Opportunities In Rare Earth Elements Stocks – Part 1

Excelsior Prosperity w/ Shad Marquitz (04/30/2025)

My investing journey in the Rare Earth Elements (REE) space began about 15 years ago, and I’ve learned some valuable things over that span of time, and want to share those key takeaways with readers here. I’m seeing a lot of hype starting to circulate around the rare earths space again, and up until now have resisted weighing in on the sector. Actually, there is a lot of hype around a number of specialty metals and critical minerals at present, and I have many thoughts about this topic for future articles. For now though, I want to focus this discussion on the rare earth sector specifically.

There are some legitimate companies in this rare earth elements space that are worth reviewing, particularly the ones involved with the downstream processing and separation of these 15 (sometimes 17) critical metals.

There are far fewer real opportunities in the upstream mining companies (despite all their pitches and slide decks to the contrary); but there are still a few solid mineral deposits worth noting. We’ll expand on some of those down the road in this series…

In this article and over the course of this series, I’ll share some companies I’ve been following for many years that have legitimate business strategies and value propositions for consideration in this sector; but we won’t be able to fit all of them or everything there is to share here into this first part.

Just as a cautionary note: Keep in mind that when small niche sectors become the proverbial “hot commodities,” then they become suddenly surrounded by a lot of garbage stocks. Hot money promoters and tired old projects pop back up like fungus all over the resource space. Unfortunately, these lure in unwitting investors to what are seemingly exciting narratives. Then when you look under the hood, these companies have very little substance to back up their big marketing pitches.

Being someone that both thrived and then was decimated by the rare earths sector in the prior cycle, and over time has learned a lot of tough investing lessons about this space, I hope to shorten the learning curve for readers here. The goal with this series will be to help folks peer through the layer of opaque fog and marketing hype around this sector, and to separate the signal from the noise. We want to get to the core of what could be genuine opportunities, as well as steering clear of all junk stocks littered along the journey that should be avoided.

So, let get into it…

My personal foray into investing within the resource sector started first with gold and silver mining companies back in 2010 (after having been stacking silver starting in 2008 as a result of the Great Financial Crisis). By late 2010 and 2011 I had really branched out and had become obsessed with the resource sector. But hey… it was in a boom back then – platinum, palladium, uranium, and yes, also rare earth elements.

