Opportunities In Growth-Oriented Gold Producers - Part 11

Excelsior Prosperity w/ Shad Marquitz (04-28-2025)

I’m happy to report that we are diving back into more opportunities within the segment of “growth-oriented junior gold producers.” Throughout 2024 and 2025 we have covered some very interesting companies thus far in this series, and it turned out that these companies were very active with newsflow and were involved in a big chunk of the M&A deals in the gold mining sector.

In full disclosure, none of these companies are paying me to write them up in these Substack articles. These company writeups here are simply about the value proposition that I personally see in stocks held within my own personal portfolio, (so yes, I’m talking my book and what I’m doing with my own money, these articles are biased in that sense).

My goal here is to have these updates be informative and topical for readers of this channel; not just with the specific companies featured, but also in the broader way of thinking about doing due diligence, and the rationale behind positioning in these types of stories within the larger resource investing universe.

Similar types of approaches and key points made within them could also be applied for investing in other stocks within the sector.

So, while I believe these are quality companies, and compelling opportunities in their own right, don’t get hung up on if you like the specific companies discussed. Instead, consider the broader points of attraction and some of the nuances around investing in this turbulent, complex, and volatile sector of junior mining stocks.

In this article we are now going to take a deeper dive into what has traditionally been the ultimate silver optionality development project and company…. but earlier this year it announced an acquisition that completely transformed this company into the next up-and-coming growth-oriented gold producer; that also has excellent development projects and compelling exploration upside. The company I’m eluding is Discovery Silver. (Yes, it also may be time for them to consider a name change that includes gold along with silver.)

So, let’s get into it…

Discovery Silver (TSX:DSV) (OTCQX: DSVSF) is a company that I’ve been invested in for almost a half dozen years at this point; trading around a core position since October of 2019. Here is a throwback post from Ceo.ca noting me getting positioned, after they had acquired Levon Resources for their massive Cordero Silver Project in Mexico.

https://ceo.ca/dsv?id=a29c72f2736e

This Cordero Silver Project is truly a world-class asset with one of the largest undeveloped silver and silver equivalent resources in the world.

The Mineral Resource Estimate for Cordero was updated in February 2024, incorporating a total of 310,900 meters of drilling in 793 drill holes.

The Measured & Indicated Resource grew to 1,202 Moz AgEq with the Inferred Resource came in at 155 Moz AgEq.

Just think for a minute what 1.35 billion ounces of silver equivalent resources would do in an environment where silver ran to $40 or $50!

Cordero is still an amazing silver, gold, lead, and zinc project globally, and it will still be a future value driver of the company. However, it has now been relegated to (Page 23) of their corporate presentation; in lieu of their standout acquisition of the gold assets earlier this year. It’s a bit amazing that the former flagship asset for so many years is now 1 slide in back end of their corporate deck.

When the news broke in late January that Discovery Silver was acquiring the Porcupine Complex from Newmont to become a gold producer, the PM investor space was stunned (in a good way).

Discovery Announces Transformational Acquisition of Newmont’s Porcupine Complex - January 27, 2025

Establishes Discovery as a growing Canadian gold producer with large Mineral Resource base in a Tier 1 jurisdiction with significant upside potential

Attractive acquisition with base case NPV of $1.2 billion using analyst consensus gold prices (including a long-term (“LT”) gold price of $2,150 per ounce) and $2.3 billion at a +23% sensitivity case using LT gold price of $2,650 per ounce

Consideration at closing of $275 million, including $200 million of cash and $75 million of equity, with additional $150 million of deferred cash consideration starting in late 2027

Attractive $555 million financing package provides substantial financial strength

Brings to the Porcupine Complex a management team, led by Tony Makuch, with a solid track record for value creation within the industry and significant experience working in the Timmins Camp

Discovery launches C$225 million(approximately $155 million) subscription receipt bought deal public offering as part of the financing package

The acquisition transaction officially closed last Friday April 25th, 2025.

The Porcupine Operations of Discovery cover approximately 1,400 km2 in and near Timmins, Ontario, with the Timmins Camp being one of the world’s most prolific gold mining camps. The Porcupine Complex has produced approximately 70 million ounces of gold since 1910.

