Opportunities In Growth-Oriented Gold Producers - Part 12

Excelsior Prosperity w/ Shad Marquitz (08-11-2025)

I’m happy to report that we are diving back into more opportunities within the segment of “growth-oriented junior gold producers.” Throughout 2024 and 2025 we have covered some very interesting companies thus far in the dozen articles within this series. As it turned out many of these companies were very active with key newsflow and milestones; and quite a few were involved in some of the notable M&A deals within the gold mining sector.

In full disclosure, none of these companies are paying for me to write them up in these Substack articles. These company writeups here are simply about the value proposition that I personally see in stocks held within my own personal portfolio, (so yes, I’m talking my book and what I’m doing with my own money, these articles are biased in that sense).

My goal here is to have these updates be informative and topical for readers of this channel; not just with the specific companies featured, but also in the broader way of thinking about doing due diligence, and the rationale behind positioning in these types of stories within the larger resource investing universe.

Similar types of approaches and key points made within them could also be applied for investing in other stocks within the sector.

So, while I believe these are quality companies, and compelling opportunities in their own right, don’t get hung up on if you like the specific companies discussed. Instead, consider the broader points of attraction and some of the nuances around investing in this turbulent, complex, and volatile sector of junior mining stocks. Many of these concepts can be applied to sifting the space for other quality opportunities.

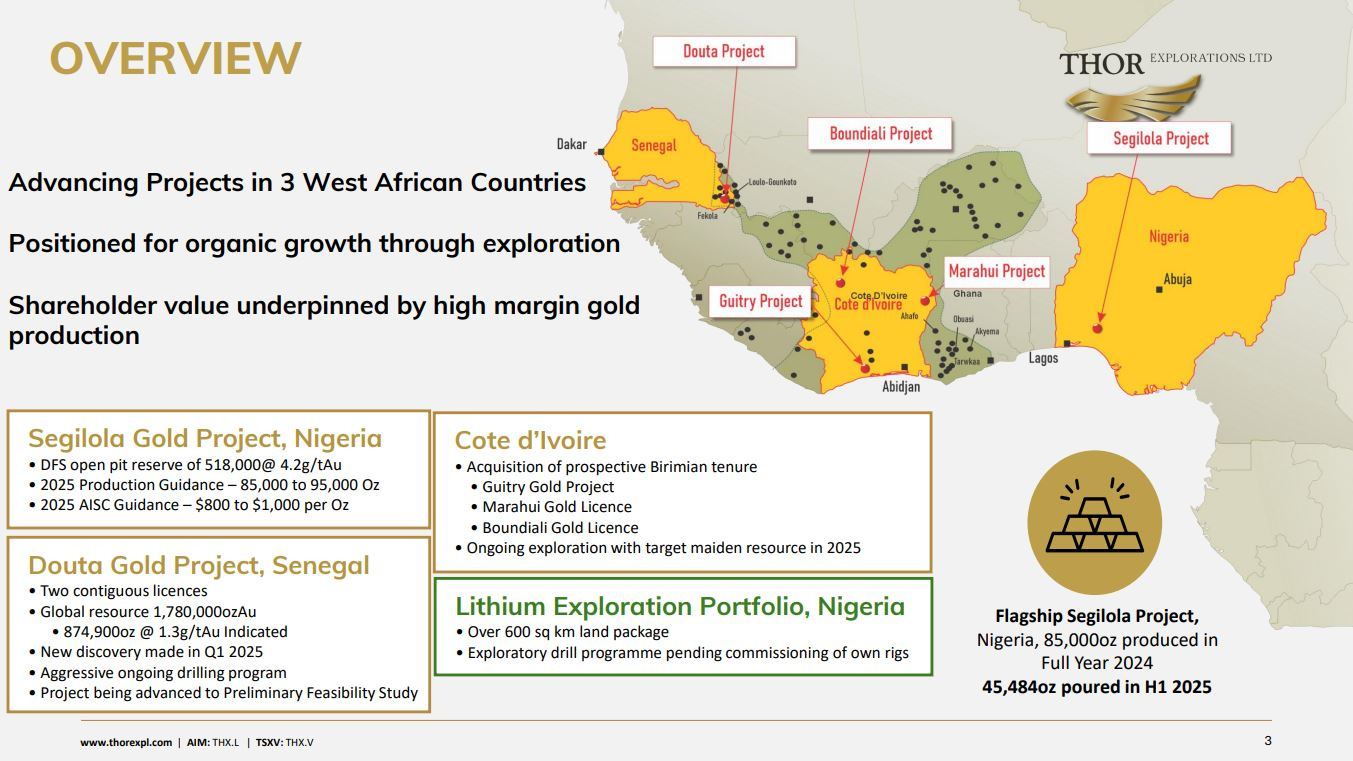

In this article we are now going to take a deeper dive into a growth-oriented gold producer that I’ve been invested in and following for a number of years now, Thor Explorations (TSX.V: THX) (AIM: THX) (OTC: THXPF). This is gold producer that I don’t see many others discussing out on the various resource investing media outlets and it rarely if ever comes up during investing conversations with most of the folks we interview on the KE Report or in private conversations with investing peers in the space.