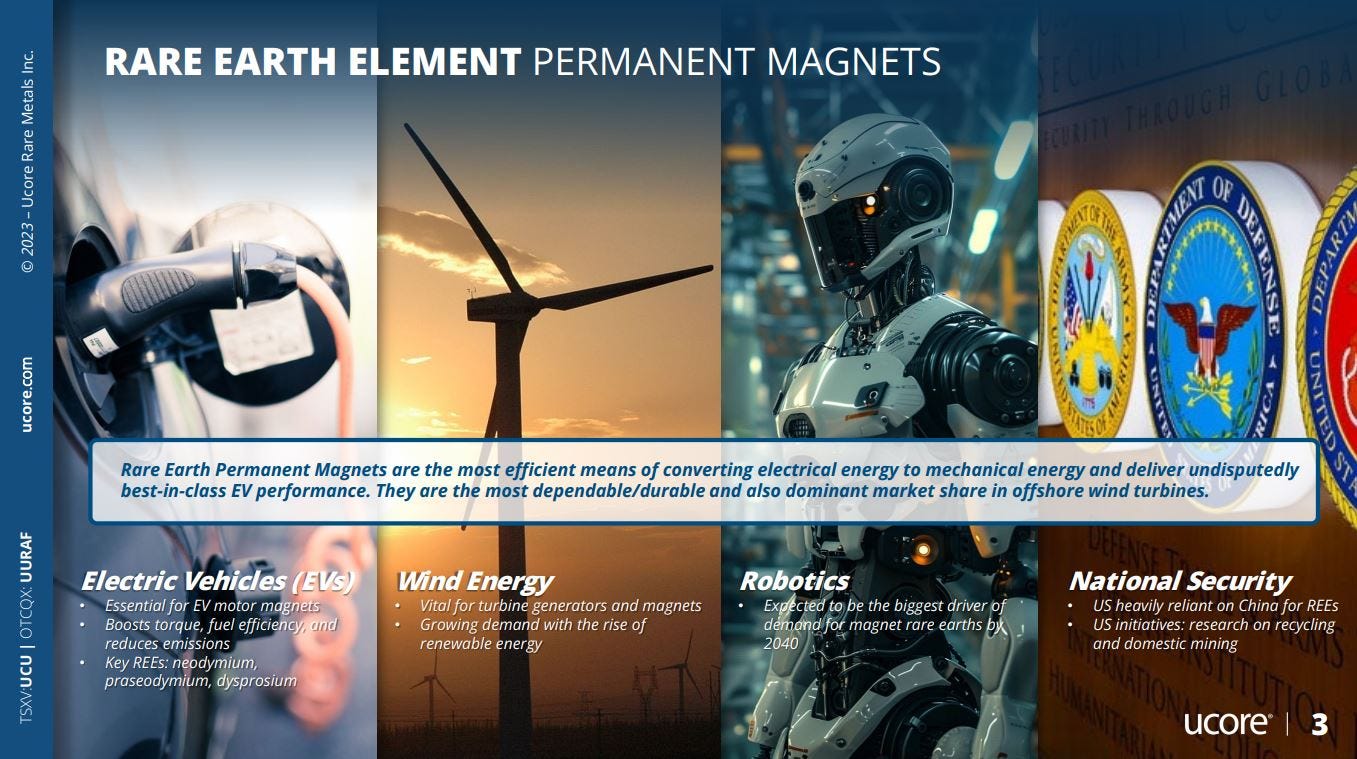

Back then (2010-2012) China was putting export quotas on the REEs (since they had and still mostly have a stranglehold on processing, separation, and refining these metals). So, it was a very similar environment that we see today with their strategy of export bans on many critical minerals. That restriction in supply was giving a big pop at that time to these niche metals used in electronics, defense, high-powered permanent magnets, windmills, lasers, and so many areas of the modern world.

Check out this headline and article from 2011 (which is just one of hundreds circulating in the prior rare earths boom), and consider how eerily similar it reads to the environment we are in today:

China’s Export Restrictions On Rare Earths - October 06, 2011

“In recent years, the Chinese government has cut down the number of export enterprises, export quotas and the annual exploitation volume of rare earth ores. Users of the minerals in industrialized countries now face tighter supplies and higher prices. China has cut its export quotas for rare earths by 35 percent in the first round of permits for 2011, threatening to extend a global shortage of the minerals needed for smart phones, hybrid cars and guided missiles.”

https://eastasiaforum.org/2011/10/06/china-s-export-restrictions-on-rare-earths/

So, we’ve seen this movie before. In fact, we saw something similar with REEs in 2020-2022 during all the disjointed supply chain challenges during the global pandemic lockdowns, which affected Chinese exports in a significant way for even a year longer than North America and Europe - well into 2022. What we are starting to see again here in 2025 is just the latest iteration of this cyclical shortage and pricing squeeze on rare earth elements, due to China’s unyielding grip on the sector.

For a great visual of this sector, have a look at prior peaks and valleys on the longer-term chart of the VanEck Vectors Rare Earth Strategic Metals ETF (REMX) – launched during the go-go years of the rare earth bubble from 2010-2012, the 2018 flare up in prices, the 2020-2022 pandemic crimping the supply chain, and the environment now. The next cycle is likely kicking off with the recent round of Chinese export bans on many critical minerals, including some of the rare earths.

It is interesting that the REMX chart above doesn’t really show the recent reaction higher by a number of junior rare earth stocks that have surged on the recent tariff tantrums newsflow.

Check out this candle-glance chart of 8 real rare earths companies and the action that they’ve been starting to see over the last few months.

The first 4 upstream companies represent the only 2 mining companies exclusively producing REEs outside of China (the Aussie producer Lynas, and the US producer MP Materials), and 2 development-stage companies with significant REE deposits (Arafura and Leading Edge Materials), both with extraction technologies outlined in pilot plants, where they could become future producers.

The next 4 downstream companies are Ucore Rare Metals, Aclara Resources, Neo Performance Materials, and CoTec Holdings. Each company has their own unique rare earth extraction, separation, and processing technologies, with Neo Performance Materials having the most real world experience actually producing saleable REE products.