Included in acquired Porcupine assets are:

Hoyle Pond: One of the North America’s highest-grade gold mines with over four million ounces produced since 1987, and an excellent track record for replacing reserves;

Borden: A relatively new mine at the centre of a 1,000 km2 land position near Chapleau, Ontario, where there is potential to extend the existing mining zones and where there has been very little exploration outside of the current mining area;

Pamour: An open-pit project that is currently commencing production and has the potential to become much larger through drilling to depth and in multiple directions;

Dome Mine: One of the pillars of Canada’s gold mining history, where there remains a large mineral resource and substantial exploration upside; and,

Dome Mill: A large-scale, central processing facility currently operating below capacity levels and with significant growth potential to accommodate increased production. All mineralization from the operating mines is treated at Dome, including mineralization from Borden, which is trucked 190 km to the Dome plant.

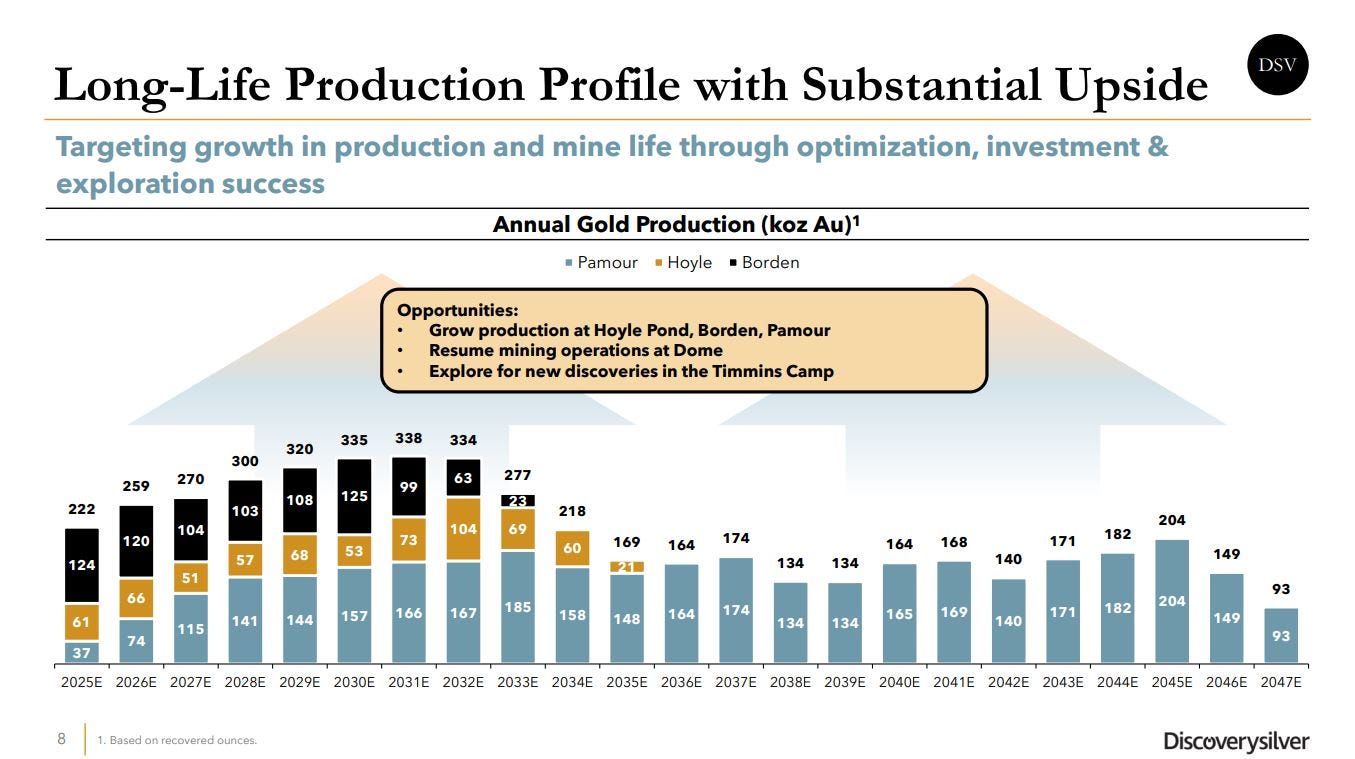

Current production comes from the Hoyle Pond and Borden underground mines, with initial production from the Pamour open-pit project expected in mid-2025. Mining at Dome ended in 2017, with a large base of remaining Mineral Resources supporting a potential resumption of operations.

Production in 2024 totaled 282,000 ounces, which resulted from processing 2.90 M tonnes at an average grade of 3.26 g/t and average recoveries of 92.9% at the Dome Mill.

· Of the 282,000 ounces of production, 130,000 ounces was from Borden, where a total of 666k tonnes was processed at an average grade of 6.54 g/t.

· Production at Hoyle Pond totaled 73,000 ounces and resulted from processing 222k tonnes at a grade of 10.8 g/t.