When I first started following this company, after getting a heads up and introduction to management from my friend Nick (@MiningBookGuy over at Ceo.ca) in early 2021, this company was still exploring and derisking their first development project; with the goal to eventually raise the money to construct it into a producing asset...

Fast-forward 4 years later to the present day, and now Thor Exploration:

Is a junior gold producer that PAYS A DIVIDEND of US$0.008942 per Ordinary Share

This company is DEBT FREE.

Thor operates a totally paid-off producing mine in Nigeria. They paid back all construction debt through the organically generated revenues from their very low-cost production. (they are also the first publicly traded gold producer to get a new mine built in country – giving them a unique first-mover advantage).

Production guidance of 85,000 oz – 95,000 oz for 2025 with an All-In Sustaining Cost (AISC) guidance of US$800 - US$1,000 per oz. (That is a far lower AISC than most other gold producers on the planet at present). That equates to a very fat margin considering those costs contrasted against the current gold price!

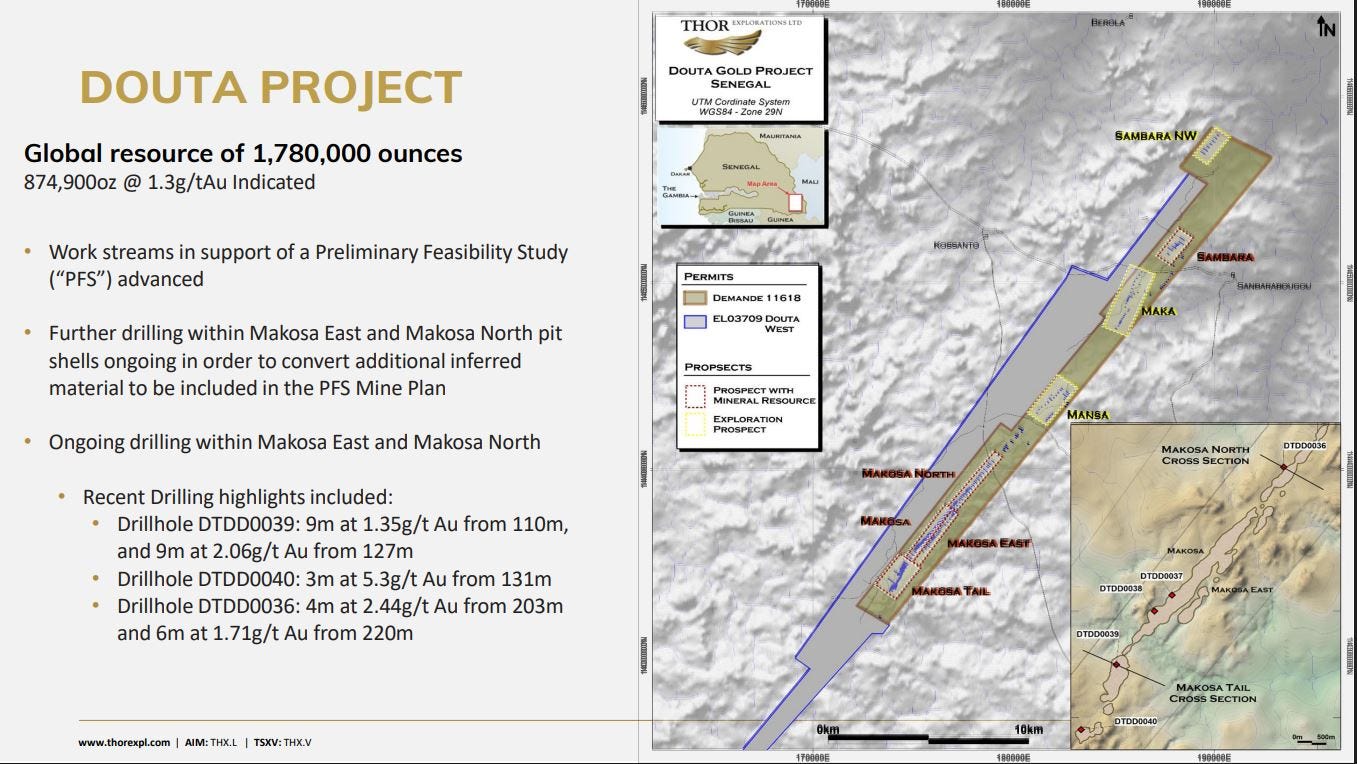

Their operations team has been working hard the last few years defining and derisking an even larger gold development-stage project in Senegal that already has 1.78 million ounces of gold in all categories.