(in full disclosure, I have started a position in Neo Performance Materials again recently, after not having owned it for many years, since back in its prior incarnation when it was called Neo Materials, but then it was merged into Molycorp… which has now been reincarnated as MP Materials - Again, the commodity sector is very cyclical).

We’ll get into some of those companies throughout this series in future articles. For this [Part 1] article, we still have a surprising opportunity to cover that is yet a 3rd company producing rare earth elements outside of China, but that is processing and separating these critical minerals domestically in the USA.

Before we get to that company though, let’s back up and get everyone here on the same page as to what precisely these rare earth elements are. This is an incredibly complex niche sector with metals names that are hard to pronounce, and with uses that are too many to list. They then break down into the “heavy” and “light” rare earths, and even metals that aren’t technically rare earths but get bundled along with them traditionally. Here is a quick primer right off Wikipedia:

Rare-earth elements

https://en.wikipedia.org/wiki/Rare-earth_element

“The rare-earth elements (REE), also called the rare-earth metals or rare earths, and sometimes the lanthanides or lanthanoids (although scandium and yttrium, which do not belong to this series, are usually included as rare earths), are a set of 17 nearly indistinguishable lustrous silvery-white soft heavy metals. Compounds containing rare earths have diverse applications in electrical and electronic components, lasers, glass, magnetic materials, and industrial processes. The term "rare-earth" is a misnomer because they are not actually scarce, but historically it took a long time to isolate these elements. They are relatively plentiful in the entire Earth's crust (cerium being the 25th-most-abundant element at 68 parts per million, more abundant than copper), but in practice they are spread thinly as trace impurities, so to obtain rare earths at usable purity requires processing enormous amounts of raw ore at great expense; thus the name ‘rare’ earths.”

“Scandium and yttrium are considered rare-earth elements because they tend to occur in the same ore deposits as the lanthanides and exhibit similar chemical properties, but have different electrical and magnetic properties.”

“Because of their geochemical properties, rare-earth elements are typically dispersed and not often found concentrated in rare-earth minerals. Consequently, economically exploitable ore deposits are sparse.”

There are many more things one can learn if interested to take a deep dive into this niche sector. However, after having done that personally for a long time, I’ve decided it is really too many rabbit holes for people to chase and get lost down. Ultimately, it is enough to know that rare earths are in continuous high demand, and that there are very few companies that can produce a product for sale to the market.

What I’ve learned is that all that knowledge on rare earths themselves isn’t nearly as important as inspecting for a good business plan within a given company, and figuring out if the company has a legitimate chance at either producing or processing REEs.

With all of that said, let’s take a deeper dive into one of the very few companies, outside of China, that is actually producing rare earth elements… Energy Fuels.