· An additional 79,000 ounces was produced at the Hollinger open pit (2.01M tonnes at an average grade of 1.35 g/t) in 2024, prior to mining operations being concluded.

The Pamour open-pit mine is the next growth engine for Discovery Silver and is anticipated to average ~150,000 ounces of gold equivalent production per year, for its over 22 years life-of-mine. Since we are only going to see the initial ramp-up into production in the second half of 2025, the company is guiding for anticipated production at Pamour at around 37,000 ounces of gold. This can at least offset about half of the production that came off-line this year with Hollinger being suspended the end of 2024. {It will be interesting to see if over time the team at discovery can find more resources at Hollinger to bring it back into production.}

Note the production growth from 2025 at 222,000 ounces of gold up to 2032 at 338,000 ounces of gold. That is significant gold production growth for Discovery Silver, and really puts them in the position of being a mid-tier gold producer almost overnight.

The next big area of growth for the company is through Exploration

Significant exploration potential exists at all sites, with Hoyle Pond, Borden, Pamour, Hollinger and Dome all possessing large bases of Mineral Resources, and multiple known targets to support additional growth going forward.

The Hoyle Pond deposit remains open at the XMS Zone, the S-vein upward and down-plunge extensions and, the NMV2 Zone near the 1350 level of the mine. In addition, the large TVZ zone, located adjacent to Hoyle Pond, represents an important potential new source of production.

The Borden deposit remains open at depth and along strike to the east and west.

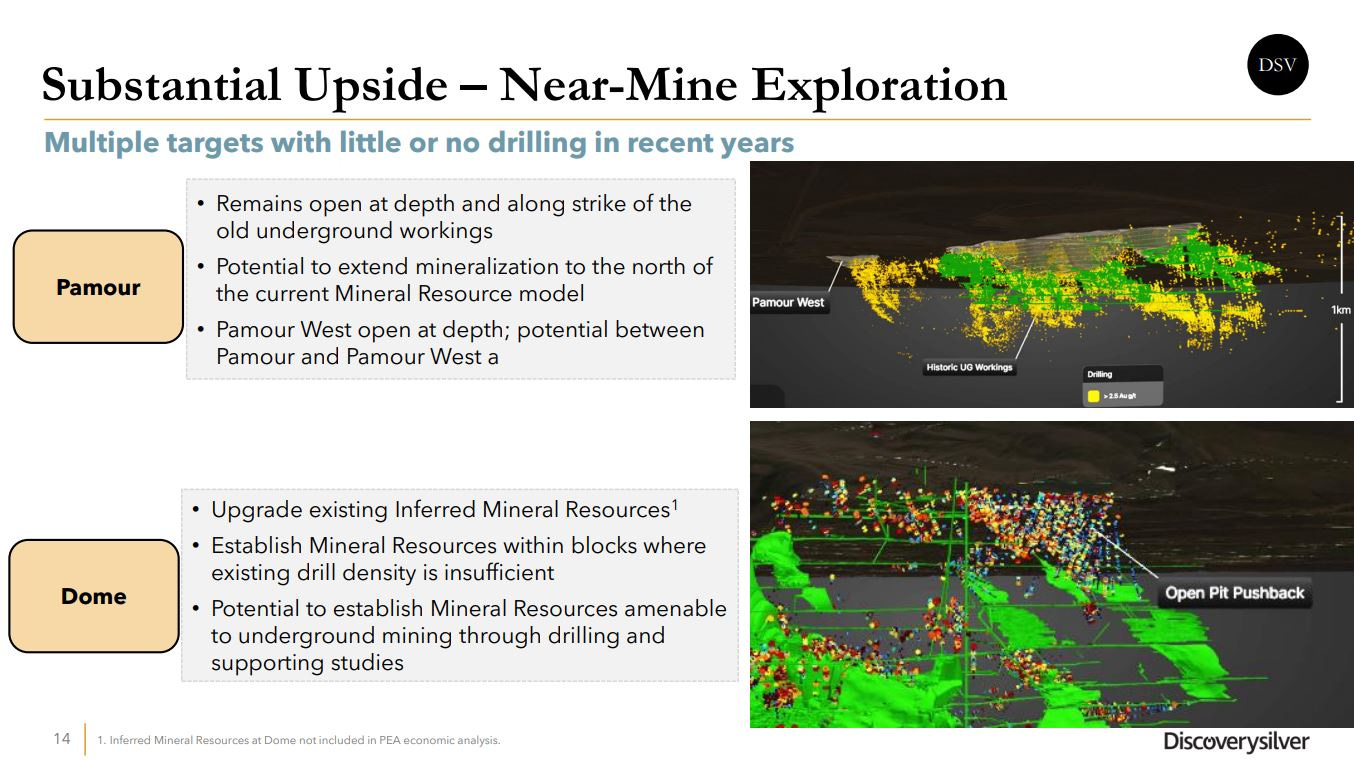

The Pamour deposit remains open at depth and along strike of the old underground workings. There is also an opportunity to extend mineralization to the north of the current resource model. In addition, the Pamour West zone remains open at depth and there is the potential for additional mineralization between the Pamour open pit and Pamour West.