For those animated by the drill bit turning, they acquired and recently started work on 3 new gold exploration projects in Cote D’Ivoire.

Now that this company became debt free at the end of 2024, they have continued forging ahead with growing organically. They have been plowing the revenues generated from their producing Segilola mine back into further exploration and development work around this existing mine, and also at multiple exploration and development projects across 3 different countries. Hence, that is why they fit quite nicely into this series on growth-oriented gold producers.

I fully recognize that not everyone is willing to invest in African mining stocks, due to the perceived jurisdiction risks of stepping outside of the more common locations of US, Canada, Mexico. Those more common North American jurisdictions often still have different or actually even greater risks than the West African countries though; when it comes to permitting or getting the social license to advance projects forward. (especially in lieu of the jurisdictions that we will discuss in this article)

From a risk mitigation standpoint, it should also be noted that this company is diversified across 3 different countries and 5 different projects. There are plenty of PM producers or developers that have either single-project or single-country risk. However, if they are in a perceived “safer” jurisdiction, then many investors ignore those risks… until they see something surface like what happened somewhat recently to Victoria Gold or Ascot Resources. Then the importance of diversification rings more loudly.

There are key milestones approaching from exploration to extend the mine life around the producing asset, along side advancing their development project further along the pathway towards a PFS and then an eventual construction decision for mine #2, and also ongoing greenfields exploration programs.

Truth be told, I’ve saved flagging this company until now, knowing some folks would balk at reviewing an African mining stock, due to perceived jurisdiction risks; regardless of if it was excelling on so many different fronts simultaneously.

{That’s fine, of course, as we all have different interests, risk tolerance levels, and investing rules; not to mention that none of this is investment advice anyway, and is merely being presented for entertainment purposes.}

My hope was to have previously laid out for readers of this channel and series a track record of picking quality stocks with solid projects, management teams that execute on initiatives, and growth on tap for future value creation. It is possible that some readers here may consider broadening their scope of potentiality, and learning more about another solid gold producer and developer operating in West Africa that has been really starting to hit its stride.

Personally, I’ve done incredibly well investing in select gold companies operating in West Africa for the last 15 years. I have had the good fortune of having been positioned in front of successful exploration targets and campaigns, companies that have attracted large strategic shareholders, development projects that then advanced successfully to production over much quicker timeframes than we’re used to in North America, and have also had portfolio positions taken over in over a half dozen M&A deals in West Africa. I enjoy the pace of activity for gold companies operating in West Africa, and that projects can advance from exploration to development and then production at a rate not seen in most other areas of the globe.

Over the last 4 years that I’ve been invested in and following the newsflow at Thor Explorations, it has been another prime example of compelling value creation, with a management team that has a proven track-record of continuing to execute on their stated strategy. They have moved things along at a very fast clip, and they’re still hitting on all cylinders.

So, let’s get into it…

___________________________________________________________________

2025 has seen the company really start to stretch its legs fundamentally and that is starting to show up technically in the pricing action and valuation on the chart.

(THX.V) is up over 290% this year from its January low of $0.2891 to its peak on Monday August 11th at $0.84.

Today was the all-time high daily close ever seen in this stock.

The pricing on this daily chart has respected the 50-day Exponential Moving Average (EMA) as an area of support multiple times. Until something changes, that level appears to be a good spot for accumulation {That’s not investment advice… just sharing my thesis}

2025 has absolutely been a good year for gold producers across the spectrum, but most of the big-boy senior producers have essentially doubled, whereas Thor Exploration has nearly tripled. This is the kind of outperformance we are looking for with these growth-oriented junior producers.

These are the types of higher-torque stocks that can really leverage the moves higher in the underlying metals, but also leverage the gains possible compared to the standard-issue senior producers… the household names that most PM investors endlessly discuss and pile into. {Past performance is not a guarantee of future performance, but Thor and many of the growth-oriented junior producers that we’ve covered in this series have trounced the returns of the senior producers, and the GDX.}

If people want to outperform the senior gold producers held in the GDX, then they have to go down the risk curve somewhat and hold companies with less awareness, less analyst coverage, and smaller assets that are not Tier 1 projects and they may be operating in countries that are not in Tier 1 jurisdictions.

Some of the best performing companies in my portfolio this year up 200%-400% have operations that most investors would consider small to medium-sized, and they are in jurisdictions like Mexico, Nicaragua, Argentina… and in this case Nigeria, that are considered risky.