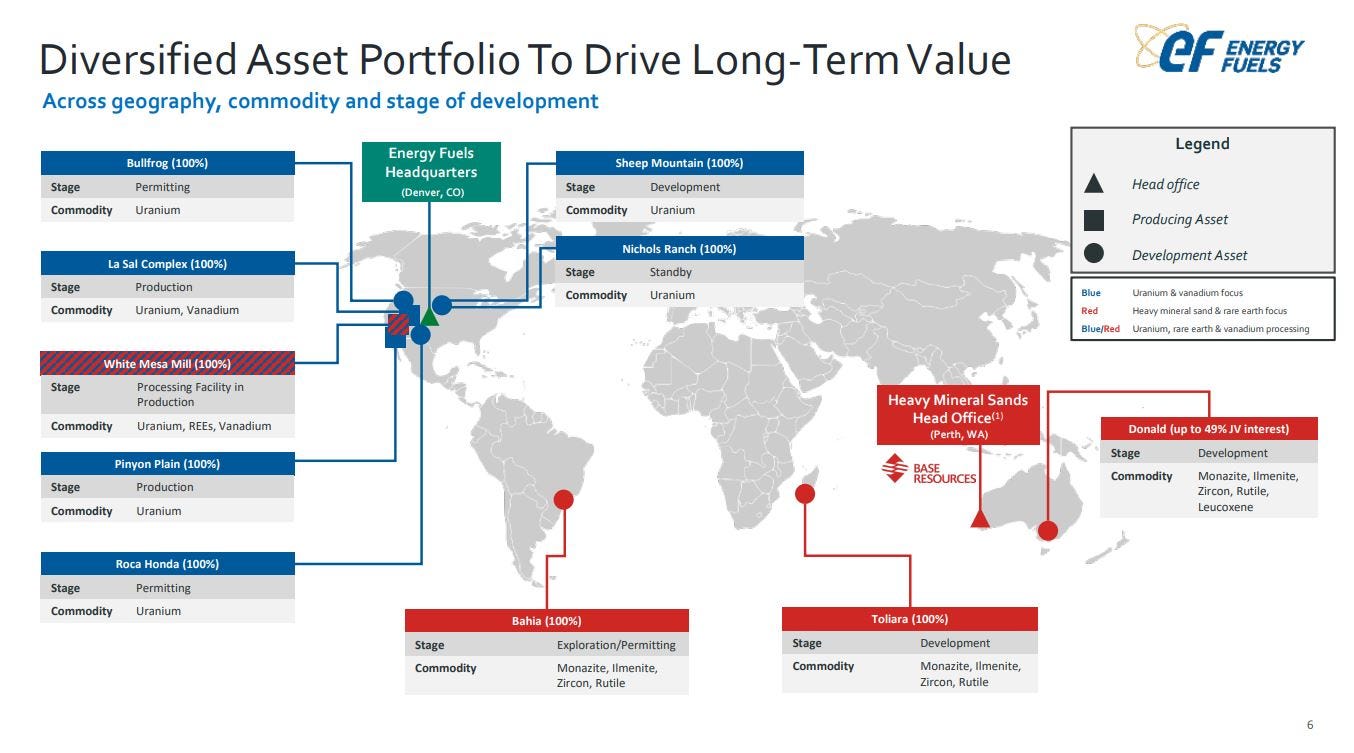

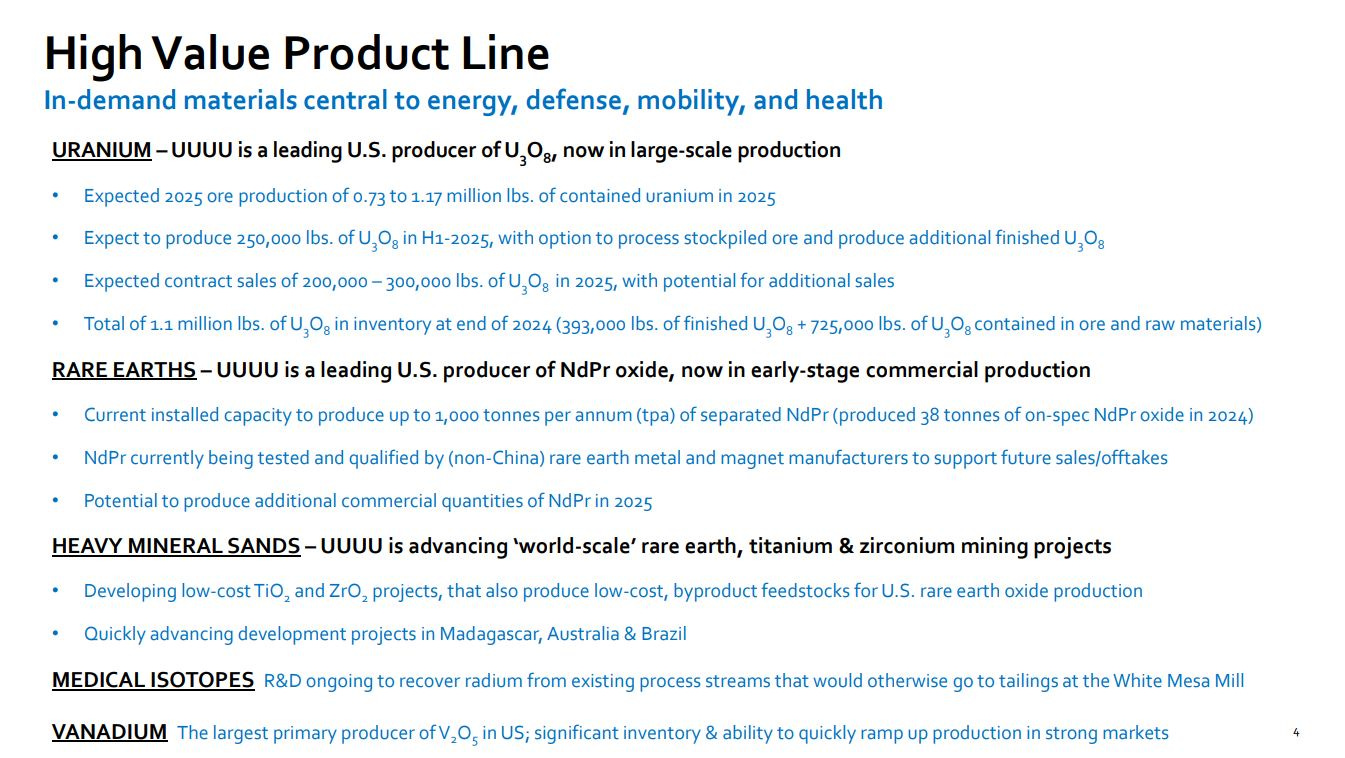

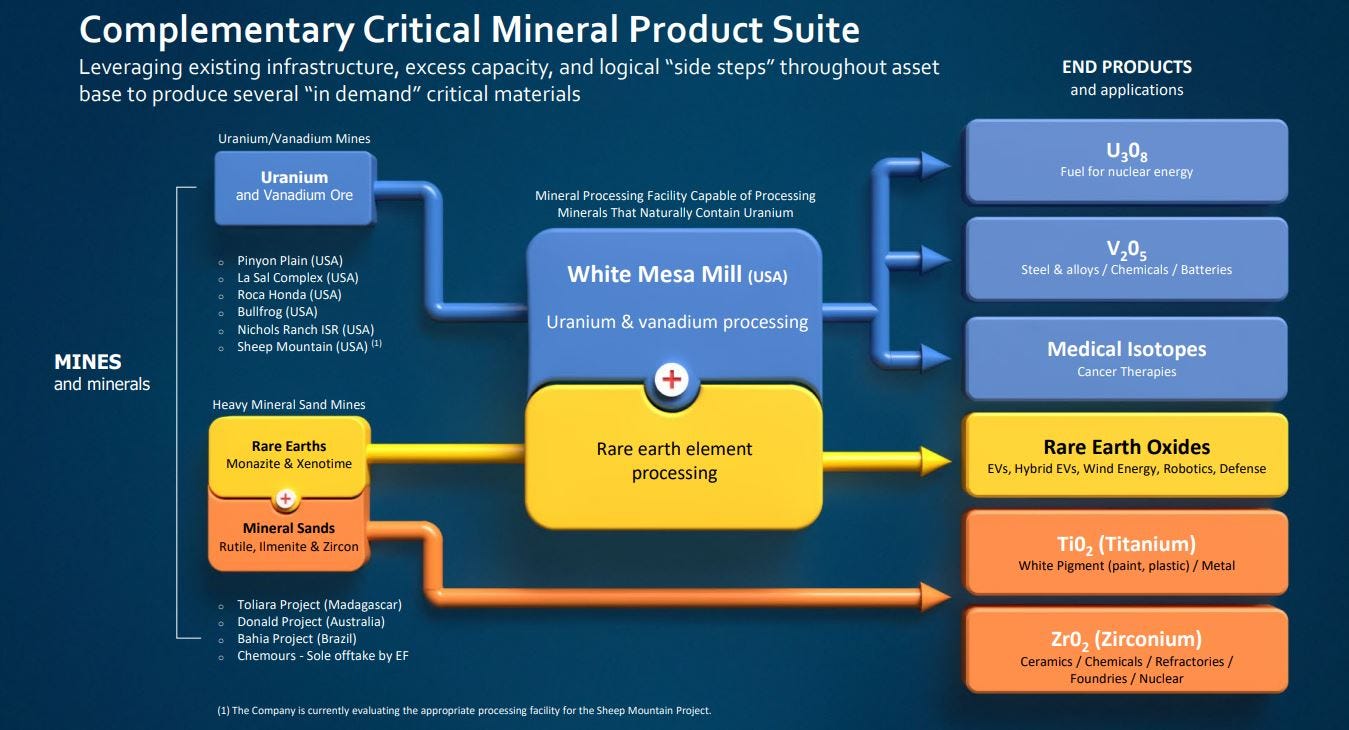

When most people think of Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR), they think of them as one of a handful of domestic uranium producers in the United States, and that is absolutely true. However, they’ve branched out to become so much more, including into the production of rare earths. Energy fuels is currently producing a NdPr oxide at their White Mesa Mill in Utah, and advancing world-scale rare earth, titanium & zirconium mining projects in Madagascar, Australia & Brazil.

Energy Fuels just acquired Base Resources in October of 2024, to expand even further into the rare earths sector and their several well-endowed mineral sands development projects.

Energy fuels has become so much more than “just another uranium producer.” In addition to the uranium and rare earths production, they can also produce vanadium, and are working towards the production of titanium and zirconium in the near-term. The company also has a medical isotopes division, focused around utilizing radium.

Just earlier this month the company put out a press release addressing the current export restrictions from China around 7 rare earths. I’m very surprised that with so many people ringing their hands over this news,that they aren’t seeing the opportunity here with Energy Fuels able to produce 6 of those 7 REEs.

U.S.-Based Energy Fuels Poised to Produce Six of the Seven Rare Earth Oxides Now Subject to Chinese Export Controls at Scale - April 17, 2025