Extensive exploration upside exists at Dome, where there is a large base of 11 million ounces of gold in the Inferred Mineral Resources. These ounces are amenable to open-pit mining and there is an ongoing opportunity to establish new Mineral Resources amenable to underground mining methods. Dome could be another huge area of production growth for the company’s future, and it is right next to the Dome Mill.

Extensive regional exploration potential also exists, with the Porcupine land position comprising a total of 140,000 hectares, including approximately 40,000 hectares centered around the renowned Porcupine-Destor Fault Zone (“PDFZ”) in Timmins and over 100,000 hectares around the Borden mine, where there has been limited past drilling outside the existing production zones.

On a regional level, there are still multiple exploration targets along the PDFZ

There are also areas around previously producing sites also provide numerous opportunities for additional exploration. These include at depth and along strike of the Hollinger–McIntyre trend, Broulan, Coniaurum, Owl Creek Deep, and the Paymaster zones.

In the Borden area, the zone west of the Borden ramp at Borden West and the B Roswell East and West zones show prospectivity.

In summary, Discovery Silver really checks all the boxes with a history of growth through 2 transformative acquisitions from Levon and Newmont, and now multi-year gold production growth, complimented by a wealth of exploration growth all over their district-scale land package.

None of that even begins to factor in the additional growth if they use this Porcupine mining complex to bring their Cordero silver project in Mexico into production during this metals cycle… which is a huge kicker that doesn’t even appear to be factored in to their current valuation.

Discovery Silver currently has a CAD$2.07 Billion valuation, which sounds big until you stop and add up all the different components.