We hear all the time that you a want to stick with investing in the best Tier One assets in the best jurisdictions, but clearly that is not always the case. There are times where smaller assets can grow much more or have their margins improve so much more on a percentage basis than larger assets. That is precisely what gives these junior producers the better torque than the seniors.

There are situations where jurisdictions considered risky (basically anywhere outside of the US, Canada, or Australia) actually have projects or companies operating with upside moves that blow past many of the “safer” jurisdictions.

Even within the leadership of larger gold producers, 2 of the biggest standouts the last couple years have been Lundin Gold (operating in Ecuador) and Dundee Precious Metals (operating in Turkey, and acquiring a company in Bosnia). Nobody would have picked either Ecuador or Turkey as best-in-class jurisdictions, and yet their returns have been just that and they’ve blown away most companies operating in Canada or the USA.

Before we move on to the fundamentals of Thor Explorations specifically, I want to embed an interview that I had over at the KE Report last week with my friend and colleague Jordan Roy-Byrne, CMT, MFTA, Editor & Publisher of The Daily Gold.

We got into this topic of why select quality growth-oriented PM juniors will outperform the wider-followed PM seniors as the bull market unfolds. It touches on a few points outlined above in a candid conversation, and sets up the right mindset for understanding the dozen articles in this series on growth-oriented gold producers thus far, including the company we will continue to cover today.

Jordan Roy-Byrne – Technical Outlook On Gold And Silver – Why Being Positioned In Growth-Oriented Juniors Will Outperform Seniors As The PM Bull Market Evolves

Let’s now dig into the fundamental value proposition in Thor Explorations.

Again, the company has the producing Segilola Mine in Nigeria, the large development-stage Douta Project in Senegal, and the 3 exploration projects in Cote D’Ivoire – Guitry, Boundiali, and Marahui. This is a solid diversified portfolio.

Segun Lawson, CEO of Thor Explorations (TSX.V: THX) (AIM: THX) (OTC: THXPF), joined me for a review of Q2 2025 operations and production metrics from its Segilola Gold mine, located in Nigeria, and for the Company’s ongoing exploration and development programs in Nigeria, Senegal and Cote D’Ivoire.

Thor Explorations – Q2 2025 Operations From The Segilola Mine – Exploration Update At Segilola, Douta, And Guitry Projects

Thor Explorations Announces Financial and Operating Results, for the Three and Six Months Ending June 30, 2025 - August 11, 2025

