwhile, they were waiting for higher metals prices to review a few initiatives at their La Cigarra Project. While I always liked the company and appreciated that they were trying to navigate difficult markets, personally I wasn’t ready to get back into a position, because I didn’t have confidence that silver prices were going to suddenly rip higher… and they didn’t.

Then in the spring and summer of 2024 the gold and silver prices were seeing more upside momentum and junior precious metals explorers were able to cash up and do more meaningful work programs last year. We caught up with the CEO Jim McDonald over behind the scenes at the KE Report over the summer, and then had the company back on the show in August to discuss their successful step-out drilling at their new Columba Project, focused on high-grade veins. I noticed that Jim seemed much more animated about this Columba project that he had been about any project in a really long time, and that got my attention.

When I was doing some portfolio rebalancing in September and had a little extra cash to deploy towards silver juniors, I decided to stake out a starter position in Kootenay Silver on September 9th, with the thesis that Kootenay should get some more interest from investors as silver and gold had kept plugging higher the prior few months, but then were taking a breather and the sector was consolidating and pulling back a little. That is when I generally like to put on positions into the weakness. It wasn’t a very long wait before some more assays came back from Kootenay Silver and a few weeks later on September 23rd this news release hit and moved me from mildly interested to very interested.

Reports Five Drill Holes including highs to 1,095 gpt Silver and 6.4% Lead-Zinc, increasing D-Vein strike to 1,275 meters at Columba Project, Chihuahua Mexico. - September 23, 2024

Hole CDH-24-166 - 28.6 meters downhole length (estimated true width 21.85 meters) averaging 176 gpt silver, 0.1% lead and 0.4% zinc downhole includes:

9.0 meters of 303 gpt silver, 0.2% lead and 0.7% zinc (6.87 meters e.t.w.)

2.5 meters of 593 gpt silver, 0.3% lead and 1.8% zinc (1.91 meters e.t.w.)

1.0 meters of 1,020 gpt silver, 1.0% lead and 2.5% zinc (0.76 meters e.t.w.)

0.5 meters of 1,095 gpt silver, 0.7% lead an 5.7% zinc (0.40 meters e.t.w.)

What caught my attention was that the overall intercept was fairly broad at 28.6 meters, but had that nice intercept within that of 9 meters of 303 gpt silver, and even that kilo hit of 1 meter of 1,020 gpt silver. I wasn’t used to Kootenay hitting higher grade like that on their other projects and so it caught my interest. The market responded with a little bump, so I could sense other investors were also paying attention to these results. We had Jim back on the KE Report in early October to discuss these results, and once again he seemed very encouraged the exploration potential at Columba.

Later in October and again in November they kept putting out higher and higher grade results, and couldn’t help but be impressed.

Expands Known Mineralization at Columba Project, Chihuahua, Mexico: Four Drill Holes Report Highs to 2,370 gpt Silver and 6.7% Lead-Zinc - October 24, 2024

First Zone – Hangingwall

1,134 gpt silver, 0.8 % lead and 3.4 % zinc over 2.6 meters

2,370 gpt silver, 1.2% lead and 5.5% zinc over 0.5 meters

Second Zone – Hangingwall

298 gpt silver, 1.3 % lead and 0.6 % zinc over 7.78 meters

627 gpt silver, 2.5% lead and 0.5% zinc over 3.14 meters

1,525 gpt silver, 1.3% lead and 0.2% zinc over 0.6 meters

Third Zone – D-Vein

338 gpt silver, 0.4% lead and 1.1% zinc over 18 meters

484 gpt silver, 0.49% lead and 1.42% zinc over 11.2 meters

923 gpt silver, 0.8% lead and 2.5% zinc over 1.5 meters

Expands Known Mineralization at Columba Project: Highs to 3,090 gpt Silver and 1.1% Lead-Zinc - November 19, 2024

Hole CDH-24-174 - Hit three significant composited intervals including a broad mineralized 41.2 meters long envelope within the B-B2 Vein corridor.

233 gpt silver, 0.1% lead and 0.3% zinc over 41.2 meters

1,100 gpt silver, 0.35% lead and 0.34% zinc over 4.0 meters

3,090 gpt silver, 0.9% lead and 0.2% zinc over 1.1 meters

I started running these results by other investors, and pointed out that the estimated true widths were actually more narrow than the intercept lengths, but still those were some impressive grades over good widths coming back from these Columba drill results. Some investors I ran the data by did think they were good, but many also downplayed them since Kootenay was a “tired old story in the silver space.” I kept reiterating, these results they were starting to hit were not tired or old, and were breathing new life into the company and this Project in particular was starting to look like something special.