Despite all of this clear focus on growing into becoming a rare earths producer and processor the last few years, I rarely hear any analysts, newsletter writers, commodities commentators, or even the mainstream media reference Energy Fuels when the rare earths discussion comes up. (That’s quite odd)

There are so many times in discussions with pundits on the KE Report, in conversations with other investors within my network, or also when I review presentations and podcasts on other platforms that supposed “experts” will bring up how much we need some domestic production and processing of rare earths. Sometimes people will claim (erroneously) that the world doesn’t have any rare earths production outside of China. This is then their rationale to go chase XYZ explorer that is going to go drill some remote land with rare earths on it. (Huh??)

When I often point out that we already have domestic rare earths production and processing with MP Materials, Neo Performance Materials, and Energy Fuels, they look like the kid that didn’t prepare for their school book report. Clearly many of these pundits are just not up to speed on the very sector that they are banging the table about; mostly due to the latest macro news out of China.

They may be aware of the 2 aforementioned companies, but very rarely do they even realize that Energy Fuels is also producing, separating & processing REEs.

Some people will even try to correct me “Well… Energy Fuels is actually a uranium company.” Often I’ll bite my tongue, as I don’t have the heart to tell them I’ve been invested in the company almost a decade (since late 2016); initially for the uranium exposure, and I’ve traded it dozens of times…. so I’m well aware that they are a uranium company… but they’re a whole lot more than that now.