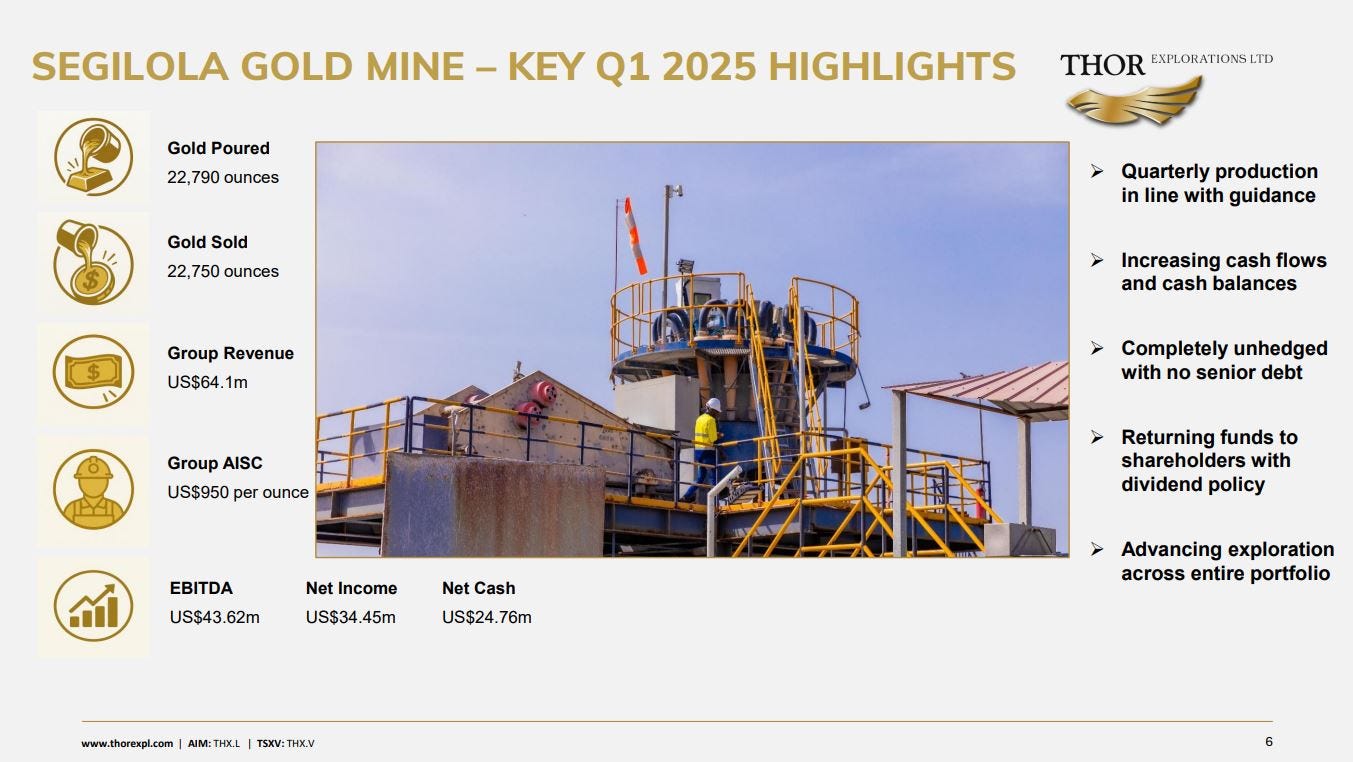

Segilola Q2 Highlights

Q2 gold poured of 22,784 ounces (“oz”)

Gold sales in Q2 2025 of 25,900 oz at an average realized price of US$3,187 resulting in revenue of $82.5 million

Gold produced from 238,425 tonnes milled at an average grade of 3.12 grammes per tonne (“g/t”) of gold and process plant recovery at 93.1%

Mine production of 242,461 tonnes at an average grade of 3.02g/t of gold for 23,573 oz

Ore stockpile decreased by 307 oz to 41,092 oz of gold at an average grade of 0.84g/t of gold

Financial Highlights for Q2 2025 and H1 2025

25,900 ounces ("oz") of gold (“Au”) sold in Q2 2025 with an average gold price of US$3,187 per oz.

Cash operating cost of US$715 per oz sold and all-in sustaining cost (“AISC”) of US$915 per oz sold.

In Q2 2025 the Company achieved quarterly records in revenue, EBITDA and net profit:

Q2 2025 revenue of US$82.7 million (Q2 2024: US$53.8 million) and H1 2025 of US$146.8 million (H1 2024: US$87.1 million).

Q2 2025 EBITDA of US$60.3 million (Q2 2024: US$37.6 million) and H1 2025 of US$103.9 million (H1 2024: US$60.9 million).

Q2 2025 net profit of US$51.6 million (Q2 2024: US$33.7 million) and H1 2025 of US$86.1 million (H1 2024: US$39.9 million).

Net cash of US$52.8 million as at June 30, 2025.