We had Jim McDonald back on the KE Report again in early December unpacking those November drill intercepts and it really got me more excited, and yet it seemed like hardly anyone else was getting that intrigued. I rarely heard Kootenay come up in investors chats when people traded ideas on junior PM stocks, and if I’d bring up their recent results, people were ambivalent about them. This type of situation usually gets my contrarian senses tingling, so I added a bit more to my Kootenay position on Dec 13th, during the heart of tax loss selling silly season.

There were more good drill results in early 2025 in both January and February, so I added another tranche to my Kootenay Silver position on March 18th of this year.

On Cinco de Mayo, the company put out a real bonanza-grade result, and the market barely blipped higher and then sold of the rest of the week and following week.

Kootenay Silver Reports Drill Results from Columba Project, Chihuahua, Mexico: Highs to 7,630 gpt Silver and 30.57% Combined Lead-Zinc - May 5, 2025

Hole CDH-25-199 - 620 gpt silver, 0.31 gpt gold, 1.01% lead and 3.61% zinc over 16.50 meters (5.78 meters estimated true width “etw”), including:

1,775 gpt silver, 0.62 gpt gold, 2.34% lead and 9.26% zinc over 5.50 meters core length (1.93 metres etw) includes individual sample intervals of;

2,920 gpt silver, 1.12 gpt gold, 7.78% lead and 29.30% zinc over 0.55 meters core length (0.19m etw)

7,630 gpt silver, 1.08 gpt gold, 5.47% lead and 25.10% zinc over 0.55 meters core length (0.19m etw)

5,620 gpt silver, 1.98 gpt gold, 2.23% lead and 22.60% zinc over 0.5 meters core length (0.18m etw)

So I fully realized that those really high 2.9, 5.6 and 7.6 kilo hits were over very narrow intercepts, but come on… that is REALLY high grade silver! The fact that the market seemed to shrug off these bonanza grade hits really puzzled me.

Long section of just the D-Vein. This is where the bulk of the drilling and corresponding resources came from at Columba.

👉 There is a famously quoted line from the movie Zoolander, which features Will Ferrell cast as an evil model, where he shouts out at one point:

“Doesn’t anyone notice this… I feel like I’m taking crazy pills.”

That’s how I was starting to feel with regards to all these good drill results stacking up for Kootenay Silver, and hardly anybody else in my immediate circle or even abroad was seeming to notice those stellar hits.

This reminded me a lot of how I felt when I was watching all the good drill results keep coming from the JAC zone at AbraSilver’s Diablillos Project, back when nobody seemed to care because it was in Argentina (back before Argentina was hip again and trending), or when Dolly Varden was getting it dialed in at Torbrit and Wolf with fantastic silver holes and it was initially shrugged off by investors as an “old, known deposit,” or when Blackrock Silver kept putting out stellar drill holes and nobody seemed to care, simply because their initial resource wasn’t what people were hoping for. Some investors get really jaded and will not accept that good results are piling in, especially if they want to hate on the company or management team. All I care about are the good results piling in.

Over and over again I’ve had these bifurcated experiences as an investor in advanced exploration stocks, where the results suddenly start coming in that are far above-average, and yet the market (for whatever reason) stays asleep on them and I feel simultaneously excited and depressed about my positions.

Humorously, those aforementioned companies kept putting out such a string of positive data that eventually it became impossible to ignore. Then they brought in whale investors, strategic investments from Majors, and raised upsized capital, and THEN the retail herds decided that they liked those companies.

Overnight they ended switching from being a pass for the masses to then becoming “best in class” and a “quality company” in the eyes of the very same people that scoffed at those same companies 6-12 months earlier; right when they were really turning the tide and demonstrating eyebrow raising results.

This is where I’ve felt Kootenay Silver has been positioned in the minds of most investors, until this week’s news dropped on their Maiden Resource Estimate.