It seems that the rare earths opportunity in Energy Fuels is still very under-the-radar, even from the very same pundits that are clamoring for domestic production, separation, and processing of these “critical minerals.”

As readers of this Substack channel will know, I’m a longer-term bull on nuclear power and the uranium sector, especially with regards to domestic producers like Energy Fuels, Uranium Energy Corp, enCore Energy, and Ur-Energy. Energy Fuels trades a bit differently that it’s uranium peers because it also can produce a range of other minerals and metals, including rare earths. I’ve watched this company put a lot of focus on growing their production and processing of key REEs critical to industry. Over the next few years this aspect of their business may even match or supersede their uranium production.

In future articles in this series we’ll get deeper into some of the other quality rare earth companies included in the chart of 8 companies noted earlier in this article, but I thought it would be interesting to kick off this series by showcasing one of the most overlooked domestic rare earth elements producers, separators, and processors - Energy Fuels.

[In full disclosure, yes I’m a shareholder of Energy Fuels at the time of this writing and may choose to buy or sell shares at any time. This is not investing advice, and I was not compensated by the company to write this article on Substack. Do your own due diligence, as I’m merely sharing my own investing thesis in this company and what I’m doing within my own portfolio.]

Thanks for reading and may you have prosperity in your trading and in life!

· Shad