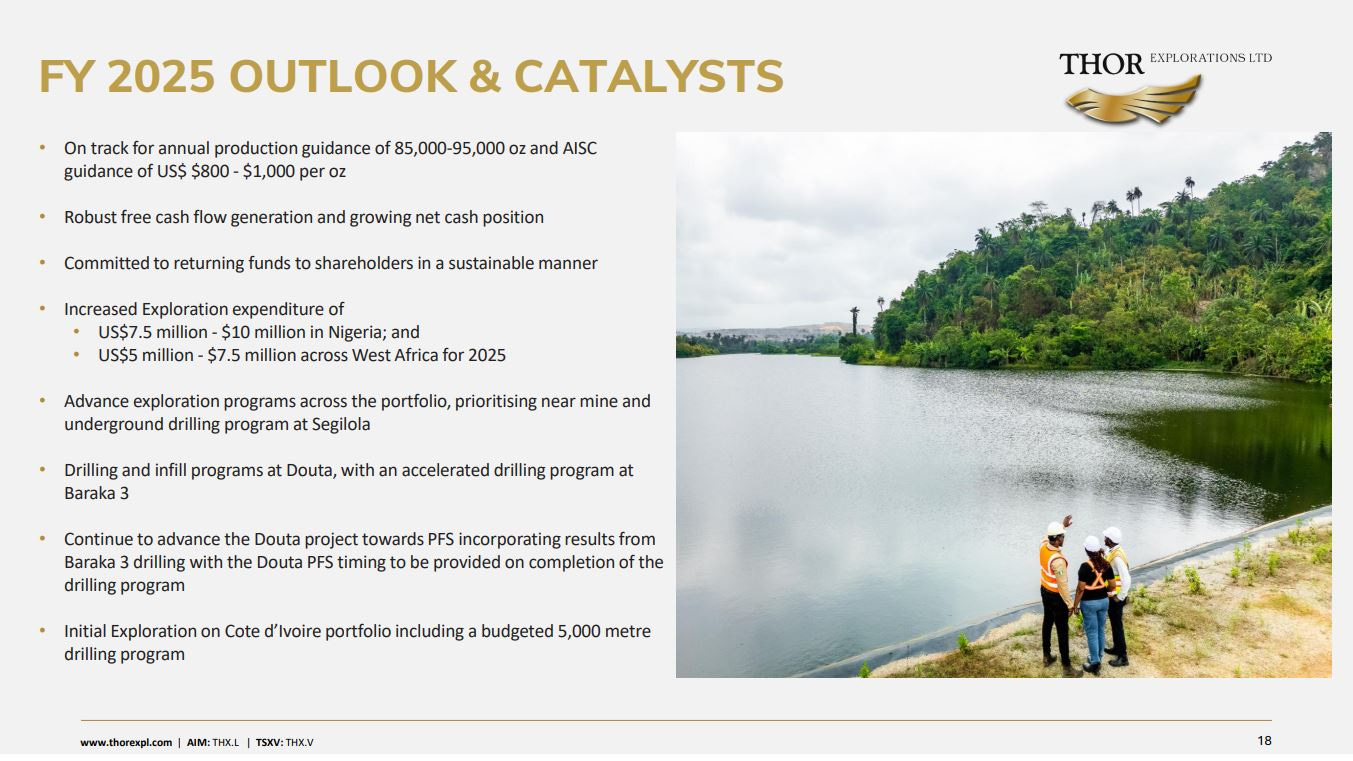

FY 2025 Outlook and Catalysts

FY 2025 production guidance range maintained at 85,000 to 95,000 oz of gold

FY 2025 All-in Sustaining Cost (“AISC”) guidance range maintained at $800 to $1,000 per ounce.

Drilling programs across all the Company’s exploration portfolio

Dividend

The Group will maintain the dividend policy announced on April 8, 2025, with the second quarterly dividend payment scheduled for August 15, 2025.

Dividends for the quarter will be paid at an amount of C$0.0125 per share.