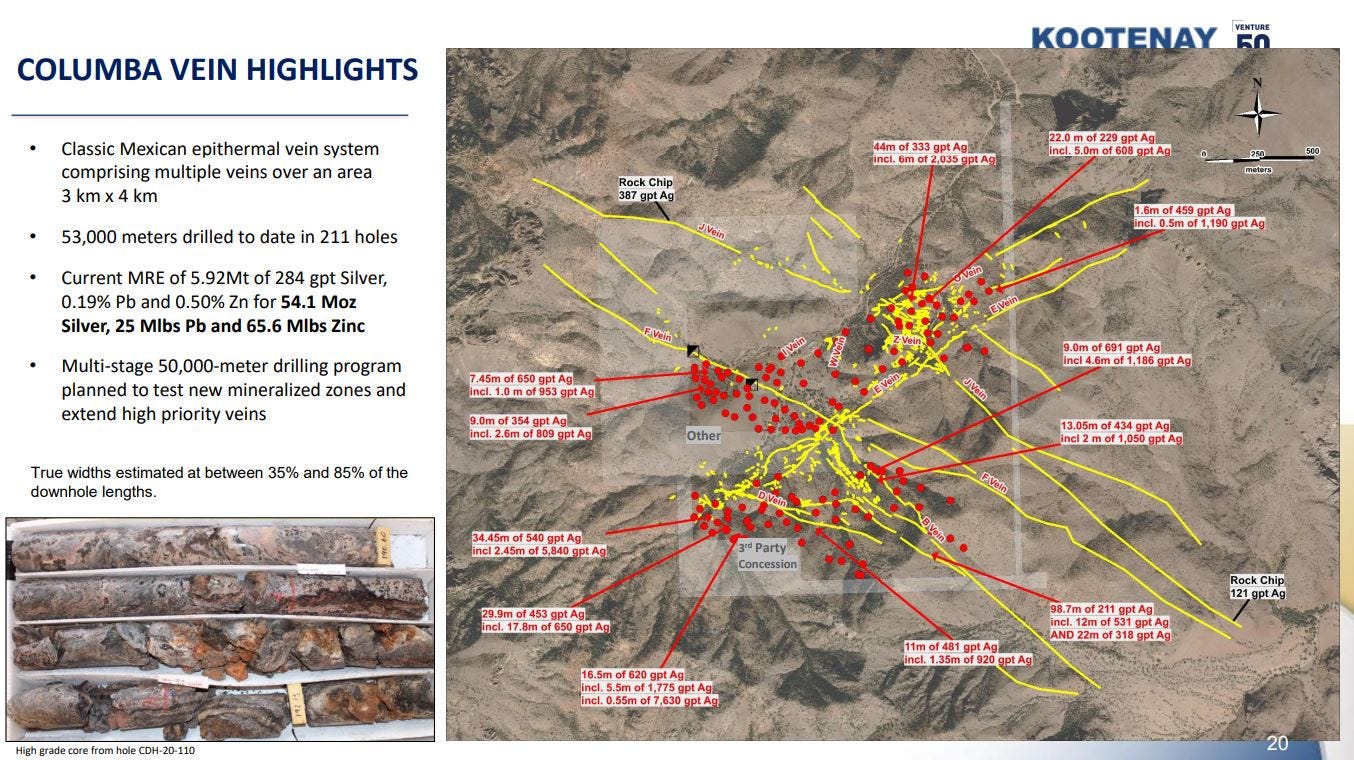

Kootenay Silver Delivers Maiden Resource Estimate of 54 Moz at 284 gpt Silver, Highlighting High-Grade Potential at Columba Project - June 17, 2025

Jim McDonald, President and CEO of Kootenay Silver, joined me earlier today to unpack the news out June 17th; announcing the completion of the high-grade maiden Mineral Resource Estimate on its 100%-owned Columba Silver Project, located in Chihuahua, Mexico.

Key takeaways from this Maiden Mineral Resource Estimate at the Columba Project:

54.1 Moz of silver, 25.2 Mlbs of lead, and 65.6 Mlbs of zinc (Inferred category)

5.92 Mt grading 284 gpt silver, 0.19% lead, and 0.50% zinc

All the mineralized veins remain wide open to expansion along strike, to depth or both.

Vein continuity is excellent

5 to 6 meters Vein width average across all zones

Silver grades are excellent across the mineralized structures

We discuss the benefit of the 54 million ounce resource being in pure silver, but also still having extra lead and zinc mineralization above the headline number. Jim mentions that some areas of mineralization at depth may lend to higher pockets of base metals and will be explored with future drilling. With regards to the silver mineralization having the average grade of 284 grams per tonne (gpt), Jim puts this in context with other silver mines in Mexico and globally that are in production at much lower levels, and this is why the company used a 150 gpt economic mining cutoff grade for this resource calculation.

The Company will continue with step out drilling of several kilometers of undrilled veins, as well as selective infill on wide-spaced intervals on the known D, B, F, I, and Lupe veins. Jim highlights that their exploration team has designed an additional 50,000 meters of drilling planned at Columba, with the first 20,000 to 30,000 meters focused on expanding the known resource.

Jim also compares Columba’s wide, high-grade intercepts to the other more bulk-tonnage resources that the Company has in their portfolio of other projects, outlining this being Kootenay’s most promising project to date. He also outlines that Kootenay Silver’s combined resources at all projects is well over 300 million ounces of silver equivalent, and those ounces should have good leverage to rising underlying metals prices.

The company also announced an upsizing to their capital raise today, showing the interest from a larger pool of investors wanting to get into position.

Kootenay Silver Announces Upsize of Bought Deal Public Offering to $17.4 Million - June 18, 2025

Well, that wraps us up for another segment on opportunities with the silver exploration and development companies, and a brief review of Kootenay Silver’s pathway into a Maiden Resource Estimate at the Columba Project. I believe it will only continue to grown and surprise investors to the upside.

Thanks for reading and may you have prosperity in your trading and in life!

Shad