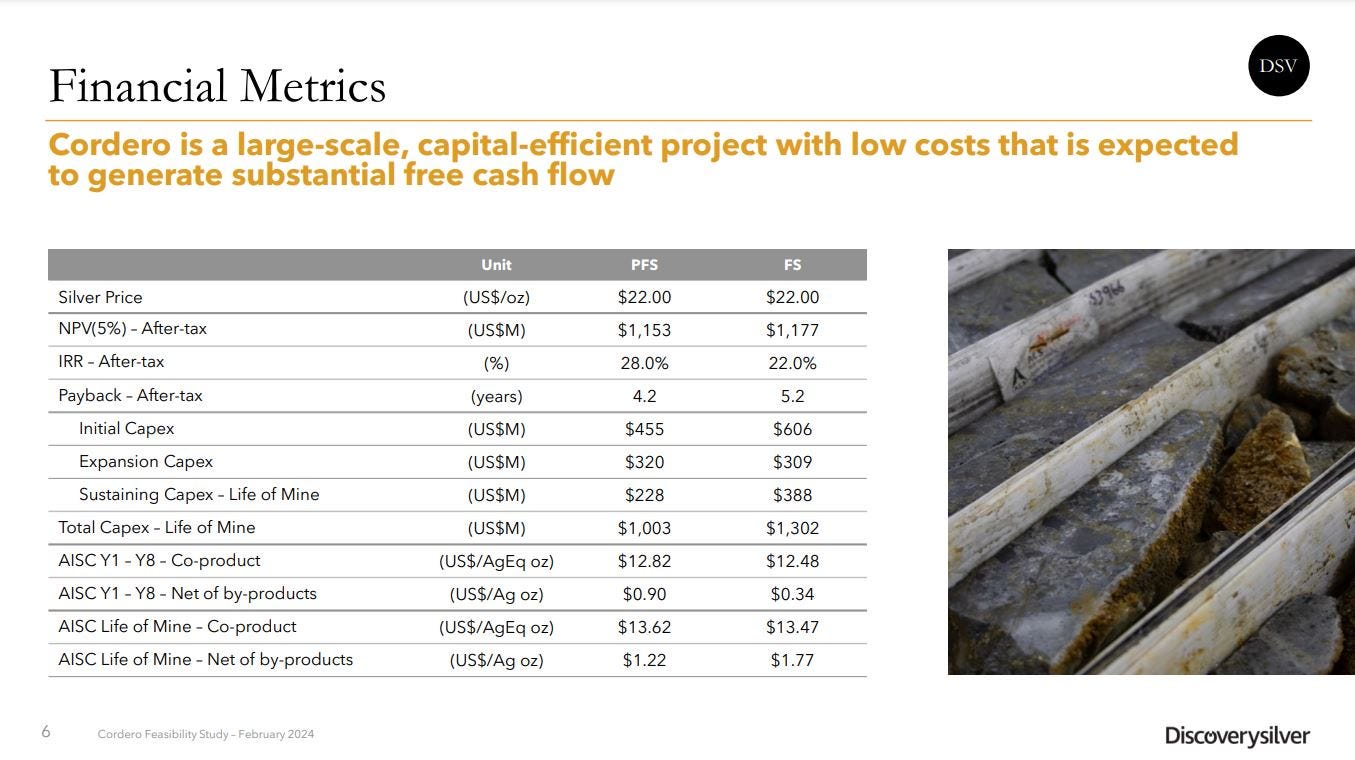

· Remember, there is a US $1.2 Billion (or ~ CAD $1.66 Billion) Net Present Value on just the Cordero Silver Project from the Feasibility Study completed in February of 2024 using $22 silver price assumptions. At $33 silver, that means that the current valuation is completely underpinned by all that silver and then an investor is getting the entire gold complex, mines and gold resources for free.

· There are 16.4 million ounces of gold in the Porcupine Complex (3.9 million in Measured and Indicated and 12.5 million in inferred).

· For a frame of reference, Skeena Resources (TSX:SKE)(NYSE:SKE) has 5.5 gold equivalent ounces at Eskay Creek and another 937,000 ounces at Snip for a total of ~7 million ounces of gold equivalent and it has a valuation of CAD $1.90 Billion. Skeena doesn’t have any production yet as its Eskay Creek Mine is still under construction.

· That means that Discovery Silver has more than twice as many gold resources as Skeena does, plus 2 active gold mines, with a 3rd gold mine coming online this year, plus a huge silver project valued at over CAD$1.6 billion, and yet Discovery Silver is currently valued at about the same market cap as Skeena . I think Skeena Resources is fairly valued at this point, but it should be obvious here how insanely undervalued Discovery Silver is in comparison.

The After-tax NPV of just the Porcupine Complex is US$2.3 Billion calculated at $2,650 per ounce of gold. Now consider that gold is over $3,300 and what that does to this valuation.

We’ve been talking about Discovery Silver in terms of its Canadian market cap, because its primary ticker is (DSV) on the TSX. However, in US dollar terms, using the (DSVSF) ticker on the OTCQX, then the market cap of Discovery silver is US $1.5 Billion. It could easily go up 2x in valuation, just to properly reflect the value of the Porcupine Complex - which at current spot prices is much closer to ~US$3 Billion.

Add in the Cordero project for roughly another US$1.5-$2 Billion in full NPV at today’s silver prices, and it isn’t outrageous to think that Discovery Silver could actually go up 3x from its current valuation. (US $1.5 Billion current versus US $4.5-$5 Billion at current spot prices)

Of course, we’d still have to account for the debt of US$550, and that Cordero won’t be fully valued until it goes into production, so maybe a 2x - 2.5x upside is more fair… (providing they never find another ounce of gold through exploration)

We could also haggle over the NPV 5% and say it should be NPV 8% or 10%. Fine, reduce it down some… the valuation is still in need of a multi-fold rerating higher for the sum of its assets.

(This is not investment advice, and I’m merely sharing my biased thesis as a current shareholder…and looking at the discrepancy between its current market cap all off its assets minus the debt. However, do your own due diligence and see what valuation you come away with.)

Key Question: Is somebody overpaying for Discovery Silver at its current market cap?

With all of that said let’s also look at the Discovery Silver chart:

Yes, the stock has begun rerating higher on the back of the acquisition news, and the US OTC ticker (DSVSF) is finally back up closer to that 2021 peak of $2.23, closing today at $1.89, and recently making it up to $2.12.

Yes, there has been share dilution one must also take into account. Still, this stock should be at a far higher price and valuation to my mind… as previously outlined.

My personal strategy is to let my position keep running to rerate higher over the fullness of time, and then possibly add more on any significant pullbacks. (again, that is not investment advice. I’m just sharing what I’m doing in my own portfolio for readers here and for information and entertainment purposes).

Thanks for reading and may you have prosperity in your trading and in life!

Shad