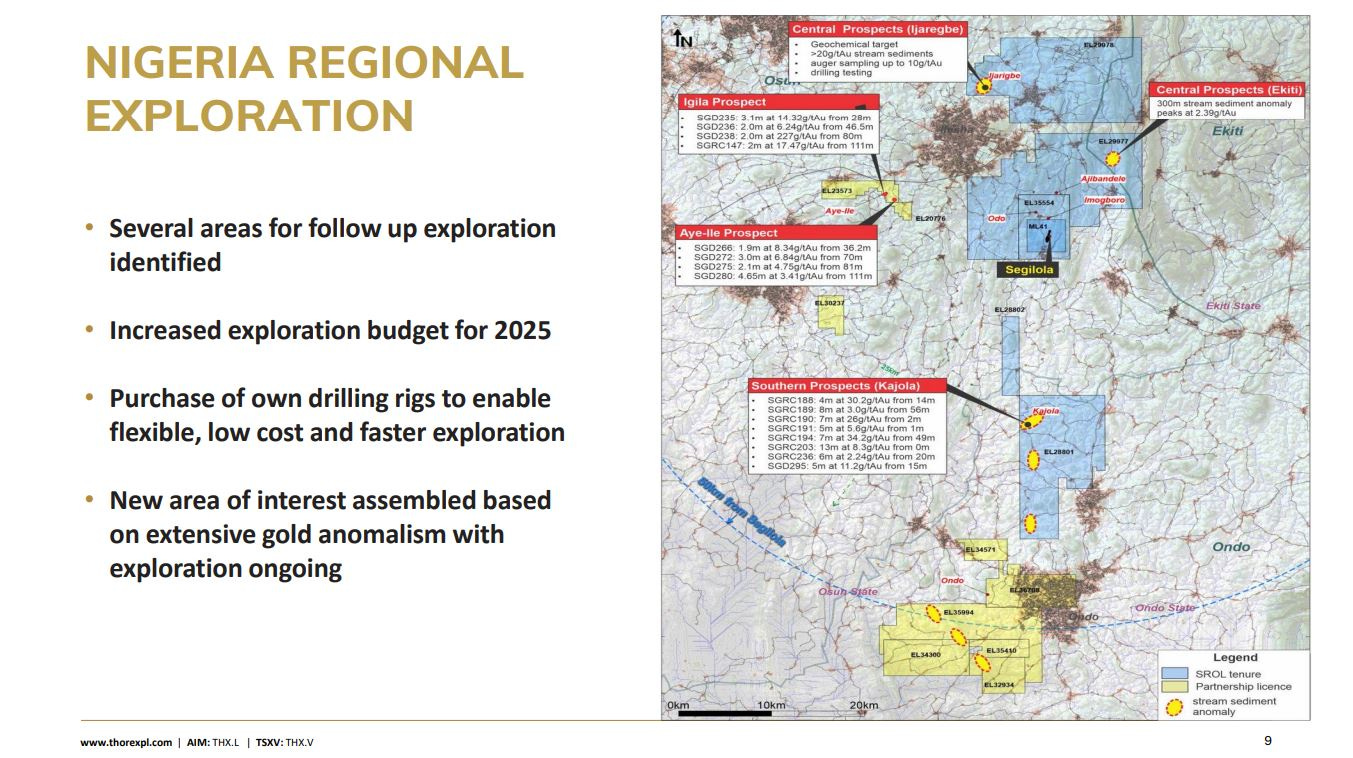

Segilola: continuation of ongoing underground drilling program

Nigeria regional targets: continuation of scout drilling programs on identified near-mine and regional targets

Senegal at the Douta Project:

Completion of drilling program at Baraka 3 prospect targeted to be incorporated into the Douta Preliminary Feasibility Study mine plan

Completion of further Reverse Circulation (“RC”) drilling targeting additional oxide resources

Following completion of Douta Project drilling programs, preparation of Updated Mineral Resource Estimate and Pre-Feasibility Study (“PFS”) at the Douta Project

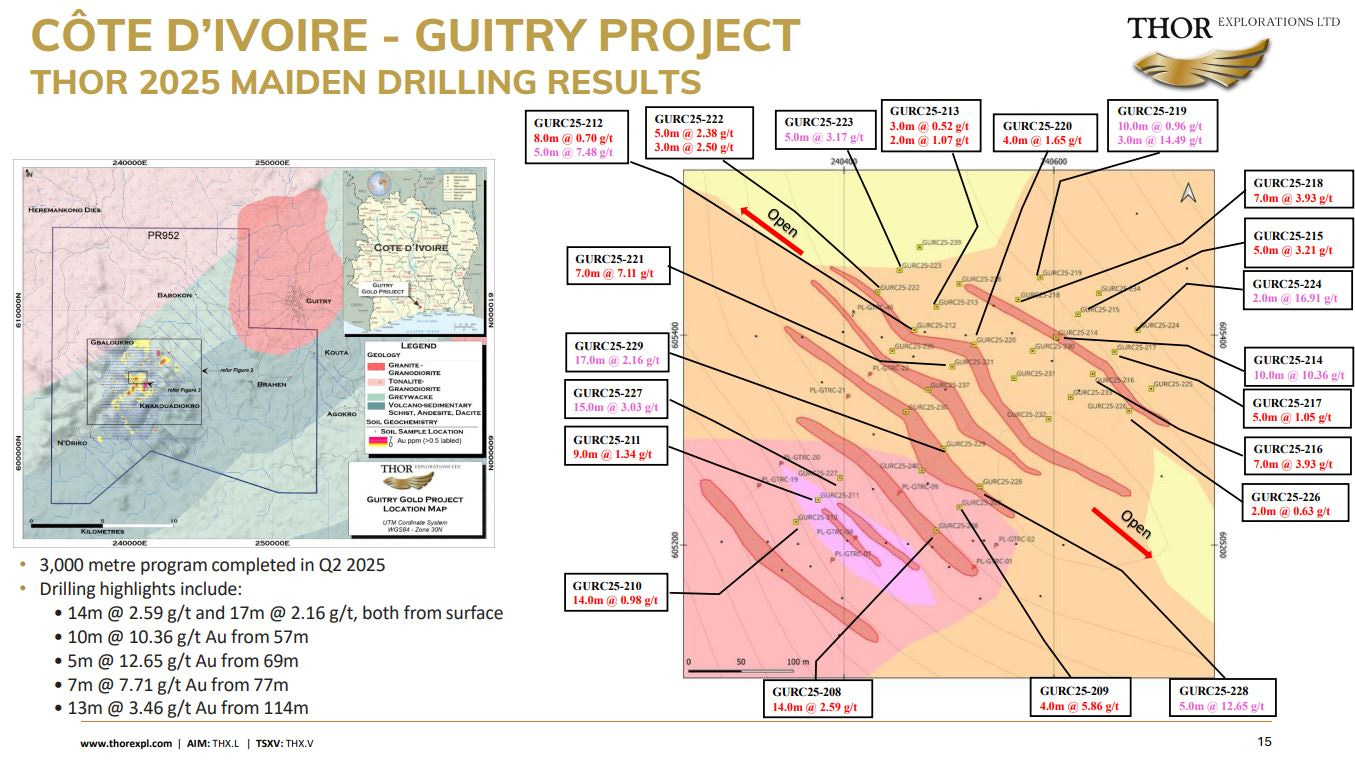

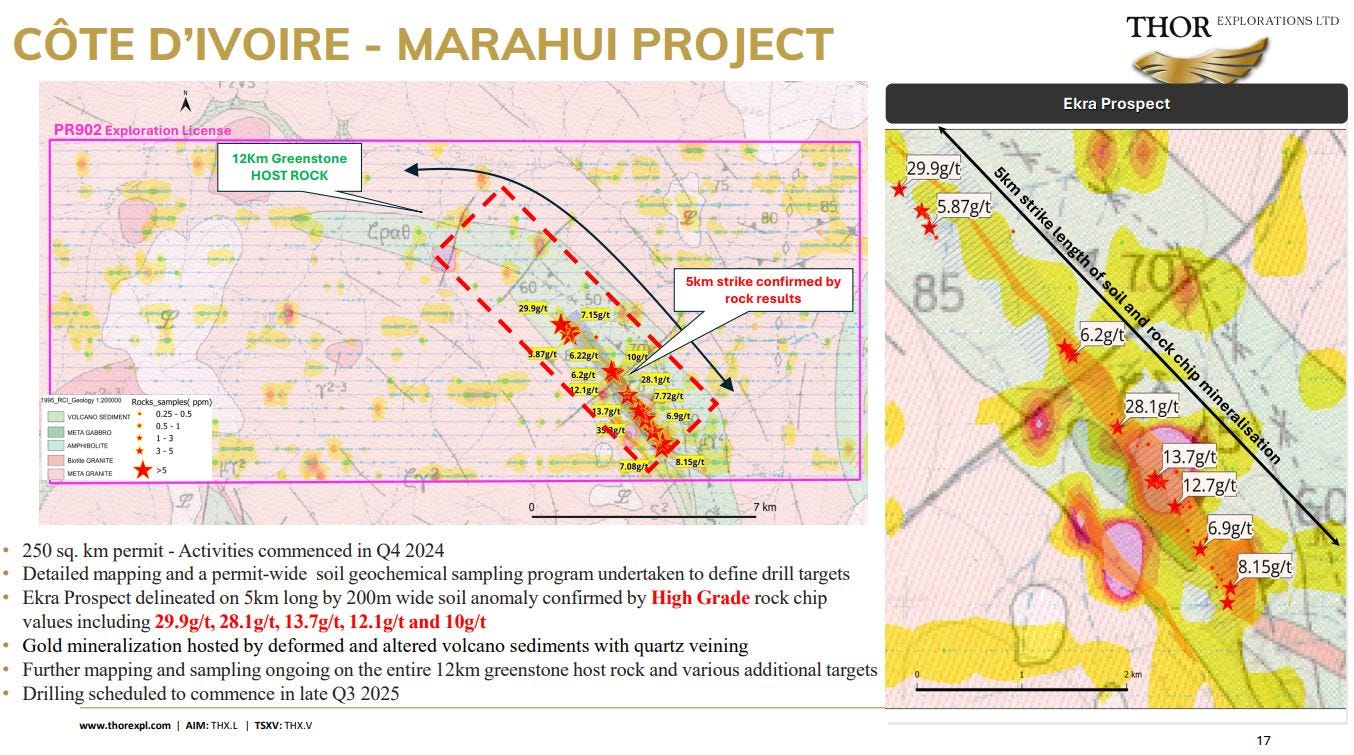

Côte d’Ivoire: Exploration being advanced on the Guitry, Marahui and Boundiali licenses, with further drilling to occur on Guitry and drilling to commence on Marahui where drill targets have been delineated.

During May and June 2025, Thor completed an initial 3,000 metre (“m“) reverse circulation (“RC”) drilling program at Guitry and has received initial assay results from the program. The objective of the program was to gain a better understanding of both the geometry and geological controls on gold mineralization based on a new interpretation of the historic drilling results obtained by Endeavour Mining, the historical owner of the asset.

MAIDEN DRILL RESULTS AT THE GUITRY PROJECT IN CÔTE D’IVOIRE

https://thorexpl.com/site/assets/files/2888/guitry_drilling_july2025_final_002.pdf

Thor Explorations is truly a growth-oriented gold producer:

Segilola mine life will be extended via the underground and near-mine open pit exploration work already demonstrating additional growing gold mineralization

The Douta Project is large, has a PFS slated for release as the next key milestone, and it is shaping up to be the next mine to build in the company’s portfolio

Guitry and Marahui have early-stage discovery drilling underway with compelling prospectivity as greenfields exploration projects.

Thanks for reading and may you have prosperity in your trading and in life!

